Beruflich Dokumente

Kultur Dokumente

122 Pacific Timber Vs CA

Hochgeladen von

Ivan ValcosOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

122 Pacific Timber Vs CA

Hochgeladen von

Ivan ValcosCopyright:

Verfügbare Formate

PACIFIC TIMBER EXPORT CORPORATION vs CA and WORKMEN'S

INSURANCE COMPANY, INC. Issues:

G.R. No. L-38613 | February 25, 1982 | DE CASTRO, J. 1. WON the cover note was null and void for lack of valuable

consideration | NO

Doctrine: Where a policy is delivered without requiring payment of the 2. WON the Insurance company was absolved from responsibility due to

premium, the presumption is that a credit was intended and policy is valid. unreasonable delay in giving notice of loss | NO

Facts: Decision:

Pacific Timber secured temporary insurance from Workmens Insurance for 1. The fact that no separate premium was paid on the Cover Note before the

its exportation of 1,250,000 board feet of Philippine Lauan and Apitong logs loss occurred does not militate against the validity of the contention even if

to be shipped from Quezon Province to Okinawa and Tokyo, Japan. no such premium was paid. All Cover Notes do not contain particulars of the

Workmens Insurance issued a cover note insuring the cargo of the shipment that would serve as basis for the computation of the premiums.

petitioner subject to its terms and conditions. Also, no separate premiums are required to be paid on a Cover Note.

The 2 marine policies bore the numbers 53 HO 1032 and 53 HO 1033.

Policy No. 53 H0 1033 was for 542 pieces of logs equivalent to 499,950 The petitioner paid in full all the premiums, hence there was no account unpaid

board feet. Policy No. 53 H0 1033 was for 853 pieces of logs equivalent to on the insurance coverage and the cover note. If the note is to be treated as a

695,548 board feet. The total cargo insured under the two marine policies separate policy instead of integrating it to the regular policies, the purpose of

consisted of 1,395 logs, or the equivalent of 1,195.498 bd. ft. the note would be meaningless. It is a contract, not a mere application for

After the issuance of the cover note, but before the issuance of the 2 insurance.

marine policies, some of the logs intended to be exported were lost

during loading operations in the Diapitan Bay. It may be true that the marine insurance policies issued were for logs no longer

While the logs were alongside the vessel, bad weather developed resulting including those which had been lost during loading operations. This had to be so

in 75 pieces of logs which were rafted together to break loose from each because the risk insured against is for loss during transit, because the logs were

other. 45 pieces of logs were salvaged, but 30 pieces were verified to have safely placed aboard.

been lost or washed away as a result of the accident.

Pacific Timber informed Workmens about the loss of 32 pieces of logs The non-payment of premium on the Cover Note is, therefore, no cause for the

during loading of SS woodlock. petitioner to lose what is due it as if there had been payment of premium, for

Pacific Timber claimed for insurance to the value of P19,286.79. non-payment by it was not chargeable against its fault. Had all the logs been lost

Workmens requested an adjustment company to assess the damage. It during the loading operations, but after the issuance of the Cover Note, liability

submitted its report, where it found that the loss of 30 pieces of logs is on the note would have already arisen even before payment of premium.

not covered by the 2 marine policies but within the Cover Note 1010

insured for $70,000.00. 2. The defense of delay cant be sustained. The facts show that instead of

invoking the ground of delay in objecting to petitioner's claim of recovery on the

The adjustment company submitted a computation of Workmen's probable

liability on the loss sustained by the shipment, in the total amount of cover note, the insurer never had this in its mind. It has a duty to inquire when

P11,042.04. the loss took place, so that it could determine whether delay would be a valid

ground of objection.

Workmens wrote Pacific Timber denying the latter's claim on the ground

that the entire shipment of logs covered by the 2 marine policies were

There was enough time for insurer to determine if petitioner was guilty of delay

received in good order at their point of destination. The said loss may

in communicating the loss to respondent company. It never did in the Insurance

be considered as covered under the Cover Note because the said Note had

Commission. Waiver can be raised against it under Section 84 of the Insurance

become null and void by virtue of the issuance of the 2 Marine Policies.

Act.

Petitioner raised the question beforef the Insurance Commissioner. The

Insurance Commissioner ruled in favor of indemnifying Pacific Timber. The

company added that the cover note is null and void for lack of valuable

consideration. The trial court ruled in petitioners favor while the CA

dismissed the case. Hence this appeal.

