Beruflich Dokumente

Kultur Dokumente

Equity Report 6 To 10 Nov

Hochgeladen von

zoidresearchOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Equity Report 6 To 10 Nov

Hochgeladen von

zoidresearchCopyright:

Verfügbare Formate

EQUITY TECHNICAL REPORT

WEEKLY

[ 06 NOV to 10 NOV 2017]

ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

06 NOV to 10 NOV 2017

NIFTY 50 10452.50 (129.00) (1.24%)

The benchmark Index Nifty logged gains on first

trading day of the week. After trading in a narrow

range throughout the day, the market has closed

on a bullish note. The week has begun on a

positive note, with the Nifty closing above the

10350 - mark. On Tuesday, Nifty50 started flat

continued led by the mixed sentiments over the

corporate earnings. Indices ended the session on a

quiet note, with the Nifty ended an almost quarter

of a percent lower. World Bank has ranked India

100 for 2018 from 130 in 2017, a huge leap of 30

places with ease of doing business compared to

other 190 Nations (Brazil-125, Russia-35, China-

78, South Africa-82). Moreover, Investor Protection

given a rank of 13 in 2017 and 4 in 2018, Getting

Credit-44 in 2017, 29 in 2018, Paying Taxes-172

in 2017 and 119 in 2018, Resolving Insolvency-

136 in 2017 and 103 in 2018. On Wednesday, The

Nifty50 scaled record high and made a strong

bullish candle on the daily chart. The Nifty 50

notched up decent gains to end the day with net

gains of 105.20 points, or 1.02 per cent On

Thursday, The Nifty50 in a narrow range before

ending the day with a minor loss of 16.70 points,

or 0.16 percent and closed at 10424. On Friday,

The benchmark Index Nifty after crossing the

10,450 level for the first time ever, The bulls are

not going to let go of the momentum easily. The

Nifty index recovered from an Intraday low of

10,403 and closed at 10,452 marks. The

benchmark Index Nifty50 (spot) opened the week at

10353.85 made a high of 10461.70 low of

10323.95 and closed the week at 10452.50.Thus

the Nifty closed the week with a gained of 129

points or 1.24%. Future Outlook:

The Nifty daily chart is consolidate trend; The Nifty

Formations has created A Hanging Man pattern is a bearish

reversal candlestick pattern that gets formed at the

The 20 days EMA are placed at end of an uptrend. It is formed when the index

witnesses significant downside in early trade, but the

10246.90 bulls manage to push it back to the opening level. we

advised to if Nifty future trade above 10500 than

The 5 days EMA are placed at

target will be around 10600. or if nifty future trade

10404.50 below at 10425 than target will be around 10325 Nifty

upside weekly Resistance is 10586-10536. level. On

the downside strong support at 10394-10300.

