Beruflich Dokumente

Kultur Dokumente

Preqin German Infrastructure June 2015

Hochgeladen von

aasgroupCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Preqin German Infrastructure June 2015

Hochgeladen von

aasgroupCopyright:

Verfügbare Formate

The Facts German Infrastructure Fund Market alternative assets. intelligent data.

German Infrastructure Fund Market

The unlisted infrastructure fund market targeting Germany, either

Key Stats: solely or as part of a wider geographic focus, remains relatively small,

with data from Preqins Infrastructure Online service revealing only

18 unlisted vehicles have reached a final close since 2010 (Fig. 1).

Fundraising has declined from six funds closing in 2013 raising an

382mn Average size of infrastructure deals

completed in Germany since 2007.

aggregate 2.7bn, to three funds closing last year raising 700mn;

so far this year there have been no unlisted infrastructure funds

closed targeting Germany. The largest Germany-focused fund

closed since 2013 is AXA Infrastructure Generation III, managed

by France-based Ardian; the fund raised 1.5bn for investments in

infrastructure entities whose main purposes are to finance, build,

Number of deals completed in

300

operate, maintain, refurbish or develop infrastructure projects

Germany since 2006 with full profiles located in European countries.

on Infrastructure Online.

The Deals module on Preqins Infrastructure Online features

information on over 11,700 infrastructure deals, including

information on over 460 completed transactions in Germany. As

Aggregate assets under shown in Fig. 2, the number of completed deals in Germany almost

3.4tn management of Germany-based

investors.

halved from 50 in 2008 to 27 in 2014; however, reported aggregate

deal value has fluctuated from a low of 1.3bn in 2009 to a high of

10.7bn in 2012, with last years total standing at 5.3bn.

Renewable energy accounts for the majority (57%) of transactions

Proportion of deals completed in

57% Germany since 2007 that are in the

since 2012, while transactions in the utilities (14%) and transport

(7%) sectors also make up notable proportions (Fig. 3). Since

renewable energy sector. 2013, the largest German transaction was the 1.9bn joint venture

by Copenhagen Infrastructure Partners I and TenneT in February

2014 for DolWin3, which involved the construction of a 900MW

offshore converter station and grid connection for wind farms

located in the south-western part of the German North Sea. As a

part of the deal, Copenhagen Infrastructure Partners I agreed to

provide an equity investment of 384mn in return for a 67% stake,

with TenneT acting as developer.

Fig. 1: Annual Germany-Focused Unlisted Infrastructure Fig. 2: Number and Aggregate Value of German Infrastructure

Fundraising, 2010 - 2015 YTD (As at 27 May 2015) Deals, 2007 - 2015 YTD (As at 27 May 2015)

7 60 12

6 50

6 50 47 10

Aggregate Deal Value (bn)

40

5 40 8

No. of Funds

No. of Deals

35 34

Closed 33

4

4 30 29 6

27

Aggregate

3 3

3 2.7 Capital

20 4

Raised (bn)

1.9 2

2

10 2

5

1 0.8 0.7

0 0

0.2 2007 2008 2009 2010 2011 2012 2013 2014

2015

0 0.0

0 YTD

2010 2011 2012 2013 2014 2015 YTD No. of Deals Reported Aggregate Deal Value (bn)

Source: Preqin Infrastructure Online Source: Preqin Infrastructure Online

Page 1 of 3 2015 Preqin Ltd. / www.preqin.com

The Facts German Infrastructure Fund Market alternative assets. intelligent data.

