Beruflich Dokumente

Kultur Dokumente

TAX2

Hochgeladen von

DeyCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

TAX2

Hochgeladen von

DeyCopyright:

Verfügbare Formate

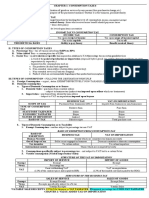

Consumption Tax (Buyer is (Buyer is non-

resident) resident)

occurs when one acquires goods or Non- Taxable No Tax

services by purchase or exchange Resident

upon utilization of goods or services by Resident Taxable Effectively No

consumers or buyers Tax

not on the sale of the seller

Rationale: Types of taxable domestic consumption

1. Promotes savings formation 1. Importation – purchase of residents of goods

from non-residents abroad

2. Helps in wealth redistribution to society

2. Sale – purchase of residents from resident

3. Supports the Benefit Received Theory

sellers

*should not be levied upon basic necessities

Consumption Tax on Importation

Income Consumption

VAT on Importation – importers of

Tax Tax

goods shall pay consumption tax; 12%

Nature Tax upon Tax upon usage

receipt of of income or of the total import cost of the goods

income capital paid prior to the withdrawal of the

Scope Tax to the Tax to all goods from the warehouse of Bureau of

capable Customs

Supporting Ability to Benefit Withholding Tax – purchaser of service

Tax Theory pay theory Received from non-residents shall likewise pay

Theory VAT on importation; 12% of the

contract price of this service

Types of Consumption Consumption Tax on Domestic Consumption

from Resident Sellers

1. Domestic Consumption – consumption of

Philippine Residents Collected from seller; sales of seller or

receipts of services

2. Foreign Consumption – consumption of non-

residents Regularly engaged in business

*only Domestic Consumption can be subjected Sellers – statutory taxpayers

to Philippine Taxation Buyers – economic taxpayers

Destination Principle – for use or consumption Consumption Tax for Resident Buyers Applies to

in the Philippines are subject to consumption Business Only

tax

Seller is not in business

Cross-Border Doctrine – goods which are Business Tax – tax on the privilege to do

destined to foreign territories should not be business; Privilege tax

taxed

Vat on Business Tax

The Seller Domestic Foreign Importation

Consumption Consumption

Basis of Tax Acquisition Sales or 1. Sales – for business which sells goods; total

Cost Receipts amount agreed as consideration for the sale of

Scope of Tax All Consumption goods whether collected or uncollected

Consumption Form

businesses 2. Receipts – for business that sells services

only

Nature of Pure Form Relative

Consumption Form Types of Business taxes:

Tax

Statutory Buyer Seller 1. VAT on Sales

Taxpayer 2. Percentage tax

The Buyer Buyer

economic 3. Excise Tax

Taxpayer

Nature of Direct Indirect Types of Business Taxpayers:

Imposition 1. VAT taxpayers – required to pay VAT

2. Non-VAT taxpayers – who pays percentage

Seller Resident Applicable tax

Buyer Consumption

Tax

Domestic

Sellers VAT on Sales

Business Business Business Tax Tax on added value – added by the

Business Non- Business Tax seller on its purchases in making sales;

Business

based upon the price increases made by

Non- Business None

the producers and distributors

business

Top-up on sales – require to be included

Non- Non- None

business business in the price of goods as a top-up;

Invoice Price (includes both); VAT

INCLUSIVE IF VAT IS NOT SEPARATELY

Seller Resident Applicable INDICATED IN THE SALES DOCUMENT

Buyer Consumption Tax Credit Method – VAT on sales shall

Tax be reduced by the amount of VAT paid

Foreign by the business on its purchases

Sellers

An explicit consumption tax – disclosed

Business Business VAT on

in the invoice or official receipt of the

importation

Business Non- VAT on seller

business importation Quarterly tax – but paid on a monthly

Non- Business VAT on basis

business importation

Methods of Computing VAT:

Non- Non- VAT on

business business importation 1. Direct Method – computed by applying the

VAT rate to the difference of the selling price

Basis of Business tax

and the purchase; not employed in the *percentage tax is computed directly on the

Philippines sales and is reported as an expense

2. Tax Credit Method – imposed upon the sales *percentage tax is presented as part of “taxes

or receipt of the business. and licenses” and a deduction against gross

income under income taxation

Special Features of the Tax Credit Method:

Who pays percentage tax?

