Beruflich Dokumente

Kultur Dokumente

CFS Bank Account Summary Report

Hochgeladen von

The Varsity100%(1)100% fanden dieses Dokument nützlich (1 Abstimmung)

63 Ansichten9 SeitenThe summary of the CFS hidden bank account audit

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThe summary of the CFS hidden bank account audit

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF herunterladen oder online auf Scribd lesen

100%(1)100% fanden dieses Dokument nützlich (1 Abstimmung)

63 Ansichten9 SeitenCFS Bank Account Summary Report

Hochgeladen von

The VarsityThe summary of the CFS hidden bank account audit

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 9

se

fcé e CANADIAN FEDERATION OF STUDENTS

FEDERATION CANADIENNE DES ETUDIANTES

May 31, 2017

Dear Members:

am writing to share with you a report regarding the activities of the CIBC bank account

prepared by Grant Thornton. Grant Thomton is a respected global accounting firm ang is.

distinct from the Federation's financial auditing firm, MNP LLP. The report summarizes

Grant Thornton's Forensic Review of the account which took place following its discovery

I know many members are deeply concemed about the existence of the CIBC bank

account, | {go am concerned and want you to know that since discovering the account, we

have done our best to respond appropriately and take action to ensure this never happens

again. When members of the at-large executive fist discovered the account in 2014, it was

immediately frozen and the forensic review was initiated shortly after.

‘This report follows the requests of members during the November 2016 National General

‘Meeting. It provides additional detail as to the transaction history of the account, including

the total amount of unauthorized deposits and withdrawals. To summarize, from July 2010

to Decamber 2014 a total of $263,052.80 in unauthorized deposits were made, and a total

of $262,776.13 in unautherized disbursements were withdrawn from the account.

‘The report confirms that the account was not known by most members of the at-large

executive of the organization, nar reported to the Federation's auditar. Instead a small group

of individuals operated this account independently and without regard to the financial

protocols of the organization. It is important to note that no one involved in the orchestration

of this account cantinues to be employed by the Federation.

‘There has been a concerted effort to change our Federation over the past two years. This,

new direction is one of an unapologetic commitment to social justice and an unambiguous

commitment to free education, It also focuses on building solidarity amongst members,

strengthening the operations of the organization and improving services. We have

positioned equity campaigns and advocacy in its rightful place at the heart of cur movement.

‘We have facilitated a fully unionized work environment for our staff and hava settled all

‘outstanding lawsuits with member locals. We have held membership referenda on three

campuses, allowing students to exercise their democratic will and with that have welcomed

ew members but have also seen members vote to leave.

‘The release of this report an our forensic review has already and will no doub! continue to

elicit attacks from those who have been interested in dismantling the Federation since the

election of national leadership in 2014 that was opposed by those with knowledge of the

account. These types of attacks wil kely include various forms of blackmail, intimidation

and character assassination through e-mail threads, general meeting motions and social

‘media harassment. We must say loudly and clearly that itis unwelcome, inappropriate and

will not be tolerated

S20 fue SOMERSET STREET WESTIOUEET | OTTAWA ONTARIO

TEEPHONENELEPHONE 1825275". | PERTELECOPEUR biooieae | Pe cesceg

ese

CANADIAN FEDERATION OF STUDENTS

TCOR camereceno se sens

Ir would be too easy to allow the good work of our movement to be overshadowed by this

unfortunate incident. instead, we must move forward with our work for social justice and

Continue our commitment to strengthen financial transparency on an ongoing basis. |

believe the approach we have taken is one that is setting the organization back on the right

‘rack. restoring confidence and ensuring these sorts of situations do not occur again.

‘We will not give one inch to intimidation and we know that members across the country will

stand together to fight for and continue to improve our national student movement.

Preceding national execulives made the dificult but necessary decision to put accountability

dnd transparency ahead of complacency by initiating the forensic review, and we hope that

{his teport will satisfy members’ desire for addtional information. Let us now recommit to

bringing about fairer, more inclusive campuses and communities that all of us desire.

