Beruflich Dokumente

Kultur Dokumente

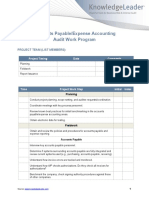

Audit Matrix Program - Revenue Cycle Review Test Area: Invoicing

Hochgeladen von

Anupam Srivastava0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

114 Ansichten3 SeitenThis document outlines an audit matrix program for reviewing a company's revenue cycle. It examines controls and procedures around the invoicing process, including accuracy of invoices, exception reporting, and summary billing. The matrix tests specific control procedures at the business unit level and documents the background information, conclusions, and work paper status for each. Areas looked at include general invoice processing, summary billing accuracy, and identifying best practices or process improvements.

Originalbeschreibung:

Originaltitel

Amp Invoicing

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis document outlines an audit matrix program for reviewing a company's revenue cycle. It examines controls and procedures around the invoicing process, including accuracy of invoices, exception reporting, and summary billing. The matrix tests specific control procedures at the business unit level and documents the background information, conclusions, and work paper status for each. Areas looked at include general invoice processing, summary billing accuracy, and identifying best practices or process improvements.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

114 Ansichten3 SeitenAudit Matrix Program - Revenue Cycle Review Test Area: Invoicing

Hochgeladen von

Anupam SrivastavaThis document outlines an audit matrix program for reviewing a company's revenue cycle. It examines controls and procedures around the invoicing process, including accuracy of invoices, exception reporting, and summary billing. The matrix tests specific control procedures at the business unit level and documents the background information, conclusions, and work paper status for each. Areas looked at include general invoice processing, summary billing accuracy, and identifying best practices or process improvements.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

Contributed September 4, 2002 by SKohl@hagemeyerna.

com

Audit Matrix Program – Revenue Cycle Review

Test Area: Invoicing

Risk Level Status

L = Low E=Enterprise D = Done

M = Medium S=Site N = Not Applicable

H = High B=Business Unit S = Scoped Out

Risk: H

Control Objectives:

1. Invoicing– Ensure procedures are in place for accuracy and completeness of the customer invoicing process

2. Reporting – Ensure that exception reports are reviewed for effective management of issue resolution

3. Summary Billing – Review accuracy of summary billing processes based on the standard operating procedures in place

Test Test / Control Procedures Background Information Control Conclusion W/P

Level (Procedures in Place, Reports (Control Met or Status/Ref

Used, and Control Owners) Action Plans and Due Date)

B A.) General Processing

1. Document and review procedures in place for

accuracy and completeness of the customer

invoicing process (automated and manual).

Include the use of prenumbered invoices, reports

used by management for processing exceptions

and procedures in place for effective review and

monitoring of the invoicing process.

Contributed September 4, 2002 by SKohl@hagemeyerna.com

Test Test / Control Procedures Background Information Control Conclusion W/P

Level (Procedures in Place, Reports (Control Met or Status/Ref

Used, and Control Owners) Action Plans and Due Date)

2. Discuss and document controls in place for

mitigating invoice duplication, shipments not

billed and unprocessed invoicing. Include

exception reporting used by management, i.e.

shipped not billed and open sales order reports.

3. Document and review sale/invoice journal

reconciliations to the G/L. Include procedures in

place and management review.

4. Discuss and note differences related to the

invoicing process related to service revenue

streams.

5. Discuss and document controls in place for

capturing all sales for invoicing. Include

exception reports used by management and

controls in place to ensure invoicing is

accounted for in the proper period..

6. Discuss and document controls in place to

ensure invoice pricing and tax rates agree with

original sales quote/order.

B B.) Summary Billings

1. Review and document procedures in place for

the summary billings process. Include

arrangements and agreements with customers,

manual and/or automated processing, timeliness,

accuracy, deferred revenue and coding of

invoices to the G/L and market segments.

2. Discuss and document controls in place to ensure

summary billings are issued and accounted for in

the proper period.

