Beruflich Dokumente

Kultur Dokumente

Equity Report 16 - 20 Oct

Hochgeladen von

zoidresearchOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Equity Report 16 - 20 Oct

Hochgeladen von

zoidresearchCopyright:

Verfügbare Formate

EQUITY TECHNICAL REPORT

WEEKLY

[ 16 OCT to 20 OCT 2017]

ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

16 OCT to 20 OCT 2017

NIFTY 50 10167.45 (187.75) (1.88%)

The benchmark Index Nifty logged small gains on first

trading day of the week. the nifty 50 witnessed a very

range bound session, as the benchmark Nifty50

moved in a capped range throughout the day, and

closed with a minor gain of 9.05 points or 0.09 per

cent and the nifty failed to settle above the

psychologically important level of 10000 mark after

hitting an Intraday high above that level. On Tuesday,

Nifty50 continued to extend its gains and ended

above the 10,000 mark. Nifty closed 0.28% up at

10017 after making a low of 10002 On Wednesday,

We had made a categorical mention about the

possibilities of profit taking bets at higher levels. The

Market witnessed heavy selling from 1 P.M. The

Benchmark Index Nifty made a high of 10067 and

finally closed at 9985. On Thursday, Jumped over

100 points and made a Solid Bull Candle on the daily

chart. The index opened at 10011 and gave sharp

buying of 127 points after making a low of 9977 to

finally close the index at 10096. WE HAD

RECOMMENDED ON LAST WEEK RESEARCH

REPORT (SEE OUR WEEKLY REPORT 03 OCT

2017 TO 06 OCT 2017) [WE ADVISED TO NIFTY

FUTURE BUY ABOVE AROUND 10000 THAN

TARGET WILL BE 10100 OUR TARGET ACHIEVED

ON THURSDAY 12/OCT/2017 NIFTY FUTURE

MADE HIGH AT 10117.4]. On Friday, The

benchmark Index Nifty hit an all-time high level

jumped on good domestic economic data. the nifty 50

rose 71.05 points to settle at 10167.45 the nifty

attained record closing high. The benchmark Index

Nifty50 (spot) opened the week at 9988.20 made a

high of 10191.90 low of 9955.8 and closed the week

at 10167.45. Thus the Nifty closed the week with a

gained of 187.75 points or 1.88%.

Future Outlook:

Formations The Nifty daily chart is Bullish

trend; we advised to Nifty future

The 20 days EMA are placed at

buy around 10150 than target will

9979.67

be 10250-10375. Nifty upside

The 5 days EMA are placed at

weekly Resistance is 10375-10285.

10063.78 level. On the downside strong

support at 10035-9877.

