Beruflich Dokumente

Kultur Dokumente

Hedgebay Index - July 2010

Hochgeladen von

economicburnOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Hedgebay Index - July 2010

Hochgeladen von

economicburnCopyright:

Verfügbare Formate

Hedgebay

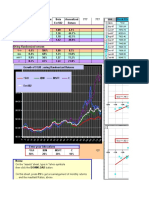

GLOBAL HEDGE FUND SECONDARY MARKET INDEX

Edition 11 July 2010

SMI for July was 75.00

A ctivity for the month of July was average for this time of the year. The index decreased in value by a little more than 300

basis points to 75. Dispersion narrowed to 35 points. The lack of “near par” transactions was abundantly obvious again in

July with all of the activity taking place in gated, suspended or side pocketed assets. With investors continuing to put money to

work on the primary side of the market in liquid funds, they continue to show their general lack of willingness to accept lock ups.

With a lot of attention focused on economic factors, the degree to which hedge fund performance exceeds interests rates and

equity returns will largely govern demand for the asset class, and consequently whether we begin to see more funds closing to

new investment. On the flip side, if hedge funds disappoint during another downturn in the economy and/or markets, will we

return to the illiquid times of 2008 and 2009 as investors scramble to get their cash back?

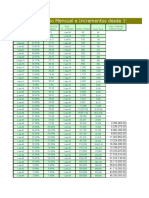

ALL FIGURES BELOW ARE RELATIVE TO A TRADE AT NAV EQUALLING 100%

Average discount or premium (to NAV) since 1999 Average price of trades

Date Average % Monthly %

108.00

106.00

of NAV change

104.00 Hedgebay SMI (ex-distressed)

102.00

100.00 31-Jul-10 75.00% -4.26%

(at NAV)

98.00

96.00 30-Jun-10 78.34% 8.11%

94.00

92.00

90.00 31-May-10 71.99% -21.56%

88.00

86.00 30-Apr-10 91.78% 7.34%

84.00

82.00

80.00 31-Mar-10 85.04% -7.02%

78.00

76.00

28-Feb-10 91.46% 3.86%

74.00

72.00

70.00 31-Jan-10 87.93% 9.27%

01-Aug-99

01-Nov-99

01-Feb-00

01-May-00

01-Aug-00

01-Nov-00

01-Feb-01

01-May-01

01-Aug-01

01-Nov-01

01-Feb-02

01-May-02

01-Aug-02

01-Nov-02

01-Feb-03

01-May-03

01-Aug-03

01-Nov-03

01-Feb-04

01-May-04

01-Aug-04

01-Nov-04

01-Feb-05

01-May-05

01-Aug-05

01-Nov-05

01-Feb-06

01-May-06

01-Aug-06

01-Nov-06

01-Feb-07

01-May-07

01-Aug-07

01-Nov-07

01-Feb-08

01-May-08

01-Aug-08

01-Nov-08

01-Feb-09

01-May-09

01-Aug-09

01-Nov-09

01-Feb-10

01-May-10

01-Jul-10

31-Dec-09 79.78% -7.34%

30-Nov-09 86.10% -0.72%

30-Oct-09 86.73% 4.41%

Top traded strategy

30-Sep-09 82.90% -6.22%

Date 1st 2nd

31-Aug-09 88.40% -0.33%

Jul-10 Relative Value Private Equity

The Hedgebay Global Secondary Market Index (GSMI) is a proprietary, asset-weighted index that describes the average premium or discount paid for hedge funds that trade in the secondary market

in any given month. An investor may wish to use the index as a sentiment indicator to describe hedge fund investors’ future expectations for performance, a benchmarking tool for hedge fund inves-

tors to assess latent value in their portfolios or as indicators of the cost of liquidity.