Contributed September 4, 2002 by SKohl@hagemeyerna.com

Test Test / Control Procedures Background Information Control Conclusion W/P

Level (Procedures in Place, Reports (Control Met or Status/Ref

Used, and Control Owners) Action Plans and Due Date)

3. Discuss and document controls in place to ensure

summary billing pricing agrees with original

sales quote/order.

B C.) Other Procedures

1. Review and document other procedures,

processes and controls related to the

invoicing process.

B D.) Best Practices/Process Improvements

1. Document best practices/ process

improvements, i.e. process efficiencies shared

and/or identified related to master data.

Das könnte Ihnen auch gefallen

- Sample Management Letter PointsDokument3 SeitenSample Management Letter PointsSummerrr33% (3)

- CIS ReportDokument10 SeitenCIS ReportMarieNoch keine Bewertungen

- Accounts Receivables Collections Work ProgramDokument6 SeitenAccounts Receivables Collections Work ProgramVassilis Bakalis0% (1)

- Auditing and Assurance Services 16th Edition Arens Solutions ManualDokument28 SeitenAuditing and Assurance Services 16th Edition Arens Solutions Manualgloriaelfleda9twuoe100% (20)

- Windrum y Koch Innovation in Public Sector Services - Entrepreneurship, Creativity and ManagementDokument265 SeitenWindrum y Koch Innovation in Public Sector Services - Entrepreneurship, Creativity and ManagementjuanNoch keine Bewertungen

- Data Governance CharterDokument3 SeitenData Governance Charterenrilei100% (2)

- Audit Matrix Program - Revenue: Test Area: Management ReportingDokument4 SeitenAudit Matrix Program - Revenue: Test Area: Management ReportingtgaNoch keine Bewertungen

- Audit Perwira Mahardika 023001800049Dokument4 SeitenAudit Perwira Mahardika 023001800049Mahardika PerwiraNoch keine Bewertungen

- Materi Test of ControlDokument66 SeitenMateri Test of ControlIntan100% (1)

- Bab 1-Audit Approach P.pointDokument17 SeitenBab 1-Audit Approach P.pointAslamaitulakma MohamadNoch keine Bewertungen

- APG - Process Review SampleDokument1 SeiteAPG - Process Review SampleDen Te FloresNoch keine Bewertungen

- ACCT3101 期末双面notes (双面打印,每面8页,必须彩印)Dokument18 SeitenACCT3101 期末双面notes (双面打印,每面8页,必须彩印)Stephanie XieNoch keine Bewertungen

- Internal Audit Program Accounts Receivable/Credit & Collections ReviewDokument5 SeitenInternal Audit Program Accounts Receivable/Credit & Collections ReviewIrwansyah IweNoch keine Bewertungen

- ENTR 20083 - Module 1Dokument6 SeitenENTR 20083 - Module 1Mar Jonathan FloresNoch keine Bewertungen

- 9.401 Auditing: The Study of Internal Control and Assessment of Control RiskDokument30 Seiten9.401 Auditing: The Study of Internal Control and Assessment of Control RiskShalin LataNoch keine Bewertungen

- System Audit FrameworkDokument6 SeitenSystem Audit FrameworkGaurav sabooNoch keine Bewertungen

- Substantive Testing, Computer Audit Techniques and Audit ProgrammesDokument46 SeitenSubstantive Testing, Computer Audit Techniques and Audit ProgrammesJeklin LewaneyNoch keine Bewertungen

- Ais3 NotesDokument26 SeitenAis3 NotesHatdogNoch keine Bewertungen

- AUDITING TECHNIQUES AND INTERNAL AUDIT NotesDokument26 SeitenAUDITING TECHNIQUES AND INTERNAL AUDIT NotesGopti EmmanuelNoch keine Bewertungen

