Beruflich Dokumente

Kultur Dokumente

Ekadharma International Tbk. (S)

Hochgeladen von

RomziOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Ekadharma International Tbk. (S)

Hochgeladen von

RomziCopyright:

Verfügbare Formate

EKAD Ekadharma International Tbk.

[S]

COMPANY REPORT : JANUARY 2017 As of 31 January 2017

Main Board Individual Index : 1,510.459

Industry Sector : Basic Industry And Chemicals (3) Listed Shares : 698,775,000

Industry Sub Sector : Chemicals (34) Market Capitalization : 415,771,125,000

406 | 0.42T | 0.007% | 99.63%

341 | 0.06T | 0.003% | 99.88%

COMPANY HISTORY SHAREHOLDERS (January 2017)

Established Date : 20-Nov-1981 1. PT Ekadharma Inti Perkasa 533,289,620 : 76.32%

Listing Date : 14-Aug-1990 2. Public (<5%) 165,485,380 : 23.68%

Under Writer IPO :

PT (Persero) Danareksa DIVIDEND ANNOUNCEMENT

PT Multicor Bonus Cash Recording Payment

F/I

PT Merchant Investment Corporation Year Shares Dividend Cum Date Ex Date Date Date

Securities Administration Bureau : 1991 125.00 17-Feb-92 18-Feb-92 25-Feb-92 11-Mar-92 I

PT Adimitra Jasa Korpora 1991 10 : 1 100.00 09-Jul-92 10-Jul-92 17-Jul-92 05-Aug-92 F

Rukan Kirana Boutique Office 1992 1:1 18-Nov-92 19-Nov-92 26-Nov-92 17-Dec-92 B

Jln. Kirana Avenue III Blok F3 No. 5, Kelapa Gading, Jakarta Utara 1992 160.00 09-Jul-93 12-Jul-93 19-Jul-93 05-Aug-93 F

Phone : (021) 2974-5222 1993 10 : 1 40.00 12-Jul-94 13-Jul-94 20-Jul-94 12-Aug-94 F

Fax : 1994 55.00 07-Jul-95 10-Jul-95 18-Jul-95 10-Aug-95 F

1995 50.00 09-Jul-96 10-Jul-96 18-Jul-96 12-Aug-96 F

BOARD OF COMMISSIONERS 1996 60.00 16-Jul-97 18-Jul-97 28-Jul-97 26-Aug-97 F

1. Rudy Kurniawan Leonardi 1998 350.00 03-Aug-99 04-Aug-99 12-Aug-99 10-Sep-99 F

2. Emil Bachtiar *) 1999 1:1 03-Aug-99 04-Aug-99 12-Aug-99 10-Sep-99 S

*) Independent Commissioners 1999 100.00 23-May-00 24-May-00 02-Jun-00 19-Jun-00 F