www.zoidresearch.com ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

06 NOV to 10 NOV 2017

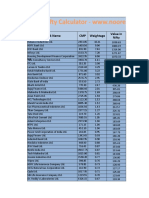

Weekly Pivot Levels for Nifty 50 Stocks

Script Symbol Resistance2 Resistance1 Pivot Support 1 Support 2

NIFTY 50 (SPOT) 10550 10501 10413 10364 10275

AUTOMOBILE

BAJAJ-AUTO 3363.68 3290.57 3250.78 3177.67 3137.88

BOSCHLTD 21649.77 21348.83 21128.97 20828.03 20608.17

EICHERMOT 33618.50 32426.80 31574.90 30383.20 29531.30

HEROMOTOCO 3956.68 3822.87 3749.08 3615.27 3541.48

M&M 1420.38 1375.57 1347.83 1303.02 1275.28

MARUTI 8338.47 8278.93 8219.47 8159.93 8100.47

TATAMTRDVR 254.13 250.52 244.38 240.77 234.63

TATAMOTORS 463.50 455.60 441.45 433.55 419.40

CEMENT & CEMENT PRODUCTS

ACC 1858.30 1831.75 1810.45 1783.90 1762.60

AMBUJACEM 293.60 288.10 283.30 277.80 273.00

ULTRACEMCO 4537.03 4456.07 4405.03 4324.07 4273.03

CONSTRUCTION

LT 1272.03 1253.52 1228.63 1210.12 1185.23

CONSUMER GOODS

ASIANPAINT 1202.85 1187.65 1183.60 1168.40 1164.35

HINDUNILVR 1285.77 1262.63 1246.32 1223.18 1206.87

ITC 274.43 269.92 266.68 262.17 258.93

ENERGY

BPCL 563.37 548.23 536.42 521.28 509.47

GAIL 485.72 474.78 468.42 457.48 451.12

IOC 427.48 420.37 415.73 408.62 403.98

NTPC 187.32 184.63 181.82 179.13 176.32

ONGC 198.48 195.17 189.88 186.57 181.28

POWERGRID 224.92 217.48 213.07 205.63 201.22

RELIANCE 971.77 958.53 944.57 931.33 917.37

TATAPOWER 90.37 87.43 85.57 82.63 80.77

FINANCIAL SERVICES

AXISBANK 586.57 563.33 522.47 499.23 458.37

BANKBARODA 192.05 181.90 174.55 164.40 157.05

HDFCBANK 1868.63 1849.67 1821.03 1802.07 1773.43

HDFC 1855.37 1815.83 1750.47 1710.93 1645.57

ICICIBANK 335.67 325.78 310.52 300.63 285.37

IBULHSGFIN 1287.98 1253.52 1234.68 1200.22 1181.38

INDUSINDBK 1718.30 1696.40 1657.25 1635.35 1596.20

KOTAKBANK 1048.73 1032.12 1020.38 1003.77 992.03

www.zoidresearch.com ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

06 NOV to 10 NOV 2017

SBIN 342.13 333.57 318.93 310.37 295.73

YESBANK 340.58 333.27 320.68 313.37 300.78

IT

HCLTECH 878.98 863.07 847.53 831.62 816.08

INFY 970.45 948.55 932.75 910.85 895.05

TCS 2719.47 2669.78 2624.32 2574.63 2529.17

TECHM 511.22 487.33 474.12 450.23 437.02

WIPRO 299.02 296.78 294.42 292.18 289.82

MEDIA & ENTERTAINMENT

ZEEL 563.72 551.33 538.37 525.98 513.02

METALS

COALINDIA 297.62 292.08 286.82 281.28 276.02

HINDALCO 283.27 276.08 270.42 263.23 257.57

TATASTEEL 751.50 730.20 713.70 692.40 675.90

VEDL 354.43 346.27 338.23 330.07 322.03

PHARMA

AUROPHARMA 825.98 806.97 780.98 761.97 735.98

CIPLA 667.87 653.98 634.27 620.38 600.67

DRREDDY 2579.70 2499.40 2423.70 2343.40 2267.70

LUPIN 1140.90 1094.30 1043.40 996.80 945.90

SUNPHARMA 584.08 567.67 555.88 539.47 527.68

SERVICES

ADANIPORTS 448.95 441.90 433.75 426.70 418.55

TELECOM

BHARTIARTL 609.45 575.35 530.70 496.60 451.95

INFRATEL 465.88 439.82 425.93 399.87 385.98

