Beruflich Dokumente

Kultur Dokumente

MSME loan rates cut by up to 55 bps

Hochgeladen von

Ajoydeep DasOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

MSME loan rates cut by up to 55 bps

Hochgeladen von

Ajoydeep DasCopyright:

Verfügbare Formate

- /e-circular

, . 13 . 433 /17-18

Micro, Small and Medium Enterprises MSMEs Sl. No. 13 O&M No. 433/17-18

Circular No. MSME/INTT RATE/ 13 /OM- 433/17-18 26-September-2017

ALL BRANCHES/OFFICES

STAFF TRAINING COLLEGES/ STAFF TRAINING CENTRES

ALL RSETIs/ ALL DEPARTMENTS AT HEAD OFFICE

Subject: Revision in Rate of Interest for MSME advances.

Priority Sector advances are thrust area of lending for the Bank. Under priority sector

advance, MSME credit not only contributes towards employment generation but also imparts

better yield in comparison to other segments.

We have observed that in the recent past many banks have reduced their pricing against

MSME loans; consequently the Bank has felt a challenge in pricing of MSME advances. To

provide competitive interest rate, aligned with the industry, for acquisition of quality MSME

advance, Bank has decided to reduce the rate of interest applicable for MSME borrowers in

order to:

a) To retain the existing quality MSME borrowers.

b) To attract and bring the new entrepreneurs in our fold.

c) To achieve the targets associated with MSE sector.

Accordingly, the revised interest rates applicable for MSME borrowers w.e.f. 03.10.2017 are

as under :

Loan Limit Existing ROI Revised ROI Applicable

(MCLR Y = 8.75%) (MCLR Y = 8.75%) Reduction

Limit upto Rs.10.00 MCLR-Y + 2.30% = 11.05 % MCLR-Y+2.00% = 10.75% 30 bps

lac

Limit above Rs.10.00 Lac based upon credit rating

UBICR-0 MCLR-Y + 1.80% = 10.55 % MCLR-Y+1.25%= 10.00% 55 bps

UBICR-1 MCLR-Y + 2.05% = 10.80 % MCLR-Y+1.50%= 10.25% 55 bps

UBICR-2 MCLR-Y + 2.55% = 11.30 % MCLR-Y+2.00%= 10.75% 55 bps

UBICR-3 MCLR-Y + 3.30% = 12.05 % MCLR-Y+2.75%=11.50% 55 bps

(Entry Level)

UBICR-4 MCLR-Y + 3.80% = 12.55 % MCLR-Y+3.25% = 12.0% 55 bps

UBICR-5 MCLR-Y + 4.80% = 13.55 % MCLR-Y+4.25%= 13.00% 55 bps

With aforesaid modification in rate of interest for MSME loans, Banks earlier circular ref. no.

RMD/MCLR-ROI/5/OM-192/17-18 dated 16.06.2017 stands revised, however additional

discount/concession with specified collaterals would remain applicable as per existing

guidelines.

As per RBI guidelines no collateral should be insisted upon for MSE loan upto Rs.10 lacs.

Accordingly, no concessional rate is applicable for MSE loans upto Rs.10 lacs. However, for

loan accounts above Rs.10 lacs, the additional discount/ reductions in rate of interest based

on percentage(%) of collateral security offered by the borrowing MSME units would be as

under :

Percentage collateral security offered Discount /Reduction in ROI

75% and above upto 100% 0.25%

100% and above 0.50%

Aforesaid rate of interest for MSME loans will be applicable for fresh/new loans along with

the loans at the time of their annual review/renewal.

All concerned are advised to take note of the instructions and ensure strict compliance of the

same.

General Manager

(MSME, Govt. Transaction & CFO)

Das könnte Ihnen auch gefallen

- MSME Overview PNBDokument29 SeitenMSME Overview PNBshobhita_9Noch keine Bewertungen

- State Bank of Pakistan Prudential Regulations For Small & Medium Enterprises FinancingDokument39 SeitenState Bank of Pakistan Prudential Regulations For Small & Medium Enterprises FinancingShahzadNasirNoch keine Bewertungen

- PRs SMEsDokument77 SeitenPRs SMEsMuhammad Arslan UsmanNoch keine Bewertungen

- Prudential Regulations by SBP For SME FinancingDokument40 SeitenPrudential Regulations by SBP For SME FinancingsirfanalizaidiNoch keine Bewertungen

