Beruflich Dokumente

Kultur Dokumente

VDC Application Form

Hochgeladen von

Mansoor AliOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

VDC Application Form

Hochgeladen von

Mansoor AliCopyright:

Verfügbare Formate

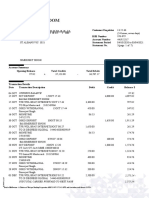

Customer #

(For Bank Use Only)

Branch Name

Date

Branch Code D D M M Y Y Y Y

Allied Cash+Shop Visa Debit/ATM Card Application Form

(Please fill the form in block letters) Existing Card #

I/We request you to:

Issue me a new VISA Debit Card

Replace my existing card (due to loss/theft/damage)

Link account to existing card (please mention your card number in the space provided above)

Migration Request (from proprietary ATM Debit Card to Allied Cash+Shop Visa Debit Card)

Account Type

PLS Savings Current Other (Please specify)

Branch Code Account # (For Unibank Accounts) Account # (For T-24 Accounts)

- - -

- - -

- - -

- - -

Full Name (As per Branch Record)

Name to appear on the Card (Maximum 19 characters including spaces, nickname not allowed)

Date of Birth Mothers Maiden Name

D D M M Y Y Y Y

CNIC

- - Gender: Male Female

Passport # (For Foreign Nationals only)

Nationality: Pakistani Other

(Please specify)

Mailing Address (As per Branch Record)

Postal Code

Tel. # Office Tel. # Res.

Mobile # E-mail

I/We confirm having read, understood and accepted the Terms and Conditions

mentioned overleaf and agree to abide by the same.

Applicants Signature(s)

For Bank Use

Application # Date

D D M M Y Y Y Y

Details verified as per branch record & approved for issuance of Card. Operation by either or survivor is confirmed for joint accounts.

Authorized Signature IBS # Authorized Signature IBS #

For Use at Card Issuance Department

Card # 4 7 6 2 1 5

Dispatched

Card Prepared By On on

D D M M Y Y Y Y D D M M Y Y Y Y

For Customer Reference

Date Application #

D D M M Y Y Y Y

Authorized Signature & Bank Stamp

Allied Cash+Shop Visa Debit/ATM Card - Terms and Conditions

These Terms and Conditions comprise the Agreement between the Bank and the Cardholder in supplier. The retailer or supplier shall under no circumstances be regarded as an agent or

connection with the Cardholders Allied Cash+Shop VISA Debit Card. These Terms and Conditions representative of the Bank and neither the Bank shall be responsible nor liable in any

must be read in conjunction with the Terms and Conditions for bank accounts as applicable from manner for any acts or omissions or breach of representations on part of the Merchant.

time to time. 12. Statement: The Cardholder must check the Transaction Records from the Account

1. In these Terms and Conditions: Statement sent by the Bank as per the set frequency or the service can be availed through

1.1 Account means the bank account held or to be held with the Bank in the name of internet banking and through mini statement from an ATM.

the Cardholder (whether solely or jointly with another person), the number of which The Cardholder will inform the Bank in writing within 7 days of Transaction or issuance of

is or shall be specified in the application form for the Card and communicated to the Statement, whichever is later, if any irregularities or discrepancies exist in the Transaction

Cardholder as appropriate. particulars of the Account on any Account Statement that the Bank sends to the Cardholder.

1.2 Bank means that branch of Allied Bank Limited, which holds the Account. If the Bank does not receive any information to the contrary within 7 days, the Bank is

entitled to assume that all Transactions are correct and can be treated as conclusive

1.3 Card means the Allied Cash+Shop VISA Debit Card, including any replacement of evidence for all purposes. In addition, in the event that the Card is used at any ATM and

the Card. the Cardholder receives short payment or no payment despite the Transaction having been

1.4 Cardholder means the person having power alone to operate the Account in successfully executed, he/she must inform the Bank in writing within 7 working days of

accordance with the Bank mandate in respect thereof. the impugned Transaction, otherwise the Banks Statement of Account and records shall

1.5 PIN means the Personal Identification Number or an encrypted number, which the be deemed to be conclusive of the matter. Furthermore, in the event the Cardholder uses

Cardholder uses from time to time with the Card and includes the Telephone Personal the Card at any ATM which is not operated by the Bank, then the Bank shall be entitled to

Identification Number or TPIN where the context so permits. rely on the records provided to it by the 1-Link switch and any omission or failure by the

1.6 Transaction means any cash withdrawal or payment made using the Card, or any Bank to contemporaneously debit the Cardholders Account for any Transaction by the

refund arising in connection with the use of the Card in any authorised manner for Cardholder may be completed by the Bank on any subsequent date by direct debit without

debit or credit to the Account. prior reference to the Cardholder.