GSMI information is obtained through the Hedgebay website and its associated marketing licensees. There are limitations in using indices for comparison purposes because such indices may have dif-

ferent inclusion criteria and other material characteristics. No representation is made about the value of GSMI as a predictive or other indicator or benchmarking tool or that any investor will achieve

any results shown. This information is not intended to be, nor should it be construed or used as, a recommendation, or investment or other advice, or an offer, or the solicitation of an offer, to buy or

sell any security, including an interest in any hedge fund, which may only be made through delivery of a fund’s confidential offering documents, which must be read carefully. There are substantial

risks in investing in hedge funds. Certain information has been obtained from third party sources and, although believed to be reliable, it has not been independently verified and its accuracy or

completeness cannot be guaranteed. Past performance is not indicative of future results. The GSMI may not be distributed without our consent.

© 2004-2010 Hedgebay Trading Corporation. All rights reserved.

Hedgebay

GLOBAL HEDGE FUND ILLIQUID ASSET INDEX

Edition 11 July 2010

IAI for July was 67.95

T he IAI rose in value to 67.95. Transactions varied between emerging markets, private equity and credit and related assets. Buy-

ers have continued to search for assets in this category as July’s level reached the highest point in almost 12 months. The last

time the difference between the two indices was this close there was a major price correction in the IAI. In fact, as of the middle of

August, the index has declined substantially from its July levels. Many different factors could be at work here and any speculation on

which ones are driving this phenomenon would be just that; speculation.

ALL FIGURES BELOW ARE RELATIVE TO A TRADE AT NAV EQUALLING 100%

Global Illiquid Assets Index (GIAI) GIA

Date GIA Monthly %

100.00 change

90.00

Jul-10 67.95 12.52%

80.00

Jun-10 59.44 46.80%

70.00

May-10 31.62 -27.06%

60.00

Apr-10 43.35 -16.25%

50.00

Mar-10 51.76 10.41%

40.00

Feb-10 46.37 7.05%

30.00 Jan-10 43.10 10.58%

20.00 Dec-09 38.54 -0.13%

10.00 Nov-09 38.59 -5.88%

0.00 Oct-09 41.00 -49.34%

01 Feb 07

01 Mar 07

01 Apr 07

01 May 07

01 Jun 07

01 Jul 07

01 Aug 07

01 Sep 07

01 Oct 07

01 Nov 07

01 Dec 07

01 Jan 08

01 Feb 08

01 Mar 08

01 Apr 08

01 May 08

01 Jun 08

01 Jul 08

01 Aug 08

01 Sep 08

01 Oct 08

01 Nov 08

01 Dec 08

01 Jan 09

01 Feb 09

01 Mar 09

01 Apr 09

01 May 09

01 Jun 09

01 Jul 09

01 Aug 09

01 Sep 09

01 Oct 09

01 Nov 09

01 Dec 09

01 Jan 10

01 Feb 10

01 Mar 10

01 Apr 10

01 May 10

01 June 10

01 July 10

Sep-09 80.93 12.28%

Aug-09 70.99 18.21%

www.hedgebay.com

The Hedgebay Global Illiquid Asset Index (GIAI) is a proprietary, asset-weighted index that describes the average discount paid for assets that have no contractual redemption rights to their investors

(including, but not limited to hedge funds and private equity) that trade in the secondary market in any given month. An investor may wish to use the index as an indicator of the cost of liquidity or a

sentiment indicator to describe investors’ future expectations for illiquid assets.

GIAI information is obtained through the Hedgebay website and its associated marketing licensees. There are limitations in using indices for comparison purposes because such indices may have

different inclusion criteria and other material characteristics. No representation is made about the value of GIAI as a predictive or other indicator or benchmarking tool or that any investor will achieve

any results shown. This information is not intended to be, nor

should it be construed or used as, a recommendation, or investment or other advice, or an offer, or the solicitation of an offer, to buy or sell any security, including an interest in any hedge fund, which

may only be made through delivery of a fund’s confidential offering documents, which must be read carefully. There are substantial risks in investing in hedge funds. Certain information has been

obtained from third party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed. Past performance is not indica-

tive of future results. The GIAI may not be distributed without our consent.

© 2004-2010 Hedgebay Trading Corporation. All rights reserved.