- Low Rate SME LoansDokument5 SeitenLow Rate SME Loansnishaantdec13Noch keine Bewertungen

- BOI MSME Loan ProductsDokument95 SeitenBOI MSME Loan ProductsganpatigajanandganeshNoch keine Bewertungen

- In Case of Manufacturing Enterprises The Calculations of Original Cost ofDokument12 SeitenIn Case of Manufacturing Enterprises The Calculations of Original Cost ofVimal kumarNoch keine Bewertungen

- Advancing rural lending through agriculture infrastructureDokument4 SeitenAdvancing rural lending through agriculture infrastructureJaspreet SinghNoch keine Bewertungen

- Banking Statistics and ConceptsDokument218 SeitenBanking Statistics and ConceptsShamanth1Noch keine Bewertungen

- 8-MM 8A-MSME FinancingDokument42 Seiten8-MM 8A-MSME Financingsenthamarai krishnan0% (1)

- Credit Guranatee Fund Trust Scheme For MicroDokument4 SeitenCredit Guranatee Fund Trust Scheme For MicroAnitha GirigoudruNoch keine Bewertungen

- Sme RoiDokument1 SeiteSme RoiSanjay KumarNoch keine Bewertungen

- MSE Policy - Display Without Rating ScoreDokument17 SeitenMSE Policy - Display Without Rating ScoreMahesh PatilNoch keine Bewertungen

- Bank's 2013-14 Credit Risk Policy Highlights Key ElementsDokument14 SeitenBank's 2013-14 Credit Risk Policy Highlights Key ElementsSaran Saru100% (2)

- Atmanirbhar Bharat (Part 1)Dokument19 SeitenAtmanirbhar Bharat (Part 1)Bhavneshsingh BhadauriyaNoch keine Bewertungen

- Chartered Accountant Meet Takeover Norms and Credit StructureDokument15 SeitenChartered Accountant Meet Takeover Norms and Credit StructureEmmy RoyNoch keine Bewertungen

- SBIDokument45 SeitenSBILakisha GriffinNoch keine Bewertungen

- SBI Current Accounts and Loans for MSMEsDokument14 SeitenSBI Current Accounts and Loans for MSMEsElora NandyNoch keine Bewertungen

- SME PresentationDokument19 SeitenSME PresentationWaqar AhmadNoch keine Bewertungen

- Ticket Mukesh AhmedabadDokument26 SeitenTicket Mukesh AhmedabadSURANA1973Noch keine Bewertungen

- The Preferred Partner in Prosperity: One Stop Solution For All Banking NeedsDokument37 SeitenThe Preferred Partner in Prosperity: One Stop Solution For All Banking NeedsvelankanniamNoch keine Bewertungen

- Vidya Deepam Circ Gist Mar20 - Mar21Dokument105 SeitenVidya Deepam Circ Gist Mar20 - Mar21pradeep kumar0% (1)

- RBI Master Circular Lending To Micro Small Medium Enterprises MSME Sector 2nd July 2012KALE LAW OFFICE CORPORATE LAWYER LAW FIR TAX CONSULTANTS COMPANY LAWYER 1Dokument7 SeitenRBI Master Circular Lending To Micro Small Medium Enterprises MSME Sector 2nd July 2012KALE LAW OFFICE CORPORATE LAWYER LAW FIR TAX CONSULTANTS COMPANY LAWYER 1Divya MewaraNoch keine Bewertungen

- Promotion Study Material I To II and II To III-1Dokument131 SeitenPromotion Study Material I To II and II To III-1Shuvajoy ChakrabortyNoch keine Bewertungen

- Meezan Bank announces highest bonuses, ESOP schemeDokument6 SeitenMeezan Bank announces highest bonuses, ESOP schemeKaleemNoch keine Bewertungen

- Bangladesh Government Stimulus Packages for COVID-19 IndustryDokument28 SeitenBangladesh Government Stimulus Packages for COVID-19 IndustryshuvojitNoch keine Bewertungen

- SME Credit Policies & Programmes in BangladeshDokument66 SeitenSME Credit Policies & Programmes in BangladeshJahangir MiltonNoch keine Bewertungen

- Unravelling The Malegam Conundrum: Merge or SubmergeDokument16 SeitenUnravelling The Malegam Conundrum: Merge or SubmergeAanchal DhingraNoch keine Bewertungen

