Beruflich Dokumente

Kultur Dokumente

Form Ir8a - Ya 2017

Hochgeladen von

Naga Raj0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

382 Ansichten2 SeitenIr82a

Originaltitel

Form Ir8a_ya 2017

Copyright

© © All Rights Reserved

Verfügbare Formate

DOC, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenIr82a

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

382 Ansichten2 SeitenForm Ir8a - Ya 2017

Hochgeladen von

Naga RajIr82a

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

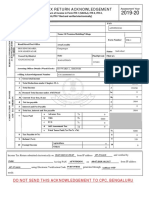

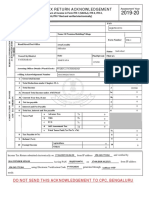

2017 FORM IR8A

Return of Employees Remuneration for the Year Ended 31 Dec 2016

Fill in this form and give it to your employee by 1 Mar 2017 for his submission together with his Income Tax Return

This Form will take about 10 minutes to complete. Please get ready the employees personal particulars and details of his/her employment

income. Please read the explanatory notes when completing this form.

Employers Tax Ref. No. / UEN Employees Tax Ref. No. : *NRIC / FIN (Foreign Identification No.)

Full Name of Employee as per NRIC / FIN Date of Birth Sex Nationality

Residential Address Designation Bank to which salary is credited

If employment commenced and/or ceased during the year, Date of Commencement Date of Cessation

state:

(See Explanatory Note 7)

INCOME (Enter NA for items that are not applicable) $

a) Gross Salary, Fees, Leave Pay, Wages and Overtime Pay (See Explanatory Note 12a)

b) Bonus (non-contractual bonus paid in 2016 and/or contractual bonus) (See Explanatory Note 12b)

c) Directors fees (approved at the companys AGM/EGM on / /.) (See Explanatory Note 12c)

d) Others:

1. Allowances: (i) Transport $ (ii) Entertainment $ (iii) Others $ [See Explanatory Note

12d(I)]

2. Gross Commission for the period to

* Monthly/other than monthly payment

3. Pension

4. Lump sum payment [See Explanatory Note 12d(II)]

(i) Gratuity $ (ii) Notice Pay $ (iii) Ex-gratia payment $

(iv) Others (please state nature) $

(v) Compensation for loss of office $ Approval obtained from IRAS: *Yes/No Date of approval: ..........

Reason for payment: Length of service:

Basis of arriving at the payment: (Give details separately if space is insufficient)

5. Retirement benefits including gratuities/pension/commutation of pension/lump sum payments, etc from

Pension/Provident Fund: Name of Fund

(Amount accrued up to 31 Dec 1992 $ ) Amount accrued from 1993:

6. Contributions made by employer to any Pension/Provident Fund constituted outside Singapore without tax concession:

Contributions made by employer to any Pension/Provident Fund constituted outside Singapore with tax

concession :

Name of the overseas pension/provident fund:

Full Amount of the contributions : Are contributions mandatory: *Yes/No

Were contributions charged / deductions claimed by a Singapore permanent establishment: *Yes/No

[See Explanatory Note 12d (III)]

7. Excess/Voluntary contribution to CPF by employer (less amount refunded/to be refunded):

[See Explanatory Note 12d (IV)] and complete the Form IR8S)

8. Gains or profits from Employee Stock Option (ESOP)/other forms of Employee Share Ownership (ESOW) Plans:

[See Explanatory Note 12d (V)] and complete the Appendix 8B)

9. Value of Benefits-in-kind (See Explanatory Notes 13 to 16 and complete the Appendix 8A):

TOTAL (items d1 to d9)

e) 1. Remission: Amount of Income $.................... (See Explanatory Note 12e)

2. Exempt/Non Taxable Income: $............... (See Explanatory Note 11)

f) If yes and fully borne by employer, DO NOT enter any amount in (i) and (ii)

Employees income

tax borne by (i) If tax is partially borne by employer, state the amount of income for which tax is borne by employer

employer?

