Beruflich Dokumente

Kultur Dokumente

Decision Making Process in Micro Small Medium Enterprises A Study On Dharwad District

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Decision Making Process in Micro Small Medium Enterprises A Study On Dharwad District

Copyright:

Verfügbare Formate

Volume 2, Issue 11, November 2017 International Journal Of Innovative Science And Research Technology

ISSN No:-2456 2165

Decision Making Process in Micro, Small & Medium

Enterprises; A Study on Dharwad District

Sandeep Kulkarni Dr. Amaresh K. Nashi

Department of Commerce, Swami Vivekanand University, M.Com, M. Phil, Ph.D

Sagar, M.P Department of Commerce, Swami Vivekanand University,

Sagar, M.P

Abstract:-Easy access to micro credit is significantly They state, Knowing an individuals decision style pattern,

associated with small business survival. Easy access to we can predict how he or she will react to various situations.

microfinance is closely associated with cordial relationship The DMS can be observed from relationships with others

and regular contact with loan field officer as well as through consultations, instructions, transferring

regular participation in microfinance. The responsibilities, or wanting to please certain people. Knowing

appropriateness of loan size, proper utilization of loan how and why decisions are taken can make the difference to

given and a good repayment plan schedule are the factors the types of DMS. Differences in demographics,

that make micro credit worthwhile for small business qualifications, socialisation, work scope, and business

operators. This Research Paper focuses its attention on environment can also affect a managers decision-making

investigating the effects of micro financing on small process and style.

business survival, growth and expansion in Dharwad

District. It intends to contribute to the array of literature Decision making in small industries is the important step to be

written by different scholars on decision making in Mses taken in small industries because the employees, clients and

Development. Despite its increasing roles, access to credit suppliers should know what decision will take about the raw

by Mses Remains one major constraint. This shows that material and about the product and about the machinery the

micro finance activities are relevant for the growth and small industries will take about the firm or their own life

development of Micro and Small-scale enterprises. .About their experience In relevant business or any other type

of business, and the reasons to start the business.

Availability of land and building ordinance or desire to own

I. INTRODUCTION enterprise. And selection of the location based on availability

of raw material or land and building or proximity to market or

Decision-making is a fundamental activity for everyone. It is a proximity to living place And the marketing strategy they are

cognitive function concerned with the process of reflecting on using advertisement, free sampling, and offers.

the consequences of a certain choice Employees are viewed as

managers in an organisation because they are increasingly In small industries they take a decision based on practical and

being asked to manage their work effectively. direct, brief and systematic, flexible and board and they

always seeking for practical result , best solution, a new idea

As innovation and creativity have been the talk of the world or a new method , and they give more attention to the current

today, more autonomy is being given to employees in making issue and problem , the future development and reaching the

decisions. Traditionally, according to Mintzberg, making target.

decisions was generally the managers job, the decisions made

would significantly affect the organisation. Therefore, it is In small industries when they do not know what actions

important to identify the type of decision-making styles should take they follow the heart, seek facts and the truth and

(DMS) a person is inclined to demonstrate. The existence of wait for some time to make decision. When they are in

different DMS has been acknowledged for decades, and one pressure to make a decision they fell stress, or concentrate on

prominent perspective is the four styles (i.e. directive, solving the problem they use technology plan to their

analytic, conceptual, and behavioural. industries.

IJISRT17NV56 www.ijisrt.com 160

Volume 2, Issue 11, November 2017 International Journal Of Innovative Science And Research Technology

ISSN No:-2456 2165

They use some technology application like internet, email, Society and Business Policy, and he was the recipient of the

word processing and data base. University Excellence in Teaching Award in 1989

In small industries they have some particular decision .they Marian R. Chertow Industrial symbiosis, as part of the

have some rules and regulation what employees and others emerging field of industrial ecology, demands resolute

should follow. attention to the flow of materials and energy through local and

regional economies. Industrial symbiosis engages traditionally

II. LITERATURE REVIEW separate industries in a collective approach to competitive

advantage involving physical exchange of materials, energy,

The challenges faced by small and medium enterprises water, and/or by-products.

