Beruflich Dokumente

Kultur Dokumente

Rating: Buy: Revs Miss, Margins Expand Own For Sustained Top-Line Growth, Margin Expansion and FCF Growth

Hochgeladen von

Man Ho LiOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Rating: Buy: Revs Miss, Margins Expand Own For Sustained Top-Line Growth, Margin Expansion and FCF Growth

Hochgeladen von

Man Ho LiCopyright:

Verfügbare Formate

Internet Media

Victor Anthony

646-502-2452

VAnthony@aegiscap.com

Company Update / Estimates Change

February 3, 2017

Key Metrics Amazon.com, Inc.

Rating: Buy

AMZN - NASDAQ $839.95

Pricing Date Feb 2 2017

$953.00

Revs Miss, Margins Expand; Own For Sustained

Price Target

52-Week Range $847.21 - $474.00

Shares Outstanding (mm) 497.0 Top-line Growth, Margin Expansion and FCF Growth

Market Capitalization (mm) $417,455.2

3-Mo Average Daily Volume 4,132,641 Investment Highlights:

Book Value/Share $28.42

Price/Book 29.6x Amazon's revenue missed our estimate by 2% with all three segments missing our

estimates. However, overall margins expanded, including at North America retail and

EPS FY: December at AWS, and were 80bps better that we were expecting. Despite the revenue miss,

Prior Curr. Prior Curr. the retail business still grew +20% YoY and AWS grew revenues a healthy 47%.

2015A 2016E 2016E 2017E 2017E The margin expansion refutes a bear case that Amazon has embarked on another

1Q-Mar (0.12) -- 1.07A 1.49E 1.15E prolonged investment cycle. The 1Q17 margin guidance was a bit light but Amazon

historically guides margins conservatively. Our thesis on the stock is unchanged.

2Q-Jun 0.19 -- 1.77A 2.45E 2.17E

Buy the stock for the share gains in retail, strong AWS growth coupled with margin

3Q-Sep 0.17 -- 0.52A 1.28E 1.10E

expansion, and overall company margin expansion despite heavy investments. See

4Q-Dec 1.00 1.39E 1.54A 2.07E 1.91E our January 20th, 2017 note "Sustained Solid Top-line Growth, With LT Margin

FY 1.25 -- 4.75E 7.30E 6.33E Expansion & FCF Growth; Initiating At Buy" for an in-depth view of our thesis on

P/E NM NM NM Amazon.

GAAP EPS

4Q16 Key Points. Reported revenue of $43.74B (+24% ex-FX vs. +28% in

REVENUE 3Q16), missed our/consensus estimates by 2%. NA retail missed our estimate by

Prior Curr. Prior Curr. 1%, while International retail missed by 4%, and AWS missed by 4%, suggesting

2015A 2016E 2016E 2017E 2017E that FX may have played a bigger role in the revenue miss vs consensus, although

1Q-Mar 22,717.0 -- 29,128.0A 35,981.1E 35,465.2E AWS was further impacted by the December price cuts. Pro-forma operating

2Q-Jun 23,185.0 -- 30,404.0A 37,367.5E 36,803.0E

margins of 5.0% expanded by 10bps and was higher than our estimate of 4.2%.

GAAP EPS of $1.54 was 15c ahead of our/consensus estimate of $1.39. North

3Q-Sep 25,358.0 -- 32,714.0A 39,933.9E 39,507.7E

American retail pro-forma margins expanded by 30bps to 5.0%. International

4Q-Dec 35,747.0 44,782.7E 43,741.0A 54,956.1E 53,193.2E margins, however, was -1.8%, turning negative for the second consecutive quarter

FY 107,007.0 --137,028.7E168,238.6E164,969.1E on investments in India and digital content. AWS margins expanded by 271bps to

31.3% but came down 30bps from 3Q16, we assume due to the December price

Company Description: cuts.

Amazon.com is one of the largest e-commerce companies in the world.

The company was incorporated in 1994, went live in July 1995, and

Other Salient Points: (1) Gross margins expanded by 189bps to 33.8% driven by

become a public company in 1997. Amazon operates principally via

three business models: core retail sales from Amazon.com, third- AWS accounting, 3P sales, and a greater mix of higher-margin categories, such

party seller programs, and Amazon Web Services (AWS). Amazon also as apparel and consumables; (2) Both fulfillment and marketing expense growth

owns the Kindle device manufacturing business and Amazon Prime

Video. Amazon has physical operations in the U.S., Canada, the U.K,

decelerated but were higher YoY as a percent of revenue; (3) Paid unit growth

Germany, France, Japan, China, Italy, Spain, and India. was 24%, decelerating from 28% in 3Q16. (4) Amazon ended the quarter with

$25.9B ($52/share) in cash and $7.69B in debt. (6) Capex was 4.6% of sales, and

capex grew 53% vs. 54% in 3Q16. (7) TTM FCF per-share grew 31% YoY to

$19.97 while TTM FCF per-share, ex lease payments, grew 20% YoY to $11.73.

Estimate Changes & Valuation. We trimmed our 2017 revenue estimate by

2% and our pro-forma operating income by 1%. Our price target, however, is

unchanged at $953 for year-end 2017. We value Amazon using a SOTP , in which

we apply a 1.5x multiple to our 2018 retail revenue estimate and a 12x multiple

to our 2018 AWS EBITDA estimate.

The Disclosure section may be found on pages 12 - 13 of this report.

Amazon.com, Inc. February 3, 2017

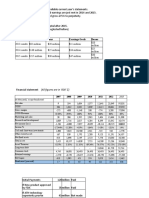

Exhibit 1. Aegis Estimate Changes

Item Aegis Estimate Guidance Prior Estimates Variance Variance %

1Q17E

Revenues $35,465 $33.25B-$35.75B $35,981 ($516) -1.5%

EBITDA $4,238 $4,159 $79 1.9%

Pro-Forma Oper Income (CSOI) $1,849 $1,948 ($99) -5.3%

Non-GAAP EPS $2.27 $2.40 ($0.14) -6.0%

GAAP EPS $1.15 $1.49 ($0.34) -29.8%

2017E

Revenues $164,969 $168,239 ($3,270) -2.0%

EBITDA $18,997 $18,349 $648 3.4%

Pro-Forma Oper Income (CSOI) $9,003 $9,099 ($96) -1.1%

Non-GAAP EPS $11.28 $11.41 ($0.13) -1.2%

GAAP EPS $6.33 $7.30 ($0.97) -15.3%

2018E

Revenues $199,029 $203,671 ($4,642) -2.3%

EBITDA $24,695 $24,072 $623 2.5%

Pro-Forma Oper Income (CSOI) $13,447 $13,662 ($215) -1.6%

Non-GAAP EPS $15.10 $15.23 ($0.13) -0.9%

GAAP EPS $8.95 $10.62 ($1.68) -18.7%

Source: Aegis Capital; Company Reports

2 AEGIS CAPITAL CORP.

Amazon.com, Inc. February 3, 2017

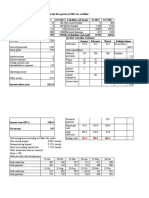

Valuation

We value Amazon using a sum-of-the-parts analysis, in which we apply a 1.5x multiple to our 2018 retail revenue estimate

and a 12x multiple to our 2018 AWS EBITDA estimate. After adjusting for cash & equivalents and debt, we arrive at a per

share value of $953 for year-end 2017%.

Exhibit 2: Sum-of-The-Parts Valuation

2018 2018 % of per

Revenue EBITDA Multiple Enterprise Value Total EV Share

Retail, Method: Revenue $171,985 1.5x $260,557 57.2% $524

Other (Ad Rev,CC Fees), Method: Revenue $2,498 1.0x $2,498 0.5% $5

Total AMZN Retail & Other $174,483 $8,416 $263,055 57.8% $529

AWS, Method: EBITDA $24,546 $16,279 12x $192,091 42.2% $387

Total AMZN Enterprise Value $455,146

Add: Cash & Equivalents, Current $25,981 $52

Less: Debt ($7,694) ($15)

Equity Value $473,433

Diluted Shares 497.0

Fair Value per Share $953

Current Share price $839.95

Upside/(Downside) 13%

Source: Aegis Capital Estimates

Amazon is currently trading above its historical price-to-sales valuation and similarly above its average relative price-to-sales

to the S&P 500, but off its peak.

