Beruflich Dokumente

Kultur Dokumente

Location of Factory / Plant

Hochgeladen von

Ghulam Ahmad0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

8 Ansichten1 SeiteAtlas Honda Limited is a Pakistani company listed on the Karachi and Lahore stock exchanges. It manufactures and markets motorcycles and auto parts. Between 2011-2014, the company saw increases in paid-up capital, reserves and shareholder equity, total assets, sales revenues, and profits. Key financial ratios like book value, current ratio, and earnings per share also improved over this period. The company pays dividends annually ranging from 65-100% of profits and saw its stock price and market capitalization rise significantly from 2011-2014.

Originalbeschreibung:

ATLH

Originaltitel

ATLH

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenAtlas Honda Limited is a Pakistani company listed on the Karachi and Lahore stock exchanges. It manufactures and markets motorcycles and auto parts. Between 2011-2014, the company saw increases in paid-up capital, reserves and shareholder equity, total assets, sales revenues, and profits. Key financial ratios like book value, current ratio, and earnings per share also improved over this period. The company pays dividends annually ranging from 65-100% of profits and saw its stock price and market capitalization rise significantly from 2011-2014.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

8 Ansichten1 SeiteLocation of Factory / Plant

Hochgeladen von

Ghulam AhmadAtlas Honda Limited is a Pakistani company listed on the Karachi and Lahore stock exchanges. It manufactures and markets motorcycles and auto parts. Between 2011-2014, the company saw increases in paid-up capital, reserves and shareholder equity, total assets, sales revenues, and profits. Key financial ratios like book value, current ratio, and earnings per share also improved over this period. The company pays dividends annually ranging from 65-100% of profits and saw its stock price and market capitalization rise significantly from 2011-2014.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

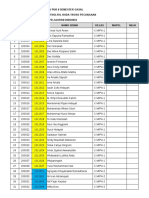

THE KARACHI STOCK EXCHANGE LIMITED

S.No.

Atlas Honda Limited

CHAIRMAN 2011 2012 2013 2014

YUSUF H. SHIRAZI FINANCIAL POSITION (Rs. In Million)

Paid-Up Capital 625.52 719.35 827.25 1034.07

CHIEF EXECUTIVE/MANAGING DIRECTOR Reserves & Surplus 3996.89 4700.58 5701.92 6879.25

SAQUIB H. SHIRAZI Sharholder's Equity 4622.41 5419.93 6529.17 7913.32

Capital Reserves 40.12 40.12 40.12 40.12

BOARD OF DEIRECTORS: Deferred Taxation / Liabilities 649.35 576.44 680.63 637.56

Long Term Loans / Deposits 0.00 0.00 0.00 0.00

YUSUF H. SHIRAZI

Current Liabilities 4349.46 4810.17 4634.39 5622.28

SANAULLAH QURESHI Total Assets 9621.23 10960.42 12014.44 14365.19

SAQUIB H. SHIRAZI Fixed Assets (Gross) 6740.78 7603.51 8743.90 9003.89

HISAO KOBAYASHI Accumulated Depreciation / 3477.60 3838.81 4353.29 4592.44

TARIQ AMIN Amortization

Fixed Assets (Net) 3263.18 3764.70 4390.61 4411.45

HIROMILSU TAKASAKI 3.15 183.33 36.69 146.15

Capital work in Progress

ABID NAQVI Long Term Investment 0.00 0.00 0.00 0.00

KAZUHSA HIROTA Current Assets 6321.73 6976.24 7553.16 9600.11

REGISTERED OFFICE: OPERATING POSITION (Rs. In Million)

Sales (Net) / Revenues 32521.40 38011.86 42325.24 44478.71

1, Mcleod Road,

Cost of Sales 30080.98 35235.89 38644.53 40253.93

Gross Profit 2440.42 2775.97 3680.71 4224.78

Lahore Operating Expenses 1235.80 1418.70 1783.50 1947.98

HEAD OFFICE: Operating Profit / (Loss) 1204.62 1357.27 1897.21 2276.80

Financial Charges 93.48 11.72 9.73 8.04

1, Mcleod Road, Other Income 299.34 274.45 322.67 420.65

Prior Year Adjustment 0.00 0.00 0.00 0.00

Profit / (Loss) Before Taxation 1410.48 1620.00 2210.16 2689.42

Lahore Taxation Current & Deff 423.30 444.94 623.03 731.18

Prior Years -15.37 -29.05 -22.39 -43.32

AUDITORS:

Total 407.93 415.89 600.64 687.86

Hameed Chaudhri & Co Profit / (Loss) After Taxation 1002.56 1204.11 1609.52 2001.56

LOCATION OF FACTORY / PLANT RATIOS

Various Locations. Book Value 73.90 75.34 78.93 76.53

Assets Turnover 3.38 3.47 3.52 3.10

YEAR ENDING: Current Ratio 1.45 1.45 1.63 1.71

Earning Per Share Pre Tax 22.55 22.52 26.72 26.01

March Earning Per Share After Tax 16.03 16.74 19.46 19.36

AUTHORISED CAPITAL: Payout Ratio After Tax 49.91 47.79 51.44 51.65

Market Capitalization 8358.82 9850.06 17868.60 29190.76

Rs: 1500 mil

DISTRIBUTION

PAID VALUE:

Cash Dividend % 65.00 65.00 75.00 100.00

Rs: 10 Stock Dividend % 15.00 15.00 25.00 0.00

Total % 80.00 80.00 100.00 100.00

SHARES TRADED:

SHARE PRICE Rs.

2.539 mil

High 160.00 159.85 285.00 355.57

No.of SHAREHOLDERS: Low 107.25 114.00 147.00 209.00

1423 Average 133.63 136.93 216.00 282.29

CAPACITY UTILISATION:

Multi Products.

COMPANY INFORMATION

Atlas Honda Limited was incorporated as a public

limited company on October 16, 1962 and its shares

are listed on Karachi and Lahore stock exchanges. The

company is principally engaged in progressive

manufacturing and marketing of motorcycles and auto

parts.

Das könnte Ihnen auch gefallen

- Atlas HondaDokument2 SeitenAtlas HondasaranidoNoch keine Bewertungen

- Analysis ReportsDokument1 SeiteAnalysis Reportsfari khNoch keine Bewertungen

- Feroze1888 Mills Limited: Formerly: Karachi Stock Exchange LimitedDokument1 SeiteFeroze1888 Mills Limited: Formerly: Karachi Stock Exchange LimitedHussain AliNoch keine Bewertungen

- Pakistan Stock Exchange Limited: The Searle Company LimitedDokument1 SeitePakistan Stock Exchange Limited: The Searle Company LimitederfanxpNoch keine Bewertungen

- Analysis Reports PDFDokument1 SeiteAnalysis Reports PDFFaizan AhmadNoch keine Bewertungen

- Pakistan Stock Exchange LimitedDokument1 SeitePakistan Stock Exchange LimitederfanxpNoch keine Bewertungen

- Pakistan Stock Exchange Limited: D. G. Khan Cement Company LimitedDokument1 SeitePakistan Stock Exchange Limited: D. G. Khan Cement Company LimitederfanxpNoch keine Bewertungen

- Maple Leaf Cement Factory Limited: Formerly: Karachi Stock Exchange LimitedDokument1 SeiteMaple Leaf Cement Factory Limited: Formerly: Karachi Stock Exchange LimitedHussain AliNoch keine Bewertungen

- Analysis ReportsDokument1 SeiteAnalysis ReportsMuiz SaddozaiNoch keine Bewertungen

- BNWMDokument1 SeiteBNWMHussain AliNoch keine Bewertungen

- Pakistan Stock Exchange Limited: Indus Motor Company LimitedDokument1 SeitePakistan Stock Exchange Limited: Indus Motor Company Limitedmusab nawazNoch keine Bewertungen

- Pakistan Stock Exchange LimitedDokument1 SeitePakistan Stock Exchange LimitedayazNoch keine Bewertungen

- Pakistan Stock Exchange LimitedDokument1 SeitePakistan Stock Exchange LimitederfanxpNoch keine Bewertungen

- Analysis Report PsoDokument3 SeitenAnalysis Report PsoMuhammad Waqas HafeezNoch keine Bewertungen

- Bestway Cement Limited: Location of Factory / PlantDokument1 SeiteBestway Cement Limited: Location of Factory / PlantBurhan Ahmed MayoNoch keine Bewertungen

- Pakistan CablesDokument2 SeitenPakistan CablesSaad SiddiquiNoch keine Bewertungen

- MCBDokument1 SeiteMCBAbdul Habib MirNoch keine Bewertungen

- CashFlow - StandaloneDokument3 SeitenCashFlow - StandaloneSourav RajeevNoch keine Bewertungen

