Beruflich Dokumente

Kultur Dokumente

SP500 Valuation

Hochgeladen von

streettalk700Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

SP500 Valuation

Hochgeladen von

streettalk700Copyright:

Verfügbare Formate

Macro: SP 500 November 30, 2017

We believe that the chief determinant of future total returns is the relative valuation of the index at the time of purchase. We measure

valuation using the Price/Peak Earnings multiple as advocated by Dr. John Hussman. We believe the main benefit of using peak

earnings is the inherent conservatism it affords: not subject to analyst estimates, not subject to the short-term ebbs and flows of

business, and not subject to short-term accounting distortions. Annualized total returns can be calculated over a horizon period for

given scenarios of multiple expansion or contraction.

Our analysis highlights expansion/contraction to the minimum, mean, average, and maximum multiples (our data-set begins in January

1900) . The baseline assumptions for nominal growth and horizon period are 6% and 10 years, respectively. We also provide graphical

analysis of how predicted returns compare to actual returns historically.

We provide sensitivity analysis to our baseline assumptions. The first sensitivity table, ceterus paribus, shows how future returns are

impacted by changing the horizon period. The second sensitivity table, ceterus paribus, shows how future returns are impacted by

changing the growth assumption.

We also include the following information: duration, over(under)-valuation, inflation adjusted price/10-year real earnings, dividend

yield, option-implied volatility, skew, realized volatility, historical relationships between inflation and p/e multiples, and historical

relationship between p/e multiples and realized returns.

Our analysis is not intended to forecast the short-term direction of the SP500 Index. The purpose of our analysis is to identify the

relative valuation and inherent risk offered by the index currently.

GTA 2017 j.brett.freeze@globaltechnicalanalysis.com 704.408.3919

Predicted Returns November 30, 2017

SP 500 Valuation Model: Peak Earnings

Predicted 10-Year Annual Return v Realized

March 1957- Current, Monthly Observations

30.00 30.00

25.00 25.00

20.00 20.00

15.00 15.00

10.00 10.00

5.00 5.00

0.00 0.00

(5.00) (5.00)

(10.00) (10.00)

Predicted 10-Y Annual Return (Maximum Price/Peak Earnings) Predicted 10-Y Annual Return (Average Price/Peak Earnings)

Predicted 10-Y Annual Return (Median Price/Peak Earnings) Predicted 10-Y Annual Return (Minimum Price/Peak Earnings)

Actual Annual Return (RHS)

As of 11/30/2017: If current Price/Peak Earnings of 23.6 expands or contracts to:

Maximum Price/Peak Earnings of 33.5, Predicted Return = 11.32%, Capital Gain 9.77% Dividend 1.55%

Minimum Price/Peak Earnings of 3.0, Predicted Return = -5.71%, Capital Gain -13.87% Dividend 8.16%

Average Price/Peak Earnings of 12.6 Predicted Return = 2.19%, Capital Gain -0.42% Dividend 2.61%

Median Price/Peak Earnings of 12.1, Predicted Return = 1.87%, Capital Gain -0.81% Dividend 2.68%

GTA 2017 j.brett.freeze@globaltechnicalanalysis.com 704.408.3919

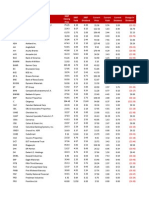

Predicted Returns: Sensitivity Analysis November 30, 2017

Price / Peak Earnings

Time Horizon 3.0 7.0 9.0 11.0 12.1 12.6 14.0 16.0 18.0 21.0 23.0 25.0 27.0 29.0 31.0 33.5

10 (5.71) (2.15) (0.45) 1.07 1.83 2.14 3.05 4.21 5.27 6.70 7.57 8.38 9.14 9.86 10.53 11.32

9 (7.67) (3.41) (1.47) 0.24 1.10 1.45 2.47 3.77 4.96 6.57 7.54 8.45 9.30 10.11 10.87 11.75

8 (10.06) (4.96) (2.74) (0.78) 0.19 0.59 1.75 3.23 4.57 6.40 7.50 8.54 9.50 10.42 11.28 12.28