In Solidarity,

LAbi,

Peyton Veitch

National Treasurer

re) GrantThornton

Forensic Review

Canadian Federation of Students

Summary Report

May 30, 2017

sanaudan Feceration of Susfeits Forensic Reviow

Gontidentia’

ay 30.2017

Introduction

for the Canadian Heder

and the Canadian Federation of Students $ (OCES.S"} colleerively Che edderaton")-

. i he Pederaion which

The work undoreaken was reatod 10 4 bank account ("the CIBC account") belonging t0 the F ses a

swas suspected te have heen misused, and the activities of which the Federation’s executive at the rime 3

aeadicors were tert made felly aware until mid-December 2014.

estemal forensic rev

as of concern:

The following were identified to us as pocential an

I. on funds deposited into the CIBC account were aot properly received or rece

tothe benefit

ss that wer

ration funds disbursed from the CIBC account were noc used for purpy

of the Federation:

3. The transactions through the CIBC account were conducted without the knowledge and approval of

lcratinn and were outside the aperating proceckures and governance structure

the executive of the

athe organization

od

4. The existence of the CIBC account and the transactions through it, were nut katown co the audiror,

thus possibly creating inaccuracies or incompleteness in the audits Far the periods concerned,

“The purpose af the forensic review was to determine the nature of the transactions in the CIBC account and

tw abtaia information concerning the activites of the individuals involved.

irane Thoraton issued # report dated January L4, 2016 which provided detailed information an the scope of

‘work and the results of thar work. This is a summary of that report and dies aut reflect any subsequent,

aulitional work

Procedures performed and records reviewed

Interviews

We conducted interviews with 16 i

on tke CIBC account.

Review of CIBC account #99-16133 records

juluals, peuple knows ar believed 1 have been connected to transactions

We conducted a review of all available documentation for CIBG account # 9916113 of the CE Jadingg

bank statements ane! transaction details for die CIBC account covering the period from its opening in July 2000

unl January 2115, “The documentation also included copies of supporting transaction related material

leporie slips, eapies af cheques deposited, debit memo ca bank draft rexuest forms, bank draft

copies. We conducted a source and use of funils analysis of the eransactions on the account,

Review of CFS and CFS-§ records and documentation,

We reviewed a number of records which icte provides by che CFS executive, including th following account

opening documencation, selected [secutive Committee minutes, staff and tected member liste,

correspondence relating te eeansactions and the parties invalved,

Digital evidence review

We frensiclly acquired images of tbree Apple iMac computers, atthe offices of the Federation. Using forensic

tools and metbodoloyies, we teviewal digital information on each of che maps computers w identify

additional rckant informacion, Specifically, we reviewed cml files, documene files, and messge files,

Research into original payors for deposits into the CIBC account

Canadian Federa

Contanen se teeaton of Students Forensic Reviow

May 30,2017

We

used a variety of in ‘

riety of information sources inchuling Federation records and public records to gather more

information rg : :

tie thew f teyardling the organizations that were the payors on che cheques depusited inte the CIBC account;

He. the source of funds deposited into the accoum).

Research into the recipients of funds disbursed from the CIBC account

We used a variety of information sources including Federation records and public records te gather more

information regarding the individuals and organizations that were the recipients of funds dishursedt from the

account,

Our Findings

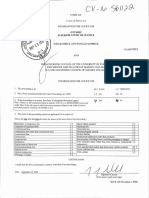

‘uur review idcatified 32 transactions on the account, consisting of 14 deposits aad 18 disbursements in addition

to interest and service charges ete. ‘The original payees on cheques deposiced into the account, and the

heneficiaries of payments our of ic were identitied and ate represented in the spreadsheet at Schedule |

