Beruflich Dokumente

Kultur Dokumente

Annex This Schedule To The Return of Income If You Have Income From Salaries

Hochgeladen von

gawtom0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

24 Ansichten1 Seitedfsdfsdfsd

Originaltitel

93

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldendfsdfsdfsd

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

24 Ansichten1 SeiteAnnex This Schedule To The Return of Income If You Have Income From Salaries

Hochgeladen von

gawtomdfsdfsdfsd

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

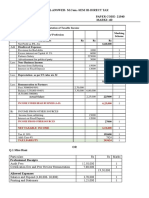

SCHEDULE 24A

Particulars of income from Salaries

Annex this Schedule to the return of income if you have income from Salaries

01 Assessment Year 02 TIN: 570056520034

2 0 1 7 - 1 8

Particulars Amount Tax exempted Taxable

(A) (B) (C = A-B)

03 Basic pay 225000 225000

04 Special pay N/A

05 Arrear pay (if not included in taxable N/A

income earlier)

06 Dearness allowance N/A

07 House rent allowance 112500 112500

08 Medical allowance 56250 56250

09 Conveyance allowance 56250 30000 26250

10 Festival Allowance 45000 45000

11 Allowance for support staff N/A

12 Leave allowance N/A

13 Honorarium/ Reward/Fee N/A

14 Overtime allowance N/A

15 Bonus / Ex-gratia N/A

16 Other allowances N/A

17 Employers contribution to a N/A

recognized provident fund

18 Interest accrued on a recognized N/A

provident fund

19 Deemed income for transport facility N/A

20 Deemed income for free furnished/ N/A

unfurnished accommodation

21 Other, if any (give detail) N/A

22 Total 296250

All figures of amount are in taka ()

Name Signature & Date

Das könnte Ihnen auch gefallen

- Annex This Schedule To The Return of Income If You Have Income From SalariesDokument7 SeitenAnnex This Schedule To The Return of Income If You Have Income From Salariesshamim islam limonNoch keine Bewertungen

- VATReturn All Annexs 3033229Dokument3 SeitenVATReturn All Annexs 3033229Faiza MinhasNoch keine Bewertungen

- OfferLetter Riya GuptaDokument2 SeitenOfferLetter Riya Guptavermatanishq1610Noch keine Bewertungen

- Summary 1689086671Dokument4 SeitenSummary 1689086671Akshay SharmaNoch keine Bewertungen

- COMPUTATION OF TOTAL INCOME MITABEN FY 22-23Dokument2 SeitenCOMPUTATION OF TOTAL INCOME MITABEN FY 22-23RaviNoch keine Bewertungen

- Income Tax Computation: Less: Standard Deduction U/S 16Dokument10 SeitenIncome Tax Computation: Less: Standard Deduction U/S 16sidrijegnoNoch keine Bewertungen

- Punjab builder files sales tax returnDokument4 SeitenPunjab builder files sales tax returnHaroon ButtNoch keine Bewertungen

- Salary On IncomeDokument22 SeitenSalary On IncomeManjunathNoch keine Bewertungen

- NIRMAL TODI'S TAX RETURNDokument24 SeitenNIRMAL TODI'S TAX RETURNSujan TripathiNoch keine Bewertungen

- 20-21 COMPUTATION (1) Amarjit KaurDokument3 Seiten20-21 COMPUTATION (1) Amarjit KaurTanvi DhingraNoch keine Bewertungen

- Punjab Revenue Authority return for inter-city transportation servicesDokument5 SeitenPunjab Revenue Authority return for inter-city transportation servicesAbbas AliNoch keine Bewertungen

- Taxation Nyama AssignmentDokument14 SeitenTaxation Nyama AssignmentTakudzwa BenjaminNoch keine Bewertungen

- Bnaking Profit and Loss Account 1Dokument12 SeitenBnaking Profit and Loss Account 1madhumathi100% (1)

- IABillDokument2 SeitenIABillTalent of PakistanNoch keine Bewertungen

- Submitted Status:: Tax Period KNTN Name Submission Date Normal AmendedDokument2 SeitenSubmitted Status:: Tax Period KNTN Name Submission Date Normal AmendedEntertaining VideosNoch keine Bewertungen

- Solution Tax667 - Jun 2016-1Dokument8 SeitenSolution Tax667 - Jun 2016-1Zahiratul QamarinaNoch keine Bewertungen

- Individual tax returnDokument2 SeitenIndividual tax returnbrs consultancyNoch keine Bewertungen

- Income From Salary Solution ZDokument3 SeitenIncome From Salary Solution ZMuhammad FaisalNoch keine Bewertungen

- VATReturn All Annexs 6402227Dokument6 SeitenVATReturn All Annexs 6402227muhammad saadNoch keine Bewertungen

- Ayub Traders Nov-23 Return PSTDokument4 SeitenAyub Traders Nov-23 Return PSTABBAS KHANNoch keine Bewertungen