www.zoidresearch.com ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

16 OCT to 20 OCT 2017

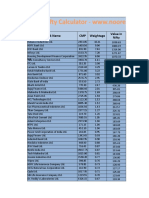

Weekly Pivot Levels for Nifty 50 Stocks

Script Symbol Resistance2 Resistance1 Pivot Support 1 Support 2

NIFTY 50 (SPOT) 10341 10254 10105 10018 9869

AUTOMOBILE

BAJAJ-AUTO 3272.38 3216.62 3161.13 3105.37 3049.88

BOSCHLTD 22218.53 21895.07 21376.53 21053.07 20534.53

EICHERMOT 32589.38 31994.32 31477.18 30882.12 30364.98

HEROMOTOCO 3867.15 3815.50 3738.35 3686.70 3609.55

M&M 1369.97 1347.63 1323.32 1300.98 1276.67

MARUTI 8033.38 7953.77 7877.38 7797.77 7721.38

TATAMTRDVR 250.13 244.07 237.23 231.17 224.33

TATAMOTORS 444.83 434.82 422.08 412.07 399.33

CEMENT & CEMENT PRODUCTS

ACC 1798.25 1784.15 1745.70 1731.60 1693.15

AMBUJACEM 287.65 282.60 277.30 272.25 266.95

ULTRACEMCO 4106.40 4055.70 3969.30 3918.60 3832.20

CONSTRUCTION

LT 1172.32 1155.48 1141.42 1124.58 1110.52

CONSUMER GOODS

ASIANPAINT 1196.85 1185.55 1165.80 1154.50 1134.75

HINDUNILVR 1287.80 1268.20 1233.40 1213.80 1179.00

ITC 271.58 268.77 266.38 263.57 261.18

ENERGY

BPCL 506.83 497.77 486.93 477.87 467.03

GAIL 465.10 451.30 443.65 429.85 422.20

IOC 431.13 422.87 416.13 407.87 401.13

NTPC 181.05 178.45 176.30 173.70 171.55

ONGC 175.98 172.82 170.28 167.12 164.58

POWERGRID 210.25 207.95 203.80 201.50 197.35

RELIANCE 927.75 902.10 865.05 839.40 802.35

TATAPOWER 83.85 82.75 81.50 80.40 79.15

FINANCIAL SERVICES

AXISBANK 555.18 542.32 521.78 508.92 488.38

BANKBARODA 147.25 143.40 139.75 135.90 132.25

HDFCBANK 1900.60 1875.70 1831.65 1806.75 1762.70

HDFC 1799.75 1783.10 1757.15 1740.50 1714.55

ICICIBANK 282.80 277.05 270.55 264.80 258.30

IBULHSGFIN 1319.57 1301.13 1274.17 1255.73 1228.77

INDUSINDBK 1811.45 1780.90 1727.45 1696.90 1643.45

KOTAKBANK 1122.45 1102.40 1068.75 1048.70 1015.05

SBIN 263.17 257.63 253.07 247.53 242.97

www.zoidresearch.com ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

16 OCT to 20 OCT 2017

YESBANK 383.90 376.80 367.90 360.80 351.90

IT

HCLTECH 958.77 942.63 919.87 903.73 880.97

INFY 953.97 942.03 928.02 916.08 902.07

TCS 2704.10 2631.35 2536.20 2463.45 2368.30

TECHM 495.90 486.00 470.00 460.10 444.10

WIPRO 301.93 296.92 290.73 285.72 279.53

MEDIA & ENTERTAINMENT

ZEEL 540.52 525.28 516.22 500.98 491.92

METALS

COALINDIA 296.55 291.90 284.35 279.70 272.15

HINDALCO 281.33 273.97 260.28 252.92 239.23

TATASTEEL 744.68 727.77 700.53 683.62 656.38

VEDL 338.37 329.88 320.02 311.53 301.67

PHARMA

AUROPHARMA 773.23 759.37 742.28 728.42 711.33

CIPLA 609.62 601.23 589.87 581.48 570.12

DRREDDY 2462.15 2408.30 2379.15 2325.30 2296.15

LUPIN 1092.83 1077.47 1055.63 1040.27 1018.43

SUNPHARMA 557.47 546.08 533.62 522.23 509.77

SERVICES

ADANIPORTS 427.33 417.77 399.93 390.37 372.53

TELECOM

BHARTIARTL 476.30 453.60 414.30 391.60 352.30

INFRATEL 491.62 470.78 434.17 413.33 376.72

Weekly Top gainers stocks

Script Symbol Previous Close Current Price % Change In Points

BHARTIARTL 382.30 430.90 12.71% 48.60

INFRATEL 399.95 449.95 12.50% 50.00

HINDALCO 250.90 266.60 6.26% 15.70

AXISBANK 503.35 529.45 5.19% 26.10

ADANIPORT 389.25 408.20 4.87% 18.95

Weekly Top losers stocks

Script Symbol Previous Close Current Price % Change In Points

GAIL 452.70 437.50 -3.36% -15.20

ONGC 173.85 169.65 -2.42% -4.20

ZEEL 521.65 510.05 -2.22% -11.60

SBIN 256.75 252.10 -1.81% -4.65

VEDL 327.15 321.40 -1.76% -5.75

www.zoidresearch.com ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

16 OCT to 20 OCT 2017

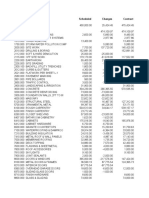

Weekly FIIS Statistics*

DATE Buy Value Sell Value Net Value

13/OCT/2017 5348.89 7047.39 -1698.5

12/OCT/2017 4095.62 4763.75 -668.13

11/OCT/2017 5489.27 5597.22 -107.95

10/OCT/2017 3518.19 4023.01 -504.82

09/OCT/2017 2882.87 3357.98 -475.11

Weekly DIIS Statistics*

DATE Buy Value Sell Value Net Value

13/OCT/2017 4722.60 3132.47 1590.13

12/OCT/2017 3507.55 2635.01 872.54

11/OCT/2017 3469.65 3235.68 233.80

10/OCT/2017 3045.65 2643.50 402.15

09/OCT/2017 2585.48 2530.06 55.42

MOST ACTIVE NIFTY CALLS & PUTS:

