Beruflich Dokumente

Kultur Dokumente

ATK - Serving Low Income Consumer PDF

Hochgeladen von

Deepak SharmaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

ATK - Serving Low Income Consumer PDF

Hochgeladen von

Deepak SharmaCopyright:

Verfügbare Formate

Management Agenda

Serving the Low-Income Consumer:

How to Tackle This Mostly Ignored Market

Facing saturation and cutthroat competition in long-established markets,

many multinational companies are seeking new markets. Yet until recently,

they have largely ignored the more than 5 billion low-income consumers,

thinking these consumers have no money to spend or are impossible to reach.

Now several companies are disproving these perceptions.

H ow many of the worlds 6.6 billion

potential consumers does your company

target? For most multinationals, it seems an

The other 5.1 billion people 78 percent of

the global population are low-income con-

sumers. Conventional wisdom says to ignore

odd question, because only 1.5 billion people this group, because there isnt any money

worldwide exceed $10,000 in purchasing there to earn, and anyway the poor are not

power parity for their personal expenditures.1 brand conscious.

Management Agenda

Our research demonstrates that both per- Who Is the Low-Income

ceptions are false. For the right companies,

serving low-income consumers can lead to sig-

Consumer?

nificant growth. Consider: Russian low-income To serve low-income consumers successfully,

consumers spend $104 billion annuallyabout companies must first account for their lower

30 percent of the total personal expenditures purchasing power. Figure 1 illustrates a widely-

in the country. Can you pass up an opportu- used threshold for defining low-income con-

nity to address even a small fraction of this sumers: $10,000 in purchasing power parity

sum? Furthermore, low-income consumers are (adjusted for living costs in different coun-

brand conscious; people with limited savings tries). More than three-quarters of the global

need good, reliable quality at a fair price. Well- population is low income, and many of them

known multinational brands are favored over have been historically beyond the reach of

domestic brands by 70 percent. These custom- organized retail.2

ers might not be able to afford a standard-sized The figure shows an additional threshold

bottle of Pantene shampoo or NIVEA hand that we think doesnt get enough attention.

cream, but they do see the high price of such While many people associate low-income

products as an indication of value. Given the consumers with the bottom of the pyramid

right-sized container, theyre happy to splurge. (incomes of less than $2,500), more than half

of these individuals actually earn between

$2,500 and $10,000. Such medium low-

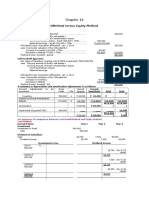

FIGURE 1 income consumers represent a great majority

of consumers in Eastern Europe, the Middle

Worldwide, approximately 78 percent of the East and Central Asia.

population is low income Furthermore, the pyramid is morphing. By

2020, the very low-income market is expected

to shrink by 24 percent, while the medium-

< 25% low market will change little and the wealthy

of world

population will grow by 80 percent. Whats happening,

Affluent

of course, is that people are marching up

Wealthy the income ladder. Sooner or later, youll be

> $10,000 PPP*

targeting people who are low-income consum-

ers today, and today is when theyre forming

> 75% < $10,000 but

of world opinions and loyalties.

population > $2,500 PPP

Before investing in this new market, com-

panies should consider two questions: Is the

< $2,500 PPP market large enough does it represent suf-

ficient expenditure to justify market entry?

*Note: PPP refers to purchasing power parity Can these customers be served profitably?

Sources: World Resources Institute; World Bank; UN; U.S. Census;

A.T. Kearney analysis For the first question, the answer is yes, the

1

A purchasing power parity exchange rate equalizes the purchasing power of different currencies in their home countries for a given basket of goods.

2

For more on improving the lives and living conditions of the worlds poor, see the white paper A New Plan for Rural Development

at www.atkearney.com.

A.T. Kearney | EXECUTIVE AGENDA 49

Management Agenda

market is large enough and we explain why in size to single sachets. This offers several advan-

the sidebar on page 51. The second question tages. For one, low-income consumers tend to

requires a longer discussion and is the basis shop for daily needs since they are often paid

of this article. by the day, which means larger packages are

simply not an option. Sachets bring a high-

priced product within reach while maintaining

Can Low-Income Consumers the perception that high price stands for high

Be Served Profitably? value. Also, small village or roadside shops have

To address the low-income consumer in these only limited stocking capacity, so smaller items

markets, our analysis builds on a concept called allow them to provide a wider product range.

the 4 As (see figure 2).3 Finally, to leverage scale effects, single sachets

Affordability. The most pressing issue can be sold for promotional purposes and to

in the low-income consumer sector is that hotels and airlines.

people have little chance to save money for There are some potential drawbacks, how-

larger investments. Generally, companies can ever. In Western Europe and North America,

address affordability by reducing packaging firms generally sell smaller packages at a higher

FIGURE 2

The 4 As of addressing low-income consumers

Reduce packaging size

Promote offerings for low price per unit

through mix of outlets Maintain operations on

Form partnerships zero (or near-zero) work-

with public and non- ing capital

governmental Leverage scale effects

organizations and sourcing network

Af

s

es

fo

en

rd

ab

ar

Aw

ili

ty

Tailor offer Restructure

to market 4 As value chain

Ac

y

lit

ce

bi

pt

la

ab

ai

ili

Av

ty

Focus development Reduce cost to serve

on customers Shorten supply chain

Employ innovative Select and support

thinking to meet retailers

customer needs Devise stocking strategy

Establish local R&D Localize sourcing

Sources: Jamie Anderson, Niels Billou, Serving the World's Poor: Innovation at the Base of the Economic Pyramid, Journal of Business Strategy, Vol. 28, No. 2;

A.T. Kearney analysis

3

The concept of the 4 As is proposed in Jamie Anderson and Niels Billou, Serving the Worlds Poor: Innovation at the Base of the Economic Pyramid,

in Journal of Business Strategy, Vol. 28, No. 2, pp. 14-21. However, our discussions of market tailoring and value chain restructuring represent

A.T. Kearney analysis.

