Beruflich Dokumente

Kultur Dokumente

Balkrishna Industries Nivesh Discovery 18022015

Hochgeladen von

Harsh VoraCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Balkrishna Industries Nivesh Discovery 18022015

Hochgeladen von

Harsh VoraCopyright:

Verfügbare Formate

Nivesh Discovery

February 18, 2015 Balkrishna Industries Ltd.

NIVESH DISCOVERY Product Features

Salient Features of reports published under Nivesh Discovery:

1) These reports may or may not be backed by any discussion or meeting with management of respective companies.

2) These reports are prepared on the basis of desk research and information available in public domain.

3) These reports may or may not be followed by any specific event update.

4) All futuristic projections are based on authors assumptions.

5) Recommendations given under Nivesh Discovery are suited for aggressive investors only seeking high risk return.

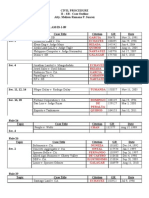

Current Previous Balkrishna Industries Limited (BKT) is engaged in the manufacture of Off Highway

Specialty Tyres. The specialty tyres manufactured by BKT is used in vehicles for

CMP : Rs.675 Agriculture, Industrial, Heavy Material Handling, Construction, Earth Moving

(OTR), Port, Mining, Forestry, Lawn & Garden Equipment along with All Terrain

Rating : BUY Rating : NR Vehicles (ATV). BKT is headquartered in Mumbai. It was established in 1987, since

then BKT has become a leading manufacturer of Off-Highway tyres having global

Target : Rs.983 Target : NR presence across 130 countries.

(NR-Not Rated) Key rationales for accumulating BKT:

1) The company is a global player in the Off-Highway tyre industry commanding

STOCK INFO

around 6% market share according to latest available update. It has four

BSE 502355 subsidiaries in Europe and North America to assist in sales and marketing

NSE BALKRISIND

activities covering around 130 countries worldwide through a network of

Bloomberg BIL IN

distributors to sell its products.

Reuters BLKI.BO

Sector TYRES 2) BKT has five state-of-the-art production facilities employing over 6000

Face Value (Rs) 2 people offering an extensive catalogue of over 2,300 products on Off-highway

Equity Capital (Rs mn) 193 tyres to meet customer (both manufacturer and end user) specification and

Mkt Cap (Rs mn) 65,225 needs. It manufactures all types of Tractor, Machinery, Trailer, Dozer, Loader,

52w H/L (Rs) 855/367.85 Dumper, Crane, Scraper, All Terrain Vehicles along with Lawn and Garden

1m Avg Daily Volume (BSE & NSE) 88,048 equipment tyres.

Source: BSE, NSE India, Capitaline, Company, IndiaNivesh Research 3) The company operates in a segment which has high entry barrier. It takes

long period of around 2 to 3 years to build a facility of around 1,50,000

SHAREHOLDING PATTERN % MTPA for Off Highway Specialty Tyres. Large variety of product offering is

(as on Dec. 2014) required while the business essentially remains a low volume one. Passenger

Promoters 58.30 car or Commercial Vehicle tyre manufacturer are not competitors of Off-

FIIs 13.41 Highway Specialty Tyre manufacturer as both are distinctly different

DIIs 15.99 segments.

Public & Others 12.30 4) BKT has undertaken massive green field capacity ramp up. It is in the process

Source: BSE, NSE India, Capitaline, Company, IndiaNivesh Research of setting up a manufacturing facility of 1,40,000 MPTA at Bhuj, from which

partial production has already commenced . According to management around

STOCK PERFORMANCE (%) 1m 3m 12m 80% of construction is over and entire facility will be available in next few

BKT 4.46 -18.56 89.26 months. The company is presently sitting on a capacity of over 2,50,000 MTPA

NIFTY 6.34 5.57 45.53 which is likely to reach 3,00,000 MPTA in next few months on completion of

Source: BSE, NSE India, Capitaline, Company, IndiaNivesh Research Bhuj facility.

5) Gross sales grew at a CAGR of over 22% in last three years outperforming

industry average growth of 4% to 5% by a wide margin in an otherwise tough

environment. Management seemed confident of maintaining revenue

growth run rate while improving on margins. Around 85% of total sales come

Dharmesh Kant from exports. According to management it was better product and

VP Strategies & Fund Manager (PMS) geographical mix which helped BKT maintain high growth trajectory. Though

companys product are priced higher than those coming from Chinese

Mobile: +91 77383 93372 factories; better product quality kept BKT above Chinese competition.

