Beruflich Dokumente

Kultur Dokumente

ACC 547 OUTLET Empowering and Inspiring

Hochgeladen von

albert01230 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

50 Ansichten7 Seiten1. In 2016, Sayers, who is single, gave an outright gift of $50,000 to a friend, Johnson, who needed the money to pay medical expenses. In filing the 2016 gift tax return, Sayers was entitled to a maximum exclusion of

2. On July 1, 2016, Vega made a transfer by gift in an amount sufficient to require the filing of a gift tax return. Vega was still alive in 2016.

Originaltitel

ACC 547 OUTLET Empowering and Inspiring/acc547outlet.com

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument melden1. In 2016, Sayers, who is single, gave an outright gift of $50,000 to a friend, Johnson, who needed the money to pay medical expenses. In filing the 2016 gift tax return, Sayers was entitled to a maximum exclusion of

2. On July 1, 2016, Vega made a transfer by gift in an amount sufficient to require the filing of a gift tax return. Vega was still alive in 2016.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

50 Ansichten7 SeitenACC 547 OUTLET Empowering and Inspiring

Hochgeladen von

albert01231. In 2016, Sayers, who is single, gave an outright gift of $50,000 to a friend, Johnson, who needed the money to pay medical expenses. In filing the 2016 gift tax return, Sayers was entitled to a maximum exclusion of

2. On July 1, 2016, Vega made a transfer by gift in an amount sufficient to require the filing of a gift tax return. Vega was still alive in 2016.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 7

ACC 547 Final Exam Guide

FOR MORE CLASSES VISIT

www.acc547outlet.com

1. In 2016, Sayers, who is single, gave an outright gift of $50,000

to a friend, Johnson, who needed the money to pay medical

expenses. In filing the 2016 gift tax return, Sayers was entitled to a

maximum exclusion of

2. On July 1, 2016, Vega made a transfer by gift in an amount

sufficient to require the filing of a gift tax return. Vega was still alive

in 2016.

If Vega did not request an extension of time for filing the 2016 gift

tax return, the due date for filing was

3. Under the unified rate schedule,

4. During the current year, Mann, an unmarried U.S. citizen, made

a $5,000 cash gift to an only child and also paid $25,000 in tuition

expenses directly to a grandchild's university on the grandchild's

behalf. Mann made no other lifetime transfers. Assume that the gift

tax annual exclusion is $14,000. For gift tax purposes, what was

Mann's taxable gift?

5. George and Suzanne have been married for 40 years. Suzanne

inherited $1,000,000 from her mother. Assume that the annual gift-tax

exclusion is $14,000. What amount of the $1,000,000 can Suzanne

give to George without incurring a gift-tax liability?

6. Which of the following payments would require the donor to file

a gift tax return?

7. The answer to each of the following questions would be relevant

in determining whether a tuition payment made on behalf of another

individual is excludible for gift tax purposes, EXCEPT:

8. When Jim and Nina became engaged in April 2016, Jim gave

Nina a ring that had a fair market value of $50,000. After their

wedding in July 2016, Jim gave Nina $75,000 in cash so that Nina

could have her own bank account. Both Jim and Nina are U.S.

citizens.

What was the amount of Jim's 2016 marital deduction?

9. Jan, an unmarried individual, gave the following outright gifts in

2016:

10. Which one of the following is a valid deduction from a decedent's

gross estate?

11. Which of the following credits may be offset against the gross

estate tax to determine the net estate tax of a U.S. citizen?

12. Under which of the following circumstances is trust property with

an independent trustee includible in the grantor's gross estate?

13. Bell, a cash basis calendar year taxpayer, died on June 1, 2016. In

2016, prior to her death, Bell incurred $2,000 in medical expenses.

The executor of the estate paid the medical expenses, which were a

claim against the estate, on July 1, 2016.

If the executor files the appropriate waiver, the medical expenses are

deductible on

14. Within how many months after the date of a decedent's death is

the federal estate tax return (Form 706) due if no extension of time for

filing is granted?

15. The generation-skipping transfer tax is imposed

16. Fred and Amy Kehl, both U.S. citizens, are married. All of their

real and personal property is owned by them as tenants by the entirety

or as joint tenants with right of survivorship. The gross estate of the

first spouse to die

17. What is the due date of a federal estate tax return (Form 706), for

a taxpayer who died on May 15, year 2, assuming that a request for an

extension of time is not filed?

18. In connection with a "buy-sell" agreement funded by a cross-

purchase insurance arrangement, business associate Adam bought a

policy on Burr's life to finance the purchase of Burr's interest. Adam,

the beneficiary, paid the premiums and retained all incidents of

ownership.

