Beruflich Dokumente

Kultur Dokumente

Birla Sun Life Premium

Hochgeladen von

BALAJI NAIK MudavatuCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Birla Sun Life Premium

Hochgeladen von

BALAJI NAIK MudavatuCopyright:

Verfügbare Formate

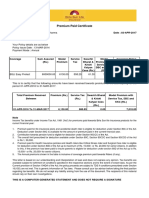

Premium Paid Certificate

Mr Narasimharao Pothamsetty Date : 03-JAN-2017

Ref: Policy No. 006109708

Your Policy details are as below

Policy Issue Date : 26-APR-2016

Payment Mode : Quarterly

Coverage Face Amount Modal Coverage Status

(Rs.) Premium (Rs.)

BSLI Wealth Secure Plan 810000.00 9000.00 Premium paying (regular)

This is to certify that the following amounts have been received towards premium for the above policy for the

period 01-APR-2016 to 03-JAN-2017.

Effective Date of Premium (Rs.)

Deposit

26-APR-2016 36,000.00

Total Received 36,000.00

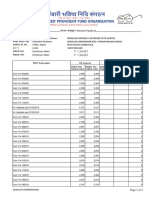

Note

Income Tax Benefits under the Income Tax Act ,1961 for premiums paid towards Birla Sun Life Insurance products for the

current financial year:

1. For Flexi Secure life Retirement (Pension) Plan: Under Section 80 CCC (1), Contribution made to pension fund upto a

maximum of Rs. 1,00,000/-.

2. For Critical illness rider under Section 80D for individual and HUF upto a maximum of Rs. 15,000/- and for senior

citizens aged 65 years above Rs. 20,000/-.

3. For all other products: Under Section 80C, annual premium only to the extent of 20% of the face amount of the policy

subject to maximum of Rs. 1,00,000/-.

4. The overall limit prescribed for Section 80C, Section 80CCC and Section 80CCD is Rs. 1,00,000/-.

5. For Health related policies and/or health related riders - The premium paid by you up to Rs.15,000 (Rs.20,000 for

senior citizens) per annum to insure yourself and/or spouse and dependent children , is eligible for tax benefit under

Section 80D of the Income Tax Act, 1961. Additionally, the premium paid by you, upto Rs.15000 (Rs.20,000 for senior

citizens), to insure your parent(s) , is eligible for tax benefit under Section 80D of the Income Tax Act, 1961. The above

benefits may change as per the extant tax laws.

This letter is based on our understanding of current tax laws prevailing in India. These laws are subject to change and any

such change could have a retrospective effect. This letter should not be construed as tax, legal or investment opinion from

us. For specific suitability, you are requested to consult your tax advisor.

THIS IS A COMPUTER GENERATED STATEMENT AND DOES NOT REQUIRE A SIGNATURE

Das könnte Ihnen auch gefallen

- Premium Paid Certificate: Date: 14-SEP-20 16Dokument1 SeitePremium Paid Certificate: Date: 14-SEP-20 16Koushik DuttaNoch keine Bewertungen

- Life Insurance PremiumDokument1 SeiteLife Insurance PremiumSufiyan Kazi0% (3)

- Premium CertificateDokument2 SeitenPremium CertificateSowmalya Mandal100% (4)

- This Is An Electronically Generated Duplicate Premium Receipt and Does Not Require Any SignatureDokument2 SeitenThis Is An Electronically Generated Duplicate Premium Receipt and Does Not Require Any SignatureBillu Gurunadham40% (5)

- AEGON RELIGARE Premium Payment Receipt 2013Dokument1 SeiteAEGON RELIGARE Premium Payment Receipt 2013Monal Bhoyar40% (5)

- Appolo Munich PolicyDokument3 SeitenAppolo Munich PolicyDineshSharma0% (2)

- 4128i HP 90979507 03 000Dokument4 Seiten4128i HP 90979507 03 000Rita OshanNoch keine Bewertungen

- PDFDokument5 SeitenPDFSandip SelokarNoch keine Bewertungen

- Mediclaim PolicyDokument5 SeitenMediclaim Policymahesh mandhareNoch keine Bewertungen