Tel: +91 22 66188890 Presently around 51% of revenue comes from Europe, 20% from America

dharmeshh.kant@indianivesh.in and 29% from rest of world.

IndiaNivesh Securities Private Limited

IndiaNivesh 601 & 602, Sukh Sagar, N. S. Patkar Marg, Girgaum Chowpatty, Mumbai 400 007. Tel: (022) 66188800

Balkrishna Industries Ltd. (contd...)

6) According to Management future growth be will largely come from America,

Emerging markets and India. In a 9 month period of FY15 it is observed that share of

Americas contribution to revenue has increased while that of Europe has declined. It

appears to be a smart move on part of management to capture growth opportunities

in economies which are doing well enabling them to tide over slow down in Europe its

biggest market till date.

7) Going forward we expect domestic market to throw up significant growth

opportunities to companies like BKT. With Make In India and Make for India

campaigns gaining traction BKT stands poised to reap benefits. Their new product

launches like all steel radial mining tyres, special puncture proof defense tyres and

solid tyres fits the bill perfectly in light of Indias landscape and Governments resolve

to boost the pace of growth. As more mines are available for mining and defense

sector opens up it will lead to increased demand of Off-Highway specialty tyres from

both replacement and OEM markets.

8) The company did a remarkable job in Q3FY15 by posting Ebitda growth of 16% and

Pat growth of 6% on Y-o-Y basis considering the fact that around 51% of sales revenue

for 9MFY15 accrued from Europe (It was 53% in H1FY15) while its currency Euro

depreciated significantly during the period. Further, their key raw material rubber is

priced in USD which appreciated against INR in the same period. According to

management it was effective currency hedges taken in time which prevented

currency related losses. They have already in place their currency exposure hedged

for FY16.

9) BKT enjoys strong cash flow situation. Its long term debt was at Rs. 1695 crores as

on 30th Sept14 (Short Term Debt stood at Rs.694 crores) which increased to Rs. 1745

crores as on 31st Dec14 implying an increase of Rs. 50 crores while its cash and

equivalents increased by Rs. 189 crores during the aforesaid period and expenditure

incurred in Bhuj plant increased from Rs. 2466 crores as on 30th Sept14 to Rs. 2570 as

on 31st Dec14 out of which Rs.1948 crores has been capitalized. Shareholders Fund

as on 30th Sept14 stood at Rs. 2068 crores.

10) Going forward management is confident of not only maintaining Ebitda margin of

around 25% ( for 9MFY15 Ebitda margin was 25.70%) but also improving it through

operating efficiencies. Bhuj plant is a strategic fit to achieve higher operational

efficiency. The new plant will result in reduction of logistics, power and fuel costs as it

is located close to the Mundra port and also has a rubber mixing plant besides a captive

20MW power plant. Once fully functional which is expected in next 3 to 4 months the

company plans to utilize it at 100% capacity level. Management expects to achieve

overhead saving of around 2 to 3 percent through this.

11) Management has guided for sales volume of around 1,55,000 MT in FY15 and

1,70,000 to 1,75,000 MT in FY16. Further, according to management the benefits of

lower input cost of rubber and crude oil will largely come from Q4FY15 due to lag

effect. For 9MFY15 sales volume stands at 114,865 MT. Assuming the company delivers

on its guidance, we expect the company to post an EPS of around Rs. 51.52 in FY15.

12) Assuming BKT deliver sales volume of 1,75,000 MT as guided by management we

expect an EPS of Rs. 65.56 in FY16 through improved blended realization, better

product mix, reduced overhead expenses for factors cited above after adjusting for

additional depreciation on full commissioning of Bhuj plant. The company has delivered

an Ebitda margin of 25.70% for 9MFY15, we have assumed an Ebitda margin of 25.63%

for FY15 while for FY16 we have assumed an Ebitda margin of 26.51%. Presently the

capacity utilization of company is around 55% to 60% and post completion of Bhuj

plant it is likely to remain in the same zone for FY16 going by managements guidance

of achieving sales volume of 1,70,000 to 1,75,000 MT. However, benefits of operating

leverage will start playing out in full swing from FY17 onwards. Valuing the company

at P/E multiple of 15x for FY16 the stock target price comes at Rs 983.

We recommend buy and accumulate on BKT for a target price of Rs 983.