EXPIRY DATE TYPE STRIKE PRICE VOLUME OPEN INTEREST

26/OCT/2017 CE 10200 351030 3989100

26/OCT/2017 CE 10300 260747 2889225

26/OCT/2017 CE 10100 180683 2492850

26/OCT/2017 PE 10100 291478 4955100

26/OCT/2017 PE 10000 265817 7154625

26/OCT/2017 PE 9900 181492 5548350

MOST ACTIVE BANK NIFTY CALLS & PUTS:

EXPIRY DATE TYPE STRIKE PRICE VOLUME OPEN INTEREST

18/OCT/2017 CE 25000 238658 585120

18/OCT/2017 CE 24800 216053 284520

18/OCT/2017 CE 24700 190966 296480

18/OCT/2017 PE 24500 151821 413400

18/OCT/2017 PE 24300 129065 420680

18/OCT/2017 PE 24400 125869 363720

www.zoidresearch.com ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

16 OCT to 20 OCT 2017

Weekly Recommendations:-

DATE SYMBOL STRATEGY ENTRY TARGET STATUS

14 OCT 17 MRPL BUY AROUND 130 135-141 OPEN

7 OCT 17 CESC BUY AROUND 1044 1088-1124 OPEN

1ST TGT

30 SEP 17 BALRAMCHIN BUY ABOVE 161 167.5-175

ACHIEVED

23 SEP 17 DIVISLAB BUY AROUND 970 1010 EXIT AT 930

TARGET

16 SEP 17 IBULHSGFIN BUY ABOVE 1276 1327

ACHIEVED

9 SEP 17 BHARTIARTL BUY ABOVE 405 420-438 OPEN

ALL TGT

2 SEP 17 GAIL BUY ON DEEPS 384 399-415

ACHIEVED

1ST TGT

26 AUG 17 APOLLOTYRE SELL ON RISE 257-259 247-235

ACHIEVED

19 AUG 17 ASHOKLEY SELL BELOW 103.5 99-95 BOOK AT 100

12 AUG 17 ENGINERSIN SELL AROUND 150-149.5 144-137 EXIT AT 157

ALL TGT

5 AUG 17 TATAMTRDVR SELL AROUND 255 245-232

ACHIEVED

ALL TGT

22 JUL 17 KTKBANK SELL BELOW 157 151-144

ACHIEVED

ALL TGT

15 JUL 17 GODREJIND SELL BELOW 660 633-605

ACHIEVED

1ST TGT

8 JUL 17 DELTACORP BUY AROUND 167 175-185

ACHIEVED

1ST TARGET

1 JUL 17 TCS BUY AROUND 2360 2455-2555

ACHIEVED

* FII & DII trading activity on NSE, BSE, and MCXSX in Capital Market Segment (in Rs. Crores)

DISCLAIMER

Stock trading involves high risk and one can lose Substantial amount of money. The recommendations made herein do

not constitute an offer to sell or solicitation to buy any of the Securities mentioned. No representations can be made

that recommendations contained herein will be profitable or they will not result in losses. Readers using the

information contained herein are solely responsible for their actions. The information is obtained from sources deemed

to be reliable but is not guaranteed as to accuracy and completeness. The above recommendations are based on

technical analysis only. NOTE WE HAVE NO HOLDINGS IN ANY OF STOCKS RECOMMENDED ABOVE

Zoid Research

202, Mangal City Mall,

PU-4 Plot No.A-1,Sch No. 54

Vijay Nagar Circle, AB Road, Indore

Pin : 452001

Mobile: +91 9039073611

Email: info@zoidresearch.com

Website: www.zoidresearch.com

www.zoidresearch.com ZOID RESEARCH TEAM

Das könnte Ihnen auch gefallen

- Equity Report 10 July To 14 JulyDokument6 SeitenEquity Report 10 July To 14 JulyzoidresearchNoch keine Bewertungen

- Equity Report 21 Aug To 25 AugDokument6 SeitenEquity Report 21 Aug To 25 AugzoidresearchNoch keine Bewertungen

- Equity Report 19 June To 23 JuneDokument6 SeitenEquity Report 19 June To 23 JunezoidresearchNoch keine Bewertungen