2000 75.00 04-Jul-01 05-Jul-01 12-Jul-01 27-Jul-01 F

BOARD OF DIRECTORS 2001 90.00 26-Jun-02 27-Jun-02 02-Jul-02 16-Jul-02 F

1. Judi Widjaja Leonardi 2002 75.00 26-Jun-03 27-Jun-03 01-Jul-03 15-Jul-03 F

2. Henry Tedjakusmana 2003 10.00 15-Jul-04 16-Jul-04 20-Jul-04 03-Aug-04 F

3. Lie Phing 2005 10.00 17-Jun-05 20-Jun-05 22-Jun-05 05-Jul-05

2005 12.50 21-Jul-06 24-Jul-06 26-Jul-06 08-Aug-06 F

AUDIT COMMITTEE 2005 8:1 21-Jul-06 24-Jul-06 26-Jul-06 08-Aug-06 S

1. Emil Bachtiar 2005 8:1 21-Jul-06 24-Jul-06 26-Jul-06 08-Aug-06 D

2. Edward Tanujaya 2006 3.00 20-Jun-07 21-Jun-07 25-Jun-07 09-Jul-07 F

3. Kurnia Irwansyah Rais 2007 2.00 18-Jun-08 19-Jun-08 23-Jun-08 07-Jul-08 F

2009 3.00 25-Sep-09 28-Sep-09 30-Sep-09 14-Oct-09 I

CORPORATE SECRETARY 2009 3.00 11-Jun-10 14-Jun-10 16-Jun-10 30-Jun-10 F

Lie Phing 2010 4:1 17-Jun-11 20-Jun-11 22-Jun-11 07-Jul-11 B

2010 8.00 17-Jun-11 20-Jun-11 22-Jun-11 07-Jul-11 F

HEAD OFFICE 2011 7.00 12-Jul-12 13-Jul-12 17-Jul-12 31-Jul-12 F

Galeri Niaga Mediterania 2 Blok L8 F-G 2012 8.00 21-Jun-13 24-Jun-13 26-Jun-13 10-Jul-13 F

Pantai Indah Kapuk 2013 9.00 16-Jun-14 17-Jun-14 19-Jun-14 03-Jul-14 F

Jakarta Utara 14460 2014 9.00 25-Jun-15 26-Jun-15 30-Jun-15 22-Jul-15 F

Phone : (021) 588-3090 2015 10.00 31-May-16 01-Jun-16 03-Jun-16 24-Jun-16 F

Fax : (021) 588-3091

ISSUED HISTORY

Homepage : www.ekadharma.com Listing Trading

Email : liephing@kdy No. Type of Listing Shares Date Date

ekadharma.com 1. First Issue 1,000,000 14-Aug-90 14-Aug-90

2. Company Listing 2,850,000 10-Jun-91 17-Jun-91

3. Bonus Shares 770,000 03-Sep-91 03-Sep-91

4. Bonus Shares 462,000 06-Aug-92 06-Aug-92

5. Bonus Shares 5,082,000 18-Dec-92 18-Dec-92

6. Dividend Shares 1,016,400 15-Aug-94 15-Aug-94

7. Stock Split 11,180,400 06-Sep-99 06-Sep-99

8. Dividend Shares 22,360,800 13-Sep-99 13-Sep-99

9. Stock Split 178,886,400 10-Feb-04 10-Feb-04

10. Bonus Shares 27,951,000 08-Aug-06 08-Aug-06

11. Dividend Shares 27,951,000 08-Aug-06 08-Aug-06

12. Stock Split 279,510,000 19-Oct-06 19-Oct-06

13. Bonus Shares 139,755,000 07-Jul-11 07-Jul-11

EKAD Ekadharma International Tbk. [S]

TRADING ACTIVITIES

Closing Price* and Trading Volume

Ekadharma International Tbk. [S] Closing Price Freq. Volume Value

Day

Closing Volume

Price* January 2013 - January 2017 (Mill. Sh) Month High Low Close (X) (Thou. Sh.) (Million Rp)

