Beruflich Dokumente

Kultur Dokumente

Mutul Funds Articles PDF

Hochgeladen von

Sweta PandeyOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Mutul Funds Articles PDF

Hochgeladen von

Sweta PandeyCopyright:

Verfügbare Formate

International Journal of Advanced Research in ISSN: 2278-6236

Management and Social Sciences Impact Factor: 6.284

PERFORMANCE OF SELECTED BANK MUTUAL FUND SCHEMES IMPACT IN

INVESTORS’ DECISION MAKING

R. Kumar Gandhi*

Dr. R. Perumal**

Abstract: This article focused on investors’ investment decision making towards mutual

funds by using of Statistical tools and ratio analysis of mutual fund schemes (tax saving

schemes) of selected banks (State Bank of India, Canara Bank- Public Bank, ICICI Bank, HDFC

Bank-Private Bank).The objective of this research work is to exploits the use of statistical

tools and ratio analysis in terms of financial performance of selected mutual fund schemes

through the statistical parameters (Standard Deviation, Beta and Alpha) and ratio analysis

(Sharpe Ratio, Treynor Ratio, Jenson Ratio, Information Ratio).The results of the research

work concern Among the Open ended – Tax Saving schemes. Based on the findings of the

Research work Canara bank performance is higher and useful for the investor to make their

investment decision in it. Also the research findings are useful to the Mutual Fund Companies

in terms of understand their performance among the mutual fund companies in the market.

Key words: Mutual Fund, Open ended schemes, Tax Saving Scheme, Ratio Analysis,

Statistical Tools, Investors’ investment decision making.

*Research Scholar, Alagappa Institute of Management, Alagappa university, Karaikudi,

Tamilnadu

**Professor of Management, Directorate of Distance Education, Alagappa University,

Karaikudi, Tamilnadu

Vol. 5 | No. 3 | March 2016 www.garph.co.uk IJARMSS | 361

International Journal of Advanced Research in ISSN: 2278-6236

Management and Social Sciences Impact Factor: 6.284

INTRODUCTION

The Securities and Exchange Board of India (SEBI) regulations 1993, defines a “mutual fund

as a fund in the form of a trust by a sponsor, to raise money by the trustees through the sale

of units to the public, under one or more schemes, for investing in securities in accordance

with these regulations”. A mutual fund is a professionally-managed form of collective

investments that pools money from many investors and invests it in stocks, bonds, short-

term money market instruments, and other securities. In a mutual fund, the fund manager,

who is also known as the portfolio manager, trades the fund's underlying securities, realizing

capital gains or losses, and collects the dividend or interest income. The investment

proceeds are then passed along to the individual investors. The value of a share of the

mutual fund, known as the net asset value per share Net Asset Value (NAV), is calculated

daily based on the total value of the fund divided by the number of shares currently issued

and outstanding. The Net Asset Value (NAV) of each of these mutual funds one year data is

taken in account to find out the standard deviation of each of the funds. These are taken

into account to measure the returns of those funds. The returns are compared with each

other. Using the NAV value of these mutual funds, beta (β) co-efficient of each of them has

been calculated to know whether they are less risky, average risky or high risky funds.

Similarly, Alpha (α), and standard deviation (α) also calculated to understand the risk and

return profile of the selected funds. The returns of these funds over the last one year are

also be analyzed. In today situation, it is mandatory that the investor should analyze the

performance of any investment. The performance of mutual fund can be assessed by using

CAPM ratios like Sharpe Ratio, Treynor Ratio, Jensen Ratio, and Information Ratio. However

these calculations can be arrived with the help of Rp, Rf, Rm, Beta, Standard Deviation. In

case if the investor doesn’t have this information, he/she can analyze the performance of

mutual fund by NAV value. I made this research material in such a way that it will be helpful

for the investors and students.

REVIEW OF LITERATURE

Review of the literature plays an important role in any research, it is considering the

importance of mutual funds and several academicians have tried to study the performance

of various mutual funds. Literature on mutual fund performance evaluation is enormous.

Vol. 5 | No. 3 | March 2016 www.garph.co.uk IJARMSS | 362

International Journal of Advanced Research in ISSN: 2278-6236

Management and Social Sciences Impact Factor: 6.284

Herewith some of the research studies that have influenced the preparation of this

Research work substantially are discussed in this section.

In depth financial review to identify among the selected equity funds that earns higher

returns than benchmark and competitors, M.Vijay Anand (2000)[1].