- Equity Weekly ReportDokument6 SeitenEquity Weekly ReportzoidresearchNoch keine Bewertungen

- Equity Report 6 To 10 NovDokument6 SeitenEquity Report 6 To 10 NovzoidresearchNoch keine Bewertungen

- Equity Technical Weekly ReportDokument6 SeitenEquity Technical Weekly ReportzoidresearchNoch keine Bewertungen

- Equity Outlook 13 Feb To 17 FebDokument6 SeitenEquity Outlook 13 Feb To 17 FebzoidresearchNoch keine Bewertungen

- Equity Report 26 June To 30 JuneDokument6 SeitenEquity Report 26 June To 30 JunezoidresearchNoch keine Bewertungen

- Equity Weekly Report 8 May To 12 MayDokument6 SeitenEquity Weekly Report 8 May To 12 MayzoidresearchNoch keine Bewertungen

- Equity Report 22 May To 26 MayDokument6 SeitenEquity Report 22 May To 26 MayzoidresearchNoch keine Bewertungen

- Equity Report 15 May To 19 MayDokument6 SeitenEquity Report 15 May To 19 MayzoidresearchNoch keine Bewertungen

- Index Movement:: National Stock Exchange of India LimitedDokument36 SeitenIndex Movement:: National Stock Exchange of India LimitedTrinadh Kumar GuthulaNoch keine Bewertungen

- Index Movement:: National Stock Exchange of India LimitedDokument37 SeitenIndex Movement:: National Stock Exchange of India LimitedJayant SharmaNoch keine Bewertungen

- Index Movement:: National Stock Exchange of India LimitedDokument36 SeitenIndex Movement:: National Stock Exchange of India Limitedanilkhubchandani9744Noch keine Bewertungen

- Symbol Open Dayhigh Daylow Lastprice Previousclose ChangeDokument4 SeitenSymbol Open Dayhigh Daylow Lastprice Previousclose ChangeVijayNoch keine Bewertungen

- Index Movement:: National Stock Exchange of India LimitedDokument27 SeitenIndex Movement:: National Stock Exchange of India LimitedjanuianNoch keine Bewertungen

- Nifty range calculator with expected price changesDokument13 SeitenNifty range calculator with expected price changesbrijsingNoch keine Bewertungen

- Gain 24 MayDokument5 SeitenGain 24 MayPallavi M SNoch keine Bewertungen

- Term PaperDokument9 SeitenTerm Paperkavya surapureddy100% (1)

- Top Performing Stocks on NSEDokument33 SeitenTop Performing Stocks on NSEAnand ChineyNoch keine Bewertungen

- MARKET CORRECTIONDokument5 SeitenMARKET CORRECTIONThiyaga RajanNoch keine Bewertungen

- Technical Morning - Call - 120922 PDFDokument5 SeitenTechnical Morning - Call - 120922 PDFSomeone 4780Noch keine Bewertungen

- Skrip Name Tran Quantity: Client Id: N147669 Client Name: Shourya Mohan Asset Class: EquityDokument12 SeitenSkrip Name Tran Quantity: Client Id: N147669 Client Name: Shourya Mohan Asset Class: EquityDeepanjaliNoch keine Bewertungen

- NSE TOP GAINERSDokument8 SeitenNSE TOP GAINERSdewanibipin0% (2)

- Stocks Monitoring - Blue Chips: SN Company Code Date 26-Jun-18 2-Dec-18 4-Dec-18 19-Jun-19 25-Mar-20Dokument3 SeitenStocks Monitoring - Blue Chips: SN Company Code Date 26-Jun-18 2-Dec-18 4-Dec-18 19-Jun-19 25-Mar-20Marcus AmabaNoch keine Bewertungen

- Weekly Newsletter Equity 30-SEPT-2017Dokument7 SeitenWeekly Newsletter Equity 30-SEPT-2017Market Magnify Investment Adviser & ResearchNoch keine Bewertungen

- Tech Report 08.12Dokument3 SeitenTech Report 08.12bnr534Noch keine Bewertungen

- Watch Out CapitalHeight Weekly Performance Report From 23 To 27 July.Dokument11 SeitenWatch Out CapitalHeight Weekly Performance Report From 23 To 27 July.Damini CapitalNoch keine Bewertungen

- Portfolio-1 with February 2022 CE writting opportunityDokument5 SeitenPortfolio-1 with February 2022 CE writting opportunityPravin SinghNoch keine Bewertungen