680 16.0 Jan-13 430 355 400 4,931 60,261 23,366 21

Feb-13 420 390 410 2,239 24,005 9,686 20

595 14.0 Mar-13 485 395 460 3,963 50,083 22,217 19

Apr-13 480 410 430 2,175 26,412 11,566 22

May-13 460 400 420 2,404 34,686 14,871 22

510 12.0

Jun-13 425 370 395 944 12,166 4,888 19

Jul-13 400 380 380 713 10,534 4,097 23

425 10.0

Aug-13 390 325 360 474 5,451 1,983 17

Sep-13 385 335 365 397 4,329 1,513 21

340 8.0

Oct-13 405 360 405 665 4,700 1,815 21

Nov-13 410 380 395 702 7,516 2,978 20

255 6.0 Dec-13 400 385 390 421 3,958 1,544 19

170 4.0 Jan-14 407 384 399 822 8,490 3,378 20

Feb-14 425 399 417 649 5,779 2,393 20

85 2.0 Mar-14 440 410 424 536 4,104 1,730 20

Apr-14 438 413 425 905 9,807 4,173 20

May-14 435 421 424 559 6,147 2,618 18

Jun-14 423 401 406 461 3,242 1,351 21

Jan-13 Jan-14 Jan-15 Jan-16 Jan-17

Jul-14 422 390 412 555 2,247 910 18

Aug-14 435 400 431 634 5,703 2,400 20

Sep-14 465 432 459 1,296 9,689 4,337 22

Closing Price*, Jakarta Composite Index (IHSG) and Oct-14 459 425 447 568 4,779 2,113 23

Basic Industry and Chemicals Index Nov-14 480 438 471 756 8,457 3,880 20

January 2013 - January 2017 Dec-14 535 460 515 1,466 12,719 6,389 20

100%

Jan-15 530 500 520 714 7,217 3,701 21

80% Feb-15 595 505 525 826 6,780 3,536 19

Mar-15 530 490 494 574 4,349 2,184 22

67.6%

60% Apr-15 498 457 470 537 2,986 1,435 21

May-15 498 446 462 455 1,683 777 19

40% Jun-15 467 410 442 511 2,264 987 21

Jul-15 450 380 415 839 3,009 1,227 19

21.8% Aug-15 418 351 357 382 957 360 17

20%

Sep-15 419 332 352 377 527 193 18

6.6% Oct-15 400 340 395 412 1,019 378 18

-

Nov-15 417 365 417 272 3,248 827 18

Dec-15 441 400 400 292 2,323 947 15

-20%

Jan-16 420 389 399 396 2,740 1,094 20

-40% Feb-16 426 384 414 272 2,212 880 20

Mar-16 425 400 421 530 2,239 926 21

-60% Apr-16 469 423 464 681 5,376 2,385 21

Jan 13 Jan 14 Jan 15 Jan 16 Jan 17 May-16 540 468 505 1,148 12,330 6,388 20

Jun-16 515 470 510 505 4,163 2,062 21

Jul-16 665 500 650 1,612 13,857 8,083 16

SHARES TRADED 2013 2014 2015 2016 Jan-17 Aug-16 665 600 615 2,053 18,499 11,497 22

Volume (Million Sh.) 244 81 36 97 2 Sep-16 630 570 600 710 4,941 2,997 21

Value (Billion Rp) 101 36 17 56 1 Oct-16 690 600 665 2,090 17,769 11,516 21

Frequency (Thou. X) 20 9 6 12 0.3 Nov-16 670 555 565 1,202 8,316 4,991 22

Days 244 242 228 245 21 Dec-16 650 560 590 633 4,950 2,913 20

Price (Rupiah) Jan-17 645 575 595 333 2,419 1,425 21

High 485 535 595 690 645

Low 325 384 332 384 575

Close 390 515 400 590 595

Close* 390 515 400 590 595

PER (X) 7.01 7.65 5.93 4.20 4.24

PER Industry (X) 6.83 16.60 4.10 20.86 23.23

PBV (X) 1.15 1.54 1.16 0.79 0.79

* Adjusted price after corporate action

EKAD Ekadharma International Tbk. [S]

Financial Data and Ratios Book End : December

Public Accountant : Budiman, Wawan, Pamudji & Rekan (Member of Eura Audit International)

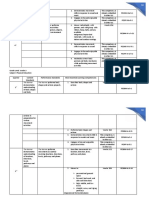

BALANCE SHEET Dec-12 Dec-13 Dec-14 Dec-15 Sep-16 TOTAL ASSETS AND LIABILITIES (Bill. Rp)