50 serving the low-income consumer

Management Agenda

Is the Market Large Enough?

In Eastern Europe, 56 percent of example, the Russian-based cos- cent of pharmaceuticals in Pakistan,

consumers, or 57 million people, metics group Kalina, which has a for example), while the largest

are low income. Additionally, Rus- distribution network touching more market of basic food products may

sian and Ukrainian populations are than 23,000 outlets, holds one- be totally closed off. In the personal

70 percent low income. Altogether, quarter of the Russian skin- and care sector, low-income consum-

190 million low-income consumers oral-care market. Its 32 brand ers typically purchase inexpensive

are geographically close to Western toothpaste is preferred by 20 per- skin care and shampoo but branded,

Europeand Western European cent of Russian buyers. Likewise, high-priced perfume. Therefore, fra-

markets. Even larger is the market Arko razor blades and complimen- grances (which comprise more than

in the Middle East and Central Asia, tary products from Turkish personal one-third of the Russian personal

where 90 percent of consumers are care company Evyap hold more care market) are an especially prom-

low income, with 315 million people than 25 percent of the Turkish ising market.

(by comparison, the total EU15 popu- market for mens shaving products. In light of this, the poten-

lation is approximately 382 million).4 Multinationals can address tial addressable market share in

Although there is a huge at best a 20 to 30 percent market Eastern Europe, Russia, Ukraine,

number of low-income consumers, share for low-income consumers. the Middle East and Central Asia

is each individuals expenditure The health and communications is $129 billion. Thus in many sec-

large enough to make the market sectors promise lots of market share tors there will indeed be sufficient

attractive? To calculate this, we (multinationals account for 60 per- expenditures to justify market entry.

multiply the number of low-income

consumers by their dollar expen-

Calculating personal expenditure by region ($ billions)

ditures.5 In the Middle East and

Central Asia, the result is $298 bil-

Western Eastern Russia and Middle East and

lion a 56 percent share of per- Europe Europe Ukraine Central Asia

sonal expenditures. Eastern Europe, Total: $7,328 Total: $476 Total: $414 Total: $534

Low income: $681 Low income: $134 Low income: $143 Low income: $298

Russia and Ukraine amount to a Percent share: 9% Percent share: 28% Percent share: 35% Percent share: 56%

$277 billion market (see figure).

Clearly, these markets are

not the sole playing field of multi-

nationals. Typically in countries

dominated by low-income consum-

ers, most food products are pro-

duced locally and sold at outdoor

markets. Similar dynamics affect

housing and household goods. Even

in the personal care sector, home-

grown competitors have a solid

standing that makes it difficult for Note: Low-income expenditures calculated using the Gini coefficient and income distributions

published in the UNs Human Development Report 2006.

multinationals to compete. For Sources: UN; World Bank; A.T. Kearney analysis

4

Countries surveyed: Egypt, Iran, Israel, Jordan, Kazakhstan, Pakistan and Turkey.

5

Many studies provide expenditures in purchasing power parity. However, companies must calculate their earnings in euros or U.S. dollars. For example,

despite being rather similar markets in purchasing power parity (about $4,320 per capita), Turkey and Kazakhstan differ significantly in current dollar

expenditures ($2,435 and $1,877, respectively).

A.T. Kearney | EXECUTIVE AGENDA 51

Management Agenda

unit price, extracting a premium for conve- In each case the company will not strip down an

nience. Reaching the low-income consumer existing model but instead develop a spacious

in a developing country requires a lower rela- vehicle especially for Indian buyers using

tive price. You dont want a premium, just a Indian labor, logistics and sales networks.

customer. The drawback is that middle- and Companies that cannot disaggregate prod-

upper-income consumers may eventually notice ucts into smaller units can aggregate consum-

the lower price, switch their buying habits and ers. Financing can often be secured by grouping

start a price erosion. several users together. For example, in Mexico,

Notwithstanding the drawbacks, India is a the international cement and construction

rich source of examples for tailoring affordable company Cemex saw a market opportunity.

products. Roughly 45 percent of smaller 50- Because of a housing shortfall and the inabil-

gram tea packs are sold in rural markets, and ity to get a construction loan, many poor

people were building their own

homes. A typical home took five

years to complete, had just one

room and no access to sewage

re aching the low - income facilities. Today, Cemex provides

families with access to credit for

consumer in a developing

cement and architectural consult-

country requires a lower relative ing, which has reduced construc-

tion time by one-third and costs

price. you don t want a by 20 percent. Three families are

premium , just a customer . grouped together into communi-

ties with joint responsibility for

weekly payments. In part because

of peer pressure, Cemex says repay-

ment rates reach 99 percent.

Hindustan Unilever Limited sells 5 billion The outlook: Making products afford-

pieces of penny candy a year, earning rev- able for the customer means employing a

enues of $50 million. Even computers are low-margin, high-volume strategy, and lever-

sold in smaller packages. Novatium, an India- aging scale effects to achieve low costs of goods

based technology company, introduced the sold. Return on capital not on revenue is

Nova netPC, a personal computer for the the critical yardstick in low-income markets.

Indian market priced at roughly $100. The Companies can achieve this goal and reduce

machines have no local storage or program- risk by operating on zero (or nearly zero)

ming. Instead, users pay a small monthly sub- working capital.

scription fee to connect to a network where Availability. Many low-income consumers

a central server hosts applications and files. live in remote villages or urban communities

Affordability is often achieved by restruc- that lack access to conventional retail markets.

turing the supply chain. Renault is planning Reaching these consumers requires creative

an automobile priced at $3,000 for the Indian thinking and finding alternative means of

market, and Tata has announced one for $2,500. transportation.

