Beruflich Dokumente

Kultur Dokumente

PlainsCapital Bank Lawsuit

Hochgeladen von

Shreveport TimesCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

PlainsCapital Bank Lawsuit

Hochgeladen von

Shreveport TimesCopyright:

Verfügbare Formate

FILED

DALLAS COUNTY

7/13/2016 10:35:19 AM

2 Cit Atty FELICIA PITRE

DISTRICT CLERK

Connie Jones

CAUSE NO. DC-16-07601

PLAINSCAPITAL BANK, § IN THE DISTRICT COURT OF

§

Plaintiff, §

§

v. § DALLAS COUNTY, TEXAS

§

FR III FUNDING LLC, DAVID §

DEBERARDINIS, STEPHEN R. §

HERBEL, PATRICK MULLIGAN, §

B. CRAIG WEBB, AND JERRY WEBB, §

§

Defendants. § 193RD JUDICIAL DISTRICT

DEFENDANTS/COUNTER-PLAINTIFFS STEPHEN R. HERBEL,

PATRICK MULLIGAN, B. CRAIG WEBB, AND JERRY WEBB’S

COUNTERCLAIMS AGAINST FR III FUNDING LLC AND DAVID

DEBERARDINIS, AND REQUEST FOR INJUNCTIVE RELIEF

TO THE HONORABLE COURT:

Defendants/Counter-Plaintiffs Stephen R. Herbel, Patrick Mulligan, B. Craig Webb, and

Jerry Webb (collectively, the “Counter-Plaintiffs”) file their Counterclaims against FR III

Funding LLC (“FR III”) and David deBerardinis and Request for Injunctive Relief, and would

show the Court as follows:

I. SUMMARY OF CASE AND REQUESTED RELIEF

What this Case Involves – An Epic Scam. Counter-Plaintiffs are the unfortunate victims

of a pervasive and sinister fraudulent business scam operated by Defendant David deBerardinis.

The word “sinister” was not chosen for dramatic effect but because it accurately describes what

has transpired in this case. Every aspect of the “business operation” run by Defendant David

deBerardinis is fake.

He created numerous non-existent trading agreements (involving real companies, no less)

on which he dutifully forged every other party’s signature; he bought dummy email domain

DEFENDANTS/COUNTER-PLAINTIFFS STEPHEN R. HERBEL, PATRICK MULLIGAN,

B. CRAIG WEBB, AND JERRY WEBB’S COUNTERCLAIMS AGAINST FR III FUNDING LLC

AND DAVID DEBERARDINIS, AND REQUEST FOR INJUNCTIVE RELIEF PAGE 1

PAGE 1 OF 18

names from which he then sent fake emails (again, supposedly from real people) that

“confirmed” the forged agreements; he fabricated trading confirmations supposedly showing

how well his “business” was doing; he created a bogus check from a make-believe account

demonstrating his non-existent “profits;” he created fictitious documents showing he had an

substantial “ownership interest” in a pipeline run by a major company; and he invented story

after fraudulent story to buttress his claim of “business success.”

As it turns out, no aspect of deBerardinis’s business operations was legitimate or genuine.

Indeed, the only real thing about David deBerardinis and his “business” was the millions in loans

he fraudulently obtained from Counter-Plaintiffs, Plaintiff PlainsCapital Bank, and others.

Worse, Counter-Plaintiffs were lured (in part based on the belief that PlainsCapital had engaged

in sufficient due diligence of the matter) into guaranteeing the loan from PlainsCapital.

The scam perpetuated by deBerardinis is now unravelling. The PlainsCapital loan is

delinquent and the bank has sued him and the Counter-Plaintiffs to collect. FR III’s “trading

partners” have disavowed the agreements as forgeries. No trading accounts, much less trading

profits, have been found. Meanwhile, Mr. deBerardinis continues to toss out false statements

about his business, hoping to mislead his creditors (e.g., his latest explanation is that FR III’s

“trading partner” is under investigation for “money laundering” and that this has tied up FR’s

“profits”).1

Most recently, Counter-Plaintiffs have become aware that deBerardinis likely diverted

borrowed funds into his own personal account. Today, despite borrowing millions of dollars and

claiming to have made millions more in trading “profits,” deBarardinis has told Counter-

1

This is entirely false. FR has no trading partners. As best Counter-Plaintiffs can tell, there are no trades. There

are no trading profits. While there is a federal investigation, it is regarding FR and Mr. deBerardinis’s fraudulent

actions.

DEFENDANTS/COUNTER-PLAINTIFFS STEPHEN R. HERBEL, PATRICK MULLIGAN,

B. CRAIG WEBB, AND JERRY WEBB’S COUNTERCLAIMS AGAINST FR III FUNDING LLC

AND DAVID DEBERARDINIS, AND REQUEST FOR INJUNCTIVE RELIEF PAGE 2

PAGE 2 OF 18

Plaintiffs that he has inusufficient funds to make any loan payments. Counter-Plaintffs do not

know exactly where or to what bank(s) deBeradinis has transferred the millions he and FR III

borrowed.

The Relief Sought by Counter-Plaintiffs -- Immediately Halt the Scam and Freeze

Assets. Counter-Plaintiffs are in imminent danger of losing everything because deBerardinis and

FR III, despite their massive fraud, retain a free hand to use, dispose and transfer assets they

obtained under false premises. Thus, Counter-Plaintffs seek immediate injunctive relief against

FR III and deBerardinis so as to (i) stop their scam and (ii) freeze assets that rightfully belong to

them and others. To do so, Counter-Plaintiffs seek to enjoin deBardinis and FR III from:

a) transferring, spending, hiding, disposing, and/or otherwise using any funds belonging

to; loaned to or otherwise traceable in any way to FR IIl or any of its affiliated

companies;

b) transferring, spending, hiding, disposing, and/or otherwise using any funds in the

possession, custody or control of deBerardinis that belong to; came from or are in any

way traceable to FR III or any of its affiliated companies;

c) incurring any new and/or additional individual or corporate debt, including those of

any affiliated companies;

d) impairing, disposing of or alienating any asset of FR III, including any such assets

possessed by others; and

e) destroying, deleting or otherwise impairing any book, record or document of FR III;

deBerardinis or any of their affiliated companies.

This immediate relief will halt the dissipation of assets wrongfully obtained. The relief is

justified because none of the funds obtained by FR III and/or deBerardinis belong to them, as all

were obtained under false and fraudulent circumstances. Further, Counter-Plaintffs seek

expedited discovery so they can determine what FR III and deBerardinis did with the wrongfully

obtained funds and trace those assets.

