Beruflich Dokumente

Kultur Dokumente

MARKET DAILY For Wednesday, September 1, 2010

Hochgeladen von

JC CalaycayOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

MARKET DAILY For Wednesday, September 1, 2010

Hochgeladen von

JC CalaycayCopyright:

Verfügbare Formate

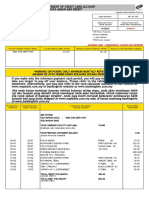

ACCORD CAPITAL EQUITIES CORPORATION

GF EC-058B East Tower, PSE Center, Exchange Road, Ortigas Center, Pasig City, PHILIPPINES 1605 (632)687-5071 (trunk)

DAILY REPORT, for Wednesday, September 1, 2010

PSEI: 3,566.23, +7.59 pts, +0.21%; Value of Trades: n/a ; Adv: 70 Dec: 60 Unch: 38

REVIEW & OUTLOOK

COMING off an extended weekend, investors refused to buckle under the pressure of

the Dow's 140 points slide overnight, sending local stocks mildly higher by 8.56

points to 3,566.23. (The PSE website's Market, which we have had difficulty accessing

through the weekend, through the Market Information link, puts the change at +7.47

points which would translate Friday's close to 3,558.76, not 3,558.27 as reported in the

daily quotations report.)

US investors have remained pessimistic even in light of a relative balance of positive

and negative numbers. Consumer spending picked up, with purchases rising 0.4%

on the back of a 0.2% increase in incomes. The savings rate dropped, however, as

disposable income, what is left of the paycheck after taxes, slid. While this has

pushed the “double-dip recession” argument one row back in the table of concerns,

the jobs market outlook remains the biggest hurdle for a sustained push.

The Nikkei 225 dug in deeper into the bear hole, losing over 3% as of noon Tuesday.

The measure is now on its fourth session under the 9,000-mark, a level it last traded

under in May 1, 2009, virtually erasing all gains over the last 16-months. It likewise

extends to a 14th session its sustained trading under the bear line of 9,450. (This

level marks the 20% retreat off the year's highest close of 11,339.30, April 5, 2010.)

Although analysts do not see the Japanese economy, which was recently overtaken

by China as the 2nd largest in the world, will recede, growth pace is seen to markedly

slow to almost a lull.

100

1

5

9

3

1

7

1

1

2

5

2

9

2

3

7

3

1

4

5

4

9

4

3

5

7

5

1

6

5

6

9

6

3

7

7

1

8

5

8

9

8

3

9

7

9

0

1

5

0

1

9

0

1

3

1

7

1

2

1

5

2

1

9

2

1

3

1

7

3

1

4

1

5

4

1

9

4

1

3

5

1

7

5

1

6

1

5

6

1

9

6

1

3

7

1

0

-100

-200

-300

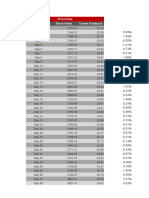

-400 PSEI rises from 3,102.59 to 3,566.23

-500

-600

-700

-800

The market's technical indicators are pretty stable with Tuesday's month-closing action making minimal changes. The PSEI uptrend remains

valid, thus further intensifying the “correction-watch”. The biggest, extended decline in the index was a five-session, 161.06 points (-4.82%) slump

from the May 21 high of 3,340.42 to and interim low of 3,179.26. This marked the index third unsuccessful attempt to make a sustained break off

the the 3,330 resistance line. That retreat erased 30% of the 542.81 points (19.4%) aggregated advance from the year's lowest close of 2,797.61

(February 9). Since then the market has added 218.25 points (6.53%.) with the biggest declines at -2.8% (May 25), -2.7% (June 7) and -2.3%

(August 24.) Roughly half of the latter's drop was contributed by a last-second sell down of ALI shares to php14.00, as well as coming off the

year's highest closing level yet at 3,613.37.

DISCLOSURES: (Monday, August 31, 2010)

Access to the PSE website remains erratic at this time (1340H). Only seven (7) disclosures have been uploaded, namely: CIP's and LMG's new schedule

for their Annual Stockholders meeting [moved to September 27]; PAL's clarification of its reported php4B fresh capital raising; APX's Trust Agreement

with Teresa Crew Gold Philippines, Mapula Creek Gold Corporation and RCB; Changes in the Beneficial Ownership of Securities of the MJC; Initial

Statement of Beneficial Ownership of Securities in BC; and IRC's Definitive Information Statement for its Annual Stockholders' Meeting on September

23, 2010, with Record Date on July 30, 2010. We cannot provide the salient points of these disclosures as we are unable to open the uploaded files.

