Beruflich Dokumente

Kultur Dokumente

Financial History and Ratios1

Hochgeladen von

Mukhlish AkhatarCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Financial History and Ratios1

Hochgeladen von

Mukhlish AkhatarCopyright:

Verfügbare Formate

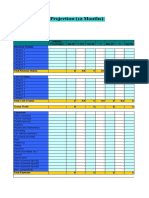

Financial history & ratios

Enter your Company Name here

In Thousands

Fiscal Year Ends Jun-30

RMA Current: from

Average mm/yyyy to

% mm/yyyy % 2000 % 1999 % 1998 %

Assets

Cash/ Equivalents $ - - $ - - $ - - $ - -

Trade Receivables - - - - Notes - on Preparation- - -

Note: You may want to print this information to use as reference

Inventory Value - - - - - - - -

later. To delete these instructions, click the border of this text box

All other current - - - - - press the DELETE

and then - key. - -

Total Current

- - - - The value

- of a spreadsheet

- is that it puts

- a lot of information

- in one

Assets

place to facilitate comparison and analysis. Enter information from

Fixed Assets (net) - - - - - - - -

your past three years' financial statements and from current year-to-

Intangibles (net) - - - - date -statements, if available,

- - the information

but simplify - in two ways

All other - - - - to fit into

- this format: - - -

Total Assets $ - 0.00% $ - 0.00% $ -

1] Compress 0.00%

your $

chart of accounts. -

Your 0.00%

financial statements, no

doubt, have many more lines than are provided on this spreadsheet.

Liabilities/ Equity % Combine categories to fit your numbers into this format.

Notes payable (ST) $ - - $ - - $ -

2] Condense -

the numbers $ ease of -comprehension.- We

for

Current L. T. Debt - - - - -

recommend that you- express your values

- -

in thousands,

Trade Payables - - - - rounding

- to the nearest

- $100; i.e., $3,275

- would be-entered as

$3.3.

Income Tax

Payable - - - - 3] Fill- in the "RMA Avg."- column. - -

All other current - - - - a. "RMA"

- refers to the-book Statement- Studies, published

- annually

by Robert Morris Associates, who are now called the Risk

Total Current Management Association. The book contains financial average data

Liabilities - - - - sorted- by type of business

- and size of-firm. It is a standard

- reference

Long-term Debt - - - - for bankers

- and financial

- analysts. You- can find it at major

- libraries,

or ask your banker.

Deferred Taxes - - - - - - - -

b. Enter the percentages and ratios from RMA for your size and type

All other non- of business in the "RMA Avg." column. You will note that the format

current - - - - of our- spreadsheet is -exactly the same- as the format -in the RMA

Net Worth - - - - book.- - - -

c. Note that for some of the ratios, the RMA book gives three

Total Liabilities & numbers. These are the median (the value in the middle of the

Net Worth $ - 0.00% $ - 0.00% $ range;- i.e.: the "average"),

0.00% the

$ upper quartile

- (the value half way

0.00%

between the middle and the extreme upper case), and the lower

quartile (the value half way between the middle and the extreme

Income Data % lower case).

Net Sales $ - 100.00% $ - 100.00% $ - 100.00% $ - 100.00%

4] Analyze your financial history:

Cost of Sales a. Look for significant changes in absolute values ($) or relative

(COGS) - - - - -

distribution of Assets, -Liabilities, or Expenses

- - do these

(%). What

Gross Profit - - - - - tell you about- how your company

changes - -

is evolving?

b. Also look for changes in your ratios. Why are ratio values shifting,

Operating and what does this mean?

Expenses - - - - - are unfamiliar- with ratio analysis,

c. If you - study the "Explanation

- ...

Operating Profit - - - - -

and Definition - sections near- the front of the- RMA book.

of Ratios"

All other expenses - - - - They-are exceptionally- clear and well written.

- Periodic- ratio analysis

will give you valuable insights into the financial dynamics of your

Pre-tax Profit $ - - $ - - $ -

company. - $ - -

d. If your ratio values differ from the industry average for similar

Ratio Analysis firms, try to understand why, and explain in the business plan.

Current Ratio 0.0 - - - -

Inventory Turnover 0.0 - - - -

Debt/ Net Worth 0.0 - - - -

% Return on Tang.

