Beruflich Dokumente

Kultur Dokumente

FFM Articles CIA

Hochgeladen von

wawahanieOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

FFM Articles CIA

Hochgeladen von

wawahanieCopyright:

Verfügbare Formate

technical

the discounted cash flow internal rate of return

relevant to CAT Scheme Papers 4 and 10

capital investment

appraisal

Sessions 18 and 19 of the Study Guide QUESTION discount factors are used to calculate further

for CAT Paper 4 are concerned with the A capital investment project has estimated net NPVs which can then be plotted on a graph

use of discounted cash flow (DCF) methods cash inflows of $60,000 per annum for six (although this is not required to answer

in the appraisal of capital investment years. Discounting the net cash flows at 10% thisquestion).

projects. These sessions on DCF cover and 20% per annum, the present values of the If discount rates of 5%, 15%, and 25%

the mathematics of discounting and how inflows are: are also used, the further NPVs are:

it is used to evaluate the worth of capital at 5% NPV = $80,560 [($60,000 x

investment projects via an analysis of cash Annual discount rate Present value of inflows 5.076*) - $224,000]

flows. The fact that these are the last sections 10% $261,300 at 15% NPV = $3,040 [($60,000 x

in the Study Guide, and are invariably 20% $199,600 3.784*) - $224,000]

covered last in study materials, may account at 25% NPV = ($46,940) [($60,000 x

for the poor performance by the majority The initial investment amount is $224,000. 2.951*) - $224,000]

of candidates when tackling questions on

thistopic. Required: * Annuity rates (ie cumulative discount factors)

My article in the April 2006 issue i Plot the NPV of the project, at discount over six years.

of student accountant focused on the rates of 10% and 20% per annum, on

identification of relevant cash flows in an graph paper. The five NPVs (at 5%, 10%, 15%, 20% and

investment project, and on the discounting ii Indicate, on the graph, an estimate of the 25%) are plotted on Graph 1.

of those cash flows in the calculation of the IRR of the project.

net present value (NPV) of an investment. In GRAPH 1: THE NPV CURVE

that article, I highlighted the common errors NPV AND DISCOUNT RATE

made by candidates in these aspects of capital To answer Part (i), the NPV of the investment

+80

investment appraisal, using Question 1 from at 10% and at 20% per annum must first

Section B of the December 2005 Paper 4 be calculated. The NPV of the cash flows is

exam as illustration. Candidates are also the total present value of the cash inflows +60

frequently unclear as to how and when to use (already given in the question), less the initial

the internal rate of return (IRR) formula in investment amount. Thus:

capital investment appraisal, and this is the at 10% NPV = $37,300 ($261,300 - +40

Net present value $000

subject of this second article. $224,000)

Understanding how the NPV of an at 20% NPV = ($24,400) ($199,600 -

investment changes as the discount rate is $224,000) +20

varied is a good start. A useful second step is Annual

an understanding of how linear interpolation The NPV of any investment that has a discount

rate %

and/or extrapolation can be used in the conventional stream of cash flows (ie 0

approximation of the IRR percentage return. investment outflow followed by a sequence 5 10 15 20 25

Part (c) of Question 1 from Section B of the of cash inflows) will decline as the discount

June 2007 Paper 4 exam (set out below), and rate increases. There is not, however, a linear -20

my comments on candidate performance, will relationship between discount rate and NPV

be used in this article to highlight and explain because of the way that discounting works.

these aspects. This can be seen more clearly if additional -40

32 student accountant April 2008

technical

The plotted values, when joined up, demonstrate very few of the candidates who did attempt Candidates need to have an

that the NPV declines in a gentle curve as the it presented good answers. Most candidates

discount rate is increased. For each percentage failed to deduct the capital investment amount appreciation of the effect that

increase in the discount rate the NPV declines of $224,000 from the present value of the the discounting process has

by a smaller and smaller absolute amount. cash inflows to arrive at the NPVs to plot on

Candidates were not required to draw a line the graph, thus also making identification

on the NPV of an investment

on the graph in order to answer Part (i) of the of the IRR impossible. Scaling and labelling project at varying discount

June 2007 question, but they did need to do of the graph was often poor, and a common rates. They then need to be able

this for Part (ii). error was to prepare a graph with time (years)

on the horizontal axis, rather than annual to calculate an approximate

THE INTERNAL RATE OF RETURN (IRR) discount rate percentage. IRR percentage return, without