1.7 VISA means Visa International Service Association. 13. Cancellation of Transactions: A Transaction cannot be cancelled by the Cardholder after

it has been completed.

2. Card Facilities:

14. Posting: Subject to these Terms and Conditions the Bank will normally debit the amount

2.1 The Card may be used to withdraw money at any Automated Teller Machine (ATM) of any Transaction to the Account as soon as the Bank receives proper instructions in

or to access any additional banking services offered through the ATMs (e.g. transfer connection therewith, provided that the Bank will not be liable for any loss resulting from

of funds locally from one account to another within the Bank or any other bank in any delay in doing so.

Pakistan, as well as payment of utility or other bills). The Card may also be used for

payment for goods and/or services at retailers or suppliers worldwide who display 15. Refund: If a retailer or supplier makes a refund by means of a Transaction the Bank will

the VISA Plus sign and who accept the Card, subject to compliance with VISA rules credit the Account when it receives the retailer or suppliers proper instructions and the

and regulations as applicable from time to time. funds in respect of such refund, provided that the Bank will not be responsible for any loss

resulting from any delay in receiving such instructions and funds.

2.2 If the Cardholder uses the Card for Transactions outside Pakistan (including ATMs),

the Cardholder will also be liable for currency conversion and service fee which is 16. Promotions: Without prejudice to the foregoing, the Bank may, from time to time and at

charged upfront at the time of the Transaction. However, the Bank makes no warranty its sole discretion, promote the goods or services of certain specified companies (affiliates)

nor assumes any liability or responsibility for any limitation on conversion or availability amongst all or any of its Cardholders. If such a promotion is made available to the Cardholder

of foreign exchange whether due to State Bank of Pakistan or otherwise. and the Cardholder avails the promotion, the Cardholder agrees that in addition to these

Terms and Conditions, the Cardholder will abide by the Terms and Conditions of the

3. Issuance of the Card: The Bank will issue a Card only if the Cardholder has duly completed promotion as stipulated by the affiliates in consultation with the Bank. Such a promotion

an application form, agreed to these Terms and Conditions and the Terms and Conditions may be withdrawn at any time without notice to the Cardholder.

for bank accounts and it has been accepted by the Bank. Opening and maintaining a bank

account with the Bank is a condition precedent for the issuance of the Card. 17. Termination: The Bank may terminate the Agreement comprised in these Terms and

Conditions by notifying the Cardholder in writing to the Cardholders last notified address

4. Ownership of the Card: The Card belongs to the Bank and the Bank or any authorised as per the Banks records. The Cardholder may terminate the Agreement comprised in

officer, servant, employee, associate or agent of the Bank may retain the Card, require the these Terms and Conditions by notifying the Bank in writing, cutting the Card in half through

Cardholder to return the Card or suspend the use of the Card at any time in its absolute the magnetic strip and returning the Card to the Bank. Such termination shall be effective,

discretion and the Bank shall not be liable for any loss suffered by the Cardholder as a subject to the provisions of the following paragraphs of this clause, upon receipt by the

result thereof. The Card may not be used by any person other than the Cardholder. Bank of such notice of termination by the Cardholder.

5. Validity and Activation: The Card will not become valid or operational until the Cardholder 18. Agreement to Remain in Full Force and Effect: The Agreement comprised in these Terms

acknowledges receipt of the Card and accepts the Terms and Conditions for Card usage. and Conditions, shall be deemed to remain in full force and effect if and in so far as any

The Card will then require to be activated by such mode as the Bank may specify. The Card Transaction is completed but not debited to the Account prior to termination thereof.

is only valid for the period shown on it and must not be used outside that period or if the

Bank has required by notice in writing to the Cardholder that it be returned to the Bank. 19. Post Termination: Termination of the Agreement comprised in these Terms and Conditions

When the period of validity of a Card expires, it must be destroyed by cutting it in half shall not prejudice any liability in respect of things done or omitted to be done prior to

through the magnetic strip. termination thereof.