7 (13.04) (6.92) (4.34) (2.09) (0.97) (0.51) 0.83 2.53 4.08 6.18 7.46 8.65 9.76 10.82 11.82 12.98

6 (16.84) (9.46) (6.44) (3.80) (2.49) (1.95) (0.39) 1.60 3.43 5.89 7.39 8.79 10.11 11.36 12.53 13.91

5 (21.85) (12.89) (9.29) (6.14) (4.57) (3.94) (2.07) 0.33 2.52 5.49 7.30 9.00 10.60 12.11 13.55 15.22

4 (28.75) (17.79) (13.40) (9.55) (7.62) (6.84) (4.53) (1.56) 1.16 4.89 7.17 9.31 11.34 13.26 15.09 17.23

3 (38.77) (25.33) (19.83) (14.95) (12.48) (11.47) (8.49) (4.62) (1.05) 3.89 6.94 9.83 12.57 15.19 17.70 20.64

2 (54.29) (38.29) (31.24) (24.77) (21.42) (20.04) (15.91) (10.46) (5.32) 1.93 6.49 10.87 15.09 19.16 23.10 27.78

1 (78.54) (64.58) (56.28) (47.73) (42.97) (40.94) (34.67) (25.88) (17.04) (3.73) 5.16 14.07 22.99 31.92 40.86 51.88

Price / Peak Earnings

Growth Rate 3.0 7.0 9.0 11.0 12.1 12.6 14.0 16.0 18.0 21.0 23.0 25.0 27.0 29.0 31.0 33.5

0.06 (5.71) (2.15) (0.45) 1.07 1.83 2.14 3.05 4.21 5.27 6.70 7.57 8.38 9.14 9.86 10.53 11.32

0.05 (6.52) (3.04) (1.35) 0.15 0.90 1.20 2.10 3.25 4.30 5.71 6.57 7.38 8.13 8.84 9.51 10.28

0.04 (7.33) (3.92) (2.26) (0.78) (0.04) 0.27 1.15 2.29 3.32 4.73 5.58 6.37 7.12 7.82 8.48 9.25

0.03 (8.15) (4.81) (3.17) (1.71) (0.97) (0.67) 0.20 1.33 2.35 3.74 4.58 5.36 6.10 6.80 7.45 8.21

0.02 (8.96) (5.70) (4.08) (2.63) (1.91) (1.61) (0.75) 0.36 1.38 2.75 3.58 4.36 5.09 5.77 6.42 7.18

0.01 (9.77) (6.58) (4.99) (3.56) (2.84) (2.55) (1.69) (0.60) 0.40 1.76 2.58 3.35 4.07 4.75 5.40 6.14

Valuation Date 11/30/2017

Current Price / Peak Earnings 23.6

Growth Rate 0.06

Time Horizon (Years) 10

Current Dividend Yield 0.0182

GTA 2017 j.brett.freeze@globaltechnicalanalysis.com 704.408.3919

Price to Peak Earnings November 30, 2017

SP 500 Valuation Model

Price / Peak Earnings

March 1957- Current, Monthly Observations

40.0

35.0

30.0

25.0

20.0

15.0

10.0

5.0

0.0

As of 11/30/2017: Price/Peak Earnings 23.6

To get at the significance of the P/E, you have to start by understanding that stocks are not a claim to earnings anyway. Stocks are a claim to a future stream of

free cash flows the cash that can actually be delivered to shareholders over time after all other obligations have been satisfied, including the provision for future

growth. Knowing this already tells us a lot. For example, price/earnings ratios based on operating earnings are inherently misleading, since that earnings figure

does not deduct interest owed to bondholders nor taxes owed to the government. This isn't to say that P/E ratios are useless, but it's important for the E

chosen by an investor to have a reasonably stable relationship to what matters, which is the long-term stream of free cash flows. For that reason, our favored

earnings measure for market valuation (though it can't be used for individual stocks) is peak earnings - the highest level of net earnings achieved to date.

(Excerpted from Dr. John Hussman)

GTA 2017 j.brett.freeze@globaltechnicalanalysis.com 704.408.3919

Duration November 30, 2017

SP 500 Valuation Model

Duration In Years (Price / Dividend)

March 1957- Current, Monthly Observations

100.0

90.0

80.0

70.0

60.0

50.0

40.0

30.0

20.0

10.0

0.0

As of 11/30/2017: Duration 55.0 years

In the case of equities, duration measures the percentage change in stock prices in response to a 1% change in the long-term return that stocks are priced to deliver.