DEFENDANTS/COUNTER-PLAINTIFFS STEPHEN R. HERBEL, PATRICK MULLIGAN,

B. CRAIG WEBB, AND JERRY WEBB’S COUNTERCLAIMS AGAINST FR III FUNDING LLC

AND DAVID DEBERARDINIS, AND REQUEST FOR INJUNCTIVE RELIEF PAGE 3

PAGE 3 OF 18

II. DISCOVERY LEVEL

1. Counter-Plaintiffs intend to conduct discovery under Level 3.

III. RULE 47 STATEMENT

2. Pursuant to Texas Rule of Civil Procedure 47, Counter-Plaintiffs state that they

seek monetary relief over $1,000,000 and non-monetary relief as specified herein.

IV. PARTIES

3. Stephen R. Herbel is an individual resident of the state of Louisiana.

4. Patrick Mulligan is an individual resident of Dallas County.

5. B. Craig Webb is an individual resident of the state of Louisiana.

6. Jerry Webb is an individual resident of the state of Louisiana.

7. FR III Funding, LLC is a Delaware limited liability company with its principal

place of business in Shreveport, Louisiana. Upon information and belief, FR III may be served

with process at 213 Texas Street, Shreveport, Louisiana, by serving Jerald R. Harper, its

registered agent. Alternatively, FR III may be served with process at its principal business office

and mailing address located at 1915 E. 70th Street, Shreveport, Louisiana 71105 by way of

David deBerardinis, its manager.

8. David deBerardinis is, upon information and belief, a Louisiana resident who may

be served with process at his last-known principal address at 300 Brookmeade, Shreveport,

Louisiana 71106. Alternatively, deBerardinis may be served at his principal place of business as

manager of FR III at 1915 E. 70th Street, Shreveport, Louisiana 71105.

DEFENDANTS/COUNTER-PLAINTIFFS STEPHEN R. HERBEL, PATRICK MULLIGAN,

B. CRAIG WEBB, AND JERRY WEBB’S COUNTERCLAIMS AGAINST FR III FUNDING LLC

AND DAVID DEBERARDINIS, AND REQUEST FOR INJUNCTIVE RELIEF PAGE 4

PAGE 4 OF 18

V. JURISDICTION AND VENUE

9. This Court has jurisdiction over the parties as each has done business in Texas

and/or because each of the parties has had sufficient minimum or continuing contacts with Texas

and is amenable to service by a Texas court.

10. This Court has subject matter jurisdiction over this action because the amount in

controversy is within the jurisdictional limits of the Court.

11. Pursuant to Tex. Civ. Prac. & Rem. Code § 15.002(a)(1), venue is proper in this

county because all or a substantial part of the events or omissions giving rise to the claims

alleged occurred herein.

12. Venue is also proper in Dallas County because Section 9.11 of the Amended and

Restated Guaranties designate this Court as the proper forum for any suit or proceeding arising

out of or relating to the Guaranties.

VI. FACTUAL BACKGROUND

13. Counter-Plaintiffs are individuals engaged in various business activities.

14. David deBerardinis is a Louisana-based individual who has been active in the oil

and gas business. He formed a company known as Financial Resources, which purportedly was

in fuel trading business. He then formed several affiliated entities, including defendant FR

Funding III, LLC, which operated as funding vehicles for his purported trading business.

15. Mr. deBarardinis claimed that FR III’s business model went something like this:

(i) FR has a valuable trading agreement in which it could buy fuel from Alon USA, Inc. (a well-

known, large and publically traded fuel company) and then re-sell it at a higher price to Freeport

McMoRan (also a large, well-known energy company); (ii) as such, the trading profits were

DEFENDANTS/COUNTER-PLAINTIFFS STEPHEN R. HERBEL, PATRICK MULLIGAN,

B. CRAIG WEBB, AND JERRY WEBB’S COUNTERCLAIMS AGAINST FR III FUNDING LLC

AND DAVID DEBERARDINIS, AND REQUEST FOR INJUNCTIVE RELIEF PAGE 5

PAGE 5 OF 18

virtually guaranteed; and thus (iii) all FR III needed was the upfront cash to buy the fuel and

make the trade.

16. Mr. deBerardinis then solicited individuals to loan FR III funds to make the

trades. According to him, the loans were of a short duration, paid a high interest and, notably,

were guaranteed by Alon.

17. Mr. deBerardinis had scores of documents to back up his purported business. He

had executed contracts with Alon, Freeport McMoRan, and others. He had trading

confirmations. He had letters from his trading “partenrs” verifying his claims.

18. On this basis, Counter-Plaintiffs (with the exception of Patrick Mulligan) made

loans in various amounts to FR III. One of those loans is attached as Exhibit A. The loans were

guaranteed by Alon.

19. Mr. deBerardinis also represented that he had some sort of ownership in a pipeline

run by Colonial Pipeline Company, a large, well-known company. Mr. deBerardinis represented

that had a “line tyme” agreement (which meant he had the ability to transport fuel using the

pipeline) and had a standing offer by Colonial to buy back his interest. Again, he had executed

agreements with Colonial to back up his claim. He also represented that his ownership interest

in the pipeline was an extremely valuable asset.

20. In 2014, deBerardinis determined that a bank loan would be a better source of

funding. He and FR III applied for a $17.5 million loan (the “Original Loan”) from

PlainsCapital Bank. Ostensibly, deBerardinis needed this infusion of capital for his “trading

operations.”

21. Counter-Plaintiffs were approached about the possibility of guaranteeing the

Original Loan. Counter-Plaintiffs believed that PlainsCapital had conducted sufficient due

DEFENDANTS/COUNTER-PLAINTIFFS STEPHEN R. HERBEL, PATRICK MULLIGAN,

B. CRAIG WEBB, AND JERRY WEBB’S COUNTERCLAIMS AGAINST FR III FUNDING LLC

AND DAVID DEBERARDINIS, AND REQUEST FOR INJUNCTIVE RELIEF PAGE 6

PAGE 6 OF 18

diligence regarding FR III and deBerardinis in order to extend the loan. On the strength of

PlainsCapital’s diligence, the structure of the loan (which involved specified accounts for the

funds), and other things, Counter-Plaintiffs agreed to guarantee the Original Loan, resulting in an

extension of more than $17 million in loans to deBerardinis on November 21, 2014.

22. In mid-July 2015, deBerardinis applied to PlainsCapital for an amendment to the

Original Loan (the “Amended Loan”) to increase the amount borrowed to $29.5 million. Yet

again, on the strength of PlainsCapital’s diligence, the specific structure of the loan, a firm

guarantee of the loan by Alon USA, Counter-Plaintiffs agreed to guarantee the Amended Loan,

resulting in an extension of more than $29 million to deBerardinis on June 22, 2015.

