Beruflich Dokumente

Kultur Dokumente

Tujijenge Afrika - GSBI 2010 - Factsheet

Hochgeladen von

seincstsCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Tujijenge Afrika - GSBI 2010 - Factsheet

Hochgeladen von

seincstsCopyright:

Verfügbare Formate

I M P R O V I N G L I V E S T H R O U G H I N N O VAT I V E M I C R O F I N A N C E

AND MOBILE BANKING SOLUTIONS

Tujijenge Afrika - GSBI™ Class of 2010

Headquarters: Dar es Salaam, Problem Statement:

Tanzania

In Tanzania 90% of the population does not have access to finan-

Established: 2006 cial services, and even more people live without electricity and

health care. A lack of competitive and robust microfinance institu-

Impact Areas: Tanzania and tions has inhibited innovation in the sector, causing people to rely

Uganda

on expensive financing alternatives that perpetuate a lifestyle of

Type: Hybrid poverty.

Sector: Microfinance

Staff Size: 120+

Annual Budget: $1.5 million

Major Funders: Triple Jump,

E+CO, Unitus, Deutsche Bank, Grass-

roots Capital, Cordaid, Oxfam Novib

Awards: 2010 Lighting Africa Award

Winner for partnership with D.Light

2010 Recognized by CGAP as one of

leading MFI’s in microfinance industry

for mobile banking

2010 Represented Tanzanian microfi-

nance industry at the World Economic

Forum in Dar-es-Salaam

Theory of Change:

Tujijenge Afrika increases income lev-

els and improves lives by leveraging

Solution:

mobile banking with energy, health-

care, and agriculture microfinance. The Tujijenge Afrika family of microfinance institutions (MFIs)

provides microfinance products through a mobile banking system

that is safe, secure and low cost. Tujijenge improves the lives of

low income, rural and urban clients in East Africa with services

that are not typically covered by other financial institutions.

“While over 20,000 people have benefited from Tujijenge’s regular credit and savings prod-

ucts, we at Tujijenge have developed innovative energy, health care and agriculture micro-

finance products that are making an even greater economic impact than traditional microfi-

nance.” - Jon Charles Gore, Business Development Executive

| www.tujijengeafrika.org | tujijengetanzania@tujijenge.org | + 255 22 2701 025 |

I M P R O V I N G L I V E S T H R O U G H I N N O VAT I V E M I C R O F I N A N C E

AND MOBILE BANKING SOLUTIONS

Milestones Achieved: Impact to Date:

2006: Started first microfinance opera- • Provided over 20,000 microloans to entrepreneurs in East

tions in Dar es Salaam, Tanzania Africa

• Offered easy and affordable access to health care for large

2008: Improved internal controls and segments of the population previously untouched ($100 for

updated banking software to prevent a family of five covers regular insurance)

fraud and improve efficiencies • Established a mobile banking system for clients to safely

2009: Became the first and exclusive and conveniently repay their loans

mobile banking provider in Tanzania • Partnered with two innovative solar energy companies to

provide access to light in villages and off grid locations

2009: Started Tujijenge Uganda, a

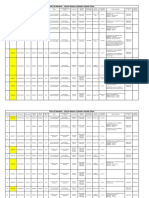

rural based MFI that provides agricul- Revenues vs. Costs

ture products

2010: Grew our Tanzania portfolio

outstanding to $3 million

Growth Plan:

2010 to 2011: Scale up mobile bank-

ing services in Tanzania to allow for

nationwide services

2011: Become regulated as a formal

bank in Tanzania

Total Clients vs. Cost per Borrower

2012: Merge our two Tanzanian MFIs

2012: Begin operations in Burundi

2014: Begin operations in Democratic

Republic of Congo

“Because of Tujijenge I now manage

to earn enough to support my family

and school-going children. Previ-

ously, I was scared about the future,

but now, I will be opening another Investment Required:

salon later this year. For this I thank Equity for two institutions totaling $800k in 2010 – 2011

Tujijenge for caring for me.” - Mama Debt for two institutions totaling $4 million in 2010 – 2013

Hans, 3-year customer and Salon Grants totaling $100k for product development and rural expan-

owner in Dar es Salaam. sion in 2010 – 2011.

This profile was developed during the 2010 Global Social Benefit Incubator™, the signature program of

Santa Clara University’s Center for Science, Technology and Society.