DISCLAIMER: THE MATERIAL CONTAINED IN THIS PUBLICATION IS FOR INFORMATION PURPOSES ONLY. IT IS NOT TO BE REPRODUCED OR COPIED OR MADE AVAILABLE TO

OTHERS. UNDER NO CIRCUMSTANCES IS IT TO BE CONSIDERED AS AN OFFER TO SELL OR A SOLICITATION TO BUY ANY SECURITY. WHILE THE INFORMATION HEREIN IS

FROM SOURCES WE BELIEVE RELIABLE, WE DO NOT REPRESENT THAT IT IS ACCURATE OR COMPLETE AND IT SHOULD NOT BE RELIED UPON AS SUCH. IN ADDITION, WE

SHALL NOT BE RESPONSIBLE FOR AMENDING, CORRECTING OR UPDATING ANY INFORMATION OR OPINIONS CONTAINED HEREIN. SOME OF THE VIEWS EXPRESSED IN THIS

REPORT ARE NOT NECESSARILY OPINIONS OF ACCORD CAPITAL EQUITIES CORPORATION ON THE CREDIT-WORTHINESS OR INVESTMENT PROFILE OF THE COMPANY OR THE

INDUSTRIES MENTIONED.

DAILY Report Page 1 of 1

Das könnte Ihnen auch gefallen

- STOCK PICKS For Week 36 Part 1Dokument3 SeitenSTOCK PICKS For Week 36 Part 1JC CalaycayNoch keine Bewertungen

- The Global Outlook Speech by Mark CarneyDokument20 SeitenThe Global Outlook Speech by Mark CarneyHao WangNoch keine Bewertungen

- Pull, Push, Pipes: Sustainable Capital Flows For A New World OrderDokument23 SeitenPull, Push, Pipes: Sustainable Capital Flows For A New World OrderHao WangNoch keine Bewertungen

- The Australian Economy and Financial Markets: July 2019Dokument33 SeitenThe Australian Economy and Financial Markets: July 2019Amita SinghNoch keine Bewertungen

- PPMC November 2023-WorkbookDokument40 SeitenPPMC November 2023-Workbookanil sharmaNoch keine Bewertungen

- Memorandum: Regi Nal A Fnewre TR Tion Nru HeadsDokument2 SeitenMemorandum: Regi Nal A Fnewre TR Tion Nru HeadsLTO PARTIDONoch keine Bewertungen

- Check in 3Dokument1 SeiteCheck in 3UrsulaNoch keine Bewertungen

- 21 Macro Economic Shocks and Their EffectsDokument14 Seiten21 Macro Economic Shocks and Their Effectssaywhat133Noch keine Bewertungen

- Basic Math FactsDokument12 SeitenBasic Math Factsapi-292521288Noch keine Bewertungen

- Sauce & Spoon Tablet Project PlanDokument9 SeitenSauce & Spoon Tablet Project PlanVaisakh100% (2)

- 3.3 Appendix 2. Personal Plan For Structure ExpansionDokument3 Seiten3.3 Appendix 2. Personal Plan For Structure ExpansionMajajana TaseskaNoch keine Bewertungen

- 2007-01-18 Early Defaults Rise in Mortgage Securitization (Moody's Special Report)Dokument6 Seiten2007-01-18 Early Defaults Rise in Mortgage Securitization (Moody's Special Report)priak11Noch keine Bewertungen

- 2007-01-18 Early Defaults Rise in Mortgage Securitization (Moody's Special Report)Dokument6 Seiten2007-01-18 Early Defaults Rise in Mortgage Securitization (Moody's Special Report)priak11Noch keine Bewertungen

- Case Study on Bharti Airtel's Company Profile and Financial PerformanceDokument7 SeitenCase Study on Bharti Airtel's Company Profile and Financial PerformanceShuvankar PoriaNoch keine Bewertungen

- Intermediate Level 3b (Reharm)Dokument2 SeitenIntermediate Level 3b (Reharm)obedientcrimeNoch keine Bewertungen

