Beruflich Dokumente

Kultur Dokumente

Tax 2

Hochgeladen von

Daichi Akiyama0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

15 Ansichten2 Seitentax 2 pdf

Originaltitel

Tax2

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldentax 2 pdf

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

15 Ansichten2 SeitenTax 2

Hochgeladen von

Daichi Akiyamatax 2 pdf

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

Shanieca Chu Tax 2 November 24,

2017

BSBA-4 Maam Emata

History of VAT in the Philippines

Value added tax or VAT was introduced less than 50 years ago and remained confined

to a handful of countries until the late 1960s. Today, however, most countries impose VAT

which raises on the average of about 25% of their tax revenues. VAT was one of the most

important fiscal innovations of the second half of the 20th century that largely replaced turnover

taxes, a defective form of tax, with no relief for tax paid at previous stages.

VAT was first introduced in the Philippines in 1988 through Executive order number 273

replacing the following indirect taxes:

- annual fixed taxes

- original sales tax on manufacturers and producers

- turnover tax on subsequent sellers

- advance sales tax

- compensating tax on importation of goods

- Miller tax

- Percentage tax on contractors, brokers, lessors of personal property/cinematographic films

- excise tax on certain articles

On 1996, there was a revision on the law, R.A 7716, Expanded Vat (EVAT) law

(inclusion of sales, barter, exchange or lease of intangible and real properties; and sale of

services in the Philippines by a non-resident person). On 1997, R.A 8241, Improved VAT(IVAT)

law (restoration of certain operators under the coverage of the common carrier's tax). On 1998,

R.A 8424 tax reform act of 1997. On 2005, R.A 9337 expanded VAT act of 2005.

The Extended Value Added Tax (EVAT) Law or Republic Act. 9337 was enacted and

begun in Metro Manila, on July 26, 2004.

This Act which is a consolidation of House Bill No. 3555, House Bill No. 3705 and

Senate Bill No. 1950 was finally passed by the House of Representatives and the Senate on

May 11, 2005 and May 10, 2005, respectively. But it was imposed a temporary suspension by

the Supreme Court a few hours after it went into effect on July 1 because of a petition from

opposition lawmakers questioning its legality.

The suspension, however, was considered as a victim of the rift between the

administration and the political opposition over the corruption and election fraud charges against

President Arroyo.

This delay in the EVAT Law, according to a Business World Research article, worsened

the budget deficit; foregone revenues are estimated to be around P5 billion.

The Expanded value-added tax (E-VAT) law was instituted as a measure to bridle the

rising foreign debt of the Philippines and to improve government services such as education,

health care, social security, and and transportation. It forms part of the package of measures

Malacaang had endorsed to help shore up the governments fiscal position and reverse the

credit rating downgrade certain rating agencies had given the Philippines.

This law was made on account that the more taxed a government can collect, the more

services and programs of the government can be implemented as infrastructure projects. The

EVAT law granted President Arroyo the stand-by authority to raise the tax from the current 10

percent to 12 percent under certain conditions. This would help in increasing government funds

and helps alleviate government deficit so that a inflation rate and unemployment can be

overcome.

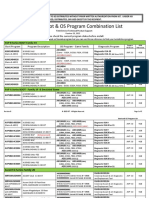

Insights on VAT of different ASEAN countries:

Sources:

http://evat-atenista.blogspot.com/2007/09/brief-history-and-rationale.html

https://www.scribd.com/doc/67229935/3-Value-Added-Tax-Its-Impact-in-the-Philippine-Economy

http://www.business-in-asia.com/asia/taxation_asia.html

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Human Computer InteractionDokument12 SeitenHuman Computer Interactionabhi37Noch keine Bewertungen

- Depreciation Methods ExplainedDokument2 SeitenDepreciation Methods ExplainedAnsha Twilight14Noch keine Bewertungen

- Built For Your Business and The Environment.: WORKFORCE PRO WF-C5290/C5790Dokument4 SeitenBuilt For Your Business and The Environment.: WORKFORCE PRO WF-C5290/C5790abe cedeevNoch keine Bewertungen