Exhibit 2. Amazon: Historical P/S and P/S Relative to S&P500

Amazon: P/Sales Amazon: Relative P/Sales, to S&P500

2.9x 1.95x

2.0x

1.8x

2.4x

1.6x

1.4x 1.28x

1.9x

1.2x

1.4x 1.0x

0.8x 0.91x

0.9x

0.6x

0.4x 0.4x

10/1/2011

10/1/2012

10/1/2013

10/1/2014

10/1/2015

10/1/2016

10/1/2011

10/1/2012

10/1/2013

10/1/2014

10/1/2015

10/1/2016

1/1/2011

4/1/2011

7/1/2011

1/1/2012

4/1/2012

7/1/2012

1/1/2013

4/1/2013

7/1/2013

1/1/2014

4/1/2014

7/1/2014

1/1/2015

4/1/2015

7/1/2015

1/1/2016

4/1/2016

7/1/2016

1/1/2011

4/1/2011

7/1/2011

1/1/2012

4/1/2012

7/1/2012

1/1/2013

4/1/2013

7/1/2013

1/1/2014

4/1/2014

7/1/2014

1/1/2015

4/1/2015

7/1/2015

1/1/2016

4/1/2016

7/1/2016

P/Sales Average Relative Valuation Min Max Average

Source: FacetSet; Aegis Capital

Interestingly, and for both illustrative and comparison purposes, Amazons current market capitalization is only 8% of its

market opportunity (global retail sales and our rough estimate for AWSs market opportunity), compared to 63% for

Facebook and 93% for Alphabet. For this comparison, we rely on the $600B global advertising market for Facebook and

3 AEGIS CAPITAL CORP.

Amazon.com, Inc. February 3, 2017

Alphabet, and ignore Facebooks under-monetized opportunities outside of advertising (Messenger, WhatsApp, Oculus, e-

commerce) and Alphabets optimality on Other Bets.

Exhibit 3. Amazons Market Capitalization % of Market Opportunity vs Facebook & Alphabet

100% 93%

90%

80%

70%

63%

60%

50%

40%

30%

20%

8%

10%

0%

Amazon Facebook Alphabet

Source: eMarketer; Company Reports; Aegis Capital

Notes: For Amazon we use $4.9T global retail sales and assume $500B AWS market opportunity. Bezos has said that the

AWS market opportunity could be larger than retail and could be in the trillions of dollars.

Facebook and Alphabet's Market opportunity limited to $600B in annual global advertising, which is the super majoity of

their revenues.

4 AEGIS CAPITAL CORP.

Amazon.com, Inc. February 3, 2017

Supplemental Charts

Exhibit 4. Amazon: Core Retail & AWS Pro-forma Operating Margins (CSOI)

35.0%

30.3% 30.2% 30.7%

30.0%

25.0% 23.7%

20.0%

14.2%

15.0%

10.0%

5.0% 3.4%

2.7% 2.6% 2.5%

1.4%

0.0%

2014 2015 2016 2017E 2018E

Retail Segment CSOI Margin AWS Segment CSOI Margin

Source: Company Reports; Aegis Estimates

Exhibit 5. Amazon: Total Company Pro-forma Operating Margin (CSOI)

8.0%

Investment Cycle Begins

7.0% 6.8%

6.0% 5.7%

5.5%

5.1%

5.0%

4.2%

4.0%

3.3%

2.7% 2.7%

3.0%

2.0%

2.0%

1.0%

0.0%

2010 2011 2012 2013 2014 2015 2016 2017E 2018E

Proforma operating margin (CSOI)

Source: Company Reports; Aegis Estimates

5 AEGIS CAPITAL CORP.

Amazon.com, Inc. February 3, 2017

Free Cash Continues To Build. Along with margin expansion, we expect free cash flow per-share to continue to increase at a

measured pace. We estimate that capital expenditures will range between 4.5% and 5.0% over the next two years leading

free cash flow per share to grow at an 17% CAGR from $20.06 per share in 2016 to $28.91 per-share in 2018.

Exhibit 6. Free-cash-flow per-share

$35.15

$30.15 $28.91

$25.12

$25.15

$20.06

$23.56

$20.15

$15.44

$17.13

$15.15

$10.15 $11.78

$10.00

$5.50

$4.55 $4.41 $4.18

$5.15

$0.86

$1.14

$0.15

2010 2011 2012 2013 2014 2015 2016 2017E 2018E

FCF Per-Share FCF Per-Share, Less Lease Payments

Source: Company Reports; Aegis Estimates

6 AEGIS CAPITAL CORP.

Amazon.com, Inc. February 3, 2017

Company Description

Amazon.com is one of the largest e-commerce companies in the world. The company was incorporated in 1994, went live in

July 1995, and become a public company in 1997. Amazon operates principally via three business models: core retail sales

from Amazon.com, third-party seller programs, and Amazon Web Services (AWS). Amazon also owns the Kindle device

manufacturing business and Amazon Prime Video. Amazon has physical operations in the U.S., Canada, the U.K, Germany,

France, Japan, China, Italy, Spain, and India.

Investment Thesis

An investment in Amazon today is a bet that: a) Amazon will continue to take share of retail sales, Prime will

continue to add subscribers, and retail top-line growth will continue in the high-teen to low-20% range; b)

AWS will continue to grow at a healthy pace, and margins continue to expand, despite rising competition; c)

overall company margins will expand despite aggressive investments in digital content, infrastructure, India

and others; and d) the current valuation will withstand potential macro shocks as well as quarterly variations

in earnings versus consensus. We see a, b, and c as highly likely over the next two years, while d, if it were

to occur, would present buying opportunities.

Risks To Our Analysis

Rising competition for retail and AWS.

Key man risk Amazons future growth and strategic direction could be negatively impacted if Jeff Bezos were not able to

perform his duties as CEO.

Macro weakness could weigh on growth.

India could impose restrictions on foreign firms that, like China, could diminish Amazons competitive position.

Trump Effect new regulations (taxes, net neutrality) could negatively impact revenues and profits.

7 AEGIS CAPITAL CORP.

Amazon.com, Inc. February 3, 2017

Amazon.com, Income Statement (in $Millions, except per share data)

Period 2013 2014 2015 1Q16 2Q16 3Q16 4Q16 2016 1Q17E 2Q17E 3Q17E 4Q17E 2017E 2018E

Media $10,808 $11,567 $12,483 $3,208 $2,928 $3,237 $4,208 $13,581 $3,417 $3,118 $3,447 $4,482 $14,464 $15,476

Electronics & Other GM $29,986 $38,517 $50,402 $13,511 $14,459 $15,327 $21,590 $64,887 $16,686 $17,857 $18,852 $26,556 $79,951 $98,340

Other $3,724 $750 $824 $277 $287 $310 $442 $1,316 $416 $402 $403 $553 $1,773 $2,163

Total North America $44,518 $50,834 $63,709 $16,996 $17,674 $18,874 $26,240 $79,784 $20,518 $21,377 $22,703 $31,590 $96,187 $115,979

y/y % change 27.9% 14.2% 25.3% 26.8% 28.1% 25.8% 22.0% 25.2% 20.7% 21.0% 20.3% 20.4% 20.6% 20.6%

Media $10,907 $10,938 $10,026 $2,480 $2,283 $2,491 $3,377 $10,631 $2,524 $2,263 $2,506 $3,549 $10,843 $11,064

Electronics & Other GM $18,817 $22,369 $25,195 $7,034 $7,504 $8,056 $10,514 $33,108 $8,637 $8,938 $9,636 $12,943 $40,154 $47,105

Other $211 $209 $197 $52 $57 $62 $74 $245 $65 $69 $74 $90 $299 $335

Total International $29,935 $33,516 $35,418 $9,566 $9,844 $10,609 $13,965 $43,984 $11,226 $11,270 $12,217 $16,582 $51,296 $58,504

y/y % change 13.9% 12.0% 5.7% 23.5% 30.1% 28.3% 17.9% 24.2% 17.4% 14.5% 15.2% 18.7% 16.6% 14.1%

AWS $3,108 $4,644 $7,880 $2,566 $2,886 $3,231 $3,536 $12,219 $3,721 $4,156 $4,588 $5,021 $17,486 $24,546

y/y % change 49.4% 69.7% 63.9% 58.2% 55.0% 47.0% 55.1% 45.0% 44.0% 42.0% 42.0% 43.1% 40.4%

Total Global Net Sales $74,453 $88,988 $107,007 $29,128 $30,404 $32,714 $43,741 $135,987 $35,465 $36,803 $39,508 $53,193 $164,969 $199,029

y/y % change 21.9% 19.5% 20.2% 28.2% 31.1% 29.0% 22.4% 27.1% 21.8% 21.0% 20.8% 21.6% 21.3% 20.6%

Total Cost of Sales $54,182 $62,752 $71,651 $18,866 $19,180 $21,260 $28,958 $88,264 $22,616 $22,849 $25,280 $34,684 $105,428 $125,210

Gross Profit 20,271 26,236 35,356 10,262 11,224 11,454 14,783 47,723 12,849 13,954 14,228 18,509 59,541 73,819

Gross Profit Margin % 27.2% 29.5% 33.0% 35.2% 36.9% 35.0% 33.8% 35.1% 36.2% 37.9% 36.0% 34.8% 36.1% 37.1%

Fulfillment $8,585 $10,766 $13,411 $3,687 $3,878 $4,335 $5,719 $17,619 $4,637 $4,728 $5,228 $7,160 $21,753 $26,088

Marketing & Sales $3,134 $4,332 $5,252 $1,436 $1,546 $1,738 $2,513 $7,233 $1,928 $1,977 $2,159 $2,887 $8,951 $10,621

Technology and Content $6,565 $9,275 $12,542 $3,526 $3,880 $4,135 $4,545 $16,086 $4,593 $4,751 $5,020 $5,963 $20,327 $24,434

General and administrative $1,128 $1,552 $1,747 $497 $580 $639 $717 $2,433 $623 $707 $775 $882 $2,986 $3,624