- Annual-Report-FY-2019-20 QDokument76 SeitenAnnual-Report-FY-2019-20 Qhesax93983Noch keine Bewertungen

- Company Info - Print FinancialsDokument2 SeitenCompany Info - Print FinancialsDhruv NarangNoch keine Bewertungen

- Financial Management II ProjectDokument11 SeitenFinancial Management II ProjectsimlimisraNoch keine Bewertungen

- (XI) Bibliography and AppendixDokument5 Seiten(XI) Bibliography and AppendixSwami Yog BirendraNoch keine Bewertungen

- Ceat Balance SheetDokument2 SeitenCeat Balance Sheetkcr kc100% (2)

- AFM Group ProjectDokument13 SeitenAFM Group ProjectMehak GargNoch keine Bewertungen

- Suzlon Energy Balance Sheet, P&L Statment, CashflowDokument10 SeitenSuzlon Energy Balance Sheet, P&L Statment, CashflowBharat RajputNoch keine Bewertungen

- Industry Segment of Bajaj CompanyDokument4 SeitenIndustry Segment of Bajaj CompanysantunusorenNoch keine Bewertungen

- ABB India: PrintDokument2 SeitenABB India: PrintAbhay Kumar SinghNoch keine Bewertungen

- Ceat Tyres LTD.: Fsa AssignmentDokument37 SeitenCeat Tyres LTD.: Fsa AssignmentSourajit SanyalNoch keine Bewertungen

- HDFC Bank LTD.: Profit and Loss A/CDokument4 SeitenHDFC Bank LTD.: Profit and Loss A/CsureshkarnaNoch keine Bewertungen

- Balance Sheet - ConsolidatedDokument3 SeitenBalance Sheet - ConsolidatedrashmiNoch keine Bewertungen

- Asian Paints BsDokument2 SeitenAsian Paints BsPriyalNoch keine Bewertungen

- Apollo Tyres: PrintDokument2 SeitenApollo Tyres: PrintTiaNoch keine Bewertungen

- Ch-3 Finance Department Trading & P&L AccountDokument4 SeitenCh-3 Finance Department Trading & P&L AccountMit MehtaNoch keine Bewertungen

- Accounts Case Study On Ratio AnalysisDokument6 SeitenAccounts Case Study On Ratio AnalysisRADHIKA.J 19MCO033Noch keine Bewertungen

- Jubilant CompleteDokument16 SeitenJubilant CompleteShivamKhareNoch keine Bewertungen

- Standalone Bal SheetDokument2 SeitenStandalone Bal SheetvaidyaaadiNoch keine Bewertungen

- Comprehensive IT Industry Analysis - ProjectDokument52 SeitenComprehensive IT Industry Analysis - ProjectdhruvNoch keine Bewertungen

- Moneycontrol United SpiritsDokument2 SeitenMoneycontrol United SpiritsBitan GhoshNoch keine Bewertungen

- Group 1 Adani PortsDokument12 SeitenGroup 1 Adani PortsshreechaNoch keine Bewertungen

- Vodafone Idea Limited: PrintDokument2 SeitenVodafone Idea Limited: PrintPrakhar KapoorNoch keine Bewertungen

- Finance Satyam AnalysisDokument12 SeitenFinance Satyam AnalysisNeha AgarwalNoch keine Bewertungen

- Atest Quarterly/Halfyearly As On (Months) : %OI %OI %OIDokument4 SeitenAtest Quarterly/Halfyearly As On (Months) : %OI %OI %OIManas AnandNoch keine Bewertungen

- Agency ProblemDokument10 SeitenAgency ProblemKARNATI CHARAN 2028331Noch keine Bewertungen

- Company Info - Print FinancialsDokument2 SeitenCompany Info - Print FinancialsDivya PandeyNoch keine Bewertungen

- Ashok Leyland Balane SheetDokument2 SeitenAshok Leyland Balane SheetNaresh Kumar NareshNoch keine Bewertungen

- Accounting For Management: Group ProjectDokument10 SeitenAccounting For Management: Group ProjectYash BhasinNoch keine Bewertungen

- Financial Statements and Ratios Flashcards QuizletDokument14 SeitenFinancial Statements and Ratios Flashcards QuizletDanish HameedNoch keine Bewertungen

- Cipla Balance SheetDokument2 SeitenCipla Balance SheetNEHA LAL100% (1)