1. Invoice-based crediting – entitlement for

input vat is to be substantiated with invoices. 1. Non-VAT Taxpayers

2. Non-observance of the matching of costs or 2. Taxpayers who sells services specifically

expenses and sales – output vat is recorded subject to percentage tax

when a sale is made; input vat is recorded when

*not exceeding the threshold

a purchase is made not when goods are sold

*the concept of sales between VAT taxpayers

VAT Taxpayers

and percentage taxpayers differs (PT – sales is

1. VAT-registered taxpayers equal to the invoice; VAT – sales plus 12%

comprises invoice)

2. VAT-registrable taxpayers

*VAT and percentage tax are mutually exclusive

*1,919,500 ( VAT taxpayers) mandatorily

(VAT taxpayers may pay both)

required to pay

Excise Tax – in addition to Vat or percentage tax

Percentage Tax – sales tax of various rates; 3%

on certain goods imposed in the Philippines for

imposed upon the gross sales or gross receipts

domestic consumption

of non-vat taxpayers

Levied on: tobacco, alcohol, petroleum,

Characteristics of the Percentage Tax

automobiles, jewelry, perfumes, toilet waters,

1. Tax on sales or gross receipts – total amount yacht, sports cars, metallic or non-metallic

due from the buyer is considered sales minerals, quarry resources, coal, coke, gold,

chromite, silver

2. An expensed tax – direct tax or privilege tax

of the sellers Seller of Resident Non-

goods Buyer resident

3. An implicit consumption tax – inclusion in the Buyer

selling price but same is not separately Vat 12% Vat on 0% Vat on

presented in the invoice; not disclosed to the Registered gross sales gross selling

buyer business price

Non-vat 3% Percentage Exempt

4. Monthly or quarterly tax – payable monthly registered tax on gross

*the concept of invoice and selling price to a business sales

percentage taxpayer is the same. The invoice Foreigners 12% Vat on Exempt

price is recorded as sales landed cost of

importation

*percentage tax and input vat paid on

purchases are not separately recognized

Seller of Resident Buyer Non- 1. Vat on Importation – on the import of goods

services resident

Buyer 2. Final Withholding Tax – purchase of services

Vat 12% Vat on gross 0% Vat on from non-residents

Registere receipts gross *payable to Bureau of Customs

d business receipts

Non-vat 3% Percentage Exempt *Withholding tax – 12% of the payment for

registered tax on gross services rendered by non-residents

business receipts

Foreigner 12% Final Exempt *resident purchaser is the one statutory liable

s Withholding Vat for the payment of VAT

VAT % Tax Excise Tax

Exempt Consumptions:

Tax Rate 12% Generall Various

y 3% and *Vat is not applied to goods considered as basic

valorem necessities

tax rates

and 1. agricultural and marine food products in their

specific original state

taxes

*nature objects of human consumption

Basis Mark-up Sales or Sales Value

or value receipts or per unit *In original state – unprocessed or simple

added of process (preparation for the market,

excisable preservation, packaging)

goods or

articles 2. fertilizers, seeds, seedlings and fingerlings,

Timing Upon Upon Upon fish, prawns, livestock and poultry feeds,

of sales or Sales or production including ingredients used in the manufacture

impositi collectio collectio or of feeds

on n n importatio

n 3. personal and household effects

Generall Bigger Smaller Both big or

*belong to Philippine Residents or non-

y paid business business small

by es es businesses residents intending to resettle in the

Export Subject Exempt Exempt ( Philippines; exempt from Customs Duties

Sales to 0% tax is

Vat reimbursa

ble) 4. professional instruments and implements,

wearing apparel, domestic animals, for their

own use and not for sale, barter or exchange

VALUE ADDED TAX ON IMPORTATION

*belong to persons who come to settle in the

Importation – refers to the purchase of gods

Philippines

including services by Philippine residents from

non-residents; domestic consumption and is *must accompany the person upon arrival or

subject to consumption tax within 90 days before or after his/her arrival

Types of Consumption Tax on Importation *must be evidence to show that the change of

residence is bona fide

*not a vehicle, machinery or other equipment 1. importer is engaged or not engaged in trade

used in the manufacturer or merchandise of any or business

kind in commercial quantity

2. importer is a Vat or non-Vat business

5. books and any newspaper, magazine, review

3. importation is for business or personal use

or bulletin which appear at regular intervals

with fixed price for subscription and sale and 4. non-resident seller is engaged or not engaged