Other Operating Expenses $114 $133 $171 $45 $55 $32 $34 $166 $34 $34 $34 $34 $136 $136

Total Operating Expenses 73,708 88,810 104,774 28,057 29,119 32,139 42,486 131,801 34,431 35,045 38,496 51,609 159,580 190,113

y/y % change 22.0% 20.5% 18.0% 24.9% 28.2% 28.8% 22.7% 25.8% 22.7% 20.4% 19.8% 21.5% 21.1% 19.1%

% of Revenues 99.0% 99.8% 97.9% 96.3% 95.8% 98.2% 97.1% 96.9% 97.1% 95.2% 97.4% 97.0% 96.7% 95.5%

EBITDA, Adj $5,246 $6,553 $10,805 $3,487 $3,656 $3,467 $4,473 $15,067 $4,238 $4,842 $4,557 $5,361 $18,997 $24,695

y/y % change 37.1% 24.9% 64.9% 63.6% 41.8% 33.8% 27.7% 39.4% 21.5% 32.4% 31.4% 19.8% 26.1% 30.0%

EBITDA Margin 7.0% 7.4% 10.1% 12.0% 12.0% 10.6% 10.2% 11.1% 11.9% 13.2% 11.5% 10.1% 11.5% 12.4%

Depreciation & Amortization $3,253 $4,745 $6,281 $1,827 $1,909 $2,084 $2,297 $8,117 $2,389 $2,461 $2,534 $2,610 $9,994 $11,249

Pro Forma Operating Income (CSOI) $1,993 $1,808 $4,524 $1,660 $2,108 $1,383 $2,176 $6,950 $1,849 $2,381 $2,022 $2,750 $9,003 $13,447

y/y % change 19.5% -9.3% 150.2% 135.1% 96.1% 39.3% 24.3% 53.6% 11.4% 13.0% 46.2% 26.4% 29.5% 49.4%

Margin 2.7% 2.0% 4.2% 5.7% 6.9% 4.2% 5.0% 5.1% 5.2% 6.5% 5.1% 5.2% 5.5% 6.8%

Operating Income $745 $178 $2,233 $1,071 $1,285 $575 $1,255 $4,186 $1,035 $1,758 $1,012 $1,584 $5,389 $8,916

y/y % change 10.2% -76.1% 1154.5% 320.0% 176.9% 41.6% 13.3% 87.5% -3.4% 36.8% 76.0% 26.2% 28.7% 65.4%

Margin 1.0% 0.2% 2.1% 3.7% 4.2% 1.8% 2.9% 3.1% 2.9% 4.8% 2.6% 3.0% 3.3% 4.5%

Interest Income $38 $39 $49 $21 $24 $26 $30 $101 $19 $12 $13 $17 $62 $120

Interest Expense ($141) ($210) ($460) ($117) ($116) ($118) ($133) ($484) ($116) ($116) ($116) ($116) ($464) ($464)

Other Income (Expenses) ($136) ($119) ($254) $81 ($14) $8 $14 $89 $0 $0 $0 $0 $0 $0

Remeasurements and other $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

PRETAX INCOME $506 ($112) $1,568 $1,056 $1,179 $491 $1,166 $3,892 $938 $1,654 $909 $1,486 $4,987 $8,572

Tax Rate % 29% 29% 29% 45% 26% 47% 36% 29% 30% 30% 30% 30% 29% 29%

Income Tax Expense (Benefit) $162 $167 $951 $475 $307 $229 $414 $1,425 $281 $496 $273 $446 $1,496 $2,571

Equity in Losses of Equity Method Investees ($71) $38 ($21) ($68) ($15) ($10) ($3) ($96) ($96) ($96) ($96) ($96) ($384) ($1,536)

Other (Amort of Goodwill, Acquisition charges, other) $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

NET INCOME $273 ($241) $596 $513 $857 $252 $749 $2,371 $561 $1,062 $540 $944 $3,107 $4,464

y/y % change -782.5% -188.3% -347.3% -1000.0% 831.5% 219.0% 55.4% 297.8% 9.3% 23.9% 114.5% 26.0% 31.0% 43.7%

Basic Shares Outstanding 457 462 468 471 473 474 476 474 478 480 482 484 481 489

Diluted Shares Outstanding 461 466 475 481 483 485 486 484 488 490 492 494 491 499

Basic GAAP EPS $0.60 ($0.52) $1.27 $1.09 $1.81 $0.53 $1.57 $5.01 $1.17 $2.21 $1.12 $1.95 $6.46 $9.13

Fully Diluted GAAP EPS $0.59 -$0.52 $1.25 $1.07 $1.77 $0.52 $1.54 $4.90 $1.15 $2.17 $1.10 $1.91 $6.33 $8.95

y/y % change -781.0% -188.0% -340.5% -970.1% 818.0% 214.4% 53.8% 290.6% 7.7% 22.1% 111.4% 24.0% 29.1% 41.4%

Pro Forma EPS (Fully Diluted) $2.21 $4.54 $0.52 $1.69 $2.40 $1.37 $2.72 $8.18 $2.27 $3.01 $2.49 $3.51 $11.28 $15.10

y/y % change 213.4% 105.7% -88.6% -176.5% 372.9% 144.6% 64.4% 1486.7% 34.3% 25.5% 81.2% 29.3% 37.9% 33.9%

Source: Company Reports; Aegis Capital Estimates

8 AEGIS CAPITAL CORP.

Amazon.com, Inc. February 3, 2017

Amazon.com Free Cash Flow (in $Millions, except per share data)

Period 2013 2014 2015 1Q16 2Q16 3Q16 4Q16 2016 1Q17E 2Q17E 3Q17E 4Q17E 2017E 2018E

TTM Free Cash Flow, TCM Calc

+ Cash from ops (SCF) $5,474 $6,841 $11,920 $11,259 $12,727 $14,603 $16,442 $16,442 $13,485 $14,479 $16,701 $19,756 $19,756 $23,382

- Capex ($3,443) ($4,892) ($4,588) ($4,896) ($5,394) ($6,040) ($6,736) ($6,736) ($7,153) ($7,098) ($7,035) ($7,424) ($7,424) ($8,956)

= Levered Free Cash Flow $2,031 $1,949 $7,332 $6,361 $7,331 $8,563 $9,706 $9,706 $6,332 $7,381 $9,666 $12,333 $12,333 $14,425

q/q % change -13.2% 15.2% 16.8% 13.3% -34.8% 16.6% 31.0% 27.6%

y/y % change 412.9% -4.0% 276.2% 101.2% 67.6% 58.6% 32.4% 32.4% -0.4% 0.7% 12.9% 27.1% 27.1% 17.0%

FCF % of EBITDA, Adjusted 38.7% 29.7% 67.9% 52.3% 55.4% 60.7% 64.4% 64.4% 23.2% 25.8% 33.7% 64.9% 64.9% 58.4%

TTM FCF per share $4.41 $4.18 $15.44 $13.22 $15.18 $17.66 $19.97 $20.06 $12.98 $15.06 $19.65 $24.96 $25.12 $28.91

q/q % change -13.2% 14.8% 16.3% 13.1% -35.0% 16.1% 30.4% 27.1%

y/y % change 411.8% -5.1% 269.1% 94.5% 65.2% 56.3% 31.0% 30.0% -1.9% -0.8% 11.3% 25.0% 25.2% 15.1%

LFCF/pro forma EPS % 199.8% 92.1% 2994.8% 299.8% 296.0% 248.2% 244.2% 245.3% 89.3% 93.1% 123.2% 221.3% 222.7% 191.4%

FCF Less Lease Principal repayments, TTM $1,251.00 $529.00 $4,748.00 $3,489.00 $3,925.00 $4,853.00 $5,699.00 $5,699.00 $2,177.17 $3,393.62 $5,680.56 $8,411.56 $8,411.52 $11,758.46

q/q % change 0.0% -26.5% 12.5% 23.6% 17.4% -61.8% 55.9% 67.4% 48.1%

y/y % change 0.0% -57.7% 797.5% 133.8% 64.5% 57.0% 20.0% 20.0% -37.6% -13.5% 17.1% 47.6% 47.6% 39.8%

FCF Per-Share Less Lease Obligations $1.14 $10.00 $7.25 $8.13 $10.01 $11.73 $11.78 $4.46 $6.93 $11.55 $17.03 $17.13 $23.56

q/q % change -26.5% 12.0% 23.1% 17.2% -62.0% 55.2% 66.7% 47.5%

y/y % change 0.0% 780.5% 126.1% 62.1% 54.7% 18.8% 17.9% -38.5% -14.8% 15.4% 45.2% 45.4% 37.5%

Source: Company Reports; Aegis Capital Estimates

AWS Estimates (in $Millions)

Period 2013 2014 2015 1Q16 2Q16 3Q16 4Q16 2016 1Q17E 2Q17E 3Q17E 4Q17E 2017E 2018E