‘The records pertaining te the CIBC account chat were provided by the hank did not contain any infisemarion

regarding the opening. of the account. The statements begin in July 2009 and indicate that the first deposit was

made on July 17,2009, We have reviewed a number of documents relating te the opening that were provided

tous by CPS and these have been verified

Review of secon opeutig decumetation

We reviewed documents that collect

¢ corroborate the information nbtained from the persons interviewed

which indicate that the CIBC account was set op as part of the Travel CUTS seceivership and sake, ‘They also

make clear thar the inital deposit of $1.6 million was specifically related to Travel CUTS, and was collateral for

Lecter of Credit in the same amount. ‘The documents also corroborate the involvement of three key

individuals in this pracess, one farmer officer and two former employees.

Phe Travel CUTS scary deposit autharized transactions

We have heen tk by persons interviewed, that the CIBC account was originally set up for the purpose of

providing s security deposit for a CFS-S subsidiary, Travel CUTS, in eelation to its debes with Moneris, ‘The

{um of $1.6 million seas placed into the xccount ss security /coliateral for a Letter of Credit taken out by Travel

CUTS during the period of its receivership soul subsequent sale, At che conclusion of the receivership

proceedings, the sum was returned to CFS-S, appaready with some interest. These stacements are carroboracel

bby other eleeteonie and documentary evidence, We have confirmed that the first these (authorized) transactions

in the CIBC account correspond with the details which we have been given regarding the Travel CUTS security

deposit.

(Our analysis indicates thar the account was apened in July 2009, and shae the initial deposit, of the sum of $1.6

rnillion from the Canadian Federation of Suudents-Services, was made on July 17, 2009, ‘There were two

subsequent disbursements ftom the account which appear to be related to the initial deposit according

evidence pravided in a number of the witness interviews.

These are as follows:

Debit memo to bank deaft ~ October 12, 200; $1.22:

1 6, QUIN: $374,468.22 (includes $368.22 in incerest)

Acthe conclusion of these theee authorized eransactions the account balance was $C.

Debit memo to bank draft — Ma

We have confirmed the decails af che Teavel CUTS receivership ehrough t

Office of the Superimendent of

Bankeuptey

Susequent, anunhoriged transactions on the CANC anconat

CCanselan Federation of Students Forensle Review

Confidential

‘ay 20. 2017

suri sit, which

‘The transactions which took place subsequent to the repayment of the Travel eel Oe See

was concluded on May 6, 2010, were outside the purpose for which the account hac ‘ion of the Federation

review has determined that they were not authorized and were noc brought to the aunerdon of ie Pee

management oF the respective Treasurers who were in office ducing the period Be ee

active. We have also been told that the existence of the accaunt and the unauthorized trans

‘Been brought to the attention of the auditor.

‘Our review identified the following unauthorized transactions which occurted after May 6, 2010:

The unauthorized depest of dived finde

14, rotalling

A series of 13 deposits were made into the account herween July 14, 2010 and March 25, 2014,

53263,052.80. These deposits appear ro have been nade at the Bank and Queen Branch of the CIBC in Oxtawa,

‘hich is a ten minute (eight block) walk from the CFS office at 338C Somerset Street,

Uneutharigad disbursements from the CIBC account

A series of 16 withdrawals were made from the account between July 15, 2010 and December 17, 2014, totaling

$262,776.13. The difference besween the unauthorized deposits and the subsequent unauthorized withdrawals

$279.67 is made up of account and other fees.

The final withdrawal, which took place on December 17, 2014, was in fact undertaken by the bank, which had

Cae 4 ft frome the CES office instructing thatthe accoune be closed and the remaining balance sent eo

CESin a date, This amour, $27,771.35, epresenting the final balance on that date, was withtawn asa deafe

wwe understand thar thesc funds have been returned to the Federation in a separate transaction, ‘The other 1

Vithdcawls cotalling $235,004.78 were macle vo atatal of 5 payees, Details ofthese transactions are at Schade

L

The closing of te CIBC asconnt

Our fining regarding transactions on the CIBC Accounts

1. The bank secords for the CIBC account indicate that it was ‘Opened on July 17, 2009 in the name of CFS.

Services, and was closed on December 47,2014,

2 The ist thee transactions on che account, a deposit of $1.6 millon on July 17,2009 and in subsequent

withdrawal in two installments on December. 10, 2009 and May 6, 2010, correlate with the details we have

‘these dee transactions were authorized and reflect che original purpose for which the Account was set up.

