Beruflich Dokumente

Kultur Dokumente

Contoh: Straight-Line Method

Hochgeladen von

Fajriansyah Herawan PangestuOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Contoh: Straight-Line Method

Hochgeladen von

Fajriansyah Herawan PangestuCopyright:

Verfügbare Formate

22/04/2017

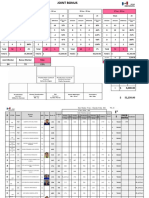

Contoh Straight-Line Method

Original Cost....... $24,000

$24,000 $2,000

Estimated Life in years.. 5 years

Estimated Life in hours.. 10,000 5 years

Estimated Residual Value... $2,000

= $4,400 annual depreciation

syamsul irham syamsul irham

Depresiasi Depresiasi

Straight-Line Rate Straight-Line Rate

$24,000 $2,000

$24,000 $2,000 = $4,400

= $4,400 5 years

5 years

$4,400

= 20.0% /yr of

$4,400 $22,000

= 18.3% /yr depreciable cost

$24,000 1

of orginal cost = 20.0% /yr

5 yr

syamsul irham syamsul irham

Depresiasi Depresiasi

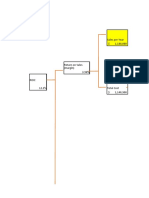

Sum of the Year Digits

Straight-Line Method

Faktor pembagi = n (n+1) / 2

CONTOH :

Accum. Depr. Book Value Depr. Book Value

Harga barang kapital = P = 100 US$

at Beginning at Beginning Expense at End Umur barang = n = 5 tahun

Year Cost of Year of Year for Year of Year Salvage value = F = 0 US$

Faktor pembagi = 5 (5+1) / 2 = 15

1 $24,000 $24,000 $4,400 $19,600 t SYD % Depreci Depreciation Capital Value

2 24,000 $ 4,400 19,600 4,400 15,200 Fraction able @t @ end of t

3 24,000 8,800 15,200 4,400 10,800 Capital

4 24,000 13,200 10,800 4,400 6,400 0 0 0% 100 0 100

5 24,000 17,600 6,400 4,400 2,000 1 5/15 33% 100 33 67

2 4/15 27% 100 27 40

Cost ($24,000) Residual Value ($2,000) Annual Depreciation 3 3/15 20% 100 20 20

= Expense ($4,400) 4 2/15 13% 100 13 7

Estimated Useful Life (5 years) 5 1/15 7% 100 7 0

syamsul irham syamsul irham

Depresiasi Depresiasi

Das könnte Ihnen auch gefallen

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsVon EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNoch keine Bewertungen

- Metode Straight Line 1/5 20%Dokument2 SeitenMetode Straight Line 1/5 20%Rifki AndriyanNoch keine Bewertungen

- Interest Rates and Discounted Cash Flow AnalysisDokument36 SeitenInterest Rates and Discounted Cash Flow AnalysisRNoch keine Bewertungen

- D5 F0121108 Helmy FebrianoDokument4 SeitenD5 F0121108 Helmy FebrianohelmyNoch keine Bewertungen

- ES032 Assignment6Dokument6 SeitenES032 Assignment6TerkNoch keine Bewertungen

- Depreciable Amt Capitalizable Cost - Scrap Value: DR 1/estmd Useful LifeDokument1 SeiteDepreciable Amt Capitalizable Cost - Scrap Value: DR 1/estmd Useful LifeReynaldo Fajardo YuNoch keine Bewertungen

- DepreciationDokument3 SeitenDepreciationPrince-SimonJohnMwanza100% (1)

- All LoansDokument39 SeitenAll LoansJohn RussellNoch keine Bewertungen

- P 9-3A 1. The Journal Entry To Record Its Purchase On January 1, 2017 Journal Entry DateDokument5 SeitenP 9-3A 1. The Journal Entry To Record Its Purchase On January 1, 2017 Journal Entry DatemuezzaNoch keine Bewertungen

- Tarea 9.2 Problemas Evaluación Proyectos 2 Loera CoronadoDokument14 SeitenTarea 9.2 Problemas Evaluación Proyectos 2 Loera CoronadoBrandon LoeraNoch keine Bewertungen