6. Loss or Theft: The Cardholder must take all precautions to prevent unauthorised use of 20. Limitation on Liability: The Bank shall not be liable to the Cardholder for any loss suffered

the Card or its PIN. If the Card is lost or stolen, the Cardholder shall immediately notify the as a result of the Bank being prevented from or delayed in providing any banking or other

Bank by telephone on the contact number(s) from time to time notified to the Cardholder services to the Cardholder due to strikes, industrial action, failure of power supplies, systems

and the Cardholder must, in addition, immediately notify the Bank in writing of such loss or equipment or causes beyond the Banks control. The Bank shall not be liable in any

or theft. The Cardholder will be liable for all Transactions until the Bank is duly notified in manner due to any accidental death, injury or property damage that may be sustained by

the foregoing manner. the Cardholder in using the Card at the ATM rooms or locations, it being agreed that the

Cardholder shall use the Card entirely at his/her own risk, cost and consequences.

The Cardholder must co-operate with any officers, employees, representatives or agents Furthermore, whenever the Card is used by the Cardholder for payment of any utility or

of the Bank and/or law enforcement agencies in any efforts to recover the Card if it is lost other bills, the Cardholder shall remain solely liable for any penalty, cost or surcharge which

or stolen. The Bank may disclose information about the Cardholder and the Account if the may be levied by the utility or service provider for late payment, irrespective of whether

Bank thinks it will help avoid or recover any loss to the Cardholder or the Bank resulting the Cardholder provided adequate notice and proper details to the Bank.

from the loss, theft, misuse or unauthorised use of the Card.

21. Change of Terms and Conditions: These Terms and Conditions and any charges relating

If the Card is found after the Bank has been given notice of its loss or theft the Cardholder thereto may be changed by the Bank at its sole option at any time and from time to time

must not use it again. The Card must be cut in half through the magnetic strip and returned by notice (whether general, specific or by publication in the Banks Schedule of Charges)

to the Bank immediately. to the Cardholder(s). Any such changes will be effective from the date stated on the notice

7. PIN: At the request of the Cardholder, the Bank will issue a PIN to the Cardholder. If the or Schedule of Charges or such later date as may be expressly specified therein by the

Bank issues a PIN, the Cardholder must take all reasonable precautions to avoid unauthorised Bank. However, any charges or fees due to VISA in respect of the use of the Card and any

use, including destroying the PIN mailer issued by the Bank promptly after receipt, never variations thereto made by VISA shall be solely to the Cardholders Account only and the

disclosing the PIN to someone else, never writing the PIN on the Card or any other item Bank shall not be liable for same.

normally kept with the Card, never writing the PIN in a way that can be understood by 22. Disclosure: The Cardholder authorises the disclosure to any company within the Banks

someone else and notifying the Bank as soon as possible if someone else knows or is group of companies, to any third party processors, service providers and/or card

suspected of knowing the PIN. personalisation firms utilised by the Bank from time to time. Such information shall include

If the PIN is held with the Card and subsequently lost or stolen, the Cardholder will be liable but not be limited to the Cardholders details, the Card, the Account and any Transaction

for all PIN related Transactions. If the Cardholder discloses the PIN then the Cardholder as the Bank considers in its sole opinion to be necessary or desirable. The Bank may also

will be liable for all subsequent PIN related Transactions. disclose such information in relation to the Cardholder, the Card, the Account or any

8. Charges: The Cardholder agrees that charges, fees, duties, levies and other expenses Transaction as may be required by law, practice or usage.

(collectively the charges) will be charged by the Bank for the issuance and usage of the 23. Indemnity: The Cardholder hereby indemnifies and holds the Bank harmless against any

Card. The Cardholder agrees to pay and reimburse the Bank all or any of such charges or all losses, damages, costs or expenses which the Bank suffers or sustains as a consequence

immediately upon demand. Such charges will change from time to time at the discretion of the Cardholder being in breach of these conditions or the Terms and Conditions governing

of the Bank and it is the Cardholders responsibility to obtain the prevailing rates of such the Account or the Cardholder using or permitting the use of the Card for any Transaction,

charges from the Banks branch nearest to him/her. All charges are non-refundable unless whether illegal, unauthorised or otherwise. In this regard, in the event of the Cardholders

otherwise indicated by the Bank. death, the Bank shall be notified immediately by the Cardholders next of kin or successors

9. Total Usage: The total amount of any Transactions carried out in any one day shall be for blockage of the Account and the Card shall be promptly returned to the Bank for

limited to such amounts and by such other conditions as shall be notified in writing to the cancellation. Pending provision of a succession certificate by the successors of the Cardholder

Cardholder by the Bank from time to time with effect from the date of such notice. The or such other document as the Bank may specify, the Cardholders Account will remain

Cardholder is not authorised to enter into Transactions using the Card to a value in excess frozen and any Transactions made on the Card prior to the date of freezing of the Account

of the credit balance (if any) of the Account from time to time. using the Cardholders PIN will be to the Cardholders sole Account until such notice of

death is received in writing by the Bank.

