Beruflich Dokumente

Kultur Dokumente

Answer Prime Cost Raw Material Purchased + Opening Stock of Raw Materials - Closing Stock of Raw

Hochgeladen von

Varun ChaitanyaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Answer Prime Cost Raw Material Purchased + Opening Stock of Raw Materials - Closing Stock of Raw

Hochgeladen von

Varun ChaitanyaCopyright:

Verfügbare Formate

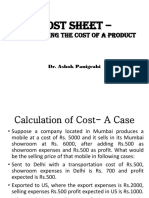

1. Determine the unit selling price if 35% profit is required by the company.

The company

plans to manufacture 12500 units in this quarter. You are given with the following data:

(All the values are in Indian rupees)

Opening stock of raw materials - 75000

Closing stock of raw materials 15000

Opening stock of work in progress 85500

Closing stock of work in progress - 53000

Opening stock of finished goods 275000

Closing stock of finished goods 77500

Raw material purchased 475000

Wages paid to the machinists 250000

Depreciation on the plant and machinery 35000

Rent for the factory building 45000

Telephone charge 65000

Salary paid to the office staff 350000

Salesmen commission 55000

Advertisement expenses 90000

Maintenance expenses (for machines in the factory) = 45000

Find also the prime cost, factory cost, cost of production, and total cost.

Answer

Prime cost = Raw material purchased + Opening stock of raw materials - Closing stock of raw

materials + Wages paid to the machinists = 475000 + 75000 15000 + 250000 = 785000

Factory cost = Prime cost + All the production overheads

= 785000 + Depreciation on the plant and machinery + Rent for the factory building

+ Maintenance expenses (for machines in the factory) + Opening stock of work in progress -

Closing stock of work in progress

= 785000 + 35000+45000+45000 + 85500 53000 = 942500

Cost of production = Factory cost + office overheads

= 942500 + Telephone charge +Salary paid to the office staff

= 942500+65000+350000 = 1357500

Cost of goods sold = Cost of production + Opening stock of finished goods - Closing

stock of finished goods

= 1357500 +275000 77500 = 1555000

Total cost = Cost of goods sold + Sales and Distribution overheads

= 1555000 + Salesmen commission + Advertisement expenses

= 1555000 + 55000 + 90000

= 1700000

Selling price per unit = (Total cost + % profit required) / Number of units manufactured

= (1700000 + 35% of 1700000) / 12500 = 183.6

Selling price per unit = Rs.183.6

Note:

1. Financial items like share market investment, income tax, loan repayment etc.

should not be added to the cost sheet.

2. Import tax paid for getting the raw material will get added to the prime cost.

Das könnte Ihnen auch gefallen

- Accounting and Finance Formulas: A Simple IntroductionVon EverandAccounting and Finance Formulas: A Simple IntroductionBewertung: 4 von 5 Sternen4/5 (8)

- Cost Sheet ProblemsDokument18 SeitenCost Sheet ProblemsMariam Mathen77% (56)

- Hospitality OperationsDokument10 SeitenHospitality OperationsbokanegNoch keine Bewertungen

- Cost Sheet ExamplesDokument16 SeitenCost Sheet ExamplesJayaKhemani82% (11)

- Ppce Unit-5Dokument21 SeitenPpce Unit-5Jackson ..Noch keine Bewertungen

- Chapter 5 Consumer BehaviourDokument5 SeitenChapter 5 Consumer BehaviourZyroneGlennJeraoSayanaNoch keine Bewertungen

- Recommendation LetterDokument2 SeitenRecommendation LetterAhmad Rizal Alias100% (1)

- Engineering CLDokument1 SeiteEngineering CLUmer Iftikhar AhmedNoch keine Bewertungen

- Standard (I Unit Produced) ParticularsDokument11 SeitenStandard (I Unit Produced) ParticularsForam Raval100% (1)

- Chapter 9Dokument33 SeitenChapter 9RockyLagishettyNoch keine Bewertungen

- Cost Analysis, Concepts & ClassificationsDokument43 SeitenCost Analysis, Concepts & Classificationsmarget85% (13)

- Fdocuments - in Chapter 11 Pricing Issues in Channel Management 2 Major Topics For CH 11Dokument26 SeitenFdocuments - in Chapter 11 Pricing Issues in Channel Management 2 Major Topics For CH 11Don DollanoNoch keine Bewertungen

