Beruflich Dokumente

Kultur Dokumente

Profitability Ratios Return On Equity: Price/earnings Ratio

Hochgeladen von

MuhammadSufian0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

24 Ansichten2 Seitenmeezan

Originaltitel

Analysis of MEEZAN

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenmeezan

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

24 Ansichten2 SeitenProfitability Ratios Return On Equity: Price/earnings Ratio

Hochgeladen von

MuhammadSufianmeezan

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

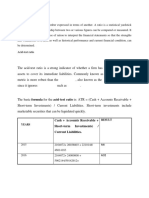

Profitability ratios

Return on Equity

Formula:

Net Income / Total Equity

ROE 18.25057661 19.06284598

The return on the equity of the bank is 19.062 in 2015 and 18.2505 in 2016. There is a slight

decrease in the ROE because of the increase in equity which gave less return in 2016 than 2015.

This shows that the generation of return from the shareholders equity has reduced for the bank

because there is bank increase in the number of shareholders.

Return on Assets

Formula:

Net Income / Total Assets

ROA 0.845528915 0.94434702

Return on assets is the profit availed from the assets invested. It considers of both long-term as

well as short-term assets. The gross yield on assets have decreased slightly but the continuous

decrease in upcoming years can affect the expense control. They need to control the utilization

of assets i.e. short-term or long-term advances or loans and exchange of balances with other

banks.

Valuation Ratio

Price to earnings ratio

Price/earnings ratio 12.1 9.1

Formula: Price / Earnings

This is a very important ratio because it shows the NI of the past of the bank and also it shows

the market value of the shares. The goodwill for the future performance of the bank depends

upon this ratio. P/E ratio has increased from 9.1 to 12.1 in the years 2015 to 2016. This is a

healthy number showing the market value of the share has increased and thus the value of the

bank has increased.

Price to Sales Ratio

Formula:

(Current share price * outstanding number of share)/Average sales of pervious one year

Price to sales 2.9 2.1

It is the indication between how much an investor paid in comparison to how much the

company sales generated per share. It is the measure of value placed on the sales by the

market. Since there is an increase in the Price to sales ratio from 2.1 to 2.9 this means that the

market is willing to pay higher for each rupee of annual sales.

Book Value per Share

Formula:

Book value per share / no. of share outstanding

Book Value per

share 32.69 29.81

The earnings received from issuing common equity, it is the value which is extracted at the end

for investors by removing preferred equity, tangible assets and liabilities. It is the value

remained after all assets are liquidated and all liabilities are dealt with. The book value per

share for meezan bank increased over the years indicating the issued common equity is

valuable in the market for meezan bank. This can retain the investors and attract new investors.

Das könnte Ihnen auch gefallen

- SPC Abc Security Agrmnt PDFDokument6 SeitenSPC Abc Security Agrmnt PDFChristian Comunity100% (3)

- Financial Ratio Analysis AssignmentDokument10 SeitenFinancial Ratio Analysis Assignmentzain5435467% (3)

- Introduction of The Ratio AnalysisDokument11 SeitenIntroduction of The Ratio AnalysisAlisha SharmaNoch keine Bewertungen

- Millionaire Next Door QuestionsDokument7 SeitenMillionaire Next Door Questionsapi-360370073Noch keine Bewertungen

- Return On EquityDokument6 SeitenReturn On EquitySharathNoch keine Bewertungen

- Concrete For Water StructureDokument22 SeitenConcrete For Water StructureIntan MadiaaNoch keine Bewertungen

- SH210 5 SERVCE CD PDF Pages 1 33Dokument33 SeitenSH210 5 SERVCE CD PDF Pages 1 33Em sulistio87% (23)

- Applied Corporate Finance. What is a Company worth?Von EverandApplied Corporate Finance. What is a Company worth?Bewertung: 3 von 5 Sternen3/5 (2)

- Emergency and Safety ProceduresDokument22 SeitenEmergency and Safety Procedurespaupastrana94% (17)

- Huawei Core Roadmap TRM10 Dec 14 2011 FinalDokument70 SeitenHuawei Core Roadmap TRM10 Dec 14 2011 Finalfirasibraheem100% (1)

- Hitt PPT 12e ch08-SMDokument32 SeitenHitt PPT 12e ch08-SMHananie NanieNoch keine Bewertungen

- White Button Mushroom Cultivation ManualDokument8 SeitenWhite Button Mushroom Cultivation ManualKhurram Ismail100% (4)