YE March (Rs. Crores) REVENUE EBITDA PAT EBITDA % PAT % EPS (Rs.) P/E (x)

FY12A 3,017.00 516.00 269.00 17.10% 8.92% 27.48 24.55x

FY13A 3,394.00 673.00 350.00 19.83% 10.31% 36.20 18.64x

FY14A 3,772.00 904.00 475.00 23.97% 12.59% 49.10 13.74x

FY15E 3,776.81 968.00 497.91 25.63% 13.18% 51.49 13.10x

FY16E 4,531.00 1,201.00 634.00 26.51% 13.99% 65.56 10.29x

Source: BSE, NSE India, Capitaline, Company, IndiaNivesh Research

IndiaNivesh Nivesh Discovery February 18, 2015 | 2

Balkrishna Industries Ltd. (contd...)

Disclaimer: This report has been prepared by IndiaNivesh Securities Private Limited (INSPL) and published in accordance with the provisions of Regulation 18 of the Securities and Exchange Board of

India (Research Analysts) Regulations, 2014, for use by the recipient as information only and is not for circulation or public distribution. INSPL includes subsidiaries, group and associate companies,

promoters, directors, employees and affiliates. This report is not to be altered, transmitted, reproduced, copied, redistributed, uploaded, published or made available to others, in any form, in whole or

in part, for any purpose without prior written permission from INSPL. The projections and the forecasts described in this report are based upon a number of estimates and assumptions and are inherently

subject to significant uncertainties and contingencies. Projections and forecasts are necessarily speculative in nature, and it can be expected that one or more of the estimates on which the projections

are forecasts were based will not materialize or will vary significantly from actual results and such variations will likely increase over the period of time. All the projections and forecasts described in this

report have been prepared solely by authors of this report independently. None of the forecasts were prepared with a view towards compliance with published guidelines or generally accepted

accounting principles.

This report should not be construed as an offer to sell or the solicitation of an offer to buy, purchase or subscribe to any securities, and neither this report nor anything contained therein shall form the

basis of or be relied upon in connection with any contract or commitment whatsoever. It does not constitute a personal recommendation or take into account the particular investment objective,

financial situation or needs of individual clients. The research analysts of INSPL have adhered to the code of conduct under Regulation 24 (2) of the Securities and Exchange Board of India (Research

Analysts) Regulations, 2014. The recipients of this report must make their own investment decisions, based on their own investment objectives, financial situation or needs and other factors. The

recipients should consider and independently evaluate whether it is suitable for its/ his/ her/their particular circumstances and if necessary, seek professional / financial advice as there is substantial risk

of loss. INSPL does not take any responsibility thereof. Any such recipient shall be responsible for conducting his/her/its/their own investigation and analysis of the information contained or referred to

in this report and of evaluating the merits and risks involved in securities forming the subject matter of this report. The price and value of the investment referred to in this report and income from them

may go up as well as down, and investors may realize profit/loss on their investments. Past performance is not a guide for future performance. Actual results may differ materially from those set forth in

the projection.

Except for the historical information contained herein, statements in this report, which contain words such as will, would, etc., and similar expressions or variations of such words may constitute

forward-looking statements. These forward-looking statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those suggested by the

forward-looking statements. Forward-looking statements are not predictions and may be subject to change without notice. INSPL undertakes no obligation to update forward-looking statements to

reflect events or circumstances after the date thereof. INSPL accepts no liabilities for any loss or damage of any kind arising out of use of this report.

This report has been prepared by INSPL based upon the information available in the public domain and other public sources believed to be reliable. Though utmost care has been taken to ensure its

accuracy and completeness, no representation or warranty, express or implied is made by INSPL that such information is accurate or complete and/or is independently verified. The contents of this report

represent the assumptions and projections of INSPL and INSPL does not guarantee the accuracy or reliability of any projection, assurances or advice made herein. Nothing in this report constitutes

investment, legal, accounting and/or tax advice or a representation that any investment or strategy is suitable or appropriate to recipients specific circumstances. This report is based / focused on

fundamentals of the Company and forward-looking statements as such, may not match with a report on a companys technical analysis report. This report may not be followed by any specific event

update/ follow-up.

