Beruflich Dokumente

Kultur Dokumente

Marco Practico

Hochgeladen von

BMuy0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

117 Ansichten2 Seitencontabilidad

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldencontabilidad

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

117 Ansichten2 SeitenMarco Practico

Hochgeladen von

BMuycontabilidad

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

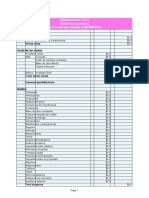

Marco practico

Anlisis vertical y horizontal

Aguita de coco, S.A. de CV

Empresa subsidiaria del grupo "X"

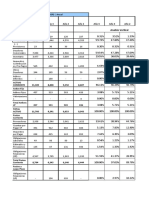

Estado de Resultados Anlisis Vertical Anlisis Horizontal

Primer semestre Segundo semestre Variacin

2016 2016 Ao 1 Ao 2 Variacin Absoluta Relativa

Ventas Q 205,670,504.00 Q 267,042,310.00 100% 100% Q 61,371,806.00 29.84%

Costo de ventas Q 133,468,857.00 Q 197,686,876.00 64.89% 74.03% Q 64,218,019.00 48.11%

Utilidad Bruta en Ventas Q 72,201,647.00 Q 69,355,434.00 35.10% 25.97% Q (2,846,213.00) -3.94%

Gastos Operacionales

Ventas Q 14,046,590.00 Q 20,085,013.00 6.83% 7.52% Q 6,038,423.00 42.99%

Administracin Q 13,180,955.00 Q 17,547,034.00 6.41% 6.57% Q 4,366,079.00 33.12%

utilidad operacional Q 44,974,102.00 Q 31,723,387.00 21.87% 11.88% Q (13,250,715.00) -29.46%

Gastos no Operacionales

Otos gastos y productos Q 31,440,514.00 Q 1,850,135.00 15.29% 0.69% Q (29,590,379.00) -94.12%

Utilidad Antes del Impuesto Q 13,533,588.00 Q 29,873,252.00 6.58% 11.19% Q 16,339,664.00 120.73%

Impuesto sobre la renta -Q 347,399.00 Q 88,917.00 -0.17% 0.03% Q 436,316.00 -125.60%

Ganancia del Ejercicio Q 13,880,987.00 Q 29,784,335.00 6.75% 11.15% Q 15,903,348.00 114.57%

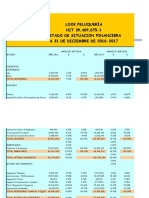

Aguita de coco, S.A. de CV

Empresa subsidiaria del grupo "X"

Balance General Anlisis Vertical Anlisis

VariacinHorizontal

Variacin

Activo Ao 2014 Ao 2015 Ao 1 Ao 2 Absoluta Relativa

Corrinte

Caja y Bancos Q 588,810.51 Q 569,917.32 7.72% 7.20% Q 18,893.19 3.21%

Cuentas y efectos por cobrar Q 2,072,548.34 Q 2,080,210.75 27.18% 26.29% Q 7,662.41 0.37%

Deudores diversos - Q 25,678.26 0.32% Q 25,678.26 0.00%

Inventarios Q 2,157,090.30 Q 2,331,606.81 28.29% 29.46% Q 174,516.51 8.09%

Total de activo corriente Q 4,818,449.15 Q 5,007,413.14 63.18% 63.27% Q 188,963.99 3.92%

No corriente

Terrenos Q 1,243,945.42 Q 1,243,945.42 16.31% 15.72% Q - 0.00%

Edificios Q 1,721,325.11 Q 1,721,325.11 22.57% 21.75% Q 0.00 0.00%

(-)Depreciacin de edificios -Q 169,891.58 -Q 84,945.79 -2.23% -1.07% Q 84,945.79 -50.00%

vehculos Q 16,948.52 Q 16,948.52 0.22% 0.21% Q - 0.00%

(-)Depreciacin de vehculos -Q 8,827.33 -Q 5,503.46 -0.12% -0.07% Q 3,323.87 -37.65%

Mobiliario y Equipo Q 50,933.96 Q 52,849.97 0.67% 0.67% Q 1,916.01 3.76%

(-) Depreciacin de Mobiliario y equipo -Q 46,751.21 -Q 38,001.43 -0.61% -0.48% Q 8,749.78 -18.72%