- ITM MaricoDokument8 SeitenITM MaricoAdarsh ChaudharyNoch keine Bewertungen

- Eveready Industries India Balance Sheet - in Rs. Cr.Dokument5 SeitenEveready Industries India Balance Sheet - in Rs. Cr.Jb SinghaNoch keine Bewertungen

- LIC Housing Finance Ltd. - Research Center: Balance SheetDokument3 SeitenLIC Housing Finance Ltd. - Research Center: Balance Sheetpriyankaanu2345Noch keine Bewertungen

- CV Assignment - Agneesh DuttaDokument9 SeitenCV Assignment - Agneesh DuttaAgneesh DuttaNoch keine Bewertungen

- Data of BhartiDokument2 SeitenData of BhartiAnkur MehtaNoch keine Bewertungen

- Eicher Motors BSDokument2 SeitenEicher Motors BSVaishnav SunilNoch keine Bewertungen

- Housing Development Finance Corporation: PrintDokument2 SeitenHousing Development Finance Corporation: PrintAbdul Khaliq ChoudharyNoch keine Bewertungen

- MKT Ca1Dokument96 SeitenMKT Ca1Nainpreet KaurNoch keine Bewertungen

- Income Statement 2018-2019 %: Sources of FundsDokument8 SeitenIncome Statement 2018-2019 %: Sources of FundsDebanjan MukherjeeNoch keine Bewertungen

- Apollo Hospitals Enterprise LimitedDokument4 SeitenApollo Hospitals Enterprise Limitedpaigesh1Noch keine Bewertungen

- 32 - Akshita - Sun Pharmaceuticals Industries.Dokument36 Seiten32 - Akshita - Sun Pharmaceuticals Industries.rajat_singlaNoch keine Bewertungen

- Securities Operations: A Guide to Trade and Position ManagementVon EverandSecurities Operations: A Guide to Trade and Position ManagementBewertung: 4 von 5 Sternen4/5 (3)

- Installation of New Clo2 Project: Activity Duration September October Number December Jan-19Dokument1 SeiteInstallation of New Clo2 Project: Activity Duration September October Number December Jan-19Ghulam AhmadNoch keine Bewertungen

- Ir03 Detailed Investigation Report: AttachmentsDokument4 SeitenIr03 Detailed Investigation Report: AttachmentsGhulam AhmadNoch keine Bewertungen

- blueEX Couriers Cod Services PDFDokument11 SeitenblueEX Couriers Cod Services PDFGhulam AhmadNoch keine Bewertungen

- Project Engineer CV - Ghulam Ahmad - Copy 2Dokument3 SeitenProject Engineer CV - Ghulam Ahmad - Copy 2Ghulam AhmadNoch keine Bewertungen

- 01 17 16 Solver OutputDokument39 Seiten01 17 16 Solver OutputGhulam AhmadNoch keine Bewertungen

- Triangular PlateDokument1 SeiteTriangular PlateGhulam AhmadNoch keine Bewertungen

- PDS OpenPlantModeler LTR en LRDokument2 SeitenPDS OpenPlantModeler LTR en LRGhulam AhmadNoch keine Bewertungen

- Deflection Check Beam PDFDokument2 SeitenDeflection Check Beam PDFGhulam AhmadNoch keine Bewertungen

- Pipeline Stress Analysis With Caesar IIDokument16 SeitenPipeline Stress Analysis With Caesar IIGhulam AhmadNoch keine Bewertungen

- DUDF 61199.aqua PlantDokument1 SeiteDUDF 61199.aqua PlantGhulam AhmadNoch keine Bewertungen

- DUDF 61197.new Feed Mill PoultryDokument1 SeiteDUDF 61197.new Feed Mill PoultryGhulam AhmadNoch keine Bewertungen

- Safurex - Sandvik Materials TechnologyDokument14 SeitenSafurex - Sandvik Materials TechnologyGhulam AhmadNoch keine Bewertungen

- Always Know The Back-Up Plan: Backover InjuriesDokument1 SeiteAlways Know The Back-Up Plan: Backover InjuriesGhulam AhmadNoch keine Bewertungen

- Some Good Engineering Follow This Practice in Case of Large Diamemeter PipeDokument2 SeitenSome Good Engineering Follow This Practice in Case of Large Diamemeter PipeGhulam AhmadNoch keine Bewertungen

- Urea 25 22 2 20030603Dokument4 SeitenUrea 25 22 2 20030603Ghulam AhmadNoch keine Bewertungen