- Unit 14 Internal Controls - Controls and Security MeasuresDokument35 SeitenUnit 14 Internal Controls - Controls and Security Measuresestihdaf استهدافNoch keine Bewertungen

- Chapter 12 Audit ProceduresDokument8 SeitenChapter 12 Audit ProceduresRichard de LeonNoch keine Bewertungen

- Chapter 12 Audit Procedures - ppt179107590Dokument8 SeitenChapter 12 Audit Procedures - ppt179107590Clar Aaron BautistaNoch keine Bewertungen

- Competency Standard: Transactions May IncludeDokument7 SeitenCompetency Standard: Transactions May IncludeLarisa BestocaNoch keine Bewertungen

- Bba H 4th-Cor. Auduting Test Checking - by DR - Kaynat TawarDokument12 SeitenBba H 4th-Cor. Auduting Test Checking - by DR - Kaynat TawarsasmallulusitakantNoch keine Bewertungen

- Tecnical Topic On System Audit FrameworkDokument9 SeitenTecnical Topic On System Audit FrameworkManishaNoch keine Bewertungen

- Audit PlanningDokument21 SeitenAudit Planningablay logeneNoch keine Bewertungen

- Auditing Summary Last PartDokument3 SeitenAuditing Summary Last PartPinky RoseNoch keine Bewertungen

- Data Integrity TemplateDokument4 SeitenData Integrity TemplateboygarfanNoch keine Bewertungen

- Solution Aud589 - Dec 2015Dokument7 SeitenSolution Aud589 - Dec 2015LANGITBIRUNoch keine Bewertungen

- At 04 Auditing PlanningDokument8 SeitenAt 04 Auditing PlanningJelyn RuazolNoch keine Bewertungen

- Example Audit Program 2017Dokument24 SeitenExample Audit Program 2017Hans DovonouNoch keine Bewertungen

- Section 404 Audits of Internal Control and Control RiskDokument36 SeitenSection 404 Audits of Internal Control and Control RiskAbdifatah Abdilahi100% (2)

- BKAA2013 Answer A182 2019 StudentDokument7 SeitenBKAA2013 Answer A182 2019 StudentJoNoch keine Bewertungen

- Audit Procures On Income Statements and PayrollDokument32 SeitenAudit Procures On Income Statements and PayrollAlex SemusuNoch keine Bewertungen

- CH 10Dokument4 SeitenCH 10Minh Thu Võ NgọcNoch keine Bewertungen

- Acctg 14Dokument25 SeitenAcctg 14MirasolamperNoch keine Bewertungen

- LS 3.00 - PSA 330 Auditor's Response To Assessed RiskDokument5 SeitenLS 3.00 - PSA 330 Auditor's Response To Assessed RiskSkye LeeNoch keine Bewertungen

- Chapter 2 Business Processes - CompressDokument3 SeitenChapter 2 Business Processes - CompressAlexxa DiazNoch keine Bewertungen

- ACCT460: Principles of AuditingDokument3 SeitenACCT460: Principles of AuditingsmaNoch keine Bewertungen

- U-Ap-2 - Other IncomeDokument3 SeitenU-Ap-2 - Other IncomeJoann Saballero HamiliNoch keine Bewertungen

- Accounts PayableExpense Accounting Audit Work ProgramDokument4 SeitenAccounts PayableExpense Accounting Audit Work Programbob2nkongNoch keine Bewertungen

- Module 2 For Acctg 3119 - Auditing and Assurance PrinciplesDokument57 SeitenModule 2 For Acctg 3119 - Auditing and Assurance PrinciplesAdeline DelveyNoch keine Bewertungen

- Problem 10-16, Page 331: RequiredDokument7 SeitenProblem 10-16, Page 331: RequiredJeric TorionNoch keine Bewertungen

- Audit PlanDokument6 SeitenAudit Plansyedumarahmed52Noch keine Bewertungen

- Applied Auditing Overview 2021Dokument6 SeitenApplied Auditing Overview 2021Shr BnNoch keine Bewertungen