Das könnte Ihnen auch gefallen

- Global Hedge Fund Secondary Market IndexDokument1 SeiteGlobal Hedge Fund Secondary Market IndexZerohedgeNoch keine Bewertungen

- Growth Porto Share PINADokument8 SeitenGrowth Porto Share PINApinaNoch keine Bewertungen

- Savings Account Rofit RatesDokument2 SeitenSavings Account Rofit RatesKhizar Muhammad KhanNoch keine Bewertungen

- 2011 StatsDokument1 Seite2011 Statscoolies123Noch keine Bewertungen

- Ric Profit Rates 17-06-2021Dokument4 SeitenRic Profit Rates 17-06-2021Mobashir Mehmood KhanNoch keine Bewertungen

- Mid Term Assignment Pop - 301 BDokument14 SeitenMid Term Assignment Pop - 301 BMahmudul HasanNoch keine Bewertungen

- Grafik Gizi Posy 2016Dokument12 SeitenGrafik Gizi Posy 2016Siti RisniaNoch keine Bewertungen

- Growth of $1.00: Using Randomized Returns: Dates DjiDokument16 SeitenGrowth of $1.00: Using Randomized Returns: Dates DjiPoorni ShivaramNoch keine Bewertungen

- ACE Nifty Futures Trading System - Performance Report (01.04.2007 To 31.03.2013)Dokument3 SeitenACE Nifty Futures Trading System - Performance Report (01.04.2007 To 31.03.2013)Prasad SwaminathanNoch keine Bewertungen

- Analisa Kesesuaian Data Exp Date Gudang FarmasiDokument5 SeitenAnalisa Kesesuaian Data Exp Date Gudang FarmasiHafiz SurahmanNoch keine Bewertungen

- Customer Retention Cohort Analysis VideoDokument8 SeitenCustomer Retention Cohort Analysis VideoMANAV SAHUNoch keine Bewertungen

- ACT HISTÓRICO SMM y CuantíasDokument9 SeitenACT HISTÓRICO SMM y CuantíasJose BustamanteNoch keine Bewertungen

- Plymouth Michigan Real Estate Stats - January 2011Dokument4 SeitenPlymouth Michigan Real Estate Stats - January 2011Todd Waller Real EstateNoch keine Bewertungen

- ROFIT RATES - SAVINGS ACCOUNT Historical Rates Remained Applicable On Savings Account From1st January, 2000 To OnwardsDokument3 SeitenROFIT RATES - SAVINGS ACCOUNT Historical Rates Remained Applicable On Savings Account From1st January, 2000 To OnwardsShahid Majeed ChaudhryNoch keine Bewertungen

- Overall Performance of the Attica Hotel Industry - Μάρτιος 2019 Έναντι Μαρτίου 2018Dokument1 SeiteOverall Performance of the Attica Hotel Industry - Μάρτιος 2019 Έναντι Μαρτίου 2018TatianaNoch keine Bewertungen

- LMP-Lampiran - KPI USE April 2019 PT PERTAMINA F1.0-28-05-2019 - 170832943Dokument8 SeitenLMP-Lampiran - KPI USE April 2019 PT PERTAMINA F1.0-28-05-2019 - 170832943Agung Ananta PutraNoch keine Bewertungen

- 0280TK021-S Curve 14 AugDokument1 Seite0280TK021-S Curve 14 AugYorgieNoch keine Bewertungen

- CASH FLOW - Financial With %Dokument1 SeiteCASH FLOW - Financial With %Chamux skalNoch keine Bewertungen

- MULA$$24Dokument6 SeitenMULA$$24ThompsonNoch keine Bewertungen

- GRAFIK GIZI WordDokument5 SeitenGRAFIK GIZI WordMoch Shoffyan LubieesNoch keine Bewertungen

- Capaian D/S Bulan MeiDokument5 SeitenCapaian D/S Bulan MeiMoch Shoffyan LubieesNoch keine Bewertungen

- Glicemia: Participante Mery Martinez CarballoDokument6 SeitenGlicemia: Participante Mery Martinez CarballoShirley Martinez CarballoNoch keine Bewertungen