which is not devoted principally to the in business

publication of paid ads

Tax basis of Vat on importation

*based upon the necessity of education and

information *computed as 12% of the total landed cost of

the importation

6. fuels, goods and supplies by persons engaged

in international shipping or air transport Composition of landed cost:

operations 1. Dutiable value

*exempt from Vat under the destination 2. Custom duty

principle

3. Excise Tax

7. cooperatives of direct farm inputs,

machineries and equipment, including spare 4. Other in-land cost

parts to be used directly and exclusively in the

production and or processing of their produce

Landed Cost – encompasses all costs of

*must be an agricultural cooperative duly importation incurred prior to the withdrawal of

registered and in good standing with the the goods from the warehouse of BOC except

Cooperative Development Authority unofficial or illegal payments made

8. transactions which are exempt under Dutiable Value – total value used by the BOC in

international agreement to which the determining the tariff and custom duties;

Philippines is signatory encompasses all costs incurred in bringing the

9. exempt under special laws goods up to the Philippine port and prior to any

other in-land costs of import

Presumption of Vatability – generally subject to

Vat unless it can be proven as exempt under 1. cost of the goods

any of those conditions 2. freight

Subsequent Sale by Exempt Person to Non- 3. insurance

exempt Persons – the non-exempt buyer shall

be subject to Vat on importation 4. other charges and costs

Vat on Importation

*since the object of taxation is the Technical Importation

consumption, the importation of goods is

- by consumers in a customs territory

subject to Vat regardless of whether the:

from person located in Special

Economic Zones

- refers to the purchase of non-Ecozone

Philippine residents from Philippine

Ecozone registered enterprise

Customs Territory – the portion of the Republic

of the Philippines outside of designated special

economic zones (foreign territories)

Withholding Vat on Import of Services

- purchase of services from non-residents

is an importation of service which is

subject to Withholding Vat

Das könnte Ihnen auch gefallen

- 1040 Exam Prep Module X: Small Business Income and ExpensesVon Everand1040 Exam Prep Module X: Small Business Income and ExpensesNoch keine Bewertungen

- Consumption Taxes: Business Tax Is A Form of Consumption TaxDokument8 SeitenConsumption Taxes: Business Tax Is A Form of Consumption TaxDenvyl MangsatNoch keine Bewertungen

- Rationale of Consumption TaxDokument3 SeitenRationale of Consumption Taxmy miNoch keine Bewertungen

- Jpia-Hau: Business and Transfer TaxationDokument12 SeitenJpia-Hau: Business and Transfer Taxationronniel tiglaoNoch keine Bewertungen

- Bustax Chapter 1Dokument9 SeitenBustax Chapter 1Pineda, Paula MarieNoch keine Bewertungen

- Tax 202 - Chapter 1 Consumption TaxDokument4 SeitenTax 202 - Chapter 1 Consumption TaxLizandraArceoBarteNoch keine Bewertungen

- Chapter 1 and 2 BUSTAXDokument6 SeitenChapter 1 and 2 BUSTAXCory RitaNoch keine Bewertungen

- Concept of Consumption and Consumption Taxes and Vat On ImportationDokument4 SeitenConcept of Consumption and Consumption Taxes and Vat On ImportationJamaica DavidNoch keine Bewertungen

- Business and Transfer TaxationDokument9 SeitenBusiness and Transfer Taxationcj8kim8maggayNoch keine Bewertungen

- Business TaxesDokument20 SeitenBusiness TaxesAnime ScreenshotsNoch keine Bewertungen

- 01 BustaxDokument10 Seiten01 BustaxJake Raphael Cruz CalaguasNoch keine Bewertungen

- Introduction To Consumption Taxes NotesDokument2 SeitenIntroduction To Consumption Taxes NotesSelene DimlaNoch keine Bewertungen

- Importation by Importers) : Income Tax Vs Consumption TaxDokument2 SeitenImportation by Importers) : Income Tax Vs Consumption TaxMark LapidNoch keine Bewertungen

- Tax 2 NotesDokument2 SeitenTax 2 NotesMark LapidNoch keine Bewertungen

- Business Tax Chapter 1Dokument3 SeitenBusiness Tax Chapter 1Mamin ChanNoch keine Bewertungen