Total de activo no corriente Q 2,807,682.89 Q 2,906,618.34 36.82% 36.73% Q 98,935.45 3.52%

TOTAL ACTIVO Q 7,626,132.04 Q 7,914,031.48 100% 100% Q 287,899.44 3.78%

Pasivo

Corrinte

Cuentas y documentos por pagar c.p. Q 1,143,215.15 Q 1,836,847.42 63.98% 74.22% Q 693,632.27 60.67%

Beneficios a los empleados por pagar Q 120,990.23 Q 114,405.01 6.77% 4.62% Q 6,585.22 5.44%

Obligaciones bancarias Q 5,518.94 0.00% 0.22% Q 5,518.94 0.00%

impuestos por pagar Q 51,482.57 Q 58,014.40 2.88% 2.34% Q 6,531.83

provisiones y retenciones por pagar Q 12,771.10 Q 14,196.28 0.71% 0.57% Q 1,425.18 11.16%

Total pasivo corriente Q 1,328,459.05 Q 2,028,982.05 74.34% 81.99% Q 700,523.00 52.73%

No corriente

Documentos por pagar largo plazo Q 12,301.52 0.00% 0.50% Q 12,301.52 0.00%

Impuesto sobre la renta diferido Q 2,000.00 Q 585.41 0.11% 0.02% Q 1,414.59 70.73%

Dividendos por pagar largo plazo Q 456,505.95 Q 432,852.27 25.55% 17.49% Q 23,653.68 5.18%

Total activo no corriente Q 458,505.95 Q 445,739.20 25.66% 18.01% Q 12,766.75 2.78%

TOTAL PASIVO Q 1,786,965.00 Q 2,474,721.25 100% 100% Q 687,756.25 38.49%

Patrimonio

Capital Social Q 2,400,000.00 Q 1,984,594.29 31.35% 25.08% Q 415,405.71 17.31%

Reserva Legal Q 386,118.91 Q 344,534.28 5.04% 4.35% Q 41,584.63 10.77%

utilidades retenidas Q 815,442.95 Q 827,112.57 10.65% 10.45% Q 11,669.62 1.43%

revalorizacin de capital propio Q 413,925.86 Q 429,389.77 5.41% 5.43% Q 15,463.91 3.74%

utilidad del ejercicio Q 1,853,679.32 Q 1,853,679.32 24.21% 23.42% Q - 0.00%

TOTAL PATRIMONIO Q 5,869,167.04 Q 5,439,310.23 76.66% 68.73% Q 429,856.81 7.32%

PATRIMONIO + PASIVO Q 7,656,132.04 Q 7,914,031.48 100% 100% Q 257,899.44 3.37%

Das könnte Ihnen auch gefallen

- Ejercicio No. 4 Estado de Flujo de Efectivo (Resuelto)Dokument8 SeitenEjercicio No. 4 Estado de Flujo de Efectivo (Resuelto)tania leonela77% (31)

- Ejemplo de Factibilidad EconomicaDokument44 SeitenEjemplo de Factibilidad EconomicaAngel Solis69% (13)

- Practica de Razones Financieras CompletoDokument2 SeitenPractica de Razones Financieras CompletoDiego Montenegro CastroNoch keine Bewertungen

- Análisis Financiero Bavaria.Dokument7 SeitenAnálisis Financiero Bavaria.Carlos Dario0% (1)

- Datos de Caso Santorino IndustrialDokument15 SeitenDatos de Caso Santorino IndustrialIrene SotoNoch keine Bewertungen

- Análisis Financiero Inti S.ADokument44 SeitenAnálisis Financiero Inti S.AIvan Escobar Vargas100% (2)

- Analisis Vertical y Horizontal S13Dokument17 SeitenAnalisis Vertical y Horizontal S13Thalia LinaresNoch keine Bewertungen

- Caso Es Hora de Urbanizar Solucion Con Riesgo Con Escudo TributarioDokument75 SeitenCaso Es Hora de Urbanizar Solucion Con Riesgo Con Escudo Tributariorafaelsis70% (10)