The IRR method of DCF involves finding the A significant number of candidates failed

percentage rate which, when used to discount to appreciate that present values for the cash

unnecessarily lengthy workings.

the cash flows expected from an investment, inflows had been provided in the question. As

will produce an NPV of zero (ie where the total a result, they wasted valuable time calculating because they were unable to apply the formula

present value of the sequence of cash inflows discount rates at 10% and 20% and then correctly. Partly as a consequence, many

is equal to the present value of the cash applying these rates to the cash flows to candidates calculated the IRR to be greater

amount invested). get the present values already provided. than 20%. This was always without comment,

Looking at the NPV graph (repeated This demonstrated a lack of understanding despite the fact that they were informed in the

as Graph 2), the IRR is therefore the point or failure to read the question carefully. A question that the NPV was negative when the

where the NPV line crosses the horizontal axis significant number of candidates also wasted cash flows were discounted at 20%. It should,

(annual discount rate %). This is at a discount time attempting a calculation of the IRR; they therefore, have been clear to candidates that

rate of 15.5% (ie the NPV is zero at this rate should have been able to indicate this on the the IRR had to be less than 20%. In addition,

of discount). graph using their plotted data, and therefore one of the reasons for the calculation of a high

without calculations. In any case, very few IRR was that candidates frequently simply

GRAPH 2: INTERNAL RATE OF RETURN OF candidates made any attempt at indicating the discounted the positive cash inflows and failed

15.5% IRR on their graph. to deduct the negative original investment.

Candidates often estimated the IRR in this

+80

CALCULATION OF THE IRR situation (ie estimated the discount rate at

Some exam questions on the topic of capital which the NPV would be zero) by using an

+60 investment project appraisal require the extrapolation formula. It would actually be

calculation of the IRR % and candidates for impossible to discount the cash flows to a

Paper 4 have demonstrated that they struggle zero NPV in such a situation because only

+40 with this. In Part (b) of Question 4 from positive cash flows were being included in the

Net present value $000

Section B of the June 2004 exam, candidates analysis. This impossibility was not recognised

were required to calculate the IRR of a project by any of thecandidates.

+20 from a given schedule of cash flows. In order

IRR =

15.5% Annual to reduce the number of calculations that were INTERPOLATION AND EXTRAPOLATION

discount required, candidates were given the NPV of the FORMULA

rate %

0 project when cash flows were discounted at a As has been noted from Graph 1, there is no

5 10 15 20 25 rate of 20% per annum. My examiners report linear relationship between discount rate and

commented as follows: NPV. As the discount rate is increased the

-20 Many candidates made a reasonable NPV falls but, as indicated by the shape of

start by doing some discounting, at 10% the curve on the graph, the NPV reduces by

and/or 14%, to get one or more further an increasingly smaller absolute amount in

-40 NPVs (although some calculated the NPV at response to successive changes of a certain

20% even though it was already provided in amount in the discount rate.

EXAMINERS REPORT thequestion). The IRR can be found by repeated trial

In my examiners report, I noted that many However, candidates often failed to and error calculations but this process can

candidates failed to attempt Part (c) of carry it through either because they used be shortened, and still produce results within

Question 1 in the June 2007 exam, and that an incorrect formula for IRR estimation or an acceptable range of values, by actually

34 student accountant April 2008

technical

assuming a linear relationship between NPV Approximate IRR = 5% + [(25 - 5%) x Approximate IRR = 5% + [(10 - 5%) x

and discount rate to approximate the IRR. The ($80,560/$80,560 +* 46,940)] = 17.6% ($80,560/$80,560 -* 37,300)] = 14.3%

key question is, when can such an assumption

be made? We will return to this question later. * In interpolation, the two figures are always * In extrapolation, one NPV is always deducted

First, the IRR approximation formula. added because both a positive value and a from the other because either two positive

Any two NPVs can be used in the negative value are involved. values or two negative values are involved.

calculation of an approximate IRR for a capital

investment project. If the two points used lie The approximate IRR of 17.6% is the value The approximate IRR of 14.3% is the value

either side of the IRR (ie one discount rate shown on broken line 1 on Graph 3, ie a linear shown on broken line 2 of Graph 3, ie a linear

lower than the IRR with a positive NPV, and relationship is assumed between values at 5% relationship is assumed between the values at

one higher with a negative NPV) then the and 25%. 5% and 10%, then extended to the horizontal

process of approximation is called interpolation axis. A closer approximation would be

