Beruflich Dokumente

Kultur Dokumente

Math 1030

Hochgeladen von

api-387874690Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Math 1030

Hochgeladen von

api-387874690Copyright:

Verfügbare Formate

Math 1030 Project 1

Name ___Ashlyn Talcott________

Buying a House

Select a house from a real estate booklet, newspaper, or website. Find something reasonable –

between $100,000 and $350,000. In reality, a trained financial professional can help you

determine what is reasonable for your financial situation. Take a screenshot of the listing for

your chosen house and attach it to this project. Assume that you will pay the asking price for

your house.

The listed selling price is __$315,000__________.

Assume that you will make a down payment of 20%.

The down payment is __$63,000__________. The amount of the mortgage is

__$252,000__________.

Ask at least two lending institutions for the interest rate for both a 15-year and a 30-year fixed

rate mortgage with no “points” or other variations on the interest rate for the loan.

Name of first lending institution: ____Wells Fargo_______________________.

Rate for 15-year mortgage: __3.375%__________. Rate for 30-year mortgage

___4.00%_________.

Name of second lending institution: _____Mountain America_________________.

Rate for 15-year mortgage: __3.25%_____. Rate for 30-year mortgage _3.875%____.

Assuming that the rates are the only difference between the different lending institutions, find the

monthly payment at the better interest rate for each type of mortgage.

15-year monthly payment: ___$1,771_. 30-year monthly payment _$1,185__.

These payments cover only the interest and the principal on the loan. They do not cover the

insurance or taxes.

To organize the information for the amortization of the loan, construct a schedule that keeps

track of: (1) the payment number and/or (2) the month and year (3) the amount of the payment,

(4) the amount of interest paid, (5) the amount of principal paid, and (6) the remaining balance.

15-year mortgage

Payment Payment Payment Interest Principal Remaining

Number Date Amount ($) Paid ($) Paid ($) Balance ($)

1. . 12/1/17 $1,770.73 $682.50 $1,088.23 $250,911.77

2. . 1/1/18 $1,770.73 $679.55 $1,091.18 $249,820,59

50. . 1/1/22 $1,770.73 $528.28 $1,242.45 $193,816.50

90. . 5/1/25 $1,770.73 $386.33 $1,384.40 $141,259.73

120. . 11/1/27 $1,770.73 $269.31 $1,501.42 $97,937.67

150. . 5/1/30 $1,770.73 $142.41 $1,628.32 $50,953,86

180. . 11/1/32 $1,770.73 $4.78 $1,764.84 $0.00. .

total ------- $318,730.29 $66,730.29 $252,000.00 ---------

Use the proper word or phrase to fill in the blanks.

The total principal paid is the same as the __mortgage________.

The total amount paid is the number of payments times ___180________.

The total interest paid is the total amount paid minus ___principal_________.

Use the proper number to fill in the blanks and cross out the improper word

in the parentheses.

Payment number __1___ is the first one in which the principal paid is greater than the

interest paid.

The total amount of interest is $66,730.29____More__ (more or less) than the mortgage.

The total amount of interest is ____73.5 ____% LESS than the mortgage.

The total amount of interest is ______26.5_______% of the mortgage.

30-year mortgage

Payment Payment Payment Interest Principal Remaining

Number Date Amount ($) Paid ($) Paid ($) Balance ($)

1. . 12/1/17 $1,096.72 $682.50 $414.22 $251,585.78

2. . 1/1/18 $1,096.72 $681.38 $415.34 $251,170.44

60. . 11/1/22 $1,096.72 $610.83 $485.89 $225,052.98

120. . 11/1/27 $1,096.72 $525.23 $571.49 $193,358.23

240. . 11/1/37 $1,096.72 $306.10 $790.62 $112,231.91

300. . 11/1/42 $1,096.72 $166.80 $929.92 $60,659.19

360. . 11/1/47 $1,096.72 $2.96 $1,093.63 $0.00. .

total ------- $394,819.07 $142,819.07 $252,000 ---------

Payment number __105___ is the first one in which the principal paid is greater than the interest

paid.

The total amount of interest is $__142,819.07 more___ (more or less) than the mortgage.

The total amount of interest is ___43.3___Less___% (more or less) than the mortgage.

The total amount of interest is ___56.7__________% of the mortgage.

Suppose you paid an additional $100 a month towards the principal:

The total amount of interest paid with the $100 monthly extra payment would be

$__117,981.96______.

The total amount of interest paid with the $100 monthly extra payment would be

$24,837.11 Less (more or less) than the interest paid for the scheduled payments only.

The total amount of interest paid with the $100 monthly extra payment would be 17% less

(more or less) than the interest paid for the scheduled payments only.

