Beruflich Dokumente

Kultur Dokumente

Holding Company Problems

Hochgeladen von

Siva SankariOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Holding Company Problems

Hochgeladen von

Siva SankariCopyright:

Verfügbare Formate

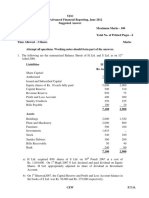

1. The summarised balance sheet of H ltd and S ltd as on 31.12.

12 are given below:

Liabilities H ltd S ltd Assets H ltd S ltd

Share capital of Rs 10 5,00,000 1,00,000 Sundry assets 5,00,000 1,70,000

P & L a/c 60,000 40,000

6,40,000 1,70,000 6,40,000 1,70,000

2,72,500 1,58,200 2,72,500 1,58,000

S ltd had the reserve of Rs.30,000 when H ltd acquired the shares in S ltd but the profit and

loss account balance of S ltd was fully earned after the purchase of shares.

S ltd decided to issue bonus shares out of the post acquisition profit in the ratio of 2 for every

5 shares held.

Calculate cost of control before and after the issue of bonus shares.

2. (Treatment of inter-company Owings, unrealised profit in stock and contingent liability)

Liabilities and assets of H ltd and its subsidiary S ltd on 31.3.2013 was as under:

Liabilities H ltd S ltd Assets H ltd S ltd

Equity shares of Land and

Rs.10 each fully paid 20,00,000 5,00,000 buildings 6,00,000 -

General reserve on Plant and

1.4.2012 3,00,000 1,00,000 machinery 20,00,000

-

Surplus a/c Furniture and

Balance on 1.4.12 4,00,000 2,00,000 fixtures 90,000 1,00,000

Profit for the year 30,000 shares

ended 31.3.12 5,00,000 2,50,000 in S ltd at cost 6,50,000 -

Bills payable 1,50,000 - Stock 4,00,000 7,50,000

Creditors 3,00,000 3,00,000 Debtors 1,00,000 2,80,000

Bank overdraft 2,00,000 - Cash in hand 10,000 20,000

Bills receivable - 2,00,000

38,50,000 13,50,000 38,50,000 13,50,000

30,000 shares in S ltd were acquired by H ltd on 1.10.2012. Bills receivable held by S td Include

bills of H ltd for Rs.1, 20,000. Included in debtors of S ltd is a sum of Rs.60, 000 owing by H ltd

in respect of goods supplied by S ltd. Stock of H ltd includes goods worth Rs.30, 000 purchased

from S ltd for which the later company has charged profit at 25% on cost. Contingent liability

for bills discounted by S ltd Rs.25, 000.

You are required to prepare a consolidated balance sheet of H ltd and its subsidiary ltd

as at 31.3.12. Give all your working notes clearly.

3. (Revaluation of assets and preference share in Subsidiary ltd)

Balance sheet of H ltd and S ltd as on 313.13 was as follows:

Liabilities H ltd S ltd Assets H ltd S ltd

10% preference - Buildings 3,10,000 1,60,000

shares of Rs.100 1,00,000

each

Equity shares of Machinery

Rs.100 each 10,00,000 4,00,000 Less: 10% 2,70,000 1,35,000

depn.

General reserve 1,00,000 50,000 3,000 shares in

S ltd 4.50,000 -

P & L A/c Stock at cost 2,20,000 1,50,000

(1/4/12) 40,000 30,000

Profit for the year Debtors 1,55,000 90,000

12-13 2,00,000 80,000

Creditors 1,50,000 70,000 Cash 85,000 1,95,000

14,90,000 7,30,000 14,90,000 7,30,000

H ltd acquired 3,000 shares in S ltd on 1/10/12. As on the date of acquisition H ltd found that

the value buildings and machinery of S ltd should be Rs.1, 50,000 and Rs.1, 92,500 respectively.

Prepare consolidated balance sheet of H ltd and its subsidiary S ltd as on 31/3/13 taking into

consideration the fact that asset to be taken at their proper values.