23. In applying for the Original and Amended Loans, deBerardinis represented that

FP III was engaged in a trading operation involving Alon USA and Freeport McMoRan.

Specifically, Counter-Plaintiffs believed and relied on the fact that PlainsCapital Bank verified

these claims as part of their due diligence. Counter-Plaintffs were made aware of the fact that

PlainsCapital and Freeport McMoRan had a common owner/director (Gerald Ford).

24. Over time, deBerardinis produced a number of documents to substantiate his

claims, including:

a. A series of agreements relating to deBerardinis’ purported ownership of

“line tyme” on the Colonial pipeline, including:

i. A December 15, 2009 letter memorializing deBerardinis’

purported purchase of 40,000 metric tons of “Colonial Line

Tyme;”

ii. Four Acknowledgments of Transfer documenting the purchase of

“Colonial Line Tyme,” each dated December 15, 2009;

iii. A Supply/Terminalling Agreement dated January 15, 2014,

between Colonial and deBerardinis;

DEFENDANTS/COUNTER-PLAINTIFFS STEPHEN R. HERBEL, PATRICK MULLIGAN,

B. CRAIG WEBB, AND JERRY WEBB’S COUNTERCLAIMS AGAINST FR III FUNDING LLC

AND DAVID DEBERARDINIS, AND REQUEST FOR INJUNCTIVE RELIEF PAGE 7

PAGE 7 OF 18

iv. A letter dated December 23, 2015, from Timothy Felt (“Felt”),

Chief Executive Officer of Colonial, identifying deBerardinis’

“tyme” as being valued at $1.9 billion;

v. A May 26, 2015 letter, from Felt containing a standing offer to buy

deBerardinis’ “tyme;” and

vi. Two Declarations of Financial Resources, establishing the

valuation of deBerardinis’ Colonial “line tyme.”

b. Documents relating to the July 2014 lease of deBerardinis’ Colonial “line

tyme” to Alon and Bielsol Ltd. (“Bielsol”).

c. A December 31, 2015 promissory note for $82,567,057.00 issued by Alon

to FR III and deBerardinis as co-borrowers.

d. Documents relating to the purported trading operation between FR III,

Alon, Colonial, and Freeport, including:

i. An Unbranded Fuel Sales Agreement dated June 14, 2013,

allegedly signed by deBerardinis; Kathleen Quirk (“Quirk”),

Freeport Chief Financial Officer; and David Wiessman, Alon

Chairman of the Board;

ii. A May 21, 2015 letter amending the Unbranded Fuel Sales

Agreement;

iii. A March 20, 2016 “Transaction Confirmation” signed by Jacob

Leviev, President of Bielsol; and

iv. A March 30, 2016 “Transaction Confirmation” signed by Quirk.

e. A copy of a “Bank Check” in the amount of $80,000,000.00.

25. It was on the basis of PlainsCapital’s supposed diligence and verification of those

facts that Counter-Plaintiffs guaranteed the Original and Amended Loans.

26. Ultimately, deBerardinis failed to make loan payments as required under the

terms of the Amended Loan, and PlainsCapital filed suit to enforce the note.

DEFENDANTS/COUNTER-PLAINTIFFS STEPHEN R. HERBEL, PATRICK MULLIGAN,

B. CRAIG WEBB, AND JERRY WEBB’S COUNTERCLAIMS AGAINST FR III FUNDING LLC

AND DAVID DEBERARDINIS, AND REQUEST FOR INJUNCTIVE RELIEF PAGE 8

PAGE 8 OF 18

27. In response to PlainsCapital’s lawsuit, Counter-Plaintiffs have determined that

deBerardinis’ records and documents are fake and/or forged, making it clear that deBerardinis is

running an illegal scheme. The following specific instances of forgery have been uncovered:

a. On June 21, 2016, Counter-Plaintiffs were informed that all signatures of

Shai Even, Alon Chief Financial Officer, contained in deBerardinis’

documents were forgeries.

b. Counter-Plaintiffs then contacted Quirk, Freeport’s Chief Financial

Officer, to verify deBerardinis’ assertions. On June 22, 2016, Quirk

informed Counter-Plaintiffs’ attorney that her signature was also a forgery.

c. Counter-Plaintiffs’ attorney next contacted Colonial. On June 22, 2016,

Colonial informed Counter-Plaintiffs that Colonial “has no agreements

with” FR III or deBerardinis. Colonial further stated that Felt’s signature

in deBerardinis’ documents was also forged.

d. Upon information and belief, all signatures in deBerardinis’ documents

purportedly of Alon Chief Executive Officer David Wiessman are also

forgeries.

28. Counter-Plaintiffs have continued to investigate, but have been unable to uncover

any evidence that deBerardinis actually engaged in any trading operations.

29. Moreover, Counter-Plaintiffs have not been able to determine either how

deBerardinis and/or FP III used the $29 million or where any remaining amounts of that loan are

located.

30. Upon information and belief, the $29 million loan has been converted to

deBerardinis’ confidential and personal accounts.

31. Upon information and belief, all documents, communications, and records

provided by DeBerardinis are forgeries.

32. To date, deBerardinis has refused to give Counter-Plaintiffs access to the FR III

books and records.

DEFENDANTS/COUNTER-PLAINTIFFS STEPHEN R. HERBEL, PATRICK MULLIGAN,

B. CRAIG WEBB, AND JERRY WEBB’S COUNTERCLAIMS AGAINST FR III FUNDING LLC

AND DAVID DEBERARDINIS, AND REQUEST FOR INJUNCTIVE RELIEF PAGE 9

PAGE 9 OF 18

33. Upon information and belief, deBerardinis will continue to use, transfer, and/or

dissipate the $29 million loan and other assets, which would irreparably harm Counter-Plaintiffs’

efforts in this and related lawsuits.

VII. NOTICE

34. Counter-Plaintiffs’ answer date for PlainsCapital’s lawsuit has not yet run.

Accordingly, Counter-Plaintiffs will answer that lawsuit and assert appropriate affirmative

defenses and claims at that time. Further, Counter-Plaintiffs have additional claims against

Third-Party Defendants that they will be asserting.

VIII. COUNTERCLAIMS

COUNTERCLAIM ONE: BREACH OF CONTRACT.

35. Counter-Plaintiffs repeat and reallege each and every allegation made in the

previous paragraphs as if fully written herein.

36. As detailed above, Counter-Plaintiffs loaned FRI III money.

37. FR III has failed to pay back those amounts, causing Counter-Plaintiffs injury in

excess of the minimum jurisdictional limits of this Court.