- Hangup Cause Code Table: AboutDokument5 SeitenHangup Cause Code Table: Aboutwhatver johnsonNoch keine Bewertungen

- Q.850 ISDN Cause CodesDokument12 SeitenQ.850 ISDN Cause CodesJack CastineNoch keine Bewertungen

- Kim Lighting WTC Wide Throw Cutoff Brochure 1976Dokument24 SeitenKim Lighting WTC Wide Throw Cutoff Brochure 1976Alan MastersNoch keine Bewertungen

- Project IGI 2 Cheat Codes, Hints, and HelpDokument4 SeitenProject IGI 2 Cheat Codes, Hints, and Helppadalakirankumar60% (5)

- Training Prospectus 2020 WebDokument89 SeitenTraining Prospectus 2020 Webamila_vithanageNoch keine Bewertungen

- Mphasis Placement PaperDokument3 SeitenMphasis Placement PapernagasaikiranNoch keine Bewertungen

- z2OrgMgmt FinalSummativeTest LearnersDokument3 Seitenz2OrgMgmt FinalSummativeTest LearnersJade ivan parrochaNoch keine Bewertungen

- Keyence Laser MicrometerDokument20 SeitenKeyence Laser MicrometerimrancenakkNoch keine Bewertungen

- bq76pl455 RegistersDokument132 Seitenbq76pl455 RegistersAhmet KARANoch keine Bewertungen

- Six Thinking Hats TrainingDokument34 SeitenSix Thinking Hats TrainingNishanthan100% (1)

- Frequently Asked Questions (And Answers) About eFPSDokument10 SeitenFrequently Asked Questions (And Answers) About eFPSghingker_blopNoch keine Bewertungen

- Mr. Arshad Nazer: Bawshar, Sultanate of OmanDokument2 SeitenMr. Arshad Nazer: Bawshar, Sultanate of OmanTop GNoch keine Bewertungen

- ReportDokument4 SeitenReportapi-463513182Noch keine Bewertungen

- 19286711Dokument8 Seiten19286711suruth242100% (1)

- Smart Card PresentationDokument4 SeitenSmart Card PresentationNitika MithalNoch keine Bewertungen

- Garments & Tailoring Business: Submitted byDokument6 SeitenGarments & Tailoring Business: Submitted bykartik DebnathNoch keine Bewertungen

- imageRUNNER_ADVANCE_715_615_525_III_Series_PC_r2_200122Dokument87 SeitenimageRUNNER_ADVANCE_715_615_525_III_Series_PC_r2_200122techwisekgNoch keine Bewertungen

- 0 - Theories of MotivationDokument5 Seiten0 - Theories of Motivationswathi krishnaNoch keine Bewertungen

- Sample Cover Letter Oil and GasDokument1 SeiteSample Cover Letter Oil and GasNadira Aqilah67% (3)

- Rheomix 141Dokument5 SeitenRheomix 141Haresh BhavnaniNoch keine Bewertungen

- JESTEC TemplateDokument11 SeitenJESTEC TemplateMuhammad FakhruddinNoch keine Bewertungen

- Igt - Boot Os List Rev B 10-28-2015Dokument5 SeitenIgt - Boot Os List Rev B 10-28-2015Hector VillarrealNoch keine Bewertungen

- Customer Channel Migration in Omnichannel RetailingDokument80 SeitenCustomer Channel Migration in Omnichannel RetailingAlberto Martín JiménezNoch keine Bewertungen

- Essential earthquake preparedness stepsDokument6 SeitenEssential earthquake preparedness stepsRalphNacisNoch keine Bewertungen

- MONETARY POLICY OBJECTIVES AND APPROACHESDokument2 SeitenMONETARY POLICY OBJECTIVES AND APPROACHESMarielle Catiis100% (1)

- Project 863 EvidenceDokument5 SeitenProject 863 EvidenceMilan TolhuisenNoch keine Bewertungen

- Risk Assessments-These Are The Risk Assessments Which Are Applicable To Works Onsite. Risk Definition and MatrixDokument8 SeitenRisk Assessments-These Are The Risk Assessments Which Are Applicable To Works Onsite. Risk Definition and MatrixTimothy AziegbemiNoch keine Bewertungen