Beruflich Dokumente

Kultur Dokumente

Part 2 Integrative Case

Hochgeladen von

ebebebyayayaOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Part 2 Integrative Case

Hochgeladen von

ebebebyayayaCopyright:

Verfügbare Formate

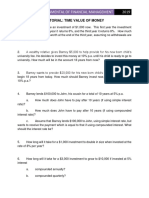

This case draws on material from Chapters 3-7

Adam Rust looked at his mechanic and sighed. The mechanic had just pronounced a

death sentence on this road-weary car. The car had served him well-at a cost of $500

it had lasted through four years of college with minimal repairs. Now, he desperately

needs wheels. He has just graduated, and has a good job at a decent starting salary. He

hopes to purchase his first new car. The car dealer seems very optimistic about this

ability to afford the car payments, another first for him.

The car Adam is considering to buy is $35,000. The dealer has given him three

payment options:

1. Zero percent financing. Make a $4,000 down payment from his savings and

finance the remainder with a 0% APR loan for 48 months. Adam has more

than enough cash for the down payment, thanks to generous graduation gifts.

2. Rebate with no money down. Receive a $4,000 rebate, which he would use for

the down payment (and leave his savings intact), and finance the rest with a

standard 48-month loan, with an 8% APR. He likes this option, as he could

think of many other uses for the $4,000.

3. Pay cash. Get the $4,000 rebate and pay the rest with cash. While Adam does

not have $35,000, he wants to evaluate this option. His parents always paid

cash when they bought a family car; Adam wonders if this really was a good

idea.

Adams fellow graduate, Jenna Hawthorne, was lucky. Her parents gave her a car for

graduation. Okay, it was a little Hyundai, and definitely not her dream car, but it was

serviceable, and Jenna didnt have to worry about buying a new car. In fact, Jenna has

trying to decide how much of her new salary she could save. Adam knows that with a

hefty car payment, savings for retirement would be very low on his priority list. Jenna

believes she could easily set aside $3000 of her $45000 salary. She is considering

putting her savings in a stock fund. She just turned 22 and has a long way to go until

retirement at age 65, and she considers this risk level reasonable. The fund she is

looking at has earned an average of 9% over the past 15 years and could be expected

to continue earning this amount, on average. While she has no current retirement

savings, five years ago Jennas grandparents gave her a new 30-year U.S. Treasury

bond with a $10,000 face value.

Jenna wants to know her retirement income is she both (1) sells her Treasury bond at

its current market value and invests the proceeds in the stock fund and (2) saves an

additional $3000 at the end of each year in the stock fund from now until she turns 65.

Once she retires, Jenna wants those savings to last for 25 years until she is 90.

Both Adam and Jenna need to determine their best options.

Case Questions

1. What are the cash flows associated with each of Adams three car financing

options?

2. Suppose that, similar to his parents, Adam had plenty of cash in the bank so

that he could easily afford to pay cash for the car without running into debt

now or in the foreseeable future. If his cash earns interest at a 5.4% APR

(based on monthly compounding) at the bank, what would be his best

purchase option for the car?

3. In fact, Adam doesnt have sufficient cash to cover all his debts including his

(substantial) student loans, The loans have a 10% APR, and any money spent

on the car could not be used to pay down the loans. What is the best option for

Adam now? (Hint: Note that having an extra $1 today saves Adam roughly

$1.10 next year because he can pay down the student loans. So, 10% is

Adams time value of money in the case.)

4. Suppose instead Adam has a lot of credit card debt, with an 18% APR, and he

doubts he will pay off this debt completely before he pays off the car. What is

Adams best option now?

5. Suppose Jennas Treasury bond has a coupon interest rate of 6.5%, paid semi-

annually, while current Treasury bonds with the same maturity date have a

yield to maturity of 5.4435% (expressed as an APR with semi-annual

compounding). If she has just received the bonds 10th coupon, for how much

can Jenna sell her treasury bond?

6. Suppose Jenna sells the bond, reinvests the proceeds, and then saves as she

planned. If, instead, Jenna earns a 9% annual return on her savings, how much

could she withdraw each year in retirement? (Assume she begins withdrawing

the money from the account in equal accounts at the end of each year once her

retirement begins.)

7. Should Jenna sell her Treasury bond and invest the proceeds in the stock fund?

Give at least one reason for and against this plan.

8. At the last minute, Jenna considers investing in Coca-Cola stock at a price of

$55.55 per share instead. The stock just paid an annual dividend of $1.76 and

she expects the dividend to grow at 4% annually. If the next dividend is due in

one year, what expected return is Coca-Cola stock offering?

