Beruflich Dokumente

Kultur Dokumente

Theory

Hochgeladen von

Pat Lanugon0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

11 Ansichten2 Seitenstudents teacher

Originaltitel

theory

Copyright

© © All Rights Reserved

Verfügbare Formate

ODT, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenstudents teacher

Copyright:

© All Rights Reserved

Verfügbare Formate

Als ODT, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

11 Ansichten2 SeitenTheory

Hochgeladen von

Pat Lanugonstudents teacher

Copyright:

© All Rights Reserved

Verfügbare Formate

Als ODT, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

Financial statement audits, operational audits, and compliance audits are

similar in that each type of audit involves accumulating and evaluating

evidence about information to ascertain and report on the degree of

correspondence between the information and established criteria and/or

procedures, rules, or regulations. The differences between each type of

audit are the information being examined and the criteria used to evaluate

the information.

A financial statement audit is conducted to determine whether financial

statements are stated in accordance with specified criteria, normally the

U.S. or international standards. Auditors not only focus on accounting

transactions, but also focus on an integrated approach in which both the

risk of misstatements and the operating controls are considered. The

auditor must have a thorough understanding of the entity and its

environment.

An operational audit evaluates the efficiency and effectiveness of any part

of an organization's operating procedures and methods. At completion of

an operational audit, management normally expects recommendations for

improving operations. In operational auditing, the reviews are not limited to

accounting. It is more difficult to objectively evaluate whether the efficiency

and effectiveness of operations meets established criteria than it is for

compliance and financial statement audits. Also, establishing criteria for

evaluating the information in an operational audit is extremely subjective.

Thus, operational auditing is more like management consulting than what is

usually considered auditing.

A compliance audit is conducted to determine whether the auditee is

following specific procedures, rules, or regulations set by some higher

authority. Results of compliance audits are typically reported to

management, like in the operational audits, rather than to outside users as

is done with financial statement audits.

An example of a financial statement audit would be the annual audit of IBM

Corporation, in which the external auditors examine IBM's financial

statements to determine the degree of correspondence between those

financial statements and generally accepted accounting principles. An

example of an operational audit would be an internal auditor's evaluation of

whether the company's computerized payroll-processing system is

operating efficiently and effectively. An example of a compliance audit

would be an IRS auditor's examination of an entity's federal tax return to

determine the degree of compliance with the Internal Revenue Code.

Terms: Financial statement audits, operational audits and compliance audits

Diff: Challenging

Objective: LO 1-6

AACSB: Analytic

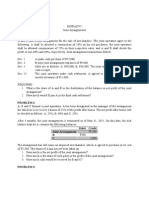

9) To perform an audit, it is necessary for the information to be in a

verifiable form and there must be some criteria by which the auditor can

evaluate the information. Detail the information and criteria that would be

used when

(A) an independent CPA firm audits a company's historical financial

statements.

(B) an Internal Revenue Service auditor audits that same company's tax

return.

(C) an internal auditor performs an operational audit to evaluate whether

the company's computerized payroll processing system is operating

efficiently and effectively.

: (A) The information used by a CPA firm in a financial statement audit is

the financial information in the company's financial statements. The most

commonly used criteria are applicable U.S. or international accounting

standards.

(B) The information used by an IRS auditor is the financial information in

the company's federal tax return. The criteria used are the internal revenue

code and interpretations.

(C) The information used by an internal auditor when performing an

operational audit of the payroll system could include various items such as

the number of errors made, costs incurred by the payroll department, and

number of payroll records processed each month. The criteria would consist

of company standards for departmental efficiency and effectiveness.

Terms: Information and criteria used by CPA firm, Internal Revenue Service

auditor, and internal auditor

Diff: Moderate

Objective: LO 1-6

AACSB: Reflective

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- 47 Terms: Log Insign UpDokument6 Seiten47 Terms: Log Insign UpPat LanugonNoch keine Bewertungen

- The Overview ofDokument24 SeitenThe Overview ofPat LanugonNoch keine Bewertungen

- Name Title AdviserDokument90 SeitenName Title AdviserPat LanugonNoch keine Bewertungen

- Accounting For Unprofitable Construction Contracts: A Teaching NoteDokument7 SeitenAccounting For Unprofitable Construction Contracts: A Teaching NotePat LanugonNoch keine Bewertungen

- Mishkin Ppt19Dokument42 SeitenMishkin Ppt19Pat LanugonNoch keine Bewertungen

- Course Syllabus - Management TrendsDokument7 SeitenCourse Syllabus - Management TrendsPat LanugonNoch keine Bewertungen

- Lecture Problems - Joint ArrangementsDokument2 SeitenLecture Problems - Joint ArrangementsPat LanugonNoch keine Bewertungen

- Quan TileDokument4 SeitenQuan TilePat LanugonNoch keine Bewertungen

- Endowments Effect Quantifies The Change of The Urban Households' MeanDokument1 SeiteEndowments Effect Quantifies The Change of The Urban Households' MeanPat LanugonNoch keine Bewertungen

- Wotsurg Stock OutDokument1 SeiteWotsurg Stock OutPat LanugonNoch keine Bewertungen

- Promoting A Collaborative Professional Culture in Three Elementary Schools That Have Beaten The OddsDokument21 SeitenPromoting A Collaborative Professional Culture in Three Elementary Schools That Have Beaten The OddsPat LanugonNoch keine Bewertungen

- Ground Pork AlfredoDokument5 SeitenGround Pork AlfredoPat LanugonNoch keine Bewertungen

