Beruflich Dokumente

Kultur Dokumente

Assessment 1 20

Hochgeladen von

Gokul KannanCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Assessment 1 20

Hochgeladen von

Gokul KannanCopyright:

Verfügbare Formate

Assessment Title : Chapter1 Total Questions : 10

Module : Chapter 1-History Of Life Insurance Total Marks : 10

Q1. The insurance products designed by the insurance Companies may not

Take care of the needs of individuals in different life stages

Provide varied investment options

Provide flexibility and add-on benefits

Guarantee capital appreciation

Q2. Insurance Agents are

Who work only for insurance company

Who work for customers

Who work in their own interest

Intermediaries

Q3. includes banks and brokers?

insurance underwriters

Intermediaries

Actuary

Compostie agents

Q4. Which of the following is not a type of insurance organization?

Ombudsman

Life insurance

Non-Life insurance

Reinsurance

Q5. Which of the following is not an indirect marketing channel

Individual agent

Bancassurance

Direct broker

E sales

Q6. ..means before loss what was his financial status and for the same financial status to bring him is called

A indemnity

material information

utmost goodfaith

none of the above

Q7. Micro insurance is transacted by

Life Insurers only

Non-Life Insurers only

non-life and life insurers

None of them

Q8. Which of the following is not a type of life insurance product

Health insurance

Whole life policy

Term insurance

Pension and Savings plans

Q9. Reinsurance means

Purchase of additional insurance by an insured person

Bringing into force a lapsed policy

Insurers seeking transfer of risk to shield themselves from over insurance

An individual insuring with different insurance companies

Q10. Which of the following statements does not apply to Direct Marketing in life insurance ?

Sourcing the business through agent advisors

Contract is concluded between the insurance companies and insured with no middlemen.

E sales refers to sales of insurance product through internet where no intermediaries are involved

The Insurance companies can sell the products much cheaper as no intermediary commissions are eliminated

Submit Assessment Cancel

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- ACC2206 Topic 9 and 10 Analysis & Interpretation of Financial ReportsDokument39 SeitenACC2206 Topic 9 and 10 Analysis & Interpretation of Financial ReportsDB BDNoch keine Bewertungen

- Chapter 8 Corporate FinanceDokument34 SeitenChapter 8 Corporate FinancediaNoch keine Bewertungen

- House No.257 Block C Unit No.10 Latifabad Abdul Khalid: Sun, 29 Sep 2019 22:47:21 +0500Dokument3 SeitenHouse No.257 Block C Unit No.10 Latifabad Abdul Khalid: Sun, 29 Sep 2019 22:47:21 +0500Ebad KhanNoch keine Bewertungen

- Simple Mortgage DeedDokument3 SeitenSimple Mortgage DeedkjapashaNoch keine Bewertungen

- Amat 172 Le3Dokument1 SeiteAmat 172 Le3Jan Christopher D. MendozaNoch keine Bewertungen

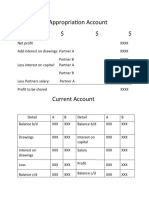

- Accounting-Formats For Cambridge IGCSEDokument11 SeitenAccounting-Formats For Cambridge IGCSEmuhtasim kabir100% (9)

- UtangDokument10 SeitenUtangrex tanongNoch keine Bewertungen

- AOA FOrmat - Public Limited CompanyDokument10 SeitenAOA FOrmat - Public Limited CompanyChethan VenkateshNoch keine Bewertungen

- DameDokument22 SeitenDameAgus SetionoNoch keine Bewertungen

- Eft How It Works Flier PDFDokument2 SeitenEft How It Works Flier PDFMikeDouglas100% (3)

- Cash Budgeting TutorialDokument4 SeitenCash Budgeting Tutorialmichellebaileylindsa100% (1)

- The Fundamental of LoanDokument6 SeitenThe Fundamental of LoanPratiksha MisalNoch keine Bewertungen

- Presentation On Senior Citizen Savings Scheme Post Office Term DepositDokument15 SeitenPresentation On Senior Citizen Savings Scheme Post Office Term DepositsnehagptNoch keine Bewertungen

- Bancassurance in Pakistan M A AhmedDokument39 SeitenBancassurance in Pakistan M A AhmedMuzammil HassanNoch keine Bewertungen

- Repuela Vs Estate of Sps. LarawanDokument9 SeitenRepuela Vs Estate of Sps. LarawangsNoch keine Bewertungen

- Loan To DirectorsDokument9 SeitenLoan To DirectorsManoj Kumar SinsinwarNoch keine Bewertungen

- CC21198 AnnualReturnSummary AR008Dokument3 SeitenCC21198 AnnualReturnSummary AR008Slate WilsonNoch keine Bewertungen

- Multiple Choice Questions. Write The Letter of The Best Answer in A Separate Sheet and Submit in The Google DriveDokument4 SeitenMultiple Choice Questions. Write The Letter of The Best Answer in A Separate Sheet and Submit in The Google DrivealyannahhidagoNoch keine Bewertungen

- Nolo Press Leases and Rental Agreements 6th (2005) PDFDokument189 SeitenNolo Press Leases and Rental Agreements 6th (2005) PDFGary SNoch keine Bewertungen

- CF MCQ ShareDokument17 SeitenCF MCQ ShareMadhav RajbanshiNoch keine Bewertungen

- Lakshwiz Bazaar - Marketing Case Study Challenge.Dokument3 SeitenLakshwiz Bazaar - Marketing Case Study Challenge.Dushyant Singh SolankiNoch keine Bewertungen

- Cruz Inc Statement of Operating Activities Indirect Method Direct MethodDokument2 SeitenCruz Inc Statement of Operating Activities Indirect Method Direct MethodKailash KumarNoch keine Bewertungen

- How Are Notes Payable Different From Accounts Payable?Dokument3 SeitenHow Are Notes Payable Different From Accounts Payable?Ellaine Pearl AlmillaNoch keine Bewertungen

- Company Profile DDDokument71 SeitenCompany Profile DDAnonymous H9Qg1iNoch keine Bewertungen

- Assignment Topic: Pakistan Monetary Policy in Last 5 DecadesDokument10 SeitenAssignment Topic: Pakistan Monetary Policy in Last 5 DecadesIsra ChaudhryNoch keine Bewertungen

- Dividend Decisions PDFDokument10 SeitenDividend Decisions PDFPradeepKumarNoch keine Bewertungen

- Test Bank For Principles of Corporate Finance 10th Edition Brealey, Myers, AllenDokument53 SeitenTest Bank For Principles of Corporate Finance 10th Edition Brealey, Myers, Allena682182415100% (2)

- Disability Plan - Short-TermDokument5 SeitenDisability Plan - Short-Termrip982Noch keine Bewertungen

- Corporation Hand Out - RevisedDokument21 SeitenCorporation Hand Out - RevisedAnnie RapanutNoch keine Bewertungen

- Long-Term Financial Planning and Growth: Answers To Concepts Review and Critical Thinking Questions 1Dokument33 SeitenLong-Term Financial Planning and Growth: Answers To Concepts Review and Critical Thinking Questions 1RabinNoch keine Bewertungen