N/W 0.00% - - - -

% Return on Assets 0.00% - - - -

Das könnte Ihnen auch gefallen

- Inboard-Outdrive Boats World Summary: Market Sector Values & Financials by CountryVon EverandInboard-Outdrive Boats World Summary: Market Sector Values & Financials by CountryNoch keine Bewertungen

- Crushing, Pulverizing & Screening Machinery World Summary: Market Sector Values & Financials by CountryVon EverandCrushing, Pulverizing & Screening Machinery World Summary: Market Sector Values & Financials by CountryNoch keine Bewertungen

- Financial History and Ratios1Dokument1 SeiteFinancial History and Ratios1Omotola Olukayode OsineyeNoch keine Bewertungen

- Company Financial History and RatiosDokument1 SeiteCompany Financial History and Ratiospradhan13Noch keine Bewertungen

- Financial History & Ratios: Enter Your Company Name HereDokument1 SeiteFinancial History & Ratios: Enter Your Company Name HereNadia.ishaqNoch keine Bewertungen

- Financial History and RatiosDokument1 SeiteFinancial History and RatiosRosana Alves LaudelinoNoch keine Bewertungen

- Financial History & Ratios: Enter Your Company Name HereDokument1 SeiteFinancial History & Ratios: Enter Your Company Name HereJeffrey BahnsenNoch keine Bewertungen

- Company Name: Purchase Without Tax Invoice / Exp Incl BillDokument10 SeitenCompany Name: Purchase Without Tax Invoice / Exp Incl BillrockyrrNoch keine Bewertungen

- Financial History and Ratios 08Dokument1 SeiteFinancial History and Ratios 08poornimaR100% (2)

- Four Year Profit Projection: Enter Your Company Name HereDokument1 SeiteFour Year Profit Projection: Enter Your Company Name HereMisscreant EveNoch keine Bewertungen

- Cash Flow SpreadsheetDokument4 SeitenCash Flow SpreadsheetIzwan HafizNoch keine Bewertungen

- Four Year Profit ProjectionDokument1 SeiteFour Year Profit Projectionbaderf75Noch keine Bewertungen

- BookkeepingDokument4 SeitenBookkeepingAriel MercialesNoch keine Bewertungen

- Four Year Profit ProjectionDokument1 SeiteFour Year Profit ProjectionDebbieNoch keine Bewertungen

- Education agency fund budget vs actual analysisDokument3 SeitenEducation agency fund budget vs actual analysisHelen Joy Grijaldo JueleNoch keine Bewertungen

- Delay Analysis 2019Dokument4 SeitenDelay Analysis 2019Alsayed DiabNoch keine Bewertungen

- Four Year Profit ProjectionDokument1 SeiteFour Year Profit Projectiondamir101Noch keine Bewertungen

- Annual Organization Budget With Cash FlowDokument6 SeitenAnnual Organization Budget With Cash FlowDiegoNoch keine Bewertungen

- 3-Year Profit and Loss Projection: Merca OnlineDokument3 Seiten3-Year Profit and Loss Projection: Merca OnlineOrlandoAvendañoNoch keine Bewertungen

- Profit and Loss ProjectionDokument3 SeitenProfit and Loss ProjectionDokumen SayaNoch keine Bewertungen

- Precedent Transaction Template - NewDokument5 SeitenPrecedent Transaction Template - NewAmay SinghNoch keine Bewertungen

- Profit and Loss StatementDokument3 SeitenProfit and Loss Statementchetnaa100% (1)

- Bloo IndDokument10 SeitenBloo IndsemledeztcvyjnmmnuNoch keine Bewertungen

- PL Bs FormatDokument782 SeitenPL Bs FormatNATIONAL FARMERS PRODUCER COMPANYNoch keine Bewertungen

- GST Annual Return 2021 2022Dokument99 SeitenGST Annual Return 2021 2022AUTHENTIC SURSEZNoch keine Bewertungen

- TDS Calculator - 2017-18Dokument9 SeitenTDS Calculator - 2017-18rohithnatramNoch keine Bewertungen

- 1.scbaa FormatDokument6 Seiten1.scbaa FormatMark EsguerraNoch keine Bewertungen

- Ultimate Annual Multi Currency Fundraising PipelineDokument57 SeitenUltimate Annual Multi Currency Fundraising PipelineDiegoNoch keine Bewertungen

- Financial TemplateDokument6 SeitenFinancial TemplateLiyin LeeNoch keine Bewertungen

- Profit Loss 12 MonthDokument6 SeitenProfit Loss 12 MonthMstefNoch keine Bewertungen

