Beruflich Dokumente

Kultur Dokumente

Boc Packing List 2017

Hochgeladen von

lito770 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

349 Ansichten5 SeitenBoc Packing List 2017

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenBoc Packing List 2017

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

349 Ansichten5 SeitenBoc Packing List 2017

Hochgeladen von

lito77Boc Packing List 2017

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 5

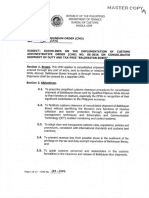

[THE REPUBLIC OF THE PHILIPPINES

DEPARTMENT OF FINANCE

BUREAU OF CUSTOMS

iE)

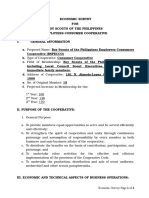

INFORMATION SHEET

{or Coneoldsted Shipments of Salkbayan Bos!

eves BOC Form No, 36-60

MBL/MAWB Number

‘Tracking Number

INSTRUCTIONS - To avold delays in the processing and release of

your Balikbayan Boxe, please fill out all elds Belew. Please type or

print legibly in capital letters.

HOW MANY COPIES OF THE INFORMATION SHEET DO I NEED PER BOX?

You need 3 copies of the Infomation Sheet per box. The 1st copy Is

attached to the box the 2nd copy Isgiven to the Consolidator; ana the

53rd copy is your copy as the Sender

WHO CAN SEND BALIKBAYAN BOXES! TO THE PHILIPPINES? Anyone

‘an send Balkbayan Boxes to the Philippines, even Corporations,

Partnerships and Sole Proprietors. ut only 2 Qualified Filaine While

Abroad’ can avall of the tax and duty-free privilege of balkbayan

boxes under Section 800 (g) of the Customs Modernization and Tart

ACLICMTAY.

WHO ARE QUALIFIED FILIPINO CITIZENS WHILE ABROAD? They are

Resident Filipinos’, Non-Resigent Fiipinos* and Overseas. Filpina

Workers

WHAT IS THE SECTION 800 (6) PRIVILEGE UNDER THE CMTA OR THE

BALIKBAYAN BOX PRIVILEGE? This isthe privilege given toa Qualified

Faipine Citizen While Abroad to send dalikoayen Boxes to Family

Member or Relative, tax and duty free,

HOW MANY TIMES CAN | SEND ALIKBAYAN BOXES? There Is no limit

Uness you wil avail ofthe Balkbayan Box Privilege.

HOW MANY TIMES CAN 1 AVAIL THE BALIKBAYAN BOX PRIVILEGE? A

Qualified Filipino While Abroad’ can avail of the. balikbayan’ box

privilege up to 3 times or up to 3 shipments in a calendar year’. The

{otal amount of all the shipments should not be more than’ Php

150,000.00 ina calendar year

INSTRUCTIONS : You must

check one type of avallment

‘TYPE OF AVAILMENT™

Dsatikbayan Box privilege

HOW MANY BALIKBAYAN BOXES CAN | SEND IN 1 SHIPMENT IF WILL

[AVAIL OF THE BALIKBAYAN BOX PRIVILEGE? There ls no limit to the

umber of Ballkbayan Boxes thet you can send per shipment but the

Size of the boxes must be no bigger than 20 cbr about the size of an

XI box) and the total value shoud not be more than Php 70,000.00

Ina calendar year.

\WHAT CAN | PUT IN MY BALIKGAYAN 80x IF WANT TO AVAIL OF THE

EALNBAYAN BOX PRIVILEGE? You can ony send household eects

fnd "personal effects. You cannot send. tems, which are in

Eommercal quantities" (a good rule of thumb i= not more thon 20

items of each kind for consummable goods and not mare than 3

items of een ine for nonconsummabie goods or send ems whch

Ste for sale. barter or hte, oF those which sre prohibited" or

‘esvrcted importatons of up to" ikrer (2000 ra) of wine and

Iiquor2 reams of cigarettes and 50 sticks of cars shal be subject

payment of excae tx only. Any excess sublet to duty, VAY and

WHAT HAPPENS IE 1 DECLARE THAT 1 WANT TO. AVAIL OF THE

BALIKBAYAN BOX EXCEED THE ALLOWED QUANTITIES OR VALUES?