- Bel Lalpathlab Cub L&TFH Maruti: Symbol Open Dayhigh Daylow Lastprice Previousclose Change PchangeDokument8 SeitenBel Lalpathlab Cub L&TFH Maruti: Symbol Open Dayhigh Daylow Lastprice Previousclose Change PchangeVijayNoch keine Bewertungen

- Daily-Equity 17 Sep 2010Dokument3 SeitenDaily-Equity 17 Sep 2010Vikram JunejaNoch keine Bewertungen

- Weekly Special Report of CapitalHeight 23 July 2018Dokument11 SeitenWeekly Special Report of CapitalHeight 23 July 2018Damini CapitalNoch keine Bewertungen

- Tech Report 24 (1) .02.2011Dokument3 SeitenTech Report 24 (1) .02.2011Arijit TagoreNoch keine Bewertungen

- CHENNAI BusinessLine provides stock market updatesDokument1 SeiteCHENNAI BusinessLine provides stock market updatestushar vermaNoch keine Bewertungen

- Tech Report 05.01Dokument3 SeitenTech Report 05.01Swayam MangwaniNoch keine Bewertungen

- ZerodhaDokument89 SeitenZerodhaAarti ParmarNoch keine Bewertungen

- June 14Dokument5 SeitenJune 14Pallavi M SNoch keine Bewertungen

- Nifty Calculator Jan 2023Dokument19 SeitenNifty Calculator Jan 2023Shovan GhoshNoch keine Bewertungen

- 802 PB 20 Pages 2 3 and 4Dokument4 Seiten802 PB 20 Pages 2 3 and 4stephanie1665Noch keine Bewertungen

- John Neff 22 Sep 2020 1116Dokument5 SeitenJohn Neff 22 Sep 2020 1116Debashish Priyanka SinhaNoch keine Bewertungen

- Stock Tracker & WatchlistDokument80 SeitenStock Tracker & WatchlistRanjith KNoch keine Bewertungen

- BSE PSU Energy StocksDokument3 SeitenBSE PSU Energy StocksYatrikNoch keine Bewertungen

- New Microsoft Excel WorksheetDokument9 SeitenNew Microsoft Excel WorksheetSneha JadhavNoch keine Bewertungen

- Tugas BanjirDokument4 SeitenTugas BanjirnindiaNoch keine Bewertungen

- Shares HIGH LOW SignalDokument10 SeitenShares HIGH LOW SignalYASH DOSHINoch keine Bewertungen

- February 16-17, 2011 - UpdateDokument2 SeitenFebruary 16-17, 2011 - UpdateJC CalaycayNoch keine Bewertungen

- Your Holding Details - B53270969Dokument4 SeitenYour Holding Details - B53270969Jai DwarikadhisNoch keine Bewertungen

- Equity StockDokument4 SeitenEquity StockChaitanya EnterprisesNoch keine Bewertungen

- Final Correct Isolated FootingDokument20 SeitenFinal Correct Isolated FootingK. S. Design GroupNoch keine Bewertungen

- Intraday Trading System 1Dokument4 SeitenIntraday Trading System 1Rajesh Chowdary ParaNoch keine Bewertungen

- Nifty 50 sectors show Mild to Super Bearish trendDokument35 SeitenNifty 50 sectors show Mild to Super Bearish trendArnab SadhukhanNoch keine Bewertungen

- Indices Data - 12.09.2023Dokument1 SeiteIndices Data - 12.09.2023PHC DUGGUDURRUNoch keine Bewertungen

- Technical Morning - Call - 200921Dokument5 SeitenTechnical Morning - Call - 200921Equity NestNoch keine Bewertungen

- Angga Prasetya - 21080118140072 - BDokument16 SeitenAngga Prasetya - 21080118140072 - BAngga PrasetyaNoch keine Bewertungen

- Client Portfolio Statement: %mkvalDokument2 SeitenClient Portfolio Statement: %mkvalMonjur MorshedNoch keine Bewertungen

- Narration Mar-19 Mar-20 Mar-21 Mar-22 Mar-23 Mar-24 Mar-25 Mar-26 Mar-27Dokument11 SeitenNarration Mar-19 Mar-20 Mar-21 Mar-22 Mar-23 Mar-24 Mar-25 Mar-26 Mar-27Manan ToganiNoch keine Bewertungen