On the death of Burr, the insurance proceeds will be

19. The federal estate tax may not be reduced by a credit of

20. Ordinary and necessary administration expenses of an estate are

deductible:

21. H and W are married citizens. All of their real and personal

property is owned as tenants by the entirety or as joint tenants with

right of survivorship. The gross estate of the first spouse to die:

22. Under the provisions of a decedent's will, the estate's executor

made the following cash disbursements:

I. A charitable bequest to the American Red Cross.

II. Payment of the decedent's funeral expenses.

What deduction(s) is(are) allowable in determining the decedent's

taxable estate?

23. Which of the following items of property would be included in

the gross estate of a decedent who died in 2016?

24. If the executor of a decedent's estate elects the alternate valuation

date and none of the property included in the gross estate has been

sold or distributed, the estate assets must be valued as of how many

months after the decedent's death?

------------------------------------------------------------------------------------

ACC 547 Week 1 Tax Research Paper

FOR MORE CLASSES VISIT

www.acc547outlet.com

Review two sources that discuss the different types of tax authority

(specifically primary and secondary sources).

Createa 700- to 1,050-word (at least meet the minimum words)

document that addresses the following:

What are the two different categories of tax research (open and

closed transactions)?

Of the two known sources, primary & secondary, which has more

authority ?

Explain your answer. Give three examples of primary and secondary

sources, discuss where you can find the sources, whether they are paid

or free sources, and what kind of information you will find about a

given tax situation.

------------------------------------------------------------------------------------

ACC 547 Week 2 Getting Personal

FOR MORE CLASSES VISIT

www.acc547outlet.com

Introduction

Gross Income

Above the Line Deductions

Itemize Deductions

Personal Exemptions

Taxable Income

Tax Credits

Conclusion

------------------------------------------------------------------------------------

ACC 547 Week 3 Comprehensive Problem Machines Inc

FOR MORE CLASSES VISIT

www.acc547outlet.com

Comprehensive Problem for Chapters 7 and 8. Sam Johnson started a

small machine shop, Machines, Inc., in his garage and incorporated it

in March of 2013 as a calendar-year corporation. At that time, he

began using his personal computer and tools solely for the business as

part of his contribution to the corporation. The computer cost $2,700

but had a fair market value of only $900 at conversion and the tools,

which had cost $1,500, were valued at $1,100. During 2013,

Machines, Inc. purchased two machines: Machine A, purchased on

May 2, cost $24,000; Machine B, purchased on June 5, cost $40,000.

The corporation expensed Machine A under Section 179. The

computer, tools, and Machine B were depreciated using accelerated

MACRS only. The corporation did not take any depreciation on the

garage nor did Sam charge the business rent because the business

moved to a building the business purchased for $125,000 on January

5, 2014. On January 20, 2014, Machines purchased $4,000 of office

furniture and on July 7, it purchased Machine C for $48,000. It

depreciated these assets under MACRS (including allowable bonus

depreciation), but did not use Section 179 expensing. Machines

acquired no new assets in 2015.

On February 4, 2016, Machines bought a new computer system for

$5,100. It sold the old computer the same day for $300. On March 15,

it sold Machine A for $6,000 and purchased a more versatile machine

for $58,000. On August 15, Machines sold bonds it had purchased

with $9,800 of the cash Sam had originally contributed to the

corporation for $10,400 to pay creditors. The business takes only the

maximum allowable MACRS depreciation deduction on assets

purchased in 2016 with no Section 179 expensing or bonus

depreciation.

Determine Machines, Inc.'s depreciation expense deductions for 2013

through 2016.Determine the realized and recognized gains or losses

on the property transactions in 2016.

------------------------------------------------------------------------------------

ACC 547 Week 5 Sales and Use Tax

FOR MORE CLASSES VISIT

www.acc547outlet.com

Sales and Use Tax: What is the Solution?

Introduction Sales and Use Tax Laws Should There Be a Federal

Sales and Use Tax System?

Conclusion

------------------------------------------------------------------------------------

ACC 547 Week 6 Godfreys Assets

FOR MORE CLASSES VISIT

www.acc547outlet.com

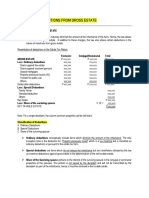

When Godfrey died in 2016, his assets were valued as follows:

Asset Date of death valuation Valuation six months later

Stocks $2,220,000 $2,180,000

Bonds 4,600,000 4,620,000

Home 800,000 780,000

Total $7,620,000 $7,580,000

The executor sold the stock two months after the decedent's death for

$2,200,000. The bonds were sold seven months after the decedent's

death for $4,630,000. What valuation should be used for the gross

estate? Prepare a 350- to 700-word document that addresses and

includes the amount of taxable estate for each of the following:

Address the question at the end of the scenario.

If Godfrey came to you before his death and told you that he had

a spouse and two children under the age of 18, what kind of

estate plan would you suggest for him?

What if Godfrey had no spouse but had two children under the

age of 18?

What if Godfrey had no spouse or children, but had a favorite

niece?