(SMEs) in India are majorly that of financing. The vast

majority of micro and small enterprises (MSEs) in developing Cynthia A. Lengnick-Hall (Ph.D., University of Texas at

countries are located in industrial clusters, and the majority of Austin) is Associate Professor of Strategic Management in the

such clusters have yet to see their growth take off. Department of Management Studies at the University of

Minnesota, Duluth. Correspondence regarding this article can

MSME Development Organization (The Small Industries be sent to her at: Department of Management Studies, 110

Development Organization (SIDO)), headed by the Additional School of Business and Economics, University of Minnesota-

Secretary & Development commissioner (Micro, Small and Duluth.

Medium Enterprises), is one of the apex bodies of the

Government of India, Ministry of Micro, Small and Medium Mark L. Lengnick-Hall (Ph.D., Purdue University) is

Enterprises, to assist the Government in formulation of Assistant Professor of Human Resources Management in the

policies and programmes, projects schemes, etc., for the Department of Management Studies at the University of

promotion and development of Micro, Small and Medium Minnesota, Duluth.

Enterprises in the country and also coordinating and

monitoring the implementation of these policies and Craig, Mcintosh, and Bruce, Wydich (2004) Competition

programmes etc. Promotion and development of Micro, Small and Microfinance talks about competition between

and Medium Enterprises is primarily the responsibility of the microfinance in developing countries have increasing

States and Union Territories (UTs) and the role of the Central drastically over last decade. This paper shows borrower began

Government (including the MSME Development Organization to obtain multiple loans, creating negative externality that

(formerly known as SIDO)) in this field is to aid and assist the leads to less favourable equilibrium loan contracts for all

States/UTs in this endeavor. borrowers and also compared different countries competition

and performance by using longitudinal research. This method

III. DECISION MAKING has used nominal variables using lambda method.

The thought process of selecting a logical choice from the Anthony, J., Ody and David, de., Ferranti. (2007) Beyond

available options. When trying to make a good decision a Microfinance: Getting Capital to Small and Medium

person must weigh the positive and negative of each option, Enterprises to Fuel Faster Development. It differentiated

and consider all the alternatives. Small and medium-sized enterprises (SMEs) to fuel faster

development and has given various suggestions on new

Kurt J. Miesenbock is a lecturer at the University of options that will emerge for meeting SMEs' financial needs,

Economics, Vienna, Austria. The present literature on including commercial banks moving "down-market," micro-

international business falls into two main categories: the first credit institutions moving "up-market," and creative

covers multinational corporations, their development, application of venture capital investing ideas has been stated

organizational and marketing problems, and strategies; in this article.

Robert C. Ford is a professor of management at the University Abiola, Babajide (2012), this paper investigates the effects of

of Alabama at Birmingham. He has authored or coauthored microfinance on micro and small business growth in Nigeria.

two texts and a number of published articles in a variety of The objectives are to examine the effects of different loan

journals including the Academy of Management Journal, administration practices on small business growth criteria and,

Journal of Management, Journal of Applied Psychology, to examine the ability of Microfinance-Banks (MFBs) towards

California Management Review, and Business Horizons. transforming micro-businesses to formal small-scale

enterprises. The paper employed panel data and multiple

Woodrow D. Richardson is an assistant professor at the regression analysis to analyze randomly selected enterprises

University of Alabama at Birmingham. He has published in by microfinance banks in Nigeria. The paper recommends a

Health Care Management Review, Simulation & Gaming, and recapitalization of the Microfinance banks to enhance their

Small Business Controlling. He teaches courses in Business & capacity to support small business growth and expansion.

IJISRT17NV56 www.ijisrt.com 161

Volume 2, Issue 11, November 2017 International Journal Of Innovative Science And Research Technology

ISSN No:-2456 2165

Prof. Vinayak, Gopal, Patil (2011), this paper discuses

regarding microfinance - its nature, objectives, framework, V. DATA COLLECTION & ANALYSIS

principles, challenges and opportunities with the reference to

Indian context. The microfinance which is becoming more Selection of Organization: 25 MSEs are selected in

important financial Dharwad District for the study based on Convenient

sampling .

