Beruflich Dokumente

Kultur Dokumente

Forward Rate Agreement Topics

Hochgeladen von

david smithOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Forward Rate Agreement Topics

Hochgeladen von

david smithCopyright:

Verfügbare Formate

Forward Rate Agreement

Topics

1. Brief Review: Fixed Income Securities

2. Yield Curve and Term Structure

3. Forward Rate Agreement

Dr. Melanie Cao, SSB, FINE6800 1

1. Brief Review of Fixed Income Securities:

A. Money Market Instruments:

short-term marketable securities

A.1 Treasure bills (T-bills):

Maturity: 3, 6, 12 months

Issued weekly through auctions by competitive bidding

Participants: banks and authorized dealers

Face value (FV): $1,000, $5,000, $25,000, $100,000 and

$1,000,000

Dr. Melanie Cao, SSB, FINE6800 2

A. Money Market Instruments:

short-term marketable securities …continued

A.2 Commercial Paper

Issued by large, well-known companies;

They are unsecured;

Backed by a bank line of credit;

Yield: slightly higher than the corresponding T-bill since

corporations are riskier than governments.

Dr. Melanie Cao, SSB, FINE6800 3

A. Money Market Instruments:

short-term marketable securities …continued

A.3 Certificates of Deposits & Deposit Notes

Certificate of Deposit (CD): time deposit with a bank

Guaranteed Investment Certificates (GIC)

A.4 Bankers’ Acceptances:

Similar to post dated checks which are guaranteed by banks

Dr. Melanie Cao, SSB, FINE6800 4

A. Money Market Instruments:

short-term marketable securities …continued

A.5 Eurodollar:

U.S. dollar denominated deposit at foreign banks

Euro currency: XXX currency denominated deposit outside

of the XXX currency jurisdiction.

Euro currency is not the same as Euro (the common currency

for the European Monetary Union adopted on Jan.1, 1999).

Dr. Melanie Cao, SSB, FINE6800 5

A. Money Market Instruments:

short-term marketable securities …continued

A.6 Repos (Repurchase Agreements):

A form of overnight borrowing;

Selling one’s asset at a price today and repurchasing it back

tomorrow at a higher price;

Term repo: maturity to 30 days.

Dr. Melanie Cao, SSB, FINE6800 6

A. Money Market Instruments:

short-term marketable securities …continued

A.7 LIBOR market:

London InterBank Offering Rate (LIBOR)

LIBOR rates are the benchmark for many derivatives, such as

swaps, the CME’s Eurodollar contract (the largest short-term

futures contracts).

Dr. Melanie Cao, SSB, FINE6800 7

B. Longer Term Fixed-Income Capital Market:

B.1 Treasure bonds (T-bonds):

Canada Savings Bonds (CSB): non-marketable, issued on

Nov. 1 each year with a 7-year maturity

Canada Bonds: marketable with maturity up to 40 years

Dr. Melanie Cao, SSB, FINE6800 8

B. Longer Term Fixed-Income Capital Market:

…continued

B.2 Local Government bonds:

Similar to T-bonds;

However, the yield is slightly higher than that of the

corresponding T-bond since local government is riskier than

the Federal government.

Dr. Melanie Cao, SSB, FINE6800 9

B. Longer Term Fixed-Income Capital Market:

…continued

B.3 Corporate Bonds:

Higher default risk;

Secured bonds are backed by the company’s assets in the event of

bankruptcy;

Unsecured bonds (or debentures) have lower priority claim than the

secured bonds in the event of bankruptcy;

Subordinated debentures: lower priority claim than debentures;

Callable bonds give firm the right to repurchase the outstanding

bonds;

Convertible bonds give the holders the right to convert bonds into

equity

Dr. Melanie Cao, SSB, FINE6800 10

2. Yield Curve and Term Structure

A. Term Structure (TS)

• Also called "yield curve" or "pure yield curve". It depicts

relationship between time-to-maturity and Yield-To-Maturity

(YTM) for zero-coupon (or discount) bonds.

• YTM is also referred as zero rate.

Dr. Melanie Cao, SSB, FINE6800 11

Illustration

Maturity YTM

(years)

1 0.1

2 0.105 What determines the shape?