- 80D CertificateDokument1 Seite80D CertificateD Kesava Rao0% (1)

- Health ReceiptDokument1 SeiteHealth ReceiptnikxguptaNoch keine Bewertungen

- Icici Lombar Health Insurance Copy ApsaraDokument3 SeitenIcici Lombar Health Insurance Copy ApsaraNicole Taylor100% (3)

- Premium Paid CertificateDokument1 SeitePremium Paid CertificateEmanuel Cooper46% (13)

- 80D - Medical Premium Receipt - SelfDokument1 Seite80D - Medical Premium Receipt - SelfJagdish Saini0% (1)

- ICICI ReceiptDokument1 SeiteICICI ReceiptShivam GuptaNoch keine Bewertungen

- Premium Paid AcknowledgementDokument1 SeitePremium Paid AcknowledgementishanpatnaikNoch keine Bewertungen

- Medical PolicyDokument1 SeiteMedical PolicyAshok Dangwal100% (4)

- Mediclaim Receipt 2019 PDFDokument1 SeiteMediclaim Receipt 2019 PDFKDR DDNoch keine Bewertungen

- RenewalReceipt 502-7066983 PolicyRenewalDokument2 SeitenRenewalReceipt 502-7066983 PolicyRenewalSoumitra GuptaNoch keine Bewertungen

- Premium Paid CertificateDokument1 SeitePremium Paid Certificatemanishjal33% (3)

- Health Insurance Premium RecieptDokument2 SeitenHealth Insurance Premium RecieptAayush40% (5)

- SBI LIFE Premium CertificateDokument1 SeiteSBI LIFE Premium Certificatehithani86% (7)

- Mediclaim Premium Receipt 2018Dokument1 SeiteMediclaim Premium Receipt 2018faizahamed111100% (1)

- HDFC Ergo Policy Renewal 2023 SelfDokument5 SeitenHDFC Ergo Policy Renewal 2023 SelfGopivishnu KanchiNoch keine Bewertungen

- Medical Receipt Premium PDFDokument1 SeiteMedical Receipt Premium PDFe2arvindNoch keine Bewertungen

- HDFC ERGO General Insurance Company LimitedDokument5 SeitenHDFC ERGO General Insurance Company LimitedChiranjib PatraNoch keine Bewertungen

- CP PremiumReceipt 50373436 10164963 2506101435563556Dokument1 SeiteCP PremiumReceipt 50373436 10164963 2506101435563556TEENTUX100% (2)

- Max Bupa Health Insurance Company LimitedDokument1 SeiteMax Bupa Health Insurance Company LimitedNiklesh ChandakNoch keine Bewertungen

- Self & Wife - Mediclaim PolicyDokument5 SeitenSelf & Wife - Mediclaim PolicyShrikant Sahu100% (4)

- 80D CertificateDokument1 Seite80D CertificateJBTechno Solutions100% (1)

- Icici Premium Paid Certificate SampleDokument1 SeiteIcici Premium Paid Certificate SampleRahul Kandiyal100% (1)

- Health Insurance PolicyDokument5 SeitenHealth Insurance Policytaralsoni100% (4)

- Premium ReceiptsDokument1 SeitePremium Receiptsmanojsh88870% (1)

- Renued InsuranceDokument5 SeitenRenued InsuranceHridya PrasadNoch keine Bewertungen

- 090003e88105430f SONIADokument3 Seiten090003e88105430f SONIAKoushik DuttaNoch keine Bewertungen

- Saraswati Tripathi Heartbeat - Platinum: Dear Mr. Sanjay Tripathi 115 SMR Vinay Endeavour Hoodi Circle Bangalore-560048Dokument1 SeiteSaraswati Tripathi Heartbeat - Platinum: Dear Mr. Sanjay Tripathi 115 SMR Vinay Endeavour Hoodi Circle Bangalore-560048Sanjay Tripathi60% (5)

- PremiumDokument2 SeitenPremiumapsec0% (2)

- Mediclaim ParentsDokument1 SeiteMediclaim ParentsCA Ashish MehtaNoch keine Bewertungen