- Simulation Input Data AnalysisDokument43 SeitenSimulation Input Data AnalysiswubiedNoch keine Bewertungen

- Hugh Trevor-Roper - History and The Enlightenment - 2010Dokument341 SeitenHugh Trevor-Roper - History and The Enlightenment - 2010GeorgeTshagharianNoch keine Bewertungen

- Dimensional Drawing of FlowmeterDokument3 SeitenDimensional Drawing of FlowmeterlatasharmaNoch keine Bewertungen

- TD SequentailDokument6 SeitenTD SequentailSteve TangNoch keine Bewertungen

- V3 - 20211108 - SP - WMK - Pembicara Pada Investor Meeting VerdhanaDokument44 SeitenV3 - 20211108 - SP - WMK - Pembicara Pada Investor Meeting VerdhanaAnnisa Amalia NoorNoch keine Bewertungen

- Interest Rate - Cap Rate Economics 2018Dokument15 SeitenInterest Rate - Cap Rate Economics 2018Geraldy Dearma PradhanaNoch keine Bewertungen

- NSE Market PulseDokument14 SeitenNSE Market PulseAjazuddin MohammedNoch keine Bewertungen

- Global Views - Cuts Are ComingDokument8 SeitenGlobal Views - Cuts Are Comingshu281992Noch keine Bewertungen

- India Strategy: Key TakeawaysDokument38 SeitenIndia Strategy: Key Takeawaysmahima patelNoch keine Bewertungen

- Financial Management System Reports and FunctionsDokument71 SeitenFinancial Management System Reports and FunctionsSAJID HUSSAINNoch keine Bewertungen

- Reopening Safely: Sample Practices From Essential BusinessesDokument8 SeitenReopening Safely: Sample Practices From Essential Businessesjcmunevar1484Noch keine Bewertungen

- MicrosoftWord ReportDebtDokument4 SeitenMicrosoftWord ReportDebtCommittee For a Responsible Federal BudgetNoch keine Bewertungen

- Presented by Amir KhanDokument22 SeitenPresented by Amir KhanGhina ShaikhNoch keine Bewertungen

- Outlook For Public and Private MarketsDokument40 SeitenOutlook For Public and Private MarketsContra_hourNoch keine Bewertungen

- Economic, Price and Financial System Stability, Outlook and PoliciesDokument28 SeitenEconomic, Price and Financial System Stability, Outlook and PoliciesSemitha KanakarathnaNoch keine Bewertungen

- 03 Knowledge Sharing 7 QC ToolsDokument107 Seiten03 Knowledge Sharing 7 QC Toolsravi javaliNoch keine Bewertungen

- Character Workbook L11 D2Dokument3 SeitenCharacter Workbook L11 D2fideb62658Noch keine Bewertungen

- Check in 3 AnswersDokument2 SeitenCheck in 3 AnswersUrsulaNoch keine Bewertungen

- Subtopic 2 - Moving AverageDokument21 SeitenSubtopic 2 - Moving AverageKim VincereNoch keine Bewertungen

- Sauce Spoon Project PlanDokument52 SeitenSauce Spoon Project PlanCALVIN AZIZNoch keine Bewertungen

- 6.02 Before Trend ChartDokument8 Seiten6.02 Before Trend ChartnsadnanNoch keine Bewertungen

- Butterfly Trades in FuturesDokument9 SeitenButterfly Trades in Futuresjalajsingh1987Noch keine Bewertungen

- BVM - Presentation - J P Morgan - Jan. 2011Dokument65 SeitenBVM - Presentation - J P Morgan - Jan. 2011Saurabh Kumar KarnNoch keine Bewertungen

- JPM Volatility 2005Dokument24 SeitenJPM Volatility 2005ZerohedgeNoch keine Bewertungen

- Route 66 (Brian Setzer Style) Solo&Chords TABSDokument5 SeitenRoute 66 (Brian Setzer Style) Solo&Chords TABSViktor KaražinecNoch keine Bewertungen

- 2020 - PSYL - Pakistan Synthetics Limited-29-30Dokument29 Seiten2020 - PSYL - Pakistan Synthetics Limited-29-30Muhammad Noman MehboobNoch keine Bewertungen

- Sauce & Spoon Project Plan OptimizationDokument48 SeitenSauce & Spoon Project Plan OptimizationLiam JoseNoch keine Bewertungen