- MT1 Ch22Dokument4 SeitenMT1 Ch22api-3725162Noch keine Bewertungen

- Solutions To Selected End-Of-Chapter 8 Problem Solving QuestionsDokument6 SeitenSolutions To Selected End-Of-Chapter 8 Problem Solving QuestionsVân Anh Đỗ LêNoch keine Bewertungen

- Obligasi - PembahasanDokument18 SeitenObligasi - Pembahasangaffar aimNoch keine Bewertungen

- C3L5 InterestsDokument15 SeitenC3L5 Interestsalayca cabatanaNoch keine Bewertungen

- IFRS Excel FormulasDokument4 SeitenIFRS Excel FormulasChristian Gonzalez LorcaNoch keine Bewertungen

- Fabozzi CH 03 Measuring Yield HW AnswersDokument5 SeitenFabozzi CH 03 Measuring Yield HW AnswershardiNoch keine Bewertungen

- Worked Examples For Chapter 9Dokument17 SeitenWorked Examples For Chapter 9JemmyNoch keine Bewertungen

- $1M Today 12.5 15.5% 20 YearsDokument4 Seiten$1M Today 12.5 15.5% 20 Yearsanna_meenaNoch keine Bewertungen

- Case 2Dokument8 SeitenCase 2yuliana100% (1)

- Yields and ReturnsDokument1 SeiteYields and ReturnsVISHAL PATILNoch keine Bewertungen

- Latihan Soal Asis Akm Ii - Sekuritas DiplutifDokument6 SeitenLatihan Soal Asis Akm Ii - Sekuritas DiplutifRADEN DIPONEGORONoch keine Bewertungen

- Franklin 2018 SIP-PresentationDokument24 SeitenFranklin 2018 SIP-PresentationRajat GuptaNoch keine Bewertungen

- DEPRECIATIONDokument14 SeitenDEPRECIATIONCandice BoodooNoch keine Bewertungen

- JB WK 26Dokument6 SeitenJB WK 26Antonia LópezNoch keine Bewertungen

- Business Finance Week 5Dokument5 SeitenBusiness Finance Week 5Ahlam KassemNoch keine Bewertungen

- Maru Batting Center Case Study Excel Group YellowDokument26 SeitenMaru Batting Center Case Study Excel Group YellowAshish PatwardhanNoch keine Bewertungen

- Cost of Owning and Operating Constructio PDFDokument10 SeitenCost of Owning and Operating Constructio PDFsunleon31Noch keine Bewertungen

- Tutorial Solution DepreciationDokument2 SeitenTutorial Solution DepreciationbillNoch keine Bewertungen

- Cap Buget ProblemsDokument8 SeitenCap Buget ProblemsramakrishnanNoch keine Bewertungen

- MK1 CH.4Dokument27 SeitenMK1 CH.4vano aldiNoch keine Bewertungen

- Chapter 9 Case Question Finance SolvedDokument1 SeiteChapter 9 Case Question Finance SolvedOwais Khan KhattakNoch keine Bewertungen

- Example FinancialsDokument177 SeitenExample FinancialsNavpreet SinghNoch keine Bewertungen

- Equipment Purchase Costs V2 07112014Dokument81 SeitenEquipment Purchase Costs V2 07112014Tom GoodladNoch keine Bewertungen

- Pertimbangan Dalam Investasi G Contoh:Rate-of-return: Metode Yang Bisa DigunakanDokument11 SeitenPertimbangan Dalam Investasi G Contoh:Rate-of-return: Metode Yang Bisa DigunakanMarojahanNoch keine Bewertungen

- Capitulo 7Dokument19 SeitenCapitulo 7thalibritNoch keine Bewertungen

- Year 0 1 Costs Benefits Cost of Capital Terminal ValueDokument4 SeitenYear 0 1 Costs Benefits Cost of Capital Terminal ValueSanjna ChimnaniNoch keine Bewertungen

- Mohsin Hassan Bba Iib BUS-19F-044 Principle of AccountingDokument7 SeitenMohsin Hassan Bba Iib BUS-19F-044 Principle of AccountingMohsin HassanNoch keine Bewertungen

- Straight-Line Depreciation: ExpenseDokument3 SeitenStraight-Line Depreciation: ExpenseGhulam-ullah KhanNoch keine Bewertungen

- (W3) ANS-Tutorial PPE Initial RecognitionDokument3 Seiten(W3) ANS-Tutorial PPE Initial RecognitionMUHAMMAD ADAM MOHD DEFIHAZRINoch keine Bewertungen