Weekly Top gainers stocks

Script Symbol Previous Close Current Price % Change In Points

BHARTIARTL 485.30 541.25 11.53% 55.95

AXISBANK 485.95 540.10 11.14% 54.15

YESBANK 307.05 325.95 6.16% 18.90

ICICIBANK 301.15 315.90 4.90% 14.75

LUPIN 1001.10 1047.70 4.65% 46.60

Weekly Top losers stocks

Script Symbol Previous Close Current Price % Change In Points

UPL 831.30 775.60 -6.70% -55.70

M&M 1387.70 1330.75 -4.10% -56.95

IBULHSGFIN 1264.30 1219.05 -3.58% -45.25

TECHM 476.40 463.45 -2.72% -12.95

HEROMOTOCO 3786.65 3689.05 -2.58% -97.60

www.zoidresearch.com ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

06 NOV to 10 NOV 2017

Weekly FIIS Statistics*

DATE Buy Value Sell Value Net Value

03/NOV/2017 4660.27 14351.11 -9690.84

02/NOV/2017 5441.78 4408.90 1032.88

01/NOV/2017 6131.83 5093.52 1038.31

31/OCT/2017 5991.94 6523.76 -531.82

30/OCT/2017 4946.40 5132.44 -186.04

Weekly DIIS Statistics*

DATE Buy Value Sell Value Net Value

03/NOV/2017 3877.08 3843.68 33.40

02/NOV/2017 4042.38 4498.89 -456.51

01/NOV/2017 4519.98 5187.89 -667.91

31/OCT/2017 3905.61 3308.69 596.92

30/OCT/2017 3773.89 3634.21 139.68

MOST ACTIVE NIFTY CALLS & PUTS:

EXPIRY DATE TYPE STRIKE PRICE VOLUME OPEN INTEREST

30/NOV/2017 CE 10500 132082 3056175

30/NOV/2017 CE 10600 86199 2543250

30/NOV/2017 CE 10700 59469 2570100

30/NOV/2017 PE 10400 117526 3438375

30/NOV/2017 PE 10300 81639 4674750

30/NOV/2017 PE 10200 71358 5257425

MOST ACTIVE BANK NIFTY CALLS & PUTS:

EXPIRY DATE TYPE STRIKE PRICE VOLUME OPEN INTEREST

09/NOV/2017 CE 25700 145565 309200

09/NOV/2017 CE 26000 128680 606280

09/NOV/2017 CE 25800 119862 322800

09/NOV/2017 PE 25500 94371 460400

09/NOV/2017 PE 25300 89525 256800

09/NOV/2017 PE 25400 86756 323000

www.zoidresearch.com ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

06 NOV to 10 NOV 2017

Weekly Recommendations:-

DATE SYMBOL STRATEGY ENTRY TARGET STATUS

3 NOV 17 PNB BUY ABOVE 208 216 OPEN

ALL TGT

14 OCT 17 MRPL BUY AROUND 130 135-141

ACHIEVED

7 OCT 17 CESC BUY AROUND 1044 1088-1124 OPEN

1ST TGT

30 SEP 17 BALRAMCHIN BUY ABOVE 161 167.5-175

ACHIEVED

23 SEP 17 DIVISLAB BUY AROUND 970 1010 EXIT AT 930

TARGET

16 SEP 17 IBULHSGFIN BUY ABOVE 1276 1327

ACHIEVED

9 SEP 17 BHARTIARTL BUY ABOVE 405 420-438 OPEN

ALL TGT

2 SEP 17 GAIL BUY ON DEEPS 384 399-415

ACHIEVED

1ST TGT

26 AUG 17 APOLLOTYRE SELL ON RISE 257-259 247-235

ACHIEVED

19 AUG 17 ASHOKLEY SELL BELOW 103.5 99-95 BOOK AT 100

12 AUG 17 ENGINERSIN SELL AROUND 150-149.5 144-137 EXIT AT 157

ALL TGT

5 AUG 17 TATAMTRDVR SELL AROUND 255 245-232

ACHIEVED

ALL TGT

22 JUL 17 KTKBANK SELL BELOW 157 151-144

ACHIEVED

ALL TGT

15 JUL 17 GODREJIND SELL BELOW 660 633-605

ACHIEVED

1ST TGT

8 JUL 17 DELTACORP BUY AROUND 167 175-185

ACHIEVED

* FII & DII trading activity on NSE, BSE, and MCXSX in Capital Market Segment (in Rs. Crores)

