Beruflich Dokumente

Kultur Dokumente

Whitehall: Monitoring The Markets Vol. 7 Iss. 44 (November 7, 2017)

Hochgeladen von

Whitehall & CompanyOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Whitehall: Monitoring The Markets Vol. 7 Iss. 44 (November 7, 2017)

Hochgeladen von

Whitehall & CompanyCopyright:

Verfügbare Formate

Volume 7, Issue 44

November 7, 2017

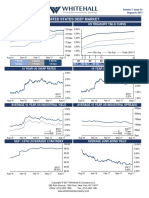

UNITED STATES DEBT MARKET

US LIBOR US TREASURY YIELD CURVE

175 bps 6.00%

150 bps 5.00%

125 bps

4.00%

100 bps

3.00%

75 bps

2.00%

50 bps

25 bps 1.00%

30yr Avg 15yr Avg Today (11/7/17)

0 bps 0.00% I I I I I I

Nov-16 Feb-17 May-17 Aug-17 Nov-17 2 3 5 7 10 30

1 Month 3 Month 6 Month 2yr 3yr 5yr 7yr 10yr 30yr

124 bps 139 bps 159 bps 1.62% 1.74% 1.98% 2.12% 2.32% 2.80%

10 YEAR US SWAP RATES 10 YEAR US TREASURY

3.00% 3.00%

2.50% 2.50%

2.00% 2.00%

1.50% 1.50%

11/7/17 11/7/17

2.29% 2.32%

1.00% 1.00%

Nov-16 Feb-17 May-17 Aug-17 Nov-17 Nov-16 Feb-17 May-17 Aug-17 Nov-17

AVERAGE 10 YEAR US INDUSTRIAL YIELD AVERAGE 10 YEAR US INDUSTRIAL SPREADS

250bps

4.50%

200bps

4.00%

3.50% 150bps

3.00% 100bps

11/7/17 11/7/17 50bps

A 2.50% A 77 bps

3.10%

BBB 3.50% BBB 117 bps

2.00% 0bps

Nov-16 Feb-17 May-17 Aug-17 Nov-17 Nov-16 Feb-17 May-17 Aug-17 Nov-17

S&P / LSTA LEVERAGED LOAN INDEX AVERAGE JUNK-BOND YIELD

100.00 10.00%

98.00 9.00%

96.00 8.00%

94.00 7.00%

92.00 6.00%

11/7/17 90.00 11/7/17 5.00%

98.13% 5.38%

88.00 4.00%

Nov-16 Feb-17 May-17 Aug-17 Nov-17 Nov-16 Feb-17 May-17 Aug-17 Nov-17

Copyright 2017 Whitehall & Company LLC

280 Park Avenue, 15th Floor, New York, NY 10017

Office: (212) 205-1380 Fax: (212) 205-1381

www.whitehallandcompany.com

Volume 7, Issue 44

November 7, 2017

SELECT US PRIVATE PLACEMENTS

Date Issuer Type $mm Years Spread Coupon Rating Sector Country

11/3 sPower Sr Notes $421 20 210bps 4.54% 2 Energy US

11/3 VTTI BV Sr Notes $100 7 160bps 3.80% 2 Energy The

$95 10 170bps 4.05% Netherlands

$65 12 180bps 4.15%

84 7 112bps 1.60%

118 10 118bps 2.05%

US PUBLIC MARKET ISSUANCES

SELECT INVESTMENT GRADE ISSUANCES

Date Issuer Type $mm Years Spread Coupon Rating Sector Country

11/2 Abu Dhabi Crude Oil Pipeline LLC Sr Secured $837 12 122bps 3.65% AA Energy United Arab

$2,200 30 165bps 4.60% Emirates

11/2 NextEa Energy Capital Holding Inc Sr Notes $550 60 243bps 4.80% BBB/Baa2 Utilities US

11/3 Wind Tre SpA Sr Secured $2,000 8 265bps 5.00% BB-/B1 Communications Italy

SELECT BELOW INVESTMENT GRADE ISSUANCES

Date Issuer Type $mm Years Spread Coupon Rating Sector Country

10/31 Global Ship Lease Inc 1st Lien $360 5 813bps 9.88% B/B3 Industrial UK

11/2 Warrior Met Coal Inc Sr Secured $350 7 570bps 8.00% B-/B3 Energy US

SELECT CLOSED SYNDICATED LOANS

Date Issuer Type $mm Months Spread Rating Sector Country

10/31 BCP Renaissance Parent LLC Term $1,250 84 400bps B+/B1 Energy US

11/2 MCC Iowa LLC Term $250 60 - BBB-/Ba2 Communications US

Term $800 86 200bps

10/31 Medallion Midland Acquistion LLC Rev $25 59 - BB-/B2 Energy US

Term $700 84 325bps

CONTACT WHITEHALL

Jon Cody Timothy Page Richard Ashby Todd Brussel Brian Burchfield Matt Cody Roland DaCosta Sim Ketchum Bob Salandra