Anything n excess of the allowable quantiy, amount or frequen

ShrlbeSubjectco duties and taxes, and cil nd crminal baie,

any

WHAT IF THE VALUE OF MY SHIPMENT (S LESS THAN PHP10,000.002

You can avail of the De Minimis privilege and you don't need to be a

Qualified Filipino While Abroad but you must have only 7 consignee

OF recipient. An Invoice or equivalent document ts required Tor

Immediate release of shipments sent by of to be receWed by a

Corporation, Partnership or Sole Prorpietorship. Even if you are

‘Qualifed Flipino While Abroad e De Minimis Value™ shipment shall

ot Be counted as an avaliment under the Balixbayan Box privilege.

‘TYPE OF SENDER

Dlouatined Fiipinos Non. quatined

ipinos

cnly. You may only avail of the isttime While Abroad (QFWA) ‘While Abroad (NOFWA)

Balikbayan Box Privilege, if you Cena time ipa Fanardas

are a Qualified Filipino While Chard time (Elpiside Aaind Dsote Prop. (om

Abroad Doe minimis value Elon Resident Fiipino CiPartnership

Einone Deorporation

PSPS ee)

Family Name* iven Name*

‘Contact Number/s:*

Business Name (Only for Sole Prop., Partnership, Corporation)

Middle Name* Suffix

Email Address, if any:

Philippine Passport Number: (For QFWAs Oniy)* 2 issued (mm/dd/yy): (For QFWAs Only)*

Expiry Date (mm/dd/yyyy): (For QFWAs Only)* Place Issued: (For QFWAS Only)*

‘Complete Current Address Abroad:* Complete Address in the Philippines:*

Total Value of all Contents of each Balikbayan Box for this shipment (in Philippine Peso):

WARNING: Offenses thr may result tothe forfeiture ofthe goods, cluding imposition of penalties and criminal prosecution ofthe offender

1. Sending of PROHIBITED or RESTRICTED GOODS:

2: Sending of REGULATED" GOODS in excess ofthe allowable limits without the necessary import permit

3. Making of any false or misleading statements to a Customs Oicer.

Page 7

required folds

MBL/MAWB Number:

CA eae Tracking Number:

Family Names* [eer Name Middle Names Suffix®

Contact Number/s:* Email Address, if any:

Complete Philippine Address:

Relationship to Sender (by affinity or consanguinity): (Check one (1) box only)

Lspouse F]chits [parent CJsibiing [Jsibiing of arent []tst cousin []iece/ephew [] Grandparent

[EJsibling of Grandparent [Grand Niece/Nephew ["]Grandchild []Great Grandchld ["] Great Grandparent

es es era a a a se

ema rare ate Mel mcteLe Leia =e necessary aa

Unie Please mark) ‘Actual or

Quantity of Goods Description Estimated Value.

Measure” New Used (Philippine Peso)

6 Tshirts at ral 0

6 Tshirts ¥ 300

8 Luncheon Meat 300

i Blender + 500

TOTAL VALUE Php

Declaration

| declare, under the penalties of falsification, that this Information Sheet has been made in good faith and to the best

of my knowiedge and belie, is true and correct pursuant to the provisions of the Customs Modernization and Tariff Act of the

Philippines and its implementing rules and regulations.