DISCLAIMER

Stock trading involves high risk and one can lose Substantial amount of money. The recommendations made herein do

not constitute an offer to sell or solicitation to buy any of the Securities mentioned. No representations can be made

that recommendations contained herein will be profitable or they will not result in losses. Readers using the

information contained herein are solely responsible for their actions. The information is obtained from sources deemed

to be reliable but is not guaranteed as to accuracy and completeness. The above recommendations are based on

technical analysis only. NOTE WE HAVE NO HOLDINGS IN ANY OF STOCKS RECOMMENDED ABOVE

Zoid Research

202, Mangal City Mall,

PU-4 Plot No.A-1,Sch No. 54

Vijay Nagar Circle, AB Road, Indore

Pin : 452001

Mobile: +91 9039073611

Email: info@zoidresearch.com

Website: www.zoidresearch.com

www.zoidresearch.com ZOID RESEARCH TEAM

Das könnte Ihnen auch gefallen

- Equity Report 16 - 20 OctDokument6 SeitenEquity Report 16 - 20 OctzoidresearchNoch keine Bewertungen

- Equity Report 19 June To 23 JuneDokument6 SeitenEquity Report 19 June To 23 JunezoidresearchNoch keine Bewertungen

- Equity Report 10 July To 14 JulyDokument6 SeitenEquity Report 10 July To 14 JulyzoidresearchNoch keine Bewertungen

- Equity Report 21 Aug To 25 AugDokument6 SeitenEquity Report 21 Aug To 25 AugzoidresearchNoch keine Bewertungen

- Equity Weekly ReportDokument6 SeitenEquity Weekly ReportzoidresearchNoch keine Bewertungen

- Equity Outlook 13 Feb To 17 FebDokument6 SeitenEquity Outlook 13 Feb To 17 FebzoidresearchNoch keine Bewertungen

- Equity Report 26 June To 30 JuneDokument6 SeitenEquity Report 26 June To 30 JunezoidresearchNoch keine Bewertungen

- Equity Technical Weekly ReportDokument6 SeitenEquity Technical Weekly ReportzoidresearchNoch keine Bewertungen

- Equity Weekly Report 8 May To 12 MayDokument6 SeitenEquity Weekly Report 8 May To 12 MayzoidresearchNoch keine Bewertungen

- Equity Report 15 May To 19 MayDokument6 SeitenEquity Report 15 May To 19 MayzoidresearchNoch keine Bewertungen

- Equity Report 22 May To 26 MayDokument6 SeitenEquity Report 22 May To 26 MayzoidresearchNoch keine Bewertungen

- Index Movement:: National Stock Exchange of India LimitedDokument37 SeitenIndex Movement:: National Stock Exchange of India LimitedJayant SharmaNoch keine Bewertungen

- Index Movement:: National Stock Exchange of India LimitedDokument36 SeitenIndex Movement:: National Stock Exchange of India LimitedTrinadh Kumar GuthulaNoch keine Bewertungen

- Index Movement:: National Stock Exchange of India LimitedDokument36 SeitenIndex Movement:: National Stock Exchange of India Limitedanilkhubchandani9744Noch keine Bewertungen

- Weekly 12082017Dokument5 SeitenWeekly 12082017Thiyaga RajanNoch keine Bewertungen

- Skrip Name Tran Quantity: Client Id: N147669 Client Name: Shourya Mohan Asset Class: EquityDokument12 SeitenSkrip Name Tran Quantity: Client Id: N147669 Client Name: Shourya Mohan Asset Class: EquityDeepanjaliNoch keine Bewertungen

- Index Movement:: National Stock Exchange of India LimitedDokument27 SeitenIndex Movement:: National Stock Exchange of India LimitedjanuianNoch keine Bewertungen