So we have a basic financial planning concept. If a buy-and-hold investor with no particular view about market conditions or future returns wishes to have a fairly

predictable amount of wealth at some future date, that investor should hold a portfolio with a duration that is roughly equal to the investment horizon. (Excerpted

from Dr. John Hussman)

GTA 2017 j.brett.freeze@globaltechnicalanalysis.com 704.408.3919

Valuation November 30, 2017

SP 500 Valuation Model

Relative to 10% Annual Total Return over 10-Year Horizon

March 1957- Current, Monthly Observations

225.000 (5.00)

A

c

200.000 t

u

175.000 a

O

v 0.00 l

e 150.000

r A

(

U n

Y

n P 125.000 n

e

e u

d 5.00 a

r 100.000 a

e r

c l

r

e

)

75.000 H

n

R

V t o

e

a a 50.000 r

10.00 t

l g i

u

u e z

25.000 r

a o

n

t n

i 0.000

O

o 15.00 v

n (25.000) e

r

(50.000)

1

0

(75.000) 20.00

-

Percentage Over(Under) Valued Actual Annual Return

As of 11/30/2017: Overvalued by 108.8%

GTA 2017 j.brett.freeze@globaltechnicalanalysis.com 704.408.3919

Inflation Adjusted PE November 30, 2017

SP500 Valuation Model

Real Price to 10-Year Real Earnings

March 1957- Current, Monthly Observations

50.0

45.0

40.0

35.0

30.0

25.0

20.0

15.0

10.0

5.0

0.0

As of 11/30/2017: Real Price to 10-Year Real Earnings 31.9x

GTA 2017 j.brett.freeze@globaltechnicalanalysis.com 704.408.3919

Dividend Yield November 30, 2017

SP 500 Valuation Model

Dividend Yield

March 1957- Current, Monthly Observations

7.00%

6.00%

5.00%

4.00%

3.00%

2.00%

1.00%

0.00%

As of 11/30/2017: Dividend Yield 1.82%

GTA 2017 j.brett.freeze@globaltechnicalanalysis.com 704.408.3919

Option Implied Volatility November 30, 2017

CBOE VIX Index

10-Day Exponential Moving Average

75.00

11/21/2008, 69.34

65.00

55.00

45.00

10/4/2011, 40.28

10/10/2002, 39.17

35.00

9/2/2015, 26.83

25.00

15.00

7/7/2014, 11.17 11/30/2017, 10.56

2/23/2007, 10.39

5.00

VIX measures 30-day expected volatility of the S&P 500 Index. The components of VIX are near- and next-term put and call

options, usually in the first and second SPX contract months. Near-term options must have at least one week to expiration; a

requirement intended to minimize pricing anomalies that might occur close to expiration.

As of 11/30/2017: 10-Day EMA 10.56

GTA 2017 j.brett.freeze@globaltechnicalanalysis.com 704.408.3919

Option Skew November 30, 2017

CBOE Skew Index

10-Day Exponential Moving Average

150.00

3/20/2017, 146.57

145.00 6/28/2016, 141.16

1/15/2016, 140.07

140.00 7/14/2014, 137.31

135.00

8/29/2005, 131.14 2/18/2011, 131.07

130.00

125.00

120.00

115.00

11/30/2017, 129.94

110.00

105.00

100.00

The CBOE SKEW Index ("SKEW") is an index derived from the price of S&P 500 tail risk. The price of S&P 500 tail risk is calculated

from the prices of S&P 500 out-of-the-money options. SKEW typically ranges from 100 to 150. A SKEW value of 100 means that

the perceived distribution of S&P 500 log-returns is normal, and the probability of outlier returns is therefore negligible. As SKEW

rises above 100, the left tail of the S&P 500 distribution acquires more weight, and the probabilities of outlier returns become

more significant.

