Beruflich Dokumente

Kultur Dokumente

Govt Chap-7 2017

Hochgeladen von

Lyanne Mae Simbre0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

8 Ansichten20 Seitengovernment accounting handouts

Originaltitel

Govt_Chap-7_2017

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldengovernment accounting handouts

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

8 Ansichten20 SeitenGovt Chap-7 2017

Hochgeladen von

Lyanne Mae Simbregovernment accounting handouts

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 20

TRIAL BALANCE,

FINANCIAL REPORTS &

STATEMENTS

CHAPTER 7

Prepared by: Robert Jade D. Dabandan, CPA, MMBM

FINANCIAL REPORTING SYSTEM

Eight General Step in the Accounting Cycle

Analyzing the transactions

Journalizing the transactions

Posting the journal entries

Preparation of trial balance (TB)

Adjusting the accounts

Closing the accounts

Preparation of the financial statements (FS)

Reversing the accounts

PPSAS 1, Presentation of Financial Statements and the

applicable PAG shall be applied in the presentation of General

Purpose FS covering: Presentation of FS, Statements of Cash

Flows, Events After the Reporting Date, Related Party

Disclosures, Accounting Policies, Changes in Accounting

Estimates and Errors and Accounting Process.

Objective of General Purpose FS

To provide information about the Financial Position, Financial

Performance and Cash Flows of an entity that is useful to wide

range of users in making and evaluating decisions about the

allocation of resources.

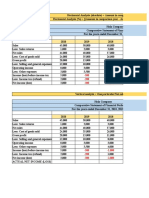

TRIAL BALANCE

Trial Balance is a listing of general ledger accounts with their

corresponding debit and credit balances. It is used to determine

equality of debit and credit balances after the recording process.

A two-money column trial balance is required under the new

system.

The preparation of a trial balance shall serve the following

purposes:

1. To prove the mathematical equality of the debits and credits

after posting.

2. To uncover errors in journalizing and posting; and

3. To serve as basis for the preparation of the FS.

ADJUSTING JOURNAL ENTRIES

The Pre-Closing TB, otherwise known as the Adjusted TB, is

prepared after adjusting journal entries are recorded in the

General Journal and posted to the General Ledger. It shows the

adjusted balances if all accounts as of given period.

Adjustments are of two main types, namely:

1. Accrued Items these are adjusting entries for economic

activities already undertaken but not yet recorded as asset

and revenue accounts or liabilities and expense accounts.

These require two types of adjusting entries such as:

1. Asset/Revenue Adjustment These involves assets and

income which exist at the end of the accounting period

but are not yet recorded.

Illustration: (Interest Income)

The interest income account of Agency ABC for the interest earned but not yet

collected no billed as of the end of the year amounts to P2,000. The journal entry

will be as follows:

Account Title Account Code Debit Credit

Interest Receivable 1-03-01050 2,000

Interest Income 4-02-02-210 2,000

2. Liability/Expense Adjustments these involve liabilities and

expenses, which already exist at the end of the accounting

period but not yet recorded.

Illustration: (Accrued Salaries)

As of year-end, Agency ABC has not yet paid salaries and wages of P25,000,

which covers the period December 16-31, 2013:

Account Title Account Debit Credit

Code

Salaries and Wages Regular 5-01-01-010

25,000

Due to Officers & Employees 2-01-01-020

25,000

2. Deferred Items these are adjusting entries transferring

data previously recorded in asset account to expense account

or data previously recorded in liability account to revenue

account. These also require two types of adjustments:

1. Asset/Expense Adjustments these involve prepaid

expenses, portion of which shall be recorded as expense

of the agency at the end of the accounting period. These

also include bad debts and depreciation.