Das könnte Ihnen auch gefallen

- Sums On Consolidation 2020 PDFDokument3 SeitenSums On Consolidation 2020 PDFRohan DharneNoch keine Bewertungen

- Test - Consolidated Financial StatementsDokument1 SeiteTest - Consolidated Financial StatementsSibika GadiaNoch keine Bewertungen

- Test - Consolidated Financial StatementsDokument1 SeiteTest - Consolidated Financial StatementsSibika GadiaNoch keine Bewertungen

- Holding Book QuestionsDokument9 SeitenHolding Book QuestionskartikNoch keine Bewertungen

- Corporate Accounting - IIDokument2 SeitenCorporate Accounting - IISiva KumarNoch keine Bewertungen

- Consolidation Part 1Dokument11 SeitenConsolidation Part 1Benita BijuNoch keine Bewertungen

- Holdinf CompanyDokument18 SeitenHoldinf CompanySuyash PatilNoch keine Bewertungen

- AmalDokument7 SeitenAmalAkki GalaNoch keine Bewertungen

- Important Que Advanced Cor AccDokument18 SeitenImportant Que Advanced Cor Accvineethaj2004Noch keine Bewertungen

- P18 - Practice Test Paper - Syl12 - Jun14 - Set 3: Paper 18 - Corporate Financial Reporting Syllabus 2012Dokument9 SeitenP18 - Practice Test Paper - Syl12 - Jun14 - Set 3: Paper 18 - Corporate Financial Reporting Syllabus 2012ChandreshNoch keine Bewertungen

- Final Ca: MAY '19 Financial ReportingDokument13 SeitenFinal Ca: MAY '19 Financial ReportingJINENDRA JAINNoch keine Bewertungen

- Illustrations AmalgamationDokument4 SeitenIllustrations Amalgamationajay2741100% (1)

- Practice Exam CADokument23 SeitenPractice Exam CAParneet Kaur SethiNoch keine Bewertungen

- Holding Company ProblemsDokument22 SeitenHolding Company ProblemsYashodhan MithareNoch keine Bewertungen

- AcctsDokument63 SeitenAcctskanchanthebest100% (1)

- Accounting For Holding Co. (Lecture 3) : Total 12,00,000 6,00,000Dokument6 SeitenAccounting For Holding Co. (Lecture 3) : Total 12,00,000 6,00,000Michael JimNoch keine Bewertungen

- Unit 2 Merger & Purchase MethodDokument11 SeitenUnit 2 Merger & Purchase MethodLuckygirl JyothiNoch keine Bewertungen

- Consolidated Financial StatementDokument6 SeitenConsolidated Financial StatementUdit RajNoch keine Bewertungen

- Practice - Exercise Consolidated - Balance - Sheet 17 06 2014Dokument7 SeitenPractice - Exercise Consolidated - Balance - Sheet 17 06 2014Deepika PadukoneNoch keine Bewertungen

- Date: 06-03-2021 Subject:Book Keeping & Time: 3 Hrs. Class:XII Com Marks: 80 Syllabus: Full SyllabusDokument5 SeitenDate: 06-03-2021 Subject:Book Keeping & Time: 3 Hrs. Class:XII Com Marks: 80 Syllabus: Full SyllabusPranit PanditNoch keine Bewertungen

- Accounts AmalgamationDokument6 SeitenAccounts AmalgamationscarunamarNoch keine Bewertungen

- Advanced Corporate AccountingDokument6 SeitenAdvanced Corporate Accountingamensinkai3133Noch keine Bewertungen

- III Year QuestionBankDokument113 SeitenIII Year QuestionBankercis6421100% (1)

- Previous Year Question Paper (FSA)Dokument16 SeitenPrevious Year Question Paper (FSA)Alisha ShawNoch keine Bewertungen

- UNIT (24) 2.08 CONSOLIDATED bALANCE SHEET PROBLEMDokument4 SeitenUNIT (24) 2.08 CONSOLIDATED bALANCE SHEET PROBLEMAaryan K MNoch keine Bewertungen

- Consolidation TutorialDokument8 SeitenConsolidation TutorialPrageeth Roshan WeerathungaNoch keine Bewertungen

- Consolidated QuestionsDokument13 SeitenConsolidated QuestionsPoojaSajnani100% (1)

- Business CombinationDokument4 SeitenBusiness CombinationA001AADITYA MALIKNoch keine Bewertungen

- ECO-14 - ENG - CompressedDokument4 SeitenECO-14 - ENG - CompressedYzNoch keine Bewertungen

- Attempt Any Four Questions. All Questions Carry Equal MarksDokument3 SeitenAttempt Any Four Questions. All Questions Carry Equal MarksVishwas Srivastava 371Noch keine Bewertungen

