Beruflich Dokumente

Kultur Dokumente

ST5 Pu 14 PDF

Hochgeladen von

PolelarOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

ST5 Pu 14 PDF

Hochgeladen von

PolelarCopyright:

Verfügbare Formate

ST5: CMP Upgrade 2013/14 Page 1

Subject ST5

CMP Upgrade 2013/14

CMP Upgrade

ActEd often produces a free CMP Upgrade, which provides details of changes to the

syllabus, Core Reading and ActEd materials. This year, however, due to the large

number of changes to the Core Reading, Course Notes, Q&A Bank and X Assignments,

it is not practical to produce a full upgrade.

We offer a full replacement set of up-to-date Course Notes/CMP at a discounted price if

you have previously bought the full-price Course Notes/CMP respectively in this

subject. The prices are given in Section 0 below.

Sections 1 to 4 of this document provide a summary of the changes so that you are

aware of the main themes of these changes and the chapters that have been subject to

the greatest change.

0 Retaker discounts

When ordering retaker-price material, please use the designated place on the order

form or tick the relevant box when using the e-store.

Students have the choice of purchasing the full CMP (printed or eBook) or just the

Course Notes (printed).

Retaker price

2014 printed CMP for those having previously purchased the 60

full-price Subject ST5 CMP

2014 CMP eBook for those having previously purchased the 20 (+VAT in EU)

full-price Subject ST5 CMP

2014 printed Course Notes for those having previously 45

purchased the full-price Subject ST5 Course Notes or CMP

The Actuarial Education Company IFE: 2014 Examinations

Page 2 ST5: CMP Upgrade 2013/14

1 Changes to the Syllabus objectives and Core Reading

1.1 Syllabus objectives

Objective (k)

This objective has been shortened as cointegration is no longer part of the ST5 Course.

It now reads:

(k) Show how actuarial techniques may be used to develop an appropriate

investment strategy.

asset pricing models

asset liability modelling

asset liability mismatch reserving

liability hedging

dynamic liability benchmarks.

IFE: 2014 Examinations The Actuarial Education Company

ST5: CMP Upgrade 2013/14 Page 3

1.2 Core Reading

Chapter 1

p13

An extra paragraph of Core Reading has been added after the first paragraph. This

section now reads:

As well as being traded on exchanges many financial derivatives are traded over-

the-counter (OTC) by investment banks. The swaps market and the market in

forward currency contracts are two very important OTC markets. The banks will

tailor a wide variety of derivatives to suit the needs of their corporate clients.

OTC markets are much less liquid and transparent than the markets in exchange-

traded derivatives and credit risk is a major factor.

Hence, regulators are seeking ways to reduce counterparty risk, such as by

encouraging the use of a central clearing system and by requiring banks to hold

additional capital in respect of derivative transactions.

Chapter 3

p6

The Core Reading on repos has been rewritten.

p12

The Core Reading on credit derivatives has been reordered and rewritten in places.

p22

The Core Reading on swaps has been reordered and rewritten in places.

Chapter 4

p16

The Core Reading on hedge funds has been rewritten.

p41

A new Core Reading section on insurance linked securities has been added. This is

now Section 7.

The Actuarial Education Company IFE: 2014 Examinations

Page 4 ST5: CMP Upgrade 2013/14

Chapter 6

p2

An extra sentence of Core Reading has been added after the existing Core Reading

paragraph. This now reads:

Students will be expected to be familiar with the relevant material from Subject

CT2, in particular, the various relationships within an organisation, agency

theory and maximising shareholder wealth.

Behavioural finance is covered in Subject CT8 and is also included in this

chapter.

Chapter 8

p16

The first Core Reading paragraph on this page has been modified slightly. It now reads:

Looking at pension fund investment in particular, fund managers are

increasingly employed on a specialist mandate basis to invest in a single asset

class, rather than on a traditional balanced or multi-asset mandate.

However, this still requires them to make operational decisions in relation to

stock selection (unless a passive index-tracking approach is to be adopted).

Managers will therefore need to be given instructions regarding any restrictions

to be applied.