R.Nithya (2004)[2] state that the values of mutual funds to the target people by identifying

Asset Management Company that is performing well and identifying the top schemes in the

category such as equity, balanced, Monthly Income Plan(MIP) & Income in the Assets

Management Company (AMC), and it performed well and met the expectations.

Prasath.R.H in Anna University (2009)[3],emphasizes the core values of mutual fund

investment, benefits of mutual funds and types of mutual funds and before choosing the

mutual fund scheme, the investor should undergo fact sheet thoroughly and he has to

choose the best one by calculating Sharpe Ratio, Treynor’s Ratio, Jensen Ratio, IR Ratio and

NAV calculation. If the investor finds difficulty of getting Rp, Rf, Standard deviation, and Beta

parameters, NAV calculations are the best alternative to assess the performance.

Open ended mutual funds have provided better returns than others and some of the funds

provided excess returns over expected returns based on both premium for systematic risk

and total risk. S Narayan Rao (2002)[4].

An Indian sponsored mutual fund seems to have outperformed both Public- sector

sponsored and Private-sector foreign sponsored mutual funds, Sharad Panwar and

Madhumathi.R, (2005)[5].

Kaushi k, Bhattacharjee and Bijan Roy (2008)[6], state that to understand whether or not the

selected mutual funds (hence forth called funds) are able to outperform the market on the

average over the studied time period and concluded that there are positive signals of

information asymmetry in the market with mutual fund managers having superior

information about the returns of stocks as a whole.

Jaspal Singh and Subhash (2006)[7], stated that the investors consider gold to be the most

preferred form of investment, followed by National Savings Certificate and Post Office

schemes. Hence, the basic psyche of an Indian investor, who still prefers to keep his savings

in the form of yellow metal, is indicated.

Vol. 5 | No. 3 | March 2016 www.garph.co.uk IJARMSS | 363

International Journal of Advanced Research in ISSN: 2278-6236

Management and Social Sciences Impact Factor: 6.284

Performance is affected saving and investment habits of the people at the second side the

confidence and loyalty of the fund Manager and rewards affects the performance of the MF

industry in India. Deepak Agrawal (2007)[8].

S. Anand & V Murugaiah (2003)[9], indicates that the majority of schemes were showed

underperformance in comparison with risk free return.

Soumya Guha Deb, Ashok Banerjee, B.B.Chakrabarti (2005)[10] stated that Indian equity

mutual fund managers have not been able to beat their style benchmarks on the average

and Mohit Gupta and Navdeep Agarwal (2009)[11] state that Prevalent modes of mutual fund

purchase Results were found to be encouraging, as far as risk mitigation is concerned.

NEED OF THE RESEARCH

Mutual fund is booming sector now a days and it has lot of scope to generate income and

providing return to the investor. The impressive growth of mutual funds in India has

attracted the attention of Indian researchers, individuals and institutional investors. The

need of the Research work is to evaluate the performance of different mutual funds in India

available in the selected banks and keep the mutual fund investors fully aware of it. Thus,

there is the need to investigate how efficiently the hard earned money of the investors and

scarce resources of the economy are efficiently utilized by

OBJECTIVES OF THE RESEARCH

1) To analyze the performance of any mutual fund scheme offered in the selected

banks like State Bank of India , Canara Bank, ICICI Bank , HDFC Bank

2) To study the performance of Mutual fund with the help different parameters such as

Standard Deviation, Beta, Sharpe Ratio, Treynor Ratio, Jenson alpha and NAV

Calculation mutual funds.

METHODOLOGY

Sampling methods

A convenient sampling is the one in which the only criterion for selecting the sampling units

in the convenience of the sample. To obtain information quickly and inexpensively a

convenience sampling could be adapted.

Vol. 5 | No. 3 | March 2016 www.garph.co.uk IJARMSS | 364

International Journal of Advanced Research in ISSN: 2278-6236

Management and Social Sciences Impact Factor: 6.284

Sample size

The 4 schemes are taken from selected Public banks (SBI & Canara Bank) and Private Bank

(HDFC & ICICI) for 1 year. All the data used for analysis is taken from the period June-2008 to

the period June-2009

TOOLS FOR ANALYSIS

STATISTICAL TOOL - STANDARD DEVIATION

Standard Deviation is a statistical tool, which measures the variability of returns from the

expected value, or volatility. It is denoted by sigma(σ) . It is calculated using the formula

mentioned below: Where, is the sample

mean, xi’s are the observations (returns), and N is the total number of observations or the

sample size. Standard Deviation allows evaluating the volatility of the fund. Volatility is often

a direct indicator of the risks taken by the fund. The standard deviation of a fund measures

this risk by measuring the degree to which the fund fluctuates in relation to its mean return,

the average return of a fund over a period of time.