IV. OBJECTIVE Sampling Population: As many as 100 samples were

included as part of data for the study. These samples were

To Examine the Risk taking ability by employees collected from top, middle management executives & at

To analyze the emotional and attitudes levels of supervisory level from micro credit institutions and new

employees. business start-up in Dharwad.

To evaluate the characteristic of employees and Rating Data Collection: An exhaustive questionnaire was

the characteristic prepared and data was collected with regard to employee

To study the individual job fit. retention and loyalty.

Figure-1: Stages of Data Collection

Sources: Authors Compilation

Stages of Data Collection

An exhaustive empowerment questionnaire was put to test. Hypothesis

Several micro credit institutions and new business start-up ,

micro credit and business survival, micro credit institution and H0 Decision Making is significant contribution to the

business growth, collateral and micro credit angles were survival of MSEs in Dharwad District.

probed and a total of nearly 15 odd areas were identified, H1 Decision Making makes significant contribution to the

which were apt, valid and relevant on five point scale, viz: survival of MSEs in Dharwad District.

Strongly agree; Agree; cant say; Disagree; and strongly H0 Decision Making does not have the capability to

disagree. Such areas put to test includes understanding the influence the expansion capacity of MSEs in Dharwad

system of analytics within the organizations, level of adoption District.

, communication process adopted, decision making process, H1 Decision Making does have the capability to influence

delegation and shared responsibility, power distribution, the expansion capacity of MSEs in Dharwad District.

degree of trust & loyalty, employee participation and the like

were put to test.

IJISRT17NV56 www.ijisrt.com 162

Volume 2, Issue 11, November 2017 International Journal Of Innovative Science And Research Technology

ISSN No:-2456 2165

VI. ANALYSIS & INTERPRETATION industries are in sure region that help the Human beings

to paintings .

The Data collected has been primarily tabulated & Master As small scale industries constantly have most effective

table was prepared, equipment gadget which might be degrease their

Sample was tested for reliability using Cronbachs alpha, movement is to studied and persuade to the alternative

Percentage analysis is the basic tool for analysis, personnel for their betterment.

They train the personnel consistent with their work how

Regression analysis a statistical process for estimating the

to paintings in an machinery, technical work and many

relationships among variables is used.

others.

In owner and hirer of earth equipments it was an excellent

VII. SUGGESTIONS enjoy to me to realize about the small industries and how

they will take the selections.

In Small industries should increase the marketing

strategy and should give some offer, free sampling to the

REFERENCES

customers because the customer will get attract to the

product

In small industries they should use technology application [1]. Littlefield, E., Murduch, J., & Hashemi, S. (2004). is

like internet, email, word processing, database because microfinance an effective strategy to attain the

the online work will be done easily. millennium development desires? (Attention notice series

In Small industries the upper management will take the no. 24). washington: cgap -consultative organization to

decision about the firms and about the employees, but assist the terrible.

they have to ask the opinion of employees. [2]. Simanowitz, A., & Brody, A. (2004). Realizing the

Small industries should participate actively for capability of microfinance. Perception, fifty one, 1-2.

sponsorships, owning of events or sports like Formula Car [3]. Germidis, Dimitri, Denis, Kessler, & Rachel, Meghir.

Racing in India, Cricket test Series. (1991). economic systems and development: what

Secondly, it make the customers make them feel that they function for the formal and casual financial sectors?

are important for the company and lastly in assessment of improvementCentre studies. paris: oecd.

the sales executives performance.. [4]. (2005). Microfinance: a view from the fund (imf paper).

Suggestion Box should be kept in the company so that washington dc: international financial fund.

innovative ideas from employees should be appreciated [5]. Quaye, D. O. (2011). the impact of micro finance

which help in getting cost measures and for smoothen the institutions at the boom of small and medium scale

functioning of the company. Awards and recognition for establishments (smes). a case study of decided on smes

valuable contributions to organization.. inside the kumasi city.