Following table contains the disclosure of interest in order to adhere to utmost transparency in the matter;

Disclosure of Interest Statement

1. Details of business activity of IndiaNivesh Securities Private Limited (INSPL) INSPL is a Stock Broker registered with BSE, NSE and MCX - SX in all the major segments viz. Cash, F & O and

CDS segments. INSPL is also a Depository Participant and registered with both Depository viz. CDSL and NSDL.

Further, INSPL is a Registered Portfolio Manager and is registered with SEBI.

2. Details of Disciplinary History of INSPL No disciplinary action is / was running / initiated against INSPL

3. Research analyst or INSPL or its relatives'/associates' financial interest in the

subject company and nature of such financial interest No (except to the extent of shares held by Research analyst or INSPL or its relatives'/associates')

4. Whether Research analyst or INSPL or its relatives'/associates' is holding the

securities of the subject company Yes

5. Research analyst or INSPL or its relatives'/associates' actual/beneficial ownership of 1% or more

in securities of the subject company, at the end of the month immediately preceding the

date of publication of the document. No

6. Research analyst or INSPL or its relatives'/associates' any other material conflict of interest

at the time of publication of the document No

7. Has research analyst or INSPL or its associates received any compensation from the

subject company in the past 12 months No

8. Has research analyst or INSPL or its associates managed or co-managed public offering of

securities for the subject company in the past 12 months No

9. Has research analyst or INSPL or its associates received any compensation for investment banking

or merchant banking or brokerage services from the subject company in the past 12 months No

10. Has research analyst or INSPL or its associates received any compensation for products or services

other than investment banking or merchant banking or brokerage services from the subject

company in the past 12 months No

11. Has research analyst or INSPL or its associates received any compensation or other benefits

from the subject company or third party in connection with the document. No

12. Has research analyst served as an officer, director or employee of the subject company No

13. Has research analyst or INSPL engaged in market making activity for the subject company No

14. Other disclosures No

INSPL, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed

herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. This information is subject to change, as per applicable law,

without any prior notice. INSPL reserves the right to make modifications and alternations to this statement, as may be required, from time to time.

Definitions of ratings

BUY. We expect this stock to deliver more than 15% returns over the next 12 months.

HOLD. We expect this stock to deliver -15% to +15% returns over the next 12 months.

SELL. We expect this stock to deliver <-15% returns over the next 12 months.

Our target prices are on a 12-month horizon basis.

Other definitions

NR = Not Rated. The investment rating and target price, if any, have been arrived at due to certain circumstances not in control of INSPL

CS = Coverage Suspended. INSPL has suspended coverage of this company.

UR=Under Review. Such e invest review happens when any developments have already occurred or likely to occur in target company & INSPL analyst is waiting for some more information to draw conclusion on

rating/target.

NA = Not Available or Not Applicable. The information is not available for display or is not applicable.

NM = Not Meaningful. The information is not meaningful and is therefore excluded.

Research Analyst has not served as an officer, director or employee of Subject Company

One year Price history of the daily closing price of the securities covered in this note is available at www.nseindia.com and www.economictimes.indiatimes.com/markets/stocks/stock-quotes. (Choose name of

company in the list browse companies and select 1 year in icon YTD in the price chart)

IndiaNivesh Securities Private Limited

601 & 602, Sukh Sagar, N. S. Patkar Marg, Girgaum Chowpatty, Mumbai 400 007.

Tel: (022) 66188800 / Fax: (022) 66188899

e-mail: research@indianivesh.in | Website: www.indianivesh.in

Home

IndiaNivesh Nivesh Discovery February 18, 2015 | 3

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Dakota Office Products CaseDokument3 SeitenDakota Office Products CaseKambria Butler89% (18)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- AIG Insurance Sample - Amit-Raipdf PDFDokument2 SeitenAIG Insurance Sample - Amit-Raipdf PDFOwais100% (1)

- Hastings Group Holdings PLC Prospectus With DisclaimerDokument301 SeitenHastings Group Holdings PLC Prospectus With DisclaimerMichael StefanNoch keine Bewertungen

- Ind Nifty500listDokument9 SeitenInd Nifty500listHarsh VoraNoch keine Bewertungen

- Financial Accounting (Canadian Edition)Dokument45 SeitenFinancial Accounting (Canadian Edition)Harsh Vora100% (1)

- Mozal CaseDokument41 SeitenMozal Casearjrocks235100% (2)

- Account Statement: Folio No.: 9383183 / 45Dokument2 SeitenAccount Statement: Folio No.: 9383183 / 45navdeep2309100% (1)