BETA

Systematic risk is measured in terms of Beta, which represents fluctuations in the NAV of

the fund vis-à-vis market. The more responsive the NAV of a Mutual Fund is to the changes

in the market; higher will be its beta. Beta is calculated by relating the returns on a Mutual

Fund with the returns in the market, Market will have beta 1.0 Mutual fund is said to be

volatile, more volatile or less volatile. If beta is greater than 1 the stock is said to be riskier

than market. If beta is less than 1, the indication is that stock is less risky in comparison to

market. If beta is zero then the risk is the same as that of the market. Negative beta is rare.

Beta is calculated as : Covariance (Rp, Rm)

β = -----------------------------

Variance ( Rm )

where, Rp is the returns on the portfolio or stock(dependent variable).Rm is the market

returns or index( independent variable).Variance is the square of standard deviation.

Covariance is a statistic that measures how two variables co-vary, and is given by:

Where, N denotes the total number of observations, and and respectively represent the

arithmetic averages of x and y. In order to calculate the beta of a portfolio, multiply the

Vol. 5 | No. 3 | March 2016 www.garph.co.uk IJARMSS | 365

International Journal of Advanced Research in ISSN: 2278-6236

Management and Social Sciences Impact Factor: 6.284

weightage of each stock in the portfolio with its beta value to arrive at the weighted average

beta of the portfolio

RETURNS

Returns for the last one-year of different schemes are taken for the comparison analysis

TOOLS FOR ANALYSIS

RATIO ANALYSIS TOOL - SHARPE RATIO

In this model, performance of a fund is evaluated on the basis of Sharpe Ratio, which is a

ratio of returns generated by the fund over and above risk free rate of return and the total

risk associated with it.

Where, Sp= Sharpe’s Ratio, Rp = portfolio return, Rf=

risk free return, σP = standard deviation of portfolio returns. While a high and positive

Sharpe Ratio shows a superior risk-adjusted performance of a fund, a low and negative

Sharpe Ratio is an indication of unfavorable performance. If Sp of the mutual fund scheme is

greater than that of the market portfolio, the fund has outperformed the market. He

assumes that a small investor invests fully in the mutual fund and does not hold any

portfolio to eliminate unsystematic risk and hence demands a premium for the total risk. A

mutual fund scheme with large Treynor ratio and low Sharpe ratio can be concluded to have

relatively larger unique risk. Thus the two indices rank the schemes differently.

TREYNOR’S RATIO

Treynor’s ratio is a measurement of the returns earned in excess of what could have been

earned on a riskless investment. Higher the Treynor Ratio is meant the better portfolio.

Where, Tp = Treynor’s performance index, Rp = Portfolio’s actual return during a specified

time period, Rf = Risk-free rate of return during the same period, βp = beta coefficient of the

portfolio. Whenever Rp> Rf and βp > 0 a larger T value means a better portfolio for all

investors regardless of their individual risk preferences. In two cases we may have a

negative T value: when Rp < Rf or when βp < 0. If T is negative because Rp < Rf, we judge the

portfolio performance as very poor. However, if the negativity of T comes from a negative

beta, fund’s performance is superb. Finally when Rp- Rf, and βp are both negative, T will be

Vol. 5 | No. 3 | March 2016 www.garph.co.uk IJARMSS | 366

International Journal of Advanced Research in ISSN: 2278-6236

Management and Social Sciences Impact Factor: 6.284

positive, but in order to qualify the fund’s performance as good or bad we should see

whether Rp is above or below the security market line pertaining to the analysis period

JENSEN RATIO

It measures the difference between market risk and actual performance of the fund.

Positive Jensen Ratio shows Superior

Michael C.Jensen (1968) has given different dimension and confined his attention to the

problem of evaluating a fund manager’s ability of providing higher returns to the investors.

He measures the performance as the excess return provided by the portfolio over the

expected (CAPM) returns.

J = Portfolio.Return − CAPM.Return

Jensen = α = R − R + β R − R

P P f P M f

Where, α p= Jenson’s measure for portfolio, Rp=portfolio return, Rf= risk free return, Rm=

Market return, βP = beta coefficient of the portfolio.