- Union Bank MSME Products for TradersDokument23 SeitenUnion Bank MSME Products for TradersAnanda Shingade100% (1)

- Tutorial 7 Questions (Chapter 3)Dokument13 SeitenTutorial 7 Questions (Chapter 3)tan JiayeeNoch keine Bewertungen

- Retail Lending Policy 2010-11Dokument25 SeitenRetail Lending Policy 2010-11Bhandup YadavNoch keine Bewertungen

- UntitledDokument12 SeitenUntitledSHER LYN LOWNoch keine Bewertungen

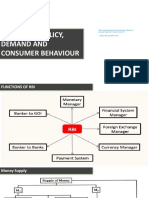

- Monetary Policy, Demand and Consumer Behaviour: Alculator/repo-Rate-Vs-Bank-Rate - HTML - Repo Rate and Bank RatreDokument23 SeitenMonetary Policy, Demand and Consumer Behaviour: Alculator/repo-Rate-Vs-Bank-Rate - HTML - Repo Rate and Bank RatreBhavya NarangNoch keine Bewertungen

- FM eases woes of MSMEs & NBFCs with Rs.5.94 lakh crore packageDokument5 SeitenFM eases woes of MSMEs & NBFCs with Rs.5.94 lakh crore packageKatta AshishNoch keine Bewertungen

- CGTMSE Presentation FinalDokument30 SeitenCGTMSE Presentation FinalVishal Chaudhari100% (1)

- Msepolciy DocumentDokument27 SeitenMsepolciy DocumentRupesh MoreNoch keine Bewertungen

- IDirect RBIActions Dec15Dokument5 SeitenIDirect RBIActions Dec15umaganNoch keine Bewertungen

- Msme - Eligibility, Scope AND BenefitsDokument8 SeitenMsme - Eligibility, Scope AND BenefitsPoonam SharmaNoch keine Bewertungen

- Priority Sector Advances Updated 2020Dokument31 SeitenPriority Sector Advances Updated 2020sailuteluguNoch keine Bewertungen

- BANKING ISSUESDokument17 SeitenBANKING ISSUESbhavyaNoch keine Bewertungen

- MCLR Linked Interest RatesDokument8 SeitenMCLR Linked Interest RatesAjoydeep DasNoch keine Bewertungen

- BMBA Media Presentation July 2012Dokument4 SeitenBMBA Media Presentation July 2012ShakilNoch keine Bewertungen

- DCB Bank Buy Emkay ResearchDokument23 SeitenDCB Bank Buy Emkay ResearchGreyFoolNoch keine Bewertungen

- Abhishek MSME SlideDokument13 SeitenAbhishek MSME SlidePratima YadavNoch keine Bewertungen

- Prudential Regulations For Small and Medium Enterprises FinancingDokument22 SeitenPrudential Regulations For Small and Medium Enterprises FinancingkashifdadaNoch keine Bewertungen

- Mrunal Sir Latest 2020 Handout 3 PDFDokument19 SeitenMrunal Sir Latest 2020 Handout 3 PDFdaljit singhNoch keine Bewertungen

- 3EF1B - HDT - RBI3 - Burning - Issues - Banking - 2020B @ PDFDokument19 Seiten3EF1B - HDT - RBI3 - Burning - Issues - Banking - 2020B @ PDFMohan DNoch keine Bewertungen

- Commercial Banking Assignment: Analysis of Assets and Liabilities of A BankDokument15 SeitenCommercial Banking Assignment: Analysis of Assets and Liabilities of A BankAyaz QaiserNoch keine Bewertungen

- Risk Management in Commercial BankDokument8 SeitenRisk Management in Commercial BankRITIKANoch keine Bewertungen

- Reserve Bank of IndiaDokument57 SeitenReserve Bank of IndiaAjinkya AghamkarNoch keine Bewertungen

- Loans To Smes and Msmes Collateral Free LoansDokument3 SeitenLoans To Smes and Msmes Collateral Free LoansShatir LaundaNoch keine Bewertungen

- ABM RBI Jul-Dec'23Dokument14 SeitenABM RBI Jul-Dec'23RaviTuduNoch keine Bewertungen

- Regulation & Financial Market: Prudential Regulations For Small & Medium Enterprises Financing Fall 2021 IBA - KarachiDokument25 SeitenRegulation & Financial Market: Prudential Regulations For Small & Medium Enterprises Financing Fall 2021 IBA - KarachialiNoch keine Bewertungen