- HSBC Think Future 2023Dokument10 SeitenHSBC Think Future 2023Angela MNoch keine Bewertungen

- CAGED SystemDokument1 SeiteCAGED SystemMarioNoch keine Bewertungen

- Performance Management System Personnel ContractDokument12 SeitenPerformance Management System Personnel ContractSamuel Kinebi OkonkwoNoch keine Bewertungen

- Preventive Maintenance PlanDokument1 SeitePreventive Maintenance PlanRizwanNoch keine Bewertungen

- Materi Seminar Market OutlookDokument58 SeitenMateri Seminar Market OutlookRiska HariyadiNoch keine Bewertungen

- Standard TuningDokument2 SeitenStandard TuningGabriel GonzálezNoch keine Bewertungen

- ECON2003 - Macroeconomic Theory: Professor Richard KnellerDokument12 SeitenECON2003 - Macroeconomic Theory: Professor Richard KnellerdsascsNoch keine Bewertungen

- Calculate payback period and acceptability of investment projectsDokument58 SeitenCalculate payback period and acceptability of investment projectsVibhuti AnandNoch keine Bewertungen

- 25 Arpeggios That Sound Amazing On A G7: and How To Use ThemDokument6 Seiten25 Arpeggios That Sound Amazing On A G7: and How To Use ThemSĩ LêNoch keine Bewertungen

- 25 Arpeggios That Sound Amazing On A G7 and How To Use ThemDokument6 Seiten25 Arpeggios That Sound Amazing On A G7 and How To Use ThemAntonio FazzioNoch keine Bewertungen

- Deadline: Saturday 18 April, 2020: Data Strucctures Assignment 2Dokument4 SeitenDeadline: Saturday 18 April, 2020: Data Strucctures Assignment 2Raza BhattiNoch keine Bewertungen

- Construction Management Exam QuestionsDokument3 SeitenConstruction Management Exam QuestionsShivam AroraNoch keine Bewertungen

- Music sheet analysis of G F 3f' E D C B ADokument1 SeiteMusic sheet analysis of G F 3f' E D C B Amakmak9Noch keine Bewertungen

- Humss S5 Answer SheetDokument3 SeitenHumss S5 Answer SheetKhen Eros NarcisoNoch keine Bewertungen

- But Beautiful: 120 G7M C13 B7 ( 9 13) E7 ( 5)Dokument4 SeitenBut Beautiful: 120 G7M C13 B7 ( 9 13) E7 ( 5)Θανάσης ΚορδαλήςNoch keine Bewertungen

- Seven Indicators That Move Markets: Forecasting Future Market Movements for Profitable InvestmentsVon EverandSeven Indicators That Move Markets: Forecasting Future Market Movements for Profitable InvestmentsBewertung: 2.5 von 5 Sternen2.5/5 (1)

- Straight Through Processing for Financial Services: The Complete GuideVon EverandStraight Through Processing for Financial Services: The Complete GuideNoch keine Bewertungen

- Market Balance - Daily For August 11, 2011Dokument3 SeitenMarket Balance - Daily For August 11, 2011JC CalaycayNoch keine Bewertungen

- Market Balance - Daily For August 10, 2011Dokument2 SeitenMarket Balance - Daily For August 10, 2011JC CalaycayNoch keine Bewertungen

- Weekly Xxvix - July 18 To 22, 2011Dokument2 SeitenWeekly Xxvix - July 18 To 22, 2011JC CalaycayNoch keine Bewertungen

- Market Notes Mining atDokument2 SeitenMarket Notes Mining atJC CalaycayNoch keine Bewertungen

- DAILY - July 22-25, 2011Dokument1 SeiteDAILY - July 22-25, 2011JC CalaycayNoch keine Bewertungen

- Market Notes June 22 WednesdayDokument2 SeitenMarket Notes June 22 WednesdayJC CalaycayNoch keine Bewertungen

- Market Notes July 22 FridayDokument1 SeiteMarket Notes July 22 FridayJC CalaycayNoch keine Bewertungen

- Weekly Xxxi - August 1 To 5, 2011Dokument2 SeitenWeekly Xxxi - August 1 To 5, 2011JC CalaycayNoch keine Bewertungen

- Weekly Report XXX - July 25 To 29, 2011Dokument2 SeitenWeekly Report XXX - July 25 To 29, 2011JC CalaycayNoch keine Bewertungen