Monthly conferences, seminars and workshops to help in [6]. Olaitan, M. A. (2006). Finance for small and medium

expanding knowledge and stay on the cutting edge of the scale corporations in nigeria. Magazine of worldwide

latest marketing trends. farm management.

Conducting numerous social activities, including Holiday [7]. Coase, R. H. (1960). the trouble of social cost. journalOf

Party and happy Hours to let you get to know great people law and economics, 1forty four.

on a personal and professional level.. [8]. Bhatt, N., & Shui, Yan T. (1998). The hassle of

transaction costs in institution based totally

microlending: an institutional perspective. World

VIII. CONCLUSION development.

[9]. Stiglitz, J. (1990). Peer tracking and credit score markets.

The world bank onetary assessment, pp. 351-366.

In small scale industries the top stage and middle washington dc.: world bank.

degree control simplest take the selection approximately [10]. Chijoriga, M. M. (2000). The overall performance

over all decisions like uncooked material and and sustainability of micro finance group in tanzania

employees. (operating paper).

In small industries the selection will made with the aid of [11]. Amin, Sajeda, & Rai, Ashok S., & Topa, Giorgio.

sole proprietor or the partners. (2003, February). Does microcredit attain the poor and

In small industries they have much less quantity of prone? Evidence from northern bangladesh. Journal of

employees but also they control the industries and that improvement economics, elsevier, 70(1), 59-82.

they deliver incentives for added paintings. the small

industries help the lower humans to get the work , the

IJISRT17NV56 www.ijisrt.com 163

Das könnte Ihnen auch gefallen

- Public Service Motivation A Complete Guide - 2021 EditionVon EverandPublic Service Motivation A Complete Guide - 2021 EditionNoch keine Bewertungen

- The Four Walls: Live Like the Wind, Free, Without HindrancesVon EverandThe Four Walls: Live Like the Wind, Free, Without HindrancesBewertung: 5 von 5 Sternen5/5 (1)

- The Human in Human ResourceVon EverandThe Human in Human ResourceNoch keine Bewertungen

- Finding Human Capital: How to Recruit the Right People for Your OrganizationVon EverandFinding Human Capital: How to Recruit the Right People for Your OrganizationNoch keine Bewertungen

- Chief Innovation Officer A Complete Guide - 2021 EditionVon EverandChief Innovation Officer A Complete Guide - 2021 EditionNoch keine Bewertungen

- CSR Corporate Social Responsibility A Complete Guide - 2021 EditionVon EverandCSR Corporate Social Responsibility A Complete Guide - 2021 EditionNoch keine Bewertungen

- HRM-Human Resource Management Syllabus SEM 3Dokument3 SeitenHRM-Human Resource Management Syllabus SEM 3Vamshi ValasaNoch keine Bewertungen

- Ethics in HRM: ManagementDokument22 SeitenEthics in HRM: ManagementSanchitaNoch keine Bewertungen

- Organization and ManagementDokument69 SeitenOrganization and ManagementMars AresNoch keine Bewertungen

- The Organizational Champion: How to Develop Passionate Change Agents at Every LevelVon EverandThe Organizational Champion: How to Develop Passionate Change Agents at Every LevelNoch keine Bewertungen

- Transformation Change A Complete Guide - 2019 EditionVon EverandTransformation Change A Complete Guide - 2019 EditionNoch keine Bewertungen

- 3472ch01creating Value HRMDokument26 Seiten3472ch01creating Value HRMSalman DanishNoch keine Bewertungen

- An Entrepreneur's Strategy for Thriving in the New Normal: From Opportunity to AdvantageVon EverandAn Entrepreneur's Strategy for Thriving in the New Normal: From Opportunity to AdvantageNoch keine Bewertungen

- Strategic Business Unit A Complete Guide - 2020 EditionVon EverandStrategic Business Unit A Complete Guide - 2020 EditionNoch keine Bewertungen

- Reputation Management A Complete Guide - 2020 EditionVon EverandReputation Management A Complete Guide - 2020 EditionNoch keine Bewertungen

- Human Resource Development and The Future Challenges PDFDokument11 SeitenHuman Resource Development and The Future Challenges PDFrahulravi4uNoch keine Bewertungen