- Week 7 Apple Case Study FinalDokument18 SeitenWeek 7 Apple Case Study Finalgopika surendranathNoch keine Bewertungen

- Estimation and Detection Theory by Don H. JohnsonDokument214 SeitenEstimation and Detection Theory by Don H. JohnsonPraveen Chandran C RNoch keine Bewertungen

- Growth Analysis: EPS Net Profit After Tax Preference Share Dividend Number of Ordinary Shares OutstandingDokument5 SeitenGrowth Analysis: EPS Net Profit After Tax Preference Share Dividend Number of Ordinary Shares OutstandingRaveena RakhraNoch keine Bewertungen

- Baximco RatioDokument9 SeitenBaximco RatioAfsana Mimi (211011065)Noch keine Bewertungen

- RatiosDokument5 SeitenRatiosSidharth Sankar RathNoch keine Bewertungen

- Ratio Analysis (Imp Points) : Firm Is Undercapitalized and Does Not Have The Resources ToDokument6 SeitenRatio Analysis (Imp Points) : Firm Is Undercapitalized and Does Not Have The Resources ToAjay BhaskarNoch keine Bewertungen

- Ratio Analysis CommentsDokument9 SeitenRatio Analysis Commentsshameeee67% (3)

- Data Analysis and Interpretation Calculation and Interpretation of RatiosDokument27 SeitenData Analysis and Interpretation Calculation and Interpretation of RatiosGGUULLSSHHAANNNoch keine Bewertungen

- Financial Statement Analysis On Fazal Textile MillsDokument5 SeitenFinancial Statement Analysis On Fazal Textile MillsSajid Ur RehmanNoch keine Bewertungen

- Analysis Far (Unit)Dokument5 SeitenAnalysis Far (Unit)Asfatin AmranNoch keine Bewertungen

- Q 2Dokument2 SeitenQ 2mohd reiNoch keine Bewertungen

- Financial Ratio Formulas: Liquidity RatiosDokument5 SeitenFinancial Ratio Formulas: Liquidity RatiosMuhammad Muavia SiddiqyNoch keine Bewertungen

- Ration Analysis: 7.3 Parties Interested in Ratio AnalysisDokument17 SeitenRation Analysis: 7.3 Parties Interested in Ratio AnalysisMuhammad NoumanNoch keine Bewertungen

- Hindustan Unilever LimitedDokument6 SeitenHindustan Unilever LimitedkpilNoch keine Bewertungen

- MAC2602 - 2013 Assignment 1 of 2 SemesterDokument22 SeitenMAC2602 - 2013 Assignment 1 of 2 SemesterAmé MoutonNoch keine Bewertungen

- Tata SteelDokument3 SeitenTata SteelBinodini SenNoch keine Bewertungen

- Ratio Analysis of Kotak Mahindra BankDokument5 SeitenRatio Analysis of Kotak Mahindra BankMayur ZambareNoch keine Bewertungen

- Britannia Industries WordDokument16 SeitenBritannia Industries WordToshini BarhateNoch keine Bewertungen

- Ratio AnalysisDokument5 SeitenRatio AnalysisDharmesh PrajapatiNoch keine Bewertungen

- Financial Statement Analysis Word FileDokument25 SeitenFinancial Statement Analysis Word FileolmezestNoch keine Bewertungen

- HDFC Standard Life Insurance Company Limited: Six Months Ended September 2010Dokument22 SeitenHDFC Standard Life Insurance Company Limited: Six Months Ended September 2010Dilip RajNoch keine Bewertungen

- 5 Remaining RatiosDokument2 Seiten5 Remaining RatioshariharanpNoch keine Bewertungen

- Bogdanka: Investment Story & RecommendationDokument4 SeitenBogdanka: Investment Story & Recommendationp_barankiewiczNoch keine Bewertungen

- PNB Analysis 2012Dokument14 SeitenPNB Analysis 2012Niraj SharmaNoch keine Bewertungen

- Sandip Voltas ReportDokument43 SeitenSandip Voltas ReportsandipNoch keine Bewertungen

- Financial RatiosDokument5 SeitenFinancial RatiosSarjeel Ahsan NiloyNoch keine Bewertungen

- Pak Electron LimitedDokument22 SeitenPak Electron LimitedSaad AnwarNoch keine Bewertungen