As of 11/30/2017: 10-Day EMA 129.94

GTA 2017 j.brett.freeze@globaltechnicalanalysis.com 704.408.3919

Realized Volatility November 30, 2017

SP500 Valuation Model

Annualized Volatility

March 1957- Current, Monthly Observations

30.00

25.00

20.00

15.00

10.00

5.00

0.00

As of 11/30/2017: 5.04%

GTA 2017 j.brett.freeze@globaltechnicalanalysis.com 704.408.3919

Inflation and PE Multiples November 30, 2017

Price to Peak Earnings v %Y/Y CPI

40.00

35.00

P

r

i

c 30.00

e

t

o 25.00

P

e

20.00

a

k

E 15.00

a

r

n

i 10.00

n

g

s

5.00

0.00

(4.00) (2.00) 0.00 2.00 4.00 6.00 8.00 10.00 12.00 14.00 16.00

%Y/Y CPI

1970s 1980s 1990s 2000s 2010s

Lower levels of inflation are rewarded with higher earnings multiples.

Higher levels of inflation are punished with lower earnings multiples.

GTA 2017 j.brett.freeze@globaltechnicalanalysis.com 704.408.3919

Inflation and PE Multiples November 30, 2017

Price to Peak Earnings v Volatility of %Y/Y CPI

40.00

35.00

P

r

i

c 30.00

e

t

o 25.00

P

e

20.00

a

k

E 15.00

a

r

n

i 10.00

n

g

s

5.00

0.00

0.00 0.50 1.00 1.50 2.00 2.50 3.00

1Y StDev %Y/Y CPI

1970s 1980s 1990s 2000s 2010s

Lower levels of volatility are rewarded with higher earnings multiples.

Higher levels of volatility are punished with lower earnings multiples.

GTA 2017 j.brett.freeze@globaltechnicalanalysis.com 704.408.3919

PE Multiples and Realized Returns November 30, 2017

Realized Returns v Valuation

20.0

R 15.0

e

a

l

i

z A

n

e 10.0

n

d

u

a

1 l

0

i

Y

z

5.0

e

R d

e

t

u

r

n 0.0

(5.0)

5.00 10.00 15.00 20.00 25.00 30.00 35.00

Price to Peak Earnings

1970s 1980s 1990s 2000s

Lower valuations are rewarded with higher realized returns.

Higher valuations are punished with lower realized returns.

As of 11/30/2017: Price to Peak Earnings 23.6x Average: 12.6x

GTA 2017 j.brett.freeze@globaltechnicalanalysis.com 704.408.3919

Das könnte Ihnen auch gefallen

- Russell 3000 "Death Cross" Signals More Pain - 03/30/20Dokument11 SeitenRussell 3000 "Death Cross" Signals More Pain - 03/30/20streettalk700Noch keine Bewertungen

- Not All The Pieces Are in Place For A Sustained Rally - World - Snapshot-3!25!20Dokument10 SeitenNot All The Pieces Are in Place For A Sustained Rally - World - Snapshot-3!25!20streettalk700Noch keine Bewertungen

- The US Jobs Market - Much Worse Than The Official Data SuggestDokument14 SeitenThe US Jobs Market - Much Worse Than The Official Data Suggeststreettalk700100% (1)

- Lance Roberts - Economic & Investment Summit 2017 Opening PresentationDokument30 SeitenLance Roberts - Economic & Investment Summit 2017 Opening Presentationstreettalk700100% (5)

- S&P 500 Monthly Valuation Analysis & ReviewDokument14 SeitenS&P 500 Monthly Valuation Analysis & Reviewstreettalk700100% (1)

- Employment Trends in The U.S.Dokument16 SeitenEmployment Trends in The U.S.streettalk700Noch keine Bewertungen

- The Great ContaigionDokument9 SeitenThe Great Contaigionstreettalk700Noch keine Bewertungen

- AroundTheWorldIn8Pages Q1 2019 LVDokument41 SeitenAroundTheWorldIn8Pages Q1 2019 LVstreettalk700Noch keine Bewertungen

- GTA Introduction RIA ProDokument7 SeitenGTA Introduction RIA Prostreettalk700100% (2)

- Unified Framework For Fixing Our Broken Tax CodeDokument9 SeitenUnified Framework For Fixing Our Broken Tax Codestreettalk700Noch keine Bewertungen