3 0.11

4 0.12

5 0.13

6 0.135

Dr. Melanie Cao, SSB, FINE6800 12

B. Three Interest Rate Theories

B.1 Expectations Theory (Hypothesis)

• Shape of TS is explained by market participants' expectations

of interest rates. Specifically, long term rate is Geometric

mean of future short rates.

Dr. Melanie Cao, SSB, FINE6800 13

Example 3.1

Calculate the yields to maturity of each bond

Maturity (years) Zero-coupon Bond Price

1 943.40

2 898.47

3 847.62

4 792.16

Dr. Melanie Cao, SSB, FINE6800 14

Forward Rates: Implied Future Spot Rates

Dr. Melanie Cao, SSB, FINE6800 15

Example 3.1

…continued

What are the implied forward rates?

Maturity (years) 1 2 3 4

Price of Bonds 943.40 898.47 847.62 792.16

YTM 5.83% 5.35% 5.51% 5.82%

Dr. Melanie Cao, SSB, FINE6800 16

B.2 Liquidity Preference Theory (Hypothesis)

• Long-term returns should be higher to compensate for

inflexibility and uncertainty.

An improvement over exp. Theory which assumes perfect

forecasts;

Also an extension of exp. Theory.

Dr. Melanie Cao, SSB, FINE6800 17

Illustration

Dr. Melanie Cao, SSB, FINE6800 18

B.3 Market Segmentation Theory (Hypothesis)

• Also known as institutional theory and hedging pressure

theory.

Demand/supple of funds are distinct in different maturity

segments. That is, short term: money market; medium:

mortgages; long term: life insurance;

Shape of term structure depends on demand/supply in each

market.

Dr. Melanie Cao, SSB, FINE6800 19

C. Term Structure Estimation: Bootstrap Method

Example 3.2

Annual Coupon Maturity (years) Bond Price

0 1 909.09

5% 2 905.39

12% 3 1026.30

7% 4 851.96

Dr. Melanie Cao, SSB, FINE6800 20

3. Forward Rate Agreement (FRA)

A. FRA is a forward contract on an interest rate for a specific

future period traded through the Over-The-Counter (OTC)

market. It is similar to the Euro-dollar futures contracts traded

at the CME (Hull, Chapter 6.4, page 137).

Dr. Melanie Cao, SSB, FINE6800 21

Example:

• Two parties agree that the one-year rate 6 months from now will be

5.5%. After 6-months, depending on the actual one-year rate, one party

will pay the other.

Dr. Melanie Cao, SSB, FINE6800 22

B. FRA’s are settled in cash

• At initiation, to make the forward contract worth zero, the agreed

forward rate should be the forward rate.

• Suppose principal is $1,000 and contract is for T* - T at the agreed rate

RK. For the short party,

Time T: -$1,000 Time T*: 1,000 e RK(T* - T)

PV of the contract = $1,000e RK(T* - T) e -r * T* - 1,000e -rT

Set it to zero and solve for RK,

Dr. Melanie Cao, SSB, FINE6800 23

B. FRA’s are settled in cash

…continued

• At any time after initiation, the contract value for a short

position:

Dr. Melanie Cao, SSB, FINE6800 24

Example:

A 2-year period FRA (T*-T = 2 years) with principal $1,000,000;

Contract rate is RK = 10%; 6 months left to maturity (T-t = 6 months);

Current 6- and 30-month rates are r (t,T) = 9.5% and r* (t, T*) = 10.5%.

Dr. Melanie Cao, SSB, FINE6800 25

Example: …continued

Then:

lost money, because the current implied forward rate is:

which is higher than the contracted rate of 0.10.

Dr. Melanie Cao, SSB, FINE6800 26

Example: …continued

6 months have passed. The FRA is at maturity. The actual 2-year

rate is 10.5%, then the cash settlement is:

Dr. Melanie Cao, SSB, FINE6800 27

Das könnte Ihnen auch gefallen

- Exchange Rate Determination Puzzle: Long Run Behavior and Short Run DynamicsVon EverandExchange Rate Determination Puzzle: Long Run Behavior and Short Run DynamicsNoch keine Bewertungen

- Modern Portfolio Theory and Investment Analysis 9th Edition Elton Test BankDokument7 SeitenModern Portfolio Theory and Investment Analysis 9th Edition Elton Test Bankamywrightrcnmqbajyg100% (13)

