Beruflich Dokumente

Kultur Dokumente

Application Form For Taxpayer's Identification Number: (To Be Filled in by The Assessee)

Hochgeladen von

Ravishek SharmaOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Application Form For Taxpayer's Identification Number: (To Be Filled in by The Assessee)

Hochgeladen von

Ravishek SharmaCopyright:

Verfügbare Formate

Application Form for Taxpayers Identification Number

Instructions: Use capital letters. Write one letter in each box. Keep an empty box in between two words. Avoid abbreviation as much as possible.

(To be filled in by the assessee)

1. Name of the assessee:

2. Fathers name/Proprietors name/Incorporation No./Registration No. (Wherever applicable):

(a)

(b)

(c)

(d)

3. Name of the Husband (Wherever applicable)

4. Date of birth/Incorporation/Registration (Wherever applicable):

Day Month Year

5. Current address:

Village/Street:

Thana:

District: Post Code

6. Permanent address:

Village/Street:

Thana:

District: Post Code

Previous GIR No. (Wherever applicable):

_____________________

Signature of the assessee

..........................................................................................................................................................................................................

(To be filled in by the concerned circle)

1. Assessment location:

Zone:

Circle:

2. Status:

IND. COM. RF. URF AOP HUF

Deputy Commissioners Comment:

Acceptable Not acceptable

Forwarded to the First Secretary (Taxes-4), NBR, Segunbagicha, Dhaka.

_______________________________________

Signature of the Deputy Commissioner of Taxes SEAL

.................................................................................................................................................................................................................

(To be filled in by the NBR)

TIN - -

______________________________

Signature of the Second Secretary, NBR SEAL

Das könnte Ihnen auch gefallen

- Share Application FormDokument2 SeitenShare Application FormKrishna Chaitanya SamudralaNoch keine Bewertungen

- LLR Subscription Form 2018Dokument1 SeiteLLR Subscription Form 2018jagshish100% (1)

- 02fencing PermitDokument2 Seiten02fencing PermitMariel Jane FuentiblancaNoch keine Bewertungen

- TREDA Membership FormDokument10 SeitenTREDA Membership FormInter 4DMNoch keine Bewertungen

- Form Da-1: Nomination: SCRN: SC90185836 SARN: SA64910972Dokument4 SeitenForm Da-1: Nomination: SCRN: SC90185836 SARN: SA64910972Manjunath AgastyaNoch keine Bewertungen

- Account Opening Form For Non Resident IndiansDokument3 SeitenAccount Opening Form For Non Resident IndiansNobleNoch keine Bewertungen

- SF1 - Employer Registration FormDokument2 SeitenSF1 - Employer Registration FormkinangaNoch keine Bewertungen

- Life CertificateDokument1 SeiteLife CertificateDollar KhokharNoch keine Bewertungen

- Application For Opening An Account Under ''Sukanya Samriddhi Account'' FORM-1Dokument3 SeitenApplication For Opening An Account Under ''Sukanya Samriddhi Account'' FORM-1shobsundar1Noch keine Bewertungen

- Application Form For Opening Individual / Joint AccountDokument4 SeitenApplication Form For Opening Individual / Joint AccountVuthpalachaitanya KrishnaNoch keine Bewertungen

- Pensioners FormDokument4 SeitenPensioners FormImran ShahidNoch keine Bewertungen

- Service Request Form 19Dokument2 SeitenService Request Form 19Venkat BadaralaNoch keine Bewertungen

- Karibu Loan Application FormDokument3 SeitenKaribu Loan Application FormIntelex Computers (The ICT HUB)Noch keine Bewertungen

- Health Insurance - Sejtrq67Dokument1 SeiteHealth Insurance - Sejtrq67Abdul SamadNoch keine Bewertungen

- Rent ReceiptDokument1 SeiteRent Receiptm.varundevNoch keine Bewertungen

- Ssy All Forms 09 08Dokument9 SeitenSsy All Forms 09 08raja.alifnoorNoch keine Bewertungen