* YES / NO (ii) If a fixed amount of tax is borne by employee, state the amount to be paid by employee

DEDUCTIONS (Enter NA for items that are not applicable)

EMPLOYEES COMPULSORY contribution to *CPF/Designated Pension or Provident Fund (less amount refunded/to be

refunded) Name of Fund :

(Please apply the appropriate CPF rates published by CPF Board on its website www.cpf.gov.sg. Do not include

excess/voluntary contributions to CPF, voluntary contributions to Medisave Account, voluntary contributions to

Retirement Sum Topping-up Scheme and SRS contributions in this item)

(See Explanatory Note 12 DEDUCTIONS)

Donations deducted from salaries for:

*Yayasan Mendaki Fund/Community Chest of Singapore/SINDA/CDAC/ECF/Other tax exempt donations

Contributions deducted from salaries to Mosque Building Fund :

Life Insurance premiums deducted from salaries:

DECLARATION (See Explanatory Note 4)

Name of Employer :

Address of Employer :

Name of authorised person making the declaration Designation Tel. No. Signature Date

There are penalties for failing to give a return or furnishing an incorrect or late return.

IR8A (1/2017) * Delete where applicable

Das könnte Ihnen auch gefallen

- SOP For ExampleDokument2 SeitenSOP For Exampleadityash9950% (4)

- E Tax 20200504201259Dokument3 SeitenE Tax 20200504201259monitganatra100% (1)

- The Implications of Educational Attainment To The Unemployment Rate Through Period of Time in The PhilippinesDokument34 SeitenThe Implications of Educational Attainment To The Unemployment Rate Through Period of Time in The PhilippinesStephRecato100% (3)

- Red Zuma ProjectDokument6 SeitenRed Zuma Projectazamat13% (8)

- 1a. IR8A (M) - YA 2012 - v1Dokument1 Seite1a. IR8A (M) - YA 2012 - v1freepublic9Noch keine Bewertungen

- Ir8a (M) 2010Dokument1 SeiteIr8a (M) 2010gk9f5e6ho1owcldxNoch keine Bewertungen

- Form IR8A YA 2018Dokument2 SeitenForm IR8A YA 2018Sandeep KumarNoch keine Bewertungen

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Dokument1 SeiteW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Adam AkbarNoch keine Bewertungen

- Singjan 22Dokument1 SeiteSingjan 22Vivien NordtNoch keine Bewertungen

- DT 0103 Personal Income Tax Return Form v1Dokument5 SeitenDT 0103 Personal Income Tax Return Form v1okatakyie1990100% (1)

- KYC Form - For IndividualDokument2 SeitenKYC Form - For IndividualBheeshm Prakash NayakNoch keine Bewertungen

- CBE UG YearbookDokument605 SeitenCBE UG Yearbookchad DanielsNoch keine Bewertungen

- Mini Case AnalysisDokument2 SeitenMini Case AnalysisErlene LinsanganNoch keine Bewertungen

- Foundation of Economics NotesDokument16 SeitenFoundation of Economics Notesrosa100% (1)

- Form 4Dokument7 SeitenForm 4Bao NguyenNoch keine Bewertungen

- FW WP Appln FormDokument22 SeitenFW WP Appln Formsanjayak_3Noch keine Bewertungen

- Policy Schedule Cum Certificate of InsuranceDokument2 SeitenPolicy Schedule Cum Certificate of Insurance058 PAUL MICHAEL SNoch keine Bewertungen

- EPOnlineSvcAccessApplnForm CompileDokument11 SeitenEPOnlineSvcAccessApplnForm CompileRia ArguellesNoch keine Bewertungen

- Computation Sheet of Taxable Income & Income TaxDokument2 SeitenComputation Sheet of Taxable Income & Income TaxPandu DoradlaNoch keine Bewertungen

- Statement of Account: Date Transaction Type Amount NAV in INR (RS.) Price in INR (RS.) Number of Units Balance UnitDokument1 SeiteStatement of Account: Date Transaction Type Amount NAV in INR (RS.) Price in INR (RS.) Number of Units Balance Unitee206023Noch keine Bewertungen

- Autopass Application FormDokument3 SeitenAutopass Application Formأم محمدNoch keine Bewertungen

- Motor Insurance - Two Wheeler Liability Only: Certificate of Insurance Cum Policy ScheduleDokument3 SeitenMotor Insurance - Two Wheeler Liability Only: Certificate of Insurance Cum Policy ScheduleHeart RockNoch keine Bewertungen