- Amalgamation, Absorption Etc PDFDokument21 SeitenAmalgamation, Absorption Etc PDFYashodhan MithareNoch keine Bewertungen

- Retierment of PartnerDokument4 SeitenRetierment of PartnerSaransh GhoshNoch keine Bewertungen

- Test 3 QPDokument7 SeitenTest 3 QPDharmateja ChakriNoch keine Bewertungen

- June 2019Dokument182 SeitenJune 2019shankar k.c.Noch keine Bewertungen

- RTP June 19 QnsDokument15 SeitenRTP June 19 QnsbinuNoch keine Bewertungen

- Afar 3 Quiz 4 Stock AcquisitionDokument4 SeitenAfar 3 Quiz 4 Stock AcquisitiondmangiginNoch keine Bewertungen

- Dissolution of Partnership FirmDokument5 SeitenDissolution of Partnership FirmPrageeth Roshan WeerathungaNoch keine Bewertungen

- PQ - Covnersion Partnership To CompanyDokument8 SeitenPQ - Covnersion Partnership To CompanyAnshul BiyaniNoch keine Bewertungen

- Admission of PartnerDokument3 SeitenAdmission of PartnerPraWin KharateNoch keine Bewertungen

- Corporate Accounting - I Semester ExaminationDokument7 SeitenCorporate Accounting - I Semester ExaminationVijay KumarNoch keine Bewertungen

- Fa - 6 Amalgamation & LLPDokument10 SeitenFa - 6 Amalgamation & LLPalokchowdhury111Noch keine Bewertungen

- Holding Company ADNRDokument10 SeitenHolding Company ADNRsachinNoch keine Bewertungen

- AdvDokument19 SeitenAdvashwin krishnaNoch keine Bewertungen

- Vineet FileDokument8 SeitenVineet FileVineet KumarNoch keine Bewertungen

- Financial Accounting & AuditingDokument13 SeitenFinancial Accounting & Auditingkashish mehtaNoch keine Bewertungen

- Financial Reporting RTP CAP-III June 2016Dokument24 SeitenFinancial Reporting RTP CAP-III June 2016Artha sarokarNoch keine Bewertungen

- Corporate AccountingDokument7 SeitenCorporate AccountingAkshit JhingranNoch keine Bewertungen

- X LTD: 1) XY LTD To Issue 600-10% Debentures of Rs 100 Each To Debenture Holders of X LTDDokument1 SeiteX LTD: 1) XY LTD To Issue 600-10% Debentures of Rs 100 Each To Debenture Holders of X LTDVishwas KrishnaNoch keine Bewertungen

- Unit III Amalgamation With Respect To A.S - 14 Purchase ConsiderationDokument17 SeitenUnit III Amalgamation With Respect To A.S - 14 Purchase ConsiderationPaulomi LahaNoch keine Bewertungen

- Mergers and Acquisitions DocDokument3 SeitenMergers and Acquisitions DocRuchita JanakiramNoch keine Bewertungen

- Chapter-2: Partnership AccountsDokument6 SeitenChapter-2: Partnership Accountsadityatiwari122006Noch keine Bewertungen

- 11 AmalgmationDokument38 Seiten11 AmalgmationPranaya Agrawal100% (1)

- Groups With Rights Issue (2021)Dokument3 SeitenGroups With Rights Issue (2021)Tawanda Tatenda HerbertNoch keine Bewertungen

- Amalgamation of Companies and External Reconstruction QuestionsDokument12 SeitenAmalgamation of Companies and External Reconstruction Questionskashish mehtaNoch keine Bewertungen

- Capiii Advaccount June12Dokument17 SeitenCapiii Advaccount June12Narendra KumarNoch keine Bewertungen

- D16. CAP - II - Dec - 2022 - CAP - II - Group - IDokument48 SeitenD16. CAP - II - Dec - 2022 - CAP - II - Group - IBharat KhanalNoch keine Bewertungen

- Chartered Accountancy Professional Ii (Cap-Ii) : Revision Test Paper Group I December 2021Dokument81 SeitenChartered Accountancy Professional Ii (Cap-Ii) : Revision Test Paper Group I December 2021Arpan ParajuliNoch keine Bewertungen

- Corporate Accounting Exam Questions PaperDokument7 SeitenCorporate Accounting Exam Questions PaperAmmar Bin NasirNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNoch keine Bewertungen