- Laboratorio Final Semana 8Dokument11 SeitenLaboratorio Final Semana 8Dania100% (1)

- Ratios RV 02Dokument12 SeitenRatios RV 02Angie EscobarNoch keine Bewertungen

- Costos Indirectos de FabDokument14 SeitenCostos Indirectos de FabMizael AlbaNoch keine Bewertungen

- Tarea Capitulo 7 Finanzas 2Dokument5 SeitenTarea Capitulo 7 Finanzas 2Unción SpaNoch keine Bewertungen

- Hoja de Trabajo 6 Conta 3Dokument4 SeitenHoja de Trabajo 6 Conta 3Alan Josué López LeveronNoch keine Bewertungen

- Ejemplo de Analisis Vertical y Horizontal 03-09-2022Dokument2 SeitenEjemplo de Analisis Vertical y Horizontal 03-09-2022Raymond LópezNoch keine Bewertungen

- 1 Análisis de Estados Financieros MateDokument8 Seiten1 Análisis de Estados Financieros MateAmilcar BatresNoch keine Bewertungen

- CenturyDokument8 SeitenCenturyPablo SolisNoch keine Bewertungen

- Lab No.1 (Pre Parcial) FinanzasDokument8 SeitenLab No.1 (Pre Parcial) FinanzasPablo SolisNoch keine Bewertungen

- Balance General La DemocraciaDokument14 SeitenBalance General La Democraciajohan velasquezNoch keine Bewertungen

- Hoja de Trabajo Finalizada Analisis Financiero de Proyectos TuristicosDokument8 SeitenHoja de Trabajo Finalizada Analisis Financiero de Proyectos TuristicosRebecaNoch keine Bewertungen

- TAREA#1Dokument1 SeiteTAREA#1ruizkatalanaNoch keine Bewertungen

- Ejercicio 2 - Jorge QuintanaDokument11 SeitenEjercicio 2 - Jorge QuintanaKATERIN MISHEL AJIN MORALESNoch keine Bewertungen

- Caso I MAF 2023Dokument1 SeiteCaso I MAF 2023Kathia Estefania Rosales MartinezNoch keine Bewertungen

- Ejercicio de Flujo de Caja Grupo No.3Dokument1 SeiteEjercicio de Flujo de Caja Grupo No.3Sergio Rafael100% (1)

- Analisis FinanzasDokument8 SeitenAnalisis FinanzasCARLA YOHANA ALVAREZ CHAPASNoch keine Bewertungen

- Flujo de Caja Arroz 90 10Dokument10 SeitenFlujo de Caja Arroz 90 10Lost InfamousNoch keine Bewertungen

- Solucion Caso Practico Eeff 2Dokument5 SeitenSolucion Caso Practico Eeff 2CARMEN DEL ROSARIONoch keine Bewertungen

- Resolucion Laboratorio 11Dokument7 SeitenResolucion Laboratorio 11NelsonNoch keine Bewertungen

- Tarea 4 - FaDokument6 SeitenTarea 4 - FaCarla SeguraNoch keine Bewertungen

- Esquemas para Resolución de Caso de Riesgos Yeclano IIDokument11 SeitenEsquemas para Resolución de Caso de Riesgos Yeclano IIDamaris CifuentesNoch keine Bewertungen

- Tarea 4 Finanzas Bryan LimaDokument19 SeitenTarea 4 Finanzas Bryan LimaBryan LimaNoch keine Bewertungen

- Analisis Horizontal y Vertical Final-CambiosDokument28 SeitenAnalisis Horizontal y Vertical Final-CambiosGabriela HernándezNoch keine Bewertungen

- Ejercicio Clase 30 de EneroDokument8 SeitenEjercicio Clase 30 de EnerojarenalesNoch keine Bewertungen

- Ejercicio 1 La Nueva GeneracionDokument5 SeitenEjercicio 1 La Nueva GeneracionoscarormeNoch keine Bewertungen

- Caso FinanzasDokument7 SeitenCaso FinanzasPablo SolisNoch keine Bewertungen

- Examen Parcial Finanzas 2 Maryuri AlvaradoDokument28 SeitenExamen Parcial Finanzas 2 Maryuri AlvaradoMaryuri AlvaradoNoch keine Bewertungen