If the Bank is asked to authorise a Transaction, the Bank may take into consideration any

other Transactions which have been authorised but which have not been debited to the 24. Bank Account Terms and Conditions: These Terms and Conditions are to be read in

Account (and any other transactional activities upon the Account) the limits and other conjunction with the Account opening Terms and Conditions as shall be applicable to the

conditions referred to in these Terms and Conditions and if the Bank determines that there Account from time to time.

are or will be insufficient available funds in the Account to pay the amount that would be 25. Governing Law: These Terms and Conditions are to be read in conjunction with the Terms

due in respect of such a Transaction, the Bank may, in its own absolute discretion, refuse and Conditions which govern the issuance and usage of debit cards issued by the Bank.

to authorise such Transaction, in which event such a Transaction will not be debited to the These Terms and Conditions are subject to the rules and regulations, circulars and directives

Account. The Bank shall not be liable for any loss resulting from any such refusal to authorise of the State Bank of Pakistan (as may be applicable from time to time) and will be governed

any Transaction. by the substantive and procedural laws of the Islamic Republic of Pakistan. The courts in

10. Insufficient Funds: In the event that there are insufficient available funds in the Account Pakistan will have exclusive jurisdiction.

to pay any Transaction or other amount payable from the Account, including any mark- 26. Interpretation: These Terms and Conditions are also being issued in Urdu and/or other

up, fees, charges, currency conversion charges, service fee or any other payments due to regional languages of Pakistan. In the event of any discrepancy or conflict between the

the Bank, the Bank may in its own absolute discretion (and without any obligation to do interpretation of the provisions of such clauses against the Terms and Conditions stated

so) transfer or arrange the transfer of sufficient funds from any other account held by the above, the English version stated above shall prevail and be deemed to be authentic.

Cardholder with the Bank to the Account. In this regard, the Cardholder permits, authorises 27. Contact Details: On notification of the Cardholder either telephonically or in writing in

and consents to the Bank consolidating, combining or setting off any such credit balances any of the document about fresh/present contact details to any of the authorized

existing in such other accounts against the Transactions charged or to be charged by the office/representative of the Bank, the Bank is authorized to update the record by amending

Cardholder against the Account. the previous particulars to fresh/latest one.

11. Refusal to Accept Card: The Bank shall not be liable for any loss resulting from the refusal

of any retailer, supplier, other bank or card operated machine to accept use of the Card in

connection with any Transaction. No claims of the Cardholder against any retailer or supplier

may be the subject of set-off, claim or counterclaim against the Bank. The Bank shall not

be liable in any way for the quality, quantity, sufficiency, acceptability, merchantability of

goods and/or services booked, used or purchased by the Cardholder through the use of

the Card or for any breach or non-performance of any card Transactions by a retailer or Signature of Applicant

Das könnte Ihnen auch gefallen

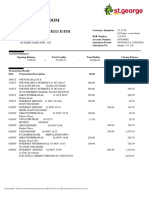

- NAB StatementDokument1 SeiteNAB StatementABC Four CornersNoch keine Bewertungen

- CompleteFreedom-2517-03Apr2021 2021-04-08 at 8.15.26 AMDokument67 SeitenCompleteFreedom-2517-03Apr2021 2021-04-08 at 8.15.26 AMSimerjeet SinghNoch keine Bewertungen

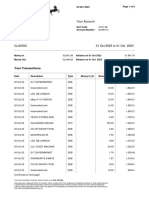

- Account StatementDokument6 SeitenAccount StatementHxor Haxor0% (1)

- ATB Direct Deposit FormDokument1 SeiteATB Direct Deposit FormThrow AwayNoch keine Bewertungen

- Banner BankDokument1 SeiteBanner BankhartNoch keine Bewertungen

- Complete List of Application Identifiers (Aid)Dokument18 SeitenComplete List of Application Identifiers (Aid)JR DeeNoch keine Bewertungen