Das könnte Ihnen auch gefallen

- Get Out of Debt! Book Three: Improving Your Quality of LifeVon EverandGet Out of Debt! Book Three: Improving Your Quality of LifeNoch keine Bewertungen

- Integrative Case (Chapter 3-7)Dokument2 SeitenIntegrative Case (Chapter 3-7)Kate SmithNoch keine Bewertungen

- Ch4ProbsetTVM13ed - MasterDokument4 SeitenCh4ProbsetTVM13ed - MasterRisaline CuaresmaNoch keine Bewertungen

- You Can Now Skip Car Loan Payments: Don’t Skip Car Loan Payments!: Financial Freedom, #116Von EverandYou Can Now Skip Car Loan Payments: Don’t Skip Car Loan Payments!: Financial Freedom, #116Noch keine Bewertungen

- Aiphung - 9p15p16p2Dokument16 SeitenAiphung - 9p15p16p2Trần Minh KhôiNoch keine Bewertungen

- TenNhom Lab8Dokument15 SeitenTenNhom Lab8Mẫn ĐứcNoch keine Bewertungen

- Cashing in on Credit Cards: Scott A. Wheeler, Rt(R)(Mr)(Ct)Von EverandCashing in on Credit Cards: Scott A. Wheeler, Rt(R)(Mr)(Ct)Bewertung: 4.5 von 5 Sternen4.5/5 (4)

- TenNhom Lab8Dokument15 SeitenTenNhom Lab8Mẫn ĐứcNoch keine Bewertungen

- Time Value of Money Practice MathDokument2 SeitenTime Value of Money Practice MathRafiul Islam AdibNoch keine Bewertungen

- Eb 2 A 97 EfDokument15 SeitenEb 2 A 97 EfMẫn ĐứcNoch keine Bewertungen

- Excel Co BanDokument14 SeitenExcel Co BanAnh Ngô BảoNoch keine Bewertungen

- Practice Set - TVMDokument2 SeitenPractice Set - TVMVignesh KivickyNoch keine Bewertungen

- Practice Assignment 2Dokument2 SeitenPractice Assignment 2Santiago BohnerNoch keine Bewertungen

- Practice Problem Set #3: Time Value of Money Theoretical and Conceptual Questions: (See Notes or Textbook For Solutions)Dokument3 SeitenPractice Problem Set #3: Time Value of Money Theoretical and Conceptual Questions: (See Notes or Textbook For Solutions)raymondNoch keine Bewertungen

- Chapter 5 - Practice Questions Set 2Dokument3 SeitenChapter 5 - Practice Questions Set 2Germain LacretteNoch keine Bewertungen

- Practices: Time Value of MoneyDokument9 SeitenPractices: Time Value of MoneysovuthyNoch keine Bewertungen

- Time Value of Money 2Dokument6 SeitenTime Value of Money 2k61.2211155018Noch keine Bewertungen

- 2022-Sesi 8-Bond Valuation-Ed 12Dokument3 Seiten2022-Sesi 8-Bond Valuation-Ed 12Gabriela ClarenceNoch keine Bewertungen

- TVM WorksheetsDokument4 SeitenTVM WorksheetsRia Pius100% (1)

- TVM WorksheetsDokument4 SeitenTVM WorksheetsRia PiusNoch keine Bewertungen

- Tutorial 2 (TVM) - Questions: Present Value Years Future ValueDokument2 SeitenTutorial 2 (TVM) - Questions: Present Value Years Future ValueSadia R ChowdhuryNoch keine Bewertungen

- Test 6 ReviewDokument4 SeitenTest 6 Reviewapi-298215585Noch keine Bewertungen

- Scenario - Teacher NotesDokument2 SeitenScenario - Teacher Notessmruti sandipNoch keine Bewertungen

- BT Chap 5Dokument4 SeitenBT Chap 5Hang NguyenNoch keine Bewertungen

- Handout2 PDFDokument2 SeitenHandout2 PDFTheresiaVickaaNoch keine Bewertungen

- Lahore School of Economics Financial Management I Time Value of Money - 2 Assignment 3Dokument2 SeitenLahore School of Economics Financial Management I Time Value of Money - 2 Assignment 3Ahmed ZafarNoch keine Bewertungen

- University of Saint LouisDokument3 SeitenUniversity of Saint LouisRommel RoyceNoch keine Bewertungen

- Assignment 1Dokument4 SeitenAssignment 1Abhay PoddarNoch keine Bewertungen

- Time Value of MoneyDokument6 SeitenTime Value of MoneyRezzan Joy Camara MejiaNoch keine Bewertungen

- Advanced Corporate Finance Group Assignment PDFDokument8 SeitenAdvanced Corporate Finance Group Assignment PDFaddisie temesgenNoch keine Bewertungen

- TaichinhdoanhngiepDokument3 SeitenTaichinhdoanhngiepLê KhánhNoch keine Bewertungen