Managing Director Managing Director Managing Director Managing Director Managing Director Managing Director Managing Director Managing Director Managing Director

(212) 205-1398 (212) 205-1399 (212) 205-1388 (212) 205-1397 (212) 205-1395 (212) 205-1398 (212) 205-1394 (212) 335-2562 (212) 335-2561

Vincas Snipas Van Thorne Geoffrey Wilson Mark Halpin Nadia Zaets Blaine Burke Nicholas Page Sang Joon Lee Aaron Richardson

Managing Director Managing Director Managing Director Director Director Vice President Vice President Associate Associate

(212) 205-1385 (212) 205-1386 (212) 205-1392 (212) 205-1393 (212) 335-2557 (212) 205-1382 (212) 205-1389 (212) 205-1391 (212) 205-1387

Ted Barrett Vitaliy Koretskyy Billy Kovanis Keir Wianecki

Analyst Analyst Analyst Analyst

(212) 205-1396 (212) 335-2551 (212) 335-2550 (212) 335-2552

Source: Bloomberg

This market letter is not to be construed as a recommendation to buy, hold or sell any particular security.

Copyright 2017 Whitehall & Company LLC

280 Park Avenue, 15th Floor, New York, NY 10017

Office: (212) 205-1380 Fax: (212) 205-1381

www.whitehallandcompany.com

Das könnte Ihnen auch gefallen

- Whitehall: Monitoring The Markets Vol. 7 Iss. 45 (November 14, 2017)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 7 Iss. 45 (November 14, 2017)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 7 Iss. 46 (November 21, 2017)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 7 Iss. 46 (November 21, 2017)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 7 Iss. 48 (December 5, 2017)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 7 Iss. 48 (December 5, 2017)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 7 Iss. 50 (December 19, 2017)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 7 Iss. 50 (December 19, 2017)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 7 Iss. 41 (October 17, 2017)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 7 Iss. 41 (October 17, 2017)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 7 Iss. 43 (October 31, 2017)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 7 Iss. 43 (October 31, 2017)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 7 Iss. 25 (June 27, 2017)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 7 Iss. 25 (June 27, 2017)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 7 Iss. 39 (October 3, 2017)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 7 Iss. 39 (October 3, 2017)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 7 Iss. 42 (October 24, 2017)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 7 Iss. 42 (October 24, 2017)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 7 Iss. 7 (February 13, 2017)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 7 Iss. 7 (February 13, 2017)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 7 Iss. 10 (March 7, 2017)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 7 Iss. 10 (March 7, 2017)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 7 Iss. 31 (August 09, 2017)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 7 Iss. 31 (August 09, 2017)Whitehall & CompanyNoch keine Bewertungen

- United States Debt Market: Us Libor Us Treasury Yield CurveDokument2 SeitenUnited States Debt Market: Us Libor Us Treasury Yield CurveWhitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 7 Iss. 21 (May 23, 2017)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 7 Iss. 21 (May 23, 2017)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 7 Iss. 24 (June 19, 2017)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 7 Iss. 24 (June 19, 2017)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 7 Iss. 11 (March 13, 2017)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 7 Iss. 11 (March 13, 2017)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 7 Iss. 23 (June 12, 2017)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 7 Iss. 23 (June 12, 2017)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 7 Iss. 36 (September 12, 2017)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 7 Iss. 36 (September 12, 2017)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 7 Iss. 8 (February 21, 2017)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 7 Iss. 8 (February 21, 2017)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 7 Iss. 38 (September 26, 2017)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 7 Iss. 38 (September 26, 2017)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 8 Iss. 12 (March 21, 2018)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 8 Iss. 12 (March 21, 2018)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 8 Iss. 13 (March 27, 2018)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 8 Iss. 13 (March 27, 2018)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 8 Iss. 25 (June 19, 2018)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 8 Iss. 25 (June 19, 2018)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 8 Iss. 27 (July 3, 2018)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 8 Iss. 27 (July 3, 2018)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 8 Iss. 10 (March 6, 2018)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 8 Iss. 10 (March 6, 2018)Whitehall & CompanyNoch keine Bewertungen