- Complete FreedomDokument24 SeitenComplete Freedomelatucker1Noch keine Bewertungen

- Account History-TD Canada Trust-Savving2122Dokument2 SeitenAccount History-TD Canada Trust-Savving2122AhsanNoch keine Bewertungen

- 2022 T1 Form - CompletedDokument8 Seiten2022 T1 Form - CompletedARSH GROVERNoch keine Bewertungen

- Different types of basic bank accounts and servicesDokument1 SeiteDifferent types of basic bank accounts and servicesAyon MandalNoch keine Bewertungen

- Bank Grindord StatementDokument5 SeitenBank Grindord StatementBD MahamudNoch keine Bewertungen

- Victor M Orozco 8860 SW 123 CT APT K310 Miami FL 33186Dokument4 SeitenVictor M Orozco 8860 SW 123 CT APT K310 Miami FL 33186Wa Riz LaiNoch keine Bewertungen

- Credit Cards in VietnamDokument16 SeitenCredit Cards in VietnamTung LamNoch keine Bewertungen

- Transaction History Statement: Freelancer International Pty Limited ACN 134 845 748Dokument8 SeitenTransaction History Statement: Freelancer International Pty Limited ACN 134 845 748HK UploadNoch keine Bewertungen

- Wells Fargo Wire Transfer Confirmation and ReceiptDokument4 SeitenWells Fargo Wire Transfer Confirmation and ReceiptvhauamirNoch keine Bewertungen

- Ned Bank Pay U AccountDokument4 SeitenNed Bank Pay U AccountavarnNoch keine Bewertungen

- City BankDokument3 SeitenCity BankChong ShanNoch keine Bewertungen

- Visa4UK - Visa Application CompleteDokument2 SeitenVisa4UK - Visa Application CompletewaseemNoch keine Bewertungen

- Private & Confidential: Re: Your Medical Card ApplicationDokument7 SeitenPrivate & Confidential: Re: Your Medical Card ApplicationjulieannagormanNoch keine Bewertungen

- KYLA CARTER Paystub March 11 2024Dokument1 SeiteKYLA CARTER Paystub March 11 2024Fake Documents of Simply Jodan's LLCNoch keine Bewertungen

- StatementDokument4 SeitenStatementtochi efienokwuNoch keine Bewertungen

- 6 Month Transaction BankDokument15 Seiten6 Month Transaction BankShravan KumarNoch keine Bewertungen

- Account - Statement 222Dokument1 SeiteAccount - Statement 222Fikile EemNoch keine Bewertungen

- Void Check Anthony McMannisDokument1 SeiteVoid Check Anthony McMannismymailsenderaolNoch keine Bewertungen

- Estmt - 2019 07 25Dokument8 SeitenEstmt - 2019 07 25Sandra RíosNoch keine Bewertungen

- Statements 3509Dokument6 SeitenStatements 3509sherrif douchebagNoch keine Bewertungen

- Account Statement Basic Bank (01.07.2021-30.06.2022)Dokument10 SeitenAccount Statement Basic Bank (01.07.2021-30.06.2022)ashif.cloudaccNoch keine Bewertungen

- Attachment 16268014602Dokument5 SeitenAttachment 16268014602Web TreamicsNoch keine Bewertungen

- My RBC Bank StatementDokument4 SeitenMy RBC Bank Statementعبد الالهNoch keine Bewertungen

- Payoff Letter From Gonzalez, Counsel Sachs Sax Caplan For Oaks at Boca Raton Property Owners AssociationDokument4 SeitenPayoff Letter From Gonzalez, Counsel Sachs Sax Caplan For Oaks at Boca Raton Property Owners Associationlarry-612445Noch keine Bewertungen

- Current Account Statement 28042023Dokument4 SeitenCurrent Account Statement 28042023rwhvz5mqwmNoch keine Bewertungen

- ANZ BankDokument6 SeitenANZ BankВлад АнгелNoch keine Bewertungen

- Estatement 20230220Dokument4 SeitenEstatement 20230220winstonnelsonNoch keine Bewertungen

- Amex EstatementDokument2 SeitenAmex Estatementjohn vikNoch keine Bewertungen

- Secured Card ApplicationDokument1 SeiteSecured Card Applicationahren gabrielNoch keine Bewertungen

