Beruflich Dokumente

Kultur Dokumente

2003 Final Project

Hochgeladen von

Asif YounasOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2003 Final Project

Hochgeladen von

Asif YounasCopyright:

Verfügbare Formate

Impact of Risk Free Rate (T-Bill) on Stock Returns

A Research Project

On

Impact of Risk Free Rate (T-Bill) on Stock Returns

KSE 100 index (Karachi Stock Exchange of Pakistan)

Submitted to:

Madam Bushra Nasreen

Degree Title:

MBA Finance (Evening)

Course Title:

Research Project

Course Code:

MGT-799

Submission Date:

July 27, 2010

Submitted By:

Asif Younas (08-Arid-1559)

Waseem Rana (08-Arid-1605)

Mehmood Akhtar (08-Arid-1582)

Pir Mehr Ali Shah

University of Arid Agriculture, Rawalpindi

University Institute of Management Sciences

PMAS UAAR University Institute of Management Sciences Page 1

Impact of Risk Free Rate (T-Bill) on Stock Returns

Plagiarism Certificate:

It has been certified that the research report submitted by:

Mehmood Akhtar (08-arid-1582)

Waseem Rana (08-arid-1605)

Asif Younas (08-arid-1559)

Was/wasn’t within the specified limits of plagiarism and was/wasn’t in accordance to

Standards specified by the institute.

Certified by

----------------------

Madam Bushra Nasreen

(Supervisor)

PMAS UAAR University Institute of Management Sciences Page 2

Impact of Risk Free Rate (T-Bill) on Stock Returns

Evaluation Form:

Mehmood Akhtar (08-arid-1582)

Waseem Rana (08-arid-1605)

Asif Younas (08-arid-1559)

Research report submitted for Final Evaluation in Partial Fulfillment of the

requirements for the Degree of

Masters of Business Administration (MBA)

It is certified that, the Research report and the work contained in it conforms to all the

standards set by the Institute for the evaluation of any such work.

1. ------------------------

Madam Bushra Nasreen

(Supervisor)

2. -------------------------

Mr. Abdul Rehman

3. ------------------------

University Institute of Management Sciences

PMAS-University of Arid Agriculture Rawalpindi

2010

PMAS UAAR University Institute of Management Sciences Page 3

Impact of Risk Free Rate (T-Bill) on Stock Returns

Dedication:

My Loving Parents:

Who always prayed for my success & their love and affection have always been a

source of inspiration for me to difficulties, this taught me a lot about life.

My Respected Teachers:

Who always provide us knowledge, skills and guidance that become a successful way

in our life.

PMAS UAAR University Institute of Management Sciences Page 4

Impact of Risk Free Rate (T-Bill) on Stock Returns

Table of contents:

1. Abstract

2. Introduction

3. Literature Review

4. Methodology

Hypothesis Test

Simple Regression Model

Correlation

Coefficient of Determinant

5. Results

6. Discussion

7. Conclusion

8. References

PMAS UAAR University Institute of Management Sciences Page 5

Impact of Risk Free Rate (T-Bill) on Stock Returns

Abstract:

In this research project, we examine or analyzed the impact of risk free rate (T-Bill)

on stock market return (KSE 100 index) on the bases of last ten years (2000-2009)

historical time series data. For this purpose, we used Simple Regression Model as

well as Correlation Matrix. In this case, KSE 100 index is taken as dependent variable

and T-Bill rate is taken as an independent variable. Our findings or results are; risk

free rate has significant impact on stock market return but it is only 5.7 percent. T-Bill

rate and KSE 100 index have opposite direction because its regression coefficient is

negative. When T-Bill rate increase then KSE 100 index will decrease and vise versa

because, we analyzed it has inverse relationship. Also weak correlation exists between

Risk free rate and Stock Return.

PMAS UAAR University Institute of Management Sciences Page 6

Impact of Risk Free Rate (T-Bill) on Stock Returns

Introduction:

In this research paper, we examine the quantitative effect of risk free rates on stock

market return data because some investors have positive point of view while some

investors have negative point of view about it. T-Bill rate is an important element to

control the money supply and interest rate in the economy which is issued by the

Central Bank of the country.