Illustration: (Prepaid Expense)

Agency ABC has prepaid expenses in the amount of P20,000, portion of which

were utilized or consumed in the amount of P5,000. Since the original entry was

debit to prepaid account, the adjusting entry would be:

Account Title Account Code Debit Credit

Rent /Lease Expense 5-02-99-050 5,000

Prepaid Rent 1-99-02-020 5,000

Illustration 2: (Bad Debts)

Per aging of the accounts, the required allowance id P20,000; while the beginning

balance of the allowance for bad debts is P15,000. No other transactions

transpired. The adjusting entry to take-up bad debts expense is as follows:

Account Title Account Debit Credit

Code

Impairment Loss -Loans & Rec. 5-05-03-020 5,000

Allowance for Impairment - AR 1-03-01-011 5,000

Illustration 3: (Depreciation)

Records of Agency ABC show the following depreciable assets, with 10% salvage

value as provided by the COA

Asset Cost Life Deprn.

Buildings 50,000,000 20 2,250,000

Machinery 150,000 5 27,000

Office Equipment 100,000 5 18,000

Furniture & Fixtures 75,000 10 6,750

Motor Vehicles 10,000,000 10 900,000

Books 10,000 5 1,800

Illustration 3: (Depreciation)

The compound adjusting entry to record the depreciation for the depreciable

assets would be:

Account Title Account Debit Credit

Code

Deprn. Exp. Bldg & Other Structures 5-05-01-040 2,250,000

Deprn. Exp Machinery & Equipment 5-05-01-050 45,000

Deprn. Exp - Furniture, Fixtures & 5-05-01-070 8,550

Books

Deprn. Exp - Trans. Equip. 5-05-01-060 900,000

Accum. Deprn. Bldg & Other 1-06-04-011 2,250,000

Structures

Accum. Deprn. Machinery & 1-06-05-011 45,000

Equipment

Accum. Deprn. - Furn.,Fixtures & 1-06-07-011 8,550

Books

Accum. Deprn. - Motor Vehicle 1-06-06-011 900,000

NOTE: Under PPSAS No. 17, method of depreciation maybe

straight line, diminishing balance, and the units of production

method to be applied consistently from one period to period.

2. Liability/Revenue Adjustments these involve

unearned revenue where the agency receives the assets,

usually cash, even before the income is actually earned.

Illustration:

The agency collected an amount of P15,000 for the rent of its facility and

originally recorded it as deferred credit to income. At the end of the fiscal year,

only P3,000 was earned. The adjusting journal entry to recognize the earned

portion would be::

Account Title Account Debit Credit

Code

Other Deferred Credits 2-05-01-990 3,000

Rent/Lease Income 4-02-02-050 3,000

CLOSING JOURNAL ENTRIES

Closing journal entries are general journal entries, which

zeroes out the balances of all nominal/temporary and

intermediate accounts at the end of the accounting period.

Nominal accounts includes subsidies, income and expense

accounts and are closed to Revenue and Expense Summary.

Balance of Revenue and Expense Summary closed to

Accumulated Surplus/(Deficit) account.

Post Closing TB shall be prepared after recording the

closing journal entries in the General Journal and posting

these entries to the General Ledger. It contains a listing of

all real accounts in the general ledger.

Illustration:

1. Reversion of unused NCA

Account Title Account Debit Credit

Code

Subsidy from NG 4-03-01-010 500,000

Cash MDS - Regular 1-01-04-040 500,000

Note : The remaining balance of Subsidy from NG is closed to Revenue and Exp.

Summary.

2. Close the balance of all income accounts to Revenue and Expense Summary

account:

Account Title Account Debit Credit

Code

Income Accounts 35,822,500

Revenue and Exp. 3-03-01-010 35,822,500

Summary

Illustration:

3. Close the balance of all expense accounts to Income and Expense Summary

account:

Account Title Account Debit Credit

Code

Revenue and Exp. Summary 3-03-01-010 5,480,835

Expense Accounts 5,480,835

4. Close the balance of the Income and Expense Summary account to

Government Equity:

Account Title Account Debit Credit

Code

Revenue and Exp. Summary 3-03-01-010 30,341,665

Accumulated 3-01-01-010 30,341,665

Surplus/(Deficit)