3+ Subsequently, a further 13 deposits and 16 disbursements were made on the CIBC account Priot to it being

Pesce These wansactions were not authorized or known of by the key exceusie members of the

Federation (the Chair, and the Treasurer) atthe time they occurred.

4 The 13 unauthorized deposits into che CIBC account all consis of fonds intended for diffetent parts of

the organization. ‘The funds included payments intended for services and advertising, refunds, return of

‘ecliness from law firms and payment relating to the national health plan as well ne mveay Payments for

eee

[SGnn Toman LF A Conan Seer of rr Then aap A At earn,

Canadian Fedration ofS

nrtion of Students Forensic Review

Confidential crensle Revi

May 30, 2097

Interastional Suudeat (D Cards. The

July 14, 2010 and March 25, 2014,

uhorized deposits totalled $263,052.80 and took place between

None of the former executives we have interviewed were aware of these additional funels being leper

inva the CIBC account. They have s1

this purpose and "

accounts at th

ed

id chat they did not know that the CIBC account was being used far

of the belief that all funds belonging to the Federation were deposited inte its

otia Bank. Two former utficers said that they had heen told of the account, but knew

fone of the specifics of either the account itself, or the details of the unauthorized transactions, Both claim

to have been told about the nature of the activities on the account at a strategie level only

‘The unauthorized disbursements made fram the CIBC account went to five recipients: two of whom, are

former employees of the Fedemtion, a further individual, one law firm and a consulting company. These

transactions, together with the closing transaction, bank fees, interest, etc, totalled $263,055.80.

Only peo former employees hav

6.

sddmitted being aware of unauthorized disbursements made from the

CIBC account. None of the other witnesses we have interviewed knesw of or approved the transactions.

“These witnesses have also stated that they were nor aware of and did aot authorize any transactions thac

svete not properly recorded in the accounts of the Federation. Many of them expressed surprise that “off

the bouk™ payments had been made an behalf of the Federation.

Our review id not validate what the recipients of the funds dispersed from the CIBC account did with the

money. Altheugh in some cases we were provided with a verbal explanation, we were not provided with

any supporting dacumentation or evidence and were not able to develop such

investigation,

9. The sp

cadsheet at

‘chedule | details all of the transactions that have hecn identified tur the CUBC account.

Restriction and Limitations

“This Summary Report was prepared in regards to che forensic review for the Federation, The Summary Report

is not te be used for any ather purpose and we specifically disclaim any responsibility for losses o¢ damages

incurred throuyh use of this Report for a purpose other than as described in this paragraph. tt showkd not be

reproduced in whole or in part withoue our express weitten permission, other than as required by you in relation,

to the above nuted intent.

We reserve the

fight, but will be under no obligation, to review and/ar revise the contents of this Report in

iglt of information which becomes known to us after the date of this Report,

‘Yours truly,

Grant Thornton LLP

ko

Ptr Greed

Jenhitce Fiddian Greet

CPA, CAIFA, (1

Parner

Sandy Boucher

BS¢, CF

Senior lavestigator

FL, CEE, CAMS

Inorder to protect the privacy af person involved, we have redacted the name> 2)

Schedule 1

Canadian Federation of Students Forensic Review

All Transactions In CIC Account Withdrawal !