- Cash Flow 4Dokument1 SeiteCash Flow 4Richard DamiagoNoch keine Bewertungen

- Type in 30 Stocks (In Column K) - Click The Download Button.: (That'll Give You 8 Years Worth of Data.)Dokument53 SeitenType in 30 Stocks (In Column K) - Click The Download Button.: (That'll Give You 8 Years Worth of Data.)Poorni ShivaramNoch keine Bewertungen

- KMMDokument6 SeitenKMMGerardo Mauricio Rodríguez FloresNoch keine Bewertungen

- Overall performance of the Attica Hotel Industry- Ιούνιος 2019, έναντι Ιουνίου 2018Dokument1 SeiteOverall performance of the Attica Hotel Industry- Ιούνιος 2019, έναντι Ιουνίου 2018Tatiana RokouNoch keine Bewertungen

- SA Historical Rates 1Dokument2 SeitenSA Historical Rates 1Mahboob RiazNoch keine Bewertungen

- Exel Laporan Ruang OperasiDokument8 SeitenExel Laporan Ruang OperasiMF MultatuliNoch keine Bewertungen

- AskingvssoldDokument2 SeitenAskingvssoldmrathbunNoch keine Bewertungen

- Plymouth Michigan Real Estate Stats - February 2011Dokument4 SeitenPlymouth Michigan Real Estate Stats - February 2011Todd Waller Real EstateNoch keine Bewertungen

- Panel OrnamentDokument2 SeitenPanel OrnamentMarketing TanajawaNoch keine Bewertungen

- LIQUIDADOR A Mar 2021Dokument5 SeitenLIQUIDADOR A Mar 2021camila cuadrosNoch keine Bewertungen

- Battery Ventures Cohort Economics TemplateDokument48 SeitenBattery Ventures Cohort Economics Templatedouglas silvaNoch keine Bewertungen

- Bahbood Savings Certificates Profit RatesDokument2 SeitenBahbood Savings Certificates Profit Ratesadnan haiderNoch keine Bewertungen

- Hedgefund Fee StructureDokument5 SeitenHedgefund Fee Structureaslam810Noch keine Bewertungen

- Hedge Fund Fee StructureDokument5 SeitenHedge Fund Fee Structureaslam810Noch keine Bewertungen

- HDFC Updated Elss Vs PPF 28th Feb 2017Dokument31 SeitenHDFC Updated Elss Vs PPF 28th Feb 2017Mukesh KumarNoch keine Bewertungen

- RIC Rates W.E.F 12 01 23Dokument2 SeitenRIC Rates W.E.F 12 01 23Federal Land CommissionNoch keine Bewertungen

- 115.00 % Luna Precedentă 100: Indicele Preţurilor de Consum Indicele Câştigurilor Salariale Medii NeteDokument9 Seiten115.00 % Luna Precedentă 100: Indicele Preţurilor de Consum Indicele Câştigurilor Salariale Medii Netemircea_ghitescuNoch keine Bewertungen

- Oklahoma Budget Overview: Trends and Outlook, August 2010Dokument45 SeitenOklahoma Budget Overview: Trends and Outlook, August 2010dblattokNoch keine Bewertungen

- Catch Up Schedule 2Dokument1 SeiteCatch Up Schedule 2JOHN CARLO AZORESNoch keine Bewertungen

- HBO Monthly Expenses Tracker - 2023Dokument81 SeitenHBO Monthly Expenses Tracker - 2023harithh.rahsiaNoch keine Bewertungen

- DP AssignmentDokument107 SeitenDP AssignmentdivyaNoch keine Bewertungen

- Analisa Kehadiran Ting 1-5 2022Dokument5 SeitenAnalisa Kehadiran Ting 1-5 2022SUHAMI BIN IBRAHIM KPM-GuruNoch keine Bewertungen

- Tabel Rekapan Survey Kepuasan Prosentase PKM Dgly 2018Dokument1 SeiteTabel Rekapan Survey Kepuasan Prosentase PKM Dgly 2018Puskesmas DuminangaNoch keine Bewertungen