- Renewal Premium ReceiptDokument1 SeiteRenewal Premium ReceiptShunta ShuntaNoch keine Bewertungen

- Mediclaim 1Dokument1 SeiteMediclaim 1Arnab RoyNoch keine Bewertungen

- Star Health PolicyDokument5 SeitenStar Health PolicyTripathy RadhakrishnaNoch keine Bewertungen

- SelfHealthInsurance PDFDokument3 SeitenSelfHealthInsurance PDFMohShaanNoch keine Bewertungen

- Max Life InsuranceDokument1 SeiteMax Life InsuranceLohith Labhala100% (1)

- Premium ReceiptDokument2 SeitenPremium ReceiptPulkit KarnawatNoch keine Bewertungen

- Health InsuranceDokument1 SeiteHealth InsuranceSiddharth ElangoNoch keine Bewertungen

- Premium Receipt PDFDokument1 SeitePremium Receipt PDFsrikanth048328733% (12)

- Jeyashri Health Insurance DocumentDokument5 SeitenJeyashri Health Insurance Documentsivakumar100% (1)

- StarDokument1 SeiteStarMADANMOHANREDDY100% (2)

- FHP H0225594Dokument2 SeitenFHP H0225594Raghavendra KamathNoch keine Bewertungen

- ICICI ReceiptDokument1 SeiteICICI ReceiptChidhambaram100% (1)

- 80D Medical InsuranceDokument3 Seiten80D Medical InsuranceRafique ShaikhNoch keine Bewertungen

- Mediclaim ReceiptDokument1 SeiteMediclaim ReceiptParthiban KNoch keine Bewertungen

- Nitin PDFDokument1 SeiteNitin PDFSheetalTyagi43% (7)

- Premium Paid Certificate: Ref: Policy No. 006409635Dokument1 SeitePremium Paid Certificate: Ref: Policy No. 006409635MukeshChoudharyNoch keine Bewertungen

- 1865362Dokument1 Seite1865362Bhavesh ParekhNoch keine Bewertungen

- Premium Paid Certificate: Date: 25-MAR-2011Dokument2 SeitenPremium Paid Certificate: Date: 25-MAR-2011sivasivaniNoch keine Bewertungen

- 2023 PDF1681368243183Dokument2 Seiten2023 PDF1681368243183RpPaNoch keine Bewertungen

- Premium Paid Certificate: Date: 14-DEC-2017Dokument1 SeitePremium Paid Certificate: Date: 14-DEC-2017zuhebNoch keine Bewertungen

- Birla Premium Paid Certificate 2020Dokument2 SeitenBirla Premium Paid Certificate 2020SindhuNoch keine Bewertungen

- Premium Paid Certificate: Date: 09-JAN-2014Dokument2 SeitenPremium Paid Certificate: Date: 09-JAN-2014kumber_singh5069Noch keine Bewertungen

- Project FIle - Balaji NAikDokument5 SeitenProject FIle - Balaji NAikBALAJI NAIK MudavatuNoch keine Bewertungen

- LicDokument1 SeiteLicBALAJI NAIK MudavatuNoch keine Bewertungen

- Nitin PDFDokument1 SeiteNitin PDFBALAJI NAIK MudavatuNoch keine Bewertungen

- Health Insurance 2018Dokument1 SeiteHealth Insurance 2018BALAJI NAIK Mudavatu33% (6)

- All Subjects-Prtc AaDokument16 SeitenAll Subjects-Prtc AaMJ Yacon100% (2)

- Final Project Report On Tax Planning PDFDokument69 SeitenFinal Project Report On Tax Planning PDFKomal Nanware75% (61)

- IT PPT For F.Y 2023-24Dokument24 SeitenIT PPT For F.Y 2023-24pritesh.ks1409Noch keine Bewertungen

- Form 16: Ibm India Private LimitedDokument7 SeitenForm 16: Ibm India Private LimitedNeha Upadhyay MehtaNoch keine Bewertungen

- End User GuideDokument29 SeitenEnd User GuidesandeepkumaryeluripatiNoch keine Bewertungen