- Apr RentDokument1 SeiteApr Rentdimple1Noch keine Bewertungen

- General Power of AttorneyDokument3 SeitenGeneral Power of Attorneyankit desaiNoch keine Bewertungen

- GH-03, Sector-2, Greater Noida West: Nirala Projects Pvt. LTDDokument6 SeitenGH-03, Sector-2, Greater Noida West: Nirala Projects Pvt. LTDmanugeorgeNoch keine Bewertungen

- Kisan Samman Nidhi Application FormDokument1 SeiteKisan Samman Nidhi Application Formradhakrishna mamidi100% (2)

- Oct RentDokument1 SeiteOct Rentdimple1Noch keine Bewertungen

- In Country PB Form 1Dokument2 SeitenIn Country PB Form 1Brother SisterNoch keine Bewertungen

- Application Form OcDokument1 SeiteApplication Form OcRiaz MirNoch keine Bewertungen

- Application Form For The Registration of Importers & ExportersDokument4 SeitenApplication Form For The Registration of Importers & ExportersNilamdeen Mohamed ZamilNoch keine Bewertungen

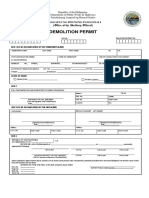

- Demolition Permit (Front) GSCDokument1 SeiteDemolition Permit (Front) GSCThe MatrixNoch keine Bewertungen

- Revised PF Withdrawal Form-19Dokument3 SeitenRevised PF Withdrawal Form-19Sukhveer SinghNoch keine Bewertungen

- APP MeritBadgeCounselor 2012 PDFDokument1 SeiteAPP MeritBadgeCounselor 2012 PDFRome PascualNoch keine Bewertungen

- Employees' Provident Fund Scheme, 1952: Form-19Dokument2 SeitenEmployees' Provident Fund Scheme, 1952: Form-19Ajay KathuriaNoch keine Bewertungen

- Form 1A LOAN APPLICATION FORM INDIVIDUALDokument11 SeitenForm 1A LOAN APPLICATION FORM INDIVIDUALMETANOIANoch keine Bewertungen

- Certificate of Occupancy FormsDokument3 SeitenCertificate of Occupancy FormsBUILDING PERMITNoch keine Bewertungen

- 1E ECSA Candidate AppformDokument8 Seiten1E ECSA Candidate AppformBlessingNoch keine Bewertungen

- CyberParkApplicationForm EDokument13 SeitenCyberParkApplicationForm EAbhishek TyagiNoch keine Bewertungen

- Rent ReceiptDokument1 SeiteRent ReceiptGovindharaj MuruganNoch keine Bewertungen

- Rent ReceiptDokument1 SeiteRent ReceiptmanojsalinNoch keine Bewertungen

- Rent Receipt Template 1. Employee DetailsDokument1 SeiteRent Receipt Template 1. Employee DetailsMohan ChoudharyNoch keine Bewertungen

- Rent ReceiptDokument1 SeiteRent ReceiptSushantNoch keine Bewertungen

- Rent Receipt7888Dokument1 SeiteRent Receipt7888SushantNoch keine Bewertungen

- Rent ReceiptDokument1 SeiteRent ReceiptAnandNoch keine Bewertungen

- Rent ReceiptDokument1 SeiteRent ReceiptEr Mehtab AlamNoch keine Bewertungen

- Rent ReceiptDokument1 SeiteRent ReceiptAnandNoch keine Bewertungen

- Rent Receipt Template 1. Employee DetailsDokument1 SeiteRent Receipt Template 1. Employee Detailskabilan aNoch keine Bewertungen

- Rent ReceiptDokument1 SeiteRent ReceiptParli BrunoNoch keine Bewertungen

- Chennai RentReceiptDokument1 SeiteChennai RentReceiptSubash NagaNoch keine Bewertungen

- RentReceipt FormatDokument1 SeiteRentReceipt Formatniraj305180Noch keine Bewertungen