- Plymouth Michigan Real Estate Stats - April 2011Dokument4 SeitenPlymouth Michigan Real Estate Stats - April 2011Todd Waller Real EstateNoch keine Bewertungen

- Monetary Policy Committee Meeting Background Data May 2023Dokument38 SeitenMonetary Policy Committee Meeting Background Data May 2023IRENE WARIARANoch keine Bewertungen

- RFT Status - August' 2014: 28th July To 3rd August Eid HolidayDokument2 SeitenRFT Status - August' 2014: 28th July To 3rd August Eid HolidayMahabbat RoniNoch keine Bewertungen

- Dividend Reinvested Record Date % of DividendDokument1 SeiteDividend Reinvested Record Date % of DividendmukeshNoch keine Bewertungen

- Tahun 2017Dokument15 SeitenTahun 2017EVI STEVENSONNoch keine Bewertungen

- UnitPrice EdibleOils MostUsed BiodieselProdDokument7 SeitenUnitPrice EdibleOils MostUsed BiodieselProdomarNoch keine Bewertungen

- Turno DIA Turno Noche: Consumo de ReactivosDokument8 SeitenTurno DIA Turno Noche: Consumo de ReactivosCHARLES DANIEL JACAY LINONoch keine Bewertungen

- 4 Stock RegressionDokument20 Seiten4 Stock RegressionPoorni ShivaramNoch keine Bewertungen

- April 2010 Plymouth MI Housing Stats - Professional One Real EstateDokument4 SeitenApril 2010 Plymouth MI Housing Stats - Professional One Real EstateTodd Waller Real EstateNoch keine Bewertungen

- Lynx Fund Performance SummaryDokument2 SeitenLynx Fund Performance Summarymrobertson3890Noch keine Bewertungen

- Lead Measure: Part Sales Score Board 2018 Periode May - JulyDokument3 SeitenLead Measure: Part Sales Score Board 2018 Periode May - JulyAdi SamsuriNoch keine Bewertungen

- Tipo Cambio RealDokument5 SeitenTipo Cambio RealCamilo Andres Bernal PuentesNoch keine Bewertungen

- Tier IndexDokument1 SeiteTier Indexkettle1Noch keine Bewertungen

- Plymouth Michigan Real Estate Stats - March 2011Dokument4 SeitenPlymouth Michigan Real Estate Stats - March 2011Todd Waller Real EstateNoch keine Bewertungen

- Chaytor Sept15 SPECIALDokument3 SeitenChaytor Sept15 SPECIALeconomicburnNoch keine Bewertungen

- US Financial Market Reform The Economics of The Dodd Frank ActDokument23 SeitenUS Financial Market Reform The Economics of The Dodd Frank ActeconomicburnNoch keine Bewertungen

- Chaytor Aug22Dokument3 SeitenChaytor Aug22economicburnNoch keine Bewertungen

- Rbs em VenezuelaDokument4 SeitenRbs em VenezuelaeconomicburnNoch keine Bewertungen

- NHRS Annuity Amounts Oct 09Dokument454 SeitenNHRS Annuity Amounts Oct 09economicburnNoch keine Bewertungen

- Global Views: The View Ahead: IFO Knock To Bond BullsDokument3 SeitenGlobal Views: The View Ahead: IFO Knock To Bond BullseconomicburnNoch keine Bewertungen

- RBS Global Daily N America 09sep10Dokument4 SeitenRBS Global Daily N America 09sep10economicburnNoch keine Bewertungen

- RBS Sept13th WeeklyDokument12 SeitenRBS Sept13th WeeklyeconomicburnNoch keine Bewertungen

- Bolstering Fed Policy Stimulus With Enhanced CommunicationsDokument4 SeitenBolstering Fed Policy Stimulus With Enhanced CommunicationseconomicburnNoch keine Bewertungen