- Tarea Capitulo 7 Finanzas Administrativas 2Dokument7 SeitenTarea Capitulo 7 Finanzas Administrativas 2Edy LimaNoch keine Bewertungen

- Granja AvicolaDokument6 SeitenGranja AvicolaJose DavilaNoch keine Bewertungen

- Lacteos La Democracia, S. ADokument12 SeitenLacteos La Democracia, S. Ajohan velasquezNoch keine Bewertungen

- Planeamiento - Analisis FinancieroDokument15 SeitenPlaneamiento - Analisis FinancieroEdilson Falla Reyes100% (1)

- Trabajo Final Contabilidad EsanDokument20 SeitenTrabajo Final Contabilidad EsanIsabel LamaNoch keine Bewertungen

- Foro Administracion FinancieraDokument16 SeitenForo Administracion FinancieraDIEGO GARCIANoch keine Bewertungen

- Sala 32Dokument7 SeitenSala 32David Adrian Diéguez UrbinaNoch keine Bewertungen

- Tarea Numero 2 de Evaluacion Financiera de ProyectosDokument15 SeitenTarea Numero 2 de Evaluacion Financiera de ProyectosEdilson VelázquezNoch keine Bewertungen

- Análisis Vertical y HorizontalDokument7 SeitenAnálisis Vertical y HorizontalLucy Yurley Alfonso GordilloNoch keine Bewertungen

- Indicadores Financieros Taller FinalDokument20 SeitenIndicadores Financieros Taller FinalGERALDINE QUIÑONES CHAMORRONoch keine Bewertungen

- Empresa Pollos A La Canaste LopezDokument3 SeitenEmpresa Pollos A La Canaste LopezBRAYAN PABLO TENORIO ROJASNoch keine Bewertungen

- Semana 8 Finanzas 2Dokument4 SeitenSemana 8 Finanzas 2Pedro OrtizNoch keine Bewertungen

- Problema Análisis Horizontal y VerticalDokument2 SeitenProblema Análisis Horizontal y VerticalKarla RíosNoch keine Bewertungen

- Analisis Vertical y HorizontalDokument4 SeitenAnalisis Vertical y HorizontalAndrea VieraNoch keine Bewertungen

- Analis Vertical Balance General Estado ResultadosDokument7 SeitenAnalis Vertical Balance General Estado Resultadosvariedades y masNoch keine Bewertungen

- Jugos Monte Alto Ejercicio 250124Dokument8 SeitenJugos Monte Alto Ejercicio 250124jarenalesNoch keine Bewertungen

- Caso de Estudio 1 Raúl SomozaDokument7 SeitenCaso de Estudio 1 Raúl SomozaRaul GolcherNoch keine Bewertungen

- Analisis Financiero - ColantaDokument4 SeitenAnalisis Financiero - Colantaronald urriolaNoch keine Bewertungen

- Coca-Cola Ko Anã - Lisis Financieros FinalDokument29 SeitenCoca-Cola Ko Anã - Lisis Financieros FinalAlexander PérezNoch keine Bewertungen

- Taller 06-07-22Dokument13 SeitenTaller 06-07-22Madelyn RojasNoch keine Bewertungen

- CálculosDokument8 SeitenCálculosAgustín Caballero VidalNoch keine Bewertungen

- Ejercicio 1 de FebreoDokument11 SeitenEjercicio 1 de FebreojarenalesNoch keine Bewertungen

- KIMBERLY-CLARK (Recuperado Automáticamente)Dokument12 SeitenKIMBERLY-CLARK (Recuperado Automáticamente)DIANA LAURA RODRIGUEZ RAMIREZNoch keine Bewertungen

- Analisis Horizontal y Vertical Porcentuado A ResolverDokument6 SeitenAnalisis Horizontal y Vertical Porcentuado A ResolverTatiana GómezNoch keine Bewertungen

- Tarea 4Dokument15 SeitenTarea 4Elder LópezNoch keine Bewertungen

- Tarea de La UDokument10 SeitenTarea de La UJavier PazNoch keine Bewertungen

- Definición de La Problemática ProyectoDokument7 SeitenDefinición de La Problemática ProyectoK-rol QuiñonezNoch keine Bewertungen