(Million Rp except Par Value) Assets Liabilities

Cash & Cash Equivalents 6,428 9,841 13,223 49,520 71,448 750

Receivables 49,704 62,633 73,855 71,150 74,493

81,649 109,379 162,139 114,683 123,415 600

Inventories

Current Assets 180,371 229,041 296,439 284,055 308,795

450

Fixed Assets 85,361 104,498 105,346 96,596 316,997

Other Assets 1,866 - 5,101 4,646 48,045

300

Total Assets 273,893 114,560 411,349 389,692 677,645

Growth (%) -58.17% 259.07% -5.26% 73.89% 150

Current Liabilities 74,814 98,355 127,249 79,594 56,956 -

Long Term Liabilities 7,101 7,539 10,901 18,136 96,138 2012 2013 2014 2015 Sep-16

Total Liabilities 81,916 105,894 138,150 97,730 153,094

Growth (%) 29.27% 30.46% -29.26% 56.65%

TOTAL EQUITY (Bill. Rp)

Authorized Capital 40,000 40,000 40,000 80,000 40,000 525

Paid up Capital 34,939 34,939 34,939 34,939 34,939 525

Paid up Capital (Shares) 699 699 699 699 699

Par Value 50 50 50 50 0

418

Retained Earnings 118,894 152,157 185,911 222,386 281,739 292

273

191,978 237,708 273,199 291,961 524,551

311

Total Equity 238

192

Growth (%) 23.82% 14.93% 6.87% 79.66% 204

INCOME STATEMENTS Dec-12 Dec-13 Dec-14 Dec-15 Sep-16 97

Total Revenues 385,037 418,669 526,574 531,538 425,249

Growth (%) 8.73% 25.77% 0.94%

-10

2012 2013 2014 2015 Sep-16

Cost of Revenues 284,653 302,324 392,784 380,173 276,270

Gross Profit 100,384 116,345 133,790 151,365 148,980

TOTAL REVENUES (Bill. Rp)

Expenses (Income) 52,454 64,357 - 85,058 50,363

Operating Profit 47,930 51,988 - - 98,616 527 532

Growth (%) 8.47% -100.00%

532

419 425

423 385

Other Income (Expenses) - - -75,068 - -

Income before Tax 47,930 51,988 58,722 66,307 98,616 315

Tax 11,733 12,538 17,966 19,267 22,218

Profit for the period 36,198 39,451 40,756 47,040 76,398 206

Growth (%) 8.99% 3.31% 15.42%

98

Period Attributable 36,198 38,853 40,043 47,149 73,541 -11

Comprehensive Income 49,224 51,320 41,781 30,401 239,578 2012 2013 2014 2015 Sep-16

Comprehensive Attributable - 50,723 41,068 30,510 236,721

RATIOS Dec-12 Dec-13 Dec-14 Dec-15 Sep-16 PROFIT FOR THE PERIOD (Bill. Rp)

Current Ratio (%) 241.09 232.87 232.96 356.88 542.16

76

Dividend (Rp) 8.00 9.00 9.00 10.00 - 76

EPS (Rp) 51.80 55.60 57.30 67.47 105.24

BV (Rp) 274.73 340.18 390.97 417.82 750.67 61

47

DAR (X) 0.30 0.92 0.34 0.25 0.23

39 41

DER(X) 0.43 0.45 0.51 0.33 0.29 36

45

ROA (%) 13.22 34.44 9.91 12.07 11.27 30

ROE (%) 18.86 16.60 14.92 16.11 14.56

GPM (%) 26.07 27.79 25.41 28.48 35.03 14

OPM (%) 12.45 12.42 - - 23.19

NPM (%) 9.40 9.42 7.74 8.85 17.97

-2

2012 2013 2014 2015 Sep-16

Payout Ratio (%) 15.44 16.19 15.71 14.82 -

Yield (%) 2.29 2.31 1.75 2.50 -

Das könnte Ihnen auch gefallen

- EkadDokument3 SeitenEkadErvin KhouwNoch keine Bewertungen

- Asgr PDFDokument3 SeitenAsgr PDFyohannestampubolonNoch keine Bewertungen

- TgkaDokument3 SeitenTgkaWira WijayaNoch keine Bewertungen

- Asbi SumDokument3 SeitenAsbi SumadjipramNoch keine Bewertungen

- Metrodata Electronics TBK.: Company Report: January 2019 As of 31 January 2019Dokument3 SeitenMetrodata Electronics TBK.: Company Report: January 2019 As of 31 January 2019Reza CahyaNoch keine Bewertungen