Chapter 14

p24

The Core Reading in Section 5.1 has been trimmed down somewhat.

Chapter 18

p4

The Core Reading in Section 1 has been trimmed significantly.

IFE: 2014 Examinations The Actuarial Education Company

ST5: CMP Upgrade 2013/14 Page 5

Chapter 19

p8

The Core Reading in Section 2 on LDI has been updated significantly.

p16

The Core Reading that was in Section 3 on Cointegration has been deleted so that

Section 3 is now on Dynamic Liability Benchmarks.

Chapter 20

p24

A new Core Reading section (Section 3.8) on the use of bond repos has been added

here.

Chapter 22

Throughout this chapter, there have been numerous minor changes of wording. For

example, A fund has been changed to An investor and An investment manager

has been changed to An investor.

Chapter 24

p3

The Core Reading definition of arbitrage has been changed to:

Arbitrage

The simultaneous buying and selling of two economically equivalent but

differently priced portfolios so as to make a risk-free profit.

The Actuarial Education Company IFE: 2014 Examinations

Page 6 ST5: CMP Upgrade 2013/14

2 Changes to the ActEd Course Notes

Chapter 3

The ActEd text surrounding the Core Reading changes and the ActEd text in the

summary have both been adjusted accordingly.

Chapter 4

The ActEd text surrounding the Core Reading changes and the ActEd text in the

summary have both been adjusted accordingly.

Chapter 14

p24

The ActEd text surrounding the Core Reading trimmed from Section 5.1 has been

adjusted accordingly.

p35

The summary on equity indices has been enhanced to make it clearer which country

each equity index is from.

Chapter 18

p4

The ActEd text surrounding the Core Reading trimmed from Section 1 has been

adjusted accordingly.

IFE: 2014 Examinations The Actuarial Education Company

ST5: CMP Upgrade 2013/14 Page 7

Chapter 19

p1

The syllabus objective has been reworded as cointegration is no longer part of the ST5

Course. It now reads:

(k) Show how actuarial techniques may be used to develop an appropriate

investment strategy.

liability hedging

dynamic liability benchmarks.

p8

The ActEd text surrounding the updated Core Reading in Section 2 on LDI has been

adjusted accordingly.

p16

Section 3 on Cointegration has been deleted so that Section 3 is now on Dynamic

Liability Benchmarks.

Chapter 20

p24

Two new self-assessment questions have been added to complement the new Core

Reading section (Section 3.8) on the use of bond repos.

The Actuarial Education Company IFE: 2014 Examinations

Page 8 ST5: CMP Upgrade 2013/14

3 Changes to the Q&A Bank

Question Details of any changes

Part (iii) of this question has been deleted as it is no longer part of

Question 1.1

the ST5 course.

Question 1.6 This question has been reworded.

Question 3.10 This question has been reworded.

This question is new here. It has been moved over from the X3

Question 3.13

Assignment where it was Question X3.6.

Question 5.3 This question has been deleted.

Question 5.4 The solution to this question has been enhanced to include liquidity

(now 5.3) risk.

IFE: 2014 Examinations The Actuarial Education Company

ST5: CMP Upgrade 2013/14 Page 9

4 Changes to the X assignments

Question X1.2 This question has been reworded.

Question X1.4 This question has been enhanced to include quantitative easing.

This question has been reworded slightly to make it clearer what is

Question X1.7

required.

Question X1.8 This question is a new question on infrastructure.

The solution to this question has been reworded and the number of

Question X2.1

marks has been adjusted down.

This question has been reworded so that it doesnt sound like the

Question X2.4

country starts from having no listing regulations.

Question X2.6 The number of marks has been adjusted down slightly.

Question X2.7 This question is a new question on behavioural finance.

This question has been replaced with a new question. The old

Question X3.6

question has moved to the Q&A Bank.

Question X4.4 This question has been moved to the Q&A Bank. X4.5 is now X4.4.

Question X4.5

The number of marks has been adjusted down.

(now X4.4)

This question has been trimmed down. Part (i) is effectively to be

Question X4.6 asked in one of the new questions and part (iv) is no longer in the

ST5 Course.