- Finance Henry BootDokument19 SeitenFinance Henry BootHassanNoch keine Bewertungen

- Chapter 2 Presentation Financial StatementDokument27 SeitenChapter 2 Presentation Financial StatementWijdan Saleem EdwanNoch keine Bewertungen

- Banking Sector Post ReformDokument21 SeitenBanking Sector Post ReformPriti KshirsagarNoch keine Bewertungen

- Analysis On Nestlé Financial Statements 2017Dokument8 SeitenAnalysis On Nestlé Financial Statements 2017Fred The FishNoch keine Bewertungen

- Inventory Turnover RatioDokument3 SeitenInventory Turnover RatioshreyashNoch keine Bewertungen

- Valuation of Stocks & Bonds: Bfinma2: Financial Management P-2Dokument47 SeitenValuation of Stocks & Bonds: Bfinma2: Financial Management P-2Dufuxwerr WerrNoch keine Bewertungen

- Submitted To: Prof. Mayank KumarDokument31 SeitenSubmitted To: Prof. Mayank KumarDayanand ChaudharyNoch keine Bewertungen

- Unit 4 IAPM FM 01Dokument42 SeitenUnit 4 IAPM FM 01areumkim261Noch keine Bewertungen

- Ratio AnalysisDokument8 SeitenRatio AnalysisikramNoch keine Bewertungen

- Analysis of Accounts: NB: The Higher The Percentage, The More Successful The Managers Are in EarningDokument7 SeitenAnalysis of Accounts: NB: The Higher The Percentage, The More Successful The Managers Are in EarningmannNoch keine Bewertungen

- Financial Analysis Report of Raymond FinalDokument14 SeitenFinancial Analysis Report of Raymond FinalAnkit prakashNoch keine Bewertungen

- Corp Fin AssignDokument9 SeitenCorp Fin AssignTwafik MoNoch keine Bewertungen

- Final Presentation On Bank Al-HabibDokument25 SeitenFinal Presentation On Bank Al-Habibimran50Noch keine Bewertungen

- Blue Star Limited: Accounting Policies Followed by The CompanyDokument8 SeitenBlue Star Limited: Accounting Policies Followed by The CompanyRitika SorengNoch keine Bewertungen

- FM PPT Ratio AnalysisDokument12 SeitenFM PPT Ratio AnalysisHarsh ManotNoch keine Bewertungen

- Analysis of Xyz Limited' Company: Liquidity RatiosDokument7 SeitenAnalysis of Xyz Limited' Company: Liquidity RatiosdharmapuriarunNoch keine Bewertungen

- Understanding Financial Statement, Taxes and Cash FlowDokument33 SeitenUnderstanding Financial Statement, Taxes and Cash Flow22GayeonNoch keine Bewertungen

- Maria FinalDokument8 SeitenMaria FinalrideralfiNoch keine Bewertungen

- Ratio Analysis: R K MohantyDokument30 SeitenRatio Analysis: R K MohantysachindhakraoNoch keine Bewertungen

- Eco Assign 2Dokument6 SeitenEco Assign 2Muhammad MustafaNoch keine Bewertungen

- Financial AnalysisDokument34 SeitenFinancial AnalysisElaijah D. SacroNoch keine Bewertungen

- Gross Profit Net Sales - Cost of Goods Sold Net Sales Gross Sales - Sales ReturnsDokument10 SeitenGross Profit Net Sales - Cost of Goods Sold Net Sales Gross Sales - Sales ReturnsZeath ElizaldeNoch keine Bewertungen

- FIN 422 (Takibul 18100042)Dokument53 SeitenFIN 422 (Takibul 18100042)Takibul HasanNoch keine Bewertungen

- The Balance Sheet: Task 1Dokument12 SeitenThe Balance Sheet: Task 1Mahmoud EsmaeilNoch keine Bewertungen

- "How Well Am I Doing?" Financial Statement Analysis: Mcgraw-Hill/IrwinDokument41 Seiten"How Well Am I Doing?" Financial Statement Analysis: Mcgraw-Hill/Irwinrayjoshua12Noch keine Bewertungen

- Ratio AnaDokument13 SeitenRatio Anakennetjoel8Noch keine Bewertungen

- Comment On Bank PerformanceDokument6 SeitenComment On Bank PerformanceHuong Mai VuNoch keine Bewertungen