- (Lengkap) Templete Laporan Keuangan UMKMDokument59 Seiten(Lengkap) Templete Laporan Keuangan UMKMHardi alifinNoch keine Bewertungen

- 2008 CashflowDokument1 Seite2008 CashflowJohn RichardsNoch keine Bewertungen

- 12 Month Profit and Loss WorksheetDokument6 Seiten12 Month Profit and Loss Worksheetaregb18Noch keine Bewertungen

- CNHS_Canteen_E-SalesDokument1 SeiteCNHS_Canteen_E-Salestiffany portezNoch keine Bewertungen

- Income Statement Analysis 2003-2011Dokument4 SeitenIncome Statement Analysis 2003-2011Sameer NevileNoch keine Bewertungen

- Petty Cash Replenisment FormatDokument4 SeitenPetty Cash Replenisment FormatJenie Marie NitoralNoch keine Bewertungen

- New Kuswaha Electric CentreDokument12 SeitenNew Kuswaha Electric Centreafroz khanNoch keine Bewertungen

- Shree Ganapati Mobile CentreDokument12 SeitenShree Ganapati Mobile Centreafroz khanNoch keine Bewertungen

- Roshan Tent HouseDokument12 SeitenRoshan Tent Houseafroz khanNoch keine Bewertungen

- 5.random ForestDokument12 Seiten5.random Forestpatil_555Noch keine Bewertungen

- Date-Shift Input Your CGL 2019 Raw Mark As Per Answer KeyDokument4 SeitenDate-Shift Input Your CGL 2019 Raw Mark As Per Answer Keypiyush33% (3)

- Major Project Report Quick Start Guide: Background InformationDokument7 SeitenMajor Project Report Quick Start Guide: Background InformationMagesh WaranNoch keine Bewertungen

- Cash Flow AnalysisDokument4 SeitenCash Flow AnalysisVdvg SrinivasNoch keine Bewertungen

- Template For Financial ProjectionDokument32 SeitenTemplate For Financial ProjectionRussel Jess HeyranaNoch keine Bewertungen

- 6,13 Open EconomyDokument7 Seiten6,13 Open EconomyHiệp Nguyễn Thị MinhNoch keine Bewertungen

- Small Business Budget Template PDFDokument6 SeitenSmall Business Budget Template PDFVeasna NounNoch keine Bewertungen

- ComputationDokument4 SeitenComputationshriniwas83Noch keine Bewertungen

- Simple Income - Expenditure ProjectionDokument3 SeitenSimple Income - Expenditure ProjectionCarol RadellantNoch keine Bewertungen

- Mfar FormatDokument21 SeitenMfar FormatKhaerul MalikNoch keine Bewertungen

- Cash-Flow Lunar: Luna Ian. Feb. Mar. Apr. Mai IncasariDokument2 SeitenCash-Flow Lunar: Luna Ian. Feb. Mar. Apr. Mai IncasariCalinCristeaNoch keine Bewertungen

- Guided Projections TMPLDokument4 SeitenGuided Projections TMPLvictorialozano013Noch keine Bewertungen

- FX Rates FY21 Jan-DecDokument3 SeitenFX Rates FY21 Jan-DecVuruvakilisurya PrakashNoch keine Bewertungen

- Income Tax Calculator FY 2019-20 (AY 2020-21)Dokument1 SeiteIncome Tax Calculator FY 2019-20 (AY 2020-21)J DassNoch keine Bewertungen

- SSC TBH Dump Prints Ps Rlip v1Dokument3 SeitenSSC TBH Dump Prints Ps Rlip v1Giovanni Ondong TabanaoNoch keine Bewertungen

- Paystub PaychexDokument1 SeitePaystub PaychexMike McKinseyNoch keine Bewertungen

- Annual Fundraising PipelineDokument82 SeitenAnnual Fundraising PipelineDiegoNoch keine Bewertungen

- Salary Adjustment SpreadsheetDokument4 SeitenSalary Adjustment SpreadsheetanasNoch keine Bewertungen

- It Manage Your IT Budget ToolDokument24 SeitenIt Manage Your IT Budget ToolYasser AbrahantesNoch keine Bewertungen

- Circular Letter: Department of Budget and ManagementDokument3 SeitenCircular Letter: Department of Budget and ManagementRoshel DoriendesNoch keine Bewertungen