A positive value of JP would indicate that the scheme has provided a higher return over the

CAPM return and lies above Security Market Line (SML) and a negative value would indicate

it has provided a lower than expected returns and lies below SML.

Jensen uses αj as his performance measure. A superior portfolio manager would have a

significant positive αj value because of the consistent positive residuals. Inferior managers,

on the other hand, would have a significant negative αj. Average portfolio managers having

no forecasting ability but, still, cannot be considered inferior would earn as much as one

could expect on the basis of the CAPM. . In other words, a positive value for Jensen's alpha

means a fund manager has beat the market with his or her stock picking skills

INFORMATION RATIO

The Information ratio is a measure of the risk-adjusted return of a financial security. The

information ratio is often used to gauge the skill of managers of mutual funds, hedge funds,

etc. A high ratio means a manager can achieve higher returns more efficiently than one:

IR= Alpha/Standard Deviation

FINDINGS

Finding of the Research work plays the crucial role or part in the research paper. Likewise, in

this article also present the research finding based on the secondary data.

Vol. 5 | No. 3 | March 2016 www.garph.co.uk IJARMSS | 367

International Journal of Advanced Research in ISSN: 2278-6236

Management and Social Sciences Impact Factor: 6.284

COMPARISON AMONG TAX SAVING SCHEMES- BY RATIO ANALYSIS AND

STATISTICAL ANALYSIS

These schemes offer tax rebates to the investors under specific provisions of the Income Tax

Act, 1961 as the Government offers tax incentives for investment in specified avenues. e.g.

Equity Linked Savings Schemes (ELSS). Pension schemes launched by the mutual funds also

offer tax benefits. These schemes are growth oriented and invest pre-dominantly in

equities. Their growth opportunities and risks associated are like any equity-oriented

scheme.

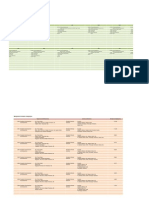

Table.1 Comparison among Tax Saving Schemes- Ratio Analysis

Treynor Rank Sharpe Information

Rank Rank

Bank/Scheme Name Ratio Ratio Ratio

Canara Robeco quity

TaxSaver 0.153 1 0.033 1 0.0250 1

HDFC Tax Saver -0.0636 2 -0.0156 2 0.0055 2

ICICI Prudential Tax

Plan -0.1181 4 -0.0278 4 -0.0104 4

SBI Magnum Tax

Gain Scheme 93 -0.078 3 -0.020 3 -0.0030 3

Source: Secondary data

Canara Bank sponsored Canara Robeco Equity Tax Saver has a higher Treynor’s ratio and

expected to perform well among the other tax saving schemes. Canara Bank sponsored

Canara Robeco Equity Tax Saver has a higher Sharpe’s ratio & expected to perform well

among the other tax saving schemes. Canara Bank sponsored Canara Robeco Equity Tax

Saver has a higher Information ratio & expected to perform well among the other tax saving

schemes

Table.2 Comparison among Tax Saving Schemes- Statistical Analysis

Fund Name Variance Standard deviation Rank Jenson Alpha Rank

Canara Robeco

Equity TaxSaver 9.828 3.135 3 0.0780 1

HDFC Tax Saver 7.888 2.809 1 0.0155 2

ICICI Prudential Tax

Plan 9.087 3.014 2 -0.0314 4

SBI Magnum Tax

Gain Scheme 93 10.03 3.17 4 -0.0090 3

Source: Secondary data

Vol. 5 | No. 3 | March 2016 www.garph.co.uk IJARMSS | 368

International Journal of Advanced Research in ISSN: 2278-6236

Management and Social Sciences Impact Factor: 6.284

HDFC offered HDFC Tax Saver scheme has a lower Variance and Standard deviation and is

expected to be less risky among the other tax saving schemes. Canara Bank offered Canara

Robeco Equity Tax Saver has the positive Alpha value of 0.0780 implies that the fund return

has over performed the benchmark index by 0.0780 percent over the last one year.

Figure.1 NAV Comparison of Tax Saving Schemes

HDFC Tax saver - Growth

SBI Magnum Tax Gain Scheme

93 - Growth

Canara Robeco Equity Taxsaver

- Growth

ICICI Prudential Taxplan -

Growth

Source: Secondary data

CONCLUSION

Among Open-Ended (Tax Saving Schemes) The Canara Robeco Equity Tax Saver schemes is

perform well in a particular scheme in banking sector. Whereas HDFC offered HDFC Tax

Saver - Growth scheme has a lower Variance and Standard deviation and that is less risky

among taken banking tax saving schemes.