COUNTERCLAIM TWO: FRAUD.

38. Counter-Plaintiffs repeat and reallege each and every allegation made in the

previous paragraphs as if fully written herein.

39. deBerardinis and FR III made material representations to induce Counter-

Plaintiffs to loan FR III funds. They include representations that:

a. FR III and deBerardinis had a trading agreement in place with Alon and

Freeport;

b. FR III and deBerardinis owned “line tyme” on a Colonial pipeline;

DEFENDANTS/COUNTER-PLAINTIFFS STEPHEN R. HERBEL, PATRICK MULLIGAN,

B. CRAIG WEBB, AND JERRY WEBB’S COUNTERCLAIMS AGAINST FR III FUNDING LLC

AND DAVID DEBERARDINIS, AND REQUEST FOR INJUNCTIVE RELIEF PAGE 10

PAGE 10 OF 18

c. FR III and deBerardinis were trading hundreds of millions of dollars in an

account managed by Alon; and

d. FR III and deBerardinis required capital and guaranties to continue and

expand on a trading operation with guaranteed returns.

40. These material misrepresentations were false, and were made knowingly or

recklessly.

41. Counter-Plaintiffs acted in reliance on these false and material misrepresentations.

42. Counter-Plaintiffs also relied on PlainsCapital’s diligence in entering into the

loans.

43. Counter-Plaintiffs have been injured as a direct and proximate cause of FP III and

deBerardinis’ fraudulent conduct.

COUNTERCLAIM THREE: ATTORNEYS’ FEES AND COURT COSTS.

44. Counter-Plaintiffs request an award of reasonable and necessary attorneys’ fees

and costs to the full extent allowed by law, including, but not limited to §§ 38.001 and 134.005

of the Texas Civil Practice and Remedies Code.

VIII. REQUESTS FOR INJUNCTIVE RELIEF

45. Counter-Plaintiffs repeat and reallege each and every allegation made in the

previous paragraphs as if fully written herein.

46. Counter-Plaintiffs seek a temporary injunction and, upon final trial hereof, a

permanent injunction as set forth herein. Upon information and belief, deBerardinis and FR III

continue to perpetuate their fraudulent scheme by transferring, spending, using, hiding, and/or

disposing of funds and assets and are likely to continue doing so absent injunctive relief.

Similarly, upon information and belief, deBerardinis and FR III continue to incur debt in

advancement of their scheme and are likely to continue doing so absent injunctive relief. If

DEFENDANTS/COUNTER-PLAINTIFFS STEPHEN R. HERBEL, PATRICK MULLIGAN,

B. CRAIG WEBB, AND JERRY WEBB’S COUNTERCLAIMS AGAINST FR III FUNDING LLC

AND DAVID DEBERARDINIS, AND REQUEST FOR INJUNCTIVE RELIEF PAGE 11

PAGE 11 OF 18

deBerardinis and FR III are not restrained, they will continue to engage in the aforementioned

actions, constituting both a continued breach of their contractual obligations and fraud. Further,

in the absence of a temporary injunction, nothing will prevent deBerardinis and/or FR III from

transferring, spending, using, hiding, and/or disposing of funds and assets in an effort to avoid

judgment in this and other, related lawsuits. Once deBerardinis and FR III succeed in these

efforts, Counter-Plaintiffs (and Plaintiff) will have no adequate remedy at law.

47. Counter-Plaintiffs are likely to succeed on the merits of this action. The facts

alleged in Counter-Plaintiffs’ Counterclaims and Request for Injunctive Relief demonstrate that

FR III and deBerardinis are in breach of their contractual obligation to Counter-Plaintiffs and

continue to engage in a massive, spectacularly fraudulent effort by way of forgery and deception.

deBerardinis’ conduct thus far has evidenced his dedication to this fraud, and none of Counter-

Plaintiffs’ efforts to obtain relief have thus far been successful.

48. Counter-Plaintiffs will provide FR III and deBerardinis with notice of any hearing

on the merits, consistent with Texas Rule of Civil Procedure 681.

49. To preserve the status quo and protect Counter-Plaintiffs’ rights during the

pendency of this action and to prevent further actions constituting breach of contract and fraud,

Counter-Plaintiffs request that deBerardinis and FR III be cited to appear and show cause: (a) as

to why any and all personal and corporate assets should not be frozen; (b) as to why any

affiliates’ corporate assets should not be frozen; (c) as to why they (or any of their agents or

representatives, including attorneys) should not be restrained or enjoined from transferring,

spending, using, hiding, disposing and/or otherwise using any funds belonging to, loaned to, or

otherwise traceable in any way to FR III or any of its affiliated companies; (d) as to why they (or

any of their agents or representatives, including attorneys) should not be restrained or enjoined

DEFENDANTS/COUNTER-PLAINTIFFS STEPHEN R. HERBEL, PATRICK MULLIGAN,

B. CRAIG WEBB, AND JERRY WEBB’S COUNTERCLAIMS AGAINST FR III FUNDING LLC

AND DAVID DEBERARDINIS, AND REQUEST FOR INJUNCTIVE RELIEF PAGE 12

PAGE 12 OF 18

from incurring any new and/or additional individual or corporate debt (including the corporate

debt of any affiliated companies); and (e) as to why they should not be ordered to immediately

turn over all documents requested by Counter-Plaintiffs, including any and all of FR III’s books

and records.

50. Specifically, Counter-Plaintiffs request that the Court enter a temporary

restraining order, which shall be effective for fourteen days, that enjoins deBerardinis and FR III

from the following actions:

a) transferring, spending, hiding, disposing, and/or otherwise using any funds belonging

to; loaned to or otherwise traceable in any way to FR IIl or any of its affiliated

companies;

b) transferring, spending, hiding, disposing, and/or otherwise using any funds in the

possession, custody or control of deBerardinis that belong to; came from or are in any

way traceable to FR III or any of its affiliated companies;

c) incurring any new and/or additional individual or corporate debt, including those of

any affiliated companies;

d) impairing, disposing of or alienating any asset of FR III, including any such assets

possessed by others; and

e) destroying, deleting or otherwise impairing any book, record or document of FR III;

deBerardinis or any of their affiliated companies.

51. Counter-Plaintiffs further request that the Court set their application for

Temporary Injunction for a hearing no more than fourteen days from the entry of the Temporary

Restraining Order, and that upon conclusion of that hearing, that the Court enter a Temporary

Injunction to remain in force for the duration of this lawsuit that enjoins FR III and deBerardinis

DEFENDANTS/COUNTER-PLAINTIFFS STEPHEN R. HERBEL, PATRICK MULLIGAN,

B. CRAIG WEBB, AND JERRY WEBB’S COUNTERCLAIMS AGAINST FR III FUNDING LLC

AND DAVID DEBERARDINIS, AND REQUEST FOR INJUNCTIVE RELIEF PAGE 13

PAGE 13 OF 18

from engaging in actions prohibited in the Temporary Restraining Order, as outlined in

Paragraph 50(a)-(e).