- Asbi PDFDokument3 SeitenAsbi PDFyohannestampubolonNoch keine Bewertungen

- AbdaDokument3 SeitenAbdahestiaa90Noch keine Bewertungen

- ASBI Idx EmitenDokument3 SeitenASBI Idx EmitenRudi PramonoNoch keine Bewertungen

- Alk - Fika - Tugas Ke 1Dokument3 SeitenAlk - Fika - Tugas Ke 1fika rizkiNoch keine Bewertungen

- Multi Bintang Indonesia TBK.: Company Report: January 2017 As of 31 January 2017Dokument3 SeitenMulti Bintang Indonesia TBK.: Company Report: January 2017 As of 31 January 2017Solihul HadiNoch keine Bewertungen

- Delta Djakarta TBK.: Company Report: January 2017 As of 31 January 2017Dokument3 SeitenDelta Djakarta TBK.: Company Report: January 2017 As of 31 January 2017Solihul HadiNoch keine Bewertungen

- Brna PDFDokument3 SeitenBrna PDFyohannestampubolonNoch keine Bewertungen

- TSPC PDFDokument3 SeitenTSPC PDFFITRA PEBRI ANSHORNoch keine Bewertungen

- ASGR SD Jan 2019Dokument3 SeitenASGR SD Jan 2019Arina Kartika RizqiNoch keine Bewertungen

- Enseval Putera Megatrading TBK.: Company Report: January 2019 As of 31 January 2019Dokument3 SeitenEnseval Putera Megatrading TBK.: Company Report: January 2019 As of 31 January 2019Nur WahyudiNoch keine Bewertungen

- Abda PDFDokument3 SeitenAbda PDFyohannestampubolonNoch keine Bewertungen

- Blta PDFDokument3 SeitenBlta PDFyohannestampubolonNoch keine Bewertungen

- BBLD PDFDokument3 SeitenBBLD PDFyohannestampubolonNoch keine Bewertungen

- Merck TBK.: Company Report: January 2019 As of 31 January 2019Dokument3 SeitenMerck TBK.: Company Report: January 2019 As of 31 January 2019hudaNoch keine Bewertungen

- Asuransi Ramayana TBKDokument3 SeitenAsuransi Ramayana TBKSanesNoch keine Bewertungen

- Asuransi Bina Dana Arta TBK.: Company History SHAREHOLDERS (July 2012)Dokument3 SeitenAsuransi Bina Dana Arta TBK.: Company History SHAREHOLDERS (July 2012)Marvin ArifinNoch keine Bewertungen

- Kalbe Farma TBK.: Company Report: January 2019 As of 31 January 2019Dokument3 SeitenKalbe Farma TBK.: Company Report: January 2019 As of 31 January 2019safiraNoch keine Bewertungen

- KLBFDokument3 SeitenKLBFSHINTA ADHA MARISKANoch keine Bewertungen

- Citra Marga Nusaphala Persada TBK.: Company Report: July 2018 As of 31 July 2018Dokument3 SeitenCitra Marga Nusaphala Persada TBK.: Company Report: July 2018 As of 31 July 2018Melinda KusumaNoch keine Bewertungen

- Ramayana Lestari Sentosa TBK.: Company Report: January 2019 As of 31 January 2019Dokument3 SeitenRamayana Lestari Sentosa TBK.: Company Report: January 2019 As of 31 January 2019Paras FebriayuniNoch keine Bewertungen

- Gajah Tunggal TBK.: Company Report: January 2019 As of 31 January 2019Dokument3 SeitenGajah Tunggal TBK.: Company Report: January 2019 As of 31 January 2019Paras FebriayuniNoch keine Bewertungen