Illustration:

5. Close the Public Infrastructure account to Government Equity and transfer the

corresponding amounts to the respective registries:

Account Title Account Debit Credit

Code

Accumulated 3-01-01-010 1,000,000

Surplus/Deficit

Road Network 1-06-03-010 1,000,000

GENERATION OF FS & SCHEDULES

The financial statements generally prepared in the National

Government are:

Statement of Financial Position

Statement of Financial Performance

Statement of Changes in Net Asset/Equity

Statement of Cash Flows

Operating activities

Inventing activities

Financing activities

Cashflow Statement Preparation Method

1. Balance Sheet Method this method shows the agencys net cashflow

from all of its activities calculated by adding the individual cash inflows

and then deducting the individual cash outflows. This is the preferred

approach.

2. Income Statement Approach this methods starts with the net income

and adds back expenses and charges that do not entail cash payments.

GENERATION OF FS & SCHEDULES

Notes to Financial Statements

Statement of Comparison of Budget and Actual Amount

(PPSAS No. 24, Presentation of Budget Information in

Financial Statements

QUALITATIVE CHARACTERISTICS

OF FINANCIAL REPORTING

A. UNDERSTANDABILITY

B. RELEVANCE

C. MATERIALITY

D. TIMELINESS

E. RELIABILITY

F. FAITHFUL REPRESENTATION

G. SUSBTANCE OVER FORM

H. NEUTRALITY

I. PRUDENCE

J. COMPLETENESS

K. COMPARABILITY

STATEMENT OF MANAGEMENT

RESPONSIBILITY FOR FS

The Statement of Management Responsibility for

Financial Statements serve as the covering letter in

transmitting the agencys financial statements to the

COA, DBM, other oversight agencies and other

responsibility. It acknowledges the agencys

responsibility for the preparation and presentation of

the financial statements. This statement shall be signed

by the Director of Finance and Management Office or

Comptrollership Office of the Chief of Office, who has

direct supervision and control over the agencys

accounting and financial transaction, and the Head of

Agency or his authorized representative.

NOTES TO FINANCIAL

STATEMENTS

Notes to FS are integral part of the FS. It provides additional

information necessary for the fair presentation of the financial

statements in conformity with GAAP. It provides an

explanation about the headings, captions or amounts of

present information that cannot be expressed in monetary

terms. It shall also include a brief description of accounting

policies being followed by the entity.

Where notes to fs appear on a separate page, the phrase See

accompanying Notes to Financial Statement shall be

indicated at the bottom of the statement.

NOTES TO FINANCIAL

STATEMENTS cont.

Types of disclosure considered necessary are as follows:

1. Events after the Reporting Date

1. Adjusting and Non Adjusting Events After Reporting Date

2. Changes in Accounting Policies

3. Changes in Accounting Estimates

4. Errors

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Avator Steel Board Meeting MinutesDokument2 SeitenAvator Steel Board Meeting MinutesTAX O WORLDNoch keine Bewertungen

- FRANKLIN TEMPLETON INVESTMENT FUNDS AUDITED ANNUAL REPORTDokument478 SeitenFRANKLIN TEMPLETON INVESTMENT FUNDS AUDITED ANNUAL REPORTread allNoch keine Bewertungen

- Test Bank Chapter10 Standard CostingDokument35 SeitenTest Bank Chapter10 Standard Costingxxx101xxxNoch keine Bewertungen

- Summary Far 350 FinalDokument9 SeitenSummary Far 350 Finalaz1anNoch keine Bewertungen

- Final Exam - Ae14 CfasDokument7 SeitenFinal Exam - Ae14 CfasVillanueva RosemarieNoch keine Bewertungen

- ACC108 Lecture 2 3Dokument32 SeitenACC108 Lecture 2 3Shivati Singh KahlonNoch keine Bewertungen