Preqins Infrastructure Online service contains detailed profiles for are also fairly numerous; each account for 16% of investors based

over 2,200 institutional investors targeting infrastructure, including in this region. In terms of assets under management (AUM), 68%

67 based in Germany. Insurance companies make up a quarter of of investors possess AUM of 10bn or more, with no institutions

Germany-based institutions, demonstrating their prominence in the holding less than 1bn in assets investing in infrastructure (Fig. 6).

region (Fig. 5). Asset managers and private sector pension funds

Fig. 3: Breakdown of German Infrastructure Deals by Industry, Fig. 4: Breakdown of German Infrastructure Deals by Project

Deals Completed 2012-2015 YTD (As at 27 May 2015) Stage, Deals Completed 2012-2015 YTD (As at 27 May 2015)

7% Renewable Energy 7%

4%

5% Utilities

6% Secondary Stage

Transport

Greenfield

7% Natural Resources

40% 53%

57% Brownfield

Education Facilities

14% Government Buildings

Other

Source: Preqin Infrastructure Online Source: Preqin Infrastructure Online

Fig. 5: Breakdown of Germany-Based Infrastructure Investors by Fig. 6: Breakdown of Germany-Based Infrastructure Investors by

Type Assets under Management

45%

Insurance Company 40%

40%

6%

3% Asset Manager 35%

3%

Proportion of Investors

25%

4% Private Sector Pension 30% 28%

Fund

Family Offices 25%

12%

20%

Bank 16% 16%

15%

Public Pension Fund

10%

16%

13% Corporate Investor 5%

0%

Investment Bank 0%

16% Less than 1-4.9bn 5-9.9bn 10-49.9bn 50bn or

Other 1bn More

Assets under Management

Source: Preqin Infrastructure Online Source: Preqin Infrastructure Online

Fig. 7: Infrastructure Investors by Source of Infrastructure Fig. 8: Preferred Route to Market of Germany-Based

Allocation: Germany-Based Investors vs. All Other Investors Infrastructure Investors

70% 90% 85%

59%

60%

Proportion of Investors

80%

Germany-

50%

Based 70%

Proportion of Investors

40% 38% Investors

60%

30% 24%23% All Other

19% 19% 50%

20% Investors

42%

11%

10% 5% 40%

0% 30%

Equity Allocation

Other

Infrastructure

Assets Allocation

Part of Private

Allocation

Separate

Part of Real

20%

10% 5%

0%

Unlisted Direct Listed

Source of Allocation Route to Market

Source: Preqin Infrastructure Online Source: Preqin Infrastructure Online

Page 2 of 3 2015 Preqin Ltd. / www.preqin.com

The Facts German Infrastructure Fund Market alternative assets. intelligent data.

A significant 59% of Germany-based infrastructure investors or real assets allocation. In terms of route to market, there is a

access the asset class through a separate infrastructure allocation clear preference among Germany-based infrastructure investors

(Fig. 7). In comparison, when looking at investors based elsewhere, for investing through unlisted vehicles: 85% gain exposure through

just 38% allocate to infrastructure via a separate bucket, with a this route (Fig. 8).

greater proportion (42%) investing as part of either a private equity

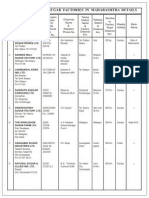

Fig. 9: Sample of Germany-Based Investors Targeting Unlisted Infrastructure Funds in the Next 12 Months

Investor Type City Investment Plans in the Next 12 Months

Looking to commit 1bn to four or five unlisted infrastructure funds in

Bavarian Pension Chamber Public Pension Fund Munich

2015. The pension fund will invest globally across all industries.

Will target unlisted infrastructure on an opportunistic basis, but intends to

Continentale Insurance Group Insurance Company Dortmund

add one fund of funds vehicle to its portfolio in 2015.

Expects to continue investing in infrastructure on an opportunistic basis,

Talanx Asset Management Asset Manager Cologne and is likely to consider unlisted fund commitments and direct equity/debt

financing opportunities, primarily within Europe and North America.