- Module 1 CIBDokument8 SeitenModule 1 CIBSiva SankariNoch keine Bewertungen

- NPV ExcelDokument2 SeitenNPV ExcelSiva SankariNoch keine Bewertungen

- Project AppraisalDokument5 SeitenProject AppraisalSiva SankariNoch keine Bewertungen

- EBIT-EPS AnalysisDokument18 SeitenEBIT-EPS AnalysisSiva SankariNoch keine Bewertungen

- ValuationDokument7 SeitenValuationSiva SankariNoch keine Bewertungen

- COnvergenceDokument10 SeitenCOnvergenceSiva SankariNoch keine Bewertungen

- Export ProcedureDokument4 SeitenExport ProcedureSiva SankariNoch keine Bewertungen

- 9 - The Following Is The Trading and Profit and Loss A/c of Sankar For The Previous YearDokument1 Seite9 - The Following Is The Trading and Profit and Loss A/c of Sankar For The Previous YearSiva SankariNoch keine Bewertungen

- Problems Tally AssignDokument6 SeitenProblems Tally AssignSiva SankariNoch keine Bewertungen

- Exercise No.: 1 M/S Anabalagan PVT., LTD., No.26, Appusamystreet, T.Nagar, ChennaiDokument2 SeitenExercise No.: 1 M/S Anabalagan PVT., LTD., No.26, Appusamystreet, T.Nagar, ChennaiSiva SankariNoch keine Bewertungen

- PR - No.11 To 17 QuestionsDokument5 SeitenPR - No.11 To 17 QuestionsSiva SankariNoch keine Bewertungen

- Income From Salary QUESTIONSDokument20 SeitenIncome From Salary QUESTIONSSiva SankariNoch keine Bewertungen

- Defect Chap 3Dokument2 SeitenDefect Chap 3Siva SankariNoch keine Bewertungen

- Assignment 2 FPTMDokument1 SeiteAssignment 2 FPTMSiva SankariNoch keine Bewertungen

- Assignment 1 FPTMDokument1 SeiteAssignment 1 FPTMSiva SankariNoch keine Bewertungen

- Assignment 1Dokument1 SeiteAssignment 1Siva SankariNoch keine Bewertungen

- Assignment 3Dokument1 SeiteAssignment 3Siva SankariNoch keine Bewertungen

- Assignment 1Dokument1 SeiteAssignment 1Siva SankariNoch keine Bewertungen

- Problem - No.1 Amalgamation in The Nature of Purchase - Net Asset Method Without Statutory Reserve)Dokument6 SeitenProblem - No.1 Amalgamation in The Nature of Purchase - Net Asset Method Without Statutory Reserve)Siva SankariNoch keine Bewertungen

- Assignment 2Dokument1 SeiteAssignment 2Siva SankariNoch keine Bewertungen

- Assignment 5Dokument1 SeiteAssignment 5Siva SankariNoch keine Bewertungen

- Assignment 3Dokument1 SeiteAssignment 3Siva SankariNoch keine Bewertungen

- GIDokument18 SeitenGISiva SankariNoch keine Bewertungen

- Assignment 2Dokument1 SeiteAssignment 2Siva SankariNoch keine Bewertungen

- Cyber LawDokument35 SeitenCyber LawSiva Sankari100% (1)

- GIDokument18 SeitenGISiva SankariNoch keine Bewertungen

- Please (Click Here) : S.No. Area/Sector No. of Visits Maximum Financial Ceiling Per EventDokument4 SeitenPlease (Click Here) : S.No. Area/Sector No. of Visits Maximum Financial Ceiling Per EventSiva SankariNoch keine Bewertungen

- IT ACt 2000Dokument44 SeitenIT ACt 2000Siva SankariNoch keine Bewertungen

- Purchases + Carriage Inwards + Other Expenses Incurred On Purchase of Materials - Closing Inventory of MaterialsDokument4 SeitenPurchases + Carriage Inwards + Other Expenses Incurred On Purchase of Materials - Closing Inventory of MaterialsSiva SankariNoch keine Bewertungen

- Respuestas Primer Examen PDFDokument4 SeitenRespuestas Primer Examen PDFpcostagi750% (2)

- BJ Assets 02Dokument63 SeitenBJ Assets 02PenjualBooxAndrooidBooxNoch keine Bewertungen

- Fusion Financials BrochureDokument16 SeitenFusion Financials Brochureshan monsiNoch keine Bewertungen