- Section 01Dokument5 SeitenSection 01HarshNoch keine Bewertungen

- Chapter 4 SolutionsDokument12 SeitenChapter 4 SolutionsEdmond ZNoch keine Bewertungen

- Valuation of Floating-Rate Instruments Theory and EvidenceDokument22 SeitenValuation of Floating-Rate Instruments Theory and EvidenceZhang PeilinNoch keine Bewertungen

- Bionic Turtle FRM Practice Questions on MortgagesDokument14 SeitenBionic Turtle FRM Practice Questions on MortgagesHoang HaNoch keine Bewertungen

- SchiffrinDokument36 SeitenSchiffrinCristina TessariNoch keine Bewertungen

- U5 Risk Premium and Term Structure of Interest RatesDokument39 SeitenU5 Risk Premium and Term Structure of Interest RatesJC HuamánNoch keine Bewertungen

- Econ 330 Midterm Exam Answers and AnalysisDokument5 SeitenEcon 330 Midterm Exam Answers and AnalysisDương NguyễnNoch keine Bewertungen

- FNCE 30001 Investments: Fixed Income FundamentalsDokument70 SeitenFNCE 30001 Investments: Fixed Income FundamentalsVrtpy CiurbanNoch keine Bewertungen

- Midterm Exam - Answer Key for Economics 135Dokument2 SeitenMidterm Exam - Answer Key for Economics 135kasimNoch keine Bewertungen

- Sumitomo IRSDokument15 SeitenSumitomo IRSRafael Lizana ZúñigaNoch keine Bewertungen

- Discussing Theories of the Term Structure of Interest RatesDokument12 SeitenDiscussing Theories of the Term Structure of Interest RatesEdwin Lwandle NcubeNoch keine Bewertungen

- Introducing Overnight Indexed SwapsDokument6 SeitenIntroducing Overnight Indexed SwapsShi PengyongNoch keine Bewertungen

- Question Paper Financial Risk Management - II (232) : October 2004Dokument12 SeitenQuestion Paper Financial Risk Management - II (232) : October 2004api-27548664100% (2)

- FIMA Act. 2Dokument2 SeitenFIMA Act. 2Donnathel BetangcorNoch keine Bewertungen

- 03 Handout 1Dokument13 Seiten03 Handout 1Adrasteia ZachryNoch keine Bewertungen

- A) Explain The Difference Between Financial Engineering and Financial Economics. List The Problems Associated With Financial EngineeringDokument10 SeitenA) Explain The Difference Between Financial Engineering and Financial Economics. List The Problems Associated With Financial EngineeringPiyush ChauhanNoch keine Bewertungen

- Interest Rate Parity, Money Market Basis Swaps, and Cross-Currency Basis SwapsDokument14 SeitenInterest Rate Parity, Money Market Basis Swaps, and Cross-Currency Basis Swapsultr4l0rd100% (1)

- Interest Rate Parity, Money Market Basis Swaps, and Cross-Currency Basis SwapsDokument14 SeitenInterest Rate Parity, Money Market Basis Swaps, and Cross-Currency Basis SwapsReema RatheeNoch keine Bewertungen

- Money Banking Outline Literature ChaptersDokument31 SeitenMoney Banking Outline Literature ChaptersIsoqjonivichNoch keine Bewertungen

- Levich Ch11 Net Assignment SolutionsDokument16 SeitenLevich Ch11 Net Assignment SolutionsNisarg JoshiNoch keine Bewertungen

- Discussion QuestionsDokument19 SeitenDiscussion QuestionsrahimNoch keine Bewertungen

- GW JEL DraftDokument65 SeitenGW JEL DraftFirman Aditya BaskoroNoch keine Bewertungen

- Derivatives - Betting: Chapter Break UpDokument34 SeitenDerivatives - Betting: Chapter Break UpJatinkatrodiyaNoch keine Bewertungen

- Derivatives - Prospects in BangladeshDokument16 SeitenDerivatives - Prospects in BangladeshTechnology And movies100% (3)

- 12.1 The Basics of Interest Rate Swaps: by ConventionDokument5 Seiten12.1 The Basics of Interest Rate Swaps: by ConventionAnna-Clara MansolahtiNoch keine Bewertungen

