Beruflich Dokumente

Kultur Dokumente

Factors Affecting Cost of Capital

Hochgeladen von

ksaw110 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

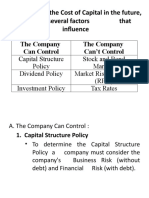

290 Ansichten1 SeiteThe company has control over several factors that affect its cost of capital:

1. Its capital structure policy, as taking on more debt or equity affects costs.

2. Its dividend policy, as payout ratios impact the cost of new equity issuances.

3. Its investment policy, as riskier investments increase debt and equity costs.

The cost of capital is also affected by uncontrollable factors like interest rates and tax rates. Higher interest rates raise debt costs, while increased tax rates lower them.

Originalbeschreibung:

Factors Affecting Cost of Capital

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThe company has control over several factors that affect its cost of capital:

1. Its capital structure policy, as taking on more debt or equity affects costs.

2. Its dividend policy, as payout ratios impact the cost of new equity issuances.

3. Its investment policy, as riskier investments increase debt and equity costs.

The cost of capital is also affected by uncontrollable factors like interest rates and tax rates. Higher interest rates raise debt costs, while increased tax rates lower them.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

290 Ansichten1 SeiteFactors Affecting Cost of Capital

Hochgeladen von

ksaw11The company has control over several factors that affect its cost of capital:

1. Its capital structure policy, as taking on more debt or equity affects costs.

2. Its dividend policy, as payout ratios impact the cost of new equity issuances.

3. Its investment policy, as riskier investments increase debt and equity costs.

The cost of capital is also affected by uncontrollable factors like interest rates and tax rates. Higher interest rates raise debt costs, while increased tax rates lower them.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

These are the factors affecting cost of capital that the company has control over:

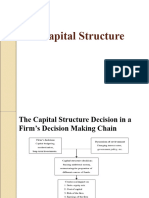

1. Capital Structure Policy

As we have been discussing above, a firm has control over its capital structure, targeting an optimal capital

structure. As more debt is issued, the cost of debt increases, and as more equity is issued, the cost of equity

increases.

2. Dividend Policy

Given that the firm has control over its payout ratio, the breakpoint of the MCC schedule can be changed.

For example, as the payout ratio of the company increases the breakpoint between lower-cost internally

generated equity and newly issued equity is lowered.

3. Investment Policy

It is assumed that, when making investment decisions, the company is making investments with similar

degrees of risk. If a company changes its investment policy relative to its risk, both the cost of debt and cost

of equity change.

Uncontrollable Factors Affecting the Cost of Capital

These are the factors affecting cost of capital that the company has no control over:

1. Level of Interest Rates

The level of interest rates will affect the cost of debt and, potentially, the cost of equity. For example, when

interest rates increase the cost of debt increases, which increases the cost of capital.

2. Tax Rates

Tax rates affect the after-tax cost of debt. As tax rates increase, the cost of debt decreases, decreasing the

cost of capital.

Das könnte Ihnen auch gefallen

- Factors Affecting Capital Structure: (A) Internal Factors (B) External Factors (C) General FactorsDokument4 SeitenFactors Affecting Capital Structure: (A) Internal Factors (B) External Factors (C) General Factorsshri277Noch keine Bewertungen

- Factors Affecting Cost of CapitalDokument11 SeitenFactors Affecting Cost of CapitalGairik Deb100% (4)

- MM HypothesisDokument2 SeitenMM HypothesisShania SainiNoch keine Bewertungen

- Cost of Capital (Sermayesi Maliyet)Dokument2 SeitenCost of Capital (Sermayesi Maliyet)Amna NawazNoch keine Bewertungen

- Financial LeverageDokument5 SeitenFinancial LeverageUdit UpretiNoch keine Bewertungen

- Financial DistressDokument5 SeitenFinancial DistresspalkeeNoch keine Bewertungen

- New Wordpad DocumentDokument4 SeitenNew Wordpad DocumentAbdul Haseeb AmjadNoch keine Bewertungen

- FM Sheet 4 (JUHI RAJWANI)Dokument8 SeitenFM Sheet 4 (JUHI RAJWANI)Mukesh SinghNoch keine Bewertungen

- Capital StructureDokument4 SeitenCapital StructurenaveenngowdaNoch keine Bewertungen