- Environemtnal Influences On HRM - PPT 03Dokument14 SeitenEnvironemtnal Influences On HRM - PPT 03Soyed Mohammed Zaber HossainNoch keine Bewertungen

- Impact of Emotional Intelligence On Human Resource Management Practices Among The Remote Working It EmployeesDokument10 SeitenImpact of Emotional Intelligence On Human Resource Management Practices Among The Remote Working It EmployeesIAEME PublicationNoch keine Bewertungen

- Information Consulting A Complete Guide - 2020 EditionVon EverandInformation Consulting A Complete Guide - 2020 EditionNoch keine Bewertungen

- The Handbook of Employee Benefits: Health and Group Benefits 7/EVon EverandThe Handbook of Employee Benefits: Health and Group Benefits 7/EBewertung: 1 von 5 Sternen1/5 (1)

- MIRDokument21 SeitenMIRSoitda BcmNoch keine Bewertungen

- PE GTU Study Material Presentations Unit-1 13082021074152PMDokument13 SeitenPE GTU Study Material Presentations Unit-1 13082021074152PMsinofe3634100% (1)

- Lecture Notes PPMDokument124 SeitenLecture Notes PPMFadil RushNoch keine Bewertungen

- CLO 1 - OB and Individual Behaviour - WorksheetDokument7 SeitenCLO 1 - OB and Individual Behaviour - WorksheetaishaNoch keine Bewertungen

- Management: Chapter 3: Managerial EnvironmentDokument21 SeitenManagement: Chapter 3: Managerial EnvironmentTrương Phúc NguyênNoch keine Bewertungen

- Unit 5 Nature and Purpose of OrganizingDokument49 SeitenUnit 5 Nature and Purpose of OrganizingAnkit Patidar100% (1)

- Case StudyDokument4 SeitenCase StudySakthi Vel100% (4)

- 1.1 Company Profile: Our VisionDokument5 Seiten1.1 Company Profile: Our VisionWebhub TechnologyNoch keine Bewertungen

- Controlling RobbinsDokument30 SeitenControlling RobbinsDantaPlayzNoch keine Bewertungen

- Enterpreneurship DevelopmentDokument25 SeitenEnterpreneurship DevelopmentRifat QaziNoch keine Bewertungen

- Chapter ThreeDokument15 SeitenChapter ThreeSalale FiicheeNoch keine Bewertungen

- External Factors Affecting Human ResourceDokument20 SeitenExternal Factors Affecting Human ResourceDale Ros Collamat100% (1)

- Research Methodology of NokiaDokument3 SeitenResearch Methodology of NokiaRAJ0% (1)

- Managers Are Made or BornDokument27 SeitenManagers Are Made or BornMihir Panchal100% (1)

- Franc and Lillian GilbrethDokument12 SeitenFranc and Lillian GilbrethANNZZ4ANNNoch keine Bewertungen

- Organization and ManagementDokument22 SeitenOrganization and ManagementTanvir SazzadNoch keine Bewertungen

- Communication Notes Unit 4 To 5 PDFDokument64 SeitenCommunication Notes Unit 4 To 5 PDFavishanaNoch keine Bewertungen

- Cite Seer XDokument15 SeitenCite Seer XRajat SharmaNoch keine Bewertungen

- Meaning and Definition of Industrial RelationDokument10 SeitenMeaning and Definition of Industrial RelationSuhas SalianNoch keine Bewertungen

- Factors Affecting Job DesignDokument12 SeitenFactors Affecting Job DesignUmi DuqueNoch keine Bewertungen

- Lecture Note of Chapter OneDokument30 SeitenLecture Note of Chapter OneAwet100% (1)

- Global Talent ManagementDokument6 SeitenGlobal Talent ManagementRentaro :DNoch keine Bewertungen

- Corporate Social ResponibilityDokument20 SeitenCorporate Social Responibilitysurjeet-virdi-4260Noch keine Bewertungen

- Chapter 1 Orgnization Al BehaviourDokument36 SeitenChapter 1 Orgnization Al BehaviourAngelica Kim QuintanaNoch keine Bewertungen