- NIFTYCALCULATOROctober2018www - Nooreshtech.co .InDokument13 SeitenNIFTYCALCULATOROctober2018www - Nooreshtech.co .InbrijsingNoch keine Bewertungen

- Technical Morning - Call - 120922 PDFDokument5 SeitenTechnical Morning - Call - 120922 PDFSomeone 4780Noch keine Bewertungen

- Tech Report 05.01Dokument3 SeitenTech Report 05.01Swayam MangwaniNoch keine Bewertungen

- Gain 24 MayDokument5 SeitenGain 24 MayPallavi M SNoch keine Bewertungen

- Tech Report 24 (1) .02.2011Dokument3 SeitenTech Report 24 (1) .02.2011Arijit TagoreNoch keine Bewertungen

- Daily Market Update OF 25 APRIL 2023-202304251728143358428Dokument4 SeitenDaily Market Update OF 25 APRIL 2023-202304251728143358428Pratik ShingareNoch keine Bewertungen

- Term PaperDokument9 SeitenTerm Paperkavya surapureddy100% (1)

- Weekly Newsletter Equity 30-SEPT-2017Dokument7 SeitenWeekly Newsletter Equity 30-SEPT-2017Market Magnify Investment Adviser & ResearchNoch keine Bewertungen

- Nifty Calculator Jan 2023Dokument19 SeitenNifty Calculator Jan 2023Shovan GhoshNoch keine Bewertungen

- Tech Report 08.12Dokument3 SeitenTech Report 08.12bnr534Noch keine Bewertungen

- February 16-17, 2011 - UpdateDokument2 SeitenFebruary 16-17, 2011 - UpdateJC CalaycayNoch keine Bewertungen

- Daily-Equity 17 Sep 2010Dokument3 SeitenDaily-Equity 17 Sep 2010Vikram JunejaNoch keine Bewertungen

- Project FRA Milestone1 JPY Nikita Chaturvedi 05.05.2022 Jupyter Notebook PDFDokument102 SeitenProject FRA Milestone1 JPY Nikita Chaturvedi 05.05.2022 Jupyter Notebook PDFRekha Rajaram74% (19)

- Watch Out CapitalHeight Weekly Performance Report From 23 To 27 July.Dokument11 SeitenWatch Out CapitalHeight Weekly Performance Report From 23 To 27 July.Damini CapitalNoch keine Bewertungen

- Daily Market Update 3 January 2023 File-202301031742097186877 PDFDokument5 SeitenDaily Market Update 3 January 2023 File-202301031742097186877 PDFChandan BaggaNoch keine Bewertungen

- Investment Self RealisationDokument18 SeitenInvestment Self Realisationankur_haldarNoch keine Bewertungen

- June 14Dokument5 SeitenJune 14Pallavi M SNoch keine Bewertungen

- Daily Market Update On 20 July 2023Dokument5 SeitenDaily Market Update On 20 July 2023Simon PeterNoch keine Bewertungen

- Nifty-50 24-01-18Dokument4 SeitenNifty-50 24-01-18AnshulNoch keine Bewertungen

- ICICIdirect ExpectedHighDividendYieldStocksDokument2 SeitenICICIdirect ExpectedHighDividendYieldStocksRamesh RajagopalanNoch keine Bewertungen

- Open High Low LTP CHNG TradeDokument33 SeitenOpen High Low LTP CHNG TradeAnand ChineyNoch keine Bewertungen

- Derivative Report 02 May UpdateDokument6 SeitenDerivative Report 02 May UpdateDEEPAK MISHRANoch keine Bewertungen

- Daily Market Update On 06 Feb 2024-202402061719034163128Dokument5 SeitenDaily Market Update On 06 Feb 2024-202402061719034163128mohil kansariyaNoch keine Bewertungen