- How Risk and Term Structure Affect Interest RatesDokument8 SeitenHow Risk and Term Structure Affect Interest RatesAisha Bint TilaNoch keine Bewertungen

- Fixed Income and Credit Risk v3Dokument27 SeitenFixed Income and Credit Risk v3FNoch keine Bewertungen

- HW NongradedDokument4 SeitenHW NongradedAnDy YiMNoch keine Bewertungen

- Silabus Sekuritas Pendapatan Tetap & Derivatif - Genap19-20 PDFDokument6 SeitenSilabus Sekuritas Pendapatan Tetap & Derivatif - Genap19-20 PDFrizkyabud budiNoch keine Bewertungen

- A Preferred-Habitat Model of The Term Structure of Interest Rates-Nov09Dokument59 SeitenA Preferred-Habitat Model of The Term Structure of Interest Rates-Nov09kevNoch keine Bewertungen

- Seminar 8 - AnswersDokument4 SeitenSeminar 8 - AnswersSlice LeNoch keine Bewertungen

- Cfi1203 Module 2 Interest Rates Determination & StructureDokument8 SeitenCfi1203 Module 2 Interest Rates Determination & StructureLeonorahNoch keine Bewertungen

- Forex Qs AnsDokument5 SeitenForex Qs AnsChoudhristNoch keine Bewertungen

- Ae 18 Financial MarketsDokument4 SeitenAe 18 Financial Marketsnglc srzNoch keine Bewertungen

- Research Paper On Term Structure of Interest RatesDokument7 SeitenResearch Paper On Term Structure of Interest RatesafdtrzkhwNoch keine Bewertungen

- Bac Cmo PrimerDokument39 SeitenBac Cmo Primerjms1999Noch keine Bewertungen

- Posner Outline Other 2011Dokument25 SeitenPosner Outline Other 2011coddusNoch keine Bewertungen

- Monetary Policy and the Term Structure in 40 CharactersDokument3 SeitenMonetary Policy and the Term Structure in 40 CharactersNerea FrancesNoch keine Bewertungen

- (Lehman Brothers, Tuckman) Interest Rate Parity, Money Market Baisis Swaps, and Cross-Currency Basis SwapsDokument14 Seiten(Lehman Brothers, Tuckman) Interest Rate Parity, Money Market Baisis Swaps, and Cross-Currency Basis SwapsJonathan Ching100% (1)

- 3 Forward Rate Agreements and Interest Rate Swaps: B. A. Eales, Financial Engineering © Brian Eales 2000Dokument2 Seiten3 Forward Rate Agreements and Interest Rate Swaps: B. A. Eales, Financial Engineering © Brian Eales 2000Thao NguyenNoch keine Bewertungen

- Financial Markets Tutorial and Self Study Questions All TopicsDokument17 SeitenFinancial Markets Tutorial and Self Study Questions All TopicsTan Nguyen100% (1)

- Lecture - Eurodollar MarketDokument37 SeitenLecture - Eurodollar MarketNiyati ShahNoch keine Bewertungen

- Interest Rates Mean and What Is Their Role in ValuationDokument5 SeitenInterest Rates Mean and What Is Their Role in ValuationTito KhanNoch keine Bewertungen

- Dwnload Full Modern Portfolio Theory and Investment Analysis 9th Edition Elton Test Bank PDFDokument35 SeitenDwnload Full Modern Portfolio Theory and Investment Analysis 9th Edition Elton Test Bank PDFamandawrightrwfdcombka100% (10)

- Convertible BondsDokument32 SeitenConvertible Bondsunion2006Noch keine Bewertungen

- Financial Management: Chapter Three Time Value of MoneyDokument16 SeitenFinancial Management: Chapter Three Time Value of MoneyLydiaNoch keine Bewertungen

- EconomicsDokument27 SeitenEconomicschirag jainNoch keine Bewertungen

- Money Market Instruments in PakistanDokument3 SeitenMoney Market Instruments in PakistanAsif PharmacistNoch keine Bewertungen

- Lesson 8 Bonds and Stock For Students 3Dokument8 SeitenLesson 8 Bonds and Stock For Students 3dorothyannvillamoraaNoch keine Bewertungen