(the calculation of an intermediate term). GRAPH 3: APPROXIMATE INTERNAL RATE obtained by extrapolating using values closer

However, extrapolation (the calculation of a OF RETURN to the IRR, for example at 10% and 15%

term outside the known range) is equally valid, discount rates. So:

+80

using either two positive NPVs (and associated

discount rates) or two negative NPVs. Approximate IRR = 10% + [(15 - 10%) x

The general formula for the estimation +60 ($37,300/$37,300 - 3,040)] = 15.4%

of the IRR of a capital investment project by

interpolation or extrapolation is: IRR APPROXIMATION RULE

+40 As a general rule, two values can reasonably

Net present value $000

Approximate IRR = lower discount rate * be used in interpolation or extrapolation as

1

[change in discount rate (%) between the two 2 long as either each NPV is less than 20% of

Interpolation (using

points x (NPV at lower discount rate change +20 Extrapolation 5% and 25%).

the undiscounted value* of the investment

in NPV between the two points)] (using 5% and Estimated IRR = project, or one of the NPVs is within 10%

10%). Estimated 17.6% of the undiscounted value (which could be

IRR = 14.3%

* This will be + if the lower discount rate 0 the other value used for the interpolation/

has a positive NPV. This will be - if the lower 5 10 15 20 25 extrapolation). This should produce a

discount rate has a negative NPV Annual sufficiently accurate approximation of the IRR

discount

-20 rate % percentage, especially if sensibly rounded

If interpolating, the factor (NPV at base point down, if interpolation, or up if extrapolation,

change in NPV between the two points to the nearest whole percentage.

used) < 1. -40

* In our example, the undiscounted value is

If extrapolating, the factor (NPV at base point $136,000, ie [($60,000 6) - $224,000].

change in NPV between the two points The interpolation seems an unreasonable

used) > 1. approximation because the estimate of CONCLUSION

17.6% is a significant overstatement when Candidates for Paper 4 need to have an

Interpolation will always overstate the true compared with our previous figure of 15.5%. appreciation of the effect that the discounting

return and thus should lead, if anything, to a This is because of the two points used. process has on the NPV of an investment

rounding downwards. Extrapolation will always Taking the two points closest to the IRR (at project at varying discount rates. They then

understate the true return and thus should 15% and 20%) the interpolation calculation need to be able to calculate an approximate

lead, if anything, to a rounding upwards. confirms the previous reading from the graph IRR percentage return, without unnecessarily

as follows: lengthy workings, by knowing the interpolation/

EXAMPLES OF INTERPOLATION AND extrapolation formula and by using it correctly

EXTRAPOLATION Approximate IRR = 15% + [(20 - 15%) x and sensibly. It is hoped that this article will

Returning to Part (c) of the June 2007 Paper 4 ($3,040/$3,040 + 24,400)] = 15.6% help candidates in these aspects of DCF capital

question used earlier, interpolation (estimating investmentappraisal.

within the range) could be done using the Extrapolation (estimating outside of the range)

NPVs at 5% and at 25% (one positive and one could be done using, for example, the NPVs at

negative NPV). Using the above formula: 5% and 10% (both positive):

April 2008 student accountant 35

Das könnte Ihnen auch gefallen

- Capital Budgeting Decisions: Dr. Narayan Baser SPM Pdpu GandhinagarDokument60 SeitenCapital Budgeting Decisions: Dr. Narayan Baser SPM Pdpu GandhinagarAman MakkadNoch keine Bewertungen

- Capital BudgetingDokument52 SeitenCapital BudgetingMichael BlueNoch keine Bewertungen

- Capital Budgeting Decisions: Should We Build This Plant?Dokument44 SeitenCapital Budgeting Decisions: Should We Build This Plant?omi_pallavi100% (2)

- Capital Budgeting: Dr. Akshita Arora IBS-GurgaonDokument24 SeitenCapital Budgeting: Dr. Akshita Arora IBS-GurgaonhitanshuNoch keine Bewertungen

- ACCA F9 Lecture 2Dokument37 SeitenACCA F9 Lecture 2Fathimath Azmath AliNoch keine Bewertungen

- Fin 425 Final NIKEDokument11 SeitenFin 425 Final NIKEcuterahaNoch keine Bewertungen

- Capital Budgeting TechniquesDokument35 SeitenCapital Budgeting TechniquesGaurav gusaiNoch keine Bewertungen