52. Counter-Plaintiffs finally request that upon a final hearing, the court enter a

Permanent Injunction that enjoins deBerardinis and FR III from the actions outlined in Paragraph

50(a)-(e).

53. Counter-Plaintiffs are willing and able to post bond, as ordered by the Court, in

support of any injunctive order issued by the Court.

IX. JURY DEMAND

54. Counter-Plaintiffs demand their right to have a trial by jury in this matter.

X. PRAYER

WHEREFORE PREMISES CONSIDERED, Counter-Plaintiffs pray:

1. That FR III and deBerardinis be cited to appear and answer herein;

2. That the Court enter judgment on Counter-Plaintiffs’ counterclaims against FR III

and deBerardinis;

3. That the Court award Counter-Plaintiffs actual damages, exemplary damages,

reasonable and necessary attorneys’ fees, court costs, pre-judgment interest, and post-judgment

interest;

4. That the Court enter a Temporary Restraining Order, in accordance with

Paragraph 50(a)-(e) of Counter-Plaintiffs’ Counterclaims and Request for Injunctive Relief;

5. That the Court set Counter-Plaintiffs’ Application for Temporary Injunction for

hearing no later than fourteen days from the entry of the Temporary Restraining Order and, upon

conclusion of the hearing on Counter-Plaintiffs’ Application for Temporary Injunction, enter a

DEFENDANTS/COUNTER-PLAINTIFFS STEPHEN R. HERBEL, PATRICK MULLIGAN,

B. CRAIG WEBB, AND JERRY WEBB’S COUNTERCLAIMS AGAINST FR III FUNDING LLC

AND DAVID DEBERARDINIS, AND REQUEST FOR INJUNCTIVE RELIEF PAGE 14

PAGE 14 OF 18

Temporary Injunction for the duration of this lawsuit in accordance with Paragraph 50-51 of

Counter-Plaintiffs’ Counterclaims and Request for Injunctive Relief;

6. That, upon a final hearing, the Court enter a Permanent Injunction, in accordance

with Paragraph 50-52 of Counter-Plaintiffs’ Counterclaims and Request for Injunctive Relief;

and

7. For all such other and further relief at law or in equity that the Court may deem

just and proper.

Dated: July 13, 2016 Respectfully submitted,

Jeffrey M. Tillotson

Texas Bar No. 20039200

jtillotson@tillotsonlaw.com

Jonathan R. Patton

Texas Bar No. 24088198

jpatton@tillotsonlaw.com

Joseph A. Irrobali

Texas Bar No. 24092564

airrobali@tillotsonlaw.com

TILLOTSON LAW

750 N. St. Paul, Suite 610

Dallas, Texas 75201

(214) 382-3041 Telephone

(214) 501-0731 Facsimile

COUNSEL FOR DEFENDANT/

COUNTER-PLAINTIFFS STEPHEN R.

HERBEL, PATRICK MULLIGAN, B. CRAIG

WEBB, AND JERRY WEBB

DEFENDANTS/COUNTER-PLAINTIFFS STEPHEN R. HERBEL, PATRICK MULLIGAN,

B. CRAIG WEBB, AND JERRY WEBB’S COUNTERCLAIMS AGAINST FR III FUNDING LLC

AND DAVID DEBERARDINIS, AND REQUEST FOR INJUNCTIVE RELIEF PAGE 15

PAGE 15 OF 18

CERTIFICATE OF IRREPARABLE HARM

I hereby certify that due to the evidence presently available and belief of fraudulent

activity, notice to the opposing party or counsel would impair and/or annul the court’s power to

grant relief because of the possibility that assets and money may be liquidated and/or transferred

if notice to FR III or deBerardinis were required.

I also certify that Plaintiffs in this matter, PlainsCapital Bank, were provided notice of

this filing.

Jeffrey M. Tillotson

CERTIFICATE OF SERVICE

I certify that a true and correct copy of the above and foregoing document was served on

all counsel of record herein on July 13, 2016 by E-Service.

I further certify that to the best of my knowledge this case is not subject to transfer under

Dallas County Local Rule 1.06.

Jeffrey M. Tillotson

DEFENDANTS/COUNTER-PLAINTIFFS STEPHEN R. HERBEL, PATRICK MULLIGAN,

B. CRAIG WEBB, AND JERRY WEBB’S COUNTERCLAIMS AGAINST FR III FUNDING LLC

AND DAVID DEBERARDINIS, AND REQUEST FOR INJUNCTIVE RELIEF PAGE 16

PAGE 16 OF 18

VERIFICATION

STATE OF TEXAS §

§

COUNTY OF DALLAS §

BEFORE ME, the undersigned notary, on this day, personally appeared Patrick Mulligan,

the affiant, a person whose identity is known to me. After I administered an oath to affiant,

affiant testified:

"My name is Patrick Mulligan. I am capable of making this verification. I have read

Plaintiffs Verified Original Petition and Application for Temporary Restraining Order,

Temporary Injunction, and Permanent Injunction.

knowledge and are true and correct."

SUBSCRIBED AND SWORN TO BEFORE me on this the /jjfday of July, 2016, to

certify which witness my hand and official seal.

SUSAN D WADE

Notary ID II 5744803

{)UQ1v- �A_-,

Notary Public, State of Texas

My Commission Expires

June 1, 2020

DEFENDANTS-COUNTER-PLAINTIFFS STEPHEN R. HERBEL, PATRICK MULLIGAN,

B. CRAIG WEBB, AND JERRY WEBB'S COUNTERCLAIMS AGAINST FR III FUNDING LLC

AND DAVID DEBERARDINIS, AND REQUEST FOR INJUNCTIVE RELIEF PAGE 16

PAGE 17 OF 18

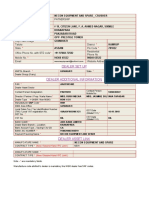

A~ USA

PROMISSORY NOTE

Amount: $1,000,000.00 September 24, 2015

Due: October 24, 2015

FOR VALUE RECEIVED, Financial Resources, LLC ("Borrower"), promises to pay to

the order of Stephen R. Herbel ("Lender") at 900 W. 70th St., Shreveport, Louisiana 71106, the

principal sum of 01\'E-:MJLLION AND NO CENTS ($1,000,000.00), or so much tl1ereof as may

- be outstanding at the time of payment, whichever is less.