Revenue $3,108 $4,644 $7,880 $2,566 $2,886 $3,231 $3,536 $12,219 $3,721 $4,156 $4,588 $5,021 $17,486 $24,546

q/q % change 6.7% 12.5% 12.0% 9.4% -69.5% 11.7% 10.4% 9.4%

y/y % change 69.0% 49.4% 69.7% 63.9% 58.2% 55.0% 47.0% 55.1% 45.0% 44.0% 42.0% 42.0% 43.1% 40.4%

y/y % change, Ex-FX 0.0% 0.0% 0.0% 64.0% 58.0% 55.0% 47.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%

% of Amazon's Revenues 7.0% 9.1% 12.4% 15.1% 16.3% 17.1% 13.5% 15.3% 18.1% 19.4% 20.2% 15.9% 18.2% 21.2%

Segment operating expenses (Ex-SBC, Amort of Intangibles)

$2,435 $3,984 $6,016 $1,850 $2,023 $2,210 $2,508 $8,591 $2,664 $2,892 $3,115 $3,537 $12,208 $17,015

q/q % change 7.7% 9.4% 9.2% 13.5% -69.0% 8.6% 7.7% 13.5%

y/y % change 0.0% 63.6% 51.0% 42.2% 41.2% 41.3% 46.0% 42.8% 44.0% 43.0% 41.0% 41.0% 42.1% 39.4%

% of revenues 78.3% 85.8% 84.0% 72.1% 70.1% 68.4% 70.9% 70.3% 71.6% 69.6% 67.9% 70.4% 69.8% 69.3%

CSOI - Segment operating income (loss) $673 $660 $1,864 $716 $863 $1,021 $1,106 $3,706 $1,057 $1,263 $1,473 $1,485 $5,278 $7,530

q/q % change 4.2% 20.5% 18.3% 8.3% -71.5% 19.6% 16.6% 0.8%

y/y % change 0.0% -1.9% 182.4% 170.2% 120.7% 96.0% 61.0% 98.8% 47.6% 46.4% 44.2% 34.2% 42.4% 42.7%

y/y % change, Ex-FX 0.0% 0.0% 0.0% 161.0% 121.0% 100.0% 62.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%

Margins 21.7% 14.2% 23.7% 27.9% 29.9% 31.6% 31.3% 30.3% 28.4% 30.4% 32.1% 29.6% 30.2% 30.7%

Source: Company Reports; Aegis Capital Estimates

9 AEGIS CAPITAL CORP.

Amazon.com, Inc. February 3, 2017

Amazon.com Balance Sheet (in $Millions, except per share data)

Period 2013 2014 2015 1Q16 2Q16 3Q16 4Q16 2016 1Q17E 2Q17E 3Q17E 4Q17E 2017E 2018E

Cash, cash equivalents, and marketable securities: $12,447 $17,416 $19,808 $15,859 $16,540 $18,347 $25,981 $25,981 $18,288 $20,111 $24,061 $34,393 $34,393 $46,151

Inventories $7,411 $8,299 $10,243 $9,582 $9,588 $10,696 $11,461 $11,461 $11,989 $11,930 $13,280 $14,498 $14,498 $18,190

Accounts receivable, net and other current assets $4,767 $5,612 $6,423 $5,072 $6,092 $6,566 $8,339 $8,339 $6,964 $8,192 $8,807 $11,323 $11,323 $15,130

Deferred tax assets, current portion $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total current assets $24,625 $31,327 $36,474 $30,513 $32,220 $35,609 $45,781 $45,781 $37,241 $40,232 $46,148 $60,214 $60,214 $79,472

Fixed assets, net $10,949 $16,967 $21,838 $23,308 $25,190 $27,177 $29,114 $29,114 $28,321 $27,517 $26,760 $26,543 $26,543 $24,251

Deferred tax assets, long term portion $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Goodwill $2,655 $3,319 $3,759 $3,785 $3,774 $3,815 $3,784 $3,784 $3,784 $3,784 $3,784 $3,784 $3,784 $3,784

Other assets $1,930 $2,892 $3,373 $3,522 $3,892 $4,296 $4,723 $4,723 $4,723 $4,723 $4,723 $4,723 $4,723 $4,723

Total Assets $40,159 $54,505 $65,444 $61,128 $65,076 $70,897 $83,402 $83,402 $74,069 $76,256 $81,415 $95,264 $95,264 $112,230

Accounts payable $15,133 $16,459 $20,397 $14,990 $16,123 $18,801 $25,309 $25,309 $17,467 $18,699 $21,794 $29,542 $29,542 $34,278

Accrued expenses and other current liabilities $6,688 $9,807 $10,384 $9,431 $9,613 $10,497 $13,739 $13,739 $12,036 $12,210 $13,293 $17,538 $17,538 $22,223

Unearned revenue $1,159 $1,823 $3,118 $3,766 $3,851 $4,200 $4,768 $4,768 $4,585 $4,662 $5,072 $5,798 $5,798 $7,016

Interest payable $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Current portion of long-term debt and other $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total current liabilities $22,980 $28,089 $33,899 $28,187 $29,587 $33,498 $43,816 $43,816 $34,088 $35,571 $40,160 $52,879 $52,879 $63,516

Long-term debt $3,191 $8,265 $8,235 $8,219 $8,158 $8,205 $7,694 $7,694 $7,694 $7,694 $7,694 $7,694 $7,694 $7,694

Other Long-term liabilities $4,242 $7,410 $9,926 $9,966 $10,793 $11,412 $12,607 $12,607 $12,607 $12,607 $12,607 $12,607 $12,607 $12,607

Issued and outstanding shares $5 $5 $5 $5 $5 $5 $5 $5 $5 $5 $5 $5 $5 $5

Treasury Stock ($1,837) ($1,837) ($1,837) ($1,837) ($1,837) ($1,837) ($1,837) ($1,837) ($1,837) ($1,837) ($1,837) ($1,837) ($1,837) ($1,837)

Additional paid-in capital $9,573 $11,135 $13,394 $14,144 $15,026 $15,968 $17,186 $17,186 $17,020 $16,663 $16,693 $16,879 $16,879 $18,743

Accumulated other comprehensive income ($185) ($511) ($723) ($614) ($571) ($521) ($985) ($985) ($985) ($985) ($985) ($985) ($985) ($985)

Accumulated deficit $2,190 $1,949 $2,545 $3,058 $3,915 $4,167 $4,916 $4,916 $5,477 $6,538 $7,079 $8,023 $8,023 $12,487

Total stockholders' equity (deficit) $9,746 $10,741 $13,384 $14,756 $16,538 $17,782 $19,285 $19,285 $19,680 $20,384 $20,955 $22,084 $22,084 $28,412

Total Liabilities & Shareholders Equity $40,159 $54,505 $65,444 $61,128 $65,076 $70,897 $83,402 $83,402 $74,069 $76,256 $81,415 $95,264 $95,264 $112,230

Source: Company Reports; Aegis Capital Estimates

Amazon.com Cash Flow Statement (in $Millions, except per share data)

Period 2013 2014 2015 1Q16 2Q16 3Q16 4Q16 2016 1Q17E 2Q17E 3Q17E 4Q17E 2017E 2018E

Net income (loss) $273 ($241) $596 $513 $857 $252 $749 $2,371 $561 $1,062 $540 $944 $3,107 $4,464

Adjustments to reconcile net income (loss) to net cash provided$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Depreciation of fixed assets, including internal-use software$3,253

and website development,

$4,745 and other

$6,281

amortization$1,827 $1,909 $2,084 $2,297 $8,117 $2,389 $2,461 $2,534 $2,610 $9,994 $11,249

Stock-based compensation $1,134 $1,497 $2,120 $544 $768 $776 $887 $2,975 $780 $589 $977 $1,132 $3,478 $4,395

Other operating expense (income) $114 $130 $155 $43 $53 $31 $31 $158 $34 $34 $34 $34 $136 $136

Losses (gains) on sales of marketable securities, net $1 ($4) $5 $2 $1 $0 $0 $3 $0 $0 $0 $0 $0 $0

Remeasurements and other $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Non-cash interest expense and other $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Other Expense (income) $166 $62 $244 ($52) $31 ($23) $21 ($23) $0 $0 $0 $0 $0 $0

Deferred income taxes ($157) ($319) $82 $11 $106 ($81) ($282) ($246) $0 $0 $0 $0 $0 $0

Excess tax benefits on stock awards ($78) ($6) ($119) ($207) ($113) ($173) ($336) ($829) $0 $0 $0 $0 $0 $0

Cumulative effect of change in accounting principle $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Changes in operating assets and liabilities:

Inventories ($1,411) ($1,193) ($2,186) $769 ($57) ($1,095) ($1,043) ($1,426) ($528) $59 ($1,351) ($1,218) ($3,037) ($3,693)

Accounts receivable, net and other current assets ($846) ($1,038) ($1,755) $412 ($1,184) ($671) ($1,924) ($3,367) $1,375 ($1,228) ($615) ($2,516) ($2,984) ($3,807)

Accounts payable $1,888 $1,758 $4,294 ($5,770) $977 $2,540 $7,283 $5,030 ($7,842) $1,232 $3,095 $7,748 $4,233 $4,735

Accrued expenses and other current liabilities $737 $709 $910 ($956) ($15) $441 $2,254 $1,724 ($1,703) $174 $1,083 $4,245 $3,799 $4,686