Central bank of the country regulates the banking sector as well as organized the

money market. Stock market plays an important role in facilitating productive

investments and promoting economic growth. So, the Pakistani Gov’t felt in

September 1948 to established Karachi Stock Exchange Market later on which is

converted into guarantee limited company in 1949 and that time its paid up capital

Rs.108. Later on, two stock markets were established in Pakistan one at Lahore (LSE)

and other at Islamabad (ISE) in 1970 and 1989 respectively.

In this case, we consider the KSE 100 index because its index made on top 100

companies and it is a large index as compare with other Pakistani stock exchanges.

Stock exchange also provide necessary refreshment to institutions working for

promoting good quality of thrift, in carrying out their aims and the main objectives are

to attract savings and to utilize them profitability for the development of industrial.

With these actions of the capital markets base of industrial finance has greatly

widened the investment opportunities and a large number of small investors are

encouraged to put their savings in equity market investment.

In other words, investors while making the investment decisions investors consider

expected return, expected risk and the expected volatility upon the available

information. Thus, the stock markets activities are generally governed by information.

While the systematically spread information determines the long-term trend and

fundamental strength of the stock market, information that comes as good or bad news

becomes a cause shocks to the stock markets and results in volatility.

Rate of return on the security is free from default risk is called risk free rate (T-Bill

rate). Theoretically the rate of return where the beta is zero is the risk free rate. The

CAPM (Capital Asset Pricing Model) predicts the relation in the risk of assets and its

expected returns. This relation is in two ways. First, it provides a benchmark for

PMAS UAAR University Institute of Management Sciences Page 7

Impact of Risk Free Rate (T-Bill) on Stock Returns

evaluating various investments. Second, it helps us to predict about the return of

assets which has not been traded in the stock market.

Risk free rate is essential part of every return computed on financial assets. The SML

(Security Market Line) shows the relationship between the expected return and

standard deviation of a single stock while CML (Capital Market Line) reflects the

relation in risk free rate & straight line emanating from risk free rate (Rf) to tangential

to the efficient Merkowitz frontier.

Investors combine their un-correlated securities that help them to reduce the risk of a

portfolio. They wanted to know about the reasonable level of risk reduction about

their portfolio. Research shows that what will happen to portfolio risk if randomly

selected stocks are combined to equally weighted portfolio. Portfolio risk is the

standard deviation of that stock. As the number of uncorrelated stocks held in the

portfolio is increases, the total risk of the portfolio reduces.

The total risk is the combination of systematic risk and unsystematic risk. The first

Systematic risk is the risk that affect the overall market and that cannot be avoided

such as changes in the economies, world political situation, world economic situation

& world energy situation and this kind of risk cannot be minimized through

diversification. Second is unsystematic risk and it is unique to particular company. It

is a type of risk that can be minimize through proper diversification. Investors always

want to some compensation for taking systematic risk.

PMAS UAAR University Institute of Management Sciences Page 8

Impact of Risk Free Rate (T-Bill) on Stock Returns

Literature Review:

Leroi Raputsoane (2009) has conducted a research on Relationship between Risk

and Stock Return. In his research, the author examines risk return relationship evident

from South African Stock market return on the base of 8 years historical data. He

analyzed the risk return relationship by using GARCH in mean model. According to

his findings, 95% stock prices index show a positive relationship between risk and

return but only 5% stock prices show negative relationship due to methodological

approach as well as data frequency. Finally, the result of this research paper is about

positive relationship. So, the behave South Africa stock market is according to

standard CAPM (Capital Assets Pricing Model). CAPM show the direct relationship

between risk and market return (high risk and high return, low risk and low return).

John Beirne (2009) has conducted a research on Effect of Interest & Exchange Rate

on Stock market Return. In this paper, the author examine the sensitivity between the

interest rate, stock market return and exchange rate risk in banking and insurance

sectors on the basis of 20 years historical data among the 16 countries by using

GARCH-M model, causality in mean, causality in variance and t-statistics. His

findings are, according to his published research paper, stock market return has a

positive effect on all financial sectors return but interest rate and exchange rate risk

has a mixed effect on financial sectors in short term as well as in long term in return.