- Functions of ManagementDokument13 SeitenFunctions of ManagementBushra ShaikhNoch keine Bewertungen

- 2002 BSEEnvironmental Management PracticesDokument24 Seiten2002 BSEEnvironmental Management Practicesmuzammal555Noch keine Bewertungen

- Contemporary Theories of Motivation in Organizational Leadership and BehaviorDokument7 SeitenContemporary Theories of Motivation in Organizational Leadership and BehaviorARCC2030Noch keine Bewertungen

- 1-1 The Importance of Business ManagementDokument30 Seiten1-1 The Importance of Business ManagementPreetaman Singh100% (1)

- Human Resource ManagementDokument14 SeitenHuman Resource ManagementChander KhatriNoch keine Bewertungen

- Principles of Management NotesDokument8 SeitenPrinciples of Management NotesmuddiiNoch keine Bewertungen

- Introduction To Human Resource DevelopmentDokument35 SeitenIntroduction To Human Resource DevelopmentAdvocate K. M. Khairul Hasan ArifNoch keine Bewertungen

- Henri Fayol's 14 Principles of Management: Click To Edit Master Subtitle StyleDokument23 SeitenHenri Fayol's 14 Principles of Management: Click To Edit Master Subtitle StyleKabil DevNoch keine Bewertungen

- IT Project Management and Virtual TeamsDokument5 SeitenIT Project Management and Virtual Teamsfoster66Noch keine Bewertungen

- HR Case 1Dokument3 SeitenHR Case 1atul kumarNoch keine Bewertungen

- Impact of Stress and Emotional Reactions due to the Covid-19 Pandemic in IndiaDokument6 SeitenImpact of Stress and Emotional Reactions due to the Covid-19 Pandemic in IndiaInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- An Overview of Lung CancerDokument6 SeitenAn Overview of Lung CancerInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Entrepreneurial Creative Thinking and Venture Performance: Reviewing the Influence of Psychomotor Education on the Profitability of Small and Medium Scale Firms in Port Harcourt MetropolisDokument10 SeitenEntrepreneurial Creative Thinking and Venture Performance: Reviewing the Influence of Psychomotor Education on the Profitability of Small and Medium Scale Firms in Port Harcourt MetropolisInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Ambulance Booking SystemDokument7 SeitenAmbulance Booking SystemInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Designing Cost-Effective SMS based Irrigation System using GSM ModuleDokument8 SeitenDesigning Cost-Effective SMS based Irrigation System using GSM ModuleInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Detection and Counting of Fake Currency & Genuine Currency Using Image ProcessingDokument6 SeitenDetection and Counting of Fake Currency & Genuine Currency Using Image ProcessingInternational Journal of Innovative Science and Research Technology100% (9)

