Beruflich Dokumente

Kultur Dokumente

Cash Budget Model Cash Budget Model - Case Study: Inflows

Hochgeladen von

ayu nailil kiromahOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Cash Budget Model Cash Budget Model - Case Study: Inflows

Hochgeladen von

ayu nailil kiromahCopyright:

Verfügbare Formate

Scroll down Cash Budget Model

Cash Budget Model - Case Study BRIGHTER BATTERIES PTY LTD. Scroll down

Scroll down BRIGHTER BATTERIES PTY LTD.

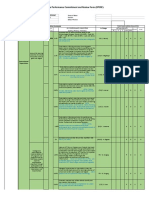

SALES COLLECTIONS: CASH BUDGET 20AD/AE

b) The following actual and budgeted financial data is for the

business of: BRIGHTER BATTERIES PTY LTD. For the years 20AD/AE MONTH OF SALE: 0.5

FIRST MONTH AFTER: 0.3 JAN FEB MAR

SECOND MONTH AFTER: 0.15

INFLOWS:

NOV DEC JAN FEB MAR NOV DEC JAN FEB MAR

Cash Sales 26,000 26,000 34,000

$ $ $ $ $ Account sales 160,000 180,000 150,000 158,000 190,000 Account sales collections 153,000 151,000 164,900

Cash Sales 20,000 24,000 26,000 26,000 34,000 Collections:

Account Sales 160,000 180,000 150,000 158,000 190,000 Month of sale: 75,000 79,000 95,000

Account Purchases 50,000 50,000 50,000 60,000 40,000 First after: 54,000 45,000 47,400 TOTAL MONTHLY INFLOW: 179,000 177,000 198,900

Wages 50,000 38,000 34,000 60,000 60,000 Second after: 24,000 27,000 22,500

Overhead Expenses 18,000 16,000 14,000 24,000 24,000 OUTFLOWS

Account sales collections 153,000 151,000 164,900

Payments to Accs Payable: 48,500 48,500 58,200

CASH SALES: Overhead payments 9,000 19,000 19,000

1) Sales collections from debtors are typically as follows: Cash Sales 26,000 26,000 34,000 Wages cash outlay: 34,000 60,000 60,000

Back to Index Tax Payable 70,000

In the month of sale: 50.00% Scroll down Loan Repayments 60,000

In the first month after month of sale: 30.00% Payments to Accounts Payable New Machine 160,000

In the second month after month of sale: 15.00%

Paid in month after sale.

Discount taken: 3.00% TOTAL MONTHLY OUTFLOW: 91,500 357,500 197,200

2) Materials purchased are paid for in the month after Acc Purchases 50,000 50,000 50,000 60,000 40,000 Back to Index

purchase. A discount is taken at: 3.00%

Payments to Accs Payable: 48,500 48,500 58,200

3) Direct labour costs are paid for during the month in

which they are incurred. OVERHEAD EXPENSES:

Overheads: 18,000 16,000 14,000 24,000 24,000

4) Monthly overhead expenses include depreciation: $5,000

The cash flow from these expenses occurs during the Depreciation content: 5,000 per month

month in which they are incurred.

Overhead payments 9,000 19,000 19,000

5) A tax assessment is payable in February: $70,000

WAGES:

6) A new machine is needed in February: $160,000

Wages cash outlay: 34,000 60,000 60,000

7) The last of five annual loan repayments is due

in March: $60,000

8) The company has a policy of maintaining a bank

balance of $80 000 at the end of each month: $80,000 OTHER ISSUES: Scroll down

Excess funds are lent at call. Financing Plan

These invested funds are added to Tax Payable $70,000

or withdrawn as necessary on the last day of the Loan Repayments $60,000 To finance the shortfall in February and March:

month. At the end of December this requirement was New Machine $160,000

satisified. Tax Committment: Short term funds.

Maintained Account balance: $80,000

Funds invested at call on December 31: $10,000 Back to index Refinancing: Consider a roll over on permanent financing

New equipment: Finance long term to match useful life.

Instructions:

The financial manager has used the information to prepare a

budget for cash receipts and payments for January to March.

