Beruflich Dokumente

Kultur Dokumente

Case Study On The IDR of Standard Chartered PLC

Hochgeladen von

Falguni MathewsOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Case Study On The IDR of Standard Chartered PLC

Hochgeladen von

Falguni MathewsCopyright:

Verfügbare Formate

History of IDR :

The first Indian Depository Receipt (IDR) was that of Standard Chartered Plc. ( StanChart), launched on May 13,

2010. This was done to boost the companys market visibility and brand perception in India. There was an issue of

240 million IDRs where every 10 IDRs represented one share of StanChart. This was their third listing, following

their listing on the London Stock Exchange and the Hong Kong Stock Exchange.

The StanChart IDR issue was opened for subscription on May 25, 2010 until May 28, 2010. Though the price band

of the IDR was between INR 100 and INR 115, most of the bids were between INR 100 and INR 104.

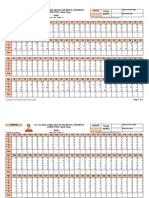

The bank issued 240 million IDRs (including the anchor investors share of 36,000,000 IDRs). The total number of

bids received at the NSE and the BSE were 312,025,000 and 137,680,000 IDRs, respectively, while the total number

of bids received at cut-off price was 15,033,200. At the BSE, the IDR issue of StanChart was subscribed 2.2 times,

while at the NSE, the issue was subscribed 1.53 times.

Problems faced by Standard Chartered during the issue

1. The two risks faced by StanChart were:

Interest rate risk due to short term borrowing to fund long term assets; and

Currency risk due to the strengthening of the US Dollar vis--vis local currencies in the countries of its

presence.

2. The pricing and price movement in IDRs was directly linked to the share price of StanChart in the London Stock

Exchange; this led to apprehension because any slowdown in the European economy would in turn affect the

valuation of the bank, which would hamper its price movement in IDRs.

3. The Income Tax Act and other regulations do not specifically refer to the taxation of IDRs. The IDRs may

therefore, be taxed differently from ordinary listed shares issued by other companies in India

Post-issue Concerns

1. Redemption: The StanChart IDR fell by almost 20% after the issue of SEBIs ircular (CIR/CFD/DIL/3/2011) on

June 3, 2011 that disallowed redemption after one year except in cases where the shares were illiquid.

2. The bulk of the investor base for StanChart was composed of Foreign Institutional Investors (FIIs). The only

reason for FIIs to invest in this IDR was that they could be obtained at lower rates in India compared to London. The

purpose of the IDR was to broaden the investor base in India. However, this objective was clearly not achieved

because FIIs were allowed to invest in the issue.

Das könnte Ihnen auch gefallen

- Issue of DebenturesDokument28 SeitenIssue of DebenturesFalguni Mathews100% (1)

- Logistics and Warehousing Management PDFDokument210 SeitenLogistics and Warehousing Management PDFFalguni MathewsNoch keine Bewertungen

- A Study On Whether Taxtion Is A Seeling Cool For Life InsuranceDokument7 SeitenA Study On Whether Taxtion Is A Seeling Cool For Life InsuranceDEEPAKNoch keine Bewertungen

- Anju Saroj Project WorkDokument101 SeitenAnju Saroj Project WorkAnju SarojNoch keine Bewertungen

- CHP 1 - Introduction To Merchant BankingDokument44 SeitenCHP 1 - Introduction To Merchant BankingFalguni MathewsNoch keine Bewertungen

- Perception of People Towards Investment and VariousDokument20 SeitenPerception of People Towards Investment and Variouscgs005Noch keine Bewertungen

- My Sbi Mutual FundDokument35 SeitenMy Sbi Mutual FundkalyanbobbydNoch keine Bewertungen

- Financial Planning For IndividualDokument93 SeitenFinancial Planning For IndividualsonalikhandeNoch keine Bewertungen

- A Study of Currency Derivatives in IndiaDokument5 SeitenA Study of Currency Derivatives in IndiaNikunj Bafna100% (1)

- Paper 307 A - International Financial ManagementDokument103 SeitenPaper 307 A - International Financial ManagementSwapnil SonjeNoch keine Bewertungen

- A Study On Changing Investment Pattern Among Youth: G.H.Patel Post Graduate Institute of Business ManagementDokument50 SeitenA Study On Changing Investment Pattern Among Youth: G.H.Patel Post Graduate Institute of Business ManagementNaveen SahaNoch keine Bewertungen

- Camlin PPT Final 2003Dokument47 SeitenCamlin PPT Final 2003Ninad Nachane100% (1)

- Objective: Fundamental Analysis of Real Estate Sector in IndiaDokument44 SeitenObjective: Fundamental Analysis of Real Estate Sector in IndiaDnyaneshwar DaundNoch keine Bewertungen

- Wealth Management in Delhi and NCR Research Report On Scope of Wealth Management in Delhi and NCR 95pDokument98 SeitenWealth Management in Delhi and NCR Research Report On Scope of Wealth Management in Delhi and NCR 95pSajal AroraNoch keine Bewertungen

- LIC Investment ManagementDokument179 SeitenLIC Investment ManagementHarshitNoch keine Bewertungen

- Reliance Mutual FundDokument32 SeitenReliance Mutual Fundshiva_kuttimma100% (1)

- Financial Literacy Project Final FileDokument70 SeitenFinancial Literacy Project Final Fileaddusaiki9999Noch keine Bewertungen

- Introduction To Investment Management: Bond, Real Estate, Mortgages EtcDokument25 SeitenIntroduction To Investment Management: Bond, Real Estate, Mortgages EtcRavi GuptaNoch keine Bewertungen

- A Study On Investment Modes With Reference To HDFC LIFEDokument135 SeitenA Study On Investment Modes With Reference To HDFC LIFEChandrsekhar ReddyNoch keine Bewertungen

- Investors' Attitude Towards Stock MarketDokument24 SeitenInvestors' Attitude Towards Stock MarketBoopathi Kalai100% (1)

- Comparative Study of Investment AvenueDokument76 SeitenComparative Study of Investment AvenueShruti HarlalkaNoch keine Bewertungen

- A Study On Different Mutual Funds Providers in IndiaDokument121 SeitenA Study On Different Mutual Funds Providers in IndiaRajesh BathulaNoch keine Bewertungen

- A Study On Preference of Mutual Funds by Investors Based On Performance of Debt and Equity SchemesDokument83 SeitenA Study On Preference of Mutual Funds by Investors Based On Performance of Debt and Equity SchemesPratiksha MisalNoch keine Bewertungen

- Pratik BBDokument74 SeitenPratik BBPratik PadmanabhanNoch keine Bewertungen

- Mutual Fund ProjectDokument35 SeitenMutual Fund ProjectKripal SinghNoch keine Bewertungen

- Ifbm 04020060202 PDFDokument9 SeitenIfbm 04020060202 PDFDhani SahuNoch keine Bewertungen

- Chapter 2Dokument66 SeitenChapter 2amitNoch keine Bewertungen

- A Study On Mutual Fund: Comparison Between Equity Diversification and Sector Specific SchemesDokument67 SeitenA Study On Mutual Fund: Comparison Between Equity Diversification and Sector Specific SchemesChethan.sNoch keine Bewertungen

- A Study On InvestmentDokument8 SeitenA Study On InvestmentSaloni GoyalNoch keine Bewertungen

- Investment and Trading Pattern of Individuals Dealing in Stock MarketDokument8 SeitenInvestment and Trading Pattern of Individuals Dealing in Stock MarketthesijNoch keine Bewertungen

- Comparative Study On MF and FDDokument6 SeitenComparative Study On MF and FDamrita thakur100% (1)

- ASSET ALLOCATION IN FINANCIAL PLANNING SAlilDokument31 SeitenASSET ALLOCATION IN FINANCIAL PLANNING SAlilSalil TimsinaNoch keine Bewertungen

- 7-Customers Perception Towards MuthootDokument15 Seiten7-Customers Perception Towards MuthootVishu RajNoch keine Bewertungen

- Edelweiss Internship ProjectDokument17 SeitenEdelweiss Internship ProjectHenal PanchmatiyaNoch keine Bewertungen

- Risk and Return Analysis of Mutual FundDokument12 SeitenRisk and Return Analysis of Mutual FundMounika Ch100% (1)

- Performance Evaluation of Mutual FundsDokument7 SeitenPerformance Evaluation of Mutual Fundskp vineetNoch keine Bewertungen

- Basics of Mutual Funds-By HDFC AMCDokument41 SeitenBasics of Mutual Funds-By HDFC AMCRupanjali Mitra BasuNoch keine Bewertungen

- Synopsis On Financial DerivativesDokument13 SeitenSynopsis On Financial Derivativesgursharan4march67% (3)

- A Summer Training Report ON "360 Degree Analysis of Financial Market" As Regard With India Info Line LimitedDokument63 SeitenA Summer Training Report ON "360 Degree Analysis of Financial Market" As Regard With India Info Line LimitedAmit DwivediNoch keine Bewertungen

- 5710 - Survey Investor Perception Towards Stock MarketDokument80 Seiten5710 - Survey Investor Perception Towards Stock MarketMinakshi SharmaNoch keine Bewertungen

- A Study On Awareness of Financial Literacy Among College Students in ChennaiDokument83 SeitenA Study On Awareness of Financial Literacy Among College Students in ChennaiGunavathi.S 016100% (1)

- A Brief Study of Mutual Funds and Comparative Study of Large Cap, Mid Cap and Small Cap FundDokument112 SeitenA Brief Study of Mutual Funds and Comparative Study of Large Cap, Mid Cap and Small Cap FundNikhil ChaudharyNoch keine Bewertungen

- Manipal University Jaipur: A Dissertation ON "Financial Planning and Comparison of Various Instruments"Dokument44 SeitenManipal University Jaipur: A Dissertation ON "Financial Planning and Comparison of Various Instruments"Saksham JainNoch keine Bewertungen

- Financial Futures With Reference To NiftyDokument73 SeitenFinancial Futures With Reference To Niftyjitendra jaushik75% (4)

- BRICS 9 NewDokument24 SeitenBRICS 9 NewAYUSHI SHARMANoch keine Bewertungen

- Data Analysis & Its InterpretationDokument23 SeitenData Analysis & Its InterpretationBharat MahajanNoch keine Bewertungen

- Investment Pattern of Investors On Different Products Introduction EXECUTIVE SUMMARY An Investment Refers To The Commitment of Funds at PresentDokument33 SeitenInvestment Pattern of Investors On Different Products Introduction EXECUTIVE SUMMARY An Investment Refers To The Commitment of Funds at Presentnehag24Noch keine Bewertungen

- A Study On Investment Pattern of Investors On Different Products Conducted at Asit CDokument64 SeitenA Study On Investment Pattern of Investors On Different Products Conducted at Asit CJaya NemaNoch keine Bewertungen

- Investing in Banking Sector Mutual Funds - An OverviewDokument5 SeitenInvesting in Banking Sector Mutual Funds - An OverviewarcherselevatorsNoch keine Bewertungen

- Saurabh Santosh YadavDokument75 SeitenSaurabh Santosh YadavEkta RuikarNoch keine Bewertungen

- Detailed Study of Edelweiss Tokio Life InsuranceDokument73 SeitenDetailed Study of Edelweiss Tokio Life InsuranceHardik AgarwalNoch keine Bewertungen

- Study of Derivatives: (Infosys LTD)Dokument66 SeitenStudy of Derivatives: (Infosys LTD)yash daraNoch keine Bewertungen

- India Infoline (Awarness About The Mutual Fund)Dokument95 SeitenIndia Infoline (Awarness About The Mutual Fund)c_nptl50% (2)

- Mutual FundDokument170 SeitenMutual FundPatel UrveshNoch keine Bewertungen

- A Study On Customers' Preference Towards Insurance Services and BancassuranceDokument13 SeitenA Study On Customers' Preference Towards Insurance Services and Bancassurancecoolams4uNoch keine Bewertungen

- Final (PPT) A Study On Investors Perception Towards MutualDokument12 SeitenFinal (PPT) A Study On Investors Perception Towards MutualAvantika JindalNoch keine Bewertungen

- Study of Dividend Policy Adopted by Companies: Master of Business AdministrationDokument125 SeitenStudy of Dividend Policy Adopted by Companies: Master of Business AdministrationtechcaresystemNoch keine Bewertungen

- PDFDokument4 SeitenPDFJanvi MandaliyaNoch keine Bewertungen

- TYBMS Problems of IfDokument13 SeitenTYBMS Problems of IfKunal MasurkarNoch keine Bewertungen

- Quarterly Report On The Results For The Second Quarter and Half Year Ended September 30, 2012Dokument54 SeitenQuarterly Report On The Results For The Second Quarter and Half Year Ended September 30, 2012mayur860Noch keine Bewertungen

- The International Banking & Money MarketDokument28 SeitenThe International Banking & Money MarketquockicungNoch keine Bewertungen

- IDR Indian Depository: ReceiptsDokument16 SeitenIDR Indian Depository: Receiptstakshu29Noch keine Bewertungen

- Production and Total Quality ManagementDokument17 SeitenProduction and Total Quality ManagementFalguni MathewsNoch keine Bewertungen

- Principles of Management SyllabusDokument2 SeitenPrinciples of Management SyllabusFalguni MathewsNoch keine Bewertungen

- DifferenceDokument1 SeiteDifferenceFalguni MathewsNoch keine Bewertungen

- Factor Affecting Climate: Weather and Climate WeatherDokument3 SeitenFactor Affecting Climate: Weather and Climate WeatherFalguni MathewsNoch keine Bewertungen

- Production and Total Quality ManagementDokument8 SeitenProduction and Total Quality ManagementFalguni MathewsNoch keine Bewertungen

- New Guidelines For Issue of Commercial PaperDokument3 SeitenNew Guidelines For Issue of Commercial PaperFalguni MathewsNoch keine Bewertungen

- RetailingDokument122 SeitenRetailingFalguni MathewsNoch keine Bewertungen

- CHP 2 - Issue ManagementDokument32 SeitenCHP 2 - Issue ManagementFalguni MathewsNoch keine Bewertungen

- Major Crops: Crop Details Region Grown in India World Sr. No. Lead Producers in India Largest Producer ChinaDokument2 SeitenMajor Crops: Crop Details Region Grown in India World Sr. No. Lead Producers in India Largest Producer ChinaFalguni MathewsNoch keine Bewertungen

- Trading in The Corporate Debt MarketDokument1 SeiteTrading in The Corporate Debt MarketFalguni MathewsNoch keine Bewertungen

- Depository Receipts: IDR and Its Legal Framework: GNLU-MA-AV-0417-02Dokument9 SeitenDepository Receipts: IDR and Its Legal Framework: GNLU-MA-AV-0417-02Falguni MathewsNoch keine Bewertungen

- CHP 2 - Origin & Nature of CRMDokument28 SeitenCHP 2 - Origin & Nature of CRMFalguni MathewsNoch keine Bewertungen

- Paper 5Dokument2 SeitenPaper 5Falguni MathewsNoch keine Bewertungen

- Chanda MamaDokument2 SeitenChanda MamaFalguni MathewsNoch keine Bewertungen