52 serving the low-income consumer

Management Agenda

One way to replace the standard retail program. Golden stores are tiny mom-and-pop

environment is to build on the entrepreneurial shops that carry 40 or more P&G products and

spirit of many low-income consumers. Recent display them together on the shelf rather than

media attention has heralded microfinance next to competing brands. In return, these mer-

institutions that make small loans to help poor chants get regular visits from P&G reps who

rural residents establish their own businesses. spruce up the displays.

These microenterprises often sell products to Sometimes creating completely new ways to

other low-income consumers in the neighbor- sell is the best path. Nestl Brazil, for example,

hood, but need a way to reach out to remote established a direct sales channel for women

villagers. Recently, Accion International devel- to sell yogurt and biscuits from their homes.

oped an application called PortaCredit, which Many customers are given two weeks (the

runs on a personal digital assistant and allows interval between sales calls) to pay. Although

loan officers to meet clients in their homes, credit is unsecured, peer pressure keeps default

input data, process the application, and calcu- rates below 2 percent. Likewise, in Russia and

late loan payments, all on a PDA.6 The result Central Asia, door-to-door selling accounts

is improved efficiency for the institution and for nearly 19 percent of the beauty market.

a faster turnaround for the applicant. China, too, has recently loosened restrictions

In Africa, cellular leader Vodacom discov- on direct selling.

ered budding entrepreneurs by tracking cell Meanwhile, in India, Hindustan Unilever

phones with an abnormally high number of provides personal care products such as soap

calls. Believing the owners were renting out and shampoo for womens Shakti self-help

their phones, the company contacted them groups to sell in their villages. The project

and offered them franchise opportunities to could expand the companys coverage and help

operate their own phone kiosks. Each kiosk is more than 30,000 entrepreneurs earn a living

run by a franchisee who invested in the initial by serving potentially up to 500,000 villages,

costs and receives one-third of the revenues. each with fewer than 2,000 residents.

To date, Vodacoms network includes about Such projects are less about helping entre-

5,000 kiosks. Also in Africa, the sale of pre- preneurs and more about expanding markets.

paid phone cards has become big business as These microenterprises represent a new logistics

most low-income consumers cannot afford the solution, shortening supply chains and lowering

mandatory two- or three-year mobile phone working capital while opening new markets.

contracts. Today, farmers in Africa use their The outlook: Although improving availabil-

mobile phones to access weather forecasts and ity often requires labor-intensive distribution,

gauge market prices. low labor costs can be leveraged. For example,

Where basic sales channels already exist, self-employed Shakti saleswomen in India earn

companies simply need to be more fastidious in $15 to $22 a month, about 8 percent of sales.

their support. Procter & Gamble told the Wall Furthermore, the direct selling approach can

Street Journal that it is targeting low-income quickly establish a sales network, bypass inter-

consumers in Mexico through its golden store mediaries and help address the final two As.

6

Accion is a nonprofit organization. The microfinance sector continually shows how commercial enterprises can learn from innovations by nonprofits,

and we expect to see this IT example replicated elsewhere.

A.T. Kearney | EXECUTIVE AGENDA 53

Management Agenda

Acceptability. Many low-income consum- by marketing edible cutlery. Its edible because

ers retain traditional roles, religious motiva- its made from sorghum flour, a popular heat-

tions and other unique cultural factors. When and drought-tolerant and nutritious crop.

we think of designing products acceptable to In other countries indeed, we must admit,

these consumers, we often think of factors such even to ourselves edible cutlery seems a bit

as halal (Islamically permissible) foods in the farfetched. But the product is designed for

Middle East and refrigeration in the tropics. Indias unique cultural factors, not ours.

As with all consumers, understanding their The circumstances surrounding daily life

daily lives and all related needs is most critical. should also be considered. Low-income con-

For example, Danone sells calcium- and iron- sumers in Brazil typically have long commutes,

leaving early and returning home late.

They must often prepare meals over

the weekend, so freezers and micro-

wave ovens are more common than

the absence of conven -

one would expect and acceptability

for frozen or semiprepared meals is

tional advertising in the growing.

Finally, one of our favorite

lives of low-income consumers examples of tailoring product offer-

ings for acceptability comes from

can be both a challenge

China, where the appliance manu-

and an opportunit y. facturer Haier simply listened to

its customers requirements. Called

to service a clogged drainpipe in one

of its clothes-washing machines,

the company discovered an unusual

enriched biscuits in China, where half of the cause: potatoes. Millions of people in the

population suffers from a lack of calcium. Sichuan region grew potatoes and used wash-

Likewise, illiteracy might suggest a product ing machines to rinse off the mud. But instead

adaptation. How does one operate an ATM, of blaming customers for misuse, Haier devel-

for example, without reading? In India, ICICI oped a machine with wider pipes that could

Bank and Citibank developed biometric ATMs, wash potatoes and other vegetables in addition

featuring fingerprint authentication and voice- to clothes. (Later, Haier developed another

enabled navigation. This technological leap- washing machine to make cheese from goats

frogging made the product more acceptable milk.) The result was a strong increase in use

to low-income consumers. To improve afford- of Haiers products among low-income con-

ability, the banks also did away with minimum sumers and market leadership in China.

account balances. The outlook: Acceptability comes from

Sometimes adaptation comes from cre- innovative thinking and a deep understand-

ative thinking about traditions. For example, ing of local needs of low-income consumers.

Indian entrepreneurs are hoping to cut down Companies with local R&D and market research

on the waste of plastic forks, knives and spoons are more likely to develop a useful product.

54 serving the low-income consumer

Management Agenda

Awareness. As with the absence of wear manufacturer Scojo Vision, which trains

conventional retail outlets, the absence of local entrepreneurs to give basic eye exams

conventional advertising in the lives of low- and sell low-cost reading glasses in their com-

income consumers can be both a challenge and munities. Theres no doubt that inexpensive

an opportunity. How will they know about reading glasses improve the lives of low-income

your product? Can you learn enough about consumersand they also open a new market

their lives to get your message across? In India, for Scojo Vision.

for example, Hindustan

Unilever uses magicians

and dancers to promote

products. Additionally,

partnerships with micro-

enterprises (as discussed

above) come with built-

in town crier awareness

opportunities.