Question X4.8 This question has been moved to the Q&A Bank.

New Question

This question is a new bookwork question on equity indices.

X4.7

New Question

This question is a new question on attribution analysis.

X4.8

Question X5.5 This question has been deleted.

Question X5.10 This question has been deleted.

This question has been deleted as we felt that there were too many

Question X5.11 policy switching questions in the X5 Assignment and in the Q&A

Bank.

The Actuarial Education Company IFE: 2014 Examinations

Page 10 ST5: CMP Upgrade 2013/14

New Question

This question is a new bookwork question on financial risk.

X5.9

New Question This question is a new bookwork question on asset liability

X5.10 mismatch reserving.

New Question This question is a new question on liability hedging and

X5.11 operational risk.

Question X6.2 Part (ii) has been deleted.

Question X6.8 The number of marks has been adjusted down.

New Question

This question is a new question on tax.

X6.10

We only accept the current version of assignments for marking, ie those published for

the sessions leading to the 2014 exams. If you wish to submit your script for marking

but have only an old version, then you can order the current assignments free of charge

if you have purchased the same assignments in the same subject the previous year (ie

sessions leading to the 2013 exams), and have purchased marking for the 2014 session.

IFE: 2014 Examinations The Actuarial Education Company

ST5: CMP Upgrade 2013/14 Page 11

5 Other tuition services

In addition to this CMP Upgrade you might find the following services helpful with

your study.

5.1 Study material

We offer the following study material in Subject ST5:

Mock Exam

Additional Mock Pack

ASET (ActEd Solutions with Exam Technique) and Mini-ASET

Sound Revision

Revision Notes

Flashcards.

For further details on ActEds study materials, please refer to the 2014 Student

Brochure, which is available from the ActEd website at www.ActEd.co.uk.

5.2 Tutorials

We offer the following tutorials in Subject ST5:

a set of Regular Tutorials (usually lasting two or three full days)

a Block Tutorial (lasting two or three full days)

a Revision Day (lasting one full day).

For further details on ActEds tutorials, please refer to our latest Tuition Bulletin, which

is available from the ActEd website at www.ActEd.co.uk.

5.3 Marking

You can have your attempts at any of our assignments or mock exams marked by

ActEd. When marking your scripts, we aim to provide specific advice to improve your

chances of success in the exam and to return your scripts as quickly as possible.

For further details on ActEds marking services, please refer to the 2014 Student

Brochure, which is available from the ActEd website at www.ActEd.co.uk.

The Actuarial Education Company IFE: 2014 Examinations

Page 12 ST5: CMP Upgrade 2013/14

6 Feedback on the study material

ActEd is always pleased to get feedback from students about any aspect of our study

programmes. Please let us know if you have any specific comments (eg about certain

sections of the notes or particular questions) or general suggestions about how we can

improve the study material. We will incorporate as many of your suggestions as we can

when we update the course material each year.

If you have any comments on this course please send them by email to ST5@bpp.com

or by fax to 01235 550085.

IFE: 2014 Examinations The Actuarial Education Company

Das könnte Ihnen auch gefallen

- Craig Turnbull (Auth.) - A History of British Actuarial Thought-Palgrave Macmillan (2017)Dokument350 SeitenCraig Turnbull (Auth.) - A History of British Actuarial Thought-Palgrave Macmillan (2017)PolelarNoch keine Bewertungen

- ch16 PDFDokument6 Seitench16 PDFRestu Petrus MatondangNoch keine Bewertungen

- Sa1 Pu 15 PDFDokument78 SeitenSa1 Pu 15 PDFPolelarNoch keine Bewertungen

- Sa1 Pu 15 PDFDokument78 SeitenSa1 Pu 15 PDFPolelarNoch keine Bewertungen

- Solution Manual For Modern Advanced Accounting in Canada 9th Edition Darrell Herauf Murray HiltonDokument37 SeitenSolution Manual For Modern Advanced Accounting in Canada 9th Edition Darrell Herauf Murray Hiltonkanttrypilentumn4l71100% (15)