Source: Preqin Infrastructure Online

Fig. 10: 10 Notable German Infrastructure Deals Completed in 2013 - 2015 YTD (As at 27 May 2015)

Total Deal

Asset Investor(s) Transaction Date Industry

Size (mn)

DolWin3 Copenhagen Infrastructure Partners, TenneT Feb-14 Power Distribution 1,900

Industry Pension Insurance, Marguerite Adviser,

Butendiek Offshore Wind Farm Pensionskassernes Administration, Siemens Feb-13 Wind Power 1,400

Financial Services, wpd

Gode Wind Farm I DONG Energy Nov-13 Wind Power 1,247

AviAlliance Public Sector Pension Investment Board May-13 Airports 1,100

Amrumbank West Wind Farm E.ON Jan-14 Wind Power 1,000

EnBW Baltic 2 Wind Farm Macquarie Bank Jan-15 Wind Power 720

A7 Bordesholm-Hamburg DIF, HOCHTIEF Concessions, Unidentified Investor/s Jun-14 Roads 600

Industry Pension Insurance, Lrernes Pension,

Gode Wind Farm II Medical Doctors' Pension Fund, Pensionskassernes Jul-14 Wind Power 600

Administration

Schleswig-Holstein University

BAM PPP, DIF, PGGM, VAMED Sep-14 Hospitals 520

Hospital

Colonial First State Global Asset Management/First Natural Resources

EVG Thueringen Oct-14 400

State Investments Pipelines

Source: Preqin Infrastructure Online

Fig. 11: Top Five Germany-Focused Unlisted Infrastructure Funds to Hold a Final Close, 2013 - 2015 YTD (As at 27 May 2015)

Fund Firm Final Close Size (mn) Final Close Date

AXA Infrastructure Generation III Ardian 1,450 Mar-13

DIF Infrastructure III DIF 800 Mar-13

Clean Energy Fund Europe II Glennmont Partners 500 Sep-14

Zouk Renewable Energy & Environmental

Zouk Capital 220 Sep-14

Infrastructure Fund II

Bouwfonds European Real Estate Parking Fund II Bouwfonds Investment Management 187 May-13

Source: Preqin Infrastructure Online

Data Source:

Access comprehensive information on all aspects of the infrastructure industry on Preqins Infrastructure Online.

Constantly updated by our team of dedicated research analysts, the service features in-depth data on fundraising, fund managers,

institutional investors, net-to-investor fund performance and much more.

For more information, or to arrange a demonstration, please visit: www.preqin.com/infrastructure

Page 3 of 3 2015 Preqin Ltd. / www.preqin.com

Das könnte Ihnen auch gefallen

- Deutsche Bank - Cloud Computing. Clear Skies AheadDokument20 SeitenDeutsche Bank - Cloud Computing. Clear Skies AheadkentselveNoch keine Bewertungen

- Kidwai Nagar FinalDokument19 SeitenKidwai Nagar FinalAr Jitendra KumarNoch keine Bewertungen

- Scheme of ArrangementDokument24 SeitenScheme of Arrangementaasgroup100% (1)

- FIFA Natural Turf Guidelines - Jan 2023 (24012023) (Pasto Natural9Dokument120 SeitenFIFA Natural Turf Guidelines - Jan 2023 (24012023) (Pasto Natural9Simon SanchezNoch keine Bewertungen

- Drycargo 05-2019Dokument134 SeitenDrycargo 05-2019fracev100% (1)

- P2 Construction Contract - GuerreroDokument22 SeitenP2 Construction Contract - GuerreroCelen OchocoNoch keine Bewertungen

- Managing The HMRC Estate: by The Comptroller and Auditor GeneralDokument52 SeitenManaging The HMRC Estate: by The Comptroller and Auditor GeneralMuhammad Faraz Hasan100% (1)

- Karnataka Tourism Policy 2014Dokument120 SeitenKarnataka Tourism Policy 2014shahnidhi1407Noch keine Bewertungen

- CIMA Case Study-IIT GuwahatiDokument24 SeitenCIMA Case Study-IIT GuwahatiPrachi AgarwalNoch keine Bewertungen