TV, Internet and

word of mouth play a

big role, too, as infor-

mation travels fast and

across purchasing-power

categories. As rural work-

ers move into the cities for employment, they Likewise, Procter & Gamble developed

become more familiar with brand-oriented a water purifier for developing countries.

lifestyles, influencing product decisions back In Uganda, the company partnered with

home where they often send money. In less Population Services International and the

media-saturated areas, companies can increase International Council of Nurses to increase

awareness by tapping into the power of social low-income consumers awareness of the

networks. For example, in rural India, Colgate- importance of safe water and the P&G prod-

Palmolive took its marketing campaign on uct offering. In a country where only half

the road with video vans that show local the population had access to safe water, and

movies and advertising for its personal care where diarrhea was a major public health issue,

products. Open-air marketing at festivals and the water treatment project reduced instances

in village markets is another cost-effective of disease by 30 to 50 percent. Its a great

approach, allowing companies to reach large example of a socially engaged company yet

numbers of consumers. P&G had undertaken it to grow revenues for

Wed like to close with one more cre- its water purifier.

ative approach for building awareness. When The outlook: Without downplaying the

addressing health or nutrition issues, coop- value and importance of doing good deeds,

eration with non-governmental organizations partnerships with philanthropic groups can

can foster mutual success. One example is the be creative ways to increase awareness. Its

Scojo Foundation, associated with the eye- just one example of the compelling economic

A.T. Kearney | EXECUTIVE AGENDA 55

Management Agenda

reasons to serve the worlds poorgiving them bonus: Companies able to cope with the require-

a choice of products they can afford to purchase ments of low-cost value chains can become more

(rather than a handout of a product they cant) competitive in their home markets.

and also increasing your revenues. Your competitors may already be discov-

ering the low-income consumer. You must act

quickly to profit from first-mover advantage

More Choices and Chances and establish your brand name among this

The advantages of the low-income consumer consumer group as it climbs the income ladder.

market should be clear: It offers growth rates well Its the classic win-win situation of the free

above long-established markets and customers market: giving people more choices and chances

hungry for new choices. There is also a hidden while increasing a companys revenues.

Consulting Authors

Peter Pfeiffer is a partner in the firms consumer industries and retail practice. Based in the Dsseldorf

office, he can be reached at peter.pfeiffer@atkearney.com.

Sven Massen is a principal in the firms consumer industries and retail practice. Based in the Munich

office, he can be reached at sven.massen@atkearney.com.

Ulrich Bombka is a consultant in the firms consumer industries and retail practice. Based in the Munich

office, he can be reached at ulrich.bombka@atkearney.com.

The authors wish to acknowledge the valuable contributions of their colleagues Lian Hoon Lim, Ruslan Korzh,

Kaustav Mukherjee and Markus Stricker in writing this article.

56 serving the low-income consumer

executive

agenda ideas and insights for business leaders

Executive Agenda is published by A.T. Kearney to offer fresh perspectives

and encourage discussion on subjects of interest to senior executives and

opinion leaders worldwide.

A.T. Kearney is a global strategic management consulting firm known for For information on obtaining

helping clients gain lasting results through a unique combination of strategic additional copies, permission

insight and collaborative working style. The firm was established in 1926 to to reprint or translate articles,

provide management advice concerning issues on the CEOs agenda. Today, and all other correspondence,

we serve the largest global clients in all major industries. A.T. Kearneys please contact:

offices are located in major business centers in 33 countries.

A.T. Kearney, Inc.

AMERICAS Atlanta | Boston | Chicago | Dallas | Detroit | Mexico City Marketing & Communications

New York | So Paulo | Silicon Valley | Toronto | Washington, D.C. 222 West Adams Street

EUROPE Amsterdam | Berlin | Brussels | Bucharest | Copenhagen Chicago, Illinois 60606 U.S.A.

Dsseldorf | Frankfurt | Helsinki | Lisbon | Ljubljana | London 1 312 648 0111

Madrid | Milan | Moscow | Munich | Oslo | Paris | Prague email: insight@atkearney.com

Rome | Stockholm | Stuttgart | Vienna | Warsaw | Zurich www.atkearney.com

ASIA Bangkok | Beijing | Hong Kong | Jakarta | Kuala Lumpur

PACIFIC Melbourne | Mumbai | New Delhi | Seoul | Shanghai

Singapore | Sydney | Tokyo

MIDDLE Dubai

EAST

PUBLISHING ADVISER EDITOR DESIGN

Wayne Boley Patricia Sibo Kevin Peschke

Copyright 2007, A.T. Kearney, Inc. All rights reserved. No part of this work may be reproduced in any form

without written permission from the copyright holder. A.T. Kearney and Executive Agenda are registered

marks of A.T. Kearney, Inc. A.T. Kearney, Inc. is an equal opportunity employer.

Das könnte Ihnen auch gefallen

- Serving The Poor Prahalad Hammond PDFDokument10 SeitenServing The Poor Prahalad Hammond PDFyamacNoch keine Bewertungen

- No B.S. Marketing to the Affluent: No Holds Barred, Take No Prisoners, Guide to Getting Really RichVon EverandNo B.S. Marketing to the Affluent: No Holds Barred, Take No Prisoners, Guide to Getting Really RichBewertung: 4 von 5 Sternen4/5 (7)

- Prahlad - Serving TheDokument11 SeitenPrahlad - Serving TheDebalina SNoch keine Bewertungen

- Harvard Business Review on Thriving in Emerging MarketsVon EverandHarvard Business Review on Thriving in Emerging MarketsNoch keine Bewertungen

- Prahalad 2002serving - Worlds - PoorDokument11 SeitenPrahalad 2002serving - Worlds - Poorzoyamalik27Noch keine Bewertungen