- Greg Morris - 2017 Economic & Investment Summit Presentation - Questionable PracticesDokument53 SeitenGreg Morris - 2017 Economic & Investment Summit Presentation - Questionable Practicesstreettalk700Noch keine Bewertungen

- Lebowitz - Valuations Matter & The Virtuous CycleDokument26 SeitenLebowitz - Valuations Matter & The Virtuous Cyclestreettalk700100% (2)

- Unconventional Policies and Their Effects On Financial Markets PDFDokument36 SeitenUnconventional Policies and Their Effects On Financial Markets PDFSoberLookNoch keine Bewertungen

- Summer Market Outlook & ForecastDokument51 SeitenSummer Market Outlook & Forecaststreettalk700Noch keine Bewertungen

- EmpDokument6 SeitenEmpdpbasicNoch keine Bewertungen

- Investor Intelligence Techical Analysis GuideDokument25 SeitenInvestor Intelligence Techical Analysis Guidestreettalk700Noch keine Bewertungen

- Psychology of Risk-Behavioral Finance PerspectiveDokument28 SeitenPsychology of Risk-Behavioral Finance Perspectivestreettalk700Noch keine Bewertungen

- RIA Economic & Investment Summit 2016Dokument55 SeitenRIA Economic & Investment Summit 2016streettalk700Noch keine Bewertungen

- Companies Paying Dividend SP500 - 2007-2015Dokument8 SeitenCompanies Paying Dividend SP500 - 2007-2015streettalk700Noch keine Bewertungen

- Companies Paying Dividend SP500 - 2007-2015Dokument8 SeitenCompanies Paying Dividend SP500 - 2007-2015streettalk700Noch keine Bewertungen

- Cycles and Possible OutcomesDokument6 SeitenCycles and Possible Outcomesstreettalk700Noch keine Bewertungen

- Companies Paying Dividend SP500 - 2007-2015Dokument8 SeitenCompanies Paying Dividend SP500 - 2007-2015streettalk700Noch keine Bewertungen

- Understanding The Bear CaseDokument17 SeitenUnderstanding The Bear Casestreettalk700Noch keine Bewertungen

- Companies That Cut Dividends in 2008Dokument3 SeitenCompanies That Cut Dividends in 2008streettalk700Noch keine Bewertungen

- Valuations Suggest Extremely Overvalued MarketDokument9 SeitenValuations Suggest Extremely Overvalued Marketstreettalk700Noch keine Bewertungen

- FOMC Overly Optimistic on Wealth Effect and Economic GrowthDokument5 SeitenFOMC Overly Optimistic on Wealth Effect and Economic GrowthTREND_7425Noch keine Bewertungen

- Value Investor Forum Presentation 2015 (Print Version)Dokument29 SeitenValue Investor Forum Presentation 2015 (Print Version)streettalk700Noch keine Bewertungen

- Modern Portfolio Theory 2Dokument21 SeitenModern Portfolio Theory 2streettalk700Noch keine Bewertungen

- Risk Revisited by Howard MarksDokument17 SeitenRisk Revisited by Howard Marksstreettalk700Noch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Developing the cycle of maslahah based performance management system implementationDokument27 SeitenDeveloping the cycle of maslahah based performance management system implementationM Audito AlfansyahNoch keine Bewertungen

- 2020 Global Finance Business Management Analyst Program - IIMDokument4 Seiten2020 Global Finance Business Management Analyst Program - IIMrishabhaaaNoch keine Bewertungen

- USDA Guide To CanningDokument7 SeitenUSDA Guide To CanningWindage and Elevation0% (1)

- DBMS Architecture FeaturesDokument30 SeitenDBMS Architecture FeaturesFred BloggsNoch keine Bewertungen

- CENG 5503 Intro to Steel & Timber StructuresDokument37 SeitenCENG 5503 Intro to Steel & Timber StructuresBern Moses DuachNoch keine Bewertungen

- Ultra Slimpak G448-0002: Bridge Input Field Configurable IsolatorDokument4 SeitenUltra Slimpak G448-0002: Bridge Input Field Configurable IsolatorVladimirNoch keine Bewertungen