- Cost Accounting Final Project ReportDokument6 SeitenCost Accounting Final Project Reportphool4u4uNoch keine Bewertungen

- Cost Sheet Practice QuestionsDokument6 SeitenCost Sheet Practice Questionsmeenagoyal995650% (2)

- Internship Report of Pakistan Accumulaters Pvt. Limited (Volta&osaka Batteries)Dokument31 SeitenInternship Report of Pakistan Accumulaters Pvt. Limited (Volta&osaka Batteries)shoaibmangla100% (1)

- Ansoff MatrixDokument5 SeitenAnsoff Matrixpranoy100% (1)

- Questionnaire For Company ProfileDokument2 SeitenQuestionnaire For Company ProfileShubham KumarNoch keine Bewertungen

- Segmentation Lego Case StudyDokument2 SeitenSegmentation Lego Case Studymaxrahul77Noch keine Bewertungen

- UNIT 3 & 5 - Cost Classification & Cost SheetDokument14 SeitenUNIT 3 & 5 - Cost Classification & Cost Sheetkevin75108Noch keine Bewertungen

- Cost Lectures DR - Mohiy SamyDokument10 SeitenCost Lectures DR - Mohiy SamyEiad WaleedNoch keine Bewertungen

- Cost Accounting CycleDokument21 SeitenCost Accounting CycleJericho PagsuguironNoch keine Bewertungen

- Chapter 2 - Cost Concepts, Information SystemsDokument42 SeitenChapter 2 - Cost Concepts, Information SystemsFaizan ChNoch keine Bewertungen

- Cost Sheet SolutionsDokument8 SeitenCost Sheet SolutionsPriya DattaNoch keine Bewertungen

- MG T 402 Subjective SolvedDokument8 SeitenMG T 402 Subjective SolvedAhsan Khan KhanNoch keine Bewertungen

- Cost & Elements of Costs: Isb & MDokument23 SeitenCost & Elements of Costs: Isb & MAdarsh AgarwalNoch keine Bewertungen

- Cost Sheet ProblemsDokument11 SeitenCost Sheet ProblemsPrem RajNoch keine Bewertungen

- Specimen of Cost Sheet and Problems-Unit-1 Cost SheetDokument11 SeitenSpecimen of Cost Sheet and Problems-Unit-1 Cost SheetRavi shankar100% (1)

- Cost Accounting AnswersDokument10 SeitenCost Accounting AnswersHaris KhanNoch keine Bewertungen

- Effect of Labor Turnover: Question No: 35 (Marks: 3)Dokument9 SeitenEffect of Labor Turnover: Question No: 35 (Marks: 3)Muhammad ZubairNoch keine Bewertungen

- Cost Sheet ProblemsDokument22 SeitenCost Sheet ProblemsAvinash Tanawade100% (4)

- Chapter Vi Unit Costing SolutionsDokument10 SeitenChapter Vi Unit Costing SolutionsKishan SolankiNoch keine Bewertungen

- Cost SheetDokument11 SeitenCost SheetPratiksha GaikwadNoch keine Bewertungen

- Job and Batch CostingDokument4 SeitenJob and Batch CostingAmber Kelly0% (1)

- MIDokument18 SeitenMImy tràNoch keine Bewertungen

- Unit 3 Part 1 - CostingDokument17 SeitenUnit 3 Part 1 - CostingPrarthana R Industrial EngineeringNoch keine Bewertungen

- CA Assignment QuestionsDokument7 SeitenCA Assignment QuestionsShagunNoch keine Bewertungen

- Costing ProblemsDokument26 SeitenCosting ProblemsNikhil PrasannaNoch keine Bewertungen

- Cost Problems 100Dokument20 SeitenCost Problems 100aquedeus.88Noch keine Bewertungen

- Cost Sheet-3Dokument77 SeitenCost Sheet-3nahi batanaNoch keine Bewertungen

- Activities For OM 103Dokument5 SeitenActivities For OM 103Trina Mae BarrogaNoch keine Bewertungen

- Answer Key (SW1 To SW3)Dokument6 SeitenAnswer Key (SW1 To SW3)MA. CRISSANDRA BUSTAMANTENoch keine Bewertungen