- Guide Chapter 28 Credit ManagementDokument26 SeitenGuide Chapter 28 Credit Management185496185496100% (1)

- Non Performing AssetsDokument12 SeitenNon Performing AssetsVikram SinghNoch keine Bewertungen

- MultitechDokument1 SeiteMultitechburnsop7Noch keine Bewertungen

- 2 - (SBP)Dokument14 Seiten2 - (SBP)Aliza FatimaNoch keine Bewertungen

- MSME SchemesDokument53 SeitenMSME SchemesKalyani BorkarNoch keine Bewertungen

- Public Financing for Small and Medium-Sized Enterprises: The Cases of the Republic of Korea and the United StatesVon EverandPublic Financing for Small and Medium-Sized Enterprises: The Cases of the Republic of Korea and the United StatesNoch keine Bewertungen

- Financing Small and Medium-Sized Enterprises in Asia and the Pacific: Credit Guarantee SchemesVon EverandFinancing Small and Medium-Sized Enterprises in Asia and the Pacific: Credit Guarantee SchemesNoch keine Bewertungen

- Rates of interest and charges for MSE loans under priority sectorDokument2 SeitenRates of interest and charges for MSE loans under priority sectorAjoydeep DasNoch keine Bewertungen

- Piggery BookletDokument30 SeitenPiggery BookletVeli Ngwenya100% (2)

- Transforming Rural YouthDokument340 SeitenTransforming Rural Youthudi9690% (2)

- Concurrent AuditorDokument67 SeitenConcurrent AuditorAjoydeep DasNoch keine Bewertungen

- Employee salary list July 2017Dokument216 SeitenEmployee salary list July 2017Ajoydeep Das0% (1)

- MCLR Linked Interest RatesDokument8 SeitenMCLR Linked Interest RatesAjoydeep DasNoch keine Bewertungen

- Application For Change of Email/MobileDokument1 SeiteApplication For Change of Email/MobileAjoydeep DasNoch keine Bewertungen

- SOP Part 1Dokument1 SeiteSOP Part 1Ajoydeep DasNoch keine Bewertungen

- SOP Part 2Dokument267 SeitenSOP Part 2Ajoydeep DasNoch keine Bewertungen

- Finacle Commands For Concurrent AuditDokument24 SeitenFinacle Commands For Concurrent AuditMayur KundarNoch keine Bewertungen

- Maintain JCB excavator loaderDokument12 SeitenMaintain JCB excavator loaderDavid Palash100% (2)

- Finacle Commands - BankDokument5 SeitenFinacle Commands - BankRobin HoodxiiNoch keine Bewertungen

- Estimasi Fuel ConsumptionDokument7 SeitenEstimasi Fuel ConsumptionDanu PutraNoch keine Bewertungen

- JCB 3DX Specifications SheetDokument2 SeitenJCB 3DX Specifications SheetIndian Autos Blog92% (26)

- Accounting Concept of Currency Chest TransactionDokument1 SeiteAccounting Concept of Currency Chest TransactionAjoydeep DasNoch keine Bewertungen

- Guidance Note On Bank Audit - 2017Dokument674 SeitenGuidance Note On Bank Audit - 2017Ajoydeep DasNoch keine Bewertungen

- Finacle 19A - Cbs Menu - UpgbDokument27 SeitenFinacle 19A - Cbs Menu - UpgbyezdiarwNoch keine Bewertungen

- Tds16a Revised As Per Notification No. 92010 Dated 18022010Dokument1 SeiteTds16a Revised As Per Notification No. 92010 Dated 18022010Sameer GanekarNoch keine Bewertungen

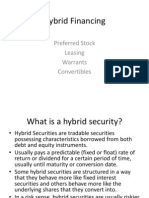

- Hybrid Financing: Understanding Preferred Stock, Leasing, Warrants and ConvertiblesDokument33 SeitenHybrid Financing: Understanding Preferred Stock, Leasing, Warrants and ConvertiblesKim Aaron T. RuizNoch keine Bewertungen

- Chapter - 9 Opening and Operating Bank AccountsDokument12 SeitenChapter - 9 Opening and Operating Bank AccountsMd Mohsin AliNoch keine Bewertungen

- Financial Assets Classification GuideDokument8 SeitenFinancial Assets Classification GuideKing BelicarioNoch keine Bewertungen