- Chapter 1 Introduction To Consumption TaxesDokument6 SeitenChapter 1 Introduction To Consumption TaxesJason MablesNoch keine Bewertungen

- Introduction To Consumption Tax PDFDokument20 SeitenIntroduction To Consumption Tax PDFShamae Duma-anNoch keine Bewertungen

- Lesson 6Dokument6 SeitenLesson 6Iris Lavigne RojoNoch keine Bewertungen

- Tax 01 Introduction To Consumption TaxesDokument3 SeitenTax 01 Introduction To Consumption TaxesShiela LlenaNoch keine Bewertungen

- Bustax Chapters 1 4Dokument6 SeitenBustax Chapters 1 4Naruto UzumakiNoch keine Bewertungen

- Business and Transfer Taxes: An Introduction To Consumption TaxesDokument16 SeitenBusiness and Transfer Taxes: An Introduction To Consumption TaxesAngelo Delos SantosNoch keine Bewertungen

- BSTX Reviewer (Midterm)Dokument7 SeitenBSTX Reviewer (Midterm)alaine daphneNoch keine Bewertungen

- Business and Transfer Taxation: TO Consumption TaxesDokument40 SeitenBusiness and Transfer Taxation: TO Consumption TaxesKC GutierrezNoch keine Bewertungen

- Introduction To Value Added TaxDokument5 SeitenIntroduction To Value Added TaxNYSHAN JOFIELYN TABBAYNoch keine Bewertungen

- M7 - Intro To Consumption Tax & VAT On Importation Students'Dokument54 SeitenM7 - Intro To Consumption Tax & VAT On Importation Students'Elaiza RegaladoNoch keine Bewertungen

- Ch. 1Dokument3 SeitenCh. 1abibiNoch keine Bewertungen

- Topic 1 - Business TaxDokument9 SeitenTopic 1 - Business Taxalexissosing.cpaNoch keine Bewertungen

- Intro To Consumption TaxesDokument9 SeitenIntro To Consumption TaxesAnna CynNoch keine Bewertungen

- Tax 2 - BanggawanDokument175 SeitenTax 2 - BanggawanJessica IslaNoch keine Bewertungen

- Chapter 1 Tax 2Dokument5 SeitenChapter 1 Tax 2Hazel Jane EsclamadaNoch keine Bewertungen

- TAX 221-AVP (Atillo, Cañete, Dejan, Manlimos, Hortellano)Dokument50 SeitenTAX 221-AVP (Atillo, Cañete, Dejan, Manlimos, Hortellano)reymardicoNoch keine Bewertungen

- Topic 1 - Consumption and Business TaxDokument4 SeitenTopic 1 - Consumption and Business TaxNicole Daphne FigueroaNoch keine Bewertungen

- Module 1 & 2: at The End of This Topic, We Should Be Able To Learn The FollowingDokument33 SeitenModule 1 & 2: at The End of This Topic, We Should Be Able To Learn The FollowingAlicia FelicianoNoch keine Bewertungen

- Input VAT ch9 IncompleteDokument3 SeitenInput VAT ch9 IncompleteMarionne GNoch keine Bewertungen

- Business Taxation Intro To Consumption Taxes: Anie P. Martinez, Cpa, MbaDokument32 SeitenBusiness Taxation Intro To Consumption Taxes: Anie P. Martinez, Cpa, MbaAnie MartinezNoch keine Bewertungen

- Chapter 1 Introduction To Consumption TaxesDokument38 SeitenChapter 1 Introduction To Consumption TaxesGenie Gonzales DimaanoNoch keine Bewertungen

- Module 6. Nature and Concepts of Business TaxesDokument6 SeitenModule 6. Nature and Concepts of Business TaxesYolly DiazNoch keine Bewertungen

- Introduction To Consumption Taxes: Prepared By: Mrs. Nelia I. Tomas, CPA, LPTDokument56 SeitenIntroduction To Consumption Taxes: Prepared By: Mrs. Nelia I. Tomas, CPA, LPTTokis SabaNoch keine Bewertungen

- CTT Examination Reviewer (Notes) Page A - 30Dokument13 SeitenCTT Examination Reviewer (Notes) Page A - 30Seneca GonzalesNoch keine Bewertungen

- Tax 2 AssignmentDokument6 SeitenTax 2 AssignmentKim EcarmaNoch keine Bewertungen