- Ratio AnalysisDokument3 SeitenRatio Analysismeyo fredNoch keine Bewertungen

- KNPL - MaDokument14 SeitenKNPL - MaChaithanya KumarNoch keine Bewertungen

- FM PDFDokument11 SeitenFM PDFRushikesh GadhaveNoch keine Bewertungen

- Impact of Compulsive Buying On Consumer BehaviorDokument6 SeitenImpact of Compulsive Buying On Consumer BehaviorMuhammadSufianNoch keine Bewertungen

- Swot Analysis StrengthsDokument11 SeitenSwot Analysis StrengthsMuhammadSufianNoch keine Bewertungen

- Customers Intention To Use Green Products The Imp PDFDokument16 SeitenCustomers Intention To Use Green Products The Imp PDFMuhammadSufianNoch keine Bewertungen

- A Happy Incident of My LifeDokument2 SeitenA Happy Incident of My LifeMuhammadSufian50% (2)

- Crisis: Qasim: Assalam-O-AllikumDokument3 SeitenCrisis: Qasim: Assalam-O-AllikumMuhammadSufianNoch keine Bewertungen

- Name: Muhammad Sufian Sec: D Id: 14u00133 Subject: Business LawDokument3 SeitenName: Muhammad Sufian Sec: D Id: 14u00133 Subject: Business LawMuhammadSufianNoch keine Bewertungen

- Om ProjectDokument10 SeitenOm ProjectMuhammadSufianNoch keine Bewertungen

- ISP Flash Microcontroller Programmer Ver 3.0: M Asim KhanDokument4 SeitenISP Flash Microcontroller Programmer Ver 3.0: M Asim KhanSrđan PavićNoch keine Bewertungen

- Methods of Teaching Syllabus - FinalDokument6 SeitenMethods of Teaching Syllabus - FinalVanessa L. VinluanNoch keine Bewertungen

- Is.14785.2000 - Coast Down Test PDFDokument12 SeitenIs.14785.2000 - Coast Down Test PDFVenkata NarayanaNoch keine Bewertungen

- Reference: Digital Image Processing Rafael C. Gonzalez Richard E. WoodsDokument43 SeitenReference: Digital Image Processing Rafael C. Gonzalez Richard E. WoodsNisha JosephNoch keine Bewertungen

- Bba Colleges in IndiaDokument7 SeitenBba Colleges in IndiaSumit GuptaNoch keine Bewertungen

- MBA - Updated ADNU GSDokument2 SeitenMBA - Updated ADNU GSPhilip Eusebio BitaoNoch keine Bewertungen

- Nat Law 2 - CasesDokument12 SeitenNat Law 2 - CasesLylo BesaresNoch keine Bewertungen

- Fundamental RightsDokument55 SeitenFundamental RightsDivanshuSharmaNoch keine Bewertungen

- Circuitos Digitales III: #IncludeDokument2 SeitenCircuitos Digitales III: #IncludeCristiamNoch keine Bewertungen

- ABB Price Book 524Dokument1 SeiteABB Price Book 524EliasNoch keine Bewertungen

- B.ST Case Study Class 12Dokument214 SeitenB.ST Case Study Class 12Anishka Rathor100% (1)

- Pega AcademyDokument10 SeitenPega AcademySasidharNoch keine Bewertungen

- Class 11 Accountancy NCERT Textbook Chapter 4 Recording of Transactions-IIDokument66 SeitenClass 11 Accountancy NCERT Textbook Chapter 4 Recording of Transactions-IIPathan KausarNoch keine Bewertungen

- PanasonicDokument35 SeitenPanasonicAsif Shaikh0% (1)

- TOEFLDokument6 SeitenTOEFLSekar InnayahNoch keine Bewertungen

- Syed Hamid Kazmi - CVDokument2 SeitenSyed Hamid Kazmi - CVHamid KazmiNoch keine Bewertungen

- SDFGHJKL ÑDokument2 SeitenSDFGHJKL ÑAlexis CaluñaNoch keine Bewertungen

- IP Based Fingerprint Access Control & Time Attendance: FeatureDokument2 SeitenIP Based Fingerprint Access Control & Time Attendance: FeaturenammarisNoch keine Bewertungen

- Small Signal Analysis Section 5 6Dokument104 SeitenSmall Signal Analysis Section 5 6fayazNoch keine Bewertungen

- Palm Manual EngDokument151 SeitenPalm Manual EngwaterloveNoch keine Bewertungen