- Chapter 5Dokument23 SeitenChapter 5Alex WorkinaNoch keine Bewertungen

- Chicago Fed Letter: How Have Banks Responded To Changes in The Yield Curve?Dokument6 SeitenChicago Fed Letter: How Have Banks Responded To Changes in The Yield Curve?Yemi AdetayoNoch keine Bewertungen

- Financial Markets and Institutions Chapter 6 SummaryDokument6 SeitenFinancial Markets and Institutions Chapter 6 SummaryAnisa Kodra100% (1)

- Forward Rate Agreement CalculationDokument4 SeitenForward Rate Agreement Calculationjustinmark99Noch keine Bewertungen

- W7 Capital Market TradingDokument12 SeitenW7 Capital Market TradingPesidas, Shiela Mae J.Noch keine Bewertungen

- Tutorial 2 Answer Scheme ECO531Dokument6 SeitenTutorial 2 Answer Scheme ECO5312019489528Noch keine Bewertungen

- SET - A (For Odd Class ID)Dokument2 SeitenSET - A (For Odd Class ID)farhanNoch keine Bewertungen

- BIS Working Papers: The Interest Rate Effects of Government Debt MaturityDokument52 SeitenBIS Working Papers: The Interest Rate Effects of Government Debt MaturityKarin Denise Zurita VidalNoch keine Bewertungen

- Measures, Integrals - SolutionsDokument336 SeitenMeasures, Integrals - Solutionshans destoitNoch keine Bewertungen

- The CVA trade-off: Capital or P&LDokument68 SeitenThe CVA trade-off: Capital or P&Ldavid smithNoch keine Bewertungen

- Object Oriented Programming: Second EditionDokument484 SeitenObject Oriented Programming: Second EditionPradeep Kumar100% (1)

- MFE Letter AnswerKey 2016Dokument10 SeitenMFE Letter AnswerKey 2016david smithNoch keine Bewertungen

- AkumeDokument10 SeitenAkumekurecaNoch keine Bewertungen

- CVA and FVA To Derivatives Trades Collateralized by CashDokument29 SeitenCVA and FVA To Derivatives Trades Collateralized by Cashdavid smithNoch keine Bewertungen

- MFE SampleQS1-76Dokument185 SeitenMFE SampleQS1-76Jihyeon Kim100% (1)

- MFE Solutions 2016 021517Dokument473 SeitenMFE Solutions 2016 021517david smithNoch keine Bewertungen

- Opinions REVISEDDokument30 SeitenOpinions REVISEDdavid smithNoch keine Bewertungen

- 6800 02 Option TradingDokument29 Seiten6800 02 Option Tradingdavid smithNoch keine Bewertungen

- Neer 493 BDokument12 SeitenNeer 493 Bdavid smithNoch keine Bewertungen

- AkumeDokument10 SeitenAkumekurecaNoch keine Bewertungen

- DsDokument46 SeitenDsdavid smithNoch keine Bewertungen

- Naoh Storage Tank Design Description:: Calculations For Tank VolumeDokument6 SeitenNaoh Storage Tank Design Description:: Calculations For Tank VolumeMaria Eloisa Angelie ArellanoNoch keine Bewertungen

- G.R. No. 122039 May 31, 2000 VICENTE CALALAS, Petitioner, Court of Appeals, Eliza Jujeurche Sunga and Francisco Salva, RespondentsDokument56 SeitenG.R. No. 122039 May 31, 2000 VICENTE CALALAS, Petitioner, Court of Appeals, Eliza Jujeurche Sunga and Francisco Salva, RespondentsJayson AbabaNoch keine Bewertungen

- Hazard Identification Priority Area Checklist Worksafe Gov AuDokument29 SeitenHazard Identification Priority Area Checklist Worksafe Gov Aufh71100% (1)

- Machine Problem 6 Securing Cloud Services in The IoTDokument4 SeitenMachine Problem 6 Securing Cloud Services in The IoTJohn Karlo KinkitoNoch keine Bewertungen

- Black Box Components and FunctionsDokument9 SeitenBlack Box Components and FunctionsSaifNoch keine Bewertungen