- Tugas ObligasiDokument15 SeitenTugas Obligasiwahdah ulin nafisahNoch keine Bewertungen

- Time Value of Money: Professor XXX Course Name/numberDokument34 SeitenTime Value of Money: Professor XXX Course Name/numbersumuewuNoch keine Bewertungen

- Mohsin Hassan Bba Iib BUS-19F-044 Principle of AccountingDokument7 SeitenMohsin Hassan Bba Iib BUS-19F-044 Principle of AccountingMohsin HassanNoch keine Bewertungen

- Profit Analysis Worksheet: ProductionDokument18 SeitenProfit Analysis Worksheet: ProductionhariveerNoch keine Bewertungen

- Capital BudgetingDokument3 SeitenCapital Budgetinghuman.resource.yesNoch keine Bewertungen

- W10 Case Study Capital BudgetingDokument2 SeitenW10 Case Study Capital BudgetingJuanNoch keine Bewertungen

- 10 YrDokument1 Seite10 Yrapi-25887578Noch keine Bewertungen

- Loan RepaymentsDokument4 SeitenLoan RepaymentsSALONI JaiswalNoch keine Bewertungen

- Project A: Question 1 AnswerDokument6 SeitenProject A: Question 1 AnswerShafiqUr RehmanNoch keine Bewertungen

- Bond Pricing - Dynamic ChartDokument4 SeitenBond Pricing - Dynamic Chartapi-3763138Noch keine Bewertungen

- Math 1090 Present and Future Value Project EportfolioDokument5 SeitenMath 1090 Present and Future Value Project Eportfolioapi-273422040Noch keine Bewertungen

- Jawaban Tes Admin-TerisiDokument4 SeitenJawaban Tes Admin-TerisiDhea AmeliaNoch keine Bewertungen

- CH 5 Part 1Dokument10 SeitenCH 5 Part 1Rawan YasserNoch keine Bewertungen

- Net Present Value Cost Savings DR 11% Discounted Cash InflowDokument10 SeitenNet Present Value Cost Savings DR 11% Discounted Cash InflowFaraz BakhshNoch keine Bewertungen

- Double Declining-Balance Depreciation: Study TipDokument1 SeiteDouble Declining-Balance Depreciation: Study Tipjustine martinNoch keine Bewertungen

- Week4 ROIC Tree SolutionDokument6 SeitenWeek4 ROIC Tree Solution刘春晓Noch keine Bewertungen

- Course Registration Fee Course Registration Fee Course Registration Fee Course Registration FeeDokument1 SeiteCourse Registration Fee Course Registration Fee Course Registration Fee Course Registration FeeUmar RehmanNoch keine Bewertungen

- Annuity ComparisonDokument6 SeitenAnnuity ComparisonMichael SherrinNoch keine Bewertungen

- PDF PDFDokument7 SeitenPDF PDFMikey MadRatNoch keine Bewertungen

- InstructionsDokument4 SeitenInstructionsmohitgaba19Noch keine Bewertungen

- S2 2017 388391 BibliographyDokument7 SeitenS2 2017 388391 BibliographyFajriansyah Herawan PangestuNoch keine Bewertungen

- Land Subsidence BantulDokument13 SeitenLand Subsidence BantulFajriansyah Herawan PangestuNoch keine Bewertungen

- Continental Margins and Ocean Basins: Major Tectonic Elements in OceanDokument114 SeitenContinental Margins and Ocean Basins: Major Tectonic Elements in OceanFajriansyah Herawan PangestuNoch keine Bewertungen

- PreviewDokument1 SeitePreviewFajriansyah Herawan PangestuNoch keine Bewertungen

- Time Value of Money: Economic Basis To Evaluate Engineering ProjectsDokument43 SeitenTime Value of Money: Economic Basis To Evaluate Engineering ProjectsFajriansyah Herawan PangestuNoch keine Bewertungen

- The Structure of Journal ArticlesDokument10 SeitenThe Structure of Journal ArticlesFajriansyah Herawan PangestuNoch keine Bewertungen

- Educationusa 2022globalguide Final Reduced SizeDokument84 SeitenEducationusa 2022globalguide Final Reduced SizeAnna ModebadzeNoch keine Bewertungen

- 7Dokument6 Seiten7Joenetha Ann Aparici100% (1)