Date Transaction epost ' te

wom Source / Rec Type _o8

‘Authorized Transactions 00

‘07/17/2009 Canaian Federation of Student Services Deposit 1,600,0004

09/18/2008. Interest Credit Memo 30822 os 00.00

2/10/2008 Canadian Federation of Student Services Bank Draft “974,268.22

95/06/2010 Canadian Federation of Student Services Bank Draft bibles

fatal Authorized Transactions 900,360.22 _1,800.968.22

‘Unauthorized Transactions

07/14/2010 Deposit / Corection Dep/Cor 29,805.20

07/14/2010 Deposit / Corection Dep/ Corr 29,805.20

07/44/2010 Walsh Wilkins Creighton LLP Deposit 29,747.86

07/14/2010 Purctator Courter Lid. Deposit aacr

‘07/18/2010 Former CFS-Quebec employes Bank Draft 25,000.00

10/18/2010 Howrey Client Escrow Account Deposit 4,872.76

10/21/2010 Exchange $USD. Service Fees 28.75

1411072010 Cartiied General Accountants Of Brtish Cohmbia Deposit 4,000.00

11/10/2010 Federation Of Post-Secondary Educators Of B.C. Deposit 3,000.00

11/10/2010 B.C. Goverment And Service Employees Union, Deposit 787.50

11/10/2010 District Realty Real Estate Trust Deposit 366.45,

102610 Evetest Restoration (Ottawa) Lid Deposit 225.00

14/12/2010 Former CFS-Quobec employee Bank Draft 17,500.00

022972011 Onlario Small Business Transition Support Deposit 1,000.00,

(02/23/2011 Momeau Sobeco Deposit 1,488.24

02/23/2011 Rights & Democracy Deposit 96457

(02/25/2011 Former employe Bank Draft 3,000.00

03/10/2011 Momeau Sobeco Deposit 188,874.32

(06/08/2011 Former employee Bank Draft 415,500.00

407272011 Brant Consulting Bank Draft 29,945.00

(01/19/2012 Clayton Ruby Professional Corp Trust Account Bonk Draft 125,000.00

2/0/2012 Former CFS-Quebec employee Bank Draft 25,000.00

(03/15/2012 Brock University Students’ Union Deposit 1,828.00

03/15/2012 International Student Identiy Card applicant Deposit 21.50

(03/18/2012 International Student Identity Card applicant Doposit 2150

03/45/2012 Intemational Studont Identity Card applicant Depasit 2150

03/5/2012 Intemational Student fdentity Card applicant Deposit 21.50

03/15/2012 Intemational Student tdentty Card applicant Deposit 2150

03/15/2012 Intemational Student Identity Card applicant Deposit 21.80

(03/15/2012 Unknown / Missing Deposit 43.00

04/24/2012 Brant Consulting ‘Bank Draft 9,800.00

(04/302012 Clayton Ruby Professional Corp Trust Account Bank Oratt 16.000,00

(09/28/2012 Bank Draft - No Name Deposit 20.00

(09/26/2012 Bank Draft - No Name Ooposit 20.00

40/16/2012 Claytan Ruby Professional Corp Trust Account Bank Draft 40,000.00

Contsenita

Page 1082

SHMINEEO PrOIECt the privacy of person involved, we have redactes the names of individuals from this schedule

Privacy of perso

Ganadian Federation of Students Forensit Review ‘Schedule 4

All Transactions in CIBC Account :