Updated 8/26/2010. www.scu.edu/sts/gsbi

| www.tujijengeafrika.org | tujijengetanzania@tujijenge.org | + 255 22 2701 025 |

Das könnte Ihnen auch gefallen

- Movirtu - Public GSBI 2010 - FactsheetDokument2 SeitenMovirtu - Public GSBI 2010 - FactsheetseincstsNoch keine Bewertungen

- Mission Goorgoorlu - GSBI 2010 - FactsheetDokument2 SeitenMission Goorgoorlu - GSBI 2010 - FactsheetseincstsNoch keine Bewertungen

- IDEI - Tech Awards 2010 - Innovation ProfileDokument2 SeitenIDEI - Tech Awards 2010 - Innovation ProfileseincstsNoch keine Bewertungen

- We Care Solar - GSBI 2010 - FactsheetDokument2 SeitenWe Care Solar - GSBI 2010 - FactsheetseincstsNoch keine Bewertungen

- The Force For Rural Empowerment and Economic Development (FREED) - GSBI 2010 - FactsheetDokument2 SeitenThe Force For Rural Empowerment and Economic Development (FREED) - GSBI 2010 - FactsheetseincstsNoch keine Bewertungen

- Paradigm Initiative Nigeria - GSBI 2010 - FactsheetDokument2 SeitenParadigm Initiative Nigeria - GSBI 2010 - FactsheetseincstsNoch keine Bewertungen

- Re:char - GSBI 2010 - FactsheetDokument2 SeitenRe:char - GSBI 2010 - FactsheetseincstsNoch keine Bewertungen

- Solar Ear - GSBI 2010 - FactsheetDokument2 SeitenSolar Ear - GSBI 2010 - FactsheetseincstsNoch keine Bewertungen

- Promethean Power Systems, Inc. - GSBI 2010 - FactsheetDokument2 SeitenPromethean Power Systems, Inc. - GSBI 2010 - FactsheetseincstsNoch keine Bewertungen

- Jaipur Rugs Foundation - GSBI 2010 - FactsheetDokument2 SeitenJaipur Rugs Foundation - GSBI 2010 - FactsheetseincstsNoch keine Bewertungen

- MAARDEC - GSBI 2010 - FactsheetDokument2 SeitenMAARDEC - GSBI 2010 - FactsheetseincstsNoch keine Bewertungen

- African Biofuel and Emission Reduction - GSBI 2010 - FactsheetDokument2 SeitenAfrican Biofuel and Emission Reduction - GSBI 2010 - FactsheetseincstsNoch keine Bewertungen

- Energy Plus LTD - GSBI 2010 - FactsheetDokument2 SeitenEnergy Plus LTD - GSBI 2010 - FactsheetseincstsNoch keine Bewertungen

- Energy in Common - GSBI 2010 - FactsheetDokument2 SeitenEnergy in Common - GSBI 2010 - FactsheetseincstsNoch keine Bewertungen

- AVANI - GSBI 2010 - FactsheetDokument2 SeitenAVANI - GSBI 2010 - FactsheetseincstsNoch keine Bewertungen

- Alternative Energy Development Corporation - GSBI 2010 - FactsheetDokument2 SeitenAlternative Energy Development Corporation - GSBI 2010 - FactsheetseincstsNoch keine Bewertungen

- World of Good Development Organization - GSBI 2010 - FactsheetDokument2 SeitenWorld of Good Development Organization - GSBI 2010 - FactsheetseincstsNoch keine Bewertungen

- Act/if Electropower - GSBI 2010 - FactsheetDokument2 SeitenAct/if Electropower - GSBI 2010 - FactsheetseincstsNoch keine Bewertungen

- Literacy Bridge - GSBI 2010 - FactsheetDokument2 SeitenLiteracy Bridge - GSBI 2010 - FactsheetseincstsNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- FS2004 - The Aircraft - CFG FileDokument5 SeitenFS2004 - The Aircraft - CFG FiletumbNoch keine Bewertungen

- CR Vs MarubeniDokument15 SeitenCR Vs MarubeniSudan TambiacNoch keine Bewertungen

- Experiences from OJT ImmersionDokument3 SeitenExperiences from OJT ImmersionTrisha Camille OrtegaNoch keine Bewertungen

- House Rules For Jforce: Penalties (First Offence/Minor Offense) Penalties (First Offence/Major Offence)Dokument4 SeitenHouse Rules For Jforce: Penalties (First Offence/Minor Offense) Penalties (First Offence/Major Offence)Raphael Eyitayor TyNoch keine Bewertungen