- AMICO Bar Grating CatalogDokument57 SeitenAMICO Bar Grating CatalogAdnanNoch keine Bewertungen

- Philodendron Plants CareDokument4 SeitenPhilodendron Plants CareSabre FortNoch keine Bewertungen

- Chapter 13 CarbohydratesDokument15 SeitenChapter 13 CarbohydratesShanna Sophia PelicanoNoch keine Bewertungen

- AE Notification 2015 NPDCLDokument24 SeitenAE Notification 2015 NPDCLSuresh DoosaNoch keine Bewertungen

- Ej. 1 Fin CorpDokument3 SeitenEj. 1 Fin CorpChantal AvilesNoch keine Bewertungen

- Alchemy of The HeartDokument7 SeitenAlchemy of The HeartAbdul RahimNoch keine Bewertungen

- 0012 Mergers and Acquisitions Current Scenario andDokument20 Seiten0012 Mergers and Acquisitions Current Scenario andJuke LastNoch keine Bewertungen

- Lady in The House, Her Responsibilities & Ambitions: Amrita DuhanDokument7 SeitenLady in The House, Her Responsibilities & Ambitions: Amrita DuhanFitness FableNoch keine Bewertungen

- Biotech NewsDokument116 SeitenBiotech NewsRahul KapoorNoch keine Bewertungen

- Ateneo de Manila University: Submitted byDokument5 SeitenAteneo de Manila University: Submitted byCuster CoNoch keine Bewertungen

- CG Photo Editing2Dokument3 SeitenCG Photo Editing2Mylene55% (11)

- NAV SOLVING PROBLEM 3 (1-20) .PpsDokument37 SeitenNAV SOLVING PROBLEM 3 (1-20) .Ppsmsk5in100% (1)

- GPP Calendar of Activities 2022 23 SdoDokument5 SeitenGPP Calendar of Activities 2022 23 SdoRomel GarciaNoch keine Bewertungen

- PD3 - Strategic Supply Chain Management: Exam Exemplar QuestionsDokument20 SeitenPD3 - Strategic Supply Chain Management: Exam Exemplar QuestionsHazel Jael HernandezNoch keine Bewertungen

- Module 6 Metal Properties and Destructive TestingDokument46 SeitenModule 6 Metal Properties and Destructive TestingMiki Jaksic100% (6)

- Mushroom Project - Part 1Dokument53 SeitenMushroom Project - Part 1Seshadev PandaNoch keine Bewertungen

- Loctite 586 PDFDokument9 SeitenLoctite 586 PDForihimieNoch keine Bewertungen

- Tese Beatbox - Florida PDFDokument110 SeitenTese Beatbox - Florida PDFSaraSilvaNoch keine Bewertungen

- Debate ReportDokument15 SeitenDebate Reportapi-435309716Noch keine Bewertungen

- Johnson & Johnson Equity Research ReportDokument13 SeitenJohnson & Johnson Equity Research ReportPraveen R V100% (3)

- Colfax MR Series CompresorDokument2 SeitenColfax MR Series CompresorinvidiuoNoch keine Bewertungen

- Simon Ardhi Yudanto UpdateDokument3 SeitenSimon Ardhi Yudanto UpdateojksunarmanNoch keine Bewertungen

- IT Level 4 COCDokument2 SeitenIT Level 4 COCfikru tesefaye0% (1)

- CBC Heo (Wheel Loader) NC IIDokument58 SeitenCBC Heo (Wheel Loader) NC IIJohn JamesNoch keine Bewertungen

- A.meaning and Scope of Education FinalDokument22 SeitenA.meaning and Scope of Education FinalMelody CamcamNoch keine Bewertungen

- RARE Manual For Training Local Nature GuidesDokument91 SeitenRARE Manual For Training Local Nature GuidesenoshaugustineNoch keine Bewertungen

- Sample Learning Module As PatternDokument23 SeitenSample Learning Module As PatternWilliam BulliganNoch keine Bewertungen

- Safety Data Sheet SDS For CB-G PG Precision Grout and CB-G MG Multipurpose Grout Documentation ASSET DOC APPROVAL 0536Dokument4 SeitenSafety Data Sheet SDS For CB-G PG Precision Grout and CB-G MG Multipurpose Grout Documentation ASSET DOC APPROVAL 0536BanyuNoch keine Bewertungen