- Festo Process Control - CatalogDokument3 SeitenFesto Process Control - Cataloglue-ookNoch keine Bewertungen

- Constitutional Law of India-II CCSU LL.B. Examination, June 2015 K-2002Dokument3 SeitenConstitutional Law of India-II CCSU LL.B. Examination, June 2015 K-2002Mukesh ShuklaNoch keine Bewertungen

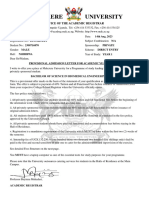

- Makerere University: Office of The Academic RegistrarDokument2 SeitenMakerere University: Office of The Academic RegistrarOPETO ISAACNoch keine Bewertungen

- CP Exit Srategy Plan TemplateDokument4 SeitenCP Exit Srategy Plan TemplateKristia Stephanie BejeranoNoch keine Bewertungen

- Master List of Approved Vendors For Manufacture and Supply of Electrical ItemsDokument52 SeitenMaster List of Approved Vendors For Manufacture and Supply of Electrical ItemsBhoopendraNoch keine Bewertungen

- Christmasworld Trend Brochure 2024Dokument23 SeitenChristmasworld Trend Brochure 2024Ольга ffNoch keine Bewertungen

- Day / Month / Year: Certificate of No Criminal Conviction Applicant Data Collection Form (LOCAL)Dokument4 SeitenDay / Month / Year: Certificate of No Criminal Conviction Applicant Data Collection Form (LOCAL)Lhea RecenteNoch keine Bewertungen

- RAMA - 54201 - 05011381320003 - 0025065101 - 0040225403 - 01 - Front - RefDokument26 SeitenRAMA - 54201 - 05011381320003 - 0025065101 - 0040225403 - 01 - Front - RefMardiana MardianaNoch keine Bewertungen

- CRM Chapter 3 Builds Customer RelationshipsDokument45 SeitenCRM Chapter 3 Builds Customer RelationshipsPriya Datta100% (1)

- Katie Todd Week 4 spd-320Dokument4 SeitenKatie Todd Week 4 spd-320api-392254752Noch keine Bewertungen

- Timesheet 2021Dokument1 SeiteTimesheet 20212ys2njx57vNoch keine Bewertungen

- NSTP 1: Pre-AssessmentDokument3 SeitenNSTP 1: Pre-AssessmentMaureen FloresNoch keine Bewertungen

- Ubaf 1Dokument6 SeitenUbaf 1ivecita27Noch keine Bewertungen

- Coronary artery diseases reviewDokument43 SeitenCoronary artery diseases reviewKeputrian FKUPNoch keine Bewertungen

- 132KV Siemens Breaker DrawingDokument13 Seiten132KV Siemens Breaker DrawingAnil100% (1)

- Torta de Riso Business PlanDokument25 SeitenTorta de Riso Business PlanSalty lNoch keine Bewertungen

- UE Capability Information (UL-DCCH) - Part2Dokument51 SeitenUE Capability Information (UL-DCCH) - Part2AhmedNoch keine Bewertungen

- Chapter 6 Performance Review and Appraisal - ReproDokument22 SeitenChapter 6 Performance Review and Appraisal - ReproPrecious SanchezNoch keine Bewertungen

- CD Plus 25-260 Instruction Book EN Antwerp 2920711112Dokument96 SeitenCD Plus 25-260 Instruction Book EN Antwerp 2920711112Miguel CastañedaNoch keine Bewertungen

- TMA - ExerciseDokument3 SeitenTMA - ExercisemorrisioNoch keine Bewertungen

- Ts 391 IltDokument5 SeitenTs 391 IltFunnypoumNoch keine Bewertungen

- Applied Econometrics ModuleDokument142 SeitenApplied Econometrics ModuleNeway Alem100% (1)

- 7 - Lakhs Bank EstimateDokument8 Seiten7 - Lakhs Bank Estimatevikram Bargur67% (3)

- Comparing environmental impacts of clay and asbestos roof tilesDokument17 SeitenComparing environmental impacts of clay and asbestos roof tilesGraham LongNoch keine Bewertungen

- PTCL History, Services, Subsidiaries & SWOT AnalysisDokument18 SeitenPTCL History, Services, Subsidiaries & SWOT AnalysiswaqarrnNoch keine Bewertungen