- Lala 1e RVGHDokument1 SeiteLala 1e RVGHPat LanugonNoch keine Bewertungen

- I Want To Download Something e Hehe DnfjneDokument1 SeiteI Want To Download Something e Hehe DnfjnePat LanugonNoch keine Bewertungen

- Edit Source Edit: Economic Public Works Agricultural SubsidiesDokument1 SeiteEdit Source Edit: Economic Public Works Agricultural SubsidiesPat LanugonNoch keine Bewertungen

- LALA PorkDokument1 SeiteLALA PorkPat LanugonNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Endowment vs. GrantDokument6 SeitenEndowment vs. GrantamalekhNoch keine Bewertungen

- G. H. Bhakta Management Academy: A ON General Study OF at Surat Submitted ToDokument43 SeitenG. H. Bhakta Management Academy: A ON General Study OF at Surat Submitted Toayush zadooNoch keine Bewertungen

- The Strategic Position and Action EvaluationDokument3 SeitenThe Strategic Position and Action EvaluationJoel Pérez GaliciaNoch keine Bewertungen

- Presentation On HUL Wal-MartDokument31 SeitenPresentation On HUL Wal-MartAmit GuptaNoch keine Bewertungen

- FM-CPA-001 Corrective Preventif Action Request Rev.02Dokument2 SeitenFM-CPA-001 Corrective Preventif Action Request Rev.02Emy SumartiniNoch keine Bewertungen

- Qingdao Tonyin Industrial Co., LTD: Importer and Distribution AgreementDokument2 SeitenQingdao Tonyin Industrial Co., LTD: Importer and Distribution AgreementThato KebuangNoch keine Bewertungen

- Accounting Solution On Basic Variance AnalysisDokument3 SeitenAccounting Solution On Basic Variance AnalysisAssignmentstore100% (2)

- Event Management CompanyDokument6 SeitenEvent Management CompanyTejas NaikNoch keine Bewertungen

- INVESTMENT IN DEBT SECURITIES DiscussionDokument12 SeitenINVESTMENT IN DEBT SECURITIES DiscussionKristine Kyle AgneNoch keine Bewertungen

- One-Pager OptaveDokument1 SeiteOne-Pager OptavedancsargentinaNoch keine Bewertungen

- Mountain EquipmentDokument1 SeiteMountain EquipmentChiragNarulaNoch keine Bewertungen

- GCA Software Sector Report Q2 2019 PDFDokument32 SeitenGCA Software Sector Report Q2 2019 PDFdear14us1984Noch keine Bewertungen

- Scope and Importance of Personal SellingDokument9 SeitenScope and Importance of Personal SellingArun Kumar SatapathyNoch keine Bewertungen

- Libro Modulo III Capítulo 3 - 9 (Koch y Macdonald)Dokument185 SeitenLibro Modulo III Capítulo 3 - 9 (Koch y Macdonald)Remy Angel Terceros FernandezNoch keine Bewertungen

- BWU Notice 2024 Pass Out Batch Hero FinCorp Limited MBADokument4 SeitenBWU Notice 2024 Pass Out Batch Hero FinCorp Limited MBAAditya Prakash ChaudharyNoch keine Bewertungen

- ENT600 G3 NPD Project - TGGL SummaryDokument23 SeitenENT600 G3 NPD Project - TGGL SummaryFahmi YahyaNoch keine Bewertungen

- Beta Case Study (Nirbhay Chauhan)Dokument10 SeitenBeta Case Study (Nirbhay Chauhan)Nirbhay ChauhanNoch keine Bewertungen

- Chapter 2 The Risk of FraudDokument49 SeitenChapter 2 The Risk of FraudcessbrightNoch keine Bewertungen

- Dispute Form - Bilingual 2019Dokument2 SeitenDispute Form - Bilingual 2019Kxng MindCtrl OrevaNoch keine Bewertungen

- Supplier APQP Process Training (In-Depth)Dokument142 SeitenSupplier APQP Process Training (In-Depth)A MNoch keine Bewertungen

- Csec CXC Pob Past Papers January 2010 Paper 02 PDFDokument5 SeitenCsec CXC Pob Past Papers January 2010 Paper 02 PDFjohnny jamesNoch keine Bewertungen

- Harley's Corner Positioning Dilemma.Dokument4 SeitenHarley's Corner Positioning Dilemma.Nikita sharmaNoch keine Bewertungen

- Banned Company WiseDokument4 SeitenBanned Company WiseAdityaNoch keine Bewertungen

- 3.1.1. Understanding Forex RolloverDokument5 Seiten3.1.1. Understanding Forex RolloverWishnu Okky Pranadi TirtaNoch keine Bewertungen

- KPIT - Campus Hiring - Management FreshersDokument7 SeitenKPIT - Campus Hiring - Management FreshersSwati MishraNoch keine Bewertungen

- Breakdown and Preventive MaintenanceDokument18 SeitenBreakdown and Preventive Maintenancem_alodat6144Noch keine Bewertungen

- JBDDokument50 SeitenJBDShahbaz Hassan WastiNoch keine Bewertungen

- International Ch3Dokument16 SeitenInternational Ch3felekebirhanu7Noch keine Bewertungen

- AFAR 04 Business CombinationDokument9 SeitenAFAR 04 Business CombinationPym-Kaytitinga St. Joseph ParishNoch keine Bewertungen

- 150 Amazing US StartupsDokument96 Seiten150 Amazing US StartupsAnkit GuptaNoch keine Bewertungen