DIRECTIONS FOR FUTURE RESEARCH

A comparative analysis is also done between the sectors, different investment avenues and

different schemes. The future work will consists of the study of the portfolio of each of the

funds. The proportion of investments of the funds invested in different sectors and also in

different type of stocks (like large cap, mid cap and small cap stocks) will also be found out

and analyzed. Thus, it will give an overall view of the risks and returns of the selected funds

over the last one year and also analysis of their portfolio to understand the variability of

returns over the last one year.

REFERENCES

[1] M.Vijay Anand (2000)“Analysis of Performance of Equity funds(Diversified) Open-

end Mutual Fund during 1997 – 2000” IFMR, Chennai.

Vol. 5 | No. 3 | March 2016 www.garph.co.uk IJARMSS | 369

International Journal of Advanced Research in ISSN: 2278-6236

Management and Social Sciences Impact Factor: 6.284

[2] R.Nithya (2004)“Performance Evaluation of Franklin Templeton Mutual Funds”

IFMR, Chennai.

[3] Prasath.R.H (2009)“A study on Analysis of the performance of mutual fund with

reference to HDFC” Anna University, Chennai.

[4] S.Narayan Rao (2002)“Performance Evaluation of Indian Mutual Funds” IITB,

Chennai.

[5] Sharad Panwar and Madhumathi.R (2005)“Characteristics and Performance

Evaluation of Selected Mutual Funds in India” IIT, Madras (Chennai).

[6] Kaushi K, Bhattacharjee and Prof. Bijan Roy (2008) “Fund Performance

measurement without benchmark – A case of selected Indian Mutual funds” ICFAI

University.

[7] Jaspal Singh and Subhash Chander (2006)“Investors' Preference for Investment in

Mutual Funds: An Empirical Evidence” Guru Nanak Dev University, Punjab.

[8] Deepak Agrawal (2007)”Measuring Performance of Indian Mutual Funds” Truba

College of Management & Technology , Indore.

[9] Dr.S. Anand & Dr.V Murugaiah(2003)“Analysis of Components of Investment

Performance – An Empirical Study of Mutual Funds in India” Goa Institute of

Management, Goa.

[10] Soumya Guha Deb, Prof. Ashok Banerjee, Prof. B.B.Chakrabarti

(2005)“Performance of Indian Equity Mutual Funds, Their Style Benchmarks – An

Empirical Exploration” IIM, Calcutta.

[11] Mohit Gupta and Navdeep Agarwal (2009)“Mutual Fund Portfolio Creation Using

Industry Concentration” ICFAI University.

Vol. 5 | No. 3 | March 2016 www.garph.co.uk IJARMSS | 370

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- MCQ-Test-Questions-on-Data-Structures-and-Algorithms-www.psexam.com_Dokument10 SeitenMCQ-Test-Questions-on-Data-Structures-and-Algorithms-www.psexam.com_Arabinda ParidaNoch keine Bewertungen

- Yell Case ExhibitsDokument11 SeitenYell Case ExhibitsSagar AggarwalNoch keine Bewertungen

- FedEx Sales Force Integration - Example of How To Do3Dokument30 SeitenFedEx Sales Force Integration - Example of How To Do3Arabinda ParidaNoch keine Bewertungen

- Business Finance ExamDokument8 SeitenBusiness Finance Examapi-342895963100% (3)

- Ch04 SolutionDokument19 SeitenCh04 SolutionMalek100% (1)

- Tes-36-158110 26 6 2016Dokument4 SeitenTes-36-158110 26 6 2016Arabinda ParidaNoch keine Bewertungen

- IJP - Sales & Marketin - 150216Dokument4 SeitenIJP - Sales & Marketin - 150216Arabinda ParidaNoch keine Bewertungen

- Nayagarh Autonmous CollegeDokument1 SeiteNayagarh Autonmous CollegeArabinda ParidaNoch keine Bewertungen

- Narayani Girls High School, Itamati, Nayagarh, Period 01.02.2013 To 22.02.2013 Arrear Bill FormDokument1 SeiteNarayani Girls High School, Itamati, Nayagarh, Period 01.02.2013 To 22.02.2013 Arrear Bill FormArabinda ParidaNoch keine Bewertungen