The $100 monthly extra payment would pay off the mortgage in _26___ years and _0___

months; that’s __48__ months sooner than paying only the scheduled payments.

Das könnte Ihnen auch gefallen

- Buying A House: Math 1030Dokument5 SeitenBuying A House: Math 1030api-382630770Noch keine Bewertungen

- Math Finance ProjectDokument4 SeitenMath Finance Projectapi-340519862Noch keine Bewertungen

- Finance Project FinalDokument5 SeitenFinance Project Finalapi-356639260Noch keine Bewertungen

- Finance ProjectDokument5 SeitenFinance Projectapi-309268752Noch keine Bewertungen

- Finance ProjectDokument5 SeitenFinance Projectapi-436954052Noch keine Bewertungen

- Math 1030Dokument5 SeitenMath 1030api-442263040Noch keine Bewertungen

- Finance ProjectDokument6 SeitenFinance Projectapi-313102357Noch keine Bewertungen

- Shanepark FinanceprojectDokument4 SeitenShanepark Financeprojectapi-339682129Noch keine Bewertungen

- Finance ProjectDokument5 SeitenFinance Projectapi-355210134Noch keine Bewertungen

- Finance ProjectDokument4 SeitenFinance Projectapi-416062482Noch keine Bewertungen

- HouseDokument14 SeitenHouseapi-435614969Noch keine Bewertungen

- Finance Project-2Dokument4 SeitenFinance Project-2api-242736484Noch keine Bewertungen

- Finance Project-3Dokument4 SeitenFinance Project-3api-284666235Noch keine Bewertungen

- Finance ProjectDokument5 SeitenFinance Projectapi-337714189Noch keine Bewertungen

- Document 1Dokument4 SeitenDocument 1api-525321076Noch keine Bewertungen

- Finance ProjectDokument5 SeitenFinance Projectapi-436951596Noch keine Bewertungen

- Finance Project-2Dokument4 SeitenFinance Project-2api-273266104Noch keine Bewertungen

- Finance Project-2Dokument6 SeitenFinance Project-2api-192665719Noch keine Bewertungen

- Finance Project - Adrian Arturo NinaDokument6 SeitenFinance Project - Adrian Arturo Ninaapi-253521109Noch keine Bewertungen

- Finance Project Final 1Dokument5 SeitenFinance Project Final 1api-332608130Noch keine Bewertungen

- Finance ProjectDokument4 SeitenFinance Projectapi-302141157Noch keine Bewertungen

- BuyingahouseDokument5 SeitenBuyingahouseapi-2530972880% (1)

- Finance Project 2Dokument5 SeitenFinance Project 2api-442104340Noch keine Bewertungen

- Math Spring Final ProjectDokument4 SeitenMath Spring Final Projectapi-355397592Noch keine Bewertungen

- Finance ProjectDokument4 SeitenFinance Projectapi-316142758Noch keine Bewertungen

- Finance ProjectdfixedDokument4 SeitenFinance Projectdfixedapi-302664379Noch keine Bewertungen

- Finance ProjectDokument4 SeitenFinance Projectapi-240285550Noch keine Bewertungen

- Finance ProjectDokument8 SeitenFinance Projectapi-355063431Noch keine Bewertungen

- Finance ProjectDokument5 SeitenFinance Projectapi-441967948Noch keine Bewertungen

- Math 1030 Finance ProjectDokument5 SeitenMath 1030 Finance Projectapi-340743737Noch keine Bewertungen

- Finance Project Math 1030Dokument5 SeitenFinance Project Math 1030api-241289407Noch keine Bewertungen

- FinanceDokument4 SeitenFinanceapi-435296787Noch keine Bewertungen

- 1030proj1-Buying A House Revisedmay25Dokument5 Seiten1030proj1-Buying A House Revisedmay25api-317268368Noch keine Bewertungen

- Finance Project-1 1Dokument5 SeitenFinance Project-1 1api-272847281Noch keine Bewertungen

- Installment BuyingDokument33 SeitenInstallment BuyingNors PataytayNoch keine Bewertungen

- Buying A House Math 1030-1Dokument3 SeitenBuying A House Math 1030-1api-341229603Noch keine Bewertungen

- Review MathDokument5 SeitenReview Mathapi-173610472Noch keine Bewertungen

- Amortization Definition - InvestopediaDokument7 SeitenAmortization Definition - InvestopediaBob KaneNoch keine Bewertungen

- Buying A House ProjectDokument4 SeitenBuying A House Projectapi-275968399Noch keine Bewertungen

- Buying A HouseDokument3 SeitenBuying A Houseapi-242207683Noch keine Bewertungen