- Resource Alam Indonesia TBKDokument3 SeitenResource Alam Indonesia TBKsriyupiagustinaNoch keine Bewertungen

- Bram PDFDokument3 SeitenBram PDFElis priyantiNoch keine Bewertungen

- RigsDokument3 SeitenRigssulaiman alfadliNoch keine Bewertungen

- CMNP SumDokument3 SeitenCMNP SumadjipramNoch keine Bewertungen

- Kalbe Farma TBKDokument3 SeitenKalbe Farma TBKK-AnggunYulianaNoch keine Bewertungen

- Indocement Tunggal Prakarsa TBKDokument3 SeitenIndocement Tunggal Prakarsa TBKRika SilvianaNoch keine Bewertungen

- AKR Corporindo Tbk. (S) : Company Report: February 2013 As of 28 February 2013Dokument3 SeitenAKR Corporindo Tbk. (S) : Company Report: February 2013 As of 28 February 2013Agung arinandaNoch keine Bewertungen

- Aqua Golden Mississippi TBK Aqua: Company History Dividend AnnouncementDokument3 SeitenAqua Golden Mississippi TBK Aqua: Company History Dividend AnnouncementJandri Zhen TomasoaNoch keine Bewertungen

- Kabelindo Murni TBKDokument3 SeitenKabelindo Murni TBKIstrinya TaehyungNoch keine Bewertungen

- Laporan Keuangan ASSIDokument3 SeitenLaporan Keuangan ASSITiti MuntiartiNoch keine Bewertungen

- Asahimas Flat Glass TBK.: Company Report: January 2019 As of 31 January 2019Dokument3 SeitenAsahimas Flat Glass TBK.: Company Report: January 2019 As of 31 January 2019Abdur RohmanNoch keine Bewertungen

- Asuransi Harta Aman Pratama TBK.: Company History SHAREHOLDERS (July 2012)Dokument3 SeitenAsuransi Harta Aman Pratama TBK.: Company History SHAREHOLDERS (July 2012)Marvin ArifinNoch keine Bewertungen

- Mayora Indah TBK.: Company Report: January 2018 As of 31 January 2018Dokument3 SeitenMayora Indah TBK.: Company Report: January 2018 As of 31 January 2018ulfaNoch keine Bewertungen

- Gudang Garam TBK.: Company Report: January 2019 As of 31 January 2019Dokument3 SeitenGudang Garam TBK.: Company Report: January 2019 As of 31 January 2019LiuKsNoch keine Bewertungen

- Jaya Real Property TBK.: Company Report: January 2019 As of 31 January 2019Dokument3 SeitenJaya Real Property TBK.: Company Report: January 2019 As of 31 January 2019Denny SiswajaNoch keine Bewertungen

- Fast Food Indonesia TBK.: Company Report: January 2019 As of 31 January 2019Dokument3 SeitenFast Food Indonesia TBK.: Company Report: January 2019 As of 31 January 2019marrifa angelicaNoch keine Bewertungen

- BRNADokument3 SeitenBRNAdennyaikiNoch keine Bewertungen

- Asuransi Dayin Mitra TBK Asdm: Company History Dividend AnnouncementDokument3 SeitenAsuransi Dayin Mitra TBK Asdm: Company History Dividend AnnouncementJandri Zhen TomasoaNoch keine Bewertungen

- Bank CIMB Niaga TBKDokument3 SeitenBank CIMB Niaga TBKEka FarahNoch keine Bewertungen

- Bumi Resources TBKDokument3 SeitenBumi Resources TBKadjipramNoch keine Bewertungen