- Planning Tool - : Please Complete The Yellow Fields Only! All Blue Fields Will Be Completed AutomaticallyDokument13 SeitenPlanning Tool - : Please Complete The Yellow Fields Only! All Blue Fields Will Be Completed AutomaticallyStoica NicolaeNoch keine Bewertungen

- COGS Practise Questions 2 SolutionDokument13 SeitenCOGS Practise Questions 2 SolutionBisma ShahabNoch keine Bewertungen

- Strategic CostDokument25 SeitenStrategic CostAllysa Del MundoNoch keine Bewertungen

- Cost Sheet PDFDokument73 SeitenCost Sheet PDFsaloniNoch keine Bewertungen

- Toluene Cost Estimation&EconomicsDokument10 SeitenToluene Cost Estimation&EconomicssapooknikNoch keine Bewertungen

- HW 1 MGT202Dokument4 SeitenHW 1 MGT202Rajnish Pandey0% (1)

- Assignment ProblemDokument7 SeitenAssignment ProblemAnantha KrishnaNoch keine Bewertungen

- Q1.What Is Meant by Cost Sheet?explain The Importance of Cost SheetDokument4 SeitenQ1.What Is Meant by Cost Sheet?explain The Importance of Cost SheetHeena SorenNoch keine Bewertungen

- Economic AnalysisDokument10 SeitenEconomic AnalysismanueltsibiaNoch keine Bewertungen

- ACMA Unit 7 Problems - Cost Sheet PDFDokument3 SeitenACMA Unit 7 Problems - Cost Sheet PDFPrabhat SinghNoch keine Bewertungen

- Problems On Cost SheetDokument3 SeitenProblems On Cost Sheetvikasevil75Noch keine Bewertungen

- Cost & RevenueDokument13 SeitenCost & RevenueDeepikaa PoobalarajaNoch keine Bewertungen

- Cost Accounting I-5. Case StudyDokument12 SeitenCost Accounting I-5. Case StudyYusuf B'aşaranNoch keine Bewertungen

- Accounting Unit Additional Execerses AA025 Sem 2, 2019/2020Dokument5 SeitenAccounting Unit Additional Execerses AA025 Sem 2, 2019/2020nur athirahNoch keine Bewertungen

- Cost AccountingDokument16 SeitenCost AccountingShreyash KoreNoch keine Bewertungen

- Questions and Answers For MGT 3 000 Level 23Dokument15 SeitenQuestions and Answers For MGT 3 000 Level 23Monsonedu IkechukwuNoch keine Bewertungen

- Cost SheetDokument9 SeitenCost Sheetnaman jainNoch keine Bewertungen

- Cost SheetDokument20 SeitenCost SheetVannoj AbhinavNoch keine Bewertungen

- Costsheet 160702125930Dokument10 SeitenCostsheet 160702125930RanDeep SinghNoch keine Bewertungen

- Managerial AccountingMid Term Examination (1) - CONSULTADokument7 SeitenManagerial AccountingMid Term Examination (1) - CONSULTAMay Ramos100% (1)

- Chapter 21Dokument4 SeitenChapter 21Rahila RafiqNoch keine Bewertungen

- Manufacturing Company by Ester Intan Sukma - 11190002Dokument12 SeitenManufacturing Company by Ester Intan Sukma - 11190002esterNoch keine Bewertungen

- Cost Lectures DR - Mohiy SamyDokument12 SeitenCost Lectures DR - Mohiy SamyEiad WaleedNoch keine Bewertungen

- Cost Sheet ExercisesDokument2 SeitenCost Sheet ExercisessivapriyakamatNoch keine Bewertungen

- Costsheet Sheet2Dokument2 SeitenCostsheet Sheet2Abhishek kumar sittuNoch keine Bewertungen

- Cost SheetDokument6 SeitenCost SheetSubham ChakrabortyNoch keine Bewertungen

- Income:: Factory SuperintendenceDokument1 SeiteIncome:: Factory SuperintendenceIrish Liezl FuentesNoch keine Bewertungen

- Chapter 7 (Tutorial) : Job Order Costing AccountingDokument31 SeitenChapter 7 (Tutorial) : Job Order Costing AccountingNurin QistinaNoch keine Bewertungen

- 09me208 PDFDokument3 Seiten09me208 PDFVarun ChaitanyaNoch keine Bewertungen

- Modeling of A Vehicle Seat Suspension System With Pneumatic Spring and Viscous DampersDokument2 SeitenModeling of A Vehicle Seat Suspension System With Pneumatic Spring and Viscous DampersVarun ChaitanyaNoch keine Bewertungen