- Buyhouse 1030 MathDokument3 SeitenBuyhouse 1030 Mathapi-260610944Noch keine Bewertungen

- 1030proj1-Buying A HouseDokument5 Seiten1030proj1-Buying A Houseapi-325431488Noch keine Bewertungen

- Fincance ProjectDokument3 SeitenFincance Projectapi-302073423Noch keine Bewertungen

- Loan Amortization and Compounding vs DiscountingDokument6 SeitenLoan Amortization and Compounding vs DiscountingHafiz AbdulwahabNoch keine Bewertungen

- Buying A HouseDokument4 SeitenBuying A Houseapi-325824593Noch keine Bewertungen

- FINA 2330 Assignment 5Dokument4 SeitenFINA 2330 Assignment 5rebaNoch keine Bewertungen

- STARTDokument5 SeitenSTARTJust LearnNoch keine Bewertungen

- Business FinanceDokument9 SeitenBusiness FinanceRonaliza GayatinNoch keine Bewertungen

- W07 Case Study Loan AssignmentDokument66 SeitenW07 Case Study Loan AssignmentArmando Aroni BacaNoch keine Bewertungen

- Exercise 2Dokument3 SeitenExercise 2Gilang PurwoNoch keine Bewertungen

- Lesson 5.5 Compounding InterestDokument23 SeitenLesson 5.5 Compounding InterestDan Frederico Pimentel AbaccoNoch keine Bewertungen

- Bagi Saving AccountsDokument5 SeitenBagi Saving Accountstengku nesaNoch keine Bewertungen

- Finance ExamplesDokument15 SeitenFinance ExamplescherifsambNoch keine Bewertungen

- Mortgage Project 1Dokument5 SeitenMortgage Project 1api-284831231Noch keine Bewertungen

- Credit Card Debt AssignmentDokument3 SeitenCredit Card Debt Assignmentapi-315882627Noch keine Bewertungen

- Finance AssignmentDokument3 SeitenFinance Assignmentapi-289243802Noch keine Bewertungen

- Full Download Personal Finance Canadian 4th Edition Madura Solutions ManualDokument35 SeitenFull Download Personal Finance Canadian 4th Edition Madura Solutions Manualsavidaoicc6100% (32)

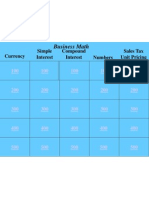

- Business Math - JeopardyDokument51 SeitenBusiness Math - Jeopardyapi-173610472Noch keine Bewertungen

- ULCR Investment Consultants Investor’s Course “The Ultimate Investor’s Educational Learning Experience on Earth...”Von EverandULCR Investment Consultants Investor’s Course “The Ultimate Investor’s Educational Learning Experience on Earth...”Noch keine Bewertungen

- Macro - E-Portfolio AssignmentDokument9 SeitenMacro - E-Portfolio Assignmentapi-387874690Noch keine Bewertungen

- Resume Ashlyn Talcott 2Dokument2 SeitenResume Ashlyn Talcott 2api-387874690Noch keine Bewertungen

- Illumination Page-TalcottDokument2 SeitenIllumination Page-Talcottapi-387874690Noch keine Bewertungen

- 2 HousesDokument3 Seiten2 Housesapi-387874690Noch keine Bewertungen

- Shabti Essay - Talcott AshlynDokument1 SeiteShabti Essay - Talcott Ashlynapi-387874690Noch keine Bewertungen

- Profile SetupDokument1 SeiteProfile Setupapi-387874690Noch keine Bewertungen

- Notebook 7Dokument6 SeitenNotebook 7api-387874690Noch keine Bewertungen

- Metoo Research Paper-2Dokument8 SeitenMetoo Research Paper-2api-387874690Noch keine Bewertungen

- Finance 1050 Final ProjectDokument21 SeitenFinance 1050 Final Projectapi-387805545Noch keine Bewertungen

- Untitled PresentationDokument1 SeiteUntitled Presentationapi-387874690Noch keine Bewertungen

- Untitled PresentationDokument1 SeiteUntitled Presentationapi-387874690Noch keine Bewertungen

- Biology Issue-2Dokument3 SeitenBiology Issue-2api-387874690Noch keine Bewertungen

- RA9HH Computation For 2354722 As of 2021-07-21Dokument1 SeiteRA9HH Computation For 2354722 As of 2021-07-21John Kendrick J. UmayamNoch keine Bewertungen

- IBEF MSME-Feb-2023Dokument31 SeitenIBEF MSME-Feb-2023Gurnam SinghNoch keine Bewertungen

- Retail Management JournalDokument86 SeitenRetail Management JournalvanshikaNoch keine Bewertungen