In this article, the researcher before 1979 find negative relationship and after this

author finds positive relationship between exchange rate risk and market return but

not find clear pattern across 16 countries. According to researcher, exchange rate has

a positive effect in all Euro economies but negative effect in the rest of world. Interest

rate and exchange rate has not equally clear effect on stock market return in all 16

countries.

PMAS UAAR University Institute of Management Sciences Page 9

Impact of Risk Free Rate (T-Bill) on Stock Returns

Atilla Cifter & Alper Ozun (2007) have conducted a research on Estimating

Effects of Interest Rate on Stock Market Index. In his article, the authors examine the

interest rate effects on Turkish stock market index on the 3 years daily bases historical

data by using Granger-causality test. This test is used for the determination of cause

and effects. According to their research, they found that long term interest rates have

impact on Istanbul Stock 100 index. Effects of changes in interest rates are increases

on stock exchange prices with increase of time scale. Interest rate negatively effects

on stock market index as compared with investors predictions. So, investor should

make decision according to the volatility in interest rates.

Konsetantines Drakos have conducted a research on Interest Rate Risk and

Common Stock Returns. They in their article used two econometric methodologies to

find out interest rate sensitivity of Greek Banks common stock returns. First, within a

single equation framework where allowing for time volatility of banks excess returns

the null of zero interest rate sensitivity was rejected in 7 banks out of 9 banks. This

opinion suggests that the bank stock return shows significant sensitivity to interest

rates movements. Second, the interdependent nature of banks excess return, a

Seemingly Unrelated Regression Model (SURE Model, by Zellner in 1962) was used

where cross equations dependencies were allowed. Having the advantage of

simultaneously estimation of interest rate sensitivities, a joint test for there

insignificance was rejected, this rejection was the implication of banks as a group

shows significant sensitivity to interest rate innovation. The Interest rate sensitivity is

uniform across banks was also rejected hat suggest the interest rate effects is banks

specific. As a result of these rejections of uniformity hypothesis an empirical

investigation as to which are possible determinants of the cross-sectional variations,

of interest rate sensitivity coefficient was pursued.

PMAS UAAR University Institute of Management Sciences Page 10

Impact of Risk Free Rate (T-Bill) on Stock Returns

Nosheen & faiza (2008) have conducted a research on Interest Rate Volatility and

Stock Return Volatility. In their research, they analysed the changes in interest rate

volatility on stock exchange return on 4 years historical data by using the GARCH

model with interest rate changes as well as ARCH model with out interest rate

changes. According to their research, they found that interest rate has negatively

affected the stock market return. When interest rate increases then investors preferred

to investment in banks saving account rather than invest in stock exchange.

Marc-Gregor Czaja, Hendrik Scholz & Marco Wilkens (2007) have

conducted a research on Interest Rate Risk Rewards in Stock Returns of Financial

Corporation in German market. In their research, the authors analysed the interest rate

risk on stock return on historical data by using the Nelson and Siegel (1987) approach

to model in the term structure. In this article, they focused on influence of interest rate

risk on stock return variability and whether the interest rate risk is priced in equity

markets in order to find out the magnitude of interest rate risk rewards and there

contribution to total stock returns. They were found that the financial institutions have

a higher exposure to interest rate risk as compared to non-financial corporations.

Standard financial theory suggests based on the some assumptions that the same risk

earns the same return in different segments of the capital market but our results

suggest that a large part of the stock returns of particularly financial institutions might

consist of rewards for bearing interest rate risk.

PMAS UAAR University Institute of Management Sciences Page 11

Impact of Risk Free Rate (T-Bill) on Stock Returns

Gulin Vardar, Gokce Aksoy and Emre Can (2008) have conducted a research

on Effect of Interest and Exchange Rate on Volatility and Return of financial Sector

Prices Index. In their research, the authors analyzed the interest rate volatility in

return on daily bases sector data over 2001 to 2008 period by using GARCH model.