Sender Signature over Printed Name

lished: _/

ied Date Accomplished: — //——

MBL/MAWB Number

D. SHIPMENT & TRANSPORT INFORMATION Tracking Number:,

Mode of Shipment: | Name of Deconsolidator/Agent: ] Name of Consolidator:

Chir Osea

Shipment Reference [Complete Address of Complete Adress of Consolidator:

Sas Nar [pemoonaee aoe

rota Wo, oF foxes —

poritracknghe:

|

Tota Measurement [contact petal of Deconsoldatar7agent | Contact Detasof Consolidator

ftonles (COM | Mobiletandline Number RebRGnaedine Namber

Date of Departure |rmall address of econsolaator: EimallAdGress of Consolidator

nyo

Tota ross Weight Name of Sender: | Name of Vessel or irra

per Tracking Ni

[Total Net Weight per | original Port and Country of Loading Container Number

{Tracking No.:

MBLMAWB Number: Tracking Number: otal insurance per ‘Total Freight per

‘Tracking No. Tracking No.:

Declaration

| declare, under the penalties of falsification, that this Information Sheet has been made in good faith and to the best of

my knowledge and belief, is true and correct pursuant to the provisions of the Customs Modernization and Tariff Act of the

Philippines and its implementing rules and regulations.

Consolidator or Authorized Representative

Signature over Printed Name

Date Accomplished: _/_/__

in a Way

ARRIVAL DETAILS (To be filled out by the Deconsolidator)

Name of Vessel or Aircraft: Registry Number of the Voyage or Flight Number:

Vessel/Aircraft:

Port of Last Call; Date of Departure | Container Number: ‘MBL/MAWS Number:

(ram/dd/yyyy):

Port of Discharge: Date of Arrival HBL/HAWB NoJ/Tracking No: | Other Information:

| (nm/ddyyyy:

Declaration

| declare, under the penalties of falsification, that this Information Sheet has been made in good faith and to the best of

my knowledge and belief, Ic true and correct pursuant to the provisions of the Customs Medernization and Tariff Act of the

Philippines ana Its implementing rules and regulations.

Deconsolidator or Authorized Representative

Signature over Printed Name

Date Accomplished: _

mee Fer questons and darfctonsvst wawcustoresgev pho yoy contacto Bur of Custer 2) 75600002) 7052

rage Misraracc al Chabert ianapement Ofc sna ube aston Rea Deson

Coed THINGS YOU SHOULD KNOW:

1. Balkbayan Boxes: refers to a corrugated box or ather container or receptacle up to a maximum volume of two hundred thousand (200,000)

_ross cule centimeters without regard as tothe shape of the container or receptacle. For purposes of duty and tax exemption the balikbayan

box should contain anly personal and household effects that shall neither be in commercial quantities nor intended for barter, sale or for hire

sent by Qualifed Flipinos While Abroad often shipped by Freight Forwarders specializing n balikbayan boxes by sea or ar.

2. Qualified Filipinos While Abroad -A collective term used to refer to Resident Filipinos, OFWs and Non-Resident Filipinas ented to send or

bringein balikbayan boxes entitled to duty and tax exemption pursuant to Section 800 (of the CMTA

4, Resident Filipinas - reer to Resident Fipino Ckizens who temporarily stay abroad which may include holders of student visa, holders of

investorsvisa, holders of tourist visa and similar visas which allow them to establish temporary stay abroad,

4. Non-Resident Filipinos - refer to Flipinos those who have established permanet residency abroad but have retained Filipino Clizenshi

whether or not they have availed of the benefits under Republic Act No. 9225 or the Citizenship Retention and Re- Acquistion Act of 2003,

5. Overseas Fillpino Worker (OFW) refers to a older of valid passport issued by the Department of Foreign Affairs (OFA) and certified by the

Department of Labor and Employment (OLE) or Philippine Overseas Employment Administration (POEA) for overseas employment purposes.

‘This covers all Filipinos working ina foreign country under emplayment contracts, regardless of their professions, skills or employment status

ina foreign country. This includes also Flipinos working abroad under job contracts who do not requirea certification from DOLE or the POEA

6. Family and Relatives refer to relatives upto the fourth (th) chil degree of consanguinity or affinity (first cousin.

7. Calendar Year - refers tothe period from January 1 to December 31 ofthe same year

8 Household Efects- refer to furniture, dishes, lines, libraries, and similar household furnishing for personal use

‘9. Personal Effects - refer to commodities whether new ar used for personal use or consumption and not for commercial purposes, such as

‘wearing apparel, personal adornment, electronic gadget, toiletries, or similar ems,

10, Commercial Quantity - refers to the quantity for a given kind or class of articles which are in excess of what is compatible with and

‘commensurate t0 the person's normal requirements for personal use. For a single sender with mukiple ultimate consignees, commercal

{quantity ofa given class shall be determined based on the total quantity thereof sent by the sender to al the consignees.