- The Millionaire Next Door (Review and Analysis of Stanley and Danko's Book)Von EverandThe Millionaire Next Door (Review and Analysis of Stanley and Danko's Book)Bewertung: 4.5 von 5 Sternen4.5/5 (4)

- The Great Retail Bifurcation: Why The Retail "Apocalypse" Is Really A RenaissanceDokument24 SeitenThe Great Retail Bifurcation: Why The Retail "Apocalypse" Is Really A RenaissanceTincho PreitiNoch keine Bewertungen

- Assignment 3 - Bottom of The PyramidDokument14 SeitenAssignment 3 - Bottom of The Pyramidディクソン KohNoch keine Bewertungen

- Summary of Fortune at The Bottom of The PyramidDokument6 SeitenSummary of Fortune at The Bottom of The PyramidSaurabhAgrawal100% (2)

- 13 The Bottom of Pyramid Strategy (BOP)Dokument16 Seiten13 The Bottom of Pyramid Strategy (BOP)suresh1969Noch keine Bewertungen

- Bottom of The Pyramid MarketingDokument26 SeitenBottom of The Pyramid MarketingAnam MalikNoch keine Bewertungen

- Serving The World's Poor, ProfitablyDokument7 SeitenServing The World's Poor, ProfitablynikeeetNoch keine Bewertungen

- We Are Like That Only - Rama BijapurkarDokument28 SeitenWe Are Like That Only - Rama BijapurkarmsulgadleNoch keine Bewertungen

- Evalueserve Whitepaper Bottom of The Pyramid Marketing Oct2008Dokument11 SeitenEvalueserve Whitepaper Bottom of The Pyramid Marketing Oct2008Vaibhav AgarwalNoch keine Bewertungen

- IBM Retail - The Future of The Consumer Products IndustryDokument28 SeitenIBM Retail - The Future of The Consumer Products IndustryIBM_RetailNoch keine Bewertungen

- THE Fortune at The BottomDokument42 SeitenTHE Fortune at The BottomDmr PandaNoch keine Bewertungen

- 4 Gate Model in EntrepreneurshipDokument20 Seiten4 Gate Model in EntrepreneurshipJarel MarabutNoch keine Bewertungen

- Case 3 3 Marketing To The Bottom of The PyramidDokument3 SeitenCase 3 3 Marketing To The Bottom of The Pyramidhedonicsunny100% (2)

- Bernstein Journal Summer08Dokument39 SeitenBernstein Journal Summer08Chaitanya JagarlapudiNoch keine Bewertungen

- Ey Operational-Excellence PDFDokument26 SeitenEy Operational-Excellence PDFĐặng Xuân HiểuNoch keine Bewertungen

- Bottom of The PyramidDokument22 SeitenBottom of The PyramidJahanzeb KhanNoch keine Bewertungen

- BOP MarketingDokument23 SeitenBOP MarketingVikas SainiNoch keine Bewertungen

- Chinese MarketDokument10 SeitenChinese Marketannagermanos4398Noch keine Bewertungen

- 9 Trends For India 09Dokument19 Seiten9 Trends For India 09Swas SwastiNoch keine Bewertungen

- Indian Consumers: Presented by SwatiDokument27 SeitenIndian Consumers: Presented by Swatitech667Noch keine Bewertungen

- COVID 19 Nielsen Report The Rise of Indias Rural Super ConsumerDokument30 SeitenCOVID 19 Nielsen Report The Rise of Indias Rural Super ConsumerAvnish TripathiNoch keine Bewertungen

- Bottom of Pyramid: Presented By-Joel JohnsonDokument21 SeitenBottom of Pyramid: Presented By-Joel JohnsonAyushi Shukla100% (1)

- Bottom of The Pyramid Marketing:: Dr. M S Balaji Assistant Professor IBS HyderabadDokument23 SeitenBottom of The Pyramid Marketing:: Dr. M S Balaji Assistant Professor IBS HyderabadVikas SainiNoch keine Bewertungen

- Trading UpDokument9 SeitenTrading UpethernalxNoch keine Bewertungen

- Trading Up p4Dokument1 SeiteTrading Up p4ethernalxNoch keine Bewertungen

- Summary of Serving The WorldDokument3 SeitenSummary of Serving The WorldgurkanNoch keine Bewertungen

- EXAMPLESDokument4 SeitenEXAMPLESHUỲNH TRẦN THIỆN PHÚC100% (1)

- A Darwinian GaleDokument100 SeitenA Darwinian GaleGiovanni Festa100% (1)

- BoP - Content Unit Wise Segmentation Feb Jul'2020Dokument163 SeitenBoP - Content Unit Wise Segmentation Feb Jul'2020Syed Ahmed SiddiqNoch keine Bewertungen

- Ey Beating Scale Barriers in Fragmented TradeDokument8 SeitenEy Beating Scale Barriers in Fragmented TradevisegaNoch keine Bewertungen

- Lessons and Strategies of A Recession: Retail Economics 101Dokument7 SeitenLessons and Strategies of A Recession: Retail Economics 101achuthaNoch keine Bewertungen

- Luxury Consumer MarketDokument9 SeitenLuxury Consumer MarketVicente J. CasanovaNoch keine Bewertungen

- Inclusive Business ModelDokument3 SeitenInclusive Business ModelSyed Tamjidur RahmanNoch keine Bewertungen

- Case 3 3 Marketing PyramidDokument3 SeitenCase 3 3 Marketing PyramidPeishi OngNoch keine Bewertungen

- GD PIsession2Dokument2 SeitenGD PIsession2Rahul AnandNoch keine Bewertungen

- Bottom of PyramidDokument32 SeitenBottom of PyramidkamalinishuklaNoch keine Bewertungen

- GX Consumer Business gplg2019 ReportDokument46 SeitenGX Consumer Business gplg2019 ReportAishwarya RaoNoch keine Bewertungen