Additions to unearned revenue $2,691 $4,433 $7,401 $2,814 $2,340 $2,802 $3,975 $11,931 ($183) $76 $411 $726 $1,030 $1,217

Amortization of previously unearned revenue ($2,291) ($3,692) ($6,108) ($2,110) ($2,208) ($2,397) ($3,261) ($9,976) $0 $0 $0 $0 $0 $0

Interest payable $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Net cash provided by (used in) operating activities $5,474 $6,841 $11,920 ($2,160) $3,465 $4,486 $10,651 $16,442 ($5,117) $4,459 $6,708 $13,706 $19,756 $23,382

Investing Activities

Purchases of fixed assets, including internal-use software and

($3,443)

website development

($4,892) ($4,588) ($1,179) ($1,711) ($1,841) ($2,005) ($6,736) ($1,596) ($1,656) ($1,778) ($2,394) ($7,424) ($8,956)

Acquisitions, net of cash acquired ($311) ($980) ($795) ($16) ($14) ($84) ($3) ($117) $0 $0 $0 $0 $0 $0

Sales and maturities of marketable securities and other investments

$2,304 $3,349 $3,025 $1,138 $931 $1,431 $1,233 $4,733 $0 $0 $0 $0 $0 $0

Purchases of marketable securities ($2,826) ($2,543) ($4,092) ($636) ($1,645) ($2,076) ($3,399) ($7,756) $0 $0 $0 $0 $0 $0

Proceeds from sale of subsidiary $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Investments in equity-method investees and other investments $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Net cash provided by (used in) investing activities ($4,276) ($5,066) ($6,450) ($693) ($2,439) ($2,570) ($4,174) ($9,876) ($1,596) ($1,656) ($1,778) ($2,394) ($7,424) ($8,956)

Financing Activities

Proceeds from exercises of stock options and other $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Excess tax benefit on stock awards $78 $6 $119 $207 $113 $173 $336 $829 $0 $0 $0 $0 $0 $0

Proceeds from issuance of common stock, net of issuance costs$0 $0 $93 $0 $0 $0 $537 $537 $0 $0 $0 $0 $0 $0

Common Stock repurchased $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Proceeds from long-term debt and other $380 $6,360 ($680) $9 $66 $8 ($84) ($1) $0 $0 $0 $0 $0 $0

Repayments of long-term debt, capital lease obligations ($997) ($1,865) ($712) ($175) ($70) ($26) $0 ($271) $0 $0 $0 $0 $0 $0

Net cash provided by (used in) financing activities ($539) $4,433 ($3,763) ($789) ($1,039) ($827) ($256) ($2,911) ($980) ($980) ($980) ($980) ($3,921) ($2,667)

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Foreign-currency effect on cash and cash equivalents ($85) ($309) ($374) $222 $64 $46 ($543) ($211) $0 $0 $0 $0 $0 $0

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Net increase (decrease) in cash and cash equivalents $574 $5,899 $1,333 ($3,420) $51 $1,135 $5,678 $3,444 ($7,693) $1,822 $3,950 $10,332 $8,412 $11,758

Cash and the beginning of period $8,084 $8,658 $14,557 $15,890 $12,470 $12,521 $13,656 $15,890 $19,334 $11,641 $13,464 $17,414 $19,334 $27,746

Cash and cash equivalents at end of period $8,658 $14,557 $15,890 $12,470 $12,521 $13,656 $19,334 $19,334 $11,641 $13,464 $17,414 $27,746 $27,746 $39,504

Source: Company Reports; Aegis Capital Estimates

10 AEGIS CAPITAL CORP.

Amazon.com, Inc. February 3, 2017

Amazon.com Statistics (in $Millions, except per share data)

Period 2013 2014 2015 1Q16 2Q16 3Q16 4Q16 2016 1Q17E 2Q17E 3Q17E 4Q17E 2017E 2018E

Revenue Mix

Total North America 59.8% 57.1% --- --- --- --- --- --- --- --- --- --- --- ---

Total International 40.2% 37.7% 33.1% 32.8% 32.4% 32.4% 31.9% 32.3% 31.7% 30.6% 30.9% 31.2% 31.1% 29.4%

Total Media 29.2% 25.3% 21.0% 19.5% 17.1% 17.5% 17.3% 17.8% 16.8% 14.6% 15.1% 15.1% 15.3% 13.3%

Total Electronics 65.5% 68.4% 70.6% 70.5% 72.2% 71.5% 73.4% 72.1% 71.4% 72.8% 72.1% 74.3% 72.8% 73.1%

Total Other 5.3% 1.1% 1.0% 1.1% 1.1% 1.1% 1.2% 1.1% 1.4% 1.3% 1.2% 1.2% 1.3% 1.3%

North America Media 14.5% 13.0% 11.7% 11.0% 9.6% 9.9% 9.6% 10.0% 9.6% 8.5% 8.7% 8.4% 8.8% 7.8%

North America Electronics 40.3% 43.3% 47.1% 46.4% 47.6% 46.9% 49.4% 47.7% 47.0% 48.5% 47.7% 49.9% 48.5% 49.4%

North America Other 5.0% 0.8% 0.8% 1.0% 0.9% 0.9% 1.0% 1.0% 1.2% 1.1% 1.0% 1.0% 1.1% 1.1%

International Media 14.6% 12.3% 9.4% 8.5% 7.5% 7.6% 7.7% 7.8% 7.1% 6.1% 6.3% 6.7% 6.6% 5.6%

International Electronics 25.3% 25.1% 23.5% 24.1% 24.7% 24.6% 24.0% 24.3% 24.4% 24.3% 24.4% 24.3% 24.3% 23.7%

International Other 0.3% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2%

Margins

Gross Margins 27.2% 29.5% 33.0% 35.2% 36.9% 35.0% 33.8% 35.1% 36.2% 37.9% 36.0% 34.8% 36.1% 37.1%

EBITDA Margins 7.0% 7.4% 10.1% 12.0% 12.0% 10.6% 10.2% 11.1% 11.9% 13.2% 11.5% 10.1% 11.5% 12.4%

Operating Margins 1.0% 0.2% 2.1% 3.7% 4.2% 1.8% 2.9% 3.1% 2.9% 4.8% 2.6% 3.0% 3.3% 4.5%

Marketing Expenses as a % of sales, ex-Stock based comp 4.1% 4.7% 4.7% 4.7% 5.0% 5.1% 5.5% 5.1% 5.2% 5.2% 5.2% 5.2% 5.2% 5.1%

Fulfillment exp. as % of Sales , ex-stock based comp 11.1% 11.7% 12.1% 12.3% 12.5% 12.7% 12.6% 12.5% 12.6% 12.5% 12.7% 13.0% 12.7% 12.6%

Technology & Content exp. as % of Sales, ex-stock based8.0%

comp 9.5% 10.6% 11.0% 12.0% 11.3% 9.3% 10.7% 11.7% 12.0% 11.3% 10.0% 11.1% 11.0%

General and administrative exp. as % of Sales, ex-stock based

1.3% comp 1.5% 1.4% 1.5% 1.7% 1.7% 1.4% 1.6% 1.5% 1.7% 1.7% 1.4% 1.6% 1.6%

Total Opex as % of Sales, ex-stock based comp 97.5% 98.1% 95.9% 94.5% 94.4% 95.9% 95.1% 95.0% 94.9% 93.6% 95.0% 94.9% 94.6% 93.3%

Expense Growth Rates

Gross Profit Growth, q/q % (10.0)% 9.4% 2.0% 29.1% --- (13.1)% 8.6% 2.0% 30.1% --- ---

Gross Profit Growth, y/y % 34.0% 29.4% 34.8% 40.2% 39.9% 33.1% 29.6% 35.0% 25.2% 24.3% 24.2% 25.2% 24.8% 24.0%

Marketing & Sales (ex-SBC), q/q% --- (18.7)% (70.2)% 19.8% 59.6% --- (23.5)% (72.5)% 11.4% 44.5% --- ---

Marketing & Sales (ex-SBC), y/y% 29.8% 38.1% 20.3% 31.7% 37.4% 35.9% 42.0% 37.4% 33.6% 26.7% 24.3% 14.7% 23.3% 18.3%

Technology and Content (ex-SBC), q/q% 0.1% 13.6% 1.5% 9.5% --- 2.4% 6.4% 1.1% 19.2% --- ---

Technology and Content (ex-SBC), y/y% 44.3% 42.1% 33.6% 27.3% 35.0% 28.2% 26.3% 29.1% 29.3% 21.1% 20.6% 31.3% 25.6% 19.5%

General and administrative (ex-SBC), q/q% 29.2% 20.1% 4.3% 12.6% --- (13.8)% 19.4% 4.1% 13.4% --- ---

General and administrative (ex-SBC), y/y% 26.8% 38.9% 12.0% 16.9% 31.1% 39.2% 82.5% 41.2% 21.8% 21.0% 20.8% 21.6% 21.3% 20.6%

Book Value per Share $21.15 $23.05 $28.18 $30.68 $34.24 $36.66 $39.68 $39.87 $40.33 $41.60 $42.59 $44.71 $44.98 $56.94