- Chapter 3: Valuing Bond: Consider The Following Three StocksDokument2 SeitenChapter 3: Valuing Bond: Consider The Following Three StocksQuân VõNoch keine Bewertungen

- Time Value of MoneyDokument1 SeiteTime Value of MoneyperiNoch keine Bewertungen

- Tutorial QuestionsDokument15 SeitenTutorial QuestionsWowKid50% (2)

- Mod9top1 App CreditfileDokument1 SeiteMod9top1 App CreditfileRidhi PapineniNoch keine Bewertungen

- FINMA1 - Time Value of Money Practice ProblemsDokument1 SeiteFINMA1 - Time Value of Money Practice Problemseath__Noch keine Bewertungen

- Tutorial TVM - S2 - 2021.22Dokument5 SeitenTutorial TVM - S2 - 2021.22Ngoc HuynhNoch keine Bewertungen

- Week1 in Class ExerciseDokument12 SeitenWeek1 in Class Exercisemuhammad AdeelNoch keine Bewertungen

- Practice Questions - Time Value of MoneyDokument1 SeitePractice Questions - Time Value of MoneySedef ErgülNoch keine Bewertungen

- Note ôn tập MidtermDokument5 SeitenNote ôn tập MidtermChu Thị Thanh ThảoNoch keine Bewertungen

- Time Value of Money Practice ProblemsDokument5 SeitenTime Value of Money Practice ProblemsMarkAntonyA.RosalesNoch keine Bewertungen

- Extra Ex For Mid TermDokument5 SeitenExtra Ex For Mid TermQuân VõNoch keine Bewertungen

- Name: - 5.1 Problem Set 115Dokument14 SeitenName: - 5.1 Problem Set 115Clair BlushNoch keine Bewertungen

- Exercises - Corporate Finance 1Dokument12 SeitenExercises - Corporate Finance 1Hông HoaNoch keine Bewertungen

- FINANCIAL MANAGEMENT Cases For Time Value of MoneyDokument1 SeiteFINANCIAL MANAGEMENT Cases For Time Value of MoneyAliyaaaahNoch keine Bewertungen

- Assignment 1Dokument7 SeitenAssignment 1Camilo Andres MesaNoch keine Bewertungen

- Bài Tập ThêmDokument9 SeitenBài Tập ThêmK59 Vu Nguyen Viet LinhNoch keine Bewertungen

- IEOR 221 s2016 Homework 1Dokument2 SeitenIEOR 221 s2016 Homework 1Suman BalaNoch keine Bewertungen

- FinanceDokument10 SeitenFinanceHaley Hamill100% (1)

- Chapter 4 Questions V4Dokument7 SeitenChapter 4 Questions V4darrrriaNoch keine Bewertungen

- Time Value of MoneyDokument9 SeitenTime Value of Moneyelarabel abellareNoch keine Bewertungen

- Tutorial 23 SeptemberDokument3 SeitenTutorial 23 SeptemberpalilesediNoch keine Bewertungen

- Additional Time Value ProblemsDokument2 SeitenAdditional Time Value ProblemsBrian WrightNoch keine Bewertungen

- Tutorial 1Dokument4 SeitenTutorial 1Thuận Nguyễn Thị KimNoch keine Bewertungen

- Purchasing A CarDokument3 SeitenPurchasing A Carapi-256424427Noch keine Bewertungen

- Tutorial Time Value of MoneyDokument5 SeitenTutorial Time Value of MoneyNgọc Ngô Minh TuyếtNoch keine Bewertungen

- Chapter 5 ExercisesDokument2 SeitenChapter 5 ExercisesTranh Meow MeowNoch keine Bewertungen

- Examen - 3 Valor Del Dinero en El Tiempo - ValuDokument17 SeitenExamen - 3 Valor Del Dinero en El Tiempo - ValuMiguel VázquezNoch keine Bewertungen

- Lecture 3: ARMA Models: Nan-Jung HsuDokument31 SeitenLecture 3: ARMA Models: Nan-Jung HsuebebebyayayaNoch keine Bewertungen

- Classic Decomposition and EDA: Nan-Jung HsuDokument18 SeitenClassic Decomposition and EDA: Nan-Jung HsuebebebyayayaNoch keine Bewertungen

- Lecture 1: Introduction: Nan-Jung HsuDokument37 SeitenLecture 1: Introduction: Nan-Jung HsuebebebyayayaNoch keine Bewertungen

- 109 學年度校本部暨南大校區 106 學年度以後入學學生畢業離校 程序公告 (2021 School leaving procedure notice)Dokument2 Seiten109 學年度校本部暨南大校區 106 學年度以後入學學生畢業離校 程序公告 (2021 School leaving procedure notice)ebebebyayayaNoch keine Bewertungen