- Final - Accounts - Xs Accounting Accounts Accounts Accounts Accounts AccountsDokument30 SeitenFinal - Accounts - Xs Accounting Accounts Accounts Accounts Accounts AccountsskibcobsaivigneshNoch keine Bewertungen

- Ch01 TB RankinDokument9 SeitenCh01 TB RankinAnton VitaliNoch keine Bewertungen

- Hico&Hico Company ProfileDokument1 SeiteHico&Hico Company ProfileAnonymous 7HGskNNoch keine Bewertungen

- Tutorial 3: Chapter Three: Audit ReportsDokument10 SeitenTutorial 3: Chapter Three: Audit ReportsyoussefasaadNoch keine Bewertungen

- BANK AL HABIB JOB: REPORTING OFFICER FOR ACCOUNTS & FIXED ASSETSDokument2 SeitenBANK AL HABIB JOB: REPORTING OFFICER FOR ACCOUNTS & FIXED ASSETSsirfanalizaidiNoch keine Bewertungen

- Preparing A Multiple Step Income StatementDokument2 SeitenPreparing A Multiple Step Income StatementCyril Joseph ViernesNoch keine Bewertungen

- Aite Matrix Evaluation Investment and Fund Accounting Systems ReportDokument25 SeitenAite Matrix Evaluation Investment and Fund Accounting Systems ReportVijayavelu AdiyapathamNoch keine Bewertungen

- Problem SolvingDokument23 SeitenProblem SolvingFery AnnNoch keine Bewertungen

- Kunjaw Medika Adijaya 2021Dokument35 SeitenKunjaw Medika Adijaya 2021NahmaKids100% (1)

- FAR08.01d-Presentation of Financial StatementsDokument7 SeitenFAR08.01d-Presentation of Financial StatementsANGELRIEH SUPERTICIOSONoch keine Bewertungen

- ch03 SolDokument12 Seitench03 SolJohn Nigz PayeeNoch keine Bewertungen

- Aud Plan 123Dokument7 SeitenAud Plan 123Mary GarciaNoch keine Bewertungen

- Final TermsDokument60 SeitenFinal Termsmaneaflr77Noch keine Bewertungen

- AARS Practice QuestionsDokument211 SeitenAARS Practice QuestionsChaudhury Ahmed HabibNoch keine Bewertungen

- Quiz 2Dokument4 SeitenQuiz 2zainabcomNoch keine Bewertungen

- Dwnload Full Introduction To Financial Accounting 11th Edition Horngren Solutions Manual PDFDokument36 SeitenDwnload Full Introduction To Financial Accounting 11th Edition Horngren Solutions Manual PDFgilmadelaurentis100% (14)

- Citi 2007: Analyzing financial reporting and regulatory capitalDokument6 SeitenCiti 2007: Analyzing financial reporting and regulatory capitalKostia RiabkovNoch keine Bewertungen

- MAS 3 SamplesDokument10 SeitenMAS 3 SamplesRujean Salar AltejarNoch keine Bewertungen

- Jurnal Agrikultur 3Dokument18 SeitenJurnal Agrikultur 3Rena YunitaNoch keine Bewertungen

- Non Integrated AccountingDokument4 SeitenNon Integrated AccountingbinuNoch keine Bewertungen

- FABM2 Q2 Module WS 1Dokument14 SeitenFABM2 Q2 Module WS 1Mitch Dumlao73% (11)

- (Materi 5) Audit Utang Jangka Panjang - Pengujian Substantif Terhadap Utang Jangka PanjangDokument5 Seiten(Materi 5) Audit Utang Jangka Panjang - Pengujian Substantif Terhadap Utang Jangka PanjangFendy ArisyandanaNoch keine Bewertungen

- Auditing Theory Answer Key 6Dokument3 SeitenAuditing Theory Answer Key 6Jasper GicaNoch keine Bewertungen

- BS Accountancy Subjects CourseDokument6 SeitenBS Accountancy Subjects CourseMhel DemabogteNoch keine Bewertungen