- Guidelines On Occupational Safety and Health in Construction, Operation and Maintenance of Biogas Plant 2016Dokument76 SeitenGuidelines On Occupational Safety and Health in Construction, Operation and Maintenance of Biogas Plant 2016kofafa100% (1)

- Hindustan Motors Case StudyDokument50 SeitenHindustan Motors Case Studyashitshekhar100% (4)

- Exercises 6 Workshops 9001 - WBP1Dokument1 SeiteExercises 6 Workshops 9001 - WBP1rameshqcNoch keine Bewertungen

- Intro To Gas DynamicsDokument8 SeitenIntro To Gas DynamicsMSK65Noch keine Bewertungen

- UAPPDokument91 SeitenUAPPMassimiliano de StellaNoch keine Bewertungen

- RUJUKANDokument3 SeitenRUJUKANMaryTibanNoch keine Bewertungen

- GIS Multi-Criteria Analysis by Ordered Weighted Averaging (OWA) : Toward An Integrated Citrus Management StrategyDokument17 SeitenGIS Multi-Criteria Analysis by Ordered Weighted Averaging (OWA) : Toward An Integrated Citrus Management StrategyJames DeanNoch keine Bewertungen

- GATE ECE 2006 Actual PaperDokument33 SeitenGATE ECE 2006 Actual Paperkibrom atsbhaNoch keine Bewertungen

- Oxford Digital Marketing Programme ProspectusDokument12 SeitenOxford Digital Marketing Programme ProspectusLeonard AbellaNoch keine Bewertungen

- AsiaSat 7 at 105Dokument14 SeitenAsiaSat 7 at 105rahman200387Noch keine Bewertungen

- Energy AnalysisDokument30 SeitenEnergy Analysisca275000Noch keine Bewertungen

- Malware Reverse Engineering Part 1 Static AnalysisDokument27 SeitenMalware Reverse Engineering Part 1 Static AnalysisBik AshNoch keine Bewertungen

- Top Malls in Chennai CityDokument8 SeitenTop Malls in Chennai CityNavin ChandarNoch keine Bewertungen

- Rubber Chemical Resistance Chart V001MAR17Dokument27 SeitenRubber Chemical Resistance Chart V001MAR17Deepak patilNoch keine Bewertungen

- CMC Ready ReckonerxlsxDokument3 SeitenCMC Ready ReckonerxlsxShalaniNoch keine Bewertungen

- Moor, The - Nature - Importance - and - Difficulty - of - Machine - EthicsDokument4 SeitenMoor, The - Nature - Importance - and - Difficulty - of - Machine - EthicsIrene IturraldeNoch keine Bewertungen

- Axe Case Study - Call Me NowDokument6 SeitenAxe Case Study - Call Me NowvirgoashishNoch keine Bewertungen

- Striedter - 2015 - Evolution of The Hippocampus in Reptiles and BirdsDokument22 SeitenStriedter - 2015 - Evolution of The Hippocampus in Reptiles and BirdsOsny SillasNoch keine Bewertungen

- Cushman Wakefield - PDS India Capability Profile.Dokument37 SeitenCushman Wakefield - PDS India Capability Profile.nafis haiderNoch keine Bewertungen

- Sanhs Ipcrf TemplateDokument20 SeitenSanhs Ipcrf TemplateStephen GimoteaNoch keine Bewertungen

- Site Visit Risk Assessment FormDokument3 SeitenSite Visit Risk Assessment FormAmanuelGirmaNoch keine Bewertungen

- LM1011 Global ReverseLogDokument4 SeitenLM1011 Global ReverseLogJustinus HerdianNoch keine Bewertungen

- Electronics Ecommerce Website: 1) Background/ Problem StatementDokument7 SeitenElectronics Ecommerce Website: 1) Background/ Problem StatementdesalegnNoch keine Bewertungen

- M8-2 - Train The Estimation ModelDokument10 SeitenM8-2 - Train The Estimation ModelJuan MolinaNoch keine Bewertungen

- Service and Maintenance Manual: Models 600A 600AJDokument342 SeitenService and Maintenance Manual: Models 600A 600AJHari Hara SuthanNoch keine Bewertungen

- C6 RS6 Engine Wiring DiagramsDokument30 SeitenC6 RS6 Engine Wiring DiagramsArtur Arturowski100% (3)