The budget shows all movements in the investment of

excess funds or recommended financing of deficiencies. Cash Balances

JAN FEB MAR

Discuss how this business might finance any Monthly Surplus (Deficit) 87,500 -180,500 1,700

short term deficiencies of funds which you have Opening Bank Balance 80,000 80,000 80,000

identified.

Funds available 167,500 -100,500 81,700

Back to index Loans redeemed/(placed) ($87,500) $180,500 ($1,700)

Bank Balance $ 80,000 $ 80,000 $ 80,000

Investment/borrowing balances

Funds Invested/(Borrowed)

Opening Balance $10,000 97,500 -83,000

Trans from/(to) Cheque Acc 87,500 -180,500 1,700

Closing balance $ 97,500 $ (83,000) $ (81,300)

Back to index

366972035.xls Page 1

Das könnte Ihnen auch gefallen

- Schedule of Duties and Professional Charges For Quantity SurveyingDokument4 SeitenSchedule of Duties and Professional Charges For Quantity SurveyingJared MakoriNoch keine Bewertungen

- Spreadsheet Modeling Ted and AliceDokument10 SeitenSpreadsheet Modeling Ted and AliceabhishekNoch keine Bewertungen

- Group: Industry: No. of CompaniesDokument14 SeitenGroup: Industry: No. of CompaniesaisinfoNoch keine Bewertungen

- 2012 International MBA Offer Compilation - Overview Instructions - 2013 Multi-MBA School International Opportunities ListDokument20 Seiten2012 International MBA Offer Compilation - Overview Instructions - 2013 Multi-MBA School International Opportunities ListSeokho SeoNoch keine Bewertungen

- Financial Budget Example: White Cells Are AdjustableDokument5 SeitenFinancial Budget Example: White Cells Are AdjustableImperoCo LLCNoch keine Bewertungen

- E1-VCP Mapping 2011-01-12 AIA 3 1 ReleaseDokument827 SeitenE1-VCP Mapping 2011-01-12 AIA 3 1 Releasesamcarte_Noch keine Bewertungen

- Just Some BlingDokument5 SeitenJust Some BlingRamesh RadhakrishnarajaNoch keine Bewertungen

- Thacher State Park Final Master PlanDokument28 SeitenThacher State Park Final Master PlanalloveralbanyNoch keine Bewertungen

- Creditors/Debtors Age AnalysisDokument2 SeitenCreditors/Debtors Age Analysishmi_pk100% (2)

- SubcontractingDokument18 SeitenSubcontractingAamir MansuriNoch keine Bewertungen

- PNB Process NoteDokument36 SeitenPNB Process NotePawan BagrechaNoch keine Bewertungen

- Personal Life Map Portfolio Fall 2018Dokument236 SeitenPersonal Life Map Portfolio Fall 2018Ian KelsoNoch keine Bewertungen

- All Schemes Half Yearly Portfolio - As On 31 March 2020Dokument1.458 SeitenAll Schemes Half Yearly Portfolio - As On 31 March 2020anjuNoch keine Bewertungen

- CMA DataDokument127 SeitenCMA DatageetaNoch keine Bewertungen

- Absa Budget PlannerDokument7 SeitenAbsa Budget PlannerShiva IyerNoch keine Bewertungen

- Sales & Revenue Dashboard: October 2012Dokument4 SeitenSales & Revenue Dashboard: October 2012Ramesh RadhakrishnarajaNoch keine Bewertungen

- RUP Informacion de ArtefactosDokument39 SeitenRUP Informacion de ArtefactosJorge Luis Idiaquez HigaNoch keine Bewertungen

- Hotel's Room RateDokument9 SeitenHotel's Room RatebeeanaclarissaNoch keine Bewertungen

- Sales PlanDokument26 SeitenSales Plansaurabh323612Noch keine Bewertungen

- Cma of HostelDokument128 SeitenCma of HostelkolnureNoch keine Bewertungen

- Boq Rev 1Dokument68 SeitenBoq Rev 1roberto cabreraNoch keine Bewertungen

- BillDokument31 SeitenBillGamitha LakshanNoch keine Bewertungen

- Financial Analysis of Nestle LTDDokument43 SeitenFinancial Analysis of Nestle LTDShahbaz AliNoch keine Bewertungen