- The Kelly Criterion in Blackjack, Sports Betting, and The Stock MarketDokument2 SeitenThe Kelly Criterion in Blackjack, Sports Betting, and The Stock MarketAbgreenNoch keine Bewertungen

- Hevo OverviewDokument27 SeitenHevo OverviewHarsh VoraNoch keine Bewertungen

- Intertek - Legal Evaluation of Pesticide Residue - Organic - 2016Dokument2 SeitenIntertek - Legal Evaluation of Pesticide Residue - Organic - 2016Harsh VoraNoch keine Bewertungen

- A Review On Organic Food Production in Malaysia: HorticulturaeDokument5 SeitenA Review On Organic Food Production in Malaysia: HorticulturaeAK FleurNoch keine Bewertungen

- Organic in India2Dokument5 SeitenOrganic in India2Harsh VoraNoch keine Bewertungen

- National Online Stores List: Organic Yellow Pages 7th Edition LaunchedDokument17 SeitenNational Online Stores List: Organic Yellow Pages 7th Edition LaunchedHarsh VoraNoch keine Bewertungen

- Internet of Things: Applications, Protocols, and Best PracticesDokument39 SeitenInternet of Things: Applications, Protocols, and Best PracticesAfrinNusratNoch keine Bewertungen

- Corporate Valuation Methods PDFDokument28 SeitenCorporate Valuation Methods PDFHarsh Vora0% (1)

- P 18Dokument304 SeitenP 18gulshan22Noch keine Bewertungen

- Capitalizing Operating Leases (No Principal Reduction)Dokument3 SeitenCapitalizing Operating Leases (No Principal Reduction)PogotoshNoch keine Bewertungen

- Iimb IconDokument6 SeitenIimb IconHarsh VoraNoch keine Bewertungen

- 536 BCG The Millennial Consumer Apr 2012 (3) Tcm80-103894Dokument15 Seiten536 BCG The Millennial Consumer Apr 2012 (3) Tcm80-103894Dhruv AggarwalNoch keine Bewertungen

- Rotman Full-Time Employment and Salary Report 2015-2016Dokument11 SeitenRotman Full-Time Employment and Salary Report 2015-2016Munir ThanwaraniNoch keine Bewertungen

- Case: Delhi Electricity Distribution SectorDokument34 SeitenCase: Delhi Electricity Distribution SectorHarsh VoraNoch keine Bewertungen

- Simulation Modeling Using RiskDokument1 SeiteSimulation Modeling Using RiskHarsh VoraNoch keine Bewertungen

- 1 s2.0 S000768130500056X Main PDFDokument9 Seiten1 s2.0 S000768130500056X Main PDFHarsh VoraNoch keine Bewertungen

- IDBI Housing FinanceDokument42 SeitenIDBI Housing FinanceAvinash MuralaNoch keine Bewertungen

- 3Eksv7L8BosildPLOdK84G1zZk6Ew1co6BVp8hm0LThwxw9APH9HOx8 PDFDokument3 Seiten3Eksv7L8BosildPLOdK84G1zZk6Ew1co6BVp8hm0LThwxw9APH9HOx8 PDFMoneycontrol NewsNoch keine Bewertungen

- Financial Accounting A Managerial Perspective PDFDokument3 SeitenFinancial Accounting A Managerial Perspective PDFHarsh VoraNoch keine Bewertungen

- Suggested ProblemsDokument11 SeitenSuggested ProblemsAnurag KhandelwalNoch keine Bewertungen

- Nirma University EventDokument1 SeiteNirma University EventHarsh VoraNoch keine Bewertungen

- India Looks Into Walmart LobbyingDokument1 SeiteIndia Looks Into Walmart LobbyingHarsh VoraNoch keine Bewertungen

- LBIC For Solar Cell CharacterizationDokument4 SeitenLBIC For Solar Cell CharacterizationHarsh VoraNoch keine Bewertungen

- Business Government and SocietyDokument4 SeitenBusiness Government and SocietyHarsh VoraNoch keine Bewertungen

- Polyface Smithfield Slides v3Dokument5 SeitenPolyface Smithfield Slides v3Harsh VoraNoch keine Bewertungen

- The Prince - MachiavelliDokument127 SeitenThe Prince - MachiavelliHarsh VoraNoch keine Bewertungen

- India Looks Into Walmart LobbyingDokument1 SeiteIndia Looks Into Walmart LobbyingHarsh VoraNoch keine Bewertungen