Cash & Equivalents per Share $27.01 $37.37 $41.70 $32.97 $34.24 $37.83 $53.46 $53.71 $37.48 $41.04 $48.90 $69.62 $70.05 $92.49

Source: Company Reports; Aegis Capital Estimates

Amazon.com Revenue Detail (in $Millions, except per share data)

Period 2013 2014 2015 1Q16 2Q16 3Q16 4Q16 2016 1Q17E 2Q17E 3Q17E 4Q17E 2017E 2018E

Total Revenues $74,453 $88,988 $107,007 $29,128 $30,404 $32,714 $43,741 $135,987 $35,465 $36,803 $39,508 $53,193 $164,969 $199,029

y/y % change 21.9% 19.5% 20.2% 28.2% 31.1% 29.0% 22.4% 27.1% 21.8% 21.0% 20.8% 21.6% 21.3% 20.6%

Product Sales $60,903 $70,080 $79,269 $20,581 $21,116 $22,339 $30,629 $94,665 $24,704 $25,192 $26,583 $36,716 $113,195 $134,579

q/q % change -22.7% 2.6% 5.8% 37.1% $0 -19.3% 2.0% 5.5% 38.1% $0 $0

y/y % change 17.7% 15.1% 13.1% 20.5% 23.5% 21.0% 15.1% 19.4% 20.0% 19.3% 19.0% 19.9% 19.6% 18.9%

% of Total 81.8% 78.8% 74.1% 70.7% 69.5% 68.3% 70.0% 69.6% 69.7% 68.5% 67.3% 69.0% 68.6% 67.6%

Service Sales $13,550 $18,908 $27,738 $8,547 $9,288 $10,375 $13,112 $41,322 $10,761 $11,611 $12,925 $16,477 $51,774 $64,450

q/q % change -6.4% 8.7% 11.7% 26.4% $0 -17.9% 7.9% 11.3% 27.5% $0 $0

y/y % change 44.8% 39.5% 46.7% 51.7% 52.7% 50.5% 43.6% 49.0% 25.9% 25.0% 24.6% 25.7% 25.3% 24.5%

% of Total 18.2% 21.2% 25.9% 29.3% 30.5% 31.7% 30.0% 30.4% 30.3% 31.5% 32.7% 31.0% 31.4% 32.4%

3P Sales $6,507 $13,305 $18,837 $5,652 $6,058 $6,772 $9,060 $27,542 $6,560 $6,984 $7,859 $10,813 $32,217 $37,406

q/q % change -12.0% 7.2% 11.8% 33.8% $0 -27.6% 6.5% 12.5% 37.6% $0 $0

y/y % change -4.8% 104.5% 41.6% 47.5% 50.6% 48.5% 41.1% 46.2% 16.1% 15.3% 16.1% 19.4% 17.0% 16.1%

% of Total 8.7% 15.0% 17.6% 19.4% 19.9% 20.7% 20.7% 20.3% 18.5% 19.0% 19.9% 20.3% 19.5% 18.8%

3P Gross Sales $38,276 $78,265 $110,806 $33,247 $35,635 $39,835 $53,294 $162,012 $38,586 $41,083 $46,232 $63,608 $189,509 $220,037

q/q % change -12.0% 7.2% 11.8% 33.8% $0 -27.6% 6.5% 12.5% 37.6% $0 $0

y/y % change -4.8% 104.5% 41.6% 47.5% 50.6% 48.5% 41.1% 46.2% 16.1% 15.3% 16.1% 19.4% 17.0% 16.1%

Commission % 17.0% 17.0% 17.0% 17.0% 17.0% 17.0% 17.0% 17.0% 17.0% 17.0% 17.0% 17.0% 17.0% 17.0%

Total Gross Product Sales $99,179 $148,345 $190,075 $53,828 $56,751 $62,174 $83,923 $256,677 $63,290 $66,276 $72,815 $100,324 $302,704 $354,616

q/q % change -16.4% 5.4% 9.6% 35.0% $0 -24.6% 4.7% 9.9% 37.8% $0 $0

y/y % change 7.9% 49.6% 28.1% 35.8% 39.2% 37.3% 30.3% 35.0% 17.6% 16.8% 17.1% 19.5% 17.9% 17.1%

1P % of Gross Product Sales 61.4% 47.2% 41.7% 38.2% 37.2% 35.9% 36.5% 36.9% 39.0% 38.0% 36.5% 36.6% 37.4% 38.0%

3P % of Gross Product Sales 38.6% 52.8% 58.3% 61.8% 62.8% 64.1% 63.5% 63.1% 61.0% 62.0% 63.5% 63.4% 62.6% 62.0%

AWS, Advertising, CC Fees $3,935 $959 $1,021 $329 $344 $372 $516 $1,561 $481 $471 $477 $643 $2,072 $2,498

q/q % change 8.6% 4.6% 8.1% 38.7% $0 -6.8% -2.1% 1.3% 34.7% $0 $0

y/y % change 56.0% -75.6% 6.5% 40.6% 46.4% 49.4% 70.3% 52.9% 46.2% 36.9% 28.3% 24.6% 32.7% 20.6%

AWS $3,108 $4,644 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Advertising & Other $827 ($3,685) $1,021 $329 $344 $372 $516 $1,561 $481 $471 $477 $643 $2,072 $2,498

Source: Company Reports; Aegis Capital Estimates

11 AEGIS CAPITAL CORP.

Amazon.com, Inc. February 3, 2017

Required Disclosures

Price Target

We have a $953 price target on Amazon

Valuation Methodology

Our price target is based on a sum-of-the-parts analysis.

Risk Factors

Rising competition for retail and AWS.

Key man risk Amazons future growth and strategic direction could be negatively impacted if Jeff Bezos were not able to perform

his duties as CEO.

Macro weakness could weigh on growth. The impact of the Brexit vote is one that we are monitoring closely.

India could impose restrictions on foreign firms that, like China, could diminish Amazons competitive position.

For important disclosures go to www.aegiscap.com.

I, Victor Anthony, hereby certify that the views expressed in this research report accurately reflect my personal views about the subject

companies and their securities. I also certify that I have not been, do not, and will not be receiving direct or indirect compensation in

exchange for expressing the specific recommendations in this report.

Research analyst compensation is not dependent upon investment banking revenues received by Aegis Capital Corp.

Aegis Capital Corp. intends to seek or expects to receive compensation for investment banking services from the subject company within

the next three months.

The firm nor the Research Analyst have any material conflict of interest in which the Research Analyst has a reason to know or knows

at the time of publication of this research report.

As of the report date neither Aegis Capital Corp. or its affiliates beneficially own 1% or more of any class of common equity securities

of the subject company of this report.

Neither the research analyst who prepared this report or a member of the research analysts household has a financial position in the debt

or equity securities of the subject company.

12 AEGIS CAPITAL CORP.

Amazon.com, Inc. February 3, 2017

Investment Banking

Services/Past 12 Mos.

Rating Percent Percent

BUY [BUY] 86.11 30.11

HOLD [HOLD] 12.96 21.43

SELL [SELL] 0.93 0.00

Meaning of Ratings

A) A Buy rating is assigned when we do not believe the stock price adequately reflects a company's prospects over 12-18 months.

B) A Hold rating is assigned when we believe the stock price adequately reflects a company's prospects over 12-18 months.

C) A Sell rating is assigned when we believe the stock price more than adequately reflects a company's prospects over 12-18 months.

Other Disclosures

Other Disclosures The information contained herein is based upon sources believed to be reliable but is not guaranteed by us and is not

considered to be all inclusive. It is not to be construed as an offer or the solicitation of an offer to sell or buy the securities mentioned herein.

Aegis Capital Corp., its affiliates, shareholders, officers, staff, and/or members of their families, may have a position in the securities

mentioned herein, and, before or after your receipt of this report, may make or recommend purchases and/or sales for their own accounts

or for the accounts of other customers of the Firm from time to time in the open market or otherwise. Opinions expressed are our present

opinions only and are subject to change without notice. Aegis Capital Corp. is under no obligation to provide updates to the opinions or

information provided herein. Additional information is available upon request.

The common stock of the subject company in this report may not be suitable for certain investors based on their investment objectives,

degree of risk, as well as their financial status.

Copyright 2017 by Aegis Capital

Aegis Capital Corp.