- Stocks Monitoring - Blue Chips: SN Company Code Date 26-Jun-18 2-Dec-18 4-Dec-18 19-Jun-19 25-Mar-20Dokument3 SeitenStocks Monitoring - Blue Chips: SN Company Code Date 26-Jun-18 2-Dec-18 4-Dec-18 19-Jun-19 25-Mar-20Marcus AmabaNoch keine Bewertungen

- June 2Dokument5 SeitenJune 2Pallavi M SNoch keine Bewertungen

- Technical Morning - Call - 200921Dokument5 SeitenTechnical Morning - Call - 200921Equity NestNoch keine Bewertungen

- Weekly Special Report of CapitalHeight 23 July 2018Dokument11 SeitenWeekly Special Report of CapitalHeight 23 July 2018Damini CapitalNoch keine Bewertungen

- Avi CapitalDokument18 SeitenAvi CapitalBharatNoch keine Bewertungen

- StockTracker Rev2 OrigDokument149 SeitenStockTracker Rev2 OrigPuneet100% (2)

- Stock Symbol 4/24 Price Current Spread 52 Week Low 52 Week High 52 Week SpreadDokument3 SeitenStock Symbol 4/24 Price Current Spread 52 Week Low 52 Week High 52 Week SpreadJohn MonroseNoch keine Bewertungen

- Way2Wealth Daily Trading Bites Apr1Dokument3 SeitenWay2Wealth Daily Trading Bites Apr1Srikanth RamakrishnaNoch keine Bewertungen

- C:/Users/User/Downloads/model - Amos - Ads - Final - Amw: Analysis Summary Date and TimeDokument37 SeitenC:/Users/User/Downloads/model - Amos - Ads - Final - Amw: Analysis Summary Date and TimeLorent JonathanNoch keine Bewertungen

- Portfolio-1 With February 2022 CE Writting OpportunityDokument5 SeitenPortfolio-1 With February 2022 CE Writting OpportunityPravin SinghNoch keine Bewertungen

- Orb Plus Excel Call Generator1Dokument8 SeitenOrb Plus Excel Call Generator1dewanibipin0% (2)

- Equity StockDokument4 SeitenEquity StockChaitanya EnterprisesNoch keine Bewertungen

- Narration Mar-19 Mar-20 Mar-21 Mar-22 Mar-23 Mar-24 Mar-25 Mar-26 Mar-27Dokument11 SeitenNarration Mar-19 Mar-20 Mar-21 Mar-22 Mar-23 Mar-24 Mar-25 Mar-26 Mar-27Manan ToganiNoch keine Bewertungen

- Category Date Buy Value Sell Value Net ValueDokument7 SeitenCategory Date Buy Value Sell Value Net ValueMohd FarazNoch keine Bewertungen

- Shareable Sheet-Protected-UnlockedDokument2 SeitenShareable Sheet-Protected-UnlockedTrading TrainingNoch keine Bewertungen

- John Neff 22 Sep 2020 1116Dokument5 SeitenJohn Neff 22 Sep 2020 1116Debashish Priyanka SinhaNoch keine Bewertungen

- NO Kode Emiten HARGA SAHAM ROE (Bigger Better) DER (Less Better)Dokument17 SeitenNO Kode Emiten HARGA SAHAM ROE (Bigger Better) DER (Less Better)Renggana Dimas Prayogi WiranataNoch keine Bewertungen

- Symbol Open Dayhigh Daylow Lastprice Previousclose ChangeDokument4 SeitenSymbol Open Dayhigh Daylow Lastprice Previousclose ChangeVijayNoch keine Bewertungen

- Equity Weekly Report 19-23 NovDokument10 SeitenEquity Weekly Report 19-23 NovzoidresearchNoch keine Bewertungen

- Nifty Technical Report (31july - 4aug)Dokument6 SeitenNifty Technical Report (31july - 4aug)zoidresearchNoch keine Bewertungen

- Equity Weekly Report - Zoid ResearchDokument9 SeitenEquity Weekly Report - Zoid ResearchzoidresearchNoch keine Bewertungen