- Rent ReceiptDokument1 SeiteRent ReceiptAbhishekNoch keine Bewertungen

- Rent ReceiptDokument1 SeiteRent Receiptfaizahamed111Noch keine Bewertungen

- Rent ReceiptDokument1 SeiteRent Receiptankitiec03Noch keine Bewertungen

- Rent ReceiptDokument1 SeiteRent ReceiptDeepak KansalNoch keine Bewertungen

- Rent Receipt For HRADokument1 SeiteRent Receipt For HRAhiteshforpsNoch keine Bewertungen

- Rent ReceiptDokument1 SeiteRent ReceiptDharmaTeja KonduriNoch keine Bewertungen

- Rent ReceiptDokument1 SeiteRent ReceiptDeepak KansalNoch keine Bewertungen

- Mobile Bill Format.x.2Dokument1 SeiteMobile Bill Format.x.2Chaitanya KambojNoch keine Bewertungen

- Health Insurance Sejtrq67Dokument1 SeiteHealth Insurance Sejtrq67ahmedlakhanNoch keine Bewertungen

- App Dup Admit Card PDFDokument2 SeitenApp Dup Admit Card PDFmanas nikhilNoch keine Bewertungen

- Canteen Card Application For Retired PDFDokument2 SeitenCanteen Card Application For Retired PDFSandy San100% (1)

- GoDokument3 SeitenGoAnuradha LankaNoch keine Bewertungen

- Probate Made Simple: The essential guide to saving money and getting the most out of your solicitorVon EverandProbate Made Simple: The essential guide to saving money and getting the most out of your solicitorNoch keine Bewertungen

- Note Brokering for Profit: Your Complete Work At Home Success ManualVon EverandNote Brokering for Profit: Your Complete Work At Home Success ManualNoch keine Bewertungen

- List of Tools in Tool Store 10 04 2019Dokument2 SeitenList of Tools in Tool Store 10 04 2019Ravishek SharmaNoch keine Bewertungen

- Vinayaka Missions Aviation Academy, Salem Set-1 Total Questions-104 Time-75 Min. Module 3-Electrical FundamentalsDokument8 SeitenVinayaka Missions Aviation Academy, Salem Set-1 Total Questions-104 Time-75 Min. Module 3-Electrical FundamentalsRavishek SharmaNoch keine Bewertungen

- CAR 147 BasicDokument48 SeitenCAR 147 BasicRavishek SharmaNoch keine Bewertungen

- Aircraft Radio Systems James Powell 1981 PDFDokument260 SeitenAircraft Radio Systems James Powell 1981 PDFRavishek SharmaNoch keine Bewertungen

- 3 Electronic Flight Deck Display Systems PDFDokument92 Seiten3 Electronic Flight Deck Display Systems PDFRavishek SharmaNoch keine Bewertungen

- Human Factors Question BankDokument87 SeitenHuman Factors Question BankRavishek Sharma100% (6)

- Name: Nur Hashikin Binti Ramly (2019170773) Course Code: Udm713 - Decision Making Methods and Analysis Assignment Title: Need Gap AnalysisDokument2 SeitenName: Nur Hashikin Binti Ramly (2019170773) Course Code: Udm713 - Decision Making Methods and Analysis Assignment Title: Need Gap AnalysisAhmad HafizNoch keine Bewertungen

- Advanced Financial Accounting and Reporting Accounting For PartnershipDokument6 SeitenAdvanced Financial Accounting and Reporting Accounting For PartnershipMaria BeatriceNoch keine Bewertungen

- Approach To A Case of ScoliosisDokument54 SeitenApproach To A Case of ScoliosisJocuri KosoNoch keine Bewertungen

- Contact Numbers of Head Office: Managing DirectorDokument6 SeitenContact Numbers of Head Office: Managing DirectorRatneshNoch keine Bewertungen

- Assignment File - Group PresentationDokument13 SeitenAssignment File - Group PresentationSAI NARASIMHULUNoch keine Bewertungen

- AITAS 8th Doctor SourcebookDokument192 SeitenAITAS 8th Doctor SourcebookClaudio Caceres100% (13)