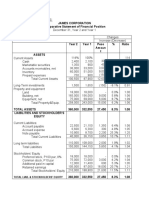

- Horizontal Analysis:: James Corporation Comparative Statement of Financial PositionDokument7 SeitenHorizontal Analysis:: James Corporation Comparative Statement of Financial PositionJohn Francis IdananNoch keine Bewertungen

- NET PRESENT VALUE AND OTHER INVESTMENT CRITERIA - Chapter 08Dokument16 SeitenNET PRESENT VALUE AND OTHER INVESTMENT CRITERIA - Chapter 08zordan100% (1)

- FIN 6060 Module 4 WorksheetDokument4 SeitenFIN 6060 Module 4 Worksheetr.olanibi55Noch keine Bewertungen

- Discounted MethodDokument33 SeitenDiscounted Methodjerickolian.delrosarioNoch keine Bewertungen

- CITATION Ste15 /L 1033Dokument5 SeitenCITATION Ste15 /L 1033GR PandeyNoch keine Bewertungen

- Capital Budgeting DecisionsDokument50 SeitenCapital Budgeting DecisionspiyushNoch keine Bewertungen

- Capital Budgeting DecisionsDokument36 SeitenCapital Budgeting DecisionsPrashant SharmaNoch keine Bewertungen

- Chapter 5 - Evaluating A Single ProjectDokument19 SeitenChapter 5 - Evaluating A Single Projectmouhammad mouhammadNoch keine Bewertungen

- Financial Management (FIN401) : Capital BudgetingDokument34 SeitenFinancial Management (FIN401) : Capital BudgetingNavid GodilNoch keine Bewertungen

- Net Present Value and Other Investment CriteriaDokument72 SeitenNet Present Value and Other Investment CriteriaAbdullah MujahidNoch keine Bewertungen

- Case Study ReportDokument7 SeitenCase Study ReportHytham RiadNoch keine Bewertungen

- Application Analysis On Internal Rate of Return Rule For Investment DecisionDokument5 SeitenApplication Analysis On Internal Rate of Return Rule For Investment DecisionAndro HutabaratNoch keine Bewertungen

- For 9.220, Term 1, 2002/03 02 - Lecture8Dokument16 SeitenFor 9.220, Term 1, 2002/03 02 - Lecture8Rajjak MohmmedNoch keine Bewertungen

- Capital BudgetingDokument45 SeitenCapital BudgetingPranav ChandraNoch keine Bewertungen

- 02 Lecture8 Organized OrganizedDokument12 Seiten02 Lecture8 Organized Organizednimona asantiNoch keine Bewertungen

- Capital Budgeting Decisions: Chapter - 8Dokument49 SeitenCapital Budgeting Decisions: Chapter - 8garv2114Noch keine Bewertungen

- Ch. 11 - 13ed CF EstimationDokument69 SeitenCh. 11 - 13ed CF EstimationFarahditaNoch keine Bewertungen

- Capital BudgetingDokument20 SeitenCapital BudgetingrishiomkumarNoch keine Bewertungen

- SFM FinDokument159 SeitenSFM FinAakashNoch keine Bewertungen

- Managerial Finance Group 2C Online Wednesday Mid Term Ahmed Mohamed Mohamed Ibrahem ID: 20122069Dokument9 SeitenManagerial Finance Group 2C Online Wednesday Mid Term Ahmed Mohamed Mohamed Ibrahem ID: 20122069Ahmed Mohamed AwadNoch keine Bewertungen

- Sessions 5 and 6Dokument69 SeitenSessions 5 and 6Priyansh SinghNoch keine Bewertungen

- Financial Management IrrDokument6 SeitenFinancial Management IrrSanjay PotterNoch keine Bewertungen

- Session8 - 13 NewDokument24 SeitenSession8 - 13 NewAbhishek KashyapNoch keine Bewertungen

- Session 7 Capital BudgetingDokument31 SeitenSession 7 Capital BudgetingSakshi VermaNoch keine Bewertungen

- Capital Budgeting CR PDFDokument24 SeitenCapital Budgeting CR PDFAshNor RandyNoch keine Bewertungen

- Net Present Value MCQ's & Descriptive TAEDokument45 SeitenNet Present Value MCQ's & Descriptive TAEJames MartinNoch keine Bewertungen