- Bus Terminal Design GuidelinesDokument225 SeitenBus Terminal Design GuidelinesReu George71% (7)

- List of Private Sugar Factories in Maharashtra DetailsDokument3 SeitenList of Private Sugar Factories in Maharashtra DetailsShivam AhujaNoch keine Bewertungen

- Building Information Modelling For Offshore Wind Projects: Improving Working Methods and Reducing CostsDokument11 SeitenBuilding Information Modelling For Offshore Wind Projects: Improving Working Methods and Reducing Costsfle92Noch keine Bewertungen

- Addis Ababa Institute of TechnologyDokument34 SeitenAddis Ababa Institute of TechnologyhanoseNoch keine Bewertungen

- Ra 9184Dokument20 SeitenRa 9184Niño Bryan AceroNoch keine Bewertungen

- EY Infrastructure Investments For Insurers PDFDokument24 SeitenEY Infrastructure Investments For Insurers PDFDallas DragonNoch keine Bewertungen

- ECSO CFS France 2021Dokument42 SeitenECSO CFS France 2021narendradpuNoch keine Bewertungen

- D9 Investor Presentation 2022 02 02 1 1Dokument29 SeitenD9 Investor Presentation 2022 02 02 1 1Seye BassirNoch keine Bewertungen

- Transport Infrastructure-Higher Investments Needed To Preserve AssetsDokument8 SeitenTransport Infrastructure-Higher Investments Needed To Preserve Assetsjoraymcortz01Noch keine Bewertungen

- ECSO CFS Portugal 2018Dokument27 SeitenECSO CFS Portugal 2018Tomas AndersonNoch keine Bewertungen

- BILFINGER TEBODIN Cost Analysis CEE 2019Dokument24 SeitenBILFINGER TEBODIN Cost Analysis CEE 2019acuzungeceNoch keine Bewertungen

- Financing and Investment Trends: Subtittle If Needed. If Not MONTH 2018Dokument48 SeitenFinancing and Investment Trends: Subtittle If Needed. If Not MONTH 2018debsNoch keine Bewertungen

- HS 全球 投资策略 智能建筑:进一步投资以推动有机增长和并购 2020.3 90页Dokument92 SeitenHS 全球 投资策略 智能建筑:进一步投资以推动有机增长和并购 2020.3 90页benNoch keine Bewertungen

- Economic Infrastructure Full ReportDokument44 SeitenEconomic Infrastructure Full ReportMichaelMonsalveNoch keine Bewertungen

- Energy Economics: Bjarne SteffenDokument15 SeitenEnergy Economics: Bjarne Steffen伍大開Noch keine Bewertungen

- Copenhagen Economics Hyperscale Data Centres and Related Infrastructures The Case of Netherlands Dec2020Dokument19 SeitenCopenhagen Economics Hyperscale Data Centres and Related Infrastructures The Case of Netherlands Dec2020ashnacs9Noch keine Bewertungen

- Friday View Greenfield InvestmentsDokument1 SeiteFriday View Greenfield Investmentsjames2roberts-2Noch keine Bewertungen

- EBTH Global Project Report 3Dokument34 SeitenEBTH Global Project Report 3rahulNoch keine Bewertungen

- Preqin Special Report Infrastructure Deals February 2014Dokument8 SeitenPreqin Special Report Infrastructure Deals February 2014aasgroupNoch keine Bewertungen

- Key Points For A Sovereign Cloud Infrastructure in GermanyDokument4 SeitenKey Points For A Sovereign Cloud Infrastructure in Germanyvitoria666Noch keine Bewertungen

- Infrastructure Monitor Report 2023Dokument82 SeitenInfrastructure Monitor Report 2023Wulan TyasNoch keine Bewertungen

- Co-Investment in Fiber Broadband Network: A Simulation Based On Rural Areas in GermanyDokument13 SeitenCo-Investment in Fiber Broadband Network: A Simulation Based On Rural Areas in GermanyKazi MilonNoch keine Bewertungen