- Drilling MachineDokument13 SeitenDrilling MachineArabinda ParidaNoch keine Bewertungen

- Air PalutionDokument13 SeitenAir PalutionArabinda ParidaNoch keine Bewertungen

- Cffinals SolutionDokument121 SeitenCffinals SolutionDavid Lim0% (1)

- Paper - The P-E RatioDokument10 SeitenPaper - The P-E RatioAngsumanMitraNoch keine Bewertungen

- Investment FundamentalsDokument16 SeitenInvestment FundamentalsJay-Jay N. ImperialNoch keine Bewertungen

- 2143Dokument69 Seiten2143Arishba RizwanNoch keine Bewertungen

- 1.about Us 2.products & Services 3.types of Accounts You Can Have Opened With UsDokument10 Seiten1.about Us 2.products & Services 3.types of Accounts You Can Have Opened With UsVikrant SinghNoch keine Bewertungen

- Asahimas Flat Glass TBK.: Company Report: January 2019 As of 31 January 2019Dokument3 SeitenAsahimas Flat Glass TBK.: Company Report: January 2019 As of 31 January 2019Abdur RohmanNoch keine Bewertungen

- Cusip Identifier PDFDokument7 SeitenCusip Identifier PDFJeromeKmt100% (1)

- Lesson 13 - Socially Responsible Investment (SRI) and SustainabilityDokument41 SeitenLesson 13 - Socially Responsible Investment (SRI) and SustainabilityMarianne Nicole Zulueta50% (2)

- Intrinsic Value - Digital BookDokument60 SeitenIntrinsic Value - Digital Bookfuzzychan50% (2)

- Chap 12Dokument44 SeitenChap 12Jehad Selawe100% (1)

- B&H CH 3 SolutinsDokument26 SeitenB&H CH 3 SolutinsCharmaine de GuzmanNoch keine Bewertungen

- Bab 2 Pemahaman Supply and Demand - Ms.enDokument18 SeitenBab 2 Pemahaman Supply and Demand - Ms.enAbdul RachmanNoch keine Bewertungen

- Villareal V RamirezDokument2 SeitenVillareal V RamirezNap GonzalesNoch keine Bewertungen

- Sip Dissertation - Final - Final For CollegeDokument17 SeitenSip Dissertation - Final - Final For Collegevikashirulkar922Noch keine Bewertungen

- Monte Carlo Fashions Limited - RHP - 21 November 2014Dokument336 SeitenMonte Carlo Fashions Limited - RHP - 21 November 2014Biswa Jyoti GuptaNoch keine Bewertungen

- High Net WorthDokument3 SeitenHigh Net Worthvinay bathijaNoch keine Bewertungen

- D-Intervenors Motion For Complete Summary Judgement With ExhibitsDokument74 SeitenD-Intervenors Motion For Complete Summary Judgement With Exhibitsapi-467534276Noch keine Bewertungen

- Karw - Icmd 2009 (B04)Dokument4 SeitenKarw - Icmd 2009 (B04)IshidaUryuuNoch keine Bewertungen

- Entrepreneurship GameDokument86 SeitenEntrepreneurship GameDotecho Jzo EyNoch keine Bewertungen

- A Dozen Things Ive Learned About Great CEOs From The Outsiders Written by William ThorndikeDokument6 SeitenA Dozen Things Ive Learned About Great CEOs From The Outsiders Written by William ThorndikepiyushNoch keine Bewertungen

- CrowdFunding Thesis PresentationDokument29 SeitenCrowdFunding Thesis PresentationRupal Sethi0% (1)

- Cost of CapitalDokument10 SeitenCost of CapitalmansurresyNoch keine Bewertungen

- Indian Stock Marke4Dokument36 SeitenIndian Stock Marke4Mridul kejriwalNoch keine Bewertungen

- The Future of Berlin As Fintech Capital, After BrexitDokument2 SeitenThe Future of Berlin As Fintech Capital, After BrexitanneczudaiNoch keine Bewertungen

- Risk, NPV and IrrDokument22 SeitenRisk, NPV and IrrLinda Chow100% (1)

- IFTA Journal 2014 PDFDokument104 SeitenIFTA Journal 2014 PDFRaptordinos100% (2)

- Product Highlights: Sun Grepa Power Builder 10Dokument9 SeitenProduct Highlights: Sun Grepa Power Builder 10Cyril Joy NagrampaNoch keine Bewertungen