Basically, this paper is about investigation of effect of interest and exchange changes

own sectors and composite returns and volatility in Istanbul Stock Exchange. The

results shows except the services factors evidence shown that index returns decreases

in response to changes in interest rates. Interest rate and exchange rates are highly

significantly affected by the informational arrivals as well as the conditional volatility

is significantly related to the interest rates in all indices but not for services and

industrial sectors.

Alon Brav & Reven Lehany (2002) have conducted a research on Expected

Return and Asset Pricing Model. In their research, the researchers have used CAPM

(Capital Asset Pricing Model) in Wall Street analyst and Value line analyst. They

come up with the following results; Beta and expected return are positively related

when expected return is used rather then realized return. The firm market value of

equity is negatively related to its expected return. The third point is that the book-to-

market value is not a risk factor. This means that there is no evidence that investors

expect high book-to-market stock to generate higher returns then low book-to-market

stock. The intercept in cross sectional regressions is positive. The last important point

in this article is the market expectations are unobservable yet there are several reasons

to believe the expectation they employ here represent at least a significant portion of

markets expectation.

PMAS UAAR University Institute of Management Sciences Page 12

Impact of Risk Free Rate (T-Bill) on Stock Returns

Guglielmo caporale & Nicola Spagnolo (2008) have conducted a research on

Interest Rate, Exchange Rate and Stock Return Risk. In their article, they investigated

on interest rate and stock market return risk on banking services, financial services

and insurance services sectors on the bases of historical long and short term in

different countries market data by using GARCH-in-mean model. According to their

results, interest rate and exchange rate risk not gives the clear pattern on all sectors

but in majority cases interest rate has negatively effect on stock return in banking,

financial and insurance sectors.

Gerald A. Pogue, Franco Modigliani and Bruno H. (2002) have conducted the

research to test CAPM on European Stock Markets. In this research they had used

trainer, Sharpe and lintner models to justify the CAPM, they had try to explain the

variables like systematic risk, economic stability, political conditions, time intervals

etc. the results of their research shows a positive relationship between return and risk

in the European stock markets while Germany shows an adverse impact they also

explained the causes of this variability some are:- lack of difference between the

portfolio beta results and lack of beta coefficients. They also explained in their

research that if the pricing of risk is rational, institutional factors or thin markets

might create market inefficiencies which were not shown the tests conducted while

studying.

Safdar Hussain Tahir (2009) has conducted a research on Impact of Risk free rate

on Stock market return. In this paper, the author examines relationship between T-bill

rate and KSE 100 index by using Simple Regression as well as correlation model.

According to his results, risk free rate has no impact on stock market return. No

correlation exists between T-bill rates and KSE100 indexes. So, stock market function

has more variables other than risk free rate.

PMAS UAAR University Institute of Management Sciences Page 13

Impact of Risk Free Rate (T-Bill) on Stock Returns

Methodology:

We use the Simple Regression Model and Correlation Matrix to find out the relation

in risk free rates (T-Bill) & stock market returns. For this purpose, we have collected

the last ten years (2000-2009) historical monthly time series data of T-Bill rates and

KSE 100 index.

Here, we take the T-Bill rates as an independent variable and stock market return as a

dependent variable.

Formulation of Hypothesis:

Hypothesis formulation is given below:

Ho: T-Bill rate has no effect on KSE 100 index

Hi: T-Bill rate has effect on KSE 100 index

Simple Regression Model

Simple Regression Model use in the given following form:

Yi = β1 + β2Xi + εi

Here,

Xi = Risk Free Rate’s Value

β1 = Y intercept

β2 = Slope Coefficient

Yi = Stock Market Return’s Value

εi = Error Term

It is estimated by;

y = Sample Value of Stock Market Returns

x = Sample Value of Risk Free Rates

β2 = Estimated Regression Equation’s Slope

β1 = Y – β2 X

X = Mean of the Risk Free Rates

Y = Mean of the Stock Market Returns

n = Number of Samples

PMAS UAAR University Institute of Management Sciences Page 14

Impact of Risk Free Rate (T-Bill) on Stock Returns

Correlation Matrix (r):

Correlation matrix or coefficient of correlation is a statistical method to use for

determined of linear relationship among two variables. Its positive result indicates the

direct relationship between the variables or both variable moves in the same direction.