- Hong Kong Station and Commercial ServicesDokument20 SeitenHong Kong Station and Commercial Servicesalfredojhutapea01Noch keine Bewertungen

- Atos SiemensDokument8 SeitenAtos SiemensconnecttoamitNoch keine Bewertungen

- Analysis of National Infrastructure and Construction Pipeline 2017Dokument59 SeitenAnalysis of National Infrastructure and Construction Pipeline 2017Mohamed AbdelaalNoch keine Bewertungen

- Managing Director's Report: New Communications BillDokument2 SeitenManaging Director's Report: New Communications BillAnu DeppNoch keine Bewertungen

- Construction Skills: CORDIS Results Pack OnDokument16 SeitenConstruction Skills: CORDIS Results Pack Ontester1972Noch keine Bewertungen

- Afar2 Construction QuizDokument2 SeitenAfar2 Construction QuizJoyce Anne MananquilNoch keine Bewertungen

- AG InsuranceDokument3 SeitenAG InsuranceABCDNoch keine Bewertungen

- Gov Pipe Nov11Dokument28 SeitenGov Pipe Nov11mdsaleemullaNoch keine Bewertungen

- Ajinomatrix 2021 Activities Overview - 22 Jan 21Dokument14 SeitenAjinomatrix 2021 Activities Overview - 22 Jan 21Gavriel WayenbergNoch keine Bewertungen

- NR 120830 Ict ContractsDokument25 SeitenNR 120830 Ict ContractsWan Liz Ozman Wan OmarNoch keine Bewertungen

- Industry 40 Booklet PDFDokument32 SeitenIndustry 40 Booklet PDFfirahliyanaNoch keine Bewertungen

- CloudComputing eDokument21 SeitenCloudComputing eVaneesha Banu ManickamNoch keine Bewertungen

- Ista International Deal DescriptionDokument5 SeitenIsta International Deal DescriptionLeopold TikvicNoch keine Bewertungen

- Energy Efficiency Report Trondheim SmartCityDokument13 SeitenEnergy Efficiency Report Trondheim SmartCityOzge KocaturkNoch keine Bewertungen

- Preqin UK Infrastructure Market May 2016Dokument4 SeitenPreqin UK Infrastructure Market May 2016aasgroupNoch keine Bewertungen

- Rendonschneir 2019Dokument19 SeitenRendonschneir 2019Nudchanan PhongsahsihdettNoch keine Bewertungen

- Axis Annual Analysis On G R Infraprojects LTD Delay in AppointedDokument23 SeitenAxis Annual Analysis On G R Infraprojects LTD Delay in AppointedManit JainNoch keine Bewertungen

- Report For Detailed Analysis: Project TitleDokument44 SeitenReport For Detailed Analysis: Project TitleSean ThomasNoch keine Bewertungen

- World of Industries 3 - 2020Dokument20 SeitenWorld of Industries 3 - 2020ZamfirMarianNoch keine Bewertungen

- IPA AR2021 Final 14julDokument62 SeitenIPA AR2021 Final 14julconnor LeeNoch keine Bewertungen

- Government Construction Strategy 2016-20 March 2016: Reporting To HM Treasury and Cabinet OfficeDokument19 SeitenGovernment Construction Strategy 2016-20 March 2016: Reporting To HM Treasury and Cabinet OfficeMark Aspinall - Good Price CambodiaNoch keine Bewertungen

- Integrated Report Vodafone Spain. INGDokument146 SeitenIntegrated Report Vodafone Spain. INGMalik Mughees AwanNoch keine Bewertungen

- Annual Review Turner Townsend Interactive PDF Version Approved 23 JulyDokument29 SeitenAnnual Review Turner Townsend Interactive PDF Version Approved 23 Julyabhigupta08Noch keine Bewertungen