- Equity Weekly Report 8 May To 12 MayDokument6 SeitenEquity Weekly Report 8 May To 12 MayzoidresearchNoch keine Bewertungen

- Equity Report 3 July To 7 JulyDokument6 SeitenEquity Report 3 July To 7 JulyzoidresearchNoch keine Bewertungen

- Equity Report 22 May To 26 MayDokument6 SeitenEquity Report 22 May To 26 MayzoidresearchNoch keine Bewertungen

- Equity Report 5 Jun To 9 JunDokument6 SeitenEquity Report 5 Jun To 9 JunzoidresearchNoch keine Bewertungen

- Equity Technical Report 30 Jan To 3 FebDokument6 SeitenEquity Technical Report 30 Jan To 3 FebzoidresearchNoch keine Bewertungen

- Equity Report 26 June To 30 JuneDokument6 SeitenEquity Report 26 June To 30 JunezoidresearchNoch keine Bewertungen

- Equity Report 15 May To 19 MayDokument6 SeitenEquity Report 15 May To 19 MayzoidresearchNoch keine Bewertungen

- Equity Weekly Report 20 Feb To 24 FebDokument6 SeitenEquity Weekly Report 20 Feb To 24 FebzoidresearchNoch keine Bewertungen

- Equity Report 24 Apr To 28 AprDokument6 SeitenEquity Report 24 Apr To 28 AprzoidresearchNoch keine Bewertungen

- Outlook On Equity Report 1 MAY To 5 MAYDokument6 SeitenOutlook On Equity Report 1 MAY To 5 MAYzoidresearchNoch keine Bewertungen

- Equity Market Outlook (3-7 April)Dokument6 SeitenEquity Market Outlook (3-7 April)zoidresearchNoch keine Bewertungen

- Equity Technical Report 10 Apr To 14 AprDokument6 SeitenEquity Technical Report 10 Apr To 14 AprzoidresearchNoch keine Bewertungen

- Equity Outlook 13 Feb To 17 FebDokument6 SeitenEquity Outlook 13 Feb To 17 FebzoidresearchNoch keine Bewertungen

- Equity Report Outlook 6 Feb To 10 FebDokument6 SeitenEquity Report Outlook 6 Feb To 10 FebzoidresearchNoch keine Bewertungen

- Equity Technical Weekly ReportDokument6 SeitenEquity Technical Weekly ReportzoidresearchNoch keine Bewertungen

- Nifty Weekly Report 17 Apr To 21 AprDokument6 SeitenNifty Weekly Report 17 Apr To 21 AprzoidresearchNoch keine Bewertungen

- Equity Technical Report 23 Jan To 27 JanDokument6 SeitenEquity Technical Report 23 Jan To 27 JanzoidresearchNoch keine Bewertungen

- Equity Technical Report 2 Jan To 6 JanDokument6 SeitenEquity Technical Report 2 Jan To 6 JanzoidresearchNoch keine Bewertungen

- Equity Report 12 Dec To 16 DecDokument6 SeitenEquity Report 12 Dec To 16 DeczoidresearchNoch keine Bewertungen

- Equity Technical Report 28 Nov To 2 DecDokument6 SeitenEquity Technical Report 28 Nov To 2 DeczoidresearchNoch keine Bewertungen

- Equity Technical Report 5 Dec To 9 DecDokument6 SeitenEquity Technical Report 5 Dec To 9 DeczoidresearchNoch keine Bewertungen

- Trading With Time Time SampleDokument12 SeitenTrading With Time Time SampleRasmi Ranjan100% (1)

- Dr.G.R.Damodaran College of ScienceDokument23 SeitenDr.G.R.Damodaran College of ScienceAbdullahNoch keine Bewertungen

- Business Ethics NotesDokument65 SeitenBusiness Ethics NotesRahul M. DasNoch keine Bewertungen