- Pertemuan IV Minggu, 3 Februari 2019. Maulina Dyah Permatasari, SE., MAK., Ak., CA., SASDokument50 SeitenPertemuan IV Minggu, 3 Februari 2019. Maulina Dyah Permatasari, SE., MAK., Ak., CA., SASDiana Rosma Dewi100% (1)

- AS 16 Borrowing Cost FinalDokument21 SeitenAS 16 Borrowing Cost FinalNilesh MandlikNoch keine Bewertungen

- Accounts Receivable - Credit & Collections Audit Program - Auditor Exchange PDFDokument5 SeitenAccounts Receivable - Credit & Collections Audit Program - Auditor Exchange PDFgong688665Noch keine Bewertungen

- Sa 230Dokument12 SeitenSa 230meghanaNoch keine Bewertungen

- Chapter 1Dokument20 SeitenChapter 1Genanew AbebeNoch keine Bewertungen

- Auditorsdesk EQCR Reporting ChecklistDokument5 SeitenAuditorsdesk EQCR Reporting ChecklistHARSHA REDDYNoch keine Bewertungen

- Application of The Risk-Based Audit Process Test of Controls and Substantive Tests of Transactions and Details of Balances, and ReportingDokument57 SeitenApplication of The Risk-Based Audit Process Test of Controls and Substantive Tests of Transactions and Details of Balances, and ReportingHannah SyNoch keine Bewertungen

- Riscuri de Denaturare Semnificat Evaluarea Controlului Intern Si A RisculuiDokument14 SeitenRiscuri de Denaturare Semnificat Evaluarea Controlului Intern Si A RisculuiNatalia CorjanNoch keine Bewertungen

- Cost AccountingDokument117 SeitenCost AccountingSIKANDARR GAMING YTNoch keine Bewertungen

- Overall Responses 5Dokument7 SeitenOverall Responses 5hmmmmnNoch keine Bewertungen

- AU 9 Consideration of ICDokument11 SeitenAU 9 Consideration of ICJb MejiaNoch keine Bewertungen

- Preparation Audit ProgramDokument8 SeitenPreparation Audit ProgramJem VadilNoch keine Bewertungen

- Audit Objectives Techniques Assertions Procedures and TestsDokument14 SeitenAudit Objectives Techniques Assertions Procedures and TestsNieza Marie MirandaNoch keine Bewertungen

- Chapter - 2 (Short Notes)Dokument4 SeitenChapter - 2 (Short Notes)Aakansha SinghNoch keine Bewertungen

- Internal Control and COSO Framework: ©2010 Prentice Hall Business Publishing, Auditing 13/e, Arens/Elder/Beasley 1 - 1Dokument43 SeitenInternal Control and COSO Framework: ©2010 Prentice Hall Business Publishing, Auditing 13/e, Arens/Elder/Beasley 1 - 1Nurul FatimahNoch keine Bewertungen

- Unit 5Dokument14 SeitenUnit 5fekadegebretsadik478729Noch keine Bewertungen

- Overall Audit Strategy and Audit Program: Concept Checks P. 385Dokument23 SeitenOverall Audit Strategy and Audit Program: Concept Checks P. 385Eileen HUANGNoch keine Bewertungen

- The Sarbanes-Oxley Section 404 Implementation Toolkit: Practice Aids for Managers and AuditorsVon EverandThe Sarbanes-Oxley Section 404 Implementation Toolkit: Practice Aids for Managers and AuditorsNoch keine Bewertungen

- Learning Outcome: Evaluator's Comments (For Instructor's Use Only)Dokument5 SeitenLearning Outcome: Evaluator's Comments (For Instructor's Use Only)Neel PrasantNoch keine Bewertungen

- Public Administration Unit-96 Forms of Public EnterpriseDokument12 SeitenPublic Administration Unit-96 Forms of Public EnterpriseDeepika SharmaNoch keine Bewertungen