- Ice FillDokument17 SeitenIce FillHemraj VermaNoch keine Bewertungen

- BOP Issue Analysis-Short VersionDokument30 SeitenBOP Issue Analysis-Short VersionHari ShettyNoch keine Bewertungen

- Retail Foods New Delhi India 7-17-2019Dokument10 SeitenRetail Foods New Delhi India 7-17-2019Amit AnandNoch keine Bewertungen

- The Birth of Consumer 3000Dokument57 SeitenThe Birth of Consumer 3000resa1786Noch keine Bewertungen

- What Consumers Want: Uniquely Indian Shopping HabitsDokument1 SeiteWhat Consumers Want: Uniquely Indian Shopping HabitsChalam JayavarapuNoch keine Bewertungen

- Selling To The World's PoorDokument9 SeitenSelling To The World's PoorPatrick AdamsNoch keine Bewertungen

- Selling To The Poor - Hammond and Prahalad PDFDokument6 SeitenSelling To The Poor - Hammond and Prahalad PDFsantanu biswasNoch keine Bewertungen

- Fortune at The-Bbottom of PyramidDokument19 SeitenFortune at The-Bbottom of PyramidPankaj AhireNoch keine Bewertungen

- InfographicDokument2 SeitenInfographicahhgoksdgnokgnskgnskNoch keine Bewertungen

- Retail ManagementDokument57 SeitenRetail Managementsaurabh gadkari100% (1)

- AbcdeDokument8 SeitenAbcdeSnehal PatelNoch keine Bewertungen

- CK Prahlad-The Economist: Submitted by Abhishek Pathak 12BSPHH010033Dokument22 SeitenCK Prahlad-The Economist: Submitted by Abhishek Pathak 12BSPHH010033simran755Noch keine Bewertungen

- McKinsey (01 Nov 2022)Dokument11 SeitenMcKinsey (01 Nov 2022)Alejandro Vargas AvilaNoch keine Bewertungen

- Mass Affluence in America Report (Nielsen)Dokument20 SeitenMass Affluence in America Report (Nielsen)Guillermo VetterNoch keine Bewertungen

- Bottom of PyramidDokument25 SeitenBottom of PyramidalinaNoch keine Bewertungen

- Fortune at Top of PyramindDokument4 SeitenFortune at Top of PyramindPrabhakarDeshpandeNoch keine Bewertungen

- Edexcel Economics AS Level Unit 1: Competitive Markets - How They Work & Why They Fail Revision NotesDokument27 SeitenEdexcel Economics AS Level Unit 1: Competitive Markets - How They Work & Why They Fail Revision NotesTayeeb Bin KalamNoch keine Bewertungen

- Aditya Birla Fashion and Retail - Result Update-Aug-18-EDEL PDFDokument14 SeitenAditya Birla Fashion and Retail - Result Update-Aug-18-EDEL PDFDeepak SharmaNoch keine Bewertungen

- Forum Interview - Trent Westside Zudio Business Analysis-15 Jul 2019 - EngDokument12 SeitenForum Interview - Trent Westside Zudio Business Analysis-15 Jul 2019 - EngDeepak SharmaNoch keine Bewertungen

- Blockchaining Facebook: Problems, and Even Be Its DisruptorDokument3 SeitenBlockchaining Facebook: Problems, and Even Be Its DisruptorDeepak SharmaNoch keine Bewertungen

- Modern Finance: Driving Transformation From Within: Brought To You by Oracle, in Collaboration With Intel May 2016Dokument14 SeitenModern Finance: Driving Transformation From Within: Brought To You by Oracle, in Collaboration With Intel May 2016Deepak SharmaNoch keine Bewertungen

- Digital Transformation A Road-Map For Billion-Dollar OrganizationsDokument68 SeitenDigital Transformation A Road-Map For Billion-Dollar Organizationsvishwanathan_ms100% (1)

- Digital TransformationDokument20 SeitenDigital TransformationGaetano DisNoch keine Bewertungen

- Oecd Privacy FrameworkDokument154 SeitenOecd Privacy FrameworkDeepak SharmaNoch keine Bewertungen

- Expectations From Credit Policy - September 2015Dokument4 SeitenExpectations From Credit Policy - September 2015Deepak SharmaNoch keine Bewertungen

- Biz ContextDokument12 SeitenBiz ContextDeepak SharmaNoch keine Bewertungen

- Oil - Islamorada November Newsletter ExtractDokument53 SeitenOil - Islamorada November Newsletter ExtractDeepak SharmaNoch keine Bewertungen

- Business Process Management Value Map - RefDokument88 SeitenBusiness Process Management Value Map - RefDeepak SharmaNoch keine Bewertungen

- Monetary Policy - April 2015Dokument4 SeitenMonetary Policy - April 2015Deepak SharmaNoch keine Bewertungen

- Accenture - Seven Myths of AgingDokument8 SeitenAccenture - Seven Myths of AgingDeepak SharmaNoch keine Bewertungen

- Indian Stock Market PDFDokument14 SeitenIndian Stock Market PDFDeepthi Thatha58% (12)

- QP XI AccountancyDokument13 SeitenQP XI AccountancySanjay Panicker100% (1)

- Financial Accounting and Reporting IDokument5 SeitenFinancial Accounting and Reporting IKim Cristian Maaño50% (2)

- Developing The Risk Acceptance CriteriaDokument5 SeitenDeveloping The Risk Acceptance CriteriaOkechukwu OnwukaNoch keine Bewertungen

- PWC SWOT & Ratio AnalysisDokument10 SeitenPWC SWOT & Ratio AnalysisRTS123asdfNoch keine Bewertungen

- ABC Corporation Annual ReportDokument9 SeitenABC Corporation Annual ReportCuong LyNoch keine Bewertungen

- FRM Presentation 2Dokument20 SeitenFRM Presentation 2Paul BanerjeeNoch keine Bewertungen