- Chapter 1 Introduction To Consumption TaxDokument15 SeitenChapter 1 Introduction To Consumption TaxNesrill Joyce AntonioNoch keine Bewertungen

- Chapter 1 Introduction To Consumption TaxesDokument21 SeitenChapter 1 Introduction To Consumption TaxesNacpil, Alyssa JesseNoch keine Bewertungen

- Chapter 9 - Input VatDokument1 SeiteChapter 9 - Input VatPremium AccountsNoch keine Bewertungen

- Chapter 9 - Input VatDokument1 SeiteChapter 9 - Input VatPremium AccountsNoch keine Bewertungen

- Chapter 9 - Input VatDokument1 SeiteChapter 9 - Input VatPremium AccountsNoch keine Bewertungen

- Chapter 9 - Input VatDokument1 SeiteChapter 9 - Input VatPremium AccountsNoch keine Bewertungen

- Chapter 9 - Input VatDokument1 SeiteChapter 9 - Input VatPremium AccountsNoch keine Bewertungen

- Chapter 9 Input VatDokument2 SeitenChapter 9 Input Vatnewlymade641Noch keine Bewertungen

- Business TaxDokument24 SeitenBusiness TaxKassandra Mari LucesNoch keine Bewertungen

- Value-Added Tax: Who Are Liable To VAT? Formula in Computing Vat PayableDokument15 SeitenValue-Added Tax: Who Are Liable To VAT? Formula in Computing Vat PayablePrimo WilliamsNoch keine Bewertungen

- Combine PDFDokument198 SeitenCombine PDFliamdrlnNoch keine Bewertungen

- Concept of Business and Business TaxesDokument3 SeitenConcept of Business and Business TaxesHazel Joy DemaganteNoch keine Bewertungen

- Reviewerrrr Tax 2 PDFDokument11 SeitenReviewerrrr Tax 2 PDFAnthony EboraNoch keine Bewertungen

- Business TaxesDokument98 SeitenBusiness TaxesAbigailRefamonteNoch keine Bewertungen

- Module Author: Charles C. Onda, MD, CpaDokument9 SeitenModule Author: Charles C. Onda, MD, CpaCSJNoch keine Bewertungen

- Business Tax Reviewer IDokument5 SeitenBusiness Tax Reviewer IMariefel Irish Jimenez KhuNoch keine Bewertungen

- Chapter 8Dokument6 SeitenChapter 8my miNoch keine Bewertungen

- MIDTERMS Business and Transfer TaxationDokument13 SeitenMIDTERMS Business and Transfer Taxationabrylle opinianoNoch keine Bewertungen

- Tax 301 - Midterm Activity 1Dokument4 SeitenTax 301 - Midterm Activity 1Nicole TeruelNoch keine Bewertungen

- Chapter 6-8Dokument10 SeitenChapter 6-8DeyNoch keine Bewertungen

- TTP IntroductionDokument8 SeitenTTP IntroductionGlen Joy GanancialNoch keine Bewertungen

- Taxation - Defined As A State Power, Legislative: Theory of Taxation - The GovernmentsDokument2 SeitenTaxation - Defined As A State Power, Legislative: Theory of Taxation - The GovernmentsDeyNoch keine Bewertungen

- Taxation - Defined As A State Power, Legislative: Theory of Taxation - The GovernmentsDokument2 SeitenTaxation - Defined As A State Power, Legislative: Theory of Taxation - The GovernmentsDeyNoch keine Bewertungen

- Partnership Ad VacDokument4 SeitenPartnership Ad VacDeyNoch keine Bewertungen

- Partnership Ad VacDokument4 SeitenPartnership Ad VacDeyNoch keine Bewertungen

- Partnership Ad VacDokument4 SeitenPartnership Ad VacDeyNoch keine Bewertungen

- Math 12 BESR ABM Q2-Week 6Dokument13 SeitenMath 12 BESR ABM Q2-Week 6Victoria Quebral Carumba100% (2)

- NeoLiberalism and The Counter-EnlightenmentDokument26 SeitenNeoLiberalism and The Counter-EnlightenmentvanathelNoch keine Bewertungen