- Assessing Credit Management at Abyssinia Bank Aksum BranchDokument42 SeitenAssessing Credit Management at Abyssinia Bank Aksum BranchAmir sabirNoch keine Bewertungen

- Internship Report On "Loan and Advance Management: A Study On IFIC Bank Limited" Nrayanganj BranchDokument44 SeitenInternship Report On "Loan and Advance Management: A Study On IFIC Bank Limited" Nrayanganj BranchArefin RidwanNoch keine Bewertungen

- Export Finance: Project Guide: Prof.S.B. Kasture Project Prepared By: Sachin Parab Nmims MFM - Iii B ROLL NO.113Dokument56 SeitenExport Finance: Project Guide: Prof.S.B. Kasture Project Prepared By: Sachin Parab Nmims MFM - Iii B ROLL NO.113rahulsatelli100% (2)

- Factors Affecting ReceivablesDokument3 SeitenFactors Affecting ReceivablesNavneet KaurNoch keine Bewertungen

- The Causes of Loan DefaultDokument9 SeitenThe Causes of Loan DefaultLazarus AmaniNoch keine Bewertungen

- Tools for Managing Working CapitalDokument21 SeitenTools for Managing Working CapitalLeteSsie60% (5)

- PassbookDokument42 SeitenPassbookCharles OkwalingaNoch keine Bewertungen

- The Closer Script: (Pull Out The Hot Buttons! Let Them Tell You How To Sell Them.)Dokument8 SeitenThe Closer Script: (Pull Out The Hot Buttons! Let Them Tell You How To Sell Them.)DMG SATYA PRASAD100% (1)

- Westpac Loan ApplicationDokument5 SeitenWestpac Loan Applicationpatrick wafulaNoch keine Bewertungen

- CREDIT PROCEDURES GUIDEDokument69 SeitenCREDIT PROCEDURES GUIDEella alfonsoNoch keine Bewertungen

- Script SaleDokument6 SeitenScript SaleQueen ZairaNoch keine Bewertungen

- Conditions Home MortgageDokument77 SeitenConditions Home MortgageamfipolitisNoch keine Bewertungen

- UNITED COCONUT PLANTERS BANK vs. SPOUSES SAMUEL and ODETTE BELUSODokument11 SeitenUNITED COCONUT PLANTERS BANK vs. SPOUSES SAMUEL and ODETTE BELUSOCyrine CalagosNoch keine Bewertungen

- Final Project FinanceDokument25 SeitenFinal Project Financetanishka kNoch keine Bewertungen

- 73e8ab49-e63b-48d0-9dc5-2459547fe32aDokument1 Seite73e8ab49-e63b-48d0-9dc5-2459547fe32arexhvelajdiamantNoch keine Bewertungen

- Wa0011Dokument75 SeitenWa0011repost terkiniiNoch keine Bewertungen

- Offering Help and SuggestionsDokument44 SeitenOffering Help and SuggestionsLovyta AmeliaaNoch keine Bewertungen

- Southeast Bank Limited: (LDO/TD) 100%: 112.43%Dokument7 SeitenSoutheast Bank Limited: (LDO/TD) 100%: 112.43%MD Meftahul AlamNoch keine Bewertungen

- A Step-by-Step Guide To Successfully Erasing Charge-Offs From Your Credit HistoryDokument6 SeitenA Step-by-Step Guide To Successfully Erasing Charge-Offs From Your Credit HistoryCherry Calfoforo Abao0% (1)

- IL&FS Default AnalysisDokument28 SeitenIL&FS Default Analysisanuj rakhejaNoch keine Bewertungen

- C8JDokument4 SeitenC8JTess De LeonNoch keine Bewertungen

- MOST IMPORTANT TERMS AND CONDITIONSDokument40 SeitenMOST IMPORTANT TERMS AND CONDITIONSwebs adwordNoch keine Bewertungen

- Ch 6 Receivables ConceptsDokument15 SeitenCh 6 Receivables ConceptsAnas Alimoda100% (2)

- Investments 9th Edition Bodie Test BankDokument17 SeitenInvestments 9th Edition Bodie Test BankEdwardMasseyentky100% (16)

- Financial Literacy of High School Students: Lewis MandellDokument2 SeitenFinancial Literacy of High School Students: Lewis MandellDUDE RYANNoch keine Bewertungen

- Installment Purchase Chapter 09 Key Learning Outcomes/TITLEDokument37 SeitenInstallment Purchase Chapter 09 Key Learning Outcomes/TITLEfatinNoch keine Bewertungen

- Pre-Approved Xpress Credit LoanDokument1 SeitePre-Approved Xpress Credit LoanArjunNoch keine Bewertungen