11. Prohibited Importation - The importation of the following goods are prohibitec:

(a) Weiten or printed goods in any form containing any matter advocating or inciting treason, rebelion, insurrection, sedition against the

government of the Philippines, or forcible resistance to any law ofthe Philippines, or written or printed goods containing any threat to take the

feof or inflict bodily harm upon any person in the Philipines;

() Goods, instruments, drugs and substances designed, intended or adapted for producing unlawful abortion, or ary printed matter which

advertises, describes or gives direct orinirect information where, how or by whom unlawful abortion is committed

(Q Witten or printed goods, negatives or cinematographic flms, photographs, engravings, lithograph, objects, paintings, drawings or other

representation of an obscene or immoral character:

(c) Any goods manufactured in whole or in par of god, sver or other precious metals or alloys and the stamp, brand or mark does not indicate

‘the actual fineness of quality ofthe metals or alloy:

(6) Any adulterated or misbranded food or goods for human consumption or any adulterated or misbranded drug in violation of relevant laws

‘and regulations;

(f Infringing goods as dened under the intellectual Property Code and related laws; and

(a) All other goods or parts thereof which importation are explicitly prohibited by law or rules and regulations issued by the competent

authority.

12, Restricted Importation - Except when authorized by law or regulation, the importation ofthe following restricted goods are prohibited:

(2) Dynamite, gunpowder, ammunitions and other explosives, firearms and weapons of war, or parts thereof;

(6) Roulette wheels, gambling outfits, loaded dice, marked cards, machines, apparatus or mechanical devices used in gambling or the

distribution of money, cigars, cigarettes or other goods when such distribution is dependent on chance, including jackpot and pinball machines

‘oF similar contrivances, or parts thereof:

(c)Lottery and sweepstakes tickets, except advertisements thereof and lists of drawings therein;

(@) Marijuana, eplum, poppies, coca leaves, heroin or other narcotics or synthetic drugs which are or may hereafter be declared habit forming

by the President of the Philippines, or any compound, manufactured salt, derivative, or preparation thereaf, except when imported by the

government of the Philipines or any person duly authorized by the Dangerous Drugs Board, for medicinal purposes;

{} Opium pipes or parts thereof, of whatever material;

(D Any other goods whose importation are restricted;

() Weapons of mass destruction and goods included in the National Strategic Goods List(NSGL) as provided under Republic Act No. 10687 or

the Strategic Teade Management Act (STIMA)

(h) Toxic and Hazardous goods under Republic Act No, 6969 or the “Toxic Substances and Hazardous and Nuclear Wastes Control Act of

1990."The restriction to import the above stated goods shal include the restriction on thelr transi.

13. De Minimis Value - FCA or FOB Value of Php10,000 or less for which no duty or taxis collected.

14, Avaliment = refers to the determination by the Bureau or by the qualified senders that the ballkbayan boxes braught in or sent are counted

2 first, second or third within a calendar year and thus entitled to duty and tax exemption pursuant to Section 800 (g), Chapter 1, Title Vil

‘CMTA. Any amount in excess ofthe allowable non-dutiable and non-taxable value shall be subject tothe applicable duties and taxes. Shipment

‘that is above the de minimis threshold shall be automatically considered as one availment. De minimis importation shall ot be included inthe

counting of availment; provided thatthe Qualified Filipinos While Abroad can only send to one ultimate consignee in one consolidated shipment

15, Regulated Importation - Goads which are subject to regulation and may be imported or released only after securing the necessary

clearances, permits, licenses, and any other requirements.