(212) 813-1010

810 Seventh Avenue, 18th Floor

New York, New York 10019

13 AEGIS CAPITAL CORP.

Das könnte Ihnen auch gefallen

- Costco Financial AnalysisDokument17 SeitenCostco Financial AnalysisAnonymous lYiJ4DYYjpNoch keine Bewertungen

- 2018-11-21 - Corp Finance Pres - v02Dokument22 Seiten2018-11-21 - Corp Finance Pres - v02yhcdyhdNoch keine Bewertungen

- Test Bank For Intermediate Accounting 10th Edition David Spiceland Mark Nelson Wayne Thomas James SepeDokument36 SeitenTest Bank For Intermediate Accounting 10th Edition David Spiceland Mark Nelson Wayne Thomas James Sepechoiceremit.reuiei100% (48)

- Rating: Buy: Sustained Solid Top-Line Growth, With LT Margin Expansion & FCF Growth Initiating at BuyDokument20 SeitenRating: Buy: Sustained Solid Top-Line Growth, With LT Margin Expansion & FCF Growth Initiating at BuyMan Ho LiNoch keine Bewertungen

- Tata Consultancy Services LTD.: Result UpdateDokument7 SeitenTata Consultancy Services LTD.: Result UpdateanjugaduNoch keine Bewertungen

- Mizuho Securities GPN SQ We Applaud Strong EBITDA COIN More of The Same GPDokument8 SeitenMizuho Securities GPN SQ We Applaud Strong EBITDA COIN More of The Same GPoldman lokNoch keine Bewertungen

- Strong 2Q On Accelerating Growth & Profit Upside Reiterate Overweight & Raising PT To $710Dokument11 SeitenStrong 2Q On Accelerating Growth & Profit Upside Reiterate Overweight & Raising PT To $710Man Ho LiNoch keine Bewertungen

- Eicher Motors: Whethering The StormDokument11 SeitenEicher Motors: Whethering The StormAnonymous y3hYf50mTNoch keine Bewertungen

- Century Pacific Food: 1Q19: Tempered Opex Buoys MarginsDokument9 SeitenCentury Pacific Food: 1Q19: Tempered Opex Buoys MarginsManjit Kour SinghNoch keine Bewertungen

- U.S HPP & Beverages: Still Weak To Start The YearDokument49 SeitenU.S HPP & Beverages: Still Weak To Start The YearTokkiNoch keine Bewertungen

- Alibaba Sept Q2017Dokument18 SeitenAlibaba Sept Q2017free meNoch keine Bewertungen

- DCB Bank Limited: Investing For Growth BUYDokument4 SeitenDCB Bank Limited: Investing For Growth BUYdarshanmadeNoch keine Bewertungen

- IEA Report 3rd FebruaryDokument24 SeitenIEA Report 3rd FebruarynarnoliaNoch keine Bewertungen

- INFY - NoDokument12 SeitenINFY - NoSrNoch keine Bewertungen

- PIZZA: Profits Grow On Margin Expansion and Healthy Topline Growth in Line With EstimatesDokument13 SeitenPIZZA: Profits Grow On Margin Expansion and Healthy Topline Growth in Line With EstimatesSanya HelinoNoch keine Bewertungen

- S&P Morning Briefing April 2, 2018Dokument8 SeitenS&P Morning Briefing April 2, 2018Abdullah18Noch keine Bewertungen

- Tao Value Q2 2020Dokument6 SeitenTao Value Q2 2020Paul AsselinNoch keine Bewertungen

- VMART Q4FY22 ResultDokument6 SeitenVMART Q4FY22 ResultKhush GosraniNoch keine Bewertungen

- Baba FinancialDokument18 SeitenBaba FinancialClararinaNoch keine Bewertungen

- NCSM WF Mar 2018Dokument5 SeitenNCSM WF Mar 2018minurkashNoch keine Bewertungen

- Enphase Energy Brings A SystemDokument2 SeitenEnphase Energy Brings A Systemmyrzakhmet.altynNoch keine Bewertungen

- Mphasis 1QFY20 Result Update - 190729 - Antique Research PDFDokument6 SeitenMphasis 1QFY20 Result Update - 190729 - Antique Research PDFdarshanmadeNoch keine Bewertungen

- Dewan Housing Finance Corporation Limited 4 QuarterUpdateDokument7 SeitenDewan Housing Finance Corporation Limited 4 QuarterUpdatesandyinsNoch keine Bewertungen

- Tata Consultancy Services: Lacks Acceleration Trigger Downgrade To HOLDDokument8 SeitenTata Consultancy Services: Lacks Acceleration Trigger Downgrade To HOLDAshokNoch keine Bewertungen

- Current Assets Are The Assets That The Firm Expects To Convert Into Cash in The Coming Year and Current Liabilities Represent TheDokument8 SeitenCurrent Assets Are The Assets That The Firm Expects To Convert Into Cash in The Coming Year and Current Liabilities Represent TheArlea AsenciNoch keine Bewertungen

- Kotak Bank Edel 220118Dokument19 SeitenKotak Bank Edel 220118suprabhattNoch keine Bewertungen

- Asian Paints 18012024 MotiDokument12 SeitenAsian Paints 18012024 Motigaurav24021990Noch keine Bewertungen

- Nirmal Bang PDFDokument11 SeitenNirmal Bang PDFBook MonkNoch keine Bewertungen

- Quick Note: JustdialDokument7 SeitenQuick Note: JustdialSubbu SuniNoch keine Bewertungen

- V I P - Industries - 13022020Dokument7 SeitenV I P - Industries - 13022020Sriram RanganathanNoch keine Bewertungen

- Tracking Our Progress: Leverage Our Win in The UNIQUE 24/7 Marketplace PortfolioDokument8 SeitenTracking Our Progress: Leverage Our Win in The UNIQUE 24/7 Marketplace PortfolioMihaiNoch keine Bewertungen

- 2023-05-01-APH.N-TD Cowen-Model Update - PT To $70 From $75-101746375Dokument11 Seiten2023-05-01-APH.N-TD Cowen-Model Update - PT To $70 From $75-101746375Nikhil PadiaNoch keine Bewertungen

- Barclays WMG U.S. Media - DIS - Still Early in The Reset PhaseDokument27 SeitenBarclays WMG U.S. Media - DIS - Still Early in The Reset PhaseraymanNoch keine Bewertungen

- Infosys (INFTEC) : Strong Execution in Q2, Caution AheadDokument13 SeitenInfosys (INFTEC) : Strong Execution in Q2, Caution AheadDinesh ChoudharyNoch keine Bewertungen

- India Bulls Infosys 20jan09Dokument5 SeitenIndia Bulls Infosys 20jan09mansi07Noch keine Bewertungen

- Kinh Do Mondelez CAGNY 2021 Presentation Slide FINAL Feb 16Dokument57 SeitenKinh Do Mondelez CAGNY 2021 Presentation Slide FINAL Feb 16My Ha KieuNoch keine Bewertungen

- Ajanta PharmaDokument9 SeitenAjanta Pharmamahima patelNoch keine Bewertungen

- Bata - Update - Oct23 - HSIE-202310031700278228381Dokument7 SeitenBata - Update - Oct23 - HSIE-202310031700278228381sankalp111Noch keine Bewertungen

- ASEAN Telecom Sector: Industry FocusDokument39 SeitenASEAN Telecom Sector: Industry FocusBunay Rizki RizanoNoch keine Bewertungen

- Centrum Suryoday Small Finance Bank Q3FY23 Result UpdateDokument10 SeitenCentrum Suryoday Small Finance Bank Q3FY23 Result UpdateDivy JainNoch keine Bewertungen

- 11.04.20 3Q 2020 Earnings Release Graphic Version FinalDokument24 Seiten11.04.20 3Q 2020 Earnings Release Graphic Version FinalHira FatimaNoch keine Bewertungen

- PC - DR Reddy Q2FY24 Update - Oct 2023 20231029213532Dokument8 SeitenPC - DR Reddy Q2FY24 Update - Oct 2023 20231029213532Research AnalystNoch keine Bewertungen

- Initiating Coverage Report On Future Lifestyle FashionDokument54 SeitenInitiating Coverage Report On Future Lifestyle Fashionsujay85Noch keine Bewertungen

- 4716156162022739schneider Electric Infrastructure Ltd. Q4FY22 - SignedDokument5 Seiten4716156162022739schneider Electric Infrastructure Ltd. Q4FY22 - SignedbradburywillsNoch keine Bewertungen

- 4116226162022832wipro Limited - 20220613 SignedDokument5 Seiten4116226162022832wipro Limited - 20220613 SignedbradburywillsNoch keine Bewertungen

- Can Fin Homes Ltd-4QFY23 Result UpdateDokument5 SeitenCan Fin Homes Ltd-4QFY23 Result UpdateUjwal KumarNoch keine Bewertungen

- Faze Three Initial (HDFC)Dokument11 SeitenFaze Three Initial (HDFC)beza manojNoch keine Bewertungen

- Infosys: Business As UsualDokument10 SeitenInfosys: Business As UsualktyNoch keine Bewertungen

- Gnaarly Sept 03Dokument74 SeitenGnaarly Sept 03Aman HunjanNoch keine Bewertungen

- Ujjivan Financial 1QFY20 Result Update - 190808 - Antique ResearchDokument4 SeitenUjjivan Financial 1QFY20 Result Update - 190808 - Antique ResearchdarshanmadeNoch keine Bewertungen

- Infosys: Growth Certainty On Explosive Deal WinsDokument2 SeitenInfosys: Growth Certainty On Explosive Deal Winsmehrotraanand016912Noch keine Bewertungen

- L&T Technology Services (LTTS IN) : Q3FY19 Result UpdateDokument9 SeitenL&T Technology Services (LTTS IN) : Q3FY19 Result UpdateanjugaduNoch keine Bewertungen

- Infosys (INFO IN) : Q1FY21 Result UpdateDokument14 SeitenInfosys (INFO IN) : Q1FY21 Result UpdatewhitenagarNoch keine Bewertungen