- The Philippine Stock Exchange - PseDokument2 SeitenThe Philippine Stock Exchange - PseJC CalaycayNoch keine Bewertungen

- Market Notes - Month Review (June 2011)Dokument2 SeitenMarket Notes - Month Review (June 2011)JC CalaycayNoch keine Bewertungen

- Weekly Xxviii - July 11 To 15, 2011Dokument2 SeitenWeekly Xxviii - July 11 To 15, 2011JC CalaycayNoch keine Bewertungen

- DAILY - June 21-22, 2011Dokument1 SeiteDAILY - June 21-22, 2011JC CalaycayNoch keine Bewertungen

- DAILY - June 22-23, 2011Dokument1 SeiteDAILY - June 22-23, 2011JC CalaycayNoch keine Bewertungen

- DAILY - June 16-17, 2011Dokument1 SeiteDAILY - June 16-17, 2011JC CalaycayNoch keine Bewertungen

- Accord Capital Equities Corporation: Outlook For Week XXV - June 21 To 24 - TD 119-122Dokument3 SeitenAccord Capital Equities Corporation: Outlook For Week XXV - June 21 To 24 - TD 119-122JC CalaycayNoch keine Bewertungen

- Market Notes June 17 FridayDokument1 SeiteMarket Notes June 17 FridayJC CalaycayNoch keine Bewertungen

- Market Notes MwideDokument2 SeitenMarket Notes MwideJC CalaycayNoch keine Bewertungen

- DAILY - June 14-15, 2011Dokument2 SeitenDAILY - June 14-15, 2011JC CalaycayNoch keine Bewertungen

- Market Notes - Food SroDokument2 SeitenMarket Notes - Food SroJC CalaycayNoch keine Bewertungen

- Market Notes - June 6, 2011 - MondayDokument2 SeitenMarket Notes - June 6, 2011 - MondayJC CalaycayNoch keine Bewertungen

- Accord Capital Equities Corporation: Outlook For Week XXIV - June 13 To 17 - TD 114-118Dokument2 SeitenAccord Capital Equities Corporation: Outlook For Week XXIV - June 13 To 17 - TD 114-118JC CalaycayNoch keine Bewertungen

- Weekly Report - Xxi - May 23 To 27, 2011Dokument3 SeitenWeekly Report - Xxi - May 23 To 27, 2011JC CalaycayNoch keine Bewertungen

- Daily - June 10, 2011 - End of WeekDokument2 SeitenDaily - June 10, 2011 - End of WeekJC CalaycayNoch keine Bewertungen

- Weekly Report - June 6-10, 2011Dokument2 SeitenWeekly Report - June 6-10, 2011JC CalaycayNoch keine Bewertungen

- DAILY - May 16-17, 2011Dokument1 SeiteDAILY - May 16-17, 2011JC CalaycayNoch keine Bewertungen

- Daily - June 7-8, 2011Dokument3 SeitenDaily - June 7-8, 2011JC CalaycayNoch keine Bewertungen

- Weekly Report - Xxii - May 30 To June 3, 2011Dokument4 SeitenWeekly Report - Xxii - May 30 To June 3, 2011JC CalaycayNoch keine Bewertungen

- DAILY - May 17-18, 2011Dokument2 SeitenDAILY - May 17-18, 2011JC CalaycayNoch keine Bewertungen

- Market Notes May 17 TuesdayDokument2 SeitenMarket Notes May 17 TuesdayJC CalaycayNoch keine Bewertungen

- How To Read and Interpret Financial Statements - A Guide To Understanding What The Numbers Really MeanDokument179 SeitenHow To Read and Interpret Financial Statements - A Guide To Understanding What The Numbers Really MeanMushahid Aly Khan100% (5)

- LT Foods Limited (DAAWAT - NS) - Long: Ritu Singh '22Dokument2 SeitenLT Foods Limited (DAAWAT - NS) - Long: Ritu Singh '22Sampann PatodiNoch keine Bewertungen

- Estimating Walmarts Cost of CapitalDokument6 SeitenEstimating Walmarts Cost of CapitalPrashuk Sethi0% (1)

- Financial Management Chapter 02 IM 10th EdDokument21 SeitenFinancial Management Chapter 02 IM 10th EdDr Rushen SinghNoch keine Bewertungen