- 091010Dokument8 Seiten091010economicburnNoch keine Bewertungen

- CLO 10sep10Dokument14 SeitenCLO 10sep10economicburnNoch keine Bewertungen

- Chaytor Aug26Dokument3 SeitenChaytor Aug26economicburnNoch keine Bewertungen

- Trim Tabs Weekly Flow Report 20100908Dokument23 SeitenTrim Tabs Weekly Flow Report 20100908economicburnNoch keine Bewertungen

- Flow of Funds Inst ReturnsDokument7 SeitenFlow of Funds Inst ReturnseconomicburnNoch keine Bewertungen

- Hewlett-Packard Company V Mark V. Hurd - Santa Clara Superior Court - 09-07-2010Dokument51 SeitenHewlett-Packard Company V Mark V. Hurd - Santa Clara Superior Court - 09-07-2010StimulatingBroadband.comNoch keine Bewertungen

- Chaytor Sept8Dokument4 SeitenChaytor Sept8economicburnNoch keine Bewertungen

- Rbs Rates Sept1Dokument3 SeitenRbs Rates Sept1economicburnNoch keine Bewertungen

- Global Views: The View Ahead: Not Enough BufferDokument4 SeitenGlobal Views: The View Ahead: Not Enough BuffereconomicburnNoch keine Bewertungen

- Love and Loathing On Main Street Trimtabs Demand Index Hits New Interim High On August 30Dokument23 SeitenLove and Loathing On Main Street Trimtabs Demand Index Hits New Interim High On August 30economicburnNoch keine Bewertungen

- Global Views: The View Ahead: Double-Dip DecisionsDokument4 SeitenGlobal Views: The View Ahead: Double-Dip DecisionseconomicburnNoch keine Bewertungen

- 8-25-10 CalSTRS Supports SEC Proxy Access RulingDokument2 Seiten8-25-10 CalSTRS Supports SEC Proxy Access RulingeconomicburnNoch keine Bewertungen

- Etfl Industry Review Jul10 UsDokument90 SeitenEtfl Industry Review Jul10 UseconomicburnNoch keine Bewertungen

- Cmbsreport RbsDokument5 SeitenCmbsreport RbseconomicburnNoch keine Bewertungen

- Global Views: The View Ahead: ExhaustedDokument3 SeitenGlobal Views: The View Ahead: ExhaustedeconomicburnNoch keine Bewertungen

- Breakfast With Dave: David A. RosenbergDokument8 SeitenBreakfast With Dave: David A. RosenbergeconomicburnNoch keine Bewertungen

- Global Views: The View Ahead: Real FragilityDokument3 SeitenGlobal Views: The View Ahead: Real FragilityeconomicburnNoch keine Bewertungen

- RBS em 121921Dokument15 SeitenRBS em 121921economicburnNoch keine Bewertungen

- If The U.S. Is Like Japan, It's The Early 2000s, Not The 1990sDokument5 SeitenIf The U.S. Is Like Japan, It's The Early 2000s, Not The 1990seconomicburnNoch keine Bewertungen

- CURRENT DEVELOPMENT OF SLAG VALORISATION IN ChinaDokument13 SeitenCURRENT DEVELOPMENT OF SLAG VALORISATION IN ChinaHung LeNoch keine Bewertungen

- Engineering Graphics and Desing P1 Memo 2021Dokument5 SeitenEngineering Graphics and Desing P1 Memo 2021dubethemba488Noch keine Bewertungen

- Account Statement From 1 Jan 2017 To 30 Jun 2017Dokument2 SeitenAccount Statement From 1 Jan 2017 To 30 Jun 2017Ujjain mpNoch keine Bewertungen

- Pronouns Workshop SENADokument7 SeitenPronouns Workshop SENAPaula Rodríguez PérezNoch keine Bewertungen

- Mooting ExampleDokument35 SeitenMooting Exampleluziro tenNoch keine Bewertungen

- Caregiving Learning Activity Sheet 3Dokument6 SeitenCaregiving Learning Activity Sheet 3Juvy Lyn CondaNoch keine Bewertungen

- L 1 One On A Page PDFDokument128 SeitenL 1 One On A Page PDFNana Kwame Osei AsareNoch keine Bewertungen

