Beruflich Dokumente

Kultur Dokumente

Financial System Report

Hochgeladen von

Ameera UdeanCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Financial System Report

Hochgeladen von

Ameera UdeanCopyright:

Verfügbare Formate

Objective

- To acknowledge the development of financial system in Malaysia

- To explore the history of the financial system that occurred Malaysia

- To identify the characteristics of financial system in Malaysia

Introduction

Malaya started their financial system by practicing barter system before 1800. In the late 1800,

money revolution takes place through the colonial invasion by practicing silver dollars. These silver

dollars having some issues regarding the value of the silver fluctuated and gold takes place. The practice

of gold standard did not last long. By 1930, Malayan dollar was produced. By that time, all the financial

practice takes place and expand until now.

History of financial system in Malaysia

Time Event

August Establishment of an interest-free institution, Pilgrim's Management and Fund

1969 Board (PMFB) or Tabung Haji.

PMFB was set up through a merger of the Malayan Muslim Pilgrim Savings

Corporation and the Pilgrims Affairs Department of the government to promote

and co-ordinate all aspects of activities connected with the Muslims going on

pilgrimage.

1980 Bumiputra Economic Congress 1980 passed a resolution urging the government

to allow the PMFB to establish an Islamic bank in Malaysia.

There are committees were formed to study the various aspects of Islamic

banking and its implementation in Malaysia.

These efforts were taken independently by such organization as the Muslim

Welfare Organization of Malaysia (PERKIM), PMFB, and the Development Bank

of Malaysia Berhad.

In various seminars at the state levels, similar resolutions were passed urging

the government to establish Islamic banks with the PMFB playing a major role.

March At the "National Seminar on the Concept of Development in Islam" organized by

1981 Universiti Kebangsaan Malaysia (UKM), another resolution was passed urging

the government to take an immediate initiative to enact a special provision of

the laws as the first step towards establishing Islamic Banks and financial

institutions consistent with Islamic principles.

Here again, seminars agreed that PMFB should be given the task of initiating the

implementation of the project.

July 1981 The government agreed to form a National Steering Committee of Islamic Banks.

This committee was led by Raja Tan Sri Mohar, the special advisor to Prime

Minister and it set up three technical committees, namely the Religious

Committee, Legal Committee, and Banking Operation Committee.

1983 Bank Islam Malaysia Berhad (BIMB) was established.

Promulgation of a new Islamic Banking Act 1983 with only certain minor changes

being made to the existing Banking Act 1973.

1989 Bafia was enacted

1990 Rating agency Malaysia

October Labuan International Offshore Financial Centre(IOFC) was established

1990

1993 The Securities Commission

December Capital Market was developed

1995

1998 The National Economic Action Council (NEAC) was set up

1

september

1998

Discussion

1. How will Malaysians face the financial crisis that happen these days that has cause massive

deflation?

2. How the financial institutions and other companies tackle this problems in order to regain

stability without burdening the public directly?

3. How can we predict the financial system in Malaysia if this crisis remained unsolved?

Conclusion

It is conclude that the Malaysian financial system has grown in order to make it compatible to the

current economy.

References

Das könnte Ihnen auch gefallen

- Work Diversity - Race and EthnicityDokument8 SeitenWork Diversity - Race and EthnicityAmeera UdeanNoch keine Bewertungen

- HSE Tutorial 2 QDokument7 SeitenHSE Tutorial 2 QAmeera UdeanNoch keine Bewertungen

- Flowchart ProgrammingDokument1 SeiteFlowchart ProgrammingAmeera UdeanNoch keine Bewertungen

- ReligionDokument8 SeitenReligionAmeera UdeanNoch keine Bewertungen

- Group Project GuidelinesDokument1 SeiteGroup Project GuidelinesAmeera UdeanNoch keine Bewertungen

- LGBT SlideDokument4 SeitenLGBT SlideAmeera UdeanNoch keine Bewertungen

- Islamic and Contemporary LeadershipDokument7 SeitenIslamic and Contemporary LeadershipAmeera UdeanNoch keine Bewertungen

- History of Financial System in Malaysia For Islamic Financial System 2Dokument1 SeiteHistory of Financial System in Malaysia For Islamic Financial System 2Ameera UdeanNoch keine Bewertungen

- Text For IclDokument1 SeiteText For IclAmeera UdeanNoch keine Bewertungen

- Conflict The Arming of LeadershipDokument17 SeitenConflict The Arming of LeadershipAmeera UdeanNoch keine Bewertungen

- Floating Offshore StructureDokument44 SeitenFloating Offshore StructureAmeera Udean100% (1)

- Student Industial Internship Programme ReportsDokument1 SeiteStudent Industial Internship Programme ReportsAmeera UdeanNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- A 2009Dokument88 SeitenA 2009heroic_aliNoch keine Bewertungen

- Right To Social JusticeDokument13 SeitenRight To Social Justicejooner45Noch keine Bewertungen