- WhitehallDokument2 SeitenWhitehallWhitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 8 Iss. 5 (January 30, 2018)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 8 Iss. 5 (January 30, 2018)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 8 Iss. 38 (September 25, 2018)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 8 Iss. 38 (September 25, 2018)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 8 Iss. 32 (August 7, 2018)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 8 Iss. 32 (August 7, 2018)Whitehall & CompanyNoch keine Bewertungen

- Structure of Interest Rates - I: Service Charges/Mark Up Rates of Refinance Facility For SmesDokument4 SeitenStructure of Interest Rates - I: Service Charges/Mark Up Rates of Refinance Facility For Smessherman ullahNoch keine Bewertungen

- Grafik PKPDokument10 SeitenGrafik PKPNIA KURNIASIHNoch keine Bewertungen

- TO% Category Format Division TO% TO% Slabs TO% Slabs TO%: Trade Offers - Secondary Towns (1st Jan Till 31st Jan)Dokument1 SeiteTO% Category Format Division TO% TO% Slabs TO% Slabs TO%: Trade Offers - Secondary Towns (1st Jan Till 31st Jan)Malik Raheel AhmadNoch keine Bewertungen

- 1ntercept: Denver Broncos (1-0)Dokument1 Seite1ntercept: Denver Broncos (1-0)api-369514202Noch keine Bewertungen

- LeadershipDokument5 SeitenLeadershipkaku009Noch keine Bewertungen

- 1ntercept: Atlanta Falcons (1-0)Dokument1 Seite1ntercept: Atlanta Falcons (1-0)api-369514202Noch keine Bewertungen

- S-Curve Talang Jimar Rev-8 (New)Dokument1 SeiteS-Curve Talang Jimar Rev-8 (New)wahyu hidayatNoch keine Bewertungen

- MITOTIC STAGE-WPS OfficeDokument5 SeitenMITOTIC STAGE-WPS OfficeJomari Cruz LlanitaNoch keine Bewertungen

- Sti170622 - Lapangan Bola Sintetik + Infill - Independent SchoolDokument5 SeitenSti170622 - Lapangan Bola Sintetik + Infill - Independent SchoolEka Sari WahyuniNoch keine Bewertungen

- 1ntercept: Cincinnati Bengals (0-1)Dokument1 Seite1ntercept: Cincinnati Bengals (0-1)api-369514202Noch keine Bewertungen

- 1ntercept: New York Giants (0-1)Dokument1 Seite1ntercept: New York Giants (0-1)api-369514202Noch keine Bewertungen

- 1.04 Whitehall: Monitoring The Markets Vol. 01 Iss. 04 (Feb. 22, 2011)Dokument2 Seiten1.04 Whitehall: Monitoring The Markets Vol. 01 Iss. 04 (Feb. 22, 2011)Whitehall & CompanyNoch keine Bewertungen

- 1ntercept: Pittsburgh Steelers (1-0)Dokument1 Seite1ntercept: Pittsburgh Steelers (1-0)api-369514202Noch keine Bewertungen

- 1.17 Whitehall: Monitoring The Markets Vol. 1 Iss. 17 (May 24, 2011)Dokument2 Seiten1.17 Whitehall: Monitoring The Markets Vol. 1 Iss. 17 (May 24, 2011)Whitehall & CompanyNoch keine Bewertungen

- 1ntercept: Baltimore Ravens (1-0)Dokument1 Seite1ntercept: Baltimore Ravens (1-0)api-369514202Noch keine Bewertungen

- 1ntercept: Tampa Bay Buccaneers (0-0)Dokument1 Seite1ntercept: Tampa Bay Buccaneers (0-0)api-369514202Noch keine Bewertungen

- Denah Ruang Operasi: SelasarDokument1 SeiteDenah Ruang Operasi: SelasarAldry Buvi Yvc-v'zeroFortysixNoch keine Bewertungen

- Downtime Dies Maintenance: 0.6% Ratio Target Ratio (MAX)Dokument6 SeitenDowntime Dies Maintenance: 0.6% Ratio Target Ratio (MAX)Ilham AkbariNoch keine Bewertungen