------------------------------------------------------------------------------------

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Estate Tax CasesDokument44 SeitenEstate Tax CasesStevensonYu100% (1)

- UP - UP v. City TreasurerDokument5 SeitenUP - UP v. City TreasurerYang AlcoranNoch keine Bewertungen

- Preboard CompreDokument191 SeitenPreboard CompreInny Agin100% (1)

- Tax QuestionsDokument10 SeitenTax QuestionsJake ManansalaNoch keine Bewertungen

- AEC 215 MidFinals ExamDokument8 SeitenAEC 215 MidFinals ExamHazel Seguerra BicadaNoch keine Bewertungen

- Estate of The Late Juliana Diez Vda. de Gabriel vs. CommissionerDokument15 SeitenEstate of The Late Juliana Diez Vda. de Gabriel vs. Commissionerangelsu04Noch keine Bewertungen

- Estate Tax ProblemsDokument3 SeitenEstate Tax ProblemsGwen BrossardNoch keine Bewertungen

- Composition of The Gross Estate of A DecedentDokument16 SeitenComposition of The Gross Estate of A DecedentBill BreisNoch keine Bewertungen

- Taxation Final Preboard CPAR 92 PDFDokument17 SeitenTaxation Final Preboard CPAR 92 PDFomer 2 gerdNoch keine Bewertungen

- Bussiness TaxationDokument5 SeitenBussiness TaxationnerieroseNoch keine Bewertungen

- DIGEST: de Borja V.S. de Borja 58 Phil. 811 (1933)Dokument4 SeitenDIGEST: de Borja V.S. de Borja 58 Phil. 811 (1933)Jhing Guzmana-UdangNoch keine Bewertungen

- Important Information For Using This Exported File From Quicken WillmakerDokument23 SeitenImportant Information For Using This Exported File From Quicken WillmakerAndrea HoffmanNoch keine Bewertungen

- Estate Tax SEC. 84. Rates of Estate Tax. - There Shall Be Levied, AssessedDokument7 SeitenEstate Tax SEC. 84. Rates of Estate Tax. - There Shall Be Levied, AssessedKyla IsidroNoch keine Bewertungen

- TSU-CBA Mid-Year 2021 Taxation NotesDokument3 SeitenTSU-CBA Mid-Year 2021 Taxation NotesMark Lawrence YusiNoch keine Bewertungen

- Gross EstateDokument3 SeitenGross EstateShielle AzonNoch keine Bewertungen

- Tax Estate TaxDokument13 SeitenTax Estate TaxAlbert Baclea-an100% (1)

- Transfer Tax ContinuationDokument6 SeitenTransfer Tax ContinuationSenianna HaleNoch keine Bewertungen

- Deductions From Gross EstateDokument20 SeitenDeductions From Gross EstateJamaica DavidNoch keine Bewertungen

- Final Report of The Expert Group On The Transfer of SMEsDokument79 SeitenFinal Report of The Expert Group On The Transfer of SMEsStudioCentroVeneto s.a.s.Noch keine Bewertungen

- Succession Case Digest 2Dokument103 SeitenSuccession Case Digest 2Lumawag SaimonNoch keine Bewertungen

- The Philippines As A StateDokument263 SeitenThe Philippines As A StateEloisa Katrina MadambaNoch keine Bewertungen

- INHERITANCE TAX DISPUTEDokument10 SeitenINHERITANCE TAX DISPUTEEmil BautistaNoch keine Bewertungen

- Title Iii Estate and Donor'S Taxes Chapter I - Estate TaxDokument9 SeitenTitle Iii Estate and Donor'S Taxes Chapter I - Estate TaxJan P. ParagadosNoch keine Bewertungen

- House Bill 1406: Washington State Wealth TaxDokument11 SeitenHouse Bill 1406: Washington State Wealth TaxGeekWireNoch keine Bewertungen

- Tax 2 Reviewer: A. Transfer TaxesDokument11 SeitenTax 2 Reviewer: A. Transfer TaxesIsay YasonNoch keine Bewertungen

- Annex C 0621-EADokument1 SeiteAnnex C 0621-EAMELLICENT LIANZANoch keine Bewertungen

- TAX 56 - Business and Transfer TaxesDokument8 SeitenTAX 56 - Business and Transfer TaxesAl JovenNoch keine Bewertungen

- First National Bank of Oregon, of The Estate of Fred M. Slade, Deceased v. United States, 488 F.2d 575, 1st Cir. (1973)Dokument5 SeitenFirst National Bank of Oregon, of The Estate of Fred M. Slade, Deceased v. United States, 488 F.2d 575, 1st Cir. (1973)Scribd Government DocsNoch keine Bewertungen

- Income Taxation PDFDokument4 SeitenIncome Taxation PDFRyon TagabanNoch keine Bewertungen

- Taxation Law: Answers To Bar Examination QuestionsDokument125 SeitenTaxation Law: Answers To Bar Examination QuestionsAnonymous bioCvBieYNoch keine Bewertungen