- June 2Dokument5 SeitenJune 2Pallavi M SNoch keine Bewertungen

- Private LTD CompaniesDokument16 SeitenPrivate LTD CompaniesanjankatamNoch keine Bewertungen

- Equity Weekly Report 19-23 NovDokument10 SeitenEquity Weekly Report 19-23 NovzoidresearchNoch keine Bewertungen

- Equity Weekly Report - Zoid ResearchDokument9 SeitenEquity Weekly Report - Zoid ResearchzoidresearchNoch keine Bewertungen

- Equity Report 26 June To 30 JuneDokument6 SeitenEquity Report 26 June To 30 JunezoidresearchNoch keine Bewertungen

- Equity Report 22 May To 26 MayDokument6 SeitenEquity Report 22 May To 26 MayzoidresearchNoch keine Bewertungen

- Equity Report 15 May To 19 MayDokument6 SeitenEquity Report 15 May To 19 MayzoidresearchNoch keine Bewertungen

- Nifty Technical Report (31july - 4aug)Dokument6 SeitenNifty Technical Report (31july - 4aug)zoidresearchNoch keine Bewertungen

- Equity Report 3 July To 7 JulyDokument6 SeitenEquity Report 3 July To 7 JulyzoidresearchNoch keine Bewertungen

- Equity Report 5 Jun To 9 JunDokument6 SeitenEquity Report 5 Jun To 9 JunzoidresearchNoch keine Bewertungen

- Outlook On Equity Report 1 MAY To 5 MAYDokument6 SeitenOutlook On Equity Report 1 MAY To 5 MAYzoidresearchNoch keine Bewertungen

- Equity Weekly Report 8 May To 12 MayDokument6 SeitenEquity Weekly Report 8 May To 12 MayzoidresearchNoch keine Bewertungen

- Equity Technical Report 10 Apr To 14 AprDokument6 SeitenEquity Technical Report 10 Apr To 14 AprzoidresearchNoch keine Bewertungen

- Nifty Weekly Report 17 Apr To 21 AprDokument6 SeitenNifty Weekly Report 17 Apr To 21 AprzoidresearchNoch keine Bewertungen

- Equity Market Outlook (3-7 April)Dokument6 SeitenEquity Market Outlook (3-7 April)zoidresearchNoch keine Bewertungen

- Equity Report 24 Apr To 28 AprDokument6 SeitenEquity Report 24 Apr To 28 AprzoidresearchNoch keine Bewertungen

- Equity Technical Weekly ReportDokument6 SeitenEquity Technical Weekly ReportzoidresearchNoch keine Bewertungen

- Equity Technical Report 30 Jan To 3 FebDokument6 SeitenEquity Technical Report 30 Jan To 3 FebzoidresearchNoch keine Bewertungen

- Equity Weekly Report 20 Feb To 24 FebDokument6 SeitenEquity Weekly Report 20 Feb To 24 FebzoidresearchNoch keine Bewertungen

- Equity Technical Report 2 Jan To 6 JanDokument6 SeitenEquity Technical Report 2 Jan To 6 JanzoidresearchNoch keine Bewertungen

- Equity Outlook 13 Feb To 17 FebDokument6 SeitenEquity Outlook 13 Feb To 17 FebzoidresearchNoch keine Bewertungen

- Equity Technical Report 23 Jan To 27 JanDokument6 SeitenEquity Technical Report 23 Jan To 27 JanzoidresearchNoch keine Bewertungen

- Equity Technical Report 28 Nov To 2 DecDokument6 SeitenEquity Technical Report 28 Nov To 2 DeczoidresearchNoch keine Bewertungen

- Equity Report Outlook 6 Feb To 10 FebDokument6 SeitenEquity Report Outlook 6 Feb To 10 FebzoidresearchNoch keine Bewertungen

- Equity Report 12 Dec To 16 DecDokument6 SeitenEquity Report 12 Dec To 16 DeczoidresearchNoch keine Bewertungen

- Equity Technical Report 5 Dec To 9 DecDokument6 SeitenEquity Technical Report 5 Dec To 9 DeczoidresearchNoch keine Bewertungen

- Cup 1 FA 1 and FA 2Dokument16 SeitenCup 1 FA 1 and FA 2Thony Danielle LabradorNoch keine Bewertungen

- How to Estimate Future Stock PricesDokument3 SeitenHow to Estimate Future Stock PricesPRERNA BAID50% (4)