- Project AppraisalDokument29 SeitenProject AppraisalsaravmbaNoch keine Bewertungen

- Course 6: The Management of Course 6: The Management of Capital CapitalDokument26 SeitenCourse 6: The Management of Course 6: The Management of Capital CapitalgkunadkatNoch keine Bewertungen

- To Determine The Cost of CapitalDokument6 SeitenTo Determine The Cost of CapitalSO NNoch keine Bewertungen

- Capital Structure PolicyDokument7 SeitenCapital Structure PolicymakulitnatupaNoch keine Bewertungen

- FNAN 3015 NOTES On Capital Structury Theory 07-09-2020Dokument2 SeitenFNAN 3015 NOTES On Capital Structury Theory 07-09-2020Sonali SharmaNoch keine Bewertungen

- Accct 1Dokument4 SeitenAccct 1Jael AlmazanNoch keine Bewertungen

- Handout On InflationDokument2 SeitenHandout On InflationRadelia GrantNoch keine Bewertungen

- Unit 3rd Financial Management BBA 4thDokument18 SeitenUnit 3rd Financial Management BBA 4thYashfeen FalakNoch keine Bewertungen

- Course 6: The Management of CapitalDokument26 SeitenCourse 6: The Management of CapitalAlif Rachmad Haidar SabiafzahNoch keine Bewertungen

- Corporate Finance Assignment 1Dokument6 SeitenCorporate Finance Assignment 1Kûnãl SälîañNoch keine Bewertungen

- Capital Structure Policy: Learning ObjectivesDokument56 SeitenCapital Structure Policy: Learning ObjectivesShoniqua Johnson100% (1)

- Factors Affecting Capital Structure DecisionsDokument6 SeitenFactors Affecting Capital Structure DecisionsAminul Haque RusselNoch keine Bewertungen

- Degree of Financial LeverageDokument2 SeitenDegree of Financial LeverageElla FuenteNoch keine Bewertungen

- Capital Structure and Componnents of CapitalDokument12 SeitenCapital Structure and Componnents of CapitalBhartiNoch keine Bewertungen

- Factors Determining Optimal Capital StructureDokument8 SeitenFactors Determining Optimal Capital StructureArindam Mitra100% (8)

- Discussion Questions:: and No Costs of Financial Distress ( M&M Theory With No Corporate Tax) - If A FirmDokument2 SeitenDiscussion Questions:: and No Costs of Financial Distress ( M&M Theory With No Corporate Tax) - If A FirmLinh MaiNoch keine Bewertungen

- Bbfa2203 Intermediate Financial Accounting IDokument23 SeitenBbfa2203 Intermediate Financial Accounting IJasmine LimNoch keine Bewertungen

- Karen Patterson - Self AssessmentDokument2 SeitenKaren Patterson - Self AssessmentpreciousNoch keine Bewertungen

- FM S5 Capitalstructure TheoriesDokument36 SeitenFM S5 Capitalstructure TheoriesSunny RajoraNoch keine Bewertungen

- CH 5Dokument10 SeitenCH 5malo baNoch keine Bewertungen

- Unit Iv: Financing DecisionsDokument11 SeitenUnit Iv: Financing DecisionsAR Ananth Rohith BhatNoch keine Bewertungen

- Capital Stucture: Compiled To Fulfill The Duties of Marketing Management CoursesDokument8 SeitenCapital Stucture: Compiled To Fulfill The Duties of Marketing Management Coursesizzah mariamiNoch keine Bewertungen

- CF 3rd AssignmentDokument6 SeitenCF 3rd AssignmentAnjum SamiraNoch keine Bewertungen

- Unit 3 FMDokument8 SeitenUnit 3 FMpurvang selaniNoch keine Bewertungen

- Capital Structure and Dividend PolicyDokument25 SeitenCapital Structure and Dividend PolicySarah Mae SudayanNoch keine Bewertungen

- Capital StructureDokument13 SeitenCapital StructureRam SharmaNoch keine Bewertungen

- Capital Structure DecisionsDokument14 SeitenCapital Structure DecisionsMukesh MukiNoch keine Bewertungen

- Module 2 - Post TaskDokument1 SeiteModule 2 - Post TaskAlizahNoch keine Bewertungen

- Impact of Capital Structure AllDokument3 SeitenImpact of Capital Structure AllAfsana PollobiNoch keine Bewertungen