Its negative result shows the inverse relationship among the variables or both variable

moves in opposite direction. It’s zero result shows the no correlation tendency

between the two variables, either it may be a positive or negative.

Coefficient of Determinant (r2):

It is a degree of association between independent and dependent variables or it tells

us, how well independent variable explains the dependent variable. It shows the

goodness of fit. It is a square of the correlation coefficient. It shows the variability in

dependent variable due to change in independent variable.

PMAS UAAR University Institute of Management Sciences Page 15

Impact of Risk Free Rate (T-Bill) on Stock Returns

Results:

Dependent Variable: Y

Method: Least Squares

Date: 07/23/10 Time: 11:13

Sample(adjusted): 1 120

Included observations: 120 after adjusting endpoints

Variable Coefficient Std. Error t-Statistic Prob.

C 0.062862 0.020109 3.126091 0.0022

X -0.075233 0.028172 -2.670508 0.0086

R-squared 0.056993 Mean dependent var 0.013889

Adjusted R-squared 0.049001 S.D. dependent var 0.092680

S.E. of regression 0.090380 Akaike info criterion -1.953053

Sum squared resid 0.963896 Schwarz criterion -1.906595

Log likelihood 119.1832 F-statistic 7.131613

Durbin-Watson stat 1.901197 Prob(F-statistic) 0.008642

PMAS UAAR University Institute of Management Sciences Page 16

Impact of Risk Free Rate (T-Bill) on Stock Returns

Discussion:

The above result is obtained from Eviews software by using last ten years monthly

data. According to above result, we reject the null hypothesis because the risk free

rate has significant impact on Stock Exchange Returns, but it is only 5.7 Percent. The

remaining 94.3 percent effect on Stock Return is due to some other unknown factors.

The regression coefficient is -0.075 shows inverse or negative relation in T-bill rates

and Stock Exchange Return. When T-bill rate increases then KSE 100 index shall go

down and vice versa. The correlation coefficient is -0.239 shows weak or low

relationship.

PMAS UAAR University Institute of Management Sciences Page 17

Impact of Risk Free Rate (T-Bill) on Stock Returns

Conclusion:

In this research project, we analyzed the impact of risk free rate on KSE 100 index by

using the simple linear regression model as well as correlation matrix on the basis of

monthly time series data. We conclude that T-Bill rate has significant effect on KSE

100 index but it has only 5.7% effect on KSE 100 index. Results show negative

relationship between our variables. That means people are more relaxed in investing

in T-bills when its interest rate is high rather then investing in Stock Exchange.

PMAS UAAR University Institute of Management Sciences Page 18

Impact of Risk Free Rate (T-Bill) on Stock Returns

References:

Cifter, Atilla and Ozun A. 2007. “Estimating the Effects of Interest Rates on

Share Prices Using Multi-Scale Causality Test in Emerging Markets: Evidence

from Turkey”, MPRA Paper No: 2485.

N.dri. Konan Léon, 2008. “The Effects of Interest Rates Volatility on Stock

Returns and Volatility: Evidence from Korea”, International Research Journal

of Finance and Economics, Issue 14, 285-290.

Vardar, Gulin; Aksoy, Gokce and Can, Emre, 2008. “Effects of Interest and

Exchange Rate on Volatility and Return of Sector Price Indices at Istanbul

Stock Exchange”, European Journal of Economics, Finance and

Administrative Sciences, Issue 11, 126-135.

Flannery, M. and James, C. (1984) “The Effect of Interest Rate Changes on

the Common Stock Returns of Financial Institutions”, Journal of Finance, 39,

1141-1153

Sweeny, R. and Warga, A. (1986) “The Pricing of Interest Rate Risk:

Evidence from the Stock Market”, Journal of Finance, 41, 393-410

Merton, R. (1973) “An Intertemporal Capital Asset Pricing Model”,

Econometrica, 867-887 Modigliani, F. and Miller, M. (1958) "The Cost of

Capital, Corporation Finance, and the Theory of Investment", American

Economic Review, 261-297

Flannery, M.J. and C.M. James (1984), “The effect of interest rate changes on

the common stock returns of financial institutions”, Journal of Finance, 39,

1141-1153.