- 1420 Form For Applicants PDFDokument21 Seiten1420 Form For Applicants PDFsarangowaNoch keine Bewertungen

- Dec Evolve and TrustDokument2 SeitenDec Evolve and TrustSafeBit ProsNoch keine Bewertungen

- Statement - 2021 08 01 - 2021 08 12 - ENDokument1 SeiteStatement - 2021 08 01 - 2021 08 12 - ENRichard GriffinNoch keine Bewertungen

- Standard Checking Summary PDFDokument2 SeitenStandard Checking Summary PDFBobby BakerNoch keine Bewertungen

- Bank statement transactions August 2020Dokument6 SeitenBank statement transactions August 2020Usama AhmadNoch keine Bewertungen

- Lloyds Bank 1Dokument8 SeitenLloyds Bank 1KabanNoch keine Bewertungen

- Important Numbers.: Bing Yu Se 1, 35 Fortescue ST Spring Hill QLD 4000Dokument2 SeitenImportant Numbers.: Bing Yu Se 1, 35 Fortescue ST Spring Hill QLD 4000janmede262100% (1)

- SeptiembreDokument8 SeitenSeptiembredakpi479Noch keine Bewertungen

- TREZ657 ExtrasEP PDFCLI 28546011 XML SIGNED 11112022h1437Dokument6 SeitenTREZ657 ExtrasEP PDFCLI 28546011 XML SIGNED 11112022h1437elena draghiciNoch keine Bewertungen

- Account Statement: Zachary Duncan William IzyaanDokument2 SeitenAccount Statement: Zachary Duncan William IzyaanhanhNoch keine Bewertungen

- Personal Bank Statement TemplateDokument4 SeitenPersonal Bank Statement TemplateMimi DiepNoch keine Bewertungen

- 2020 - Income Tax - If CPP-D Is Non-Taxable Due To Retroactive Changes Regulation in 2023Dokument8 Seiten2020 - Income Tax - If CPP-D Is Non-Taxable Due To Retroactive Changes Regulation in 2023api-348726621Noch keine Bewertungen

- Preliminary Statement: Description Booking Date Amount 02.02.2021Dokument3 SeitenPreliminary Statement: Description Booking Date Amount 02.02.202113KARATNoch keine Bewertungen

- December StatementDokument3 SeitenDecember StatementNoriely Altagracia Paulino RivasNoch keine Bewertungen

- Online StatementDokument6 SeitenOnline Statementdaliesavard32Noch keine Bewertungen

- Statement 6Dokument2 SeitenStatement 6kezjana dardha0% (1)

- Credit Card Statement SummaryDokument2 SeitenCredit Card Statement SummaryGerson ChirinosNoch keine Bewertungen

- Date Transaction Description Amount (In RS.)Dokument2 SeitenDate Transaction Description Amount (In RS.)MITESH KUMAR100% (1)

- Business Account Statement: Account Summary For This PeriodDokument2 SeitenBusiness Account Statement: Account Summary For This PeriodBrian TalentoNoch keine Bewertungen

- FCM01934989518 BNZDokument2 SeitenFCM01934989518 BNZMitesh PrajapatiNoch keine Bewertungen

- USA Citibank BankDokument1 SeiteUSA Citibank BankPolo OaracilNoch keine Bewertungen

- Portfolio 74246 OnDate 5-5-2022Dokument1 SeitePortfolio 74246 OnDate 5-5-2022Shahid MahmudNoch keine Bewertungen

- Citibank CreditCard 6942stmt 26042021 1621910053011Dokument6 SeitenCitibank CreditCard 6942stmt 26042021 1621910053011Raul RoxasNoch keine Bewertungen

- Num 1Dokument6 SeitenNum 1moniquarashaad12Noch keine Bewertungen

- AMEX FeburaryDokument4 SeitenAMEX FeburaryJoe KingNoch keine Bewertungen

- New TT ApplicationDokument3 SeitenNew TT ApplicationEdu DharmasenaNoch keine Bewertungen

- Direct Credit Authorisation Form: InstructionsDokument1 SeiteDirect Credit Authorisation Form: InstructionsAbh ParNoch keine Bewertungen

- ATMEGA32Dokument346 SeitenATMEGA32salmanarshad2009Noch keine Bewertungen

- Search documentation by language or keywordDokument1 SeiteSearch documentation by language or keywordsalmanarshad2009Noch keine Bewertungen