- Midterm ExamDokument3 SeitenMidterm ExamRafael CensonNoch keine Bewertungen

- C.V ZeeshanDokument1 SeiteC.V ZeeshanZeeshan ArshadNoch keine Bewertungen

- Ermitage Academic Calendar IBP 2022-23Dokument1 SeiteErmitage Academic Calendar IBP 2022-23NADIA ELWARDINoch keine Bewertungen

- Bagabag National High School Instructional Modules in FABM 1Dokument2 SeitenBagabag National High School Instructional Modules in FABM 1marissa casareno almueteNoch keine Bewertungen

- Chelsea FC HistoryDokument16 SeitenChelsea FC Historybasir annas sidiqNoch keine Bewertungen

- (Group 2) Cearts 1 - Philippine Popular CultureDokument3 Seiten(Group 2) Cearts 1 - Philippine Popular Culturerandom aestheticNoch keine Bewertungen

- MII-U2-Actividad 4. Práctica de La GramáticaDokument1 SeiteMII-U2-Actividad 4. Práctica de La GramáticaCESARNoch keine Bewertungen

- Managing New VenturesDokument1 SeiteManaging New VenturesPrateek RaoNoch keine Bewertungen

- State of Cyber-Security in IndonesiaDokument32 SeitenState of Cyber-Security in IndonesiaharisNoch keine Bewertungen

- Intertek India Private LimitedDokument8 SeitenIntertek India Private LimitedAjay RottiNoch keine Bewertungen

- G.R. No. 187512 June 13, 2012 Republic of The Phils Vs Yolanda Cadacio GranadaDokument7 SeitenG.R. No. 187512 June 13, 2012 Republic of The Phils Vs Yolanda Cadacio GranadaDexter Lee GonzalesNoch keine Bewertungen

- Animal AkanDokument96 SeitenAnimal AkanSah Ara SAnkh Sanu-tNoch keine Bewertungen

- Compiled LR PDFDokument13 SeitenCompiled LR PDFFrh RzmnNoch keine Bewertungen

- Test Bank OB 221 ch9Dokument42 SeitenTest Bank OB 221 ch9deema twNoch keine Bewertungen

- Affidavit of GC - Reject PlaintDokument9 SeitenAffidavit of GC - Reject PlaintVishnu R. VenkatramanNoch keine Bewertungen

- Luovutuskirja Ajoneuvon Vesikulkuneuvon Omistusoikeuden Siirrosta B124eDokument2 SeitenLuovutuskirja Ajoneuvon Vesikulkuneuvon Omistusoikeuden Siirrosta B124eAirsoftNoch keine Bewertungen

- Module - No. 7 CGP G12. - Name of AuthorsDokument77 SeitenModule - No. 7 CGP G12. - Name of AuthorsJericson San Jose100% (1)

- Ryterna Modul Architectural Challenge 2021Dokument11 SeitenRyterna Modul Architectural Challenge 2021Pham QuangdieuNoch keine Bewertungen

- SweetPond Project Report-2Dokument12 SeitenSweetPond Project Report-2khanak bodraNoch keine Bewertungen

- Sherwood (1985) - Engels, Marx, Malthus, and The MachineDokument30 SeitenSherwood (1985) - Engels, Marx, Malthus, and The Machineverdi rossiNoch keine Bewertungen

- United States v. Larry Walton, 552 F.2d 1354, 10th Cir. (1977)Dokument16 SeitenUnited States v. Larry Walton, 552 F.2d 1354, 10th Cir. (1977)Scribd Government DocsNoch keine Bewertungen

- Tutorial Week 3 - WillDokument4 SeitenTutorial Week 3 - WillArif HaiqalNoch keine Bewertungen

- Quotes For Essay and Ethics CompilationDokument5 SeitenQuotes For Essay and Ethics CompilationAnkit Kumar SinghNoch keine Bewertungen

- NMML Occasional Paper: The Anticolonial Ethics of Lala Har Dayal'sDokument22 SeitenNMML Occasional Paper: The Anticolonial Ethics of Lala Har Dayal'sСаша ПаповићNoch keine Bewertungen

- List of Directors - Indian CompaniesDokument209 SeitenList of Directors - Indian CompaniesAditya Sharma100% (1)

- Causes of UnemploymentDokument7 SeitenCauses of UnemploymentBishwaranjan RoyNoch keine Bewertungen

- Stamp Duty (Amendment) Act, 2022Dokument5 SeitenStamp Duty (Amendment) Act, 2022Kirunda ramadhanNoch keine Bewertungen