- EAR Versus APRDokument2 SeitenEAR Versus APRebebebyayayaNoch keine Bewertungen

- Adv3 FinalsDokument7 SeitenAdv3 FinalsMylscheNoch keine Bewertungen

- Silabus PA - Genap2021-22 - Non-AkuntansiDokument4 SeitenSilabus PA - Genap2021-22 - Non-AkuntansiGea CherlitaNoch keine Bewertungen

- RSA Vs RSUDokument15 SeitenRSA Vs RSUEleonora Buzzetti0% (1)

- Toa PreboardDokument9 SeitenToa PreboardLeisleiRagoNoch keine Bewertungen

- Study On Awareness of Mutual FundDokument75 SeitenStudy On Awareness of Mutual FundSHELDEN LOPES100% (2)

- POB P1 JUN 2014 - Answers PDFDokument9 SeitenPOB P1 JUN 2014 - Answers PDFStacy ann williamsNoch keine Bewertungen

- Allison Blake ResumeDokument1 SeiteAllison Blake Resumeapi-380141609Noch keine Bewertungen

- Arbitrage in India: Past, Present and FutureDokument22 SeitenArbitrage in India: Past, Present and FuturetushartutuNoch keine Bewertungen

- Advanced Financial AccountingDokument6 SeitenAdvanced Financial AccountingsathishNoch keine Bewertungen

- Julia Haart v. Silvio Scaglia, Amended and Supplemental Verified Petition For ReliefDokument46 SeitenJulia Haart v. Silvio Scaglia, Amended and Supplemental Verified Petition For ReliefDebbie MolloyNoch keine Bewertungen

- Chapter 6 (Efficient Capital Market)Dokument44 SeitenChapter 6 (Efficient Capital Market)Abuzafar Abdullah100% (1)

- Accounting and Finance For The Non Financial Executive - An IntDokument305 SeitenAccounting and Finance For The Non Financial Executive - An Intgasiorska100% (2)

- Annual Report of The Keepers Holdings. Inc. For Cy 2021Dokument201 SeitenAnnual Report of The Keepers Holdings. Inc. For Cy 2021ignaciomannyNoch keine Bewertungen

- Simon Cash Machine1Dokument12 SeitenSimon Cash Machine1TerryNoch keine Bewertungen

- A Snapshot: Grupo Empresarial San José, S.A. by Gotham InsightsDokument15 SeitenA Snapshot: Grupo Empresarial San José, S.A. by Gotham InsightsGotham Insights100% (1)

- Financial Management Paper f9 Revision Question Bank F 9fm RQB As d08Dokument153 SeitenFinancial Management Paper f9 Revision Question Bank F 9fm RQB As d08Ranjisi chimbanguNoch keine Bewertungen

- Chapter 4 - Fundamentals of Corporate Finance 9th Edition - Test BankDokument26 SeitenChapter 4 - Fundamentals of Corporate Finance 9th Edition - Test BankKellyGibbons100% (2)

- Mutual Funds at KarvyDokument77 SeitenMutual Funds at KarvyNaveen KumarNoch keine Bewertungen

- Solution Ipa Week 1 Chapter 3Dokument47 SeitenSolution Ipa Week 1 Chapter 3Aura MaghfiraNoch keine Bewertungen

- A 11 Internal Reconstruction of A CompanyDokument18 SeitenA 11 Internal Reconstruction of A CompanyDhananjay Pawar50% (2)

- History of The Indian Stock MarketDokument11 SeitenHistory of The Indian Stock MarketManasi30Noch keine Bewertungen

- Financial Accounting and Reporting (Accounting 15) InvestmentsDokument10 SeitenFinancial Accounting and Reporting (Accounting 15) InvestmentsJoel Christian MascariñaNoch keine Bewertungen

- Union Bank of India FormatDokument1 SeiteUnion Bank of India FormatboomtechNoch keine Bewertungen

- Corpo RecapDokument8 SeitenCorpo RecapErwin April MidsapakNoch keine Bewertungen

- Kinfo Import TemplateDokument4 SeitenKinfo Import Templatemaik practiceNoch keine Bewertungen

- Ebook PDF Corporate Finance 8th Canadian Edition by Stephen A Ross PDFDokument41 SeitenEbook PDF Corporate Finance 8th Canadian Edition by Stephen A Ross PDFjennifer.browne345100% (37)

- 11 - Chapter 2Dokument98 Seiten11 - Chapter 2Nour Aira NaoNoch keine Bewertungen

- KEY WORDS - Income TaxationDokument23 SeitenKEY WORDS - Income TaxationQueenVictoriaAshleyPrietoNoch keine Bewertungen

- DAVAO v. APHIDokument2 SeitenDAVAO v. APHIEnverga Law School Corporation Law SC Division100% (1)

- BloombergBrief HF Newsletter 201459Dokument9 SeitenBloombergBrief HF Newsletter 201459AbhishekSinghGaurNoch keine Bewertungen