- Tds On SalaryDokument3 SeitenTds On SalaryRakeshsingh145Noch keine Bewertungen

- JHGGGGDokument1 SeiteJHGGGGMukhlish AkhatarNoch keine Bewertungen

- Civil TechDokument358 SeitenCivil TechGunaNoch keine Bewertungen

- Business Structure Selector1Dokument3 SeitenBusiness Structure Selector1mukhleshNoch keine Bewertungen

- Employee Shift Schedule1Dokument2 SeitenEmployee Shift Schedule1kg1240Noch keine Bewertungen

- AbDokument1 SeiteAbMukhlish AkhatarNoch keine Bewertungen

- Column Design LinkDokument10 SeitenColumn Design LinkMukhlish AkhatarNoch keine Bewertungen

- IuiuioiioDokument1 SeiteIuiuioiioMukhlish AkhatarNoch keine Bewertungen

- Civil Delhi24-7 PDFDokument142 SeitenCivil Delhi24-7 PDFMukhlish AkhatarNoch keine Bewertungen

- ADokument1 SeiteAMukhlish AkhatarNoch keine Bewertungen

- Controls & Planning Management PlanDokument14 SeitenControls & Planning Management PlanmukhleshNoch keine Bewertungen

- 12 Month Cash Flow Statement1AZXDokument6 Seiten12 Month Cash Flow Statement1AZXMukhlish AkhatarNoch keine Bewertungen

- 12 Month Cash Flow Statement1AZXDokument2 Seiten12 Month Cash Flow Statement1AZXmukhleshNoch keine Bewertungen

- Opening Day Balance SheetDokument2 SeitenOpening Day Balance Sheetapi-3809857Noch keine Bewertungen

- Water Tank Design As Per Moody ChartDokument20 SeitenWater Tank Design As Per Moody ChartMukhlish AkhatarNoch keine Bewertungen

- Corbel: 25 415 Bearing in Steel Plate Cast 0.8Dokument3 SeitenCorbel: 25 415 Bearing in Steel Plate Cast 0.8mukhleshNoch keine Bewertungen

- LRFD Compression Member DesignDokument248 SeitenLRFD Compression Member DesignMukhlish Akhatar100% (1)

- Cantilever SlabDokument16 SeitenCantilever SlabMukhlish AkhatarNoch keine Bewertungen

- RCC Rate AnalsysisDokument2 SeitenRCC Rate AnalsysisjowarNoch keine Bewertungen

- Project Performance Tracking and ReportingDokument9 SeitenProject Performance Tracking and ReportingUbuntu LinuxNoch keine Bewertungen

- PO100 Acme Inc. purchase order for $0Dokument1 SeitePO100 Acme Inc. purchase order for $0Mukhlish AkhatarNoch keine Bewertungen

- Petty Cash Request4Dokument1 SeitePetty Cash Request4Mukhlish AkhatarNoch keine Bewertungen

- Start Up CapitalDokument1 SeiteStart Up Capitalshegel100% (4)

- Petty Cash Request4Dokument1 SeitePetty Cash Request4Mukhlish AkhatarNoch keine Bewertungen

- NSW & ACT Construction Rail Codes V1.1Dokument7 SeitenNSW & ACT Construction Rail Codes V1.1Mukhlish AkhatarNoch keine Bewertungen

- KPM Uncertainty Input SheetDokument210 SeitenKPM Uncertainty Input SheetMukhlish AkhatarNoch keine Bewertungen

- Profit and Loss Summary: Budget Summary ReportDokument6 SeitenProfit and Loss Summary: Budget Summary ReportIslam Ayman AbdelwahabNoch keine Bewertungen

- General Ledger1Dokument8 SeitenGeneral Ledger1Mukhlish AkhatarNoch keine Bewertungen

- Income StatementDokument19 SeitenIncome StatementiPakistan67% (3)

- Idprd 281298Dokument2 SeitenIdprd 281298Mukhlish AkhatarNoch keine Bewertungen

- Customers Pivot TableDokument71 SeitenCustomers Pivot TableAdie MorganNoch keine Bewertungen

- Sales Forecast Spreadsheet TemplateDokument6 SeitenSales Forecast Spreadsheet TemplateNithya RajNoch keine Bewertungen

- Funskool Case Study - Group 3Dokument7 SeitenFunskool Case Study - Group 3Megha MarwariNoch keine Bewertungen

- Tourism 2020: Policies To Promote Competitive and Sustainable TourismDokument32 SeitenTourism 2020: Policies To Promote Competitive and Sustainable TourismHesham ANoch keine Bewertungen