- Cost Estimation BundDokument46 SeitenCost Estimation Bundmohan890Noch keine Bewertungen

- Construction of 10 Bedded Hospital at Chipurson Gojal Hunza.Dokument45 SeitenConstruction of 10 Bedded Hospital at Chipurson Gojal Hunza.qazalbash1109588Noch keine Bewertungen

- Tati Nomination FormsDokument16 SeitenTati Nomination FormsAl Manar PetroleumNoch keine Bewertungen

- Business Application System Development, Acquisition, Implementation, and MaintenanceDokument111 SeitenBusiness Application System Development, Acquisition, Implementation, and MaintenanceSudhir PatilNoch keine Bewertungen

- PRM Self Assessment ToolDokument26 SeitenPRM Self Assessment ToolBinson VargheseNoch keine Bewertungen

- Break-Even Visualizer TemplateDokument4 SeitenBreak-Even Visualizer TemplateAnnaNoch keine Bewertungen

- Cash Flow StatementDokument6 SeitenCash Flow StatementLakshya BatraNoch keine Bewertungen

- IC Construction Project Budget 11292Dokument8 SeitenIC Construction Project Budget 11292Muhammad FarooqNoch keine Bewertungen

- Sadguru Construction Cma 16-17 To 2020-21Dokument8 SeitenSadguru Construction Cma 16-17 To 2020-21vdtaudit 1Noch keine Bewertungen

- Qarghayi ANP EstimationDokument4 SeitenQarghayi ANP Estimationiqbal safiNoch keine Bewertungen

- Emperor - Financial Model - 5 8 15 1Dokument55 SeitenEmperor - Financial Model - 5 8 15 1api-301355911Noch keine Bewertungen

- Tender EvaluationDokument1 SeiteTender EvaluationpradeepNoch keine Bewertungen

- Investment Analysis - Project ReportDokument15 SeitenInvestment Analysis - Project ReportChirag PatelNoch keine Bewertungen

- Budget Vs Actual Spreadsheet TemplateDokument6 SeitenBudget Vs Actual Spreadsheet TemplateGolamMostafaNoch keine Bewertungen

- Untitled SpreadsheetDokument816 SeitenUntitled SpreadsheetrakhalbanglaNoch keine Bewertungen

- Financial Feasibility of Product ADokument4 SeitenFinancial Feasibility of Product AMuhammad AsadNoch keine Bewertungen

- Mixed Use JK PDFDokument9 SeitenMixed Use JK PDFAnkit ChaudhariNoch keine Bewertungen

- Product CostingDokument8 SeitenProduct CostingHitesh RawatNoch keine Bewertungen

- Property Info: Operation CostsDokument2 SeitenProperty Info: Operation CostsKilogram LossNoch keine Bewertungen

- Responsibility MatrixDokument1 SeiteResponsibility MatrixAzeemNoch keine Bewertungen

- Office Performance Commitment and Review Form (OPCRF) : Olgrethil L. CamongayDokument10 SeitenOffice Performance Commitment and Review Form (OPCRF) : Olgrethil L. CamongayOlgrethil CamongayNoch keine Bewertungen

- Financial Decision Making ExercisesDokument57 SeitenFinancial Decision Making Exercisescvilalobos198527100% (1)

- Mapping New Expert-KEUDokument37 SeitenMapping New Expert-KEUApdev OptionNoch keine Bewertungen

- Final DisertationDokument27 SeitenFinal DisertationSumana DuttaNoch keine Bewertungen

- Investment Analysis Square PharmaDokument62 SeitenInvestment Analysis Square PharmaFaraz SjNoch keine Bewertungen

- Cash Flow Forecast ADokument7 SeitenCash Flow Forecast Am qaiserNoch keine Bewertungen

- Project ReportDokument16 SeitenProject Reportmaxaryan0% (1)