- Taller de IndicadoresDokument18 SeitenTaller de IndicadoresDâyąnã RûîzNoch keine Bewertungen

- Casos Analisis HorizontalDokument45 SeitenCasos Analisis HorizontalDONIS DINAEL ALVARADO VELASQUEZNoch keine Bewertungen

- Programa Programacion 2 0092 v2Dokument3 SeitenPrograma Programacion 2 0092 v2BMuyNoch keine Bewertungen

- MG 1Dokument16 SeitenMG 1BMuyNoch keine Bewertungen

- RoscaDokument1 SeiteRoscaBMuyNoch keine Bewertungen

- Proyecto Progra 092Dokument11 SeitenProyecto Progra 092BMuyNoch keine Bewertungen

- Roscado de InterioresDokument1 SeiteRoscado de InterioresBMuyNoch keine Bewertungen

- Tarea 2 Progra 092Dokument5 SeitenTarea 2 Progra 092BMuyNoch keine Bewertungen

- Venti Laci OnDokument11 SeitenVenti Laci OnBMuyNoch keine Bewertungen

- Venti Laci OnDokument11 SeitenVenti Laci OnBMuyNoch keine Bewertungen

- Apendice ADokument22 SeitenApendice ABMuyNoch keine Bewertungen

- Calendarizacion F2 2015Dokument1 SeiteCalendarizacion F2 2015BMuyNoch keine Bewertungen

- Diagrama Hombre-Máquina - Ejemplo 1Dokument1 SeiteDiagrama Hombre-Máquina - Ejemplo 1BMuyNoch keine Bewertungen

- Instructivo Practica 2 Fuerza Hidrostatica Sobre Superficies Planas Sumergidas y Centro de PresionDokument12 SeitenInstructivo Practica 2 Fuerza Hidrostatica Sobre Superficies Planas Sumergidas y Centro de PresionBMuy100% (2)

- Datos r1Dokument1 SeiteDatos r1BMuyNoch keine Bewertungen

- FisicaDokument2 SeitenFisicaBMuyNoch keine Bewertungen

- Parcial 2009-2Dokument7 SeitenParcial 2009-2Martinez Mamani MamaniNoch keine Bewertungen

- Teoria de MotivacionDokument5 SeitenTeoria de MotivacionBMuyNoch keine Bewertungen

- Aprenda Servlets de Java Como Si Estuviera en SegundoDokument65 SeitenAprenda Servlets de Java Como Si Estuviera en SegundoCarola Prada MartinezNoch keine Bewertungen

- Tarea Propiedades Básicas y Viscosidad 1er Semestre 2015Dokument3 SeitenTarea Propiedades Básicas y Viscosidad 1er Semestre 2015BMuyNoch keine Bewertungen

- Metodo POTDokument5 SeitenMetodo POTBMuyNoch keine Bewertungen

- Practik 5 NxasDokument1 SeitePractik 5 NxasBMuyNoch keine Bewertungen

- Presion Hidrostatica y Manometros Diferenciales 1er Semestre 2015Dokument8 SeitenPresion Hidrostatica y Manometros Diferenciales 1er Semestre 2015BMuyNoch keine Bewertungen

- Metodos de Valuación Peps Ueps y PromedioDokument12 SeitenMetodos de Valuación Peps Ueps y PromedioBMuyNoch keine Bewertungen

- Cap2 Problemas Propuestos EnunciadosDokument12 SeitenCap2 Problemas Propuestos EnunciadosJuan ArevaloNoch keine Bewertungen

- Teoria de MotivacionDokument5 SeitenTeoria de MotivacionBMuyNoch keine Bewertungen

- Fisica 2Dokument32 SeitenFisica 2BMuyNoch keine Bewertungen

- 125846246Dokument4 Seiten125846246BMuyNoch keine Bewertungen

- Presion Hidrostatica y Manometros Diferenciales 1er Semestre 2015Dokument8 SeitenPresion Hidrostatica y Manometros Diferenciales 1er Semestre 2015BMuyNoch keine Bewertungen