Elyasiani, E. and Mansur, I. (1998) “Sensitivity of Bank Stock Returns

Distribution to

Changes in the Level and Volatility of Interest Rate: A GARCH-M Model”,

Journal of Banking and Finance, 22, 535-563

Choi, J., Elyasiani, E. and Kopecky, K. (1992) “The Sensitivity of Bank Stock

Returns to Market, Interest and Exchange Rate Risks”, Journal of Banking and

Finance, 16, 983- 1004

PMAS UAAR University Institute of Management Sciences Page 19

Impact of Risk Free Rate (T-Bill) on Stock Returns

Akella, S. and Greenbaum, S. (1992) “Innovations in Interest Rates, Duration

Transformation and Bank Stock Returns”, Journal of Money, Credit and

Banking, 24, 27-42

Bae, S.C. (1990), “Interest rate changes and common stock returns of financial

institutions”, Journal of Financial Research, 13, 71-79.

Choi, J.J., Elyasiani E. and K.J. Kopecky (1992), “The sensitivity of bank

stock returns to market, interest and exchange rate risks”, Journal of Banking

and Finance, 16, 983-1004.

Leon A., Nave J. and Rubio, G., 2005, "The Relationship between Risk and

Expected Return in Europe," DFAEII Working Papers No. 200508, University

of the Basque Country - Department of Foundations of Economic Analysis II

Bae, S.C., ‘Interest Rate Changes and Common Stock Returns of Financial

Institutions: Revisited’, Journal of Financial Research, Vol. 13, 1990, pp. 71-

79.

Dinenis, E. and Staikouras, S.K., ‘Interest Rate Changes and Common Stock

Returns of Financial Institutions: Evidence from the UK’, European Journal of

Finance, Vol. 4, 1998, pp. 113-127.

Oertmann, P., Rendu, C. and Zimmermann, H., ‘Interest Rate Risk of

European Financial Corporations’, European Financial Management, Vol. 6,

2000, pp. 459-478.

Stone, B.K., ‘Systematic Interest Rate Risk in a Two-Index Model of

Returns’, Journal of Financial and Quantitative Analysis, Vol. 9, 1974, pp.

709-721.

Cifter, Atilla and Ozun A., 2007. “Estimating the Effects of Interest Rates on

Share Prices Using Multi-Scale Causality Test in Emerging Markets: Evidence

from Turkey”, MPRA Paper No: 2485,

Erdem Cumhur, Arslan C. K. and Erdem M. S., 2005 “Effects of

macroeconomic variables on Istanbul stock exchange indexes”, Applied

Financial Economics 15, pp. 987-994

Hashemzadeh, N. and Taylor, P., 1988. “Stock prices, money supply, and

interest rate: the question of causality”, Applied Economics 20, pp. 1603–

1611.

PMAS UAAR University Institute of Management Sciences Page 20

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- DNV Os C104 2014Dokument40 SeitenDNV Os C104 2014Moe LattNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Refrigerador Haier Service Manual Mother ModelDokument32 SeitenRefrigerador Haier Service Manual Mother Modelnibble1974100% (1)

- MB Truck Explorer Manual GB PDFDokument117 SeitenMB Truck Explorer Manual GB PDFاحمد ابو عبداللهNoch keine Bewertungen

- ATR 72 - Flight ManualDokument490 SeitenATR 72 - Flight Manualmuya78100% (1)

- X 09 CDX 09 High Security LocksDokument8 SeitenX 09 CDX 09 High Security LocksBenoit CarrenandNoch keine Bewertungen

- RENAULT Quality PlanningDokument20 SeitenRENAULT Quality PlanningEhsan ArbabtaftiNoch keine Bewertungen