- Rethinking Monetary Policy After the CrisisDokument23 SeitenRethinking Monetary Policy After the CrisisAlexDuarteVelasquezNoch keine Bewertungen

- List of Companies: Group - 1 (1-22)Dokument7 SeitenList of Companies: Group - 1 (1-22)Mohammad ShuaibNoch keine Bewertungen

- Tax Invoice for Digital SubscriptionDokument3 SeitenTax Invoice for Digital SubscriptionPushpendra VermaNoch keine Bewertungen

- Marico's Leading Brands and Targeting StrategiesDokument11 SeitenMarico's Leading Brands and Targeting StrategiesSatyendr KulkarniNoch keine Bewertungen

- Blkpay YyyymmddDokument4 SeitenBlkpay YyyymmddRamesh PatelNoch keine Bewertungen

- Unit 6 Mutual FundDokument46 SeitenUnit 6 Mutual Fundpadmakar_rajNoch keine Bewertungen

- Ex 400-1 1ST BLDokument1 SeiteEx 400-1 1ST BLkeralainternationalNoch keine Bewertungen

- HR McqsDokument12 SeitenHR McqsHammadNoch keine Bewertungen

- Characteristics and Economic Outlook of Indonesia in the Globalization EraDokument63 SeitenCharacteristics and Economic Outlook of Indonesia in the Globalization EraALIFAHNoch keine Bewertungen

- Ralph & Eileen Swett Foundation - Grant ApplicationDokument8 SeitenRalph & Eileen Swett Foundation - Grant ApplicationRafael Kieran MondayNoch keine Bewertungen

- Common Rationality CentipedeDokument4 SeitenCommon Rationality Centipedesyzyx2003Noch keine Bewertungen

- Lead Dev Talk (Fork) PDFDokument45 SeitenLead Dev Talk (Fork) PDFyosiamanurunNoch keine Bewertungen

- Ramos ReportDokument9 SeitenRamos ReportOnaysha YuNoch keine Bewertungen

- Investment Opportunities in Bosnia and Herzegovina 2016Dokument69 SeitenInvestment Opportunities in Bosnia and Herzegovina 2016Elvir Harun Ibrovic100% (1)

- Mortgage 2 PDFDokument5 SeitenMortgage 2 PDFClerry SamuelNoch keine Bewertungen

- ARGA Investment Management L.P.: Valuation-Based Global Equity ManagerDokument1 SeiteARGA Investment Management L.P.: Valuation-Based Global Equity ManagerkunalNoch keine Bewertungen

- 5014 Environmental Management: MARK SCHEME For The May/June 2015 SeriesDokument3 Seiten5014 Environmental Management: MARK SCHEME For The May/June 2015 Seriesmuti rehmanNoch keine Bewertungen

- ReidtaylorDokument326 SeitenReidtayloralankriti12345Noch keine Bewertungen

- High Potential Near MissDokument12 SeitenHigh Potential Near Missja23gonzNoch keine Bewertungen

- Trust Receipt Law NotesDokument8 SeitenTrust Receipt Law NotesValentine MoralesNoch keine Bewertungen

- Questionnaires On Entrepreneurship DevelopmentDokument24 SeitenQuestionnaires On Entrepreneurship DevelopmentKawalpreet Singh Makkar100% (1)

- Tour Guiding Introduction to the Tourism IndustryDokument13 SeitenTour Guiding Introduction to the Tourism Industryqueenie esguerraNoch keine Bewertungen

- Balance StatementDokument5 SeitenBalance Statementmichael anthonyNoch keine Bewertungen

- AMULDokument27 SeitenAMULSewanti DharNoch keine Bewertungen

- BlackBuck Looks To Disrupt B2B Logistics Market Apart From The Regular GPS-Enabled Freight Management, It Offers Features Such As Track and Trace, Truck Mapping - The Financial ExpressDokument2 SeitenBlackBuck Looks To Disrupt B2B Logistics Market Apart From The Regular GPS-Enabled Freight Management, It Offers Features Such As Track and Trace, Truck Mapping - The Financial ExpressPrashant100% (1)

- 20 Years of Ecotourism Letter From DR Kelly BrickerDokument1 Seite20 Years of Ecotourism Letter From DR Kelly BrickerThe International Ecotourism SocietyNoch keine Bewertungen

- Russia and Lithuania Economic RelationsDokument40 SeitenRussia and Lithuania Economic RelationsYi Zhu-tangNoch keine Bewertungen