- Composting CalculationsDokument17 SeitenComposting Calculationswilsonbravo30Noch keine Bewertungen

- IPTC CMA Bank FormatDokument12 SeitenIPTC CMA Bank FormatRadhesh BhootNoch keine Bewertungen

- FormworksDokument94 SeitenFormworksLouie Zavalla LeyvaNoch keine Bewertungen

- SCCDDokument10 SeitenSCCDG.RameshNoch keine Bewertungen

- Update Project Control Sheet PT Sekman Wisata 27 April 2020Dokument27 SeitenUpdate Project Control Sheet PT Sekman Wisata 27 April 2020dedy suryaNoch keine Bewertungen

- Contract Summary-UpdatedDokument6 SeitenContract Summary-UpdatedCristy EvangelistaNoch keine Bewertungen

- Micro Eportfolio Competition Spreadsheet Data-Fall 18Dokument4 SeitenMicro Eportfolio Competition Spreadsheet Data-Fall 18api-334921583Noch keine Bewertungen

- Answer Key Materi 1 UtsDokument10 SeitenAnswer Key Materi 1 UtsKusuma Aji SuryaNoch keine Bewertungen

- Andluru Naga Muneswar Reddy Payslip Aug 2022Dokument1 SeiteAndluru Naga Muneswar Reddy Payslip Aug 2022ykeerthisharanNoch keine Bewertungen

- Assignment TwoDokument10 SeitenAssignment TwoTeke TarekegnNoch keine Bewertungen

- Biaya ModalDokument42 SeitenBiaya Modalayu nailil kiromahNoch keine Bewertungen

- Gading Putra, Ud April 2023Dokument3 SeitenGading Putra, Ud April 2023ayu nailil kiromahNoch keine Bewertungen

- 2019 Kusub BlimGuDokument159 Seiten2019 Kusub BlimGuayu nailil kiromahNoch keine Bewertungen

- Ayu Nailil Kiromah - Tugas 8Dokument3 SeitenAyu Nailil Kiromah - Tugas 8ayu nailil kiromahNoch keine Bewertungen

- ID Aplikasi Penerapan Metode Neural NetworkDokument14 SeitenID Aplikasi Penerapan Metode Neural Networkayu nailil kiromahNoch keine Bewertungen

- Audit Sampling and Other Selective Testing ProceduresDokument35 SeitenAudit Sampling and Other Selective Testing ProceduresGabriellaNoch keine Bewertungen

- Lecture 8 - DRPDokument40 SeitenLecture 8 - DRPayu nailil kiromah0% (1)

- Chapter 004 Managerial Accounting-Hilton-2nd Edition SolutionsDokument54 SeitenChapter 004 Managerial Accounting-Hilton-2nd Edition SolutionsMuhammed GhazanfarNoch keine Bewertungen

- Kocakulah ACCT315001 Fall15Dokument6 SeitenKocakulah ACCT315001 Fall15ayu nailil kiromahNoch keine Bewertungen

- Kel 3 - Shariah Compliance Parameter - Saiful AzharDokument15 SeitenKel 3 - Shariah Compliance Parameter - Saiful Azharayu nailil kiromahNoch keine Bewertungen

- Fm10 Op and Fin LeverageDokument63 SeitenFm10 Op and Fin Leverageayu nailil kiromahNoch keine Bewertungen

- ID Perencanaan Stratejik Sistem Informasi DDokument18 SeitenID Perencanaan Stratejik Sistem Informasi Dayu nailil kiromahNoch keine Bewertungen

- Ch01 6e Slutions HoyleDokument46 SeitenCh01 6e Slutions Hoyleayu nailil kiromahNoch keine Bewertungen

- Chapter 5Dokument12 SeitenChapter 5ayu nailil kiromahNoch keine Bewertungen

- Manafort Govt Exhibit ListDokument24 SeitenManafort Govt Exhibit ListStephen LoiaconiNoch keine Bewertungen

- Financial Inclusion Bank of Baroda: Summer Training Project ReportDokument102 SeitenFinancial Inclusion Bank of Baroda: Summer Training Project ReportHashmi SutariyaNoch keine Bewertungen