- LpgiDokument3 SeitenLpgiSyafira FirdausiNoch keine Bewertungen

- Amfg PDFDokument3 SeitenAmfg PDFyohannestampubolonNoch keine Bewertungen

- DildDokument3 SeitenDildPrasetyo Indra SuronoNoch keine Bewertungen

- Indofood Sukses Makmur TBK.: Company Report: January 2019 As of 31 January 2019Dokument3 SeitenIndofood Sukses Makmur TBK.: Company Report: January 2019 As of 31 January 2019Aryanto ArNoch keine Bewertungen

- RalsDokument3 SeitenRalsulffah juliandNoch keine Bewertungen

- Maskapai Reasuransi Indonesia TBKDokument3 SeitenMaskapai Reasuransi Indonesia TBKisjonNoch keine Bewertungen

- Bank Pan Indonesia TBKDokument3 SeitenBank Pan Indonesia TBKParas FebriayuniNoch keine Bewertungen

- Astra Agro Lestari TBKDokument3 SeitenAstra Agro Lestari TBKsalmunNoch keine Bewertungen

- ASIIDokument3 SeitenASIIhoga_dreamlandNoch keine Bewertungen

- Aali PDFDokument3 SeitenAali PDFroy manchenNoch keine Bewertungen

- Profile of the International Pump Industry: Market Prospects to 2010Von EverandProfile of the International Pump Industry: Market Prospects to 2010Bewertung: 1 von 5 Sternen1/5 (1)

- Commodity Investing: Maximizing Returns Through Fundamental AnalysisVon EverandCommodity Investing: Maximizing Returns Through Fundamental AnalysisNoch keine Bewertungen

- Juliet SlidesCarnivalDokument27 SeitenJuliet SlidesCarnivalRomziNoch keine Bewertungen

- International Journal of Surgery Case ReportsDokument3 SeitenInternational Journal of Surgery Case ReportsRomziNoch keine Bewertungen

- Instruments For Leadership in Children and YouthDokument6 SeitenInstruments For Leadership in Children and YouthRomziNoch keine Bewertungen

- Tunas Baru Lampung TBKDokument3 SeitenTunas Baru Lampung TBKRomziNoch keine Bewertungen

- T5 B11 Victor Manuel Lopez-Flores FDR - FBI 302s Re VA ID Cards For Hanjour and Almihdhar 195Dokument11 SeitenT5 B11 Victor Manuel Lopez-Flores FDR - FBI 302s Re VA ID Cards For Hanjour and Almihdhar 1959/11 Document Archive100% (2)

- Comparison of PubMed, Scopus, Web of Science, and Google Scholar - Strengths and WeaknessesDokument5 SeitenComparison of PubMed, Scopus, Web of Science, and Google Scholar - Strengths and WeaknessesMostafa AbdelrahmanNoch keine Bewertungen

- Random Variables Random Variables - A Random Variable Is A Process, Which When FollowedDokument2 SeitenRandom Variables Random Variables - A Random Variable Is A Process, Which When FollowedsdlfNoch keine Bewertungen

- Basic Econometrics Questions and AnswersDokument3 SeitenBasic Econometrics Questions and AnswersRutendo TarabukuNoch keine Bewertungen

- Civ Beyond Earth HotkeysDokument1 SeiteCiv Beyond Earth HotkeysExirtisNoch keine Bewertungen

- Organization Culture Impacts On Employee Motivation: A Case Study On An Apparel Company in Sri LankaDokument4 SeitenOrganization Culture Impacts On Employee Motivation: A Case Study On An Apparel Company in Sri LankaSupreet PurohitNoch keine Bewertungen

- How To Convert Files To Binary FormatDokument1 SeiteHow To Convert Files To Binary FormatAhmed Riyadh100% (1)

- Midi Pro Adapter ManualDokument34 SeitenMidi Pro Adapter ManualUli ZukowskiNoch keine Bewertungen

- Introduction To DifferentiationDokument10 SeitenIntroduction To DifferentiationaurennosNoch keine Bewertungen