- (Advances in Cryogenic Engineering 37) Takayuki Kishi, Mizuo Kudo, Hiromasa Iisaka (Auth.), R. W. Fast (Eds.) - Advances in Cryogenic Engineering-Springer US (1991)Dokument729 Seiten(Advances in Cryogenic Engineering 37) Takayuki Kishi, Mizuo Kudo, Hiromasa Iisaka (Auth.), R. W. Fast (Eds.) - Advances in Cryogenic Engineering-Springer US (1991)ksvvijNoch keine Bewertungen

- MPLS QAsDokument6 SeitenMPLS QAsLaxman Shrestha100% (1)

- DPWH Design Assessment ChecklistDokument18 SeitenDPWH Design Assessment ChecklistGeovanni DumpasanNoch keine Bewertungen

- 0580 w13 QP 41Dokument20 Seiten0580 w13 QP 41Haider AliNoch keine Bewertungen

- Single Point of Failure (SPOF) Transmission - MaintenanceDokument10 SeitenSingle Point of Failure (SPOF) Transmission - MaintenanceInam M. KhanNoch keine Bewertungen

- ZTE NODE-B ConnectivityDokument19 SeitenZTE NODE-B ConnectivitySanjeet Doodi100% (7)

- A Steganography Intrusion Detection SystemDokument21 SeitenA Steganography Intrusion Detection SystemjamessomNoch keine Bewertungen

- Materi Welding Defect IIDokument64 SeitenMateri Welding Defect IIsmartz inspectionNoch keine Bewertungen

- Manual F700GS 2013Dokument164 SeitenManual F700GS 2013j gfatggNoch keine Bewertungen

- Timetable Saturday 31 Dec 2022Dokument1 SeiteTimetable Saturday 31 Dec 2022Khan AadiNoch keine Bewertungen

- Touareg FL Dimensions PDFDokument2 SeitenTouareg FL Dimensions PDFZeljko PekicNoch keine Bewertungen

- Chapter 3 - Methods of Analysis: N N N N A A A ADokument15 SeitenChapter 3 - Methods of Analysis: N N N N A A A AvampakkNoch keine Bewertungen

- Refining of MaterialsDokument38 SeitenRefining of MaterialsJAWAD AHMAD BURTNoch keine Bewertungen

- Búsqueda Del Medio - RENR6305 - 994F Wheel Loader Power TrainDokument5 SeitenBúsqueda Del Medio - RENR6305 - 994F Wheel Loader Power TrainDavidCPNoch keine Bewertungen

- PD05P XXX XXX B SeDokument2 SeitenPD05P XXX XXX B SemaaoeNoch keine Bewertungen

- On Handwritten Digit RecognitionDokument15 SeitenOn Handwritten Digit RecognitionAnkit Upadhyay100% (1)

- Wa0000.Dokument7 SeitenWa0000.Kumkum KumbarahalliNoch keine Bewertungen

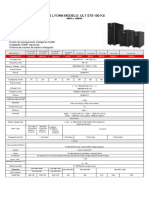

- Ups Lyonn Modelo: Ult St5-100 KS: 10KVA A 120KVADokument1 SeiteUps Lyonn Modelo: Ult St5-100 KS: 10KVA A 120KVASebastian Matias CruzNoch keine Bewertungen

- Echotrac Mkiii: Operator'S ManualDokument48 SeitenEchotrac Mkiii: Operator'S ManualKhắc PhongNoch keine Bewertungen

- Matrix Assisted Laser Desorption Ionization Mass Spectrometry Maldi-Tof MsDokument4 SeitenMatrix Assisted Laser Desorption Ionization Mass Spectrometry Maldi-Tof MsElizabeth Katherine Aigaje EspinosaNoch keine Bewertungen

- Creating A BSP Application - Purchase Order Details Display - v1Dokument13 SeitenCreating A BSP Application - Purchase Order Details Display - v1Amitabha SamajpatiNoch keine Bewertungen

- Canon I Sensys LBP5300 5360Dokument192 SeitenCanon I Sensys LBP5300 5360GonzaloNoch keine Bewertungen

- TG 7FS LTE A Product Data Sheet Final WEB WhiteDokument2 SeitenTG 7FS LTE A Product Data Sheet Final WEB WhiteMedSparkNoch keine Bewertungen