- Basics of Stock Market Trading GuideDokument10 SeitenBasics of Stock Market Trading Guidegokul kNoch keine Bewertungen

- The Organizational Plan: Learning ObjectivesDokument37 SeitenThe Organizational Plan: Learning ObjectivesJAYANT MAHAJANNoch keine Bewertungen

- Ceo Summit 2019 ProgramDokument4 SeitenCeo Summit 2019 ProgramChris AnnNoch keine Bewertungen

- Case 3 FSA-1Dokument2 SeitenCase 3 FSA-1Avinaba GuhaNoch keine Bewertungen

- Board StructureDokument21 SeitenBoard Structureharman singhNoch keine Bewertungen

- No Par Value Stock DefinitionDokument2 SeitenNo Par Value Stock DefinitionblezylNoch keine Bewertungen

- Week 2Dokument41 SeitenWeek 2jc cNoch keine Bewertungen

- Business Finance - ADM - Module 1 Q1 WK 1 To 2 Introduction To Financial Management 3Dokument37 SeitenBusiness Finance - ADM - Module 1 Q1 WK 1 To 2 Introduction To Financial Management 3Angela France LarugalNoch keine Bewertungen

- Lembar KerjaDokument48 SeitenLembar KerjareiNoch keine Bewertungen

- Derivatives Title - Impact of Derivatives On The Non-Financial Firms in UKDokument15 SeitenDerivatives Title - Impact of Derivatives On The Non-Financial Firms in UKPankaj KhannaNoch keine Bewertungen

- Financial Metrics ExampleDokument2 SeitenFinancial Metrics ExampleSourav shabuNoch keine Bewertungen

- TVM and No-Arbitrage Principle: Practice Questions and ProblemsDokument2 SeitenTVM and No-Arbitrage Principle: Practice Questions and ProblemsMavisNoch keine Bewertungen

- Free CFA Level 1 Mock Exam 300hrsDokument26 SeitenFree CFA Level 1 Mock Exam 300hrstakudzwariogaNoch keine Bewertungen

- AF210 Unit 3 Tutorial Suggested SolutionsDokument5 SeitenAF210 Unit 3 Tutorial Suggested SolutionsChand DivneshNoch keine Bewertungen

- PAS 33-Earnings Per ShareDokument38 SeitenPAS 33-Earnings Per Sharerena chavezNoch keine Bewertungen

- Mergers and Acquisitions REVDokument18 SeitenMergers and Acquisitions REVhizelaryaNoch keine Bewertungen

- ACCO 30023 - Accounting For Business Combination (IM)Dokument74 SeitenACCO 30023 - Accounting For Business Combination (IM)rachel banana hammockNoch keine Bewertungen

- Trade PlanDokument6 SeitenTrade PlanFazri Ashari RomadhonNoch keine Bewertungen

- Ch05 Banks and Analysts - 3edDokument22 SeitenCh05 Banks and Analysts - 3edSarah AliNoch keine Bewertungen

- ACCO101Dokument37 SeitenACCO101Belle AustriaNoch keine Bewertungen

- Time Allowed: 3 Hours Maximum Marks: 80 General InstructionsDokument32 SeitenTime Allowed: 3 Hours Maximum Marks: 80 General InstructionsRohit MatoliyaNoch keine Bewertungen

- Financial Engineering - Futures, Forwards and SwapsDokument114 SeitenFinancial Engineering - Futures, Forwards and Swapsqari saibNoch keine Bewertungen

- Questions 2Dokument12 SeitenQuestions 2venice cambryNoch keine Bewertungen

- ACTG 431 QUIZ Week 2 Theory of Accounts Part 2 - NOTES AND LOANS RECEIVABLE QUIZDokument6 SeitenACTG 431 QUIZ Week 2 Theory of Accounts Part 2 - NOTES AND LOANS RECEIVABLE QUIZMarilou Arcillas PanisalesNoch keine Bewertungen

- Rules of Debit and CreditDokument4 SeitenRules of Debit and CreditGlesa SalienteNoch keine Bewertungen

- Solution Manual For Financial and Managerial Accounting Williams Haka Bettner Carcello 16th EditionDokument13 SeitenSolution Manual For Financial and Managerial Accounting Williams Haka Bettner Carcello 16th EditionToni Johnston100% (33)

- Financial Statement AnalysisDokument28 SeitenFinancial Statement AnalysisSachin Methree75% (4)