16, Unit of Measure - e.g. pleces, dozens, boxes, bundle

17. Ultimate Recipient or Consignee - refers tothe Family Member or Relative of the Sender of the Balikbayan Sox who will be the utimate

beneficiary ofthe sam

Page 4

| FoR oFFiciaL USE ONLY | Tiamat Tag

Quanti Tariff Rate Value Discrepancy

Heading: of < __|__Declared Less As Found

Duty: Foreign | Peso | Foreign Peso

Currency: (Php): Currency: (Php):

]

|

TOTAL:

SUMMARY OF CHARGES

Customs Duty:

VAT:

Excise Tax:

Service Fee (including

s - 250.00

Legal Research Fee):

Other Charges:

Surcharge:

rom =f ss

coon

coov

Page 5

DATE,

DATE,

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1091)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Boy Scouts Games-LpvDokument129 SeitenBoy Scouts Games-Lpvlito77100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Property Management AgreementDokument2 SeitenProperty Management Agreementlito77100% (1)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Economic Survey BSPECCODokument4 SeitenEconomic Survey BSPECCOlito7750% (2)

- Syllabi-2017 Customs Broker Licensure Examination (CBLE)Dokument5 SeitenSyllabi-2017 Customs Broker Licensure Examination (CBLE)lito77100% (2)

- Primer AHTNDokument5 SeitenPrimer AHTNlito77100% (1)

- Treasurer'S Affidavit: Philippines Employees Consumers Cooperative (Bspecco) ToDokument2 SeitenTreasurer'S Affidavit: Philippines Employees Consumers Cooperative (Bspecco) Tolito77Noch keine Bewertungen

- Primer AcftaDokument6 SeitenPrimer Acftalito77Noch keine Bewertungen

- Balikbayan Information SheetDokument5 SeitenBalikbayan Information Sheetlito77Noch keine Bewertungen

- Cmo 33 2016 Guidelines On The Implementation of Cao No. 05 2016 Consolidated Shipment of Duty and Tax Free Balikbayan BoxesDokument17 SeitenCmo 33 2016 Guidelines On The Implementation of Cao No. 05 2016 Consolidated Shipment of Duty and Tax Free Balikbayan Boxeslito77Noch keine Bewertungen

- GPPB Resolution No. 26-2017Dokument8 SeitenGPPB Resolution No. 26-2017lito77Noch keine Bewertungen

- Cmta 2016 LitovelascoDokument114 SeitenCmta 2016 Litovelascolito77Noch keine Bewertungen

- Attendance: Boy Scouts of The PhilippinesDokument4 SeitenAttendance: Boy Scouts of The Philippineslito77Noch keine Bewertungen

- The Role of Youth in Sustainable Community DevelopmentDokument5 SeitenThe Role of Youth in Sustainable Community Developmentlito77100% (1)

- Text PDFDokument231 SeitenText PDFCristina Andreea OpreaNoch keine Bewertungen

- 9.1 Training Team AppointmentsDokument4 Seiten9.1 Training Team Appointmentslito77Noch keine Bewertungen

- Notice of Abandonment Port of Manila As of May 25 216Dokument4 SeitenNotice of Abandonment Port of Manila As of May 25 216lito77Noch keine Bewertungen

- Gealic Realty Services: But Till Date, We Have Not Received Anything and You Did Not Even Inform Us About This DelayDokument1 SeiteGealic Realty Services: But Till Date, We Have Not Received Anything and You Did Not Even Inform Us About This Delaylito77Noch keine Bewertungen

- G.R. 117131Dokument75 SeitenG.R. 117131lito77Noch keine Bewertungen

- AnnualReport - 2013 - BSPDokument88 SeitenAnnualReport - 2013 - BSPlito77Noch keine Bewertungen

- UK FATCA Self Certification FormDokument10 SeitenUK FATCA Self Certification Formlito77Noch keine Bewertungen

- Disclosures For Confirmation With Legal DepartmentDokument9 SeitenDisclosures For Confirmation With Legal Departmentlito77Noch keine Bewertungen

- Coverletter Embassy-ArgetinaDokument1 SeiteCoverletter Embassy-Argetinalito77Noch keine Bewertungen