- Weygandt, Kieso, & Kimmel: Managerial AccountingDokument54 SeitenWeygandt, Kieso, & Kimmel: Managerial AccountingGiulia TabaraNoch keine Bewertungen

- Capital BudgetingDokument39 SeitenCapital BudgetingSiddhesh AsatkarNoch keine Bewertungen

- Finance - Assignment SampleDokument11 SeitenFinance - Assignment Samplejithujosevet100% (5)

- FMTII Session 4&5 Capital BudgetingDokument56 SeitenFMTII Session 4&5 Capital Budgetingbhushankankariya5Noch keine Bewertungen

- Pak Taufikur CH 11 Financial Management BrighamDokument69 SeitenPak Taufikur CH 11 Financial Management BrighamRidhoVerianNoch keine Bewertungen

- CF EstimationDokument97 SeitenCF Estimationdanish khanNoch keine Bewertungen

- Capital Budgeting-Investment Decision CriteriaDokument57 SeitenCapital Budgeting-Investment Decision CriteriaSheila ArjonaNoch keine Bewertungen

- Capital Budgeting Decision Rules: What Real Investments Should Firms Make?Dokument29 SeitenCapital Budgeting Decision Rules: What Real Investments Should Firms Make?Durre NayabNoch keine Bewertungen

- 2.4 Risk Analysis in Capital BudgetingDokument68 Seiten2.4 Risk Analysis in Capital BudgetingMaha Bianca Charisma CastroNoch keine Bewertungen

- 308 CH 13 NotesDokument10 Seiten308 CH 13 NotesRayan LahlouNoch keine Bewertungen

- Risk Analysis in InvestmentDokument39 SeitenRisk Analysis in InvestmentJoel AriahuNoch keine Bewertungen

- IV-Economics in Ship DesignDokument24 SeitenIV-Economics in Ship DesignDhebdjshdn ShxhshushdNoch keine Bewertungen

- IUP - Case 15 - Group 14Dokument8 SeitenIUP - Case 15 - Group 14Steven Nathanael LiyantoNoch keine Bewertungen

- Chap 11 Problem SolutionsDokument46 SeitenChap 11 Problem SolutionsNaufal FigoNoch keine Bewertungen

- Lecture 4-Capital BudgetingDokument38 SeitenLecture 4-Capital BudgetingadmiremukureNoch keine Bewertungen

- 8 11 Module EVALUATION OF INVESTMENT PROPOSALDokument17 Seiten8 11 Module EVALUATION OF INVESTMENT PROPOSALRishelle Mae C. AcademíaNoch keine Bewertungen

- Coursework Assignment Strategic Financial ManagementDokument9 SeitenCoursework Assignment Strategic Financial ManagementaliNoch keine Bewertungen

- Cash FLowDokument60 SeitenCash FLowSakshi SharmaNoch keine Bewertungen

- Capital Budgeting: Learning ObjectivesDokument41 SeitenCapital Budgeting: Learning ObjectivesJane Michelle EmanNoch keine Bewertungen

- Investment DecDokument29 SeitenInvestment DecSajal BasuNoch keine Bewertungen

- Corporate Finance 4Dokument8 SeitenCorporate Finance 4Zahid HasanNoch keine Bewertungen

- Capital BudgetingDokument69 SeitenCapital BudgetingFarman ArshadNoch keine Bewertungen

- NPV ProfileDokument5 SeitenNPV ProfilesaketNoch keine Bewertungen

- NPV and IRR Do Not AgreeDokument18 SeitenNPV and IRR Do Not AgreeGUNAWAN WICAKSONO -Noch keine Bewertungen

- NPV and IRR Do Not AgreeDokument17 SeitenNPV and IRR Do Not Agreeiqbal irfaniNoch keine Bewertungen

- Capital Budgeting Techniques Under UncertaintiesDokument26 SeitenCapital Budgeting Techniques Under Uncertaintieskenneth kayetaNoch keine Bewertungen

- DemoDokument15 SeitenDemoaastha soniNoch keine Bewertungen

- DCF Budgeting: A Step-By-Step Guide to Financial SuccessVon EverandDCF Budgeting: A Step-By-Step Guide to Financial SuccessNoch keine Bewertungen

- Discounted Cash Flow Demystified: A Comprehensive Guide to DCF BudgetingVon EverandDiscounted Cash Flow Demystified: A Comprehensive Guide to DCF BudgetingNoch keine Bewertungen