- Utilization of Waste Heat Emitted by the KilnDokument2 SeitenUtilization of Waste Heat Emitted by the KilnInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Forensic Advantages and Disadvantages of Raman Spectroscopy Methods in Various Banknotes Analysis and The Observed Discordant ResultsDokument12 SeitenForensic Advantages and Disadvantages of Raman Spectroscopy Methods in Various Banknotes Analysis and The Observed Discordant ResultsInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Digital Finance-Fintech and it’s Impact on Financial Inclusion in IndiaDokument10 SeitenDigital Finance-Fintech and it’s Impact on Financial Inclusion in IndiaInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Computer Vision Gestures Recognition System Using Centralized Cloud ServerDokument9 SeitenComputer Vision Gestures Recognition System Using Centralized Cloud ServerInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Study Assessing Viability of Installing 20kw Solar Power For The Electrical & Electronic Engineering Department Rufus Giwa Polytechnic OwoDokument6 SeitenStudy Assessing Viability of Installing 20kw Solar Power For The Electrical & Electronic Engineering Department Rufus Giwa Polytechnic OwoInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Predictive Analytics for Motorcycle Theft Detection and RecoveryDokument5 SeitenPredictive Analytics for Motorcycle Theft Detection and RecoveryInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Auto Tix: Automated Bus Ticket SolutionDokument5 SeitenAuto Tix: Automated Bus Ticket SolutionInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Effect of Solid Waste Management on Socio-Economic Development of Urban Area: A Case of Kicukiro DistrictDokument13 SeitenEffect of Solid Waste Management on Socio-Economic Development of Urban Area: A Case of Kicukiro DistrictInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Smart Health Care SystemDokument8 SeitenSmart Health Care SystemInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Blockchain Based Decentralized ApplicationDokument7 SeitenBlockchain Based Decentralized ApplicationInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Factors Influencing The Use of Improved Maize Seed and Participation in The Seed Demonstration Program by Smallholder Farmers in Kwali Area Council Abuja, NigeriaDokument6 SeitenFactors Influencing The Use of Improved Maize Seed and Participation in The Seed Demonstration Program by Smallholder Farmers in Kwali Area Council Abuja, NigeriaInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Cyber Security Awareness and Educational Outcomes of Grade 4 LearnersDokument33 SeitenCyber Security Awareness and Educational Outcomes of Grade 4 LearnersInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Visual Water: An Integration of App and Web To Understand Chemical ElementsDokument5 SeitenVisual Water: An Integration of App and Web To Understand Chemical ElementsInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Unmasking Phishing Threats Through Cutting-Edge Machine LearningDokument8 SeitenUnmasking Phishing Threats Through Cutting-Edge Machine LearningInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Compact and Wearable Ventilator System For Enhanced Patient CareDokument4 SeitenCompact and Wearable Ventilator System For Enhanced Patient CareInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- An Industry That Capitalizes Off of Women's Insecurities?Dokument8 SeitenAn Industry That Capitalizes Off of Women's Insecurities?International Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Implications of Adnexal Invasions in Primary Extramammary Paget's Disease: A Systematic ReviewDokument6 SeitenImplications of Adnexal Invasions in Primary Extramammary Paget's Disease: A Systematic ReviewInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Smart Cities: Boosting Economic Growth Through Innovation and EfficiencyDokument19 SeitenSmart Cities: Boosting Economic Growth Through Innovation and EfficiencyInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Insights Into Nipah Virus: A Review of Epidemiology, Pathogenesis, and Therapeutic AdvancesDokument8 SeitenInsights Into Nipah Virus: A Review of Epidemiology, Pathogenesis, and Therapeutic AdvancesInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Air Quality Index Prediction Using Bi-LSTMDokument8 SeitenAir Quality Index Prediction Using Bi-LSTMInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Parastomal Hernia: A Case Report, Repaired by Modified Laparascopic Sugarbaker TechniqueDokument2 SeitenParastomal Hernia: A Case Report, Repaired by Modified Laparascopic Sugarbaker TechniqueInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Impact of Silver Nanoparticles Infused in Blood in A Stenosed Artery Under The Effect of Magnetic Field Imp. of Silver Nano. Inf. in Blood in A Sten. Art. Under The Eff. of Mag. FieldDokument6 SeitenImpact of Silver Nanoparticles Infused in Blood in A Stenosed Artery Under The Effect of Magnetic Field Imp. of Silver Nano. Inf. in Blood in A Sten. Art. Under The Eff. of Mag. FieldInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Predict The Heart Attack Possibilities Using Machine LearningDokument2 SeitenPredict The Heart Attack Possibilities Using Machine LearningInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Parkinson's Detection Using Voice Features and Spiral DrawingsDokument5 SeitenParkinson's Detection Using Voice Features and Spiral DrawingsInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- FIN 1finDokument41 SeitenFIN 1finSudamMeryaNoch keine Bewertungen

- Full Text CaseDokument10 SeitenFull Text CaseAron MenguitoNoch keine Bewertungen

- Weekly Bond ListDokument83 SeitenWeekly Bond ListMohan MirpuriNoch keine Bewertungen

- List of Scheduled Commercial Banks: (Refer To para 2 (B) of Notification Dated October 08, 2018)Dokument2 SeitenList of Scheduled Commercial Banks: (Refer To para 2 (B) of Notification Dated October 08, 2018)Vikram PhalakNoch keine Bewertungen

