Beruflich Dokumente

Kultur Dokumente

Fiedacan - Paulchristian Adv2BusnCombi

Hochgeladen von

Paul Christian Lopez Fiedacan0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

19 Ansichten3 SeitenBusncombi

Originaltitel

fiedacan.paulchristian_Adv2BusnCombi

Copyright

© © All Rights Reserved

Verfügbare Formate

XLSX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenBusncombi

Copyright:

© All Rights Reserved

Verfügbare Formate

Als XLSX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

19 Ansichten3 SeitenFiedacan - Paulchristian Adv2BusnCombi

Hochgeladen von

Paul Christian Lopez FiedacanBusncombi

Copyright:

© All Rights Reserved

Verfügbare Formate

Als XLSX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

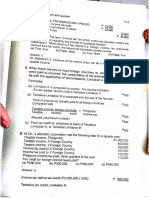

PROBLEM I

1 The consideration transferred is the fair market value of shares issued by Robin of P2,240,000 (P28 x 80,000 sh).

2 Consideration transferred P 2,240,000

Less: FV of Hope's net assets (2,720,000+200,000-1,200,000) 1,720,000

Goodwill P 520,000

PROBLEM II

1 Accounts receivable 180,000

Inventory 400,000

Land 50,000

Building 60,000

Equipment 70,000

Patent 20,000

Goodwill 10,000

Acquisition expense 20,000

Current liabilities 70,000

Long-term debt 160,000

Cash 580,000

Consideration transferred P 560,000

Less: FV of West's net assets

(P180,000 + P400,000 +P 50,000 +

P60,000 + P70,000 + P20,000 -

P70,000 - P160,000) 550,000

Goodwill P 10,000

2 Accounts receivable 180,000

Inventory 400,000

Land 50,000

Building 60,000

Equipment 70,000

Patent 20,000

Acquisition expense 20,000

Current liabilities 70,000

Long-term debt 160,000

Cash 520,000

Gain on acquisition 50,000

Consideration transferred P 500,000

Less: FV of West's net assets

(P180,000 + P400,000 +P 50,000 +

P60,000 + P70,000 + P20,000 -

P70,000 - P160,000) 550,000

Bargain purchase gain P 50,000

PROBLEM III

Accounts receivable 231,000

Inventory 330,000

Land 550,000

Buildings and equipment (net) 1,144,000

Goodwill 848,000

Allowance for Uncollectible Accounts (231,000 - 198,000) 33,000

Current liabilities 275,000

Bonds payable 450,000

Premium on bonds payable (495,000 -450,000) 45,000

Preferred stock (15,000 x 100) 1,500,000

Common stock (30,000 x 10) 300,000

Other contributed capital [(25-10) x 30,000] 450,000

Cash 50,000

Consideration transferred (1,500,000 + 750,000 + 50,000) P 2,300,000

Less: FV of net assets (198,000 + 330,000 +

550,000 + 1,144,000 - 275,000 - 495,000) 145,200

Goodwill P 848,000

0,000 (P28 x 80,000 sh).

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Format PB-CompilationDokument1 SeiteFormat PB-CompilationPaul Christian Lopez FiedacanNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- New Doc 2019 04 22 2 PDFDokument6 SeitenNew Doc 2019 04 22 2 PDFPaul Christian Lopez FiedacanNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Obligations 2Dokument20 SeitenObligations 2Paul Christian Lopez FiedacanNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Commisioner of Internal Revenue Vs Standard Insurance Co., IncDokument2 SeitenCommisioner of Internal Revenue Vs Standard Insurance Co., IncPaul Christian Lopez FiedacanNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- New Doc 2019 04 22 2 PDFDokument6 SeitenNew Doc 2019 04 22 2 PDFPaul Christian Lopez FiedacanNoch keine Bewertungen

- Paul Christian L. Fiedacan 37304 Iac Advanced Financial Accounting and ReportingDokument2 SeitenPaul Christian L. Fiedacan 37304 Iac Advanced Financial Accounting and ReportingPaul Christian Lopez FiedacanNoch keine Bewertungen

- CompiDokument28 SeitenCompiPaul Christian Lopez FiedacanNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Consent NotarypublicDokument1 SeiteConsent NotarypublicPaul Christian Lopez FiedacanNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Paul Christian L. Fiedacan 37304 Iac Advanced Financial Accounting and ReportingDokument2 SeitenPaul Christian L. Fiedacan 37304 Iac Advanced Financial Accounting and ReportingPaul Christian Lopez FiedacanNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- National Mock Board Examination 2019: General GuidelinesDokument12 SeitenNational Mock Board Examination 2019: General GuidelinesPaul Christian Lopez FiedacanNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Sales Procedure: Internal Control (COSO) Internal Control WeaknessDokument2 SeitenSales Procedure: Internal Control (COSO) Internal Control WeaknessPaul Christian Lopez FiedacanNoch keine Bewertungen

- ProspectusDokument25 SeitenProspectusPaul Christian Lopez FiedacanNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- PV Examples S10Dokument6 SeitenPV Examples S10Paul Christian Lopez FiedacanNoch keine Bewertungen