- Account Statement: Page 1 of 3Dokument3 SeitenAccount Statement: Page 1 of 3achyut kumarNoch keine Bewertungen

- Chandrakant G Tandel PDFDokument2 SeitenChandrakant G Tandel PDFKarina TandelNoch keine Bewertungen

- Employment Pass / S Pass Application Form (Form 8)Dokument12 SeitenEmployment Pass / S Pass Application Form (Form 8)edep_scribdNoch keine Bewertungen

- 2019 03 27 19 17 48 254 - DGCPK4360Q - 2018Dokument5 Seiten2019 03 27 19 17 48 254 - DGCPK4360Q - 2018TAX GURUNoch keine Bewertungen

- 3-Gmc Claim Form HDFC ErgoDokument3 Seiten3-Gmc Claim Form HDFC ErgoDT worldNoch keine Bewertungen

- Certificate of Collection or Deduction of Tax-2018-19Dokument2 SeitenCertificate of Collection or Deduction of Tax-2018-19Sarfraz Ali100% (1)

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Dokument1 SeiteW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Andres AlcantarNoch keine Bewertungen

- Account Statement: Folio Number: 1038047310Dokument2 SeitenAccount Statement: Folio Number: 1038047310Rajat RK KumarNoch keine Bewertungen

- Motor Insurance - Miscellaneous Carrying Comprehensive: Certificate of Insurance Cum Policy ScheduleDokument3 SeitenMotor Insurance - Miscellaneous Carrying Comprehensive: Certificate of Insurance Cum Policy ScheduleShiva DegaNoch keine Bewertungen

- Statement of Account: Date Transaction Type Amount NAV in INR (RS.) Price in INR (RS.) Number of Units Balance UnitDokument3 SeitenStatement of Account: Date Transaction Type Amount NAV in INR (RS.) Price in INR (RS.) Number of Units Balance UnitKumar ManojNoch keine Bewertungen

- Computation 3Dokument2 SeitenComputation 3Sai DyNoch keine Bewertungen

- Ack NSDL000043902Dokument1 SeiteAck NSDL000043902JohnsonNoch keine Bewertungen

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Dokument1 SeiteW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Moon Debbarma100% (1)

- US Internal Revenue Service: f1040nr - 2005Dokument5 SeitenUS Internal Revenue Service: f1040nr - 2005IRSNoch keine Bewertungen

- Dusty YearEnd 2022 FEC RepotDokument140 SeitenDusty YearEnd 2022 FEC RepotPat PowersNoch keine Bewertungen

- Tax Invoice: Original For RecipientDokument6 SeitenTax Invoice: Original For RecipientHarshal KolheNoch keine Bewertungen

- Form 16-2017-18Dokument4 SeitenForm 16-2017-18Yaswitha SadhuNoch keine Bewertungen

- MHBAN00187340000543428 NewDokument2 SeitenMHBAN00187340000543428 NewSiddhartha SrivastavaNoch keine Bewertungen

- 2019 07 09 15 30 29 717 - 1562666429717 - XXXPI9203X - Acknowledgement PDFDokument1 Seite2019 07 09 15 30 29 717 - 1562666429717 - XXXPI9203X - Acknowledgement PDFindu chauhanNoch keine Bewertungen

- 2019 12 20 11 04 21 881 - 1576820061881 - XXXPJ2291X - Acknowledgement PDFDokument1 Seite2019 12 20 11 04 21 881 - 1576820061881 - XXXPJ2291X - Acknowledgement PDFArjunJaiNoch keine Bewertungen

- 0 - 1098 Mortgage Interest 2022 - 01122023 - 162111Dokument1 Seite0 - 1098 Mortgage Interest 2022 - 01122023 - 162111Osvaldo CalderonUACJNoch keine Bewertungen

- 2019 11 01 21 37 31 963 - 1572624451963 - XXXPP7803X - Acknowledgement PDFDokument1 Seite2019 11 01 21 37 31 963 - 1572624451963 - XXXPP7803X - Acknowledgement PDFKunal PaulNoch keine Bewertungen