- PMP Study Plan G42Dokument4 SeitenPMP Study Plan G42MidyolNoch keine Bewertungen

- What Is A Quality Management SystemDokument6 SeitenWhat Is A Quality Management Systemsunilkhairnar38Noch keine Bewertungen

- Territory Sales Manager Consumer Goods in Buffalo NY Resume Brian BogartDokument2 SeitenTerritory Sales Manager Consumer Goods in Buffalo NY Resume Brian BogartBrianBogartNoch keine Bewertungen

- Muhammad Yudith Eddwina (CV)Dokument1 SeiteMuhammad Yudith Eddwina (CV)yuditheddwinaNoch keine Bewertungen

- Implementing Corporate Environmental StrategiesDokument37 SeitenImplementing Corporate Environmental StrategiesDavid BoyerNoch keine Bewertungen

- Data Warehouse VS Data MiningDokument7 SeitenData Warehouse VS Data MiningPriya kambleNoch keine Bewertungen

- Human ResourseDokument16 SeitenHuman Resoursekhurram imtiazNoch keine Bewertungen

- A-Levels Business Studies - Unit 4, NotesDokument12 SeitenA-Levels Business Studies - Unit 4, NotesRafay Mahmood88% (8)

- E Procurement 151027114919 Lva1 App6892Dokument15 SeitenE Procurement 151027114919 Lva1 App6892Priya KhareNoch keine Bewertungen

- Introduction To StrategyDokument22 SeitenIntroduction To Strategythabiti mohamediNoch keine Bewertungen

- Blue Nile and Diamond Retailing: A Case Study ReviewDokument16 SeitenBlue Nile and Diamond Retailing: A Case Study ReviewDaivik TandelNoch keine Bewertungen

- Strategic TrainingDokument25 SeitenStrategic TrainingG.alex RajeshNoch keine Bewertungen

- Think Marketing First Canadian Edition Canadian 1st Edition Tuckwell Test BankDokument18 SeitenThink Marketing First Canadian Edition Canadian 1st Edition Tuckwell Test Bankclitusquanghbz9up100% (23)

- A.lalitha Bhavani FolderDokument9 SeitenA.lalitha Bhavani FolderAshok Kumar SatuluriNoch keine Bewertungen

- Videos To DownloadDokument23 SeitenVideos To DownloadJohnMedinaNoch keine Bewertungen

- 102 Strategy: Case Discussion NotesDokument3 Seiten102 Strategy: Case Discussion NotesYashrajsing LuckkanaNoch keine Bewertungen

- Accounting Information Systems: An OverviewDokument21 SeitenAccounting Information Systems: An OverviewDian Nur IlmiNoch keine Bewertungen

- External Audit ThesisDokument8 SeitenExternal Audit ThesisLisa Riley100% (2)

- L16 Problem On Transfer PricingDokument20 SeitenL16 Problem On Transfer Pricingapi-382061990% (20)

- RCS Audit ChecklistDokument1 SeiteRCS Audit ChecklistAnwar Hossain HM100% (1)

- Q1-Rainbow's End InterviewDokument3 SeitenQ1-Rainbow's End InterviewMuhammad HamzaNoch keine Bewertungen

- Iip Final Report FormatDokument2 SeitenIip Final Report FormatKASTURI P (Marketing 21-23)Noch keine Bewertungen

- CA04CA3401Software Life Cycle and Case StudyDokument19 SeitenCA04CA3401Software Life Cycle and Case StudysyedNoch keine Bewertungen

- Suruchi Kakkar Khanna: Contact Career ObjectiveDokument1 SeiteSuruchi Kakkar Khanna: Contact Career ObjectiveNeeraj singhNoch keine Bewertungen

- Feasibility Study - SDI UgandaDokument59 SeitenFeasibility Study - SDI UgandanoslidoNoch keine Bewertungen