- The Permission Wheel Hawkes L PDFDokument8 SeitenThe Permission Wheel Hawkes L PDFNandita Asthana SankerNoch keine Bewertungen

- Kozier Erbs Fundamentals of Nursing 8E Berman TBDokument4 SeitenKozier Erbs Fundamentals of Nursing 8E Berman TBdanie_pojNoch keine Bewertungen

- LR 7833Dokument11 SeitenLR 7833Trung ĐinhNoch keine Bewertungen

- Symptoms: Generalized Anxiety Disorder (GAD)Dokument3 SeitenSymptoms: Generalized Anxiety Disorder (GAD)Nur WahyudiantoNoch keine Bewertungen

- DH 0507Dokument12 SeitenDH 0507The Delphos HeraldNoch keine Bewertungen

- Cct4-1causal Learning PDFDokument48 SeitenCct4-1causal Learning PDFsgonzalez_638672wNoch keine Bewertungen

- MagmatismDokument12 SeitenMagmatismVea Patricia Angelo100% (1)

- Jurnal Perdata K 1Dokument3 SeitenJurnal Perdata K 1Edi nur HandokoNoch keine Bewertungen

- ANSI-ISA-S5.4-1991 - Instrument Loop DiagramsDokument22 SeitenANSI-ISA-S5.4-1991 - Instrument Loop DiagramsCarlos Poveda100% (2)

- Rid and Clean Safety DataDokument1 SeiteRid and Clean Safety DataElizabeth GraceNoch keine Bewertungen

- Filehost - CIA - Mind Control Techniques - (Ebook 197602 .TXT) (TEC@NZ)Dokument52 SeitenFilehost - CIA - Mind Control Techniques - (Ebook 197602 .TXT) (TEC@NZ)razvan_9100% (1)

- A List of Run Commands For Wind - Sem AutorDokument6 SeitenA List of Run Commands For Wind - Sem AutorJoão José SantosNoch keine Bewertungen

- FCAPSDokument5 SeitenFCAPSPablo ParreñoNoch keine Bewertungen

- OPSS 415 Feb90Dokument7 SeitenOPSS 415 Feb90Muhammad UmarNoch keine Bewertungen

- Taxation: Presented By: Gaurav Yadav Rishabh Sharma Sandeep SinghDokument32 SeitenTaxation: Presented By: Gaurav Yadav Rishabh Sharma Sandeep SinghjurdaNoch keine Bewertungen

- Research PaperDokument9 SeitenResearch PaperMegha BoranaNoch keine Bewertungen

- Financial Performance Report General Tyres and Rubber Company-FinalDokument29 SeitenFinancial Performance Report General Tyres and Rubber Company-FinalKabeer QureshiNoch keine Bewertungen

- Cover Letter For Lettings Negotiator JobDokument9 SeitenCover Letter For Lettings Negotiator Jobsun1g0gujyp2100% (1)

- Health and Hatha Yoga by Swami Sivananda CompressDokument356 SeitenHealth and Hatha Yoga by Swami Sivananda CompressLama Fera with Yachna JainNoch keine Bewertungen

- Walt Whitman Video Worksheet. CompletedDokument1 SeiteWalt Whitman Video Worksheet. CompletedelizabethannelangehennigNoch keine Bewertungen

- Responsive Docs - CREW Versus Department of Justice (DOJ) : Regarding Investigation Records of Magliocchetti: 11/12/13 - Part 3Dokument172 SeitenResponsive Docs - CREW Versus Department of Justice (DOJ) : Regarding Investigation Records of Magliocchetti: 11/12/13 - Part 3CREWNoch keine Bewertungen

- The Rise of Political Fact CheckingDokument17 SeitenThe Rise of Political Fact CheckingGlennKesslerWPNoch keine Bewertungen

- 401 Lourdes School Quezon City Inc. v. GarciaDokument2 Seiten401 Lourdes School Quezon City Inc. v. GarciaIldefonso HernaezNoch keine Bewertungen

- Manhole DetailDokument1 SeiteManhole DetailchrisNoch keine Bewertungen