- ICAP Income Tax Numericals Regards Awais Ali PDFDokument52 SeitenICAP Income Tax Numericals Regards Awais Ali PDFInam Ul Haq Minhas0% (2)

- TK-Become A Member - EmployeeDokument3 SeitenTK-Become A Member - EmployeeAngela FernandesNoch keine Bewertungen

- WBHS Related G.O.s. For PensionersDokument13 SeitenWBHS Related G.O.s. For PensionerssudipNoch keine Bewertungen

- NPS-103 - Death Withdrawal FormDokument5 SeitenNPS-103 - Death Withdrawal FormSubahan ShaikNoch keine Bewertungen

- Policies of Telangana State in TeluguDokument3 SeitenPolicies of Telangana State in TeluguGameloftersupportNoch keine Bewertungen

- Explanatory Notes Tax Return Form C 2018Dokument78 SeitenExplanatory Notes Tax Return Form C 2018Pepe Garcia GarciaNoch keine Bewertungen

- Polytechnic University of The Philippines: ST NDDokument10 SeitenPolytechnic University of The Philippines: ST NDShania BuenaventuraNoch keine Bewertungen

- State Budget Analysis 2023-24 RajasthanDokument7 SeitenState Budget Analysis 2023-24 RajasthanArunNoch keine Bewertungen

- Upper Bucks Free Press - September 2012Dokument20 SeitenUpper Bucks Free Press - September 2012Christopher BetzNoch keine Bewertungen

- G.R. No. 174173 March 7, 2012 MA. MELISSA A. GALANG, Petitioner, JULIA MALASUGUI, RespondentDokument21 SeitenG.R. No. 174173 March 7, 2012 MA. MELISSA A. GALANG, Petitioner, JULIA MALASUGUI, RespondentJoseph Santos GacayanNoch keine Bewertungen

- Punjab Government Servants Benevolent Fund, Part-I (Disbursement) Rules, 1965Dokument18 SeitenPunjab Government Servants Benevolent Fund, Part-I (Disbursement) Rules, 1965haaldayNoch keine Bewertungen

- Gsis Claims & Privileges - HR CSC - 031116Dokument131 SeitenGsis Claims & Privileges - HR CSC - 031116alexes24Noch keine Bewertungen

- Baby BoomerDokument18 SeitenBaby BoomerBethany CrusantNoch keine Bewertungen

- Case 84 in Re ZialcitaDokument4 SeitenCase 84 in Re ZialcitaAlexis Ailex Villamor Jr.Noch keine Bewertungen

- JOB ORDER COSTING-notes and IllustrationDokument25 SeitenJOB ORDER COSTING-notes and IllustrationKristienalyn De AsisNoch keine Bewertungen

- Intimation Form Dd44e4Dokument2 SeitenIntimation Form Dd44e4Manoj MantriNoch keine Bewertungen

- Gsis V CSCDokument6 SeitenGsis V CSCseentherellaaaNoch keine Bewertungen

- ECHS Revised Application2015 PDFDokument17 SeitenECHS Revised Application2015 PDFNarayana Swaroop VeerubhotlaNoch keine Bewertungen

- Format Meo Deo-1Dokument3 SeitenFormat Meo Deo-1Vasu AmmuluNoch keine Bewertungen

- Oman Arab Bank RatesDokument5 SeitenOman Arab Bank Ratesakhilr141Noch keine Bewertungen

- Income From Salary (Chapter 6)Dokument4 SeitenIncome From Salary (Chapter 6)Fahim Shahriar MozumderNoch keine Bewertungen

- Adoption of NPS in Chennai Port AuthorityDokument25 SeitenAdoption of NPS in Chennai Port AuthorityTHOR -Noch keine Bewertungen

- LNL Iklcqd /: Employee Share Employer Share Employee Share Employer ShareDokument3 SeitenLNL Iklcqd /: Employee Share Employer Share Employee Share Employer ShareMadhusmita MishraNoch keine Bewertungen

- The New Old AgeDokument88 SeitenThe New Old AgeNestaNoch keine Bewertungen

- Bengzon V Drilon PDFDokument3 SeitenBengzon V Drilon PDFMarl Dela ROsaNoch keine Bewertungen