- Customer S Satisfaction of Honda Two WheelersDokument58 SeitenCustomer S Satisfaction of Honda Two WheelersAbhinash KanigelpulaNoch keine Bewertungen

- BMX XXX CheatsDokument4 SeitenBMX XXX Cheatspujimelati3Noch keine Bewertungen

- REVIT Catalogo Dealer Workbook SS13 Final EU WEB PDFDokument266 SeitenREVIT Catalogo Dealer Workbook SS13 Final EU WEB PDFMecanikos Motor100% (1)

- C CCCCCCCCCCCCCCCCCCCCCCCCCCCCC C: CCC CCCDokument6 SeitenC CCCCCCCCCCCCCCCCCCCCCCCCCCCCC C: CCC CCCYassh RastogiNoch keine Bewertungen

- Quaife ATB DiffDokument5 SeitenQuaife ATB DiffMaxim MackenzyNoch keine Bewertungen

- Welcome : To The Cannondale TeamDokument28 SeitenWelcome : To The Cannondale TeamBui Trung HieuNoch keine Bewertungen

- EX250KCFDokument5 SeitenEX250KCFAlbert Steven TjongNoch keine Bewertungen

- Bahasa Inggris XiiDokument20 SeitenBahasa Inggris XiiAbdul RoufNoch keine Bewertungen

- 1k Most CommonDokument17 Seiten1k Most CommonRamanjit kaurNoch keine Bewertungen

- Speech 3 ResearchDokument18 SeitenSpeech 3 Researchapi-310395421Noch keine Bewertungen

- S38B38 TechnicalInfoDokument15 SeitenS38B38 TechnicalInfoKristian Kind OlsenNoch keine Bewertungen

- Stab Fast EDokument4 SeitenStab Fast EFernando SaavedraNoch keine Bewertungen

- BSA Bicycle TouringDokument18 SeitenBSA Bicycle Touringtspinner19Noch keine Bewertungen

- Charterhouse 8 July 2011 CatalogueDokument27 SeitenCharterhouse 8 July 2011 CatalogueabromellNoch keine Bewertungen

- Motorcycle MagazineDokument156 SeitenMotorcycle Magazinephantomx75% (4)

- Suzuki AY50 Katana SH RIP ManualDokument105 SeitenSuzuki AY50 Katana SH RIP ManualDimitar Georgiev100% (1)

- 2013 Opel Corsa D Service and Repair ManualDokument7 Seiten2013 Opel Corsa D Service and Repair ManualAndreea A0% (2)

- A Study On Customer Preference and Satisfaction Towards Bajaj Bikes-2Dokument115 SeitenA Study On Customer Preference and Satisfaction Towards Bajaj Bikes-2guhan subramanianNoch keine Bewertungen

- FZ6 Vs Z750Dokument6 SeitenFZ6 Vs Z750Andrea MancaNoch keine Bewertungen

- GM Vin Card 2008Dokument4 SeitenGM Vin Card 2008jONATHANNoch keine Bewertungen

- Booklet Road Traffic Signs and Regulations in The Netherlands - tcm174-337519Dokument84 SeitenBooklet Road Traffic Signs and Regulations in The Netherlands - tcm174-337519Janki VernekarNoch keine Bewertungen

- Official Police CatalogDokument15 SeitenOfficial Police CatalogPablo LoboNoch keine Bewertungen

- Catalog JPX PDFDokument76 SeitenCatalog JPX PDFSeptianNoch keine Bewertungen

- CatalogoDokument24 SeitenCatalogoMassimo IntelviNoch keine Bewertungen

- Triumph Collection 2010 BDokument75 SeitenTriumph Collection 2010 BAnonymous GKqp4HnNoch keine Bewertungen

- KJ Bike Dynamics IEEE2005Dokument22 SeitenKJ Bike Dynamics IEEE2005momo899Noch keine Bewertungen

- FL Violation Point and Statute ReferenceDokument27 SeitenFL Violation Point and Statute ReferenceJenniferRaePittsNoch keine Bewertungen

- TVS Apache RTR 160Dokument23 SeitenTVS Apache RTR 160Praveesh Ambalathody75% (4)

- PROJECTDokument13 SeitenPROJECTRoshiney AntonittaNoch keine Bewertungen

- Second Hand Bikes - BangaloreDokument49 SeitenSecond Hand Bikes - BangaloreTejashviNoch keine Bewertungen