- PpeDokument5 SeitenPpeXairah Kriselle de OcampoNoch keine Bewertungen

- Problem 4Dokument4 SeitenProblem 4Ashley CandiceNoch keine Bewertungen

- SP Gsci Rebalance 2018Dokument26 SeitenSP Gsci Rebalance 2018Maximiliano RojasNoch keine Bewertungen

- Sample MidtermDokument6 SeitenSample MidtermJake FeigelesNoch keine Bewertungen

- NASDAQ Market OverviewDokument4 SeitenNASDAQ Market OverviewsserifundNoch keine Bewertungen

- 2018 Level III Mock Exam 2 Questions PDFDokument60 Seiten2018 Level III Mock Exam 2 Questions PDFKeith LoNoch keine Bewertungen

- Portfolio Evaluation and Investment Decisions Literature ReviewDokument4 SeitenPortfolio Evaluation and Investment Decisions Literature ReviewHari PriyaNoch keine Bewertungen

- Articles of Incorporation for Alpha IncDokument5 SeitenArticles of Incorporation for Alpha IncgilbertmalcolmNoch keine Bewertungen

- Shaheed Sukhdev College of Business Studies Ratio AnalysisDokument21 SeitenShaheed Sukhdev College of Business Studies Ratio Analysisdhruvagarwal12Noch keine Bewertungen

- Understanding Equity RiskDokument55 SeitenUnderstanding Equity RiskMiguel RevillaNoch keine Bewertungen

- Virtual University of Pakistan: Assignment NO 1 Spring 2019Dokument5 SeitenVirtual University of Pakistan: Assignment NO 1 Spring 2019Asad ShahNoch keine Bewertungen

- SEBI regulations for mutual funds in IndiaDokument6 SeitenSEBI regulations for mutual funds in Indiashobhit_patel19Noch keine Bewertungen

- Analyzing TransactionsDokument3 SeitenAnalyzing TransactionsMark SantosNoch keine Bewertungen

- Feasibility Report - Basic Concepts With ExampleDokument6 SeitenFeasibility Report - Basic Concepts With ExampleShaileshDayaniNoch keine Bewertungen

- Elysium Capital India Commentary 090609Dokument2 SeitenElysium Capital India Commentary 090609oontiverosNoch keine Bewertungen

- Common Stocks and Uncommon Profits and Other WritingsDokument13 SeitenCommon Stocks and Uncommon Profits and Other WritingsAnirbanDeshmukhNoch keine Bewertungen

- Maximizing Equity Through ManagementDokument20 SeitenMaximizing Equity Through ManagementHazel HizoleNoch keine Bewertungen

- Implied Vol SurfaceDokument10 SeitenImplied Vol SurfaceHenry ChowNoch keine Bewertungen

- Statements of Adventa Berhad Marketing EssayDokument41 SeitenStatements of Adventa Berhad Marketing EssayHND Assignment Help100% (1)

- ch14 InvestmentsDokument45 Seitench14 InvestmentsKaren TacadenaNoch keine Bewertungen

- Chapter Two Problems SolutionsDokument49 SeitenChapter Two Problems SolutionsLovan So0% (1)

- VC investments in Latin America doubled for a second year to nearly $2B in 2018Dokument8 SeitenVC investments in Latin America doubled for a second year to nearly $2B in 2018Thomas HeilbornNoch keine Bewertungen

- FIN 400 Midterm Review QuestionDokument4 SeitenFIN 400 Midterm Review Questionlinh trangNoch keine Bewertungen

- Mr. Mir Ashraf Ali ROLL NO: 2281-14-672-077: "Demat Account"Dokument103 SeitenMr. Mir Ashraf Ali ROLL NO: 2281-14-672-077: "Demat Account"ahmedNoch keine Bewertungen

- Final Exam Essay QuestionsDokument4 SeitenFinal Exam Essay Questionsapi-408647155Noch keine Bewertungen

- Far 01Dokument27 SeitenFar 01AJ CresmundoNoch keine Bewertungen

- Banking Basics and Silk Bank OverviewDokument47 SeitenBanking Basics and Silk Bank OverviewShahid MehmoodNoch keine Bewertungen

- Coconut levy funds ownership and use challengedDokument21 SeitenCoconut levy funds ownership and use challengedM Azeneth JJNoch keine Bewertungen