- Question Workbook With Case Studies With Amendments 150519 PDFDokument45 SeitenQuestion Workbook With Case Studies With Amendments 150519 PDFNikita Jindal0% (1)

- Wire TRF TutDokument12 SeitenWire TRF Tutsnazzy100% (2)

- Problemset2 PDFDokument4 SeitenProblemset2 PDFAbhishekKumarNoch keine Bewertungen

- Introduction To Actuarial Science - ElementaryDokument17 SeitenIntroduction To Actuarial Science - ElementaryPolelarNoch keine Bewertungen

- Applied Corporate Finance. What is a Company worth?Von EverandApplied Corporate Finance. What is a Company worth?Bewertung: 3 von 5 Sternen3/5 (2)

- CB1 CMP Upgrade 2022Dokument80 SeitenCB1 CMP Upgrade 2022Linh TinhNoch keine Bewertungen

- SP1 2021Dokument1.848 SeitenSP1 2021HANSHU LIUNoch keine Bewertungen

- Essentials of Corporate Financial Management 2ndDokument99 SeitenEssentials of Corporate Financial Management 2ndcharlisyuenNoch keine Bewertungen

- True or FalseDokument27 SeitenTrue or FalseMary DenizeNoch keine Bewertungen

- 01 REA Mock 250 ItemsDokument31 Seiten01 REA Mock 250 ItemsRECEPTION AND DIAGNOSTIC CENTER RDC MEDICAL SECTIONNoch keine Bewertungen

- ST4 Pu 14 PDFDokument10 SeitenST4 Pu 14 PDFPolelarNoch keine Bewertungen

- Sa2 Pu 14 PDFDokument150 SeitenSa2 Pu 14 PDFPolelarNoch keine Bewertungen

- Sa2 Pu 14 PDFDokument150 SeitenSa2 Pu 14 PDFPolelarNoch keine Bewertungen

- Abu L&T SoaDokument2 SeitenAbu L&T Soaமானங்கெட்ட மனசுNoch keine Bewertungen

- Performing Key Bookkeeping TasksDokument15 SeitenPerforming Key Bookkeeping TasksNicole Ann Blando BaroniaNoch keine Bewertungen

- (EAA Series) Mario V. Wüthrich (Auth.) - Market-Consistent Actuarial Valuation-Springer International Publishing (2016) PDFDokument145 Seiten(EAA Series) Mario V. Wüthrich (Auth.) - Market-Consistent Actuarial Valuation-Springer International Publishing (2016) PDFPolelarNoch keine Bewertungen

- Fin119 CSG PDFDokument514 SeitenFin119 CSG PDFjamesbook100% (1)

- Benefits Realisation Management: The Benefit Manager's Desktop Step-by-Step GuideVon EverandBenefits Realisation Management: The Benefit Manager's Desktop Step-by-Step GuideNoch keine Bewertungen

- Earned Value Project Management (Fourth Edition)Von EverandEarned Value Project Management (Fourth Edition)Bewertung: 1 von 5 Sternen1/5 (2)

- CT6 CMP Upgrade 09-10Dokument220 SeitenCT6 CMP Upgrade 09-10ravindrakpNoch keine Bewertungen

- ST2 Pu 15 PDFDokument26 SeitenST2 Pu 15 PDFPolelarNoch keine Bewertungen

- ST8 Pu 15 PDFDokument58 SeitenST8 Pu 15 PDFPolelarNoch keine Bewertungen

- CT7 Pu 15 PDFDokument8 SeitenCT7 Pu 15 PDFPolelarNoch keine Bewertungen

- Ca1 Pu 15 PDFDokument30 SeitenCa1 Pu 15 PDFPolelar0% (1)

- Sa1 Pu 14 PDFDokument212 SeitenSa1 Pu 14 PDFPolelarNoch keine Bewertungen

- Sa3 Pu 14 PDFDokument114 SeitenSa3 Pu 14 PDFPolelarNoch keine Bewertungen

- ST2 Pu 13Dokument44 SeitenST2 Pu 13Shabbeer ZafarNoch keine Bewertungen

- CT4 CMP Upgrade 11Dokument6 SeitenCT4 CMP Upgrade 11ifthkar100% (1)