- F.S BookDokument51 SeitenF.S BookKARANNoch keine Bewertungen

- Edu Loan For Foreign StudyDokument17 SeitenEdu Loan For Foreign StudyGurbani Kaur SuriNoch keine Bewertungen

- Sunflag Iron and Steel Company ProfileDokument66 SeitenSunflag Iron and Steel Company ProfileprashantNoch keine Bewertungen

- RPT MATH DLP YEAR 5 2023-2024 by Rozayus AcademyDokument21 SeitenRPT MATH DLP YEAR 5 2023-2024 by Rozayus AcademyROSMALIZA BINTI ABDUL LATIB MoeNoch keine Bewertungen

- Or Problems For LINGO ExerciseDokument10 SeitenOr Problems For LINGO ExerciseVisakh RadhakrishnanNoch keine Bewertungen

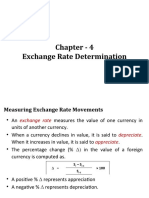

- Chapter - 4 Exchange Rate DeterminationDokument14 SeitenChapter - 4 Exchange Rate DeterminationAshiqur RahmanNoch keine Bewertungen

- Fin 254 - Chapter 5 CorrectedDokument61 SeitenFin 254 - Chapter 5 CorrectedsajedulNoch keine Bewertungen

- Ratio Analysis Part 1Dokument27 SeitenRatio Analysis Part 1RAVI KUMARNoch keine Bewertungen

- Chapter20 PDFDokument31 SeitenChapter20 PDFRoberto CipponeNoch keine Bewertungen

- Cash Poolg CMdfsDokument88 SeitenCash Poolg CMdfsLaurentiu SavaNoch keine Bewertungen

- June 2017 'Dokument57 SeitenJune 2017 'Umer VaqarNoch keine Bewertungen

- Construction of The Argentine Term Structure of Interest Rates Applied To Risk Management Decisions - Immunization of Fixed Income PortfoliosDokument31 SeitenConstruction of The Argentine Term Structure of Interest Rates Applied To Risk Management Decisions - Immunization of Fixed Income PortfoliosSebastian SalvayNoch keine Bewertungen

- Chapter 5 - How Do Risk and Term Structure Affect Interest RatesDokument59 SeitenChapter 5 - How Do Risk and Term Structure Affect Interest Ratesmichellebaileylindsa0% (1)

- Credit Transactions - RevisedDokument123 SeitenCredit Transactions - RevisedLiene Lalu NadongaNoch keine Bewertungen

- Peoples Union For Civil Liberties PUCL and Ors Vs s030229COM640521Dokument52 SeitenPeoples Union For Civil Liberties PUCL and Ors Vs s030229COM640521Avni Kumar SrivastavaNoch keine Bewertungen

- 03 Sources of Funds PDFDokument12 Seiten03 Sources of Funds PDFSuraj SurajNoch keine Bewertungen

- Kel 12, Bahasa InggrisDokument21 SeitenKel 12, Bahasa InggrisYahya AdiNoch keine Bewertungen

- IAS Plus IFRS For Small An..Dokument23 SeitenIAS Plus IFRS For Small An..Buddha BlessedNoch keine Bewertungen

- Hands On BankingDokument134 SeitenHands On BankingTaufiquer RahmanNoch keine Bewertungen

- FP Report 2012Dokument180 SeitenFP Report 2012CY LiuNoch keine Bewertungen

- ch09 SM Carlon 5eDokument41 Seitench09 SM Carlon 5eKyle100% (1)

- LNS 2018 1 24 OthhcoDokument13 SeitenLNS 2018 1 24 OthhcoSrikumar RameshNoch keine Bewertungen

- 4 - Audit of InvestmentsDokument11 Seiten4 - Audit of InvestmentsSharmaine Clemencio0Noch keine Bewertungen

- Education Loan InterestDokument1 SeiteEducation Loan Interestravi lingam100% (2)

- STPM 950 SP Math (M) (9.3.12)Dokument54 SeitenSTPM 950 SP Math (M) (9.3.12)abnu98Noch keine Bewertungen

- Varun Nagar Agricultural Cooperative Society operations reviewDokument2 SeitenVarun Nagar Agricultural Cooperative Society operations reviewPrachi SinghalNoch keine Bewertungen

- 6EC02 June 2009 MSDokument16 Seiten6EC02 June 2009 MSStevenNoch keine Bewertungen