- Official Score Report: Overall Assessment: B1 4.9Dokument4 SeitenOfficial Score Report: Overall Assessment: B1 4.9Juan David Cardozo FajardoNoch keine Bewertungen

- Addis School Proposed Soccer Field-SnDokument1 SeiteAddis School Proposed Soccer Field-SnmohammednasruNoch keine Bewertungen

- 1ntercept: Washington Redskins (0-1)Dokument1 Seite1ntercept: Washington Redskins (0-1)api-369514202Noch keine Bewertungen

- Learning Isotopes and Relative Atomic MassDokument1 SeiteLearning Isotopes and Relative Atomic MassVanessa PassarelloNoch keine Bewertungen

- Official Score Report: Overall Assessment: B2 3.9Dokument3 SeitenOfficial Score Report: Overall Assessment: B2 3.9nanaNoch keine Bewertungen

- 1ntercept: Jacksonville Jaguars (1-0)Dokument1 Seite1ntercept: Jacksonville Jaguars (1-0)api-369514202Noch keine Bewertungen

- Official Score Report: Overall Assessment: B2 5.3Dokument4 SeitenOfficial Score Report: Overall Assessment: B2 5.3zullyNoch keine Bewertungen

- 1ntercept: Minnesota Vikings (1-0)Dokument1 Seite1ntercept: Minnesota Vikings (1-0)api-369514202Noch keine Bewertungen

- Leger X TKJ A SMT 1Dokument9 SeitenLeger X TKJ A SMT 1bahrumjajiNoch keine Bewertungen

- 1ntercept: Oakland Raiders (1-0)Dokument1 Seite1ntercept: Oakland Raiders (1-0)api-369514202Noch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 7 Iss. 29 (July 25, 2017)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 7 Iss. 29 (July 25, 2017)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 8 Iss. 38 (September 25, 2018)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 8 Iss. 38 (September 25, 2018)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 8 Iss. 34 (August 21, 2018)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 8 Iss. 34 (August 21, 2018)Whitehall & CompanyNoch keine Bewertungen

- WhitehallDokument2 SeitenWhitehallWhitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 8 Iss. 32 (August 7, 2018)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 8 Iss. 32 (August 7, 2018)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 8 Iss. 36 (September 5, 2018)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 8 Iss. 36 (September 5, 2018)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 7 Iss. 22 (June 5, 2017)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 7 Iss. 22 (June 5, 2017)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 8 Iss. 28 (July 10, 2018)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 8 Iss. 28 (July 10, 2018)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 8 Iss. 24 (June 12, 2018)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 8 Iss. 24 (June 12, 2018)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 8 Iss. 25 (June 19, 2018)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 8 Iss. 25 (June 19, 2018)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 8 Iss. 10 (March 6, 2018)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 8 Iss. 10 (March 6, 2018)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 8 Iss. 27 (July 3, 2018)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 8 Iss. 27 (July 3, 2018)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 8 Iss. 23 (June 5, 2018)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 8 Iss. 23 (June 5, 2018)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 7 Iss. 18Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 7 Iss. 18Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 8 Iss. 16 (April 17, 2018)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 8 Iss. 16 (April 17, 2018)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 8 Iss. 18 (May 1, 2018)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 8 Iss. 18 (May 1, 2018)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 8 Iss. 13 (March 27, 2018)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 8 Iss. 13 (March 27, 2018)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 8 Iss. 12 (March 21, 2018)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 8 Iss. 12 (March 21, 2018)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 8 Iss. 11 (March 13, 2018)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 8 Iss. 11 (March 13, 2018)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 7 Iss. 18Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 7 Iss. 18Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 8 Iss. 15 (April 10, 2018)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 8 Iss. 15 (April 10, 2018)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 8 Iss. 8 (February 21, 2018)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 8 Iss. 8 (February 21, 2018)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 8 Iss. 9 (February 27, 2018)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 8 Iss. 9 (February 27, 2018)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 8 Iss. 5 (January 30, 2018)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 8 Iss. 5 (January 30, 2018)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 8 Iss. 7 (February 13, 2018)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 8 Iss. 7 (February 13, 2018)Whitehall & CompanyNoch keine Bewertungen

- Whitehall: Monitoring The Markets Vol. 7 Iss. 6 (February 6, 2017)Dokument2 SeitenWhitehall: Monitoring The Markets Vol. 7 Iss. 6 (February 6, 2017)Whitehall & CompanyNoch keine Bewertungen