- 3g-Income-Statement FinalDokument13 Seiten3g-Income-Statement FinalPERCIVAL DOMINGONoch keine Bewertungen

- Scottish IndependenceDokument128 SeitenScottish IndependenceScottishIndependence100% (2)

- Neuberger Berman StudyDokument10 SeitenNeuberger Berman StudyjohnolavinNoch keine Bewertungen

- ExamDokument3 SeitenExamMIN THANTNoch keine Bewertungen

- Renewable Energy: in RomaniaDokument56 SeitenRenewable Energy: in RomaniaIonut AndreiNoch keine Bewertungen

- Treasury SharesDokument9 SeitenTreasury SharesKathleenNoch keine Bewertungen

- Homework Week5Dokument3 SeitenHomework Week5Baladashyalan RajandranNoch keine Bewertungen

- Revocable Living TrustDokument1 SeiteRevocable Living TrustTricia100% (1)

- Midterm - ReviewerDokument11 SeitenMidterm - Reviewerangel ciiiNoch keine Bewertungen

- CeraDokument32 SeitenCeraRohit ThapliyalNoch keine Bewertungen

- 05 Lecture - The Time Value of Money PDFDokument26 Seiten05 Lecture - The Time Value of Money PDFjgutierrez_castro7724Noch keine Bewertungen

- Partnership Agreement On Investment and Financial Co-OPERATION No.: RZC/CHI /500M/161120202020Dokument11 SeitenPartnership Agreement On Investment and Financial Co-OPERATION No.: RZC/CHI /500M/161120202020Мухаммед Али100% (2)

- Icpenney Operates A Chain of Retail Department Stores Selling ApparelDokument1 SeiteIcpenney Operates A Chain of Retail Department Stores Selling ApparelHassan JanNoch keine Bewertungen

- English Common ErrorDokument59 SeitenEnglish Common ErrorRohini murugan85% (55)

- Time Value of MoneyDokument5 SeitenTime Value of MoneyTennya Kua Yen Fong100% (1)

- Ishares Core Growth Etf Portfolio: Key FactsDokument2 SeitenIshares Core Growth Etf Portfolio: Key FactsTushar PatelNoch keine Bewertungen

- Address Updating WhitepaperDokument11 SeitenAddress Updating WhitepaperFreeInformation4ALLNoch keine Bewertungen

- India: A Capsule On Accounting Standards For Quick RecapDokument26 SeitenIndia: A Capsule On Accounting Standards For Quick RecappreetNoch keine Bewertungen

- Generic PSADokument15 SeitenGeneric PSADenis BrosnanNoch keine Bewertungen

- Barchart OnDemand - Market Data APIsDokument10 SeitenBarchart OnDemand - Market Data APIsenghoss77Noch keine Bewertungen

- Chapter 23 Associates and Joint Ventures (Samplepractice-Exam-18-September-2018-Questions-And-Answers)Dokument18 SeitenChapter 23 Associates and Joint Ventures (Samplepractice-Exam-18-September-2018-Questions-And-Answers)XNoch keine Bewertungen

- Chapter 25Dokument4 SeitenChapter 25Xynith Nicole RamosNoch keine Bewertungen

- Investment Advisory Business Plan TemplateDokument22 SeitenInvestment Advisory Business Plan TemplatesolomonNoch keine Bewertungen

- Entrega de Trabajo 01Dokument4 SeitenEntrega de Trabajo 01YESSIRA PILAR GALARZA LOPEZNoch keine Bewertungen

- CN 20190801 6HGQ26 Bse65887 0 PDFDokument8 SeitenCN 20190801 6HGQ26 Bse65887 0 PDFVenu MadhavNoch keine Bewertungen

- Sustainable Tourism DevelopmentDokument7 SeitenSustainable Tourism DevelopmentEmma ZoeNoch keine Bewertungen

- SS9 FMDokument2 SeitenSS9 FMNguyễn Hồng HạnhNoch keine Bewertungen