- Factors Affecting Capital StructureDokument2 SeitenFactors Affecting Capital StructurePrajakta TondlekarNoch keine Bewertungen

- Financial Management: 1st Theory of Capital StructureDokument7 SeitenFinancial Management: 1st Theory of Capital StructureYash AgarwalNoch keine Bewertungen

- Financial Management IIDokument78 SeitenFinancial Management IIDawit NegashNoch keine Bewertungen

- Financial Managers Play An Important Role in The Development of Modern CompanyDokument11 SeitenFinancial Managers Play An Important Role in The Development of Modern CompanyHadie Aria JayaNoch keine Bewertungen

- Capital Structure: Definition: Capital Structure Is The Mix of Financial Securities Used To Finance The FirmDokument11 SeitenCapital Structure: Definition: Capital Structure Is The Mix of Financial Securities Used To Finance The FirmArun NairNoch keine Bewertungen

- Capitasl Expenditure (Final Project)Dokument42 SeitenCapitasl Expenditure (Final Project)nikhil_jbp100% (1)

- HARSHIT VIJAY 138 Corporate Finance2Dokument7 SeitenHARSHIT VIJAY 138 Corporate Finance2harshitvj24Noch keine Bewertungen

- Factors Determining Capital StructureDokument3 SeitenFactors Determining Capital StructuretushNoch keine Bewertungen

- Financial ManagementDokument11 SeitenFinancial ManagementManish KumarNoch keine Bewertungen

- Introduction To Financial ManagementDokument22 SeitenIntroduction To Financial ManagementAli RazaNoch keine Bewertungen

- Capital Structure Issues: V. VI. V.1 Mergers and Acquisitions Definition and DifferencesDokument26 SeitenCapital Structure Issues: V. VI. V.1 Mergers and Acquisitions Definition and Differenceskelvin pogiNoch keine Bewertungen

- Importance of Capital StructureDokument2 SeitenImportance of Capital StructureShruti JoseNoch keine Bewertungen

- Module Iv Capital Structure÷nd DecisionsDokument37 SeitenModule Iv Capital Structure÷nd DecisionsMidhun George VargheseNoch keine Bewertungen

- Chapter OneDokument22 SeitenChapter OneFirdows SuleymanNoch keine Bewertungen

- An Overview of Financial ManagementDokument46 SeitenAn Overview of Financial ManagementKiran IfciNoch keine Bewertungen

- Corporate FinanceDokument5 SeitenCorporate FinanceAvi AggarwalNoch keine Bewertungen

- Hill Country Snack Foods Case AnalysisDokument5 SeitenHill Country Snack Foods Case Analysisdivakar62Noch keine Bewertungen

- Busines DDokument5 SeitenBusines DMadhav SakhujaNoch keine Bewertungen

- Fin435 10mayDokument1 SeiteFin435 10mayAnna MahmudNoch keine Bewertungen

- FMF T8 DoneDokument10 SeitenFMF T8 DoneThongkit ThoNoch keine Bewertungen

- Dividend Investing for Beginners & DummiesVon EverandDividend Investing for Beginners & DummiesBewertung: 5 von 5 Sternen5/5 (1)

- The BMW X3 Brochure August 2016 v2Dokument26 SeitenThe BMW X3 Brochure August 2016 v2ksaw110% (2)

- Concentration Levels : High To "Total" ConcentrationDokument2 SeitenConcentration Levels : High To "Total" Concentrationksaw11Noch keine Bewertungen

- Credit Risk Report TemplateDokument52 SeitenCredit Risk Report Templateksaw11100% (2)

- British Banks - Cracking The Oligopoly (NOT MUCH)Dokument2 SeitenBritish Banks - Cracking The Oligopoly (NOT MUCH)ksaw11Noch keine Bewertungen

- A Data Warehouse Framework For Basel II ImplementationDokument6 SeitenA Data Warehouse Framework For Basel II Implementationksaw11Noch keine Bewertungen

- Creditrisk Plus PDFDokument72 SeitenCreditrisk Plus PDFNayeline CastilloNoch keine Bewertungen

- Higher Algebra - Hall & KnightDokument593 SeitenHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- Control-M Concepts GuideDokument50 SeitenControl-M Concepts Guideksaw11100% (1)