- Sip & Micro Sip PDC Form - 29.04.2013Dokument4 SeitenSip & Micro Sip PDC Form - 29.04.2013Aayush ShahNoch keine Bewertungen

- Rahasyathraya SaramDokument1 SeiteRahasyathraya SaramGopalachari RagunathanNoch keine Bewertungen

- Declaration Form PDFDokument2 SeitenDeclaration Form PDFBoopathi KalaiNoch keine Bewertungen

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 409150350210720 Assessment Year: 2020-21Dokument7 SeitenItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 409150350210720 Assessment Year: 2020-21Vasanth Kumar AllaNoch keine Bewertungen

- Readers Digest PetitionDokument13 SeitenReaders Digest PetitionmwoehrNoch keine Bewertungen

- Aaecc2134l 2023 PDFDokument4 SeitenAaecc2134l 2023 PDFVineet KhuranaNoch keine Bewertungen

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDokument1 SeiteIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAnsar ValiNoch keine Bewertungen

- 14374752Dokument2 Seiten14374752Anshul MehtaNoch keine Bewertungen

- DFCPS4106B Ay201920 16 Unsigned PDFDokument6 SeitenDFCPS4106B Ay201920 16 Unsigned PDFAnuj SrivastavaNoch keine Bewertungen

- Pay Bill GazettedDokument3 SeitenPay Bill Gazettedibrahimshahghotki_20Noch keine Bewertungen

- 2019 08 30 10 26 32 104 - 1567140992104 - XXXPK6719X - Acknowledgement PDFDokument1 Seite2019 08 30 10 26 32 104 - 1567140992104 - XXXPK6719X - Acknowledgement PDFRaviranjan KumarNoch keine Bewertungen

- Iffco-Tokio General Insurance Co - LTD: Servicing OfficeDokument2 SeitenIffco-Tokio General Insurance Co - LTD: Servicing OfficeRANGITHNoch keine Bewertungen

- FATCA Form Individual 061015 V1Dokument2 SeitenFATCA Form Individual 061015 V1sanjay901Noch keine Bewertungen

- Credit Card Application For Principal CardholderDokument1 SeiteCredit Card Application For Principal CardholderLoay RashadNoch keine Bewertungen

- Balwinder Singh ITR 2Dokument1 SeiteBalwinder Singh ITR 2Pawan KumarNoch keine Bewertungen

- 2019 10 01 16 36 43 414 - 1569928003414 - XXXPK7141X - Acknowledgement PDFDokument1 Seite2019 10 01 16 36 43 414 - 1569928003414 - XXXPK7141X - Acknowledgement PDFAtul TiwariNoch keine Bewertungen

- Arrest Form in Christopher Luis April 12 Arrest in Feb 13 ShootingDokument1 SeiteArrest Form in Christopher Luis April 12 Arrest in Feb 13 ShootingAndreaTorresNoch keine Bewertungen

- Renewal Premium Receipt: This Receipt Is Subject To Realisation of Cheque AmountDokument1 SeiteRenewal Premium Receipt: This Receipt Is Subject To Realisation of Cheque AmountjontyamitNoch keine Bewertungen

- Mushtaq & IshfaqDokument1 SeiteMushtaq & IshfaqAʌĸʌsʜ AƴʌŋNoch keine Bewertungen

- Employee Proof Submission Form - 2011-12Dokument5 SeitenEmployee Proof Submission Form - 2011-12aby_000Noch keine Bewertungen

- Pdf&rendition 1 PDFDokument1 SeitePdf&rendition 1 PDFainaa batrisyiaNoch keine Bewertungen

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementVon EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNoch keine Bewertungen

- 1 Barethan Murugesu 2 Vigneshwaran Sakthi Tharan 3 Thevakaleshwaran Kumaran 4 Yoganatha Arul Kumar 5 Janani Varman 6 Thanam S.RaipanDokument1 Seite1 Barethan Murugesu 2 Vigneshwaran Sakthi Tharan 3 Thevakaleshwaran Kumaran 4 Yoganatha Arul Kumar 5 Janani Varman 6 Thanam S.RaipanNaga RajNoch keine Bewertungen