- Futures Volume 1 Issue 3 1969 (Doi 10.1016/0016-3287 (69) 90026-3) Dennis Livingston - Science Fiction As A Source of Forecast MaterialDokument7 SeitenFutures Volume 1 Issue 3 1969 (Doi 10.1016/0016-3287 (69) 90026-3) Dennis Livingston - Science Fiction As A Source of Forecast MaterialManticora VenerabilisNoch keine Bewertungen

- 1.SDH Basics PDFDokument37 Seiten1.SDH Basics PDFsafder wahabNoch keine Bewertungen

- Instant Download Ebook PDF Ecology Concepts and Applications 8th Edition PDF ScribdDokument41 SeitenInstant Download Ebook PDF Ecology Concepts and Applications 8th Edition PDF Scribdsteven.cross256100% (45)

- Trade MarkDokument2 SeitenTrade MarkRohit ThoratNoch keine Bewertungen

- 2 To 20 Years - Girls Stature-For-Age and Weight-For-Age PercentilesDokument1 Seite2 To 20 Years - Girls Stature-For-Age and Weight-For-Age PercentilesRajalakshmi Vengadasamy0% (1)

- M. Ircham Mansyur 07224005 Microprocessor-2 (H13)Dokument7 SeitenM. Ircham Mansyur 07224005 Microprocessor-2 (H13)emiierNoch keine Bewertungen

- Final Selection Criteria Tunnel Cons TraDokument32 SeitenFinal Selection Criteria Tunnel Cons TraMd Mobshshir NayeemNoch keine Bewertungen

- Hydro Electric Fire HistoryDokument3 SeitenHydro Electric Fire HistorygdmurfNoch keine Bewertungen

- Bajaj Vs Hero HondaDokument63 SeitenBajaj Vs Hero HondaHansini Premi100% (1)

- Stone As A Building Material: LateriteDokument13 SeitenStone As A Building Material: LateriteSatyajeet ChavanNoch keine Bewertungen

- Internship Report Format For Associate Degree ProgramDokument5 SeitenInternship Report Format For Associate Degree ProgramBisma AmjaidNoch keine Bewertungen

- ZygalDokument22 SeitenZygalShubham KandiNoch keine Bewertungen

- NABARD R&D Seminar FormatDokument7 SeitenNABARD R&D Seminar FormatAnupam G. RatheeNoch keine Bewertungen

- Morfologi Dan Citra Kota Kawasan Kauman, Kecamatan Juwana, Kabupaten Pati The Morphology and Image of Kauman Town, Juwana Sub District, Pati RegencyDokument16 SeitenMorfologi Dan Citra Kota Kawasan Kauman, Kecamatan Juwana, Kabupaten Pati The Morphology and Image of Kauman Town, Juwana Sub District, Pati RegencyRABIAH ARDIANTI TUM TOMAGOLANoch keine Bewertungen

- Standard Test Methods For Rheological Properties of Non-Newtonian Materials by Rotational (Brookfield Type) ViscometerDokument8 SeitenStandard Test Methods For Rheological Properties of Non-Newtonian Materials by Rotational (Brookfield Type) ViscometerRodrigo LopezNoch keine Bewertungen

- Manual E07ei1Dokument57 SeitenManual E07ei1EiriHouseNoch keine Bewertungen

- PE MELCs Grade 3Dokument4 SeitenPE MELCs Grade 3MARISSA BERNALDONoch keine Bewertungen

- Binge Eating Disorder ANNADokument12 SeitenBinge Eating Disorder ANNAloloasbNoch keine Bewertungen

- UNCITRAL Guide United Nations Commission On International Trade LawDokument56 SeitenUNCITRAL Guide United Nations Commission On International Trade Lawsabiont100% (2)

- DION IMPACT 9102 SeriesDokument5 SeitenDION IMPACT 9102 SeriesLENEEVERSONNoch keine Bewertungen

- The Kicker TranscriptionDokument4 SeitenThe Kicker TranscriptionmilesNoch keine Bewertungen