Beruflich Dokumente

Kultur Dokumente

Finact 1 Chapter 12

Hochgeladen von

Divine Carrera0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

49 Ansichten1 SeiteSummary Notes

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenSummary Notes

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

49 Ansichten1 SeiteFinact 1 Chapter 12

Hochgeladen von

Divine CarreraSummary Notes

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

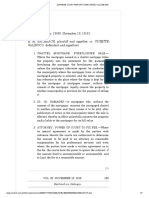

Misnomer because All notes

implicitly contain interest.

Chapter 12: NOTES RECEIVABLE Interest being included in the

face amount, rather than

Notes Receivable being stated as separate rate

Claims supported by formal promises to

pay usually in the form of notes

Represents only claims arising from sale Interest Non-Interest bearing

of merchandise or service in the bearing

ordinary course of business Initial Face Value PV (discounted value of

Notes received from officers /PV upon the Future cash flow using

Designated

separately Employees issuance the EIR)

Shareholders and affiliates

Negotiable promissory note

Unconditional promise in writing made Subsequent Amortized Amortized cost is the

by one person to another, signed by the cost using PV+amortization of the

maker, engaging to pay on demand or EIM discount

at fixed determinable future time a sum

certain in money to order or to bearer FV-unamortized unearned

int income

Promissory note

Written contract in which one person,

known as the maker, promises to pay Amortized Cost

another person, known as the payee, a Amount at which the note receivable is

definite sum of money measured initially

Note may be payable on demand or at a 1. Minus Principally repayment

definite future date 2. Plus/ Minus cumulative

amortization of an difference

Dishonored Notes between the initial carrying amount

Promissory matures and is not paid and the principal maturity amount

Dishonored receivable shall be removed 3. Minus reduction for impairment or

form NR account and transferred to AR uncollectibility

Initial Measurement of NR

1. PV sum of all future cash flows

discounted using the prevailing market

rate of interest(Effective interest rate)

for similar notes

2. Short term @ Face value

Short term NR are not

discounted because the effect

of discounting is usually not

material

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- EvalsDokument11 SeitenEvalsPaul Adriel Balmes50% (2)

- Calculating Overtime For Non-Exempt Employees and The Flsa Regular RateDokument42 SeitenCalculating Overtime For Non-Exempt Employees and The Flsa Regular RateJohn DavisNoch keine Bewertungen

- Article 1484Dokument1 SeiteArticle 1484Divine CarreraNoch keine Bewertungen

- CARRERA, Divine Grace GALLARDO, Lea Samantha PoliticalDokument2 SeitenCARRERA, Divine Grace GALLARDO, Lea Samantha PoliticalDivine CarreraNoch keine Bewertungen

- Test BanksDokument7 SeitenTest BanksDivine CarreraNoch keine Bewertungen

- Debt Restructure - 10Dokument2 SeitenDebt Restructure - 10Divine CarreraNoch keine Bewertungen

- PDF Template Divorce Settlement Agreement TemplateDokument16 SeitenPDF Template Divorce Settlement Agreement Templatejames benedictNoch keine Bewertungen

- Ruks Konsult vs. Adworld SignDokument11 SeitenRuks Konsult vs. Adworld SignLauriz EsquivelNoch keine Bewertungen

- Gilles v. CA (2009)Dokument5 SeitenGilles v. CA (2009)Zy AquilizanNoch keine Bewertungen

- SBR NotesDokument165 SeitenSBR NotesMD SAIFUL ISLAMNoch keine Bewertungen

- Alipio Vs CADokument2 SeitenAlipio Vs CASuiNoch keine Bewertungen

- Bachrach vs. Golingco., 39 Phil., 138Dokument7 SeitenBachrach vs. Golingco., 39 Phil., 138AJ LeoNoch keine Bewertungen

- Law 1 Final Term Exam AY 2018-2019 Second SemesterDokument6 SeitenLaw 1 Final Term Exam AY 2018-2019 Second SemesterGeorge MelitsNoch keine Bewertungen

- 5 Central Bank V CADokument14 Seiten5 Central Bank V CADonnie Ray SolonNoch keine Bewertungen

- MSA Template - 2019 - (For Reference Only To Be Used in Response Template)Dokument31 SeitenMSA Template - 2019 - (For Reference Only To Be Used in Response Template)Trinca DiplomaNoch keine Bewertungen

- 59Dokument4 Seiten59KAYE JAVELLANANoch keine Bewertungen

- Separation and Release AgreementDokument4 SeitenSeparation and Release AgreementKOLD News 13Noch keine Bewertungen

- Oracle SCM Functional Process FlowDokument12 SeitenOracle SCM Functional Process FlowVenkatNoch keine Bewertungen

- Practice MCQ and A Btc1110Dokument3 SeitenPractice MCQ and A Btc1110Lisa KangNoch keine Bewertungen

- Caltex Vs Ca DigestDokument2 SeitenCaltex Vs Ca DigestAnonymous joKjxH6Noch keine Bewertungen

- Expenditure Verification ReportDokument21 SeitenExpenditure Verification ReportAnonymous XSixrIu100% (1)

- 4471242v6 1rq National Collective Agreement 2007-2009 Wage Attachment 2016Dokument15 Seiten4471242v6 1rq National Collective Agreement 2007-2009 Wage Attachment 2016AdityaNoch keine Bewertungen

- The EstimateDokument2 SeitenThe EstimateGaby PcNoch keine Bewertungen

- Exam QuestionsDokument53 SeitenExam QuestionssuswagatNoch keine Bewertungen

- The Impact of New Nigerian Petroleum Industry Bill PIB 2021 On Government andDokument39 SeitenThe Impact of New Nigerian Petroleum Industry Bill PIB 2021 On Government andIbrahim SalahudinNoch keine Bewertungen

- Lease Accounting Lecture in Power PointDokument22 SeitenLease Accounting Lecture in Power PointEjaz AhmadNoch keine Bewertungen

- Chattanooga Police Department Pay Disparity ComplaintDokument22 SeitenChattanooga Police Department Pay Disparity ComplaintLee DavisNoch keine Bewertungen

- MALAYAWATA STEEL BERHAD V GOVERNMENT OF MALA PDFDokument4 SeitenMALAYAWATA STEEL BERHAD V GOVERNMENT OF MALA PDFMary Michael100% (1)

- Presentation On Indemnities, Performance Securities, Retention Money & Insurances in FIDIC Red Book 1987Dokument20 SeitenPresentation On Indemnities, Performance Securities, Retention Money & Insurances in FIDIC Red Book 1987hannykhawajaNoch keine Bewertungen

- Appointment Letter of PRIYANKA JUYALDokument11 SeitenAppointment Letter of PRIYANKA JUYALpriyankahumanityNoch keine Bewertungen

- BailmentDokument6 SeitenBailmentNimmi GopinathNoch keine Bewertungen

- NCNDDokument2 SeitenNCNDrealestatemikeNoch keine Bewertungen

- RBP Agreement - True Corporate Business SolutionsDokument14 SeitenRBP Agreement - True Corporate Business SolutionsCuthbert MunhupedziNoch keine Bewertungen