- Segundo Parcial Distribucion de Salones Fisica 1Dokument1 SeiteSegundo Parcial Distribucion de Salones Fisica 1BMuyNoch keine Bewertungen

- Tarea Propiedades Básicas y Viscosidad 1er Semestre 2015Dokument3 SeitenTarea Propiedades Básicas y Viscosidad 1er Semestre 2015BMuyNoch keine Bewertungen

- Tarea 7Dokument6 SeitenTarea 7Elvira Muñoz DonosoNoch keine Bewertungen

- 8.cuentas PrincipalesDokument6 Seiten8.cuentas PrincipalesJuanNoch keine Bewertungen

- EconomíaDokument10 SeitenEconomíaviking6461Noch keine Bewertungen

- Actividad #1-Administración Finaniera.Dokument5 SeitenActividad #1-Administración Finaniera.Adenarey LuqueNoch keine Bewertungen

- Capitulo 5 Contabilidad para Administradores 1 GalileoDokument5 SeitenCapitulo 5 Contabilidad para Administradores 1 GalileoselvinNoch keine Bewertungen

- Ir-2-2018 Examen 1Dokument27 SeitenIr-2-2018 Examen 1anabelNoch keine Bewertungen

- Contabilidad Financiera 1Dokument74 SeitenContabilidad Financiera 1Marco CanalesNoch keine Bewertungen

- La Contabilidad y Los Estados FinancierosDokument7 SeitenLa Contabilidad y Los Estados Financierosfabricio sebastian Serrudo jimenezNoch keine Bewertungen

- U1 A5 Caso Ppto Utilidades. SI I HDokument10 SeitenU1 A5 Caso Ppto Utilidades. SI I HJenevieer HNoch keine Bewertungen

- Guia Contabilidad 2 Periodo Once 1Dokument4 SeitenGuia Contabilidad 2 Periodo Once 1Garcés Juan SebastianNoch keine Bewertungen

- Normas de ValuaciónDokument12 SeitenNormas de ValuaciónAngel7710qNoch keine Bewertungen

- Tarea 2 - Informe Sistema Financiero.Dokument15 SeitenTarea 2 - Informe Sistema Financiero.Policlínica CiénagaNoch keine Bewertungen

- Plantilla Estado de ResultadosDokument2 SeitenPlantilla Estado de ResultadosYureny QuinteroNoch keine Bewertungen

- Cash Forecast TemplateDokument7 SeitenCash Forecast TemplateCristina AlvaradoNoch keine Bewertungen

- Eeff - Ratios - Unacem SaaDokument81 SeitenEeff - Ratios - Unacem SaasandraNoch keine Bewertungen

- Contabilidad I UNIDADDokument30 SeitenContabilidad I UNIDADYEFERSON ALEXANDER HERRERA GONZALESNoch keine Bewertungen

- Tesis Paula Labarca y Gaiber OrtegaDokument72 SeitenTesis Paula Labarca y Gaiber Ortegacopisa79Noch keine Bewertungen

- Análisis Vertical o EstáticoDokument6 SeitenAnálisis Vertical o EstáticoYaneth RoaNoch keine Bewertungen

- Luis Arturo Gómez Examen 1Dokument3 SeitenLuis Arturo Gómez Examen 1luis arturo gomez castro0% (1)

- UF0314 Actividad Sociada Al CE3.10Dokument3 SeitenUF0314 Actividad Sociada Al CE3.10puriescuredoNoch keine Bewertungen

- Caso de ContabilidadDokument43 SeitenCaso de ContabilidadJuan SebastianNoch keine Bewertungen

- Ejercicio 27 y 28 ContaaDokument28 SeitenEjercicio 27 y 28 ContaaJose GaliciaNoch keine Bewertungen

- Hoja de TrabajoDokument4 SeitenHoja de TrabajoSARAI BELN ROCHA RODRÍGUEZNoch keine Bewertungen

- Balance VivianaDokument2 SeitenBalance VivianaViviana PulidoNoch keine Bewertungen

- Anexo 16-ADokument132 SeitenAnexo 16-AMARIA FERNANDA ALVAREZ ARZOLANoch keine Bewertungen