- Annulment of MortgageDokument3 SeitenAnnulment of MortgagenaziyrNoch keine Bewertungen

- Legal Scrutiny ReportDokument8 SeitenLegal Scrutiny ReportUñkñøwñ ÃrtstNoch keine Bewertungen

- For Booking EnquiriesDokument12 SeitenFor Booking EnquiriesMonish MNoch keine Bewertungen

- iIIR - SHASHI PRABHADokument5 SeiteniIIR - SHASHI PRABHAprashashiNoch keine Bewertungen

- Assignment Assumption and Recognition Agreement UBS IndymacDokument10 SeitenAssignment Assumption and Recognition Agreement UBS IndymacTBNoch keine Bewertungen

- Union Bank V TiuDokument6 SeitenUnion Bank V TiuPepper TzuNoch keine Bewertungen

- Balance Transfer From Last Month Salary Amount in Hand OthersDokument3 SeitenBalance Transfer From Last Month Salary Amount in Hand OthersJithin RoyNoch keine Bewertungen

- EAR&APRDokument3 SeitenEAR&APRAndy JbNoch keine Bewertungen

- Tongoy vs. CA, 123 SCRA 99Dokument12 SeitenTongoy vs. CA, 123 SCRA 99DNAANoch keine Bewertungen

- Case Studyon Capital Structure Analysisof SAILDokument22 SeitenCase Studyon Capital Structure Analysisof SAILAritra MukherjeeNoch keine Bewertungen

- SSS Ira Version EditedDokument52 SeitenSSS Ira Version EditedOscar E ValeroNoch keine Bewertungen

- Marine InsuranceDokument27 SeitenMarine Insuranceabdulkiam67% (3)

- Problem Solving Using Programmed SolutionsDokument2 SeitenProblem Solving Using Programmed SolutionsAyu Wulandari100% (1)

- Partnership Cases Part 1Dokument17 SeitenPartnership Cases Part 1Alvin JohnNoch keine Bewertungen

- Articles of AgreementDokument2 SeitenArticles of AgreementMd Rajikul IslamNoch keine Bewertungen

- The Interaction of Contract Law and Tort and Property Law in Europe A Comparative StudyDokument574 SeitenThe Interaction of Contract Law and Tort and Property Law in Europe A Comparative StudyIrma Rahmanisa75% (4)

- Jay CVDokument3 SeitenJay CVJay UdeshiNoch keine Bewertungen

- GSIP BrochureDokument2 SeitenGSIP Brochureabdul.nm4064Noch keine Bewertungen

- College Algebra Quick ReferDokument2 SeitenCollege Algebra Quick Refertxungo100% (1)

- Don Coxe Basic Points Two Days After Hallowe'en 101310Dokument51 SeitenDon Coxe Basic Points Two Days After Hallowe'en 101310B_U_C_KNoch keine Bewertungen

- Loan Calculator With Extra PaymentsDokument2.415 SeitenLoan Calculator With Extra PaymentsRst BruneiNoch keine Bewertungen

- Islamic FinancingDokument1 SeiteIslamic FinancingMicheal WorthNoch keine Bewertungen

- Dabor 01Dokument2 SeitenDabor 01Mark ChristiansonNoch keine Bewertungen

- Ip NewDokument17 SeitenIp NewNiket Gandhir88% (8)

- HP-12C Solutions HandbookDokument165 SeitenHP-12C Solutions Handbookjfvegaya100% (1)

- Iso-885dfdfd9-1 - Time Value of Money 2Dokument33 SeitenIso-885dfdfd9-1 - Time Value of Money 2kdfohasfowdeshNoch keine Bewertungen

- BPI Family Savings Bank V Golden Power Diesel SaleDokument3 SeitenBPI Family Savings Bank V Golden Power Diesel SaleJaz SumalinogNoch keine Bewertungen

- Shipinvest4004 Introduction - Executive VersionDokument30 SeitenShipinvest4004 Introduction - Executive VersionDPR007Noch keine Bewertungen