- GAMDOORDokument2 SeitenGAMDOORRashpreet PandiNoch keine Bewertungen

- Salary Slip (70015409 February, 2023)Dokument1 SeiteSalary Slip (70015409 February, 2023)حامدولیNoch keine Bewertungen

- 2018 11 12 09 56 17 498 - Cinpm3915m - 2018 - PDFDokument5 Seiten2018 11 12 09 56 17 498 - Cinpm3915m - 2018 - PDFMohammed MaazNoch keine Bewertungen

- Provisional Taxsheet Mar 2020Dokument1 SeiteProvisional Taxsheet Mar 2020vivianNoch keine Bewertungen

- Payslip 10105020 12-2021 2022-01-28 20 36 58 61f4069221c44Dokument1 SeitePayslip 10105020 12-2021 2022-01-28 20 36 58 61f4069221c44ginizoneNoch keine Bewertungen

- Sonali Securities WTR (Jan'22-June'22) 75ADokument8 SeitenSonali Securities WTR (Jan'22-June'22) 75Alimon islamNoch keine Bewertungen

- 2022 23 Sample Return MaleDokument28 Seiten2022 23 Sample Return Malepk ghosh100% (1)

- Salary and Benefits BreakdownDokument1 SeiteSalary and Benefits BreakdownMohamed AhmedNoch keine Bewertungen

- Sales Tax Return Sept 10Dokument6 SeitenSales Tax Return Sept 10Raheel BaigNoch keine Bewertungen

- EMPH2800 TAXSHEET March 2021Dokument1 SeiteEMPH2800 TAXSHEET March 2021the anonymousNoch keine Bewertungen

- Itr-1 Sahaj Individual Income Tax Return: Acknowledgement Number: 856116270220718 Assessment Year: 2018-19Dokument5 SeitenItr-1 Sahaj Individual Income Tax Return: Acknowledgement Number: 856116270220718 Assessment Year: 2018-19sky2flyboy@gmail.comNoch keine Bewertungen

- Salary Slip (10511035 December, 2016)Dokument1 SeiteSalary Slip (10511035 December, 2016)Syed Tabish AliNoch keine Bewertungen

- Salary Details and Tax DeductionsDokument1 SeiteSalary Details and Tax DeductionsArsalan KhanNoch keine Bewertungen

- Zaib - Altaf - Naik - Payslip - July - 2022 (1) NewDokument2 SeitenZaib - Altaf - Naik - Payslip - July - 2022 (1) Newzuber shaikhNoch keine Bewertungen

- Micro Tiles 2015 Income Statement and FinancialsDokument45 SeitenMicro Tiles 2015 Income Statement and FinancialsAimee ChantengcoNoch keine Bewertungen

- W201977 - Naveenkumar Duraisamysalary SlipDokument3 SeitenW201977 - Naveenkumar Duraisamysalary SlipSRV MOTORSSNoch keine Bewertungen

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDokument2 SeitenConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVanessa SarraNoch keine Bewertungen

- Aakash PaySlip April 2022Dokument2 SeitenAakash PaySlip April 2022Prateek KwatraNoch keine Bewertungen

- Deloitte Financial Advisory Services India Private LimitedDokument1 SeiteDeloitte Financial Advisory Services India Private LimitedPRASHANT BANDAWARNoch keine Bewertungen

- Payslips 5Dokument1 SeitePayslips 5Tech stackNoch keine Bewertungen

- OfferLetter 225107Dokument2 SeitenOfferLetter 225107NIKHIL RANANoch keine Bewertungen

- Assignment No 02 Business Law and Taxation: Tauraira Arshad 16320 SolutionDokument2 SeitenAssignment No 02 Business Law and Taxation: Tauraira Arshad 16320 SolutionSYEDA -Noch keine Bewertungen

- Tax Records SummaryDokument12 SeitenTax Records SummaryChristopher ApadNoch keine Bewertungen

- Withholding Tax Return Excell FormatDokument18 SeitenWithholding Tax Return Excell FormatMohammad Shah Alam ChowdhuryNoch keine Bewertungen

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDokument1 SeiteIndian Income Tax Return Acknowledgement 2021-22: Assessment YearAbhinaba SahaNoch keine Bewertungen

- Annex This Schedule To The Return of Income If You Have Income From SalariesDokument18 SeitenAnnex This Schedule To The Return of Income If You Have Income From SalariessajedulNoch keine Bewertungen

- Computation of Taxable Income Marking Scheme Particulars Rs Rs Rs 6,60,000Dokument8 SeitenComputation of Taxable Income Marking Scheme Particulars Rs Rs Rs 6,60,000LAKHAN TRIVEDINoch keine Bewertungen

- Deepak ComputationDokument3 SeitenDeepak ComputationRavi YadavNoch keine Bewertungen

- Spice Deals MemoDokument2 SeitenSpice Deals MemoSelma IilongaNoch keine Bewertungen

- 2 - Australian Taxation OfficeDokument2 Seiten2 - Australian Taxation Officelakshmi.bodduluruNoch keine Bewertungen

- Revised Estimation - FY 2023-24Dokument1 SeiteRevised Estimation - FY 2023-24Debojyoti MukherjeeNoch keine Bewertungen

- Return of Income: For An Individual AssesseeDokument44 SeitenReturn of Income: For An Individual AssesseeSammyNoch keine Bewertungen

- Computation of Total Income: Zenit - A KDK Software Software ProductDokument2 SeitenComputation of Total Income: Zenit - A KDK Software Software ProductKartik RajputNoch keine Bewertungen

- US Internal Revenue Service: f990t - 1994Dokument4 SeitenUS Internal Revenue Service: f990t - 1994IRSNoch keine Bewertungen

- Paystub 202311Dokument1 SeitePaystub 202311Gss ChaitanyaNoch keine Bewertungen

- Adjustment FormDokument2 SeitenAdjustment Formimtsal ahmadNoch keine Bewertungen

- Payslip March 2022Dokument1 SeitePayslip March 2022sunanda singhNoch keine Bewertungen

- APT Tax AssignmentDokument11 SeitenAPT Tax AssignmentMalik JavidNoch keine Bewertungen

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineVon EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNoch keine Bewertungen

- J.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnVon EverandJ.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnNoch keine Bewertungen

- K2P1 01 M FM 02Dokument1 SeiteK2P1 01 M FM 02gawtomNoch keine Bewertungen

- DN700 22.5 2Dokument1 SeiteDN700 22.5 2gawtomNoch keine Bewertungen

- K2P1 01 M FM 02Dokument1 SeiteK2P1 01 M FM 02gawtomNoch keine Bewertungen

- DN700 22.5 2Dokument1 SeiteDN700 22.5 2gawtomNoch keine Bewertungen

- DN700 22.5 2Dokument1 SeiteDN700 22.5 2gawtomNoch keine Bewertungen

- DN700 22.5 2Dokument1 SeiteDN700 22.5 2gawtomNoch keine Bewertungen

- DN700 22.5 2Dokument1 SeiteDN700 22.5 2gawtomNoch keine Bewertungen

- KWSP As Built Drawings Vol 2Dokument1 SeiteKWSP As Built Drawings Vol 2gawtomNoch keine Bewertungen

- DN700 22.5 2Dokument1 SeiteDN700 22.5 2gawtomNoch keine Bewertungen

- KWSP As Built Drawings Vol 2Dokument1 SeiteKWSP As Built Drawings Vol 2gawtomNoch keine Bewertungen

- KWSP As Built Drawings Vol 2Dokument1 SeiteKWSP As Built Drawings Vol 2gawtomNoch keine Bewertungen

- DN700 22.5 2Dokument1 SeiteDN700 22.5 2gawtomNoch keine Bewertungen

- Intake flow meter chamber planDokument1 SeiteIntake flow meter chamber plangawtomNoch keine Bewertungen

- KWSP As Built Drawings Vol 2Dokument1 SeiteKWSP As Built Drawings Vol 2gawtomNoch keine Bewertungen

- NBD Inlet ChamberDokument1 SeiteNBD Inlet ChambergawtomNoch keine Bewertungen

- DN700 22.5 2Dokument1 SeiteDN700 22.5 2gawtomNoch keine Bewertungen

- DN700 22.5 2Dokument1 SeiteDN700 22.5 2gawtomNoch keine Bewertungen

- DN700 22.5 2Dokument1 SeiteDN700 22.5 2gawtomNoch keine Bewertungen

- DN700 22.5 2Dokument1 SeiteDN700 22.5 2gawtomNoch keine Bewertungen

- DN700 22.5 2Dokument1 SeiteDN700 22.5 2gawtomNoch keine Bewertungen

- DN700 22.5 2Dokument1 SeiteDN700 22.5 2gawtomNoch keine Bewertungen

- DN700 22.5 2Dokument1 SeiteDN700 22.5 2gawtomNoch keine Bewertungen

- DN700 22.5 2Dokument1 SeiteDN700 22.5 2gawtomNoch keine Bewertungen

- DN700 22.5 2Dokument1 SeiteDN700 22.5 2gawtomNoch keine Bewertungen

- DN700 22.5 2Dokument1 SeiteDN700 22.5 2gawtomNoch keine Bewertungen

- DN700 22.5 2Dokument1 SeiteDN700 22.5 2gawtomNoch keine Bewertungen

- DN700 22.5 2Dokument1 SeiteDN700 22.5 2gawtomNoch keine Bewertungen

- DN700 22.5 2Dokument1 SeiteDN700 22.5 2gawtomNoch keine Bewertungen

- DN700 22.5 2Dokument1 SeiteDN700 22.5 2gawtomNoch keine Bewertungen

- DN700 22.5 2Dokument1 SeiteDN700 22.5 2gawtomNoch keine Bewertungen