The aggregate outstanding principal shall bear interest at $81,000.00.

No monthly payments of principal shall be required of the Borrower. This Promissory

Note is due and payable on October 24, 2015.

The Borrower may prepay this Promissory Note without penalty subject to any lender's

consent if appropriate.

This Promissory Note represents a new transaction, and any and all prior debt

transactions between Borrower and Lender have been successfully concluded and fonn no part

of the new transaction represented by this Promissory Note.

This Promissory Note shall be governed by and construed under the laws of the State of

Louisiana.

IN WITNESS WHEREOF, the Borrower has caused this Promissory Note to be executed

and delivered on the day first written above.

The payment of this Promissory Note is guaranteed by Alon u;s.A. and Babran Global.

Alon U.S.A.

By: - -. 1:&/!t:J:

Shai Even, Senior Vice President and

Chief Financial Officer

Alon USA•7616 LBJ frreeway, Suite 300•Dallas, Texas 75251-7030•Phone (972) 367-3600

PAGE 18 OF 18

EXHIBIT A

Das könnte Ihnen auch gefallen

- USA V Sales - IndictmentDokument6 SeitenUSA V Sales - IndictmentJustin OkunNoch keine Bewertungen

- Ash V Bank of AmericaDokument22 SeitenAsh V Bank of AmericarichdebtNoch keine Bewertungen

- Joint Rule 26 ReportDokument10 SeitenJoint Rule 26 ReportLarry Brennan100% (2)

- The Code of HammurabiDokument46 SeitenThe Code of HammurabiCorina Elena NiculaeNoch keine Bewertungen

- Request For Judicial NoticeDokument2 SeitenRequest For Judicial NoticeJohn ReedNoch keine Bewertungen

- Invitation LetterDokument1 SeiteInvitation Lettershaik yaqoobNoch keine Bewertungen

- Motion For A Hearing (7/25/18)Dokument3 SeitenMotion For A Hearing (7/25/18)joshblackman0% (1)

- 10-04-12 Request For Inquiry by Senator Christopher Dodd, Chair of The Senate Banking Committee On OCC and US Dept of JusticeDokument17 Seiten10-04-12 Request For Inquiry by Senator Christopher Dodd, Chair of The Senate Banking Committee On OCC and US Dept of JusticeHuman Rights Alert - NGO (RA)100% (1)

- S.E.C.'s 2nd Amended Complaint Against Bank of AmericaDokument24 SeitenS.E.C.'s 2nd Amended Complaint Against Bank of AmericaDealBook100% (1)

- Motion For EnlargementDokument2 SeitenMotion For EnlargementSteven Jones100% (1)

- Ohtzu3jp20fmm0wabnlrf4hg 5729bfed d2c5 45ff 820b 9f75ed07adafDokument4 SeitenOhtzu3jp20fmm0wabnlrf4hg 5729bfed d2c5 45ff 820b 9f75ed07adafCaleb TaylorNoch keine Bewertungen

- State Request For Statements of InterestDokument3 SeitenState Request For Statements of InterestThe Republican/MassLive.comNoch keine Bewertungen

- Nevada - in Forma Pauperis Application FormDokument4 SeitenNevada - in Forma Pauperis Application FormthadzigsNoch keine Bewertungen

- I1040 IRS Instruction BookDokument174 SeitenI1040 IRS Instruction BookgalaxianNoch keine Bewertungen

- Jane Doe Liberty CounterclaimDokument5 SeitenJane Doe Liberty CounterclaimPat ThomasNoch keine Bewertungen

- Gordon LawsuitDokument17 SeitenGordon LawsuitABC15 NewsNoch keine Bewertungen

- Terry J. Walker V County of Gloucester, Salem County Correctional Facility Warden Raymond Skradzinski, Former Salem County Corrections Officer Elbert B. Johnson IIDokument30 SeitenTerry J. Walker V County of Gloucester, Salem County Correctional Facility Warden Raymond Skradzinski, Former Salem County Corrections Officer Elbert B. Johnson IIopracrusadesNoch keine Bewertungen

- Wintrust LawsuitDokument16 SeitenWintrust LawsuitRobert GarciaNoch keine Bewertungen

- 3 Warranty DeedDokument2 Seiten3 Warranty DeedAsif Ahmed ShaikhNoch keine Bewertungen

- Econ Notes 3Dokument13 SeitenEcon Notes 3Engineers UniqueNoch keine Bewertungen

- Countrywide Mortgage v. BERLIUK - Judge COSTELLO 1 3mar2008Dokument58 SeitenCountrywide Mortgage v. BERLIUK - Judge COSTELLO 1 3mar2008Lishabi BriggsNoch keine Bewertungen

- Petition To Modify Protection From Abuse OrderDokument13 SeitenPetition To Modify Protection From Abuse OrderBINGE TV EXCLUSIVENoch keine Bewertungen

- Michael Redmond - Notice of ViolationDokument22 SeitenMichael Redmond - Notice of ViolationNational Content DeskNoch keine Bewertungen

- Beneficiary Affidavit For The RFEDokument4 SeitenBeneficiary Affidavit For The RFESampath SLGNoch keine Bewertungen

- 1a. Motion To DismissDokument7 Seiten1a. Motion To Dismiss1SantaFeanNoch keine Bewertungen

- Order To Show Cause - DETR LawsuitDokument4 SeitenOrder To Show Cause - DETR LawsuitMichelle RindelsNoch keine Bewertungen

- 37 2016 00015560 CL en CTL Roa 1-05-09 16 CA Labor Board Judgment Digital Ear, IncDokument15 Seiten37 2016 00015560 CL en CTL Roa 1-05-09 16 CA Labor Board Judgment Digital Ear, IncdigitalearinfoNoch keine Bewertungen

- 06-21-10 - Notice of Voluntary DismissalDokument5 Seiten06-21-10 - Notice of Voluntary DismissalOrlando Tea PartyNoch keine Bewertungen

- Action To Quiet TitleDokument7 SeitenAction To Quiet TitleDaryl BerryNoch keine Bewertungen

- 3 Nof Ca Irs 3176CDokument2 Seiten3 Nof Ca Irs 3176CMichael KovachNoch keine Bewertungen

- (Contractor Name, Complete Address Including ZIP Code and Legal Title) (Surety Name and Complete Address Including ZIP Code)Dokument3 Seiten(Contractor Name, Complete Address Including ZIP Code and Legal Title) (Surety Name and Complete Address Including ZIP Code)HR LEGOLANDNoch keine Bewertungen

- Civ Procedure NotesDokument15 SeitenCiv Procedure Notesmcb0040100% (1)