- Sa5 Pu 14 PDFDokument102 SeitenSa5 Pu 14 PDFPolelarNoch keine Bewertungen

- Sa4 Pu 15 PDFDokument9 SeitenSa4 Pu 15 PDFPolelarNoch keine Bewertungen

- CT4-PU-15 UpgradeDokument40 SeitenCT4-PU-15 UpgradeQuag AccidentalCitizenNoch keine Bewertungen

- Microeconomics Canadian 14th Edition Ragan Solutions ManualDokument11 SeitenMicroeconomics Canadian 14th Edition Ragan Solutions Manualelfledalayla5900x100% (32)

- Ca1 Pu 13Dokument46 SeitenCa1 Pu 13Shabbeer ZafarNoch keine Bewertungen

- ST7 Pu 15 PDFDokument82 SeitenST7 Pu 15 PDFPolelarNoch keine Bewertungen

- CT1 Pu 17Dokument20 SeitenCT1 Pu 17dexterity2rsNoch keine Bewertungen

- CT1 Pu 13 PDFDokument7 SeitenCT1 Pu 13 PDFJosephato De MwanziaNoch keine Bewertungen

- ST8 Pu 14 PDFDokument42 SeitenST8 Pu 14 PDFPolelarNoch keine Bewertungen

- FM MJ23 Examiner's Report - FinalDokument22 SeitenFM MJ23 Examiner's Report - FinalchadyudilNoch keine Bewertungen

- CP1 CMP Upgrade 2023Dokument28 SeitenCP1 CMP Upgrade 2023Rahul BNoch keine Bewertungen

- Study System Session Topic Study Bank Date Completed 0 SyllabusDokument10 SeitenStudy System Session Topic Study Bank Date Completed 0 SyllabusMadalina CiupercaNoch keine Bewertungen

- AFA 716 Chap 1 SolutionsDokument35 SeitenAFA 716 Chap 1 SolutionsMarc ColalilloNoch keine Bewertungen

- IandF CA11 201204 Examiners' ReportDokument19 SeitenIandF CA11 201204 Examiners' ReportSaad MalikNoch keine Bewertungen

- AF7 2022-23 Practice Test 3 (July 2020 EG) PDFDokument26 SeitenAF7 2022-23 Practice Test 3 (July 2020 EG) PDFAnan Guidel AnanNoch keine Bewertungen

- CP2 CMP Upgrade 2023Dokument28 SeitenCP2 CMP Upgrade 2023Rahul BNoch keine Bewertungen

- AF7 2022-23 Practice Test 1 (October 2019 EG) PDFDokument25 SeitenAF7 2022-23 Practice Test 1 (October 2019 EG) PDFAnan Guidel AnanNoch keine Bewertungen

- Accounting What The Numbers Mean Marshall 10th Edition Solutions ManualDokument30 SeitenAccounting What The Numbers Mean Marshall 10th Edition Solutions ManualDrMartinSmithbxnd100% (34)

- FN2191 Commentary 2022 OctoberDokument13 SeitenFN2191 Commentary 2022 OctoberAishwarya PotdarNoch keine Bewertungen

- Stimation of Expected Return - CAPM vs. Fama and FrenchDokument21 SeitenStimation of Expected Return - CAPM vs. Fama and FrenchAhmed MostafaNoch keine Bewertungen

- AF7 2022-23 Practice Test 6 (September 2021 EG) PDFDokument27 SeitenAF7 2022-23 Practice Test 6 (September 2021 EG) PDFAnan Guidel AnanNoch keine Bewertungen

- fn3092 Exc 13Dokument26 Seitenfn3092 Exc 13guestuser1993Noch keine Bewertungen

- ST7 Pu 14 PDFDokument84 SeitenST7 Pu 14 PDFPolelarNoch keine Bewertungen

- Individual Assignment v1Dokument4 SeitenIndividual Assignment v1Vie TrầnNoch keine Bewertungen

- Stage: Initiation Project Proposal 2006/7 Upgrade of ERI SUN Accounting SystemDokument6 SeitenStage: Initiation Project Proposal 2006/7 Upgrade of ERI SUN Accounting SystemKevin Ruel Manuto OlivesNoch keine Bewertungen