- Birch Bark Roll of The Woodcraft Indians Containing Their Constitution Laws Games and Deeds Ernest Thompson Seton 1907Dokument88 SeitenBirch Bark Roll of The Woodcraft Indians Containing Their Constitution Laws Games and Deeds Ernest Thompson Seton 1907Shivananda2012100% (2)

- Cases NOvember 21Dokument31 SeitenCases NOvember 21Wilfredo Guerrero IIINoch keine Bewertungen

- Motion For Preliminary InjunctionDokument4 SeitenMotion For Preliminary InjunctionElliott SchuchardtNoch keine Bewertungen

- Tugas BPFDokument2 SeitenTugas BPFRichard JapardiNoch keine Bewertungen

- BalayanDokument7 SeitenBalayananakbalayanNoch keine Bewertungen

- Student School PoliciesDokument2 SeitenStudent School Policiesapi-320463853Noch keine Bewertungen

- 55 Salas, Jr. vs. Aguila, G.R. 202370, September 23, 2013Dokument3 Seiten55 Salas, Jr. vs. Aguila, G.R. 202370, September 23, 2013Lara Yulo100% (1)

- Install HelpDokument318 SeitenInstall HelpHenry Daniel VerdugoNoch keine Bewertungen

- HW1Dokument4 SeitenHW1hung hoangNoch keine Bewertungen

- Approach To Hackiing in Cameroon:Overview and Mitigation TechniquesDokument14 SeitenApproach To Hackiing in Cameroon:Overview and Mitigation TechniquesWilly NibaNoch keine Bewertungen

- Answers Chapter 4 QuizDokument2 SeitenAnswers Chapter 4 QuizZenni T XinNoch keine Bewertungen

- AEC - 12 - Q1 - 0401 - SS2 Reinforcement - Investments, Interest Rate, and Rental Concerns of Filipino EntrepreneursDokument5 SeitenAEC - 12 - Q1 - 0401 - SS2 Reinforcement - Investments, Interest Rate, and Rental Concerns of Filipino EntrepreneursVanessa Fampula FaigaoNoch keine Bewertungen

- PTS 30061020Dokument54 SeitenPTS 30061020ronelbarafaeldiegoNoch keine Bewertungen

- My Disneyland Tickets and PassesDokument5 SeitenMy Disneyland Tickets and Passesyusup jamaludinNoch keine Bewertungen

- Special Topics in Income TaxationDokument78 SeitenSpecial Topics in Income TaxationPantas DiwaNoch keine Bewertungen

- UOK-Ph.D. Fee StructureDokument2 SeitenUOK-Ph.D. Fee StructureNeeraj MeenaNoch keine Bewertungen

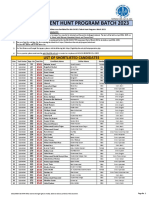

- Iba Ogdcl Talent Hunt Program Batch 2023: List of Shortlisted CandidatesDokument30 SeitenIba Ogdcl Talent Hunt Program Batch 2023: List of Shortlisted CandidatesSomil KumarNoch keine Bewertungen

- F8 Theory NotesDokument29 SeitenF8 Theory NotesKhizer KhalidNoch keine Bewertungen

- Dead Man Walking Worksheet PDFDokument5 SeitenDead Man Walking Worksheet PDFCarola BergaminiNoch keine Bewertungen

- 9 Keland Cossia 2019 Form 1099-MISCDokument1 Seite9 Keland Cossia 2019 Form 1099-MISCpeter parkinsonNoch keine Bewertungen

- BBM 301 Advanced Accounting Chapter 1, Section 2Dokument6 SeitenBBM 301 Advanced Accounting Chapter 1, Section 2lil telNoch keine Bewertungen

- Create An Informational Flyer AssignmentDokument4 SeitenCreate An Informational Flyer AssignmentALEEHA BUTTNoch keine Bewertungen

- Accounting SyllabiDokument2 SeitenAccounting SyllabiJyotirmaya MaharanaNoch keine Bewertungen

- Intro To Lockpicking and Key Bumping WWDokument72 SeitenIntro To Lockpicking and Key Bumping WWapi-3777781100% (8)

- POLITICAL SYSTEM of USADokument23 SeitenPOLITICAL SYSTEM of USAMahtab HusaainNoch keine Bewertungen

- Pastor Bonus Seminary: Fr. Ramon Barua, S.J. Street, Tetuan, P.O. Box 15 7000 Zamboanga City PhilippinesDokument2 SeitenPastor Bonus Seminary: Fr. Ramon Barua, S.J. Street, Tetuan, P.O. Box 15 7000 Zamboanga City PhilippinesJeremiah Marvin ChuaNoch keine Bewertungen

- Barandon Vs FerrerDokument3 SeitenBarandon Vs FerrerCorina Jane Antiga100% (1)

- Association of Mutual Funds in India: Application Form For Renewal of Arn/ EuinDokument5 SeitenAssociation of Mutual Funds in India: Application Form For Renewal of Arn/ EuinPiyushJainNoch keine Bewertungen