- Foreclosure MSJ by Regions. Eaton v. RegionsDokument143 SeitenForeclosure MSJ by Regions. Eaton v. Regionsmigratesouth100% (1)

- RFK Jr. Lawsuit vs. (Utah 2023)Dokument26 SeitenRFK Jr. Lawsuit vs. (Utah 2023)Michael HouckNoch keine Bewertungen

- HAN Grievance Memorandum Against DAUGHERTYDokument13 SeitenHAN Grievance Memorandum Against DAUGHERTYDocument RepositoryNoch keine Bewertungen

- Puente - Arizona - Et - Al - v. - Arpai Defendants' Amended Joint Controverting Statement of FactsDokument64 SeitenPuente - Arizona - Et - Al - v. - Arpai Defendants' Amended Joint Controverting Statement of FactsChelle CalderonNoch keine Bewertungen

- KTCDokument114 SeitenKTCSashi KanthNoch keine Bewertungen

- Doc. 192 - MDHS Motion For Leave To Amend ComplaintDokument3 SeitenDoc. 192 - MDHS Motion For Leave To Amend ComplaintRuss LatinoNoch keine Bewertungen

- Law of FiduciaryDokument2 SeitenLaw of FiduciaryravenmailmeNoch keine Bewertungen

- ACLU Lawsuit Wait-TimesDokument66 SeitenACLU Lawsuit Wait-TimesPennLiveNoch keine Bewertungen

- Order Re Motion For Summary Judgment (District Judge Vicky Johnson)Dokument21 SeitenOrder Re Motion For Summary Judgment (District Judge Vicky Johnson)hefflingerNoch keine Bewertungen

- SuperintendingcontrolDokument10 SeitenSuperintendingcontrolJOEMAFLAGENoch keine Bewertungen

- Bhatnagar LawsuitDokument56 SeitenBhatnagar LawsuitWHYY NewsNoch keine Bewertungen

- 2018-12-13 08-57-55 Pineapple Motion For Prejudgment AttachmentDokument9 Seiten2018-12-13 08-57-55 Pineapple Motion For Prejudgment AttachmentjasonblevinsNoch keine Bewertungen

- Supreme Court of The United States: Petitioners Pro SeDokument72 SeitenSupreme Court of The United States: Petitioners Pro SeNye LavalleNoch keine Bewertungen

- Louis Posner v. New York City Police Department - Appellate Division, State of New YorkDokument64 SeitenLouis Posner v. New York City Police Department - Appellate Division, State of New YorkJonathan S. Gould, Esq.Noch keine Bewertungen

- DeAlva Graves v. Onewest Bank, F.S.B., 4th Cir. (2016)Dokument2 SeitenDeAlva Graves v. Onewest Bank, F.S.B., 4th Cir. (2016)Scribd Government DocsNoch keine Bewertungen

- Zalonda Woods Fair Housing ComplaintDokument6 SeitenZalonda Woods Fair Housing ComplaintJordan Green100% (1)

- Complaint For Injunctive Relief 53801828Dokument9 SeitenComplaint For Injunctive Relief 53801828Anonymous 1upeZsNoch keine Bewertungen

- Funimation - Notice of Hearing On Motion To DismissDokument2 SeitenFunimation - Notice of Hearing On Motion To DismissAnonymous RtqI2MNoch keine Bewertungen

- Notice of E-Filing #130831690, Tu-Quynh Nguyen Vu Un, Esq. Sachs Sax Caplan - Oaks V Schneider 17-004532Dokument2 SeitenNotice of E-Filing #130831690, Tu-Quynh Nguyen Vu Un, Esq. Sachs Sax Caplan - Oaks V Schneider 17-004532larry-612445Noch keine Bewertungen

- Rosenfield v. HSBC Bank, USA, 10th Cir. (2012)Dokument36 SeitenRosenfield v. HSBC Bank, USA, 10th Cir. (2012)Scribd Government DocsNoch keine Bewertungen

- United States Treasury Creditor Treasury Bond + 720564834Dokument12 SeitenUnited States Treasury Creditor Treasury Bond + 720564834shasha ann beyNoch keine Bewertungen

- Declaration Letter SampleDokument2 SeitenDeclaration Letter SamplechristyNoch keine Bewertungen

- Nursing License Suspended DummDokument1 SeiteNursing License Suspended DummKristin NelsonNoch keine Bewertungen

- Constitution of the State of Minnesota — 1876 VersionVon EverandConstitution of the State of Minnesota — 1876 VersionNoch keine Bewertungen

- The Declaration of Independence: A Play for Many ReadersVon EverandThe Declaration of Independence: A Play for Many ReadersNoch keine Bewertungen

- Constitution of the State of Minnesota — Republican VersionVon EverandConstitution of the State of Minnesota — Republican VersionNoch keine Bewertungen

- Confederate Monument RulingDokument20 SeitenConfederate Monument RulingShreveport TimesNoch keine Bewertungen

- Complaint Filed by Morris & DicksonDokument18 SeitenComplaint Filed by Morris & DicksonShreveport Times100% (1)

- Dupont Fish Market ViolationDokument6 SeitenDupont Fish Market ViolationShreveport TimesNoch keine Bewertungen

- Transcript - DemossDokument10 SeitenTranscript - DemossShreveport TimesNoch keine Bewertungen

- Bossier Opioid SuitDokument79 SeitenBossier Opioid SuitShreveport TimesNoch keine Bewertungen

- Restraining OrderDokument2 SeitenRestraining OrderShreveport TimesNoch keine Bewertungen

- 2018 Shreveport DTN Final - FAA ReportDokument16 Seiten2018 Shreveport DTN Final - FAA ReportShreveport TimesNoch keine Bewertungen

- Does 1-7 v. Bossier - Anonymous MotionDokument77 SeitenDoes 1-7 v. Bossier - Anonymous MotionShreveport TimesNoch keine Bewertungen

- US District Court Ruling Denying Monument InjunctionDokument20 SeitenUS District Court Ruling Denying Monument InjunctionShreveport TimesNoch keine Bewertungen

- Does 1-4 v. Bossier Parish School Board ComplaintDokument33 SeitenDoes 1-4 v. Bossier Parish School Board ComplaintShreveport Times100% (1)

- DeBeradinis Redacted IndictmentDokument10 SeitenDeBeradinis Redacted IndictmentShreveport TimesNoch keine Bewertungen

- Huntington (9 12) ProposalDokument4 SeitenHuntington (9 12) ProposalShreveport TimesNoch keine Bewertungen