- Free Case PrepDokument26 SeitenFree Case PrepNikhil JainNoch keine Bewertungen

- 3.investments Portfolio Management Process and EvaluationDokument17 Seiten3.investments Portfolio Management Process and EvaluationSasquarch VeinNoch keine Bewertungen

- ABC Term SheetDokument10 SeitenABC Term SheetJennifer LeeNoch keine Bewertungen

- Epc Vs BotDokument3 SeitenEpc Vs BotPayal ChauhanNoch keine Bewertungen

- DFDL Vietnam Investment Guide 2018 WebsiteDokument192 SeitenDFDL Vietnam Investment Guide 2018 WebsiteHoài NguyễnNoch keine Bewertungen

- Refund of Excess TDS PaidDokument2 SeitenRefund of Excess TDS PaidSunil AggarwalNoch keine Bewertungen

- Assignment For Corporate Financial AccountingDokument6 SeitenAssignment For Corporate Financial AccountingFlemin GeorgeNoch keine Bewertungen

- 6 RR 05-99 PDFDokument5 Seiten6 RR 05-99 PDFbiklatNoch keine Bewertungen

- Foreclosure DoctrinesDokument6 SeitenForeclosure DoctrinesRonnel DeinlaNoch keine Bewertungen

- Rule 23-38Dokument5 SeitenRule 23-38Resci Angelli Rizada-NolascoNoch keine Bewertungen

- The Grow Rich BluePrint PDFDokument13 SeitenThe Grow Rich BluePrint PDFAnonymous OKLEZIuf3m76% (17)

- Pos Malaysia Berhad Swot Analysis BacDokument7 SeitenPos Malaysia Berhad Swot Analysis BacNour Ly100% (1)

- Dombivli Shikshan Prasarak Mandal'S K. V. Pendharkar College of Arts, Science and Commerce (Autonomous)Dokument17 SeitenDombivli Shikshan Prasarak Mandal'S K. V. Pendharkar College of Arts, Science and Commerce (Autonomous)Nayna PanigrahiNoch keine Bewertungen

- ME Board Exam April 2002Dokument19 SeitenME Board Exam April 2002Julie Ann ZafraNoch keine Bewertungen

- COURSE OUTLINE - Project and Infrastructure FinanceDokument6 SeitenCOURSE OUTLINE - Project and Infrastructure FinanceAnkit BhardwajNoch keine Bewertungen

- Chapter 1 - The Accountancy ProfessionDokument4 SeitenChapter 1 - The Accountancy Professionforn lettyNoch keine Bewertungen

- TAXATION - Republic-CIR Vs Team Energy Corp - Tax Refund Credit PDFDokument12 SeitenTAXATION - Republic-CIR Vs Team Energy Corp - Tax Refund Credit PDFNatura ManilaNoch keine Bewertungen

- FINC+220+Syllabus Spring+2019+ (1 4 19)Dokument5 SeitenFINC+220+Syllabus Spring+2019+ (1 4 19)mzhao8Noch keine Bewertungen

- Seminar Solutions - Term 2Dokument36 SeitenSeminar Solutions - Term 2bontom333Noch keine Bewertungen

- Eng Kah Corporation BerhadDokument5 SeitenEng Kah Corporation BerhadNoel KlNoch keine Bewertungen

- Earnings Management in India: Managers' Fixation On Operating ProfitsDokument27 SeitenEarnings Management in India: Managers' Fixation On Operating ProfitsVaibhav KaushikNoch keine Bewertungen

- 2019 Level II CIPM Mock Exam Questions and AnswersDokument62 Seiten2019 Level II CIPM Mock Exam Questions and AnswersPaulius BaltrusaitisNoch keine Bewertungen

- Knight Frank Technical Due Diligence March 2013Dokument2 SeitenKnight Frank Technical Due Diligence March 2013Chris GonzalesNoch keine Bewertungen

- The Obstacles To Regulating The Hawala - A Cultural Norm or A TerrDokument57 SeitenThe Obstacles To Regulating The Hawala - A Cultural Norm or A TerrBrendan LanzaNoch keine Bewertungen

- Frequently Asked Questions UP Provident FundDokument2 SeitenFrequently Asked Questions UP Provident FundPam Otic-ReyesNoch keine Bewertungen

- CostOfCapital RDDokument24 SeitenCostOfCapital RDSephardNoch keine Bewertungen