- Impact Grammar Book Foundation Unit 1Dokument3 SeitenImpact Grammar Book Foundation Unit 1Domingo Juan de LeónNoch keine Bewertungen

- Trần Phương Mai - Literature - Irony in "Letter to a Funeral Parlor" by Lydia DavisDokument2 SeitenTrần Phương Mai - Literature - Irony in "Letter to a Funeral Parlor" by Lydia DavisTrần Phương MaiNoch keine Bewertungen

- Veritas CloudPoint Administrator's GuideDokument294 SeitenVeritas CloudPoint Administrator's Guidebalamurali_aNoch keine Bewertungen

- Undertaking:-: Prime Membership Application Form (Fill With All Capital Letters)Dokument3 SeitenUndertaking:-: Prime Membership Application Form (Fill With All Capital Letters)Anuj ManglaNoch keine Bewertungen

- Political and Institutional Challenges of ReforminDokument28 SeitenPolitical and Institutional Challenges of ReforminferreiraccarolinaNoch keine Bewertungen

- Cambridge IGCSE Business Studies 4th Edition © Hodder & Stoughton LTD 2013Dokument1 SeiteCambridge IGCSE Business Studies 4th Edition © Hodder & Stoughton LTD 2013RedrioxNoch keine Bewertungen

- BirdLife South Africa Checklist of Birds 2023 ExcelDokument96 SeitenBirdLife South Africa Checklist of Birds 2023 ExcelAkash AnandrajNoch keine Bewertungen

- Sarcini: Caiet de PracticaDokument3 SeitenSarcini: Caiet de PracticaGeorgian CristinaNoch keine Bewertungen

- QTP Common FunctionsDokument55 SeitenQTP Common FunctionsAnkur TiwariNoch keine Bewertungen

- Borer (2013) Advanced Exercise Endocrinology PDFDokument272 SeitenBorer (2013) Advanced Exercise Endocrinology PDFNicolás Bastarrica100% (1)

- Crime Scene Drawing January Incident 10501-10600Dokument100 SeitenCrime Scene Drawing January Incident 10501-10600columbinefamilyrequest100% (2)

- Roman Roads in Southeast Wales Year 3Dokument81 SeitenRoman Roads in Southeast Wales Year 3The Glamorgan-Gwent Archaeological Trust LtdNoch keine Bewertungen

- Group 4 - Regional and Social DialectDokument12 SeitenGroup 4 - Regional and Social DialectazizaNoch keine Bewertungen

- Multi Grade-ReportDokument19 SeitenMulti Grade-Reportjoy pamorNoch keine Bewertungen

- Economies of Scale in European Manufacturing Revisited: July 2001Dokument31 SeitenEconomies of Scale in European Manufacturing Revisited: July 2001vladut_stan_5Noch keine Bewertungen

- Matthew DeCossas SuitDokument31 SeitenMatthew DeCossas SuitJeff NowakNoch keine Bewertungen

- Volvo D16 Engine Family: SpecificationsDokument3 SeitenVolvo D16 Engine Family: SpecificationsJicheng PiaoNoch keine Bewertungen

- Theo Hermans (Cáp. 3)Dokument3 SeitenTheo Hermans (Cáp. 3)cookinglike100% (1)

- BRAC BrochureDokument2 SeitenBRAC BrochureKristin SoukupNoch keine Bewertungen

- ICONS+Character+Creator+2007+v0 73Dokument214 SeitenICONS+Character+Creator+2007+v0 73C.M. LewisNoch keine Bewertungen

- Soal Bahasa Inggris Sastra Semester Genap KLS Xi 2023Dokument3 SeitenSoal Bahasa Inggris Sastra Semester Genap KLS Xi 2023Ika Endah MadyasariNoch keine Bewertungen

- Formal Letter Format Sample To Whom It May ConcernDokument6 SeitenFormal Letter Format Sample To Whom It May Concernoyutlormd100% (1)

- Equivalence ProblemsDokument2 SeitenEquivalence ProblemsRomalyn GalinganNoch keine Bewertungen