- Sourcing - Report SEE 2019Dokument23 SeitenSourcing - Report SEE 2019Jovan KolovNoch keine Bewertungen

- DL 171222 T Mobile Upc AustriaDokument8 SeitenDL 171222 T Mobile Upc AustriaAnna MalikNoch keine Bewertungen

- SN 01432Dokument16 SeitenSN 01432James CNoch keine Bewertungen

- Occupier Cost Index 2022Dokument7 SeitenOccupier Cost Index 2022Dakshya82Noch keine Bewertungen

- European Venture Capital Deal Term Review 2021Dokument20 SeitenEuropean Venture Capital Deal Term Review 2021Tobias TemmenNoch keine Bewertungen

- Development Projects at The Year 2012 L&TDokument13 SeitenDevelopment Projects at The Year 2012 L&TDurai Tamil GamerNoch keine Bewertungen

- Dealroom+Speedinvest - Industrial Tech-Report 2021Dokument51 SeitenDealroom+Speedinvest - Industrial Tech-Report 2021Ryo OkumuraNoch keine Bewertungen

- Broadband Access in EUDokument13 SeitenBroadband Access in EUf7jtbtdqnyNoch keine Bewertungen

- PPP 101 - 58249115Dokument10 SeitenPPP 101 - 58249115Strategy PlugNoch keine Bewertungen

- Lessons From PFI and Other Projects: Report by The Comptroller and Auditor GeneralDokument9 SeitenLessons From PFI and Other Projects: Report by The Comptroller and Auditor Generalshitake999Noch keine Bewertungen

- IREF V 6 Pager Brochure - Regular UnitsDokument6 SeitenIREF V 6 Pager Brochure - Regular UnitsPushpa DeviNoch keine Bewertungen

- Sub30 - Minerals Council of AustraliaDokument2 SeitenSub30 - Minerals Council of AustraliaSayed JafarNoch keine Bewertungen

- Document PDFDokument75 SeitenDocument PDFjamesNoch keine Bewertungen

- Project Financing and Verticalization in Infrastructure Project Evaluation. A Case Study of AbengoaDokument25 SeitenProject Financing and Verticalization in Infrastructure Project Evaluation. A Case Study of AbengoaVivian Nwanze AdamolekunNoch keine Bewertungen

- China's Emerging Hydrogen Economy: Rifs StudyDokument93 SeitenChina's Emerging Hydrogen Economy: Rifs StudyaasgroupNoch keine Bewertungen

- Climate Stress TestsDokument11 SeitenClimate Stress TestsaasgroupNoch keine Bewertungen

- 1714025115198Dokument34 Seiten1714025115198aasgroupNoch keine Bewertungen

- Preqin Special Report Infrastructure Deals February 2014Dokument8 SeitenPreqin Special Report Infrastructure Deals February 2014aasgroupNoch keine Bewertungen

- Preqin UK Infrastructure Market May 2016Dokument4 SeitenPreqin UK Infrastructure Market May 2016aasgroupNoch keine Bewertungen

- Report and Recommendation of The President To The Board of DirectorsDokument15 SeitenReport and Recommendation of The President To The Board of DirectorsaasgroupNoch keine Bewertungen

- 5.3 Judy-Li Ernst&Young enDokument11 Seiten5.3 Judy-Li Ernst&Young enaasgroupNoch keine Bewertungen

- FDI LLP Approval 11may2011Dokument2 SeitenFDI LLP Approval 11may2011aasgroupNoch keine Bewertungen

- Word - Jump To Next Track Change With Keyboard - CyberText NewsletterDokument5 SeitenWord - Jump To Next Track Change With Keyboard - CyberText NewsletteraasgroupNoch keine Bewertungen

- Ord 2009 04 02 CNo 88 of 2008Dokument6 SeitenOrd 2009 04 02 CNo 88 of 2008aasgroupNoch keine Bewertungen