- Solution Chapter 16Dokument90 SeitenSolution Chapter 16Frances Chariz YbioNoch keine Bewertungen

- FinTech Playbook - Buy Now Pay Later - HSIE-202201081155123688696.cleanedDokument43 SeitenFinTech Playbook - Buy Now Pay Later - HSIE-202201081155123688696.cleanedhojunxiongNoch keine Bewertungen

- Sip Project SBI HomeloanDokument45 SeitenSip Project SBI HomeloanAkshay RautNoch keine Bewertungen

- Chapter 8 PDFDokument22 SeitenChapter 8 PDFJay BrockNoch keine Bewertungen

- Dividend / Zakat & Tax Deduction Summary Report: 3520227087109 Muhammad Omar QureshiDokument2 SeitenDividend / Zakat & Tax Deduction Summary Report: 3520227087109 Muhammad Omar QureshiIkramNoch keine Bewertungen

- A-Balance SheetDokument2 SeitenA-Balance SheetBabbu DHURIANoch keine Bewertungen

- Chapter One Overview of Financial Management: 1.1. Finance As An Area of StrudyDokument33 SeitenChapter One Overview of Financial Management: 1.1. Finance As An Area of Strudysamuel kebedeNoch keine Bewertungen

- Chapter 27: The Theory of Active Portfolio Management: Problem SetsDokument1 SeiteChapter 27: The Theory of Active Portfolio Management: Problem SetsMehrab Jami Aumit 1812818630Noch keine Bewertungen

- Republic Act No. 3765 Truth in Lending ActDokument6 SeitenRepublic Act No. 3765 Truth in Lending ActMarc Geoffrey HababNoch keine Bewertungen

- Chapter 3 Problems - FinmgtDokument11 SeitenChapter 3 Problems - FinmgtLaisa Vinia TaypenNoch keine Bewertungen

- A Study On Imapct of Behavioural Biases On Retail InvestorsDokument60 SeitenA Study On Imapct of Behavioural Biases On Retail InvestorsNisha DhanasekaranNoch keine Bewertungen

- Valuation Provision GST S.No Particulars 1 Sec. 15 (1) Definition of ValueDokument5 SeitenValuation Provision GST S.No Particulars 1 Sec. 15 (1) Definition of ValueAnonymous ikQZphNoch keine Bewertungen

- Svci Fieldtrip FormDokument1 SeiteSvci Fieldtrip FormSheNoch keine Bewertungen

- Group 1 - Tactical Accounting and Financial Information Systems PDFDokument9 SeitenGroup 1 - Tactical Accounting and Financial Information Systems PDFX BorgNoch keine Bewertungen

- Bank of The Philippine Islands Green Finance FrameworkDokument7 SeitenBank of The Philippine Islands Green Finance FrameworkMarilyn CailaoNoch keine Bewertungen

- Basic Accounting For Small GroupsDokument158 SeitenBasic Accounting For Small GroupsOxfamNoch keine Bewertungen

- 5-1 Problem SolvingDokument11 Seiten5-1 Problem SolvingRianne GliocamNoch keine Bewertungen

- Cambridge IGCSE™: Business Studies 0450/12 March 2021Dokument24 SeitenCambridge IGCSE™: Business Studies 0450/12 March 2021Wilfred BryanNoch keine Bewertungen

- Accounting For Franchise Operations2Dokument21 SeitenAccounting For Franchise Operations2Jaira Mae AustriaNoch keine Bewertungen

- Pas 20 - Acctg For Govt Grants & Disclosure of Govt AssistanceDokument12 SeitenPas 20 - Acctg For Govt Grants & Disclosure of Govt AssistanceGraciasNoch keine Bewertungen

- International EconomicsDokument2 SeitenInternational Economicsvivek2270834Noch keine Bewertungen

- Financial Derivatives - Prof. Vandana BhamaDokument3 SeitenFinancial Derivatives - Prof. Vandana BhamakaranNoch keine Bewertungen

- Ruma GhoshDokument26 SeitenRuma GhoshhritamgemsNoch keine Bewertungen

- Summary: $100M Leads: How to Get Strangers to Want to Buy Your Stuff by Alex Hormozi: Key Takeaways, Summary & Analysis IncludedVon EverandSummary: $100M Leads: How to Get Strangers to Want to Buy Your Stuff by Alex Hormozi: Key Takeaways, Summary & Analysis IncludedBewertung: 3 von 5 Sternen3/5 (6)

- Fascinate: How to Make Your Brand Impossible to ResistVon EverandFascinate: How to Make Your Brand Impossible to ResistBewertung: 5 von 5 Sternen5/5 (1)

- $100M Offers: How to Make Offers So Good People Feel Stupid Saying NoVon Everand$100M Offers: How to Make Offers So Good People Feel Stupid Saying NoBewertung: 5 von 5 Sternen5/5 (24)

- Jab, Jab, Jab, Right Hook: How to Tell Your Story in a Noisy Social WorldVon EverandJab, Jab, Jab, Right Hook: How to Tell Your Story in a Noisy Social WorldBewertung: 4.5 von 5 Sternen4.5/5 (18)

- When Helping Hurts: How to Alleviate Poverty Without Hurting the Poor . . . and YourselfVon EverandWhen Helping Hurts: How to Alleviate Poverty Without Hurting the Poor . . . and YourselfBewertung: 5 von 5 Sternen5/5 (36)

- $100M Leads: How to Get Strangers to Want to Buy Your StuffVon Everand$100M Leads: How to Get Strangers to Want to Buy Your StuffBewertung: 5 von 5 Sternen5/5 (19)

- The Meth Lunches: Food and Longing in an American CityVon EverandThe Meth Lunches: Food and Longing in an American CityBewertung: 5 von 5 Sternen5/5 (5)

- The Catalyst: How to Change Anyone's MindVon EverandThe Catalyst: How to Change Anyone's MindBewertung: 4.5 von 5 Sternen4.5/5 (275)