- Comparison Tool: Geometry Check Surfaces ComparisonDokument1 SeiteComparison Tool: Geometry Check Surfaces ComparisonVarun ChaitanyaNoch keine Bewertungen

- 4 Shrink Wrap - 13Dokument2 Seiten4 Shrink Wrap - 13Varun ChaitanyaNoch keine Bewertungen

- 4 Shrink Wrap - 13Dokument2 Seiten4 Shrink Wrap - 13Varun ChaitanyaNoch keine Bewertungen

- Test Report: Issued byDokument2 SeitenTest Report: Issued byVarun ChaitanyaNoch keine Bewertungen

- 1 1D Meshing - 13Dokument2 Seiten1 1D Meshing - 13Varun ChaitanyaNoch keine Bewertungen

- 2 Tetra Meshing - 13Dokument11 Seiten2 Tetra Meshing - 13Varun ChaitanyaNoch keine Bewertungen

- Likithnath Reddy: InterestsDokument1 SeiteLikithnath Reddy: InterestsVarun ChaitanyaNoch keine Bewertungen

- Customer Preferences For Restaurant Technology InnovationsDokument22 SeitenCustomer Preferences For Restaurant Technology InnovationsDeepankar SinghNoch keine Bewertungen

- Internship Report On: Marketing Strategies of EXIM Bank Limited BangladeshDokument79 SeitenInternship Report On: Marketing Strategies of EXIM Bank Limited BangladeshNoman ParvezNoch keine Bewertungen

- Assignment On Public Relations: Submitted To: Submitted byDokument8 SeitenAssignment On Public Relations: Submitted To: Submitted bynick'sNoch keine Bewertungen

- Business Portfolio Analysis: By: Prajakta, Pallavi, Prachiti and NehaDokument13 SeitenBusiness Portfolio Analysis: By: Prajakta, Pallavi, Prachiti and NehaNeha ChandrasekharNoch keine Bewertungen

- CASE STUDY OF IB FinalDokument10 SeitenCASE STUDY OF IB FinalAakriti Paudel50% (2)

- UK Diabolo Manual-E05Dokument19 SeitenUK Diabolo Manual-E05Eliott WalletNoch keine Bewertungen

- Chapter 3 F&B ManagementDokument45 SeitenChapter 3 F&B ManagementMohd Faizal Bin AyobNoch keine Bewertungen

- Project For SaloonDokument4 SeitenProject For SaloonPreetesh AnandNoch keine Bewertungen

- Breezy CompanyDokument2 SeitenBreezy CompanychrisNoch keine Bewertungen

- A Case Study On Sona Chandi ChawanprashDokument13 SeitenA Case Study On Sona Chandi ChawanprashSayan Basu ChaudhuryNoch keine Bewertungen

- Principle of Information System: Chapter 10Dokument6 SeitenPrinciple of Information System: Chapter 10idilhaqNoch keine Bewertungen

- BBA (Hons) Internship FormatDokument8 SeitenBBA (Hons) Internship FormatHamid Asghar0% (2)

- AFL 1 Marketing Strategy Matthew Clement 0106021910041Dokument4 SeitenAFL 1 Marketing Strategy Matthew Clement 0106021910041Matthew ClementNoch keine Bewertungen

- Pepsi CaseDokument36 SeitenPepsi CaseErman DemirNoch keine Bewertungen

- MKTG2501 - Session 1 IntroductionDokument83 SeitenMKTG2501 - Session 1 IntroductionThomas KWANNoch keine Bewertungen

- Experienal Report On OtobiDokument34 SeitenExperienal Report On OtobiTasmim TabassumNoch keine Bewertungen

- TvsDokument64 SeitenTvsKunal Jagad50% (2)

- LOreal 2015 Annual Report PDFDokument60 SeitenLOreal 2015 Annual Report PDFStefania ChristiNoch keine Bewertungen

- Sybms - Public Relations NotesDokument15 SeitenSybms - Public Relations NoteskishankrrishNoch keine Bewertungen

- TheHub Master BrochureDokument30 SeitenTheHub Master BrochureOliver GiamNoch keine Bewertungen

- EAC Question BankDokument4 SeitenEAC Question BanksaravmbaNoch keine Bewertungen