- 100 Training Games - Kroehnert, GaryDokument180 Seiten100 Training Games - Kroehnert, GarywindsorccNoch keine Bewertungen

- PowerPointHub Student Planner B2hqY8Dokument25 SeitenPowerPointHub Student Planner B2hqY8jersey10kNoch keine Bewertungen

- Vector 4114NS Sis TDSDokument2 SeitenVector 4114NS Sis TDSCaio OliveiraNoch keine Bewertungen

- Excess AirDokument10 SeitenExcess AirjkaunoNoch keine Bewertungen

- Joining Instruction 4 Years 22 23Dokument11 SeitenJoining Instruction 4 Years 22 23Salmini ShamteNoch keine Bewertungen

- Allan S. Cu v. Small Business Guarantee and FinanceDokument2 SeitenAllan S. Cu v. Small Business Guarantee and FinanceFrancis Coronel Jr.Noch keine Bewertungen

- Mutual Fund PDFDokument22 SeitenMutual Fund PDFRajNoch keine Bewertungen

- Alignment of Railway Track Nptel PDFDokument18 SeitenAlignment of Railway Track Nptel PDFAshutosh MauryaNoch keine Bewertungen

- Induction ClassesDokument20 SeitenInduction ClassesMichelle MarconiNoch keine Bewertungen

- Philippine Army BDU BidDokument2 SeitenPhilippine Army BDU BidMaria TeresaNoch keine Bewertungen

- HP HP3-X11 Exam: A Composite Solution With Just One ClickDokument17 SeitenHP HP3-X11 Exam: A Composite Solution With Just One ClicksunnyNoch keine Bewertungen

- Excel Solver Optimization ReportDokument9 SeitenExcel Solver Optimization ReportMy Duyen NguyenNoch keine Bewertungen

- ERIKS Dynamic SealsDokument28 SeitenERIKS Dynamic Sealsdd82ddNoch keine Bewertungen

- October 2009 Centeral Aucland, Royal Forest and Bird Protecton Society NewsletterDokument8 SeitenOctober 2009 Centeral Aucland, Royal Forest and Bird Protecton Society NewsletterRoyal Forest and Bird Protecton SocietyNoch keine Bewertungen

- H I ĐĂNG Assigment 3 1641Dokument17 SeitenH I ĐĂNG Assigment 3 1641Huynh Ngoc Hai Dang (FGW DN)Noch keine Bewertungen

- Condition Based Monitoring System Using IoTDokument5 SeitenCondition Based Monitoring System Using IoTKaranMuvvalaRaoNoch keine Bewertungen

- A Database of Chromatographic Properties and Mass Spectra of Fatty Acid Methyl Esters From Omega-3 ProductsDokument9 SeitenA Database of Chromatographic Properties and Mass Spectra of Fatty Acid Methyl Esters From Omega-3 ProductsmisaelNoch keine Bewertungen

- Individual Performance Commitment and Review Form (Ipcrf) : Mfos Kras Objectives Timeline Weight Per KRADokument4 SeitenIndividual Performance Commitment and Review Form (Ipcrf) : Mfos Kras Objectives Timeline Weight Per KRAChris21JinkyNoch keine Bewertungen

- Inventory ControlDokument26 SeitenInventory ControlhajarawNoch keine Bewertungen

- AVR Instruction Set Addressing ModesDokument4 SeitenAVR Instruction Set Addressing ModesSundari Devi BodasinghNoch keine Bewertungen

- Product Data Sheet For CP 680-P and CP 680-M Cast-In Firestop Devices Technical Information ASSET DOC LOC 1540966Dokument1 SeiteProduct Data Sheet For CP 680-P and CP 680-M Cast-In Firestop Devices Technical Information ASSET DOC LOC 1540966shama093Noch keine Bewertungen

- Open Far CasesDokument8 SeitenOpen Far CasesGDoony8553Noch keine Bewertungen

- Ratio Analysis of PIADokument16 SeitenRatio Analysis of PIAMalik Saad Noman100% (5)

- Bula Defense M14 Operator's ManualDokument32 SeitenBula Defense M14 Operator's ManualmeNoch keine Bewertungen