- Financial Statements (Format)Dokument2 SeitenFinancial Statements (Format)jayNoch keine Bewertungen

- FINC600 Homework Template Week 3 Jan2013Dokument16 SeitenFINC600 Homework Template Week 3 Jan2013joeNoch keine Bewertungen

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownDokument23 SeitenInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownVha AnggrainiNoch keine Bewertungen

- BetaDokument3 SeitenBetaDwi LinggarniNoch keine Bewertungen

- ARW Online Long Exam Part 2 PDFDokument13 SeitenARW Online Long Exam Part 2 PDFMansour HamjaNoch keine Bewertungen

- National Mock Board Examination 2017 Financial Accounting and ReportingDokument9 SeitenNational Mock Board Examination 2017 Financial Accounting and ReportingSam0% (1)

- Business Finance Chapter 4Dokument21 SeitenBusiness Finance Chapter 4Eli DeeNoch keine Bewertungen

- Mbaproject - Kotak Sec PDFDokument63 SeitenMbaproject - Kotak Sec PDFNAWAZ SHAIKHNoch keine Bewertungen

- Answer: Difficulty: Objective: Terms To Learn: Capital BudgetingDokument7 SeitenAnswer: Difficulty: Objective: Terms To Learn: Capital BudgetingMaha HamdyNoch keine Bewertungen

- CV CFO Mario Perez Ago 22Dokument2 SeitenCV CFO Mario Perez Ago 22alfredoNoch keine Bewertungen

- BB 107 - BBB1023 - BBS1083 Janl '24 Group Assignment QDokument3 SeitenBB 107 - BBB1023 - BBS1083 Janl '24 Group Assignment QJean珈祯Noch keine Bewertungen

- S SdfafdafdafdafDokument8 SeitenS SdfafdafdafdafMark Domingo MendozaNoch keine Bewertungen

- Pre-Week Batch 90 (TAX)Dokument12 SeitenPre-Week Batch 90 (TAX)Elaine Joyce GarciaNoch keine Bewertungen

- 42 CTP PAAS Result Sheet 2016Dokument2 Seiten42 CTP PAAS Result Sheet 2016Syed Aziz Hussain0% (1)

- Proven Skills in Wealth GenerationDokument3 SeitenProven Skills in Wealth GenerationsunilkumarhgNoch keine Bewertungen

- Learning Objective 16-1: Chapter 16 The Statement of Cash FlowsDokument105 SeitenLearning Objective 16-1: Chapter 16 The Statement of Cash FlowsMarqaz MarqazNoch keine Bewertungen

- ASR3 Materials - Auditing Equity and Debt InvestmentsDokument4 SeitenASR3 Materials - Auditing Equity and Debt InvestmentsHannah Jane ToribioNoch keine Bewertungen

- LBO Valuation - Working File CV2Dokument5 SeitenLBO Valuation - Working File CV2Ayushi GuptaNoch keine Bewertungen

- 04 Homework - Answer KeyDokument3 Seiten04 Homework - Answer KeyVeralou UrbinoNoch keine Bewertungen

- GI Book 6e-Chuong6Dokument56 SeitenGI Book 6e-Chuong6ngocnguyen.31211022349Noch keine Bewertungen

- Shareholder MaximizationDokument12 SeitenShareholder MaximizationROMMEL ROYCE CADAPAN100% (1)

- BOP One Pager Jan 2019Dokument1 SeiteBOP One Pager Jan 2019Ashwin HasyagarNoch keine Bewertungen

- CV Sridharan Swaminathan 022721Dokument8 SeitenCV Sridharan Swaminathan 022721sriNoch keine Bewertungen

- Solved You Are Driving On A Trip and Have Two ChoicesDokument1 SeiteSolved You Are Driving On A Trip and Have Two ChoicesM Bilal SaleemNoch keine Bewertungen

- 3 Departmental AccountsDokument13 Seiten3 Departmental AccountsJayesh VyasNoch keine Bewertungen

- ADJUSTING Activities With AnswersDokument5 SeitenADJUSTING Activities With AnswersRenz RaphNoch keine Bewertungen

- Error Correction - ExercisesDokument4 SeitenError Correction - ExercisesDe Chavez May Ann M.Noch keine Bewertungen

- Havells India 3QF14 Result Review 30-01-14Dokument8 SeitenHavells India 3QF14 Result Review 30-01-14GaneshNoch keine Bewertungen