- Invty EstimationDokument6 SeitenInvty EstimationdmiahalNoch keine Bewertungen

- 2CEXAM Mock Question Mandatory Provident Fund Schemes ExaminationDokument35 Seiten2CEXAM Mock Question Mandatory Provident Fund Schemes ExaminationTsz Ngong KoNoch keine Bewertungen

- Taizya RevisionDokument2 SeitenTaizya Revisiongostavis chilamoNoch keine Bewertungen

- PT Nagai Plastic Indonesia Feb 2015 - 06072015 Draft6jul15Dokument41 SeitenPT Nagai Plastic Indonesia Feb 2015 - 06072015 Draft6jul15nogoenogoe yahoo.co.idNoch keine Bewertungen

- Peachtree Training ManualDokument17 SeitenPeachtree Training ManualMa Nepali92% (13)

- ILAM FAHARI I REIT - Audited Finacncials 2020Dokument1 SeiteILAM FAHARI I REIT - Audited Finacncials 2020An AntonyNoch keine Bewertungen

- Goa University International Economics Sem V SyllabusDokument3 SeitenGoa University International Economics Sem V SyllabusMyron VazNoch keine Bewertungen

- Pamantasan NG Cabuyao: Katapatan Subd., Banay Banay, City of CabuyaoDokument5 SeitenPamantasan NG Cabuyao: Katapatan Subd., Banay Banay, City of CabuyaoLyca SorianoNoch keine Bewertungen

- Time Value of MoneyDokument22 SeitenTime Value of Moneyshubham abrolNoch keine Bewertungen

- UntitledDokument267 SeitenUntitledGaurav KothariNoch keine Bewertungen

- Chapter 02Dokument11 SeitenChapter 02Saad mubeenNoch keine Bewertungen

- Part 5555Dokument2 SeitenPart 5555RhoizNoch keine Bewertungen

- LESSON PLAN 7 - Saving and InvestingDokument19 SeitenLESSON PLAN 7 - Saving and InvestingNikita MundadaNoch keine Bewertungen

- BPI-OTC Payment of Fee - 1 PDFDokument2 SeitenBPI-OTC Payment of Fee - 1 PDFPhilip Ebersole100% (1)

- New FORM 15H Applicable PY 2016-17Dokument2 SeitenNew FORM 15H Applicable PY 2016-17addsingh100% (1)

- Ministry of Revenues: Tax Audit ManualDokument304 SeitenMinistry of Revenues: Tax Audit ManualYoNoch keine Bewertungen

- Lesson 1 ExtendDokument6 SeitenLesson 1 ExtendRoel Cababao50% (2)

- LJK UkkDokument55 SeitenLJK UkkSaepul RohmanNoch keine Bewertungen

- Functions of Treasury MGTDokument5 SeitenFunctions of Treasury MGTk-911Noch keine Bewertungen

- Clause 49 of Listing AgreementDokument18 SeitenClause 49 of Listing AgreementJatin AhujaNoch keine Bewertungen

- Chapter 7Dokument6 SeitenChapter 7Pranshu GuptaNoch keine Bewertungen

- Errata Group Statements Vol 2 17th Ed Reprint 2021Dokument10 SeitenErrata Group Statements Vol 2 17th Ed Reprint 2021THABO CLARENCE MohleleNoch keine Bewertungen

- Junior Accountant RoleDokument1 SeiteJunior Accountant RoleRICARDO PROMOTIONNoch keine Bewertungen

- 122 1004Dokument32 Seiten122 1004api-275486640% (1)

- Bansi Khakhkhar PDFDokument74 SeitenBansi Khakhkhar PDFVishu MakwanaNoch keine Bewertungen

- Solved Ballou Corporation Distributes 200 000 in Cash To Its Sharehold PDFDokument1 SeiteSolved Ballou Corporation Distributes 200 000 in Cash To Its Sharehold PDFAnbu jaromiaNoch keine Bewertungen

- DrewDokument2 SeitenDrewmusunna galibNoch keine Bewertungen

- Statement of AccountDokument7 SeitenStatement of AccountHamza CollectionNoch keine Bewertungen

- Mutual Funds - IntroductionDokument9 SeitenMutual Funds - IntroductionMd Zainuddin IbrahimNoch keine Bewertungen

- WFP Cash and Vouchers ManualDokument92 SeitenWFP Cash and Vouchers ManualSoroush AsifNoch keine Bewertungen