- ReyesDokument3 SeitenReyesPaul Christian Lopez FiedacanNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Aud - Cis Syll Sem1 Sy2018 2019 PDFDokument7 SeitenAud - Cis Syll Sem1 Sy2018 2019 PDFPaul Christian Lopez FiedacanNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Pdic LawDokument28 SeitenPdic LawPaul Christian Lopez Fiedacan100% (3)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Batas Pambansa Blg. 22 An Act Penalizing The Making or Drawing and Issuance of A Check Without Sufficient Funds or Credit and For Other PurposesDokument28 SeitenBatas Pambansa Blg. 22 An Act Penalizing The Making or Drawing and Issuance of A Check Without Sufficient Funds or Credit and For Other PurposesPaul Christian Lopez FiedacanNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- DerivativesDokument79 SeitenDerivativesPaul Christian Lopez FiedacanNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Open Gapps LogDokument2 SeitenOpen Gapps LogPaul Christian Lopez FiedacanNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Brain Slides SEMINAR 1 - 220606 - 142811 - 220606 - 223805Dokument32 SeitenBrain Slides SEMINAR 1 - 220606 - 142811 - 220606 - 223805pang pangNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Userguide SW-MC V2 2015-W45 EN S034308Dokument131 SeitenUserguide SW-MC V2 2015-W45 EN S034308ReneNoch keine Bewertungen

- CRM McDonalds ScribdDokument9 SeitenCRM McDonalds ScribdArun SanalNoch keine Bewertungen

- Presentation - Factors Affecting ClimateDokument16 SeitenPresentation - Factors Affecting ClimateAltoverosDihsarlaNoch keine Bewertungen

- Brachiocephalic TrunkDokument3 SeitenBrachiocephalic TrunkstephNoch keine Bewertungen

- Studovaný Okruh: Physical Therapist Sample Test Questions (G5+)Dokument8 SeitenStudovaný Okruh: Physical Therapist Sample Test Questions (G5+)AndreeaNoch keine Bewertungen

- Just Another RantDokument6 SeitenJust Another RantJuan Manuel VargasNoch keine Bewertungen

- Aircaft Avionics SystemDokument21 SeitenAircaft Avionics SystemPavan KumarNoch keine Bewertungen

- D05 Directional Control Valves EngineeringDokument11 SeitenD05 Directional Control Valves EngineeringVentas Control HidráulicoNoch keine Bewertungen

- Data Management For Human Resource Information SystemDokument14 SeitenData Management For Human Resource Information SystemRajeshsharmapurangNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- HEYER VizOR - Product List - 1015Dokument7 SeitenHEYER VizOR - Product List - 1015kalandorka92Noch keine Bewertungen

- EngineCleaningAndVolcanicAsh InternDokument69 SeitenEngineCleaningAndVolcanicAsh InternLucio Portuguez AlmanzaNoch keine Bewertungen

- Moderated Caucus Speech Samples For MUNDokument2 SeitenModerated Caucus Speech Samples For MUNihabNoch keine Bewertungen

- Transmission Line Loading Sag CalculatioDokument25 SeitenTransmission Line Loading Sag Calculatiooaktree2010Noch keine Bewertungen

- CampingDokument25 SeitenCampingChristine May SusanaNoch keine Bewertungen

- Wago PCB Terminal Blocks and Connectors Catalog 7Dokument105 SeitenWago PCB Terminal Blocks and Connectors Catalog 7alinupNoch keine Bewertungen

- Ground-Fault Protection - All You Need To KnowDokument9 SeitenGround-Fault Protection - All You Need To KnowCamila RubioNoch keine Bewertungen

- Api 579-2 - 4.4Dokument22 SeitenApi 579-2 - 4.4Robiansah Tri AchbarNoch keine Bewertungen

- 2017 LT4 Wiring DiagramDokument10 Seiten2017 LT4 Wiring DiagramThomasNoch keine Bewertungen

- 2023 VGP Checklist Rev 0 - 23 - 1 - 2023 - 9 - 36 - 20Dokument10 Seiten2023 VGP Checklist Rev 0 - 23 - 1 - 2023 - 9 - 36 - 20mgalphamrn100% (1)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Bulk-Fill Composite RestorationsDokument9 SeitenBulk-Fill Composite RestorationssusethNoch keine Bewertungen

- Quinta RuedaDokument20 SeitenQuinta RuedaArturo RengifoNoch keine Bewertungen

- Cooling SistemadeRefrigeracion RefroidissementDokument124 SeitenCooling SistemadeRefrigeracion RefroidissementPacoNoch keine Bewertungen

- Pengaruh Penambahan Lateks Pada Campuran Asphalt Concrete Binder Course (AC-BC)Dokument10 SeitenPengaruh Penambahan Lateks Pada Campuran Asphalt Concrete Binder Course (AC-BC)Haris FirdausNoch keine Bewertungen

- Ainsworth, The One-Year-Old Task of The Strange SituationDokument20 SeitenAinsworth, The One-Year-Old Task of The Strange SituationliliaNoch keine Bewertungen

- Select Event Venue and SiteDokument11 SeitenSelect Event Venue and SiteLloyd Arnold Catabona100% (1)

- Gintex DSDokument1 SeiteGintex DSRaihanulKabirNoch keine Bewertungen

- Private Standard: Shahram GhanbarichelaresiDokument2 SeitenPrivate Standard: Shahram Ghanbarichelaresiarian tejaratNoch keine Bewertungen

- Group 7 Worksheet No. 1 2Dokument24 SeitenGroup 7 Worksheet No. 1 2calliemozartNoch keine Bewertungen

- Cape 2 Biology - Homeostasis &excretionDokument9 SeitenCape 2 Biology - Homeostasis &excretionTamicka BonnickNoch keine Bewertungen

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNVon Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNBewertung: 4.5 von 5 Sternen4.5/5 (3)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisVon EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisBewertung: 5 von 5 Sternen5/5 (6)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaVon EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaBewertung: 3.5 von 5 Sternen3.5/5 (8)