- 056 LamechDokument4 Seiten056 LamechaasgroupNoch keine Bewertungen

- List of Acronyms of Multilateral OrganisationsDokument2 SeitenList of Acronyms of Multilateral OrganisationsaasgroupNoch keine Bewertungen

- Final Slump Sale Agreement UpssclDokument42 SeitenFinal Slump Sale Agreement UpssclavikothariNoch keine Bewertungen

- Ebdp Tigbao 2023-2025 11282023Dokument194 SeitenEbdp Tigbao 2023-2025 11282023kookiev143Noch keine Bewertungen

- Tenkasi City PlanDokument191 SeitenTenkasi City PlanChenthur GardenNoch keine Bewertungen

- List of IRCDokument12 SeitenList of IRCSreesree SreeNoch keine Bewertungen

- Dams and Barrages: Dhrubajyoti Sen Department of Civil Engineering Indian Institute of Technology, KharagpurDokument29 SeitenDams and Barrages: Dhrubajyoti Sen Department of Civil Engineering Indian Institute of Technology, Kharagpurdeepak_ram_5Noch keine Bewertungen

- IELTS Unit 5 WritingDokument2 SeitenIELTS Unit 5 WritingLê Đức KhôiNoch keine Bewertungen

- DOH AO No. 2023-0014Dokument7 SeitenDOH AO No. 2023-0014LEAH ROSE PARASNoch keine Bewertungen

- Chapter 3 Elements of Cross-Section Lecture2 PDFDokument19 SeitenChapter 3 Elements of Cross-Section Lecture2 PDFRabin DhakalNoch keine Bewertungen

- Geo NetsDokument4 SeitenGeo NetsGGNoch keine Bewertungen

- Alpen Capital GCC Insurance Industry Report 2022 FinalDokument108 SeitenAlpen Capital GCC Insurance Industry Report 2022 FinalMonica AhujaNoch keine Bewertungen

- Indonesian Ocean Policy HavasDokument18 SeitenIndonesian Ocean Policy Havasindra alverdianNoch keine Bewertungen

- Daily Construction Report: Commercial & Luxury ApartmentsDokument3 SeitenDaily Construction Report: Commercial & Luxury ApartmentsFaheem MushtaqNoch keine Bewertungen

- Ramesh Singh Indian Economy Class 21Dokument70 SeitenRamesh Singh Indian Economy Class 21Abhijit NathNoch keine Bewertungen

- RoadmarkingsDokument12 SeitenRoadmarkingsNikesh RamNoch keine Bewertungen

- Bore Hole InvestigationDokument4 SeitenBore Hole InvestigationSathish KumarNoch keine Bewertungen

- All About Introduction To URPDokument36 SeitenAll About Introduction To URPFaria HossainNoch keine Bewertungen

- Mid Term Appraisal - 11th Plan FullDokument500 SeitenMid Term Appraisal - 11th Plan FullDheeraj012Noch keine Bewertungen

- Chapter Six IndexDokument18 SeitenChapter Six IndexRichard WestonyNoch keine Bewertungen

- Tom Report County (Recovered)Dokument10 SeitenTom Report County (Recovered)SAMUEL KIMANINoch keine Bewertungen

- Position of GeoCentrexDokument12 SeitenPosition of GeoCentrexThanh le VanNoch keine Bewertungen

- Brosur Produk PT Beton Prima Indonesia 01Dokument2 SeitenBrosur Produk PT Beton Prima Indonesia 01Kartika SaktiNoch keine Bewertungen

- Aiming HigherDokument13 SeitenAiming Highersbiswas21Noch keine Bewertungen

- AESOP 2010 Abstract BookDokument562 SeitenAESOP 2010 Abstract BookJoão Soeiro GonçalvesNoch keine Bewertungen

- Indian Economy On The Eve of IndependenceDokument17 SeitenIndian Economy On The Eve of IndependenceNoorunnishaNoch keine Bewertungen