Marr) Transaction Deposit? ‘Withdrawal

Source / Recipient Credit

10/16/2012 Former CFS-Cuebec employes Bank Draft moe

C¥15i2013 Intemational Student Klensity Card applicent Dopost ao

01/15/2013 Intemational Student Identity Card applicant Deposit iene

01/16/2013 Intemational Student Identity Gard applicant Deposit on

01/15/2013 Intemational Student Identity Card applicant Deposit an

01/15/2013 Intemational Student Idantity Card applicant Deposit za09

0115/2013 Bank Draft- No Name Deposit

o1rs2013 Federation Des Etudiants Et Etudiates DuCenve ——nyaoga 799.00

Universitaire De Moncton nde 5,350.78

02/04/2013 Clayton Ruby Professional Corp Trust Account Bank Drak 1,000.00

02/04/2013 Former employee ; om Dra ae

04/26/2013 Intemational Student Identity Card applicant enn6

04/25/2013 Intemational Student Identity Card applicant Deposit za00

04/25/2013 International Student Identity Card applicant oerest ae

04/26/2013 Intemational Student Identity Card applicant Depost 2180

04/26/2013 International Student Identity Card applicant ets a150

04/25/2013 Intemational Student Identity Card applicant ped

(04/25/2013 International Student Identity Card applicant Deposit 2150

04/28/2013 _Internaliona! Student Identity Card applicant rosie wae

04/25/2013 Gowlings Lip . . 41.36.20

06/18/2013 Tarace 8 Distt Community Sendcas Socity Deposit 8820

06/18/2013 International Student Identity Card, apphican| Deposit 5506

06/18/2013 Intemational Student Identity Card @pplicant Deposit o00

(06/18/2013 International Student Identity Card applicant om nee

06/18/2013 Intemational Student identity Card applicant it 2000

06/18/2013 Intemational Student! Identity Card ee Deposit 2000

06/18/2013 International Student Identity Card applicar onset oe

06/48/2013 International Student Identity Card applicant Enea aaa

06/18/2013 International Student identity Card applicant Come a

12/12/2013 Loyalist Cotege Eon =a

12/12/2013 DomainPeople Inc. fovea aan

12/12/2013 Former employes Bark Ort s4ooe0

12/12/2013 Former employee Deposit 47,033.00

03/25/2014 Gowlings LLP a 33.00

03/25/2014 Canada Post Fea ae

03/25/2014 Bank oan x ale becoa eed

14 Bank Draft = No Nama annas

‘asia Carns coven er toi Seve esi Mero a0

01/14/2015 Credit Memo acl soe

various Service Fees (57 transactions) ee cust Gace)

07/14/2010 Deposit / Correction

263,055.80 263,055.80

[otal All Transactions 1,065,42402 1,863,424.02]

fotal A Trat

Das könnte Ihnen auch gefallen

- Full Memorandum of Agreement - CUPE 3902, Unit 1Dokument91 SeitenFull Memorandum of Agreement - CUPE 3902, Unit 1The VarsityNoch keine Bewertungen

- CFS Bank Account Summary ReportDokument9 SeitenCFS Bank Account Summary ReportThe VarsityNoch keine Bewertungen

- UTSU/Memmel Statement of DefenceDokument6 SeitenUTSU/Memmel Statement of DefenceThe VarsityNoch keine Bewertungen

- Open Letter To President Gertler On Hate Speech On CampusDokument3 SeitenOpen Letter To President Gertler On Hate Speech On CampusThe VarsityNoch keine Bewertungen

- Kobrick v. Massey College Statement of ClaimDokument11 SeitenKobrick v. Massey College Statement of ClaimThe VarsityNoch keine Bewertungen

- Amended Statement of ClaimDokument21 SeitenAmended Statement of ClaimThe VarsityNoch keine Bewertungen

- Amended Statement of ClaimDokument21 SeitenAmended Statement of ClaimThe VarsityNoch keine Bewertungen

- Callaghan - Reply and Defence To CounterclaimDokument7 SeitenCallaghan - Reply and Defence To CounterclaimThe VarsityNoch keine Bewertungen

- Callaghan - Statement of ClaimDokument11 SeitenCallaghan - Statement of ClaimThe VarsityNoch keine Bewertungen

- Letter To J Peterson - Oct3Dokument2 SeitenLetter To J Peterson - Oct3The Varsity100% (1)

- Letter To J. Peterson - 18oct2016Dokument3 SeitenLetter To J. Peterson - 18oct2016The Varsity50% (4)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)