- Contoh Halaman Muka Kulit Depan Kerja KursusDokument5 SeitenContoh Halaman Muka Kulit Depan Kerja KursusNaga RajNoch keine Bewertungen

- Side FailDokument1 SeiteSide FailNaga RajNoch keine Bewertungen

- Buuton Bottle Water Pen Pencil Laptop Eraser CameraDokument1 SeiteBuuton Bottle Water Pen Pencil Laptop Eraser CameraNaga RajNoch keine Bewertungen

- Monday Tuesday Wednedsday Thursday Friday Saturday SundayDokument1 SeiteMonday Tuesday Wednedsday Thursday Friday Saturday SundayNaga RajNoch keine Bewertungen

- Letter HeadDokument1 SeiteLetter Headmelvin bautistaNoch keine Bewertungen

- Recap: Globalization: Pro-Globalist vs. Anti-Globalist DebateDokument5 SeitenRecap: Globalization: Pro-Globalist vs. Anti-Globalist DebateRJ MatilaNoch keine Bewertungen

- Play Fair at The Olympics: Respect Workers' Rights in The Sportswear IndustryDokument12 SeitenPlay Fair at The Olympics: Respect Workers' Rights in The Sportswear IndustryOxfamNoch keine Bewertungen

- Business Development ResumeDokument1 SeiteBusiness Development ResumeCharlie HolmesNoch keine Bewertungen

- Financial Accounting: Accounting For Merchandise OperationsDokument84 SeitenFinancial Accounting: Accounting For Merchandise OperationsAnnie DuolingoNoch keine Bewertungen

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Dokument1 SeiteTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Nishkarsh SinghNoch keine Bewertungen

- Ecommerce Platform "Lensyara" Launched With An Eye To The FutureDokument3 SeitenEcommerce Platform "Lensyara" Launched With An Eye To The FuturePR.comNoch keine Bewertungen

- Ecs Exam PackDokument137 SeitenEcs Exam PackWah NgcoboNoch keine Bewertungen

- Chapter 3Dokument5 SeitenChapter 3Elsa Mendoza50% (2)

- Klabin S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)Dokument66 SeitenKlabin S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)Klabin_RINoch keine Bewertungen

- Interest Rate Swaptions: DefinitionDokument2 SeitenInterest Rate Swaptions: DefinitionAnurag ChaturvediNoch keine Bewertungen

- 3 MM01 Tcode in SAP - How To Create Material Master in SAP MMDokument5 Seiten3 MM01 Tcode in SAP - How To Create Material Master in SAP MMmanjuNoch keine Bewertungen

- HULDokument2 SeitenHULShruti JainNoch keine Bewertungen

- Solution Jan 2018Dokument8 SeitenSolution Jan 2018anis izzatiNoch keine Bewertungen

- Thiess Induction - Brief History of ThiessDokument116 SeitenThiess Induction - Brief History of Thiessangshuman87Noch keine Bewertungen

- LadderforLeaders2023 273 PDFDokument699 SeitenLadderforLeaders2023 273 PDFsantosh kumarNoch keine Bewertungen

- A Platform For Innovation: Speech Given by Mark Carney, Governor Bank of EnglandDokument7 SeitenA Platform For Innovation: Speech Given by Mark Carney, Governor Bank of EnglandHao WangNoch keine Bewertungen

- Study On Non Performing AssetsDokument6 SeitenStudy On Non Performing AssetsHarshal RavankarNoch keine Bewertungen

- Marketing Plan GuidelinesDokument24 SeitenMarketing Plan Guidelinesrajeshiipm08Noch keine Bewertungen

- VisionLife EN 100801Dokument26 SeitenVisionLife EN 100801Jeff HsiaoNoch keine Bewertungen

- Hotel Financial ConceptsDokument17 SeitenHotel Financial ConceptsMargeryNoch keine Bewertungen

- Cooperation Proposal Oriental Logistics Indonesia PDFDokument9 SeitenCooperation Proposal Oriental Logistics Indonesia PDFMobius AlexanderNoch keine Bewertungen

- Chapter 5Dokument42 SeitenChapter 5Aamrh AmrnNoch keine Bewertungen

- sportstuff.comDokument3 Seitensportstuff.comRanjitha KumaranNoch keine Bewertungen