- Dealers of Lightning: Xerox PARC and the Dawn of the Computer AgeVon EverandDealers of Lightning: Xerox PARC and the Dawn of the Computer AgeBewertung: 4 von 5 Sternen4/5 (88)

- Summary: Traction: Get a Grip on Your Business: by Gino Wickman: Key Takeaways, Summary, and AnalysisVon EverandSummary: Traction: Get a Grip on Your Business: by Gino Wickman: Key Takeaways, Summary, and AnalysisBewertung: 5 von 5 Sternen5/5 (10)

- Yes!: 50 Scientifically Proven Ways to Be PersuasiveVon EverandYes!: 50 Scientifically Proven Ways to Be PersuasiveBewertung: 4 von 5 Sternen4/5 (154)

- Summary: Dotcom Secrets: The Underground Playbook for Growing Your Company Online with Sales Funnels by Russell Brunson: Key Takeaways, Summary & Analysis IncludedVon EverandSummary: Dotcom Secrets: The Underground Playbook for Growing Your Company Online with Sales Funnels by Russell Brunson: Key Takeaways, Summary & Analysis IncludedBewertung: 5 von 5 Sternen5/5 (2)

- Obviously Awesome: How to Nail Product Positioning so Customers Get It, Buy It, Love ItVon EverandObviously Awesome: How to Nail Product Positioning so Customers Get It, Buy It, Love ItBewertung: 4.5 von 5 Sternen4.5/5 (152)

- High-Risers: Cabrini-Green and the Fate of American Public HousingVon EverandHigh-Risers: Cabrini-Green and the Fate of American Public HousingNoch keine Bewertungen

- Invisible Influence: The Hidden Forces that Shape BehaviorVon EverandInvisible Influence: The Hidden Forces that Shape BehaviorBewertung: 4.5 von 5 Sternen4.5/5 (131)

- Workin' Our Way Home: The Incredible True Story of a Homeless Ex-Con and a Grieving Millionaire Thrown Together to Save Each OtherVon EverandWorkin' Our Way Home: The Incredible True Story of a Homeless Ex-Con and a Grieving Millionaire Thrown Together to Save Each OtherNoch keine Bewertungen

- Brand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleVon EverandBrand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleBewertung: 4.5 von 5 Sternen4.5/5 (48)

- How to Read People: The Complete Psychology Guide to Analyzing People, Reading Body Language, and Persuading, Manipulating and Understanding How to Influence Human BehaviorVon EverandHow to Read People: The Complete Psychology Guide to Analyzing People, Reading Body Language, and Persuading, Manipulating and Understanding How to Influence Human BehaviorBewertung: 4.5 von 5 Sternen4.5/5 (33)

- Visibility Marketing: The No-Holds-Barred Truth About What It Takes to Grab Attention, Build Your Brand, and Win New BusinessVon EverandVisibility Marketing: The No-Holds-Barred Truth About What It Takes to Grab Attention, Build Your Brand, and Win New BusinessBewertung: 4.5 von 5 Sternen4.5/5 (7)

- Ca$hvertising: How to Use More than 100 Secrets of Ad-Agency Psychology to Make Big Money Selling Anything to AnyoneVon EverandCa$hvertising: How to Use More than 100 Secrets of Ad-Agency Psychology to Make Big Money Selling Anything to AnyoneBewertung: 5 von 5 Sternen5/5 (114)

- Create Once, Distribute Forever: How Great Creators Spread Their Ideas and How You Can TooVon EverandCreate Once, Distribute Forever: How Great Creators Spread Their Ideas and How You Can TooNoch keine Bewertungen

- ChatGPT Millionaire 2024 - Bot-Driven Side Hustles, Prompt Engineering Shortcut Secrets, and Automated Income Streams that Print Money While You Sleep. The Ultimate Beginner’s Guide for AI BusinessVon EverandChatGPT Millionaire 2024 - Bot-Driven Side Hustles, Prompt Engineering Shortcut Secrets, and Automated Income Streams that Print Money While You Sleep. The Ultimate Beginner’s Guide for AI BusinessNoch keine Bewertungen

- Understanding Digital Marketing: Marketing Strategies for Engaging the Digital GenerationVon EverandUnderstanding Digital Marketing: Marketing Strategies for Engaging the Digital GenerationBewertung: 4 von 5 Sternen4/5 (22)

- The Power of Why: Breaking Out In a Competitive MarketplaceVon EverandThe Power of Why: Breaking Out In a Competitive MarketplaceBewertung: 4 von 5 Sternen4/5 (5)

- Storytelling: A Guide on How to Tell a Story with Storytelling Techniques and Storytelling SecretsVon EverandStorytelling: A Guide on How to Tell a Story with Storytelling Techniques and Storytelling SecretsBewertung: 4.5 von 5 Sternen4.5/5 (72)

- Summary: Range: Why Generalists Triumph in a Specialized World by David Epstein: Key Takeaways, Summary & Analysis IncludedVon EverandSummary: Range: Why Generalists Triumph in a Specialized World by David Epstein: Key Takeaways, Summary & Analysis IncludedBewertung: 4.5 von 5 Sternen4.5/5 (6)

- Summary: The Intelligent Investor: The Definitive Book on Value Investing by Benjamin Graham: Key Takeaways, Summary & AnalysisVon EverandSummary: The Intelligent Investor: The Definitive Book on Value Investing by Benjamin Graham: Key Takeaways, Summary & AnalysisBewertung: 4 von 5 Sternen4/5 (4)

- Summary: Influence: The Psychology of Persuasion by Robert B. Cialdini Ph.D.: Key Takeaways, Summary & AnalysisVon EverandSummary: Influence: The Psychology of Persuasion by Robert B. Cialdini Ph.D.: Key Takeaways, Summary & AnalysisBewertung: 5 von 5 Sternen5/5 (4)