- Confluent Inc. (CFLT) - Cloud Momentum Continues As Growth Accelerates - 3Q21 ResultsDokument9 SeitenConfluent Inc. (CFLT) - Cloud Momentum Continues As Growth Accelerates - 3Q21 ResultsShingYiuNoch keine Bewertungen

- KHC 2024 02 14 - 240327 - 045438Dokument3 SeitenKHC 2024 02 14 - 240327 - 045438Rizwan AshrafNoch keine Bewertungen

- NFLXDokument7 SeitenNFLXe39dinanNoch keine Bewertungen

- Triveni Turbine: Margins SurpriseDokument9 SeitenTriveni Turbine: Margins SurprisejaimaaganNoch keine Bewertungen

- Monthly Report Aug 23 SeriesDokument17 SeitenMonthly Report Aug 23 SeriesAyushi ShahNoch keine Bewertungen

- Aavas Financiers - Result Update-Oct 19-EDEL PDFDokument16 SeitenAavas Financiers - Result Update-Oct 19-EDEL PDFPrakhar AgarwalNoch keine Bewertungen

- Infosys: Strong Revenue, Margin Resilience Is KeyDokument8 SeitenInfosys: Strong Revenue, Margin Resilience Is KeyKrish JNoch keine Bewertungen

- Curing Corporate Short-Termism: Future Growth vs. Current EarningsVon EverandCuring Corporate Short-Termism: Future Growth vs. Current EarningsNoch keine Bewertungen

- Libname: '//filestore - Soton.ac - uk/users/mhl1g18/mydocuments/SAS Assignment/MANG6231 - Assignment'Dokument6 SeitenLibname: '//filestore - Soton.ac - uk/users/mhl1g18/mydocuments/SAS Assignment/MANG6231 - Assignment'Man Ho LiNoch keine Bewertungen

- CCB International Se CCBIS China E Commerce All in For e Com 1Dokument112 SeitenCCB International Se CCBIS China E Commerce All in For e Com 1Man Ho LiNoch keine Bewertungen

- Result PDFDokument6 SeitenResult PDFMan Ho LiNoch keine Bewertungen

- L2 - Hypothesis TestingDokument62 SeitenL2 - Hypothesis TestingMan Ho LiNoch keine Bewertungen

- What Is ThisDokument46 SeitenWhat Is ThisMan Ho LiNoch keine Bewertungen

- Shenwan Hongyuan Co Delayed Alibaba Group Holding BABA US 1Dokument61 SeitenShenwan Hongyuan Co Delayed Alibaba Group Holding BABA US 1Man Ho LiNoch keine Bewertungen

- JP Morgan Delayed Alibaba Group Holding Limited 1Dokument13 SeitenJP Morgan Delayed Alibaba Group Holding Limited 1Man Ho LiNoch keine Bewertungen

- JP Morgan Delayed Alibaba Group Holding Limited 1Dokument10 SeitenJP Morgan Delayed Alibaba Group Holding Limited 1Man Ho LiNoch keine Bewertungen

- China Renaissance Re BABA Monetization Upside Supported by U 1Dokument27 SeitenChina Renaissance Re BABA Monetization Upside Supported by U 1Man Ho LiNoch keine Bewertungen

- The Hidden Costs of Stock Market Liquidity : Amar BhideDokument21 SeitenThe Hidden Costs of Stock Market Liquidity : Amar BhideMan Ho LiNoch keine Bewertungen

- Upgrading To A BUY From HOLD, Establishing $1100 PTDokument25 SeitenUpgrading To A BUY From HOLD, Establishing $1100 PTMan Ho LiNoch keine Bewertungen

- Environmental Support: BYD (1211 HK)Dokument9 SeitenEnvironmental Support: BYD (1211 HK)Man Ho LiNoch keine Bewertungen

- HOLD (AMZN, $359.76) : Technology ResearchDokument13 SeitenHOLD (AMZN, $359.76) : Technology ResearchMan Ho LiNoch keine Bewertungen

- Draft of China Investment Ver 1.1Dokument2 SeitenDraft of China Investment Ver 1.1Man Ho LiNoch keine Bewertungen

- Unchecked Intermediaries:price Manipulation in An Emerging Stock MarketDokument39 SeitenUnchecked Intermediaries:price Manipulation in An Emerging Stock MarketMan Ho LiNoch keine Bewertungen

- 2015 Spring Midterm GDokument3 Seiten2015 Spring Midterm GMan Ho LiNoch keine Bewertungen

- Global Macro Consulting Inc.: Expression of InterestDokument1 SeiteGlobal Macro Consulting Inc.: Expression of InterestMan Ho LiNoch keine Bewertungen

- Graduate Trainee - Assistant Personal B... Ang Commercial Bank - jobsDB Hong KongDokument2 SeitenGraduate Trainee - Assistant Personal B... Ang Commercial Bank - jobsDB Hong KongMan Ho LiNoch keine Bewertungen

- Salary Structure CreationDokument4 SeitenSalary Structure CreationPriyankaNoch keine Bewertungen

- Finance Act 2010Dokument5 SeitenFinance Act 2010Tapia MelvinNoch keine Bewertungen

- Sta. Lucia Land, Inc. - PDS GroupDokument9 SeitenSta. Lucia Land, Inc. - PDS GroupKai SanchezNoch keine Bewertungen

- I. Income StatementDokument27 SeitenI. Income StatementNidhi KaushikNoch keine Bewertungen

- Bài tập lớnDokument9 SeitenBài tập lớnHà Chi NguyễnNoch keine Bewertungen

- Chapter 31 - AnswerDokument15 SeitenChapter 31 - AnswerPam PolonioNoch keine Bewertungen

- Earn Pay-Outs: Sales Goals Bonus Earnings Goals BonusDokument5 SeitenEarn Pay-Outs: Sales Goals Bonus Earnings Goals BonusUjjwal BhardwajNoch keine Bewertungen

- WC 2007Dokument156 SeitenWC 2007BETTY ELIZABETH JUI�A QUILACHAMINNoch keine Bewertungen

- SipDokument79 SeitenSipGangani PinalNoch keine Bewertungen

- Corporate Income TaxDokument14 SeitenCorporate Income Tax36. Lê Minh Phương 12A3Noch keine Bewertungen

- CFA-FRA-R15-26-updated 0110122Dokument532 SeitenCFA-FRA-R15-26-updated 0110122Trang NgôNoch keine Bewertungen

- Utilization of Lumi Apps For g12 Abm On Incom2Dokument4 SeitenUtilization of Lumi Apps For g12 Abm On Incom2Moon MensaheraNoch keine Bewertungen

- 2nd Quiz Variable CostingDokument2 Seiten2nd Quiz Variable CostingSwap WerdNoch keine Bewertungen

- Sukalp Parihar1Dokument45 SeitenSukalp Parihar1Vandita KhudiaNoch keine Bewertungen

- Investment in Associates (PAS 28) : Conceptual Framework and Accounting StandardsDokument6 SeitenInvestment in Associates (PAS 28) : Conceptual Framework and Accounting StandardsMeg sharkNoch keine Bewertungen

- Moylan IndictmentDokument10 SeitenMoylan IndictmentRyan BriggsNoch keine Bewertungen

- Assignment 1Dokument4 SeitenAssignment 1t524qjc9bvNoch keine Bewertungen

- Manual On Financial Manager of Barangays Module 3Dokument11 SeitenManual On Financial Manager of Barangays Module 3vicsNoch keine Bewertungen

- Hs Ar 2020 enDokument257 SeitenHs Ar 2020 enSaxon ChanNoch keine Bewertungen

- Alibaba Group Announces March Quarter and Full Fiscal Year 2023 ResultsDokument44 SeitenAlibaba Group Announces March Quarter and Full Fiscal Year 2023 ResultsAdemarjr JuniorNoch keine Bewertungen

- Gce Departmental Accounting - Com PDFDokument5 SeitenGce Departmental Accounting - Com PDFShakun ThapaNoch keine Bewertungen

- FINANCIAL STATEMENT ANALYSIS (Assignment 1)Dokument21 SeitenFINANCIAL STATEMENT ANALYSIS (Assignment 1)Syafiqah AmranNoch keine Bewertungen

- CFAS New FormativesDokument44 SeitenCFAS New FormativesCarlito DiamononNoch keine Bewertungen

- Annual Report 2019 FinalDokument51 SeitenAnnual Report 2019 FinaldawNoch keine Bewertungen

- Cost of CapitalDokument27 SeitenCost of CapitalMadhukant KumarNoch keine Bewertungen

- Session1 Introduction To Book KeepingDokument37 SeitenSession1 Introduction To Book KeepingSagar ParateNoch keine Bewertungen

- MO QuestionDokument2 SeitenMO Questionlingly justNoch keine Bewertungen

- Tds Rate Chart Fy 2021-22Dokument3 SeitenTds Rate Chart Fy 2021-22Kadambari ShelkeNoch keine Bewertungen

- First Quiz Financial Statement Analysis PDFDokument4 SeitenFirst Quiz Financial Statement Analysis PDFRandy ManzanoNoch keine Bewertungen