- Tariff NDokument12 SeitenTariff Nsalmanarshad2009Noch keine Bewertungen

- TR600 With RS485Dokument16 SeitenTR600 With RS485salmanarshad2009Noch keine Bewertungen

- Fin533 Tutorial Consumer CreditDokument2 SeitenFin533 Tutorial Consumer CreditNadia AbdullahNoch keine Bewertungen

- 3 de Thi ToeicDokument115 Seiten3 de Thi ToeicTiểu MinhNoch keine Bewertungen

- CmsaklDokument15 SeitenCmsaklkerleighltdNoch keine Bewertungen

- User Bank Charges by Payment ChannelDokument1 SeiteUser Bank Charges by Payment ChannelMani Rathinam RajamaniNoch keine Bewertungen

- Fees and ChargesDokument59 SeitenFees and ChargesgivamathanNoch keine Bewertungen

- Karthikeyan G - Updated ResumeDokument7 SeitenKarthikeyan G - Updated ResumeKarthikeyan GangadharanNoch keine Bewertungen

- Chequing Statement-1200 2023-05-15Dokument5 SeitenChequing Statement-1200 2023-05-15lauramartinez2313Noch keine Bewertungen

- Electronic Payment System (EPS)Dokument37 SeitenElectronic Payment System (EPS)Jivika Patil100% (1)

- Project Report of PVR GroupDokument28 SeitenProject Report of PVR GroupNamita Varahamurthy83% (6)

- Ameya LakheDokument3 SeitenAmeya Lakheameya lakheNoch keine Bewertungen

- Account Opening FormDokument2 SeitenAccount Opening Formsalmanarshad2009Noch keine Bewertungen

- Virtual Pos Tech SheetDokument2 SeitenVirtual Pos Tech SheetJonathan VardouniotisNoch keine Bewertungen

- Narrative ReportDokument3 SeitenNarrative ReportKrissie Jane MorinNoch keine Bewertungen

- Maverick Ministries To The Legal Services Board Victoria AustraliaDokument11 SeitenMaverick Ministries To The Legal Services Board Victoria AustraliaSenateBriberyInquiryNoch keine Bewertungen

- Goodbye, Passwords. Hello, Biometrics.: 1 Global Insights Visa ConfidentialDokument9 SeitenGoodbye, Passwords. Hello, Biometrics.: 1 Global Insights Visa ConfidentialVJNoch keine Bewertungen

- EMV/CAM2 Exits For APTRA Advance NDC: NCR University CourseDokument11 SeitenEMV/CAM2 Exits For APTRA Advance NDC: NCR University CourseRonlee SobersNoch keine Bewertungen

- Visa Consulting and AnalyticsDokument20 SeitenVisa Consulting and AnalyticsKristen NguyenNoch keine Bewertungen

- The University's Tuition Fee Deposit Policy 2022 (6788)Dokument3 SeitenThe University's Tuition Fee Deposit Policy 2022 (6788)AYOOLUWA OBATOMOWONoch keine Bewertungen

- Visa Inc Fiscal 2021 Annual ReportDokument134 SeitenVisa Inc Fiscal 2021 Annual ReportzoolandoNoch keine Bewertungen

- TdBank EditavelDokument4 SeitenTdBank Editaveltudo doidoNoch keine Bewertungen

- Your Current Account TermsDokument28 SeitenYour Current Account TermsaNoch keine Bewertungen

- How To Start A Travel Agency in NigeriaDokument6 SeitenHow To Start A Travel Agency in NigeriatunlajiNoch keine Bewertungen

- Atm OutsourcingDokument61 SeitenAtm OutsourcingMahalakshmi RavikumarNoch keine Bewertungen

- Ali Raza ABL PDFDokument4 SeitenAli Raza ABL PDFHajveri Printing ServicesNoch keine Bewertungen

- Fee Information Document: Service Fee General Account ServicesDokument7 SeitenFee Information Document: Service Fee General Account ServicesAndreea SaftaNoch keine Bewertungen

- 40 Corporate Innovation Labs in Finance: The TitleDokument47 Seiten40 Corporate Innovation Labs in Finance: The Titledrestadyumna ChilspiderNoch keine Bewertungen

- Annual Report 2012Dokument250 SeitenAnnual Report 2012Enamul HaqueNoch keine Bewertungen

- Money ATM MachinesDokument11 SeitenMoney ATM MachinesBabmani ManiNoch keine Bewertungen