- List of AMCs in IndiaDokument1 SeiteList of AMCs in Indiaajayterdal8471Noch keine Bewertungen

- Banco Scotiabank A 31 Dic2017 UsDokument2 SeitenBanco Scotiabank A 31 Dic2017 UsHenry olmos torresNoch keine Bewertungen

- Value Based Current Accounts Schedule of ChargesDokument2 SeitenValue Based Current Accounts Schedule of ChargesDhawan SandeepNoch keine Bewertungen

- IRA Blank Form 2017 1Dokument1 SeiteIRA Blank Form 2017 1ValerieAnnVilleroAlvarezValienteNoch keine Bewertungen

- Consortium AdvancesDokument10 SeitenConsortium Advancesmedhekar_renukaNoch keine Bewertungen

- Modul 10Dokument9 SeitenModul 10Herdian KusumahNoch keine Bewertungen

- Cash ManagementDokument79 SeitenCash ManagementVinayaka Mc100% (3)

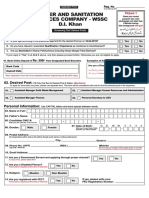

- Water and Sanitation Services Company - WSSC D.I. Khan: Eligibility CriteriaDokument4 SeitenWater and Sanitation Services Company - WSSC D.I. Khan: Eligibility CriteriakabirNoch keine Bewertungen

- FintechFinance1 Online v3Dokument128 SeitenFintechFinance1 Online v3Santosh KadamNoch keine Bewertungen

- Zakat Declaration Form CZ501Dokument1 SeiteZakat Declaration Form CZ501Zahid BashirNoch keine Bewertungen

- Rates HomeworkDokument4 SeitenRates HomeworkperwinsharmaNoch keine Bewertungen

- Banking Letters: 1) Somatie de PlataDokument7 SeitenBanking Letters: 1) Somatie de PlataMireanu ElenaNoch keine Bewertungen

- Sps Jonsay V SolidbankDokument2 SeitenSps Jonsay V SolidbankRobert RosalesNoch keine Bewertungen

- Conclusion It or EbankDokument1 SeiteConclusion It or EbankchandamatlaniNoch keine Bewertungen

- Application Form: Loan Requested Purpose of Loan DateDokument2 SeitenApplication Form: Loan Requested Purpose of Loan DateZulueta Jing MjNoch keine Bewertungen

- Sample Questions For Itb Modular ExamDokument4 SeitenSample Questions For Itb Modular Exam_23100% (2)

- Functions of Five Departments of Bangladesh BankDokument32 SeitenFunctions of Five Departments of Bangladesh BankFarhad RezaNoch keine Bewertungen

- Contact Information (Responses)Dokument9 SeitenContact Information (Responses)Muhammad Faris GymnastiarNoch keine Bewertungen

- RAF List Sep 1939Dokument552 SeitenRAF List Sep 1939Robert MacDonaldNoch keine Bewertungen

- Account Office University of Central Punjab Bank Copy University of Central Punjab Student Copy University of Central PunjabDokument1 SeiteAccount Office University of Central Punjab Bank Copy University of Central Punjab Student Copy University of Central Punjabھاشم عمران واھلہNoch keine Bewertungen

- Transfer Pag Ibig Loan2Dokument2 SeitenTransfer Pag Ibig Loan2Christopher LaputNoch keine Bewertungen

- Teen Cash ClassDokument65 SeitenTeen Cash ClassAkirah McEwen100% (1)

- Project On SebiDokument15 SeitenProject On SebiVrushti Parmar86% (14)

- Value of A Bond: Arbitrage-Free Valuation Approach For BondsDokument5 SeitenValue of A Bond: Arbitrage-Free Valuation Approach For BondsXyza Faye RegaladoNoch keine Bewertungen

- Debt Recovery AgentDokument4 SeitenDebt Recovery AgentTulchha RamNoch keine Bewertungen

- Cadiz V CaDokument2 SeitenCadiz V CaCocoyPangilinanNoch keine Bewertungen