- SOC Against Eddie Lyons, Raymond JamesDokument9 SeitenSOC Against Eddie Lyons, Raymond JamesShreveport TimesNoch keine Bewertungen

- La Student Rights ReviewDokument15 SeitenLa Student Rights ReviewHoward FriedmanNoch keine Bewertungen

- Bossier Parish Schools, LA - Classroom PrayerDokument2 SeitenBossier Parish Schools, LA - Classroom PrayerShreveport TimesNoch keine Bewertungen

- Samuel Policereport RotatedDokument2 SeitenSamuel Policereport RotatedShreveport TimesNoch keine Bewertungen

- Lyons RaymondJamesSuitDokument25 SeitenLyons RaymondJamesSuitShreveport TimesNoch keine Bewertungen

- SOC Against Eddie Lyons, Raymond JamesDokument9 SeitenSOC Against Eddie Lyons, Raymond JamesShreveport TimesNoch keine Bewertungen

- Lyons RaymondJamesOilSuitDokument17 SeitenLyons RaymondJamesOilSuitShreveport Times100% (1)

- Chancellor Message WillisDokument1 SeiteChancellor Message WillisShreveport TimesNoch keine Bewertungen

- LHSAA Response RotatedDokument2 SeitenLHSAA Response RotatedShreveport TimesNoch keine Bewertungen

- Bossier Response To Nonprofit-RotatedDokument2 SeitenBossier Response To Nonprofit-RotatedShreveport TimesNoch keine Bewertungen

- Letter To Smith-RotatedDokument5 SeitenLetter To Smith-RotatedShreveport TimesNoch keine Bewertungen

- Minniear SuspensionDokument2 SeitenMinniear SuspensionShreveport TimesNoch keine Bewertungen

- Rex Dukes at CP Courthouse RevisedDokument2 SeitenRex Dukes at CP Courthouse RevisedShreveport TimesNoch keine Bewertungen

- The Criminal Procedure (Identification) Act, 2022 A Constitutional CritiqueDokument28 SeitenThe Criminal Procedure (Identification) Act, 2022 A Constitutional CritiqueArunNoch keine Bewertungen

- Office of The Punong Barangay: Executive Order No. 04Dokument1 SeiteOffice of The Punong Barangay: Executive Order No. 04Pao LonzagaNoch keine Bewertungen

- Quick NSR FormatDokument2 SeitenQuick NSR FormatRossking GarciaNoch keine Bewertungen

- Track Changes of Doctrine and Covenants Section 8Dokument2 SeitenTrack Changes of Doctrine and Covenants Section 8Bomo NomoNoch keine Bewertungen

- BACK EmfDokument12 SeitenBACK Emfarshad_rcciitNoch keine Bewertungen

- Research - Procedure - Law of The Case DoctrineDokument11 SeitenResearch - Procedure - Law of The Case DoctrineJunnieson BonielNoch keine Bewertungen

- Legal Aid Doc Something To Do With M V A Case Cornerstone Jan AprDokument40 SeitenLegal Aid Doc Something To Do With M V A Case Cornerstone Jan AprCharlton ButlerNoch keine Bewertungen

- Aeris Product Sheet ConnectionLockDokument2 SeitenAeris Product Sheet ConnectionLockGadakNoch keine Bewertungen

- Lancesoft Offer LetterDokument5 SeitenLancesoft Offer LetterYogendraNoch keine Bewertungen

- 70ba5 Inventec KRUG14 DIS 0503Dokument97 Seiten70ba5 Inventec KRUG14 DIS 0503Abubakar Siddiq HolmNoch keine Bewertungen

- Practice in The Trial of Civil SuitsDokument54 SeitenPractice in The Trial of Civil SuitsCool dude 101Noch keine Bewertungen

- CH05 Transaction List by Date 2026Dokument4 SeitenCH05 Transaction List by Date 2026kjoel.ngugiNoch keine Bewertungen

- Moovo Press ReleaseDokument1 SeiteMoovo Press ReleaseAditya PrakashNoch keine Bewertungen

- ASME B31.5-1994 Addend Refrigeration PipingDokument166 SeitenASME B31.5-1994 Addend Refrigeration PipingFRANCISCO TORRES100% (1)

- 2011 CIVITAS Benefit JournalDokument40 Seiten2011 CIVITAS Benefit JournalCIVITASNoch keine Bewertungen

- NISM Series IX Merchant Banking Workbook February 2019 PDFDokument211 SeitenNISM Series IX Merchant Banking Workbook February 2019 PDFBiswajit SarmaNoch keine Bewertungen

- Stress and StrainDokument2 SeitenStress and StrainbabeNoch keine Bewertungen

- Loss or CRDokument4 SeitenLoss or CRJRMSU Finance OfficeNoch keine Bewertungen

- CHAPTER 12 Partnerships Basic Considerations and FormationsDokument9 SeitenCHAPTER 12 Partnerships Basic Considerations and FormationsGabrielle Joshebed AbaricoNoch keine Bewertungen

- Pranali Rane Appointment Letter - PranaliDokument7 SeitenPranali Rane Appointment Letter - PranaliinboxvijuNoch keine Bewertungen

- Narcotrafico: El Gran Desafío de Calderón (Book Review)Dokument5 SeitenNarcotrafico: El Gran Desafío de Calderón (Book Review)James CreechanNoch keine Bewertungen

- Internal Orders / Requisitions - Oracle Order ManagementDokument14 SeitenInternal Orders / Requisitions - Oracle Order ManagementtsurendarNoch keine Bewertungen

- SaraikistanDokument31 SeitenSaraikistanKhadija MirNoch keine Bewertungen

- Rfso S A0011749958 1Dokument3 SeitenRfso S A0011749958 1Marian DimaNoch keine Bewertungen

- People vs. BartolayDokument6 SeitenPeople vs. BartolayPrince CayabyabNoch keine Bewertungen

- Tecno Spark Power 2 Misty Grey, 64 GB: Grand Total 9999.00Dokument2 SeitenTecno Spark Power 2 Misty Grey, 64 GB: Grand Total 9999.00Lucky KumarNoch keine Bewertungen

- 1 Dealer AddressDokument1 Seite1 Dealer AddressguneshwwarNoch keine Bewertungen

- Cibse Lighting LevelsDokument3 SeitenCibse Lighting LevelsmdeenkNoch keine Bewertungen

- Scott Gessler Appeal of Ethics Commission Sanctions - Opening BriefDokument56 SeitenScott Gessler Appeal of Ethics Commission Sanctions - Opening BriefColorado Ethics WatchNoch keine Bewertungen

- Navarro Vs DomagtoyDokument3 SeitenNavarro Vs Domagtoykvisca_martinoNoch keine Bewertungen