- IasDokument229 SeitenIasPeter Apollo Latosa100% (1)

- ACC 318 Module Four Assignment TemplateDokument2 SeitenACC 318 Module Four Assignment Templateefren9397Noch keine Bewertungen

- Chapter-11 Stock Return and ValuationDokument7 SeitenChapter-11 Stock Return and ValuationAnushrut MNoch keine Bewertungen

- Test Bank For Fundamentals of Corporate Finance 9th Edition Richard Brealey Stewart Myers Alan MarcusDokument47 SeitenTest Bank For Fundamentals of Corporate Finance 9th Edition Richard Brealey Stewart Myers Alan Marcusdouglaskleinkzfmjoxsqg100% (19)

- Optimize portfolio returns with expert managementDokument73 SeitenOptimize portfolio returns with expert managementArunKumarNoch keine Bewertungen

- ASA Valuing Machinery and Equipment 4th Edition 2020-0620 PDFDokument589 SeitenASA Valuing Machinery and Equipment 4th Edition 2020-0620 PDFLea Ann Cruz100% (1)

- Graham Paul BarmanDokument122 SeitenGraham Paul BarmanMonique HoNoch keine Bewertungen

- Gen MathDokument25 SeitenGen MathAndreaaAAaa TagleNoch keine Bewertungen

- Anagram 2011 PicksDokument17 SeitenAnagram 2011 Picksnarsi76Noch keine Bewertungen

- Price Data Date Stock Index Turner FastbuckDokument14 SeitenPrice Data Date Stock Index Turner FastbuckRampraveen ChamarthiNoch keine Bewertungen

- Turnover Ratio Formula Excel TemplateDokument7 SeitenTurnover Ratio Formula Excel TemplateMustafa Ricky Pramana SeNoch keine Bewertungen

- Comm 457 Solutions To Practice MidtermDokument9 SeitenComm 457 Solutions To Practice MidtermJason SNoch keine Bewertungen

- Maybank Card - Convenience, Savings and Rewards: Maybank Islamic Berhad (787435-M)Dokument3 SeitenMaybank Card - Convenience, Savings and Rewards: Maybank Islamic Berhad (787435-M)SZF sumaiyyaNoch keine Bewertungen

- Lot Traded Profit and Capital Table Shows Trading Strategy Over TimeDokument14 SeitenLot Traded Profit and Capital Table Shows Trading Strategy Over TimeAmandeep SinghNoch keine Bewertungen

- Investments Kapitel 5Dokument40 SeitenInvestments Kapitel 57srq2nrhytNoch keine Bewertungen

- Exchange Ratio - Problems N SolutionsDokument26 SeitenExchange Ratio - Problems N SolutionsBrowse Purpose82% (17)

- Acct 2001 Chapter 1 Student LectureDokument38 SeitenAcct 2001 Chapter 1 Student LectureJosephNoch keine Bewertungen

- Introduction To Financial ManagementDokument29 SeitenIntroduction To Financial Managementraymundojr.junioNoch keine Bewertungen

- Supply Chain Management PPT Final EditedDokument17 SeitenSupply Chain Management PPT Final Editedimran khanNoch keine Bewertungen

- Corporate Finance - KS KimDokument5 SeitenCorporate Finance - KS Kim01202750693Noch keine Bewertungen

- Ziraat Bank 2014 US Resolution PlanDokument9 SeitenZiraat Bank 2014 US Resolution Planahmet aslanNoch keine Bewertungen

- Paper - Iii Commerce: Note: Attempt All The Questions. Each Question Carries Two (2) MarksDokument26 SeitenPaper - Iii Commerce: Note: Attempt All The Questions. Each Question Carries Two (2) MarksashaNoch keine Bewertungen

- PMBA PB6020 July2020 Cases Questions 23june2020Dokument24 SeitenPMBA PB6020 July2020 Cases Questions 23june2020Deepa GNoch keine Bewertungen

- Edge Trading Secrets BookDokument80 SeitenEdge Trading Secrets BookJorge Simoes100% (4)

- Investment AppraisalDokument36 SeitenInvestment AppraisalSilky SmoothNoch keine Bewertungen

- Practice For Quiz #3 Solutions For StudentsDokument10 SeitenPractice For Quiz #3 Solutions For Studentssylstria.mcNoch keine Bewertungen