- AF7 2022-23 Practice Test 5 (February 2021 EG) PDFDokument25 SeitenAF7 2022-23 Practice Test 5 (February 2021 EG) PDFAnan Guidel AnanNoch keine Bewertungen

- Us DPP Book Fas123r PDFDokument466 SeitenUs DPP Book Fas123r PDFNavya BinaniNoch keine Bewertungen

- Caledonia Products Integrative ProblemsDokument5 SeitenCaledonia Products Integrative Problemstwalkthis069Noch keine Bewertungen

- AF7 2022-23 Practice Test 4 (October 2020 EG) PDFDokument28 SeitenAF7 2022-23 Practice Test 4 (October 2020 EG) PDFAnan Guidel AnanNoch keine Bewertungen

- Ch13 Wiley Plus Wk3Dokument58 SeitenCh13 Wiley Plus Wk3Prakash VaidhyanathanNoch keine Bewertungen

- Solution Manual For Modern Advanced Accounting in Canada 9th Edition Darrell Herauf Murray HiltonDokument35 SeitenSolution Manual For Modern Advanced Accounting in Canada 9th Edition Darrell Herauf Murray Hiltoncravingcoarctdbw6wNoch keine Bewertungen

- Planning and Operational VariancesDokument3 SeitenPlanning and Operational VariancesOvais MuhammadNoch keine Bewertungen

- CAPM: Theory, Advantages, and DisadvantagesDokument9 SeitenCAPM: Theory, Advantages, and DisadvantagesMuhammad YahyaNoch keine Bewertungen

- FN2191 Commentary 2021Dokument26 SeitenFN2191 Commentary 2021slimshadyNoch keine Bewertungen

- Accounting Unit 2 Theoretical Anwers Collection AlifDokument77 SeitenAccounting Unit 2 Theoretical Anwers Collection AlifMahmudul Hasan IshaNoch keine Bewertungen

- CB2 CMP Upgrade 2022Dokument84 SeitenCB2 CMP Upgrade 2022Linh TinhNoch keine Bewertungen

- ASAL Business WB Chapter 28 AnswersDokument3 SeitenASAL Business WB Chapter 28 AnswersElgin LohNoch keine Bewertungen

- Sa4 Pu 15 PDFDokument9 SeitenSa4 Pu 15 PDFPolelarNoch keine Bewertungen

- ST7 Pu 15 PDFDokument82 SeitenST7 Pu 15 PDFPolelarNoch keine Bewertungen

- Ca1 Pu 15 PDFDokument30 SeitenCa1 Pu 15 PDFPolelar0% (1)

- Ca3 Pu 15 PDFDokument10 SeitenCa3 Pu 15 PDFPolelarNoch keine Bewertungen

- Sa1 Pu 14 PDFDokument212 SeitenSa1 Pu 14 PDFPolelarNoch keine Bewertungen

- ST8 Pu 14 PDFDokument42 SeitenST8 Pu 14 PDFPolelarNoch keine Bewertungen

- Sa5 Pu 14 PDFDokument102 SeitenSa5 Pu 14 PDFPolelarNoch keine Bewertungen

- ST7 Pu 14 PDFDokument84 SeitenST7 Pu 14 PDFPolelarNoch keine Bewertungen

- Sa6 Pu 14 PDFDokument118 SeitenSa6 Pu 14 PDFPolelarNoch keine Bewertungen

- R.C. Sproul and Greg Bahnsen Debate - Greg Bahnsen's IntroductionDokument2 SeitenR.C. Sproul and Greg Bahnsen Debate - Greg Bahnsen's IntroductionPolelarNoch keine Bewertungen

- Sa3 Pu 14 PDFDokument114 SeitenSa3 Pu 14 PDFPolelarNoch keine Bewertungen

- Thesis On Social Investment by Gibbs - Medias - StellenboschDokument81 SeitenThesis On Social Investment by Gibbs - Medias - StellenboschPolelarNoch keine Bewertungen

- Chapman &: HalucrcDokument99 SeitenChapman &: HalucrcPolelarNoch keine Bewertungen

- Institute of Actuaries Publications Unit Book SaleDokument42 SeitenInstitute of Actuaries Publications Unit Book SalePolelarNoch keine Bewertungen

- Varanasi DCCB Par 31.03.2023Dokument28 SeitenVaranasi DCCB Par 31.03.2023Anuj Kumar SinghNoch keine Bewertungen

- Annuity Due ExplainedDokument7 SeitenAnnuity Due ExplainedHassleBustNoch keine Bewertungen

- Ole of Management Information System in Banking Sector IndustryDokument3 SeitenOle of Management Information System in Banking Sector IndustryArijit sahaNoch keine Bewertungen

- Finable 23Dokument45 SeitenFinable 23Manisha PandaNoch keine Bewertungen

- Amalgamation Journal EntriesDokument5 SeitenAmalgamation Journal EntriesBCS78% (9)

- Robert Campbell and Carol Morris Are Senior Vice Presidents ofDokument2 SeitenRobert Campbell and Carol Morris Are Senior Vice Presidents ofAmit PandeyNoch keine Bewertungen

- CH 4 Non-Generic SwapsDokument31 SeitenCH 4 Non-Generic SwapsEd ZNoch keine Bewertungen

- Summer Internship Project ReportDokument42 SeitenSummer Internship Project ReportTarun Bhatia50% (2)

- Inflation: Samir K MahajanDokument9 SeitenInflation: Samir K MahajanKeval VoraNoch keine Bewertungen

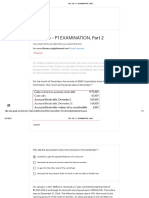

- Acc 106 - P1 Examination, Pa 2: Your Email Will Be Recorded When You Submit This FormDokument17 SeitenAcc 106 - P1 Examination, Pa 2: Your Email Will Be Recorded When You Submit This FormATHALIAH LUNA MERCADEJASNoch keine Bewertungen

- 3.1 Reviewer in Partnership Operations and DissolutionDokument33 Seiten3.1 Reviewer in Partnership Operations and Dissolutionlavender hazeNoch keine Bewertungen

- Contoh Penghitungan Pajak PenghasilanDokument13 SeitenContoh Penghitungan Pajak PenghasilantorangsiagianNoch keine Bewertungen

- Prime Bank LimitedDokument29 SeitenPrime Bank LimitedShouravNoch keine Bewertungen

- Paytm First Card 2019 FAQDokument59 SeitenPaytm First Card 2019 FAQankit0076Noch keine Bewertungen

- Assignment # 4 Submitted By: Registration #: Submitted ToDokument10 SeitenAssignment # 4 Submitted By: Registration #: Submitted ToASAD ULLAHNoch keine Bewertungen

- Banking - Term Project: Running Head: Silk Bank - Final ReportDokument45 SeitenBanking - Term Project: Running Head: Silk Bank - Final ReportAman Ahmad UrfiNoch keine Bewertungen

- Session 9-10Dokument42 SeitenSession 9-10Dishant KhanejaNoch keine Bewertungen

- Ccris BNM BookletDokument11 SeitenCcris BNM BookletMuhamad AzmirNoch keine Bewertungen

- There Is Revaluation of Assets Equal To P50,000Dokument2 SeitenThere Is Revaluation of Assets Equal To P50,000Joana TrinidadNoch keine Bewertungen

- Chapter 1 Introduction To Money and BankingDokument65 SeitenChapter 1 Introduction To Money and BankingLâm BullsNoch keine Bewertungen

- Challan 0Dokument1 SeiteChallan 0Murtaza HashimNoch keine Bewertungen

- Myperfectice Level3Dokument22 SeitenMyperfectice Level3Nagendra Babu Naidu100% (2)

- Jul-21 Company Name Claim Buddy Numbers From Ir Base Year Below (In Consistent Units) This YearDokument32 SeitenJul-21 Company Name Claim Buddy Numbers From Ir Base Year Below (In Consistent Units) This YearProtyay ChakrabortyNoch keine Bewertungen