Das könnte Ihnen auch gefallen

- People V Rolando CamayDokument2 SeitenPeople V Rolando CamayIvan ValcosNoch keine Bewertungen

- Leviste Vs AlamedaDokument2 SeitenLeviste Vs AlamedaIvan ValcosNoch keine Bewertungen

- 306 Dizon Vs BeltranDokument1 Seite306 Dizon Vs BeltranIvan ValcosNoch keine Bewertungen

- Municipality of San Fernando Vs FirmeDokument2 SeitenMunicipality of San Fernando Vs FirmeIvan ValcosNoch keine Bewertungen

- 147 Phil. Manufacturing Vs Union InsuranceDokument1 Seite147 Phil. Manufacturing Vs Union InsuranceIvan ValcosNoch keine Bewertungen

- 84 Remo Vs Secretary of Foreign AffairsDokument1 Seite84 Remo Vs Secretary of Foreign AffairsIvan ValcosNoch keine Bewertungen

- 016 Yngson Vs PNBDokument2 Seiten016 Yngson Vs PNBIvan ValcosNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- People Vs OritaDokument2 SeitenPeople Vs OritaGrace PoliNoch keine Bewertungen

- Letter On Ivan Robles NavejasDokument3 SeitenLetter On Ivan Robles NavejasJohn BinderNoch keine Bewertungen

- EDITED Resent BAYSACDokument14 SeitenEDITED Resent BAYSACleeNoch keine Bewertungen

- de Dios Vs CaDokument7 Seitende Dios Vs CalewildaleNoch keine Bewertungen

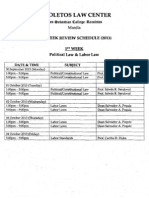

- Recoletos Law Center 2013 Pre-Week Bar ReviewDokument4 SeitenRecoletos Law Center 2013 Pre-Week Bar ReviewJef SantiagoNoch keine Bewertungen

- Unincorporated Business TrustDokument9 SeitenUnincorporated Business TrustSpencerRyanOneal98% (43)

- Metropolitan Bank vs. Tobias 664 SCRA 165Dokument2 SeitenMetropolitan Bank vs. Tobias 664 SCRA 165Cel Delabahan100% (2)

- 2nd Motex VergaraDokument4 Seiten2nd Motex VergaraMarie AlarconNoch keine Bewertungen

- On Directors Rights and Duties or LiabilitiesDokument19 SeitenOn Directors Rights and Duties or LiabilitiesSachin Saxena89% (9)

- Sale DeedDokument9 SeitenSale Deedsparsh9634Noch keine Bewertungen

- Challenges Facing Criminal Justice System in Relation To Witness Protection in KenyaDokument5 SeitenChallenges Facing Criminal Justice System in Relation To Witness Protection in KenyaIOSRjournalNoch keine Bewertungen

- Pre Trial BriefDokument4 SeitenPre Trial BriefJustine Ria AlmojuelaNoch keine Bewertungen

- TORTS 2 Mejo FinalDokument490 SeitenTORTS 2 Mejo FinalJon SnowNoch keine Bewertungen

- Cabarles v. MacedaDokument2 SeitenCabarles v. MacedaCharisse Christianne Yu CabanlitNoch keine Bewertungen

- Intellectual Property Law ReviewerDokument2 SeitenIntellectual Property Law ReviewerLadyfirst MANoch keine Bewertungen

- Florida Department of Law Enforcement Investigative Report of Carl Stanley McGeeDokument2 SeitenFlorida Department of Law Enforcement Investigative Report of Carl Stanley McGeerob2953Noch keine Bewertungen

- PRC Resolution No. 2006-313 Series of 2006Dokument2 SeitenPRC Resolution No. 2006-313 Series of 2006PhilippineNursingDirectory.comNoch keine Bewertungen

- Case Digest Dreamwork Vs JaniolaDokument2 SeitenCase Digest Dreamwork Vs JaniolaLee Yu100% (2)

- Opinion PDFDokument161 SeitenOpinion PDFTMJ4 NewsNoch keine Bewertungen

- Chua Vs CSCDokument2 SeitenChua Vs CSCChris Ross100% (2)

- Syllabus Law-on-Sales UpdatedDokument8 SeitenSyllabus Law-on-Sales UpdatedAstakunNoch keine Bewertungen

- JurisprudenceDokument13 SeitenJurisprudenceSanjay Ram Diwakar100% (1)

- Gestopa vs. CA (Case Digest)Dokument2 SeitenGestopa vs. CA (Case Digest)Angelo Castillo100% (1)

- Project of Taxation LawDokument5 SeitenProject of Taxation Lawzaiba rehmanNoch keine Bewertungen

- Final Special Leave PetitionDokument153 SeitenFinal Special Leave PetitionRoopa RoyNoch keine Bewertungen

- LUPA Opening Brief FinalDokument43 SeitenLUPA Opening Brief Finalbritte1Noch keine Bewertungen

- Herman Duarte v. United States of America and United States Coast Guard, 532 F.2d 850, 2d Cir. (1976)Dokument4 SeitenHerman Duarte v. United States of America and United States Coast Guard, 532 F.2d 850, 2d Cir. (1976)Scribd Government DocsNoch keine Bewertungen

- DOCDokument103 SeitenDOCwinona mae marzoccoNoch keine Bewertungen

- Case ListDokument4 SeitenCase ListCriscell JaneNoch keine Bewertungen

- 20160519-Schorel-Hlavka O.W.B. To County Court of Victoria-Re Written Submission ADDRESS To The COURT-APPEAL-15-2502Dokument45 Seiten20160519-Schorel-Hlavka O.W.B. To County Court of Victoria-Re Written Submission ADDRESS